Get Irs 14402 Form

Navigating through tax documentation and procedures can often feel like a maze, especially when it comes to dealing with penalties and trying to mitigate them. Among the various forms the IRS provides for specific purposes, Form 14402 plays a crucial role for individuals facing penalties for frivolous tax submissions. Introduced by the IRS in November 2012, Form 14402 serves as a lifeline for taxpayers seeking relief from penalties imposed under Internal Revenue Code (IRC) sections 6702(a) or 6702(b), which deal with frivolous tax submissions. This form is grounded in the provisions of IRC 6702(d), which allows for a reduction of these penalties under certain conditions, as detailed in Revenue Procedure 2012-43. Essentially, by completing and submitting this form, taxpayers can request the IRS to reduce their penalty to $500 provided they meet specific eligibility criteria. These criteria encompass a range of compliance and procedural benchmarks including, but not limited to, the filing of all federal tax returns due for the six years prior to the request, full payment of all federal tax liabilities (except the IRC section 6702 penalties in question), and adherence to other tax-related obligations. Additionally, Form 14402 requires detailed information about the requestor, including taxpayer identification number and contact details, and sets forth payment options for the reduced penalty amount. Importantly, the form also necessitates a declaration under penalties of perjury, affirming the accuracy and completeness of the information provided. Understanding and fulfilling the requirements laid out in Form 14402 can significantly impact a taxpayer's financial responsibilities towards penalty payments, making it a vital document for those eligible for such relief.

