Get Irs 14242 Form

In the labyrinthine world of tax regulation and oversight, Form 14242 plays a crucial role as a tool provided by the Department of the Treasury - Internal Revenue Service to safeguard the integrity of the tax system. Issued in October 2016, this form specifically targets the reporting of suspected abusive tax avoidance schemes and the tax return preparers who may promote these questionable strategies. Designed to empower individuals with the means to report activities that potentially undermine fair tax administration, Form 14242 also opens a pathway for citizens to participate actively in the enforcement process by identifying and detailing such schemes. The form not only asks for comprehensive details about the suspected promotion, including the how and when of the taxpayer's awareness but also solicits information on the promoters or preparers involved, including their contact details and any promotional material related to the scheme. Importantly, it provides an option for the reporter to claim a reward for their information, thereby incentivizing the reporting process, though this requires the filing of a separate form, Form 211, Application for Reward for Original Information. Such mechanisms are integral to maintaining transparency and fairness in the tax system, reflecting the IRS’s ongoing efforts to combat tax avoidance schemes and ensure that all taxpayers contribute their fair share.

Irs 14242 Example

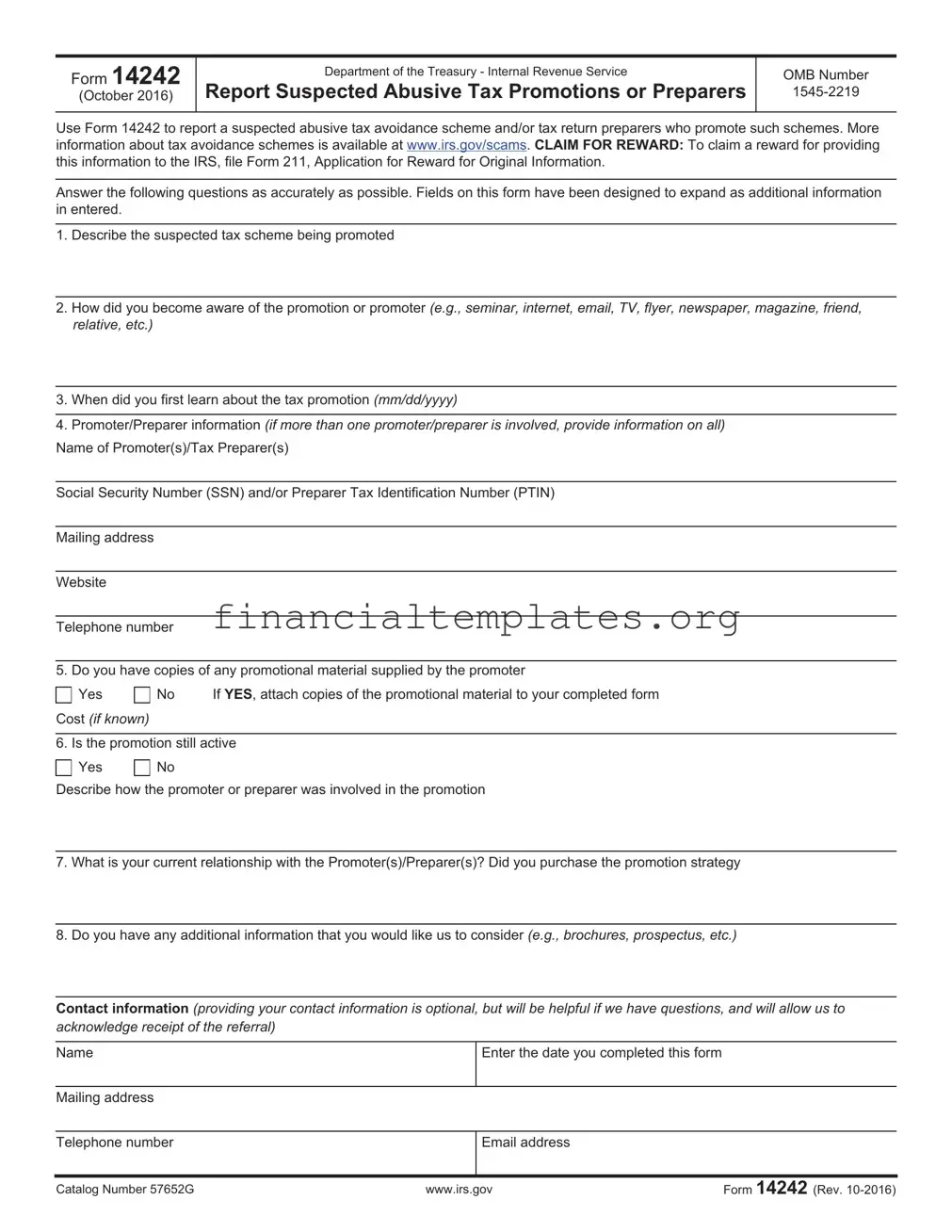

Form 14242

(October 2016)

Department of the Treasury - Internal Revenue Service

Report Suspected Abusive Tax Promotions or Preparers

OMB Number

Use Form 14242 to report a suspected abusive tax avoidance scheme and/or tax return preparers who promote such schemes. More information about tax avoidance schemes is available at www.irs.gov/scams. CLAIM FOR REWARD: To claim a reward for providing this information to the IRS, file Form 211, Application for Reward for Original Information.

Answer the following questions as accurately as possible. Fields on this form have been designed to expand as additional information in entered.

1.Describe the suspected tax scheme being promoted

2.How did you become aware of the promotion or promoter (e.g., seminar, internet, email, TV, flyer, newspaper, magazine, friend, relative, etc.)

3.When did you first learn about the tax promotion (mm/dd/yyyy)

4.Promoter/Preparer information (if more than one promoter/preparer is involved, provide information on all)

Name of Promoter(s)/Tax Preparer(s)

Social Security Number (SSN) and/or Preparer Tax Identification Number (PTIN)

Mailing address

Website

Telephone number

5. Do you have copies of any promotional material supplied by the promoter

Yes

Cost (if known)

No |

If YES, attach copies of the promotional material to your completed form |

6. Is the promotion still active

Yes

No

Describe how the promoter or preparer was involved in the promotion

