Get IRS 14039 Form

In the landscape of identity protection and tax administration, the IRS 14039 form emerges as a pivotal tool for individuals who find themselves navigating the unsettling waters of identity theft or believe they may be at risk for such an event. This critical document serves multiple functions, primarily aimed at alerting the Internal Revenue Service (IRS) to the potential misuse of a taxpayer's identity. By completing and submitting this form, taxpayers essentially place the IRS on notice, thereby initiating a series of protective measures designed to safeguard the taxpayer's information and ensure the integrity of their tax records. The form requires detailed personal information and a description of the circumstances that led the taxpayer to believe their identity has been compromised. Moreover, it acts as a gateway for the IRS to implement additional scrutiny and verification processes to prevent fraudulent tax filings under the victim's name. As identity theft continues to pose a significant threat, understanding the operational framework and implications of the IRS 14039 form is indispensable for both victims of such crimes and individuals proactively seeking to protect their financial and personal information. The convergence of legal mechanisms and procedural safeguards encapsulated by this form highlights the ongoing efforts to combat identity theft and underscores the importance of responsive action in the face of potential vulnerabilities.

IRS 14039 Example

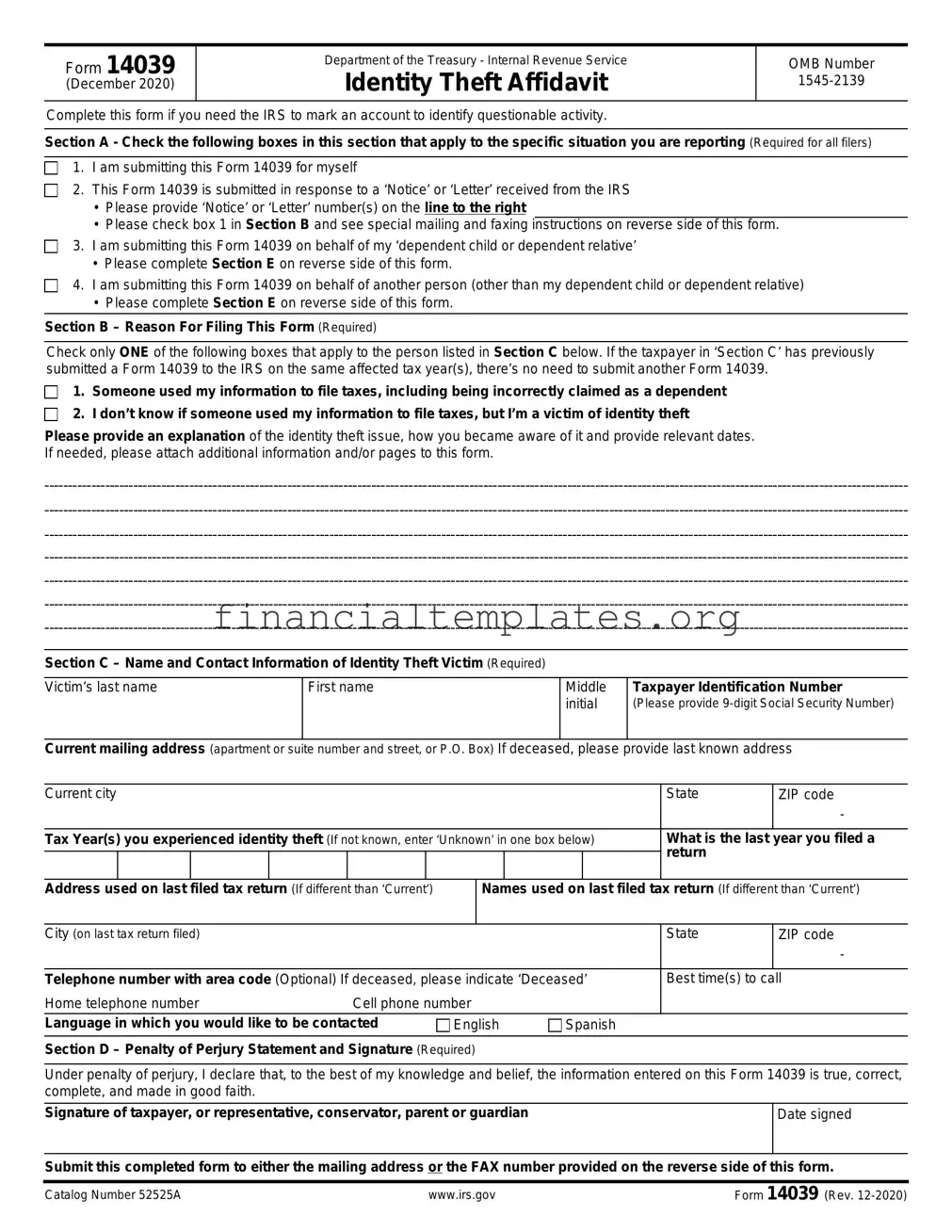

Form 14039

(December 2020)

Department of the Treasury - Internal Revenue Service

Identity Theft Affidavit

OMB Number

Complete this form if you need the IRS to mark an account to identify questionable activity.

Section A - Check the following boxes in this section that apply to the specific situation you are reporting (Required for all filers)

1. I am submitting this Form 14039 for myself

2. This Form 14039 is submitted in response to a ‘Notice’ or ‘Letter’ received from the IRS

•Please provide ‘Notice’ or ‘Letter’ number(s) on the line to the right

•Please check box 1 in Section B and see special mailing and faxing instructions on reverse side of this form.

3. I am submitting this Form 14039 on behalf of my ‘dependent child or dependent relative’

• Please complete Section E on reverse side of this form.

4. I am submitting this Form 14039 on behalf of another person (other than my dependent child or dependent relative)