Irs 14402 Example

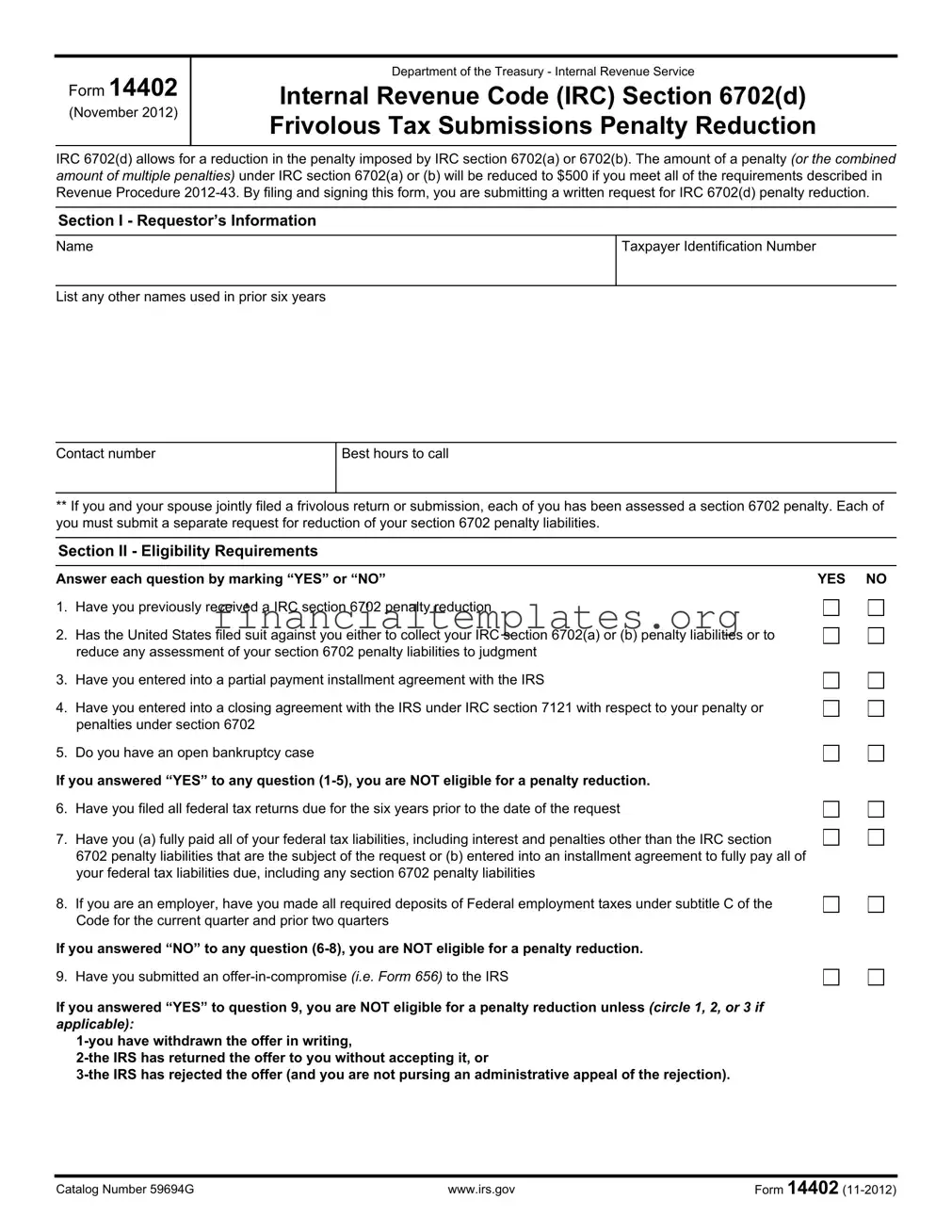

Form 14402

(November 2012)

Department of the Treasury - Internal Revenue Service

Internal Revenue Code (IRC) Section 6702(d) Frivolous Tax Submissions Penalty Reduction

IRC 6702(d) allows for a reduction in the penalty imposed by IRC section 6702(a) or 6702(b). The amount of a penalty (or the combined amount of multiple penalties) under IRC section 6702(a) or (b) will be reduced to $500 if you meet all of the requirements described in Revenue Procedure

Section I - Requestor’s Information

Name

Taxpayer Identification Number

List any other names used in prior six years

Contact number

Best hours to call

**If you and your spouse jointly filed a frivolous return or submission, each of you has been assessed a section 6702 penalty. Each of you must submit a separate request for reduction of your section 6702 penalty liabilities.

Section II - Eligibility Requirements

Answer each question by marking “YES” or “NO” |

YES NO |

1. Have you previously received a IRC section 6702 penalty reduction

2. Has the United States filed suit against you either to collect your IRC section 6702(a) or (b) penalty liabilities or to reduce any assessment of your section 6702 penalty liabilities to judgment

3. Have you entered into a partial payment installment agreement with the IRS

4. Have you entered into a closing agreement with the IRS under IRC section 7121 with respect to your penalty or penalties under section 6702

5. Do you have an open bankruptcy case

If you answered “YES” to any question

6. Have you filed all federal tax returns due for the six years prior to the date of the request

7. Have you (a) fully paid all of your federal tax liabilities, including interest and penalties other than the IRC section 6702 penalty liabilities that are the subject of the request or (b) entered into an installment agreement to fully pay all of your federal tax liabilities due, including any section 6702 penalty liabilities

8. If you are an employer, have you made all required deposits of Federal employment taxes under subtitle C of the Code for the current quarter and prior two quarters

If you answered “NO” to any question

9. Have you submitted an

If you answered “YES” to question 9, you are NOT eligible for a penalty reduction unless (circle 1, 2, or 3 if applicable):

Catalog Number 59694G |

www.irs.gov |

Form 14402 |

Page 2

Section III - Payment Information (minimum payment is $250.00 unless you are in compliance with a full payment installment agreement)

YES NO

1. Have you made an electronic payment or included a payment of at least $250 (and up to $500) with this request

Amount enclosed

Check number

Electronic payment amount

Payment date

2. Have you entered into an approved installment agreement with the IRS

If you answered “NO” to both questions 1 and 2, then you will NOT receive a reduction of your section 6702 penalty liabilities.

Section IV - Request For Penalty Reduction Relief

Requested Penalty Reduction

Tax form number(s)

Tax year(s)

Section V - Declaration Under Penalties Of Perjury

I understand and agree that if a reduction is granted, I will not be entitled to another reduction if the IRC section 6702 penalty is assessed again.

If I am under an installment agreement, I understand that if I meet all the requirements and my request for reduction is approved, the penalty or penalties will be reduced only upon completion of all payments required to satisfy all outstanding tax liabilities other than the section 6702 penalties that exceed $500 and are the subject of this request. In addition, if prior to completion of these payments, I am declared in default of an installment agreement, the penalty will not be reduced.