7.What is your current relationship with the Promoter(s)/Preparer(s)? Did you purchase the promotion strategy

8.Do you have any additional information that you would like us to consider (e.g., brochures, prospectus, etc.)

Contact information (providing your contact information is optional, but will be helpful if we have questions, and will allow us to acknowledge receipt of the referral)

Name

Enter the date you completed this form

Mailing address

Telephone number

Email address

Catalog Number 57652G |

www.irs.gov |

Form 14242 (Rev. |

Page 2 of 2

FAX your completed form to: (877)

Mail the completed form to:

Internal Revenue Service

Lead Development Center Stop MS5040

24000 Avila Road

Laguna Niguel, CA 92677

(IRS Employees ONLY SHOULD

Privacy Act and Paperwork Reduction Act Notice

This information is solicited under authority of 5 U.S.C. 301, 26 U.S.C. 7801 and 26 U.S.C. 7803. The primary purpose of this form is to report violation of the Internal Revenue laws.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal

Providing this information is voluntary. Not providing all or part of the information will not affect you. Providing false or fraudulent information may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is: Preparing and sending the form to the IRS should involve 10 minutes. If you have comments concerning the accuracy of the time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the IRS at the address listed in the Instructions.

Catalog Number 57652G |

www.irs.gov |

Form 14242 (Rev. |

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | Form 14242 is used to report suspected abusive tax avoidance schemes and/or tax return preparers who promote such schemes. |

| Form Revision Date | The form was last revised in October 2016. |

| OMB Number | 1545-2219 |

| Reward Claim | To claim a reward for providing information, filers must submit Form 211, Application for Reward for Original Information. |

| Information Submission Method | Completed forms can be faxed to (877) 477-9135 or mailed to the IRS Lead Development Center in Laguna Niguel, CA. |

| Governing Authority | This form is solicited under the authority of 5 U.S.C. 301, 26 U.S.C. 7801, and 26 U.S.C. 7803. Its primary purpose is to report violations of Internal Revenue laws. |

| Voluntary Submission | Providing information on this form is voluntary, but providing false or fraudulent information may lead to penalties. |

Guide to Writing Irs 14242

Upon completing the IRS Form 14242, it is pivotal to ensure every detail within is accurate and provides a comprehensive overview of the suspected abusive tax scheme. This diligence is not only instrumental in aiding the IRS in its investigation but also in ensuring any potential abusive tax promotions or preparers are duly scrutinized. With all necessary information meticulously compiled, the subsequent steps ensure the information reaches the IRS through the appropriate channels, either via fax or mail.