•Please complete Section E on reverse side of this form. Section B – Reason For Filing This Form (Required)

Check only ONE of the following boxes that apply to the person listed in Section C below. If the taxpayer in ‘Section C’ has previously submitted a Form 14039 to the IRS on the same affected tax year(s), there’s no need to submit another Form 14039.

1. Someone used my information to file taxes, including being incorrectly claimed as a dependent

2. I don’t know if someone used my information to file taxes, but I’m a victim of identity theft

Please provide an explanation of the identity theft issue, how you became aware of it and provide relevant dates. If needed, please attach additional information and/or pages to this form.

Section C – Name and Contact Information of Identity Theft Victim (Required)

Victim’s last name

First name

Middle initial

Taxpayer Identification Number

(Please provide

Current mailing address (apartment or suite number and street, or P.O. Box) If deceased, please provide last known address

Current city |

|

|

|

|

|

|

|

State |

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Tax Year(s) you experienced identity theft (If not known, enter ‘Unknown’ in one box below) |

What is the last year you filed a |

||||||||||

|

|

|

|

|

|

|

|

|

|

return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address used on last filed tax return (If different than ‘Current’) |

|

Names used on last filed tax return (If different than ‘Current’) |

|||||||||

|

|

|

|

|

|

|

|

|

|

||

City (on last tax return filed) |

|

|

|

|

|

|

|

State |

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

||||||||

Telephone number with area code (Optional) If deceased, please indicate ‘Deceased’ |

Best time(s) to call |

||||||||||

Home telephone number |

|

Cell phone number |

|

|

|

|

|||||

Language in which you would like to be contacted |

English |

Spanish |

|

|

|||||||

Section D – Penalty of Perjury Statement and Signature (Required)

Under penalty of perjury, I declare that, to the best of my knowledge and belief, the information entered on this Form 14039 is true, correct, complete, and made in good faith.

Signature of taxpayer, or representative, conservator, parent or guardian

Date signed

Submit this completed form to either the mailing address or the FAX number provided on the reverse side of this form.