I understand that any request for reduction of my section 6702 penalty liabilities will be rejected if it does not meet all of the conditions of Revenue Procedure

Under penalties of perjury, I declare that I have filed all returns (including any accompanying schedules and statements) and paid or entered into a full payment installment agreement to pay all taxes and liabilities as described in Revenue Procedure

Signature

Date signed

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue Laws of the United States. Section 6702(d) and Revenue Procedure

We may disclose this information to the Department of Justice for civil or criminal litigation, and to cities, states, and the District of Columbia for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to Federal and state agencies to enforce Federal nontax criminal laws, or to Federal law enforcement and intelligence agencies to combat terrorism. Generally, tax returns and tax return information are confidential, as required by section 6103.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

The time needed to complete this form will vary depending on particular circumstances. The estimated average time is: Recordkeeping……………………………………………

Learning about the law of the form………………………

Preparing the form……………………………………….

Copying, assembling, and sending the form to the IRS….

Catalog Number 59694G |

www.irs.gov |

Form 14402 |

Page 3

Instructions for Form 14402, Internal Revenue Code (IRC) Section 6702(d)

Frivolous Tax Submissions Penalty Reduction

General Instructions

Purpose of Form

Use Form 14402 to request a reduction in your unpaid section 6702 penalty liabilities. Section 6702(d) of the Internal Revenue Code authorizes the Internal Revenue Service (IRS) to reduce the amount of the frivolous tax submissions penalty assessed under section 6702(a) or (b) if the IRS determines that a reduction would promote compliance with and administration of the Federal tax laws.

Revenue Procedure

The Service will treat a written statement that includes the same information prescribed by Form 14402 and these instructions as the submission of Form 14402 if the statement is filed in accordance with Revenue Procedure

Do not use Form 14402 if you want to challenge the merits of a section 6702 penalty assessment. Other procedures may be available to challenge the merits, such as paying the penalty and filing a refund claim or raising the issue in a Collection Due Process hearing.

Do not use Form 14402 to request a refund of any section 6702 penalty liabilities that you have already paid in full or in part. If you have fully paid any assessed section 6702 penalty liabilities, you are not eligible for reduction.

Who Can File

Any person may use Form 14402 to request a reduction of any unpaid section 6702 penalty liabilities.

Where to File

To request a reduction of your unpaid section 6702 penalty liabilities, you must mail a completed Form 14402 to the following address.

Internal Revenue Service

Frivolous Return Program

1973 N Rulon White Blvd. M/S 4450 Ogden, UT 84404

Specific Instructions

Section I – Requestor’s Information. You must provide your name, Social Security Number (SSN) or other Tax Identification Number, and contact information so we can access your account and contact you if we need to clarify any of the information you provide on the form.

Section II – Eligibility Requirements. You must check either “YES” or “NO” to every question in this section to determine whether you meet the requirements described in Revenue Procedure

Question 1

If we have previously reduced any of your section 6702 penalty liabilities, then you are not eligible for another reduction of any section 6702 penalty liabilities.

Question 2

If the United States has filed suit against you either to collect your section 6702 penalty liabilities or to reduce any assessment of your section 6702 penalty liabilities to judgment, then you are not eligible for a section 6702 penalty reduction. Unless you have been served a complaint filed by the Department of Justice in United States District Court to collect your unpaid tax liabilities, you should check “NO” to this question.

Question 3

If you have entered into a partial payment installment agreement with us, then you are not eligible for a section 6702 penalty reduction because successful completion of the agreement will result in you paying less than the full amount of your federal tax liabilities. All taxpayers are expected to immediately pay their tax liabilities in full. When immediate payment is not possible, we may enter into agreements under section 6159 that allow taxpayers to pay their tax liabilities in installments over a prescribed period of time. Generally, we have ten years to collect tax liabilities after they are assessed. If taxpayers cannot fully pay their liabilities before this collection statute of limitations period expires, we may enter into partial payment installment agreements that allow taxpayers to pay as much of their tax liabilities as possible.

Question 4

If you have entered into a closing agreement with the IRS under section 7121 (for example, Form 906, Closing Agreement on Final Determination Covering Specific Matters) with respect to your section 6702 penalty liabilities, then you are not eligible for a section 6702 penalty reduction.

Question 5

If you have an open bankruptcy case, then you are not eligible for a section 6702 penalty reduction. A bankruptcy case is considered open from the date you file a bankruptcy petition to the date the case is dismissed or you receive a discharge.