- Begin by thoroughly describing the suspected tax scheme being promoted. Detail is key, so include all pertinent information that showcases why the promotion is suspected of being abusive.

- Explain how you became aware of the promotion or the promoter. This can include a variety of avenues such as seminars, internet, emails, TV, flyers, newspapers, magazines, friends, or relatives.

- Indicate the date when you first learned about the tax promotion in the format mm/dd/yyyy.

- Provide comprehensive information about the Promoter/Preparer involved. If multiple individuals are involved, ensure you include details for each:

- Name of Promoter(s)/Tax Preparer(s)

- Social Security Number (SSN) and/or Preparer Tax Identification Number (PTIN)

- Mailing address

- Website

- Telephone number

- State whether you have copies of any promotional material supplied by the promoter. If yes, attach copies to your completed form and include any known costs.

- Indicate if the promotion is still active. This helps the IRS determine the urgency and approach for investigation.

- Describe your current relationship with the Promoter(s)/Preparer(s) and whether you purchased the promotion strategy.

- Provide any additional information that you think could be beneficial for the IRS to consider. This can include brochures, prospectuses, or any other relevant documents.

- Lastly, include your contact information. Though this step is optional, it aids the IRS in case there are further questions or to acknowledge receipt of your referral:

- Name

- Mailing address

- Telephone number

- Email address

- Enter the date you completed this form.

Once the form is filled out, choose the preferred method of submission. You can fax the completed form to (877) 477-9135. Alternatively, you can mail it to the Internal Revenue Service Lead Development Center, Stop MS5040, 24000 Avila Road, Laguna Niguel, CA 92677. Selecting the correct submission method ensures your report is processed efficiently, facilitating timely action against the reported abusive tax schemes or preparers.

Understanding Irs 14242

What is IRS Form 14242, and why would someone need to use it?

IRS Form 14242, officially titled "Report Suspected Abusive Tax Promotions or Preparers," serves as a crucial tool for reporting suspected tax avoidance schemes and the individuals or entities promoting such schemes. This form is instrumental for individuals wishing to inform the IRS about activities they believe to be facilitating tax evasion or exploiting tax laws in ways that are not intended by lawmakers. It plays a vital role in the IRS's efforts to investigate and curb abusive tax avoidance strategies, thereby ensuring the fairness and integrity of the tax system.

Where can information about tax avoidance schemes be found?

Information concerning tax avoidance schemes, including what constitutes an abusive tax promotion and examples of such activities, can be obtained from the IRS's official website at www.irs.gov/scams. This resource offers comprehensive details about various schemes, how they work, and the IRS's ongoing efforts to combat such fraudulent activities.

Can individuals claim a reward for reporting such activities through Form 14242?

Yes, individuals who report suspected abusive tax promotions or preparers using Form 14242 may be eligible to claim a reward. To do so, they must file Form 211, titled "Application for Reward for Original Information." This additional form allows individuals to provide detailed information that could lead to the detection and penalization of tax evasion schemes, potentially earning them a financial reward for their contribution to maintaining tax compliance.

What specific information is required when completing Form 14242?

The form requests detailed information about the suspected scheme, including a description of the tax avoidance strategy being promoted, how the individual became aware of it, and the date of first awareness. It also requires detailed information about the promoter or preparer involved, such as their name, contact details, and any promotional materials related to the scheme. If the promotion is active, the form asks for a description of the promoter's involvement and the respondent's relationship with the promoter/preparer.

Is it necessary to attach promotional materials to the completed Form 14242?

Yes, if the individual reporting the alleged abuse has copies of any promotional materials supplied by the promoter, attaching these materials to the completed Form 14242 is highly encouraged. These materials may include brochures, flyers, or any form of communication used to promote the abusive tax scheme. They serve as crucial evidence for the IRS to evaluate the nature of the promotion and take appropriate actions.

How can individuals submit Form 14242 to the IRS?