Catalog Number 52525A |

www.irs.gov |

Form 14039 (Rev. |

Page 2

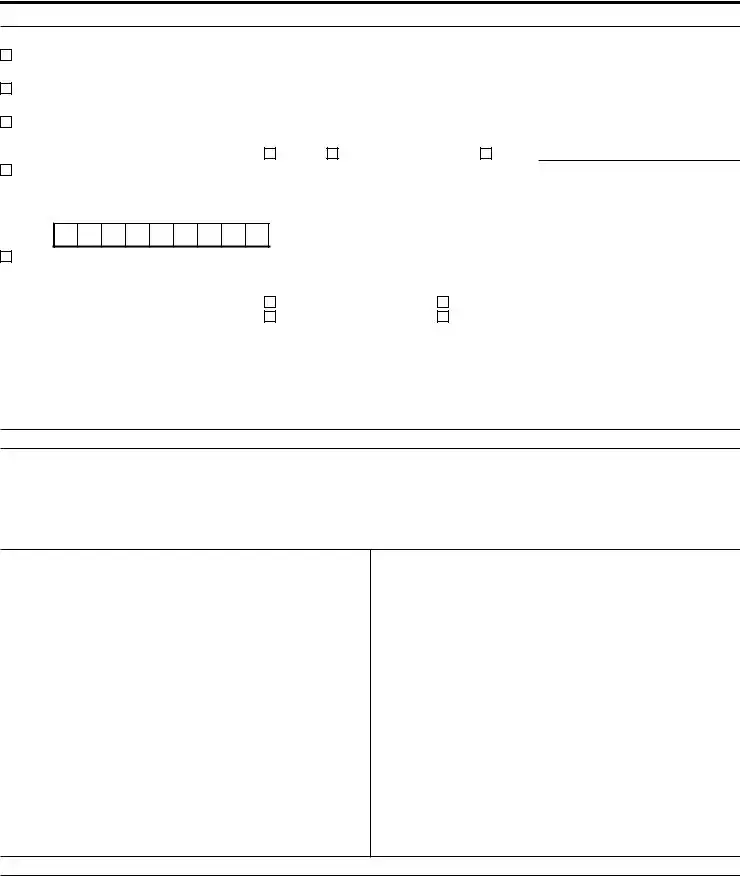

Section E – Representative, Conservator, Parent or Guardian Information (Required if completing Form 14039 on someone else’s behalf)

Check only ONE of the following five boxes next to the reason you are submitting this form

1. The taxpayer is deceased and I am the surviving spouse

• No attachments are required, including death certificate.

2. The taxpayer is deceased and I am the

• Attach a copy of the court certificate showing your appointment.

3. The taxpayer is deceased and a

• |

Attach copy of death certificate or formal notification from a government office informing next of kin of the decedent’s death. |

|||

• |

Indicate your relationship to decedent: |

Child |

Parent/Legal Guardian |

Other |

4. The taxpayer is unable to complete this form and I am the appointed conservator or have Power of Attorney/Declaration of Representative authorization per IRS Form 2848

•Attach a copy of documentation showing your appointment as conservator or POA authorization.

•If you have an IRS issued Centralized Authorization File (CAF) number, enter the

5. The person is my dependent child or my dependent relative

By checking this box and signing below you are indicating that you are an authorized representative, as parent, guardian or legal guardian, to file a legal document on the dependent’s behalf.

• Indicate your relationship to person: |

Parent/Legal Guardian |

Fiduciary Relationship per IRS Form 56 |

||

|

Power of Attorney |

Other |

||

Representative's name |

|

|

|

|

Last name |

|

First name |

|

Middle initial |

|

|

|||

|

|

|

|

|

Representative’s current mailing address (City, town or post |

office, state, and ZIP code) |

|

|

|

|

|

|

|

|

Representative’s telephone number |

|

|

|

|

Instructions for Submitting this Form

Submit this completed and signed form to the IRS via Mail or FAX to specialized IRS processing areas dedicated to assist you. In Section C of this form, be sure to include the Social Security Number in the ‘Taxpayer Identification Number’ field.

Help us avoid delays:

•Choose one method of submitting this form either by Mail or by FAX, not both.

•Please provide clear and readable photocopies of any additional information you may choose to provide.