Catalog Number 59694G |

www.irs.gov |

Form 14402 |

Page 4

Question 6

If you have not filed all federal tax returns due for the six years prior to the date of your reduction request, then you are not eligible for a section 6702 penalty reduction. This requirement means a person must file all individual returns and all returns for any entity in which the person has a controlling interest. For example, an individual taxpayer who requests a section 6702 penalty reduction on May 15, 2012 must have filed valid tax returns for tax years 2011, 2010, 2009, 2008, 2007 and 2006. Refer to Revenue Procedure

Question 7

You are not eligible for a section 6702 penalty reduction unless you have paid all your federal tax liabilities other than section 6702 penalties and interest thereon or you have entered into an installment agreement to fully pay all your federal tax liabilities including the section 6702 penalty liabilities. If you have entered into a full payment installment agreement, you must continue timely making your installment agreement payments to receive a section 6702 penalty reduction. Your section 6702 penalty liabilities will be reduced only when you complete all payments required to satisfy all outstanding tax liabilities other than the section 6702 penalties that are the subject of the request for reduction. If you fail to make all payments required by your full payment installment agreement, your section 6702 penalty liabilities will not be reduced.

If you have already fully paid all federal tax liabilities, including interest and penalties other than the section 6702 penalty liabilities, then you are eligible for a section 6702 penalty reduction. You should not submit this form if you have already fully paid your section 6702 liabilities because you have no outstanding section 6702 penalty liabilities to reduce.

Question 8

If you are an employer that has not made all required deposits of Federal employment taxes under subtitle C of the Code for the current quarter and the prior two quarters, then you are not eligible for a section 6702 penalty reduction.

Question 9

In general, if you have submitted an

**Note. You may still be eligible for a section 6702 penalty reduction if you have withdrawn your offer in writing, we have returned your offer to you without accepting it, or we rejected your offer and you are not pursuing an administrative appeal of the rejection.

Section III – Payment Information. If you meet the requirements described in Revenue Procedure

First, you may submit a payment of at least $250 (but not more than $500) with your request for reduction. You may submit a payment of the entire $500 balance. Your payment will be applied to your unpaid section 6702 penalty liabilities, whether or not we grant your request for reduction.

**Note. If you choose to pay the entire $500 balance with your request for reduction and we grant your request, any interest that has accrued on your section 6702 penalty liabilities will be abated.

If you choose to pay less than $500 and we grant your request for a penalty reduction, you will remain liable for the remaining balance of the reduced penalties until the balance is satisfied. Interest will continue to accrue on the remaining balance of the reduced penalties from the date we assessed the earliest unpaid section 6702 penalty falling under these procedures. You must pay the remaining balance of the reduced penalties (plus interest). If you fail to pay the remaining balance, we may use any available remedy to collect the balance (plus interest).

**Caution. You must submit a payment of at least $250 with your request for reduction even if you have, prior to filing your request for reduction, paid either voluntarily or by an overpayment offset, a portion of the section 6702 penalty liabilities that are the subject of your request for reduction.

Second, if you have entered into and are in compliance with an installment agreement to fully pay all assessed federal tax liabilities (including the section 6702 penalty liabilities) for which the period for collection under section 6502 remains open, you may pay the reduced section 6702 penalty of $500 as part of the installment agreement. Your section 6702 penalty liabilities will be reduced only upon completion of all payments required to satisfy all unpaid tax liabilities other than the section 6702 penalties that are the subject of the request for reduction. We will notify you when you have paid all of your unpaid federal tax liabilities plus the $500 remaining balance of your reduced section 6702 penalty liabilities. If you fail to continue timely making all payments required by your full payment installment agreement, your section 6702 penalty liabilities will not be reduced.

**Note. If you pay the $500 balance as part of your full payment installment agreement, any interest that has accrued on your unpaid section 6702 penalty liabilities will be abated.

Catalog Number 59694G |

www.irs.gov |

Form 14402 |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of the Form | Form 14402 is used to request a reduction in the IRS section 6702 penalties for frivolous tax submissions, promoting compliance with federal tax laws. |

| Eligibility Criteria | Eligibility for penalty reduction is determined by answering specific questions regarding prior penalties, legal actions, agreement statuses, bankruptcy, tax filing and payment history. |

| Payment Information Requirement | The requestor may need to make a minimum payment of $250 with the submission, with different stipulations for those under payment installment agreements. |

| Governing Law | Form 14402 operates under the Internal Revenue Code (IRC) Section 6702(d) and Revenue Procedure 2012-43, focusing on reducing penalties for frivolous tax submissions. |

Guide to Writing Irs 14402

When dealing with IRS Form 14402, it’s important to carefully follow each step to ensure that your request for a reduction of the frivolous tax submissions penalty under IRC Section 6702(d) is processed efficiently. This form is designed for those who have been penalized under the specific sections of the Internal Revenue Code and meet certain criteria that may qualify them for a reduction in that penalty. Filling out this form correctly is vital for the submission to be considered.