There are two primary methods for submitting Form 14242 to the IRS. Individuals can fax the completed form to (877) 477-9135 or mail it to the Internal Revenue Service Lead Development Center at Stop MS5040, 24000 Avila Road, Laguna Niguel, CA 92677. This flexibility ensures that the process is accessible to all, allowing for timely reporting of suspicious activities.

Is providing contact information on Form 14242 mandatory?

While providing contact information on Form 14242 is optional, it is beneficial for multiple reasons. It allows the IRS to clarify any ambiguities or questions regarding the report and acknowledges receipt of the referral. However, individuals can choose to remain anonymous if they prefer not to disclose their identity.

What are the consequences of submitting false information on Form 14242?

Submitting false or fraudulent information on Form 14242 is a serious offense that may subject the individual to penalties. It is imperative that all information provided on the form is accurate and truthful to the best of the individual's knowledge, as the IRS uses this information to conduct investigations that can have legal and financial implications for those involved.

Where can suggestions or comments about Form 14242 be directed?

Individuals who have suggestions for improving Form 14242 or comments on the accuracy of the time estimate for completing and filing it can write to the IRS at the address listed in the Instructions. The IRS values feedback from the public as it strives to make its forms and procedures as user-friendly and effective as possible.

Common mistakes

Filling out IRS Form 14242 is essential for reporting suspected abusive tax promotions or preparers. However, individuals often make mistakes when completing this form, affecting the effectiveness of the report. Here are seven common errors:

Not providing detailed descriptions of the suspected tax scheme, which is crucial for the IRS to understand and investigate the issue.

Failing to report how they became aware of the promotion, which can help the IRS identify patterns or widespread schemes.

Excluding the date when they first learned about the promotion, details that could be vital in tracking the timeline of the abusive scheme.

Omitting promoter/preparer information, such as names, SSN/PTIN, mailing addresses, and contact details, making it difficult for the IRS to locate and investigate the entities involved.

Forgetting to attach copies of promotional material if available. This supporting documentation is essential for substantiating the report.

Not clarifying whether the promotion is still active, which can indicate to the IRS the urgency and potential scope of the issue.

Withholding their relationship with the promoter(s) or if they engaged with the tax avoidance scheme, information that can provide valuable context for the investigation.

Besides these common mistakes, individuals should remember:

- Provide as much information as possible to ensure the report is comprehensive.

- Contact information is optional but can be extremely helpful if the IRS needs further clarification or to acknowledge receipt of the referral.

- The information provided is used under strict confidentiality agreements and is essential in combating tax avoidance schemes.

By avoiding these errors and providing clear, detailed information, individuals can significantly assist the IRS in identifying and investigating abusive tax schemes and promoters.

Documents used along the form

When dealing with the IRS Form 14242, a tool designed to report suspected abusive tax promotions or preparers, individuals may find themselves navigating a complex landscape of additional forms and documentation. This form serves as a critical means for the IRS to identify and investigate potentially dishonest schemes, but it often does not stand alone in the reporting process. A variety of other documents are commonly used alongside Form 14242 to provide a comprehensive view of the issue at hand.

- Form 211: Application for Reward for Original Information. This form is used to claim a reward for reporting tax evasion, including abusive tax schemes. It complements Form 14242 by offering an incentive for whistleblowers to come forward with valuable information.

- Form 3949-A: Information Referral. If someone suspects fraud or significant noncompliance with tax laws but it's not specifically related to abusive tax promotions, this form is the right tool. It helps report a variety of tax law violations.

- Publication 1: Your Rights as a Taxpayer. This document outlines the rights every taxpayer has, ensuring individuals understand their protections, especially when reporting suspected abusive schemes.

- Form 1040: U.S. Individual Income Tax Return. Though not directly connected to reporting schemes, Form 1040 may be required to correct any personal tax inaccuracies due to involvement with an abusive tax promotion.

- Form 433-A: Collection Information Statement for Wage Earners and Self-Employed Individuals. If an individual's taxes are impacted by a scheme, this form may be needed to provide financial information to the IRS for setting up payment plans or resolving tax debts.

- Form 8300: Report of Cash Payments Over $10,000 Received in a Trade or Business. While this form is primarily used for reporting large cash transactions, it can be associated with investigations into tax schemes that involve significant cash transactions.