•Note that ‘tax returns’ may not be submitted to either the mailing address or FAX number.

|

Submitting by Mail |

|

Submitting by FAX |

• |

If you checked Box 1 in Section B in response to a notice or |

• |

If you checked Box 1 in Section B of Form 14039 and are |

|

letter received from the IRS, return this form and if possible, a |

|

submitting this form in response to a notice or letter received |

|

copy of the notice or letter to the address contained in the |

|

from the IRS. If it provides a FAX number, you should send |

|

notice or letter. |

|

there. |

• |

If you checked Box 1 in Section B of Form 14039, are unable |

|

If no FAX number is shown on the notice or letter, please follow |

|

to file your tax return electronically because the primary and/ |

|

the mailing instructions on the notice or letter. |

|

or secondary SSN was misused, attach this Form 14039 to the |

• |

Include a cover sheet marked ‘Confidential’. |

|

back of your paper tax return and submit to the IRS location |

• |

If you checked Box 2 in Section B of Form 14039 (no current |

|

where you normally file your tax return. |

||

• |

If you’ve already filed your paper return, please submit this |

|

|

|

|||

|

Form 14039 to the IRS location where you normally file. Refer to |

|

|

|

the ‘Where Do You File’ section of your return instructions or visit |

|

|

|

IRS.gov and input the search term ‘Where to File’. |

|

|

•If you checked Box 2 in Section B of Form 14039 (no current

Department of the Treasury

Internal Revenue Service

Fresno, CA

Privacy Act and Paperwork Reduction Notice

Our legal authority to request the information is 26 U.S.C. 6001. The primary purpose of the form is to provide a method of reporting identity theft issues to the IRS so that the IRS may document situations where individuals are or may be victims of identity theft. Additional purposes include the use in the determination of proper tax liability and to relieve taxpayer burden. The information may be disclosed only as provided by 26 U.S.C. 6103. Providing the information on this form is voluntary. However, if you do not provide the information it may be more difficult to assist you in resolving your identity theft issue. If you are a potential victim of identity theft and do not provide the required substantiation information, we may not be able to place a marker on your account to assist with future protection. If you are a victim of identity theft and do not provide the required information, it may be difficult for IRS to determine your correct tax liability. If you intentionally provide false information, you may be subject to criminal penalties. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. Public reporting burden for this collection of information is estimated to average 15 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW,

Catalog Number 52525A |

www.irs.gov |

Form 14039 (Rev. |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 14039 | This form is an Identity Theft Affidavit used to report a fraudulent federal income tax return filed with the Internal Revenue Service (IRS) using a taxpayer's identity. |

| When to Use | Form 14039 should be used if someone believes they are a victim of tax-related identity theft or if the IRS directs them to fill it out. |

| Submission Methods | The form can be submitted to the IRS via fax or mail, although the IRS encourages the use of fax for faster processing. |

| Attachment Requirements | When submitting Form 14039, it's required to attach a copy of one's Social Security card, driver's license, or another government-issued identification to verify their identity. |

Guide to Writing IRS 14039

Once you suspect or become aware that your identity has been used fraudulently for tax purposes, taking immediate action is crucial. Filling out the IRS 14039 form is a significant first step in alerting the authorities and protecting your financial integrity. This document notifies the IRS of the identity theft issue, enabling them to secure your tax account. After you submit the form, you can expect the IRS to take steps to verify your identity, safeguard your tax records, and guide you through any necessary actions to rectify the fraudulent activity. Below is a guide on how to complete the form accurately and efficiently.

- Download the latest version of the IRS 14039 form from the official IRS website to ensure you have the most current information and instructions.

- Read the instructions provided with the form carefully. These will guide you on whether you should fill out the form in your situation and how to proceed.

- Enter your full name, date of birth, and social security number (SSN) or individual taxpayer identification number (ITIN) in the designated sections.

- Provide your current mailing address. If you have recently moved, make sure to include your previous address to help the IRS correctly identify your records.

- If you're filing this form on behalf of someone else, such as a deceased relative, make sure to fill out the section labeled "Representative, estate, or trust's name" with the necessary details.

- Check the box that most closely corresponds to your situation under Section A, indicating the reason you believe you are a victim of tax-related identity theft. If none of the predefined reasons apply, select the box for 'Other' and provide a brief explanation.