- Section I - Requestor’s Information:

- Enter your full name as it appears on your tax documents.

- Provide your Taxpayer Identification Number, such as your Social Security Number.

- List any other names you have used in the previous six years.

- Include a contact number and specify the best hours for the IRS to call you.

- Section II - Eligibility Requirements:

- For questions 1 to 5, mark “YES” or “NO” to determine your initial eligibility. If you answer “YES” to any of these, you are not eligible for a penalty reduction.

- Questions 6 to 8 are equally crucial. A “NO” answer to any of them means you are not eligible for a penalty reduction.

- Question 9 deals with whether you have submitted an offer-in-compromise. Mark “YES” only if applicable and specify the condition (1, 2, or 3) that applies to your situation.

- Section III - Payment Information:

- State whether you have made an electronic payment of at least $250 or included a check with your request. Fill in the payment amount, check number if applicable, and payment date.

- Answer whether you have entered into an approved installment agreement with the IRS. A “NO” answer to both questions in this section means your penalty will not be reduced.

- Section IV - Request For Penalty Reduction:

- Specify the tax form number(s) and tax year(s) for which you are requesting a penalty reduction.

- Section V - Declaration Under Penalties Of Perjury:

- Carefully read the declaration statement acknowledging your understanding of the terms and providing your consent.

- Sign and date the form to attest to the accuracy and completeness of the information provided.

After completing and reviewing Form 14402 for accuracy, you should mail it to the specified address at the Internal Revenue Service. It's crucial to keep a copy of this form for your records. The IRS will review your submission and determine if you qualify for the penalty reduction. You will be notified of their decision, and it is important to remember that you may not appeal the rejection of your request to the IRS Office of Appeals. Completing this form carefully and honestly is essential for a favorable consideration.

Understanding Irs 14402

- What is IRS Form 14402?

IRS Form 14402 is used to request a reduction in penalties assessed for frivolous tax submissions under Internal Revenue Code (IRC) sections 6702(a) or (b). This form allows individuals who meet specific criteria outlined in Revenue Procedure 2012-43 to have these penalties reduced to $500.

- Who is eligible to file Form 14402?

Individuals who have been assessed a penalty under IRC section 6702(a) or (b) for frivolous tax submissions and who meet the requirements specified in Revenue Procedure 2012-43 are eligible. This includes having not received a reduction of the section 6702 penalty previously, not currently being involved in litigation or bankruptcy regarding these penalties, being up to date on federal tax filings for the past six years, having paid or arranged to pay all federal tax liabilities, and meeting other specific criteria outlined in the form's instructions.

- What requirements must be met for penalty reduction?

To qualify for a penalty reduction, individuals must not have previously received a section 6702 penalty reduction, must not be currently sued by the United States for these penalties, must have a clean record of tax compliance for the past six years, and must have paid all federal tax liabilities. Additionally, if you're an employer, you must have made all required federal employment tax deposits. Requests for an offer in compromise must not be open unless they meet specific exceptions.

- What payment is required when filing Form 14402?

Along with the request for penalty reduction, a minimum payment of $250 is required unless the individual is in compliance with a full payment installment agreement with the IRS. This payment can be up to the full penalty amount of $500. Failure to include at least a $250 payment with the reduction request will result in denial of the penalty reduction.

- Where should Form 14402 be submitted?

The completed Form 14402 should be mailed to the Internal Revenue Service Frivolous Return Program at 1973 N Rulon White Blvd., M/S 4450, Ogden, UT 84404. This submission is the first step towards receiving a determination on the penalty reduction request. It's crucial to ensure all information is accurate and complete to avoid delays or denial of the reduction.

Common mistakes

Filling out the IRS 14402 form, related to Internal Revenue Code Section 6702(d) for frivolous tax submissions penalty reduction, often involves complexities that lead individuals to make mistakes. Recognizing and avoiding these errors can be crucial in successfully reducing penalty amounts. Here are ten common mistakes people make:

- Not fully reading and understanding Revenue Procedure 2012-43, which outlines the eligibility requirements for penalty reduction. This document provides the foundational knowledge needed to navigate the form successfully.