Each of these forms and documents plays a vital role in enabling individuals and businesses to report suspicious activities and correct their tax records. While navigating the complexities of tax laws and the IRS's reporting system can be daunting, these resources provide essential channels for maintaining integrity within the tax system. Reporting suspected abusive tax promotions or preparers using Form 14242, along with any relevant supplementary documentation, contributes significantly to the IRS's ability to enforce tax laws and uphold fairness for all taxpayers.

Similar forms

The IRS Form 211, "Application for Reward for Original Information," closely resembles Form 14242 in its purpose to incentivize individuals to report activities that undermine tax laws. While Form 14242 is geared towards reporting abusive tax promotions and preparers, Form 211 takes a broader approach by allowing individuals to report any under-the-table information regarding tax evasion directly to the IRS and potentially receive a reward. Both forms serve as tools in the IRS's efforts to enforce tax compliance and integrity within the tax system.

Form 3949-A, "Information Referral," is another document that shares similarities with Form 14242 since it is used to report suspected tax law violations to the IRS. This form covers a wide range of tax-related misconduct, from unreported income to fraudulent activities by individuals or businesses. Though Form 14242 specifically addresses abusive tax promotions and preparers, both forms encourage public participation in identifying and preventing tax evasion schemes, enhancing the efficacy of tax law enforcement.

The IRS's Whistleblower Informant Award Program operates in conjunction with forms like the 14242, promoting the disclosure of violations not limited to but including abusive schemes and preparer misconduct. While not a form per se, this program outlines the process and potential rewards for reporting significant tax noncompliance, much like the reward system mentioned in Form 14242 for reporting abusive tax promotions. The alignment between the intent of this program and the purpose of Form 14242 further solidifies the IRS's commitment to combating tax evasion with the help of the public.

Form 8857, "Request for Innocent Spouse Relief," while not directly aimed at reporting tax avoidance schemes or preparer fraud, intersects with Form 14242 on the premise of protecting taxpayers. It provides relief to individuals facing unfair tax burdens due to the actions or fraud of their spouse or former spouse. This form, like Form 14242, addresses the issue of fairness and integrity within the tax system, offering individuals a means to report situations that could lead to unjust tax liabilities.

Lastly, the Schedule C (Form 1040), "Profit or Loss from Business," though fundamentally a tax filing form for self-employed individuals, indirectly relates to the purpose behind Form 14242. Misuse or aggressive manipulation of Schedule C expenses can be indicative of the abusive tax schemes Form 14242 aims to combat. The reporting and scrutiny of Schedule C help in curbing tax avoidance strategies by highlighting irregularities in reported income or expenses, thus maintaining the transparency and fairness of the tax system.

Dos and Don'ts

When filling out IRS Form 14242, which is used to report suspected abusive tax promotions or preparers, it is crucial to proceed with both accuracy and thoroughness. This form plays a significant role in identifying and taking action against tax avoidance schemes. Below are essential dos and don'ts to consider when completing this form.

Dos:

- Provide detailed descriptions of the suspected tax scheme being promoted. It’s essential to include all relevant information that can help the IRS understand the specifics of the scheme.

- Explain how you became aware of the promotion or the promoter. Whether it was through a seminar, internet advertisement, email, or any other means, providing this information can help the IRS in their investigation.

- Attach copies of any promotional materials supplied by the promoter if available. These materials can serve as critical evidence in evaluating the promotion.

- Include information about the promoter or preparer, such as names, social security numbers (SSN) or Preparer Tax Identification Numbers (PTIN), mailing addresses, and other contact information.

- Complete the form with your contact information. While optional, providing your details can be helpful if the IRS has questions or needs to acknowledge receipt of your referral.

- Mail or fax the completed form to the appropriate address as indicated on the form. Ensure it reaches the IRS to take the necessary actions.

Don'ts:

- Avoid leaving sections blank that apply to your situation. If a question is relevant, provide as complete an answer as possible.

- Refrain from submitting incomplete or vague descriptions of the tax scheme. Lack of clarity can hinder the effectiveness of the investigation.

- Do not submit the form without attaching relevant promotional materials if you have affirmed their availability in your report.