- Failing to provide accurate Requestor’s Information in Section I. This section demands the taxpayer's name, identification number, alternative names used in the past six years, contact number, and preferred calling hours. Inaccuracies here can lead to processing delays or rejections.

- Incorrectly answering the Eligibility Requirements in Section II, particularly not accurately assessing prior penalty reductions, ongoing lawsuits, installment agreements, or bankruptcy cases. Mistaken 'YES' or 'NO' responses can immediately disqualify an applicant.

- Overlooking the requirement to have filed all federal tax returns due in the six years prior to the reduction request date. This common mistake can automatically render one ineligible for penalty reduction.

- Not understanding the implications of the question about making required deposits of Federal employment taxes for employers. This is a critical requirement for businesses seeking penalty reductions.

- Submitting an application while an offer-in-compromise is still being considered by the IRS, without meeting the specific conditions that still allow for eligibility (e.g., withdrawing the offer).

- Overlooking the Payment Information section, particularly failing to include a payment of at least $250 with the request or not being in compliance with an approved installment agreement.

- Misunderstanding the option to pay the penalty reduction amount upfront. Some applicants do not realize that paying the full $500 amount upfront can abate any accrued interest on the section 6702 penalties.

- Emitting required signatures and dates under the penalties of perjury declaration, which validates the truthfulness and completeness of the information provided on the form.

- Ignoring the Privacy Act and Paperwork Reduction Act Notice. Although seemingly procedural, understanding these notices provides insight into how the information provided might be used and the importance of accuracy to avoid legal repercussions.

Each of these mistakes can delay or undermine the penalty reduction process, emphasizing the need for careful attention to detail when filling out the IRS 14402 form. By avoiding these errors, individuals can enhance their chances of achieving a successful penalty reduction.

Documents used along the form

When dealing with the IRS and particularly when submitting a Form 14402, individuals often need to manage and provide other forms and documents to ensure compliance or enhance their submission. Understanding these additional documents can help navigate through the IRS's processes more effectively.

- Form 656: Offer in Compromise. This form is used when you want to settle your tax debt for less than the full amount owed. It's pertinent for those considering penalty reduction as eligibility for Form 14402 is affected by submission of an Offer in Compromise.

- Form 9465: Installment Agreement Request. Filers can use this to request a monthly installment plan if they cannot pay the full amount due. This form is relevant for question 3 of Section II on Form 14402 regarding installment agreements.

- Form 433-F: Collection Information Statement. This form is used to provide financial information necessary for the IRS to determine how you can settle your tax debt, often accompanying Form 656 or Form 9465.

- Form 2848: Power of Attorney and Declaration of Representative. This allows individuals to authorize someone else, usually a tax professional, to represent them before the IRS, which could be important during the penalty reduction process.

- Form 8821: Tax Information Authorization. This form permits individuals to appoint any individual, corporation, firm, organization, or partnership to inspect and/or receive confidential information in any office of the IRS for the type of tax and the years or periods you list on the form.

- Form 1040: U.S. Individual Income Tax Return. Necessary for ensuring that all federal tax returns for the six years prior to the reduction request have been filed, as required by Section II, question 6 on Form 14402.

- Form 433-A: Collection Information Statement for Wage Earners and Self-Employed Individuals. Similar to Form 433-F but specifically for individuals, providing detailed financial information for determining payment options.

- Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return. While not directly related to the penalty reduction process of Form 14402, it's an example of another form that may need to be filed to maintain compliance with federal tax responsibilities.

These documents play critical roles in various situations, from demonstrating financial hardship to authorizing representation. They can support the penalty reduction process by ensuring that all other tax obligations are met and providing a clearer picture of an individual's financial situation to the IRS. Whether seeking penalty reduction, setting up payment plans, or dealing with more complex tax issues, having a thorough understanding and awareness of these forms can significantly impact the outcome.

Similar forms

The IRS Form 656, or Offer in Compromise, shares similarities with IRS Form 14402 as both relate to taxpayers seeking relief from their liabilities. Form 656 enables taxpayers to settle tax debts for less than the full amount owed, contingent upon certain conditions, much like Form 14402 allows for a reduction in penalties under specific criteria. Both forms require detailed financial information and represent an agreement between the taxpayer and IRS to resolve tax obligations outside the standard full payment route.

IRS Form 9465, the Installment Agreement Request, is another document mirroring aspects of Form 14402. While Form 9465 is used to request a payment plan for tax debts, it similarly provides a structured way for taxpayers to manage their liabilities. Eligibility for penalty reduction under Form 14402, as with entering an installment agreement using Form 9465, hinges on meeting certain conditions such as filing all required tax returns and not being in bankruptcy proceedings.

The Application for Reduced User Fee for Installment Agreements, otherwise not specifically numbered but related to Form 9465, shares a purpose with Form 14402 to lessen the financial burden on eligible taxpayers. Both aim at making it easier for taxpayers to comply with their obligations by lowering the cost associated with repayment plans or penalty assessments.

IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, is used to collect financial information from taxpayers seeking payment alternatives or penalty reductions. Like Form 14402, it aids the IRS in determining a taxpayer's ability to pay and eligibility for certain relief programs, delineating a comprehensive overview of the taxpayer's financial situation to facilitate a fair resolution.

Form 433-F, Collection Information Statement, is employed similarly to Form 433-A but is a shorter version. Both forms collect vital financial data and are pivotal in the process for applying for various relief options, including the penalty reduction sought through Form 14402. These forms help the IRS assess the taxpayer’s comprehensive financial standing, enabling decisions on relief eligibility.

IRS Form 843, Claim for Refund and Request for Abatement, although primarily for claiming refunds or requesting the abatement of certain taxes, penalties, and interest, parallels Form 14402 in its purpose of seeking financial relief from tax-related burdens. Both forms are pathways through which taxpayers can request the IRS to reassess and potentially reduce their tax liabilities.

IRS Form 8857, Request for Innocent Spouse Relief, provides a means for requesting relief from joint tax liabilities. Similar to Form 14402’s penalty reduction request, Form 8857 involves a detailed examination of circumstances and equity to afford relief from tax obligations that would otherwise present a financial hardship, highlighting the IRS’s capacity to mitigate tax liabilities under qualifying conditions.

IRS Form 12277, Application for Withdrawal of Filed Notice of Federal Tax Lien, somewhat mirrors the intention behind Form 14402 by offering a form of relief from the implications of tax debts. While Form 12277 specifically addresses the withdrawal of tax liens, it similarly represents an avenue for taxpayers to alleviate the burdens of their tax liabilities and improve their financial situation.

The Bankruptcy Forms, particularly those involving the filing of a tax entity’s bankruptcy case, share the theme of financial relief found in Form 14402. Although bankruptcy is a broader and more severe financial remedy, both the process of declaring bankruptcy and seeking penalty reduction via Form 14402 aim at providing taxpayers with means to manage overwhelming tax obligations.

Lastly, the IRS Form 1040-X, Amended U.S. Individual Income Tax Return, although primarily for correcting previously filed tax returns, embodies the principle of modifying tax obligations based on accurate and updated information. Like Form 14402, which offers a penalty reduction for meeting certain criteria, Form 1040-X allows taxpayers to adjust their tax liabilities, potentially leading to refunds or reduced tax obligations.

Dos and Don'ts

When dealing with the IRS Form 14402, it's crucial to navigate the filing process correctly to ensure a successful penalty reduction request under IRC Section 6702(d). Below are guidelines detailing what you should and shouldn't do when completing this form.

Do:

- Ensure that you meet all eligibility criteria detailed in Section II before proceeding. It's vital to confirm your eligibility for a penalty reduction to avoid unnecessary processing delays.

- Accurately provide all requested information in Section I, Requestor’s Information, including your name, Taxpayer Identification Number, and contact details. This information is critical for the IRS to identify and communicate with you regarding your request.

- Answer every question in Section II, Eligibility Requirements, truthfully and to the best of your knowledge. Incorrect or incomplete answers can lead to the rejection of your request.

- Include the required payment information in Section III if you qualify for a penalty reduction. Either submit a payment with your request or confirm your compliance with an approved installment agreement.

- Sign and date the form under Section V, Declaration Under Penalties of Perjury, confirming that all information provided is accurate and complete. This declaration is a legal statement verifying the truthfulness of your submission.

Don't:

- Attempt to request a reduction if you have previously received a penalty reduction under IRC section 6702 or if you do not meet the specific conditions set forth in Revenue Procedure 2012-43.

- Leave any questions unanswered in Section II. Every question is designed to determine your eligibility for a penalty reduction, and skipping a question could result in automatic disqualification.

- Submit the form without the minimum required payment or evidence of an installment agreement if you're seeking a reduction of your section 6702 penalty liabilities. Failure to include this information will lead to the denial of your request.