- Do not provide inaccurate or fabricated information about the promoter/preparer or the scheme. This can lead to legal consequences and undermine the investigation.

- Avoid overlooking the privacy notice and the implications of submitting the form. Understand that providing false information can have penalties.

- Resist the temptation to follow up excessively. While it’s understandable to be curious about the progress of your report, the IRS processes a large number of these forms and may take time to investigate.

Filling out Form 14242 with a careful approach not only assists the IRS in addressing tax avoidance schemes but also contributes to maintaining the integrity of the tax system. By following these guidelines, individuals can ensure that their submissions are both valuable and effective.

Misconceptions

Misconceptions about the IRS Form 14242, which is designed for reporting suspected abusive tax promotions or preparers, are not uncommon. Understanding the form correctly is crucial to ensure that it is used appropriately and effectively. Here are seven common misconceptions and the realities behind them.

It's only for reporting individuals, not companies: Contrary to this belief, Form 14242 can be used to report both individual preparers and entities that promote abusive tax schemes.

Filing this form will automatically entitle you to a reward: Filing Form 14242 itself does not guarantee a reward. To potentially receive a reward, one must file Form 211, Application for Reward for Original Information, in addition to providing information through Form 14242.

You need to provide your contact information: Providing contact information is optional. However, including it can be helpful if the IRS has questions or needs to acknowledge receipt of the referral. Opting not to provide contact information will not affect the investigation of the report.

It's a complicated process: While it may appear daunting, reporting suspected abusive tax promotions or preparers via Form 14242 is relatively straightforward. Instructions aim to facilitate clear and direct reporting, requiring information that you likely already know or have access to.

All submitted reports lead to immediate action: The IRS reviews each submission carefully, but not all reports will lead to immediate or direct action. The process involves validation and prioritization among numerous reports received.

It's pointless to report without promotional material: While supplying promotional material can strengthen a report, its absence does not invalidate a report. Descriptions of the promotion, how you became aware of it, and any relevant details about the promotors can still provide valuable information for IRS investigation.

Reports are only effective for recent schemes: It is beneficial to report schemes as soon as they are discovered. However, reporting older or ongoing schemes is also important, as abusive tax promotions may have long-term implications or may be part of larger patterns of fraud or evasion that the IRS is tracking.

Understanding the realities behind these misconceptions encourages appropriate use of IRS Form 14242, helping individuals report abusive tax schemes accurately and effectively. It represents an important tool in maintaining the integrity of the tax system, with the IRS using this information to pursue investigations that protect taxpayers and the tax collection process.

Key takeaways

Filing Form 14242 with the IRS is essential for reporting suspected abusive tax avoidance schemes and the tax return preparers who promote them. Here are seven key takeaways to remember when dealing with this form:

- The primary purpose of Form 14242 is to report activities that could be considered abusive tax avoidance schemes as well as the preparers promoting these activities.

- Anyone can use this form to report questionable schemes; you don’t have to be directly involved to file a report.

- To potentially receive a reward for the information provided, you must also file Form 211, Application for Reward for Original Information, alongside Form 14242.

- The form prompts you to provide detailed information about the promoter or tax preparation professional, including their name, contact information, and any promotional material they've distributed. If possible, attach copies of these promotional materials to your submission.

- Being thorough in your response—including dates you learned of the promotion, how you were made aware, and your relationship to the promoter—can help the IRS in its investigation.

- Providing your contact information is optional but recommended. It allows the IRS to reach out if further information is needed and to acknowledge receipt of your referral.

- Form 14242 can be submitted either by fax or mail to the addresses provided on the form. This ensures accessibility in reporting, even for those who may not have internet access.

It’s everyone's responsibility to help maintain the integrity of the tax system. Reporting suspicious activities through Form 14242 is a valuable way for individuals to assist in this effort. The information gathered through these reports plays a crucial role in identifying and stopping abusive tax avoidance strategies.

Popular PDF Documents

Form 8853 - It helps in detailing distributions that are used for qualified medical expenses, thus not subject to tax.

How to Get Certificate of Tax Clearance - Non-compliance or discrepancies in the TC1 form can hinder professional licensure and contractual opportunities.

Irs Form 703 - Helps in determining the portion of pension or annuity subject to taxes.