- Use Form 14402 if you are seeking to challenge the merits of a section 6702 penalty assessment or request a refund of penalties already paid. Other procedures are available for these actions.

- Forge or falsify information on the form. Providing false information can result in severe penalties, including legal action for attempting to defraud the Internal Revenue Service.

Misconceptions

Understanding the IRS Form 14402 and its associated penalty reduction process can be complex, and there are quite a few misconceptions floating around. Here's a closer look at some common ones:

- Misconception 1: The process is only available to individuals, not businesses.

Actually, any person, including businesses, can file Form 14402 to request a reduction of their unpaid section 6702 penalties if they meet the eligibility criteria.

- Misconception 2: Once you've paid your penalties in full, you can apply for a reduction.

This is not true. The form is intended for reducing unpaid section 6702 penalties. If you've paid your penalties entirely, you're considered not eligible since there's nothing to reduce.

- Misconception 3: Filing this form also challenges the merit of the penalty.

Filing Form 14402 does not allow you to challenge the merits of your penalty assessment. It is strictly for requesting a penalty reduction under specific conditions.

- Misconception 4: You can request a reduction for penalties that have already been fully or partially refunded.

If you have already received a refund for your penalties, this form is not the correct avenue for further action as it only applies to unpaid penalties.

- Misconception 5: The form can be used to request refunds.

Form 14402 is not for refund requests. It's exclusively for reducing unpaid section 6702 penalties.

- Misconception 6: Eligibility for penalty reduction automatically means your request will be approved.

Meeting the eligibility criteria is just the first step. The IRS still needs to review each request to determine if reducing the penalty will promote compliance with tax laws.

- Misconception 7: The penalty reduction request can be appealed.

If your request for penalty reduction gets rejected, there's no appeal process with the IRS Office of Appeals for this decision.

Understanding these misconceptions can clarify the purpose of Form 14402 and the penalty reduction process, ensuring that those who are eligible can correctly apply for relief. If you're considering this route, make sure you fully understand the eligibility requirements and the process involved.

Key takeaways

Filing IRS Form 14402 is essential for anyone seeking a reduction in their penalty under Internal Revenue Code Section 6702(d), related to frivolous tax submissions. Understanding how to correctly fill out and submit this form is crucial to take advantage of this potential reduction. Here's what you need to know:

- Eligibility is key: To qualify for a penalty reduction, you must meet certain conditions outlined in Revenue Procedure 2012-43.

- Separate submissions for spouses: If you and your spouse jointly filed a return that was deemed frivolous, each of you needs to submit a separate Form 14402 to request a penalty reduction.

- Initial payment requirement: A minimum payment of $250 is required when submitting your request unless you are in compliance with a full payment installment agreement.

- Detailed personal information is necessary: Section I of Form 14402 requires your name, taxpayer identification number, other names used in the past six years, contact number, and best hours to call.

- Your eligibility status: Answering the questions in Section II accurately is crucial to determine your eligibility for the penalty reduction.

- Penalties won’t be reduced if a suit has been filed: If the United States has initiated a lawsuit against you to collect the penalty or reduce it to judgment, you are not eligible for a reduction.

- Full compliance with federal tax responsibilities is a must: You must have filed all required federal tax returns for the six years prior to your request and paid, or arranged to pay, all federal tax liabilities to be eligible.

- Offers in compromise affect eligibility: Submitting an offer in compromise may render you ineligible for a penalty reduction, with certain exceptions.

- Complete payment information is crucial: Section III requires specific details about your payment, including the method and amount, to process the penalty reduction.

- Understanding the declaration: By signing the form, you agree to the terms outlined and affirm all information provided is accurate, under penalties of perjury.

- Privacy and paperwork compliance: The Privacy Act and Paperwork Reduction Act Notice explains the legal basis for requesting the information on Form 14402, reinforcing the importance of providing accurate details to avoid potential penalties.

Successfully navigating the requirements and accurately completing IRS Form 14402 can lead to a significant reduction in penalties for frivolous tax submissions, making it an important process for eligible individuals to understand and follow.

Popular PDF Documents

Tax POA - It’s a safeguard ensuring that taxes are paid and processed correctly, avoiding penalties.

IRS 1099-C - A form that underlines the intricacies of tax implications stemming from debt forgiveness, requiring detailed attention.

Doctors First Report - Streamlines the injury reporting process in the workplace, ensuring detailed documentation for compensation and healthcare follow-up.