- In Section B, specify if the IRS has already notified you that you may be a victim of identity theft. If so, include any identity protection PIN (IP PIN) you have received.

- Sign and date the form. If you're completing this form on behalf of someone else, you must sign your own name and indicate your relationship to the person you're representing.

- Review the form to ensure all information is accurate and complete. Incomplete or inaccurate forms can delay the process.

- Mail or fax the completed form to the IRS using the contact information provided in the instructions. The IRS does not currently accept this form electronically.

After the form is submitted, patience is necessary. The IRS may take time to investigate and resolve issues concerning identity theft. Meanwhile, keep records of all communications with the IRS and monitor your tax records and credit reports for further irregularities. The completion and submission of IRS Form 14039 is a step toward regaining control of your personal information and ensuring your tax records are accurate.

Understanding IRS 14039

-

What is the IRS 14039 form, and who needs to file it?

The IRS 14039 form, otherwise known as the Identity Theft Affidavit, is a document designed for taxpayers to report suspected fraud and identity theft regarding their tax returns to the Internal Revenue Service (IRS). Individuals should file this form if they believe or have confirmed that someone has used their personal information without their permission to commit tax fraud. This includes situations where a tax return was filed in their name without their consent, or if they have received IRS correspondence indicating a problem that suggests identity theft.

-

How can someone file a Form 14039, and are there any specific deadlines?

To file a Form 14039, taxpayers must complete the form with accurate and comprehensive information regarding their identity theft issue. They need to provide personal identification data and describe the specifics of the fraud in the designated sections. Importantly, the completed form should be attached to the front of the taxpayer's tax return if they are paper-filing and prompted to file by IRS instructions related to identity theft. For those who have already filed their tax returns or have been instructed by the IRS to submit Form 14039 alone, mailing or faxing options are available, as outlined on the IRS website. There is no strict deadline for filing Form 14039, but it should be submitted as soon as possible after the taxpayer becomes aware of or suspects identity theft to protect their tax records and prevent further fraudulent activity.

-

What happens after Form 14039 is filed?

After a taxpayer files Form 14039, the IRS takes several steps to secure the taxpayer's account against potential or further identity theft. This process includes marking the account to flag it for additional scrutiny to prevent unauthorized actions. The IRS may also issue an Identity Protection PIN (IP PIN) - a unique six-digit number that offers additional protection. The taxpayer must use this IP PIN on all future tax returns. While the IRS aims to resolve identity theft cases as swiftly as possible, complex cases may take longer to be fully resolved. Taxpayers can expect initial communication from the IRS within 30 days of the Form 14039's submission, although complete resolution could take 120 days or more, depending on the specifics of the case.

-

Is there any protection or prevention measure for taxpayers worried about identity theft?

For taxpayers concerned about identity theft, the IRS offers several protection and prevention measures. The most notable is the Identity Protection PIN (IP PIN) program, which is now available to all taxpayers who can verify their identity. Once obtained, this PIN adds an extra layer of security by ensuring that only the taxpayer and the IRS know the PIN, making it significantly harder for unauthorized individuals to file fraudulent tax returns. Additionally, the IRS recommends that taxpayers consistently review their tax records, credit reports, and be vigilant for any IRS notices or letters that could indicate unauthorized activities. Taxpayers should also secure personal and financial records in a safe place and be cautious about sharing personal information, especially online.

Common mistakes

Filling out the IRS Form 14039, which is the Identity Theft Affidavit, requires careful attention. Individuals often make mistakes that can delay the process of resolving their tax-related identity theft issues. Below are ten common mistakes to avoid:

Not checking the correct box to indicate the reason the form is being filed. This form can be used for different situations, and choosing the wrong reason can lead to unnecessary delays.

Failing to provide a detailed explanation in Part III about the identity theft issue. A succinct and clear explanation helps the IRS understand your situation better.

Omitting to sign and date the form. An unsigned form is invalid and will be returned, slowing down the resolution process.

Using incorrect or incomplete personal information. Ensure your name, Social Security number, and contact information are accurate and match the records the IRS has.

Not attaching the required documentation. This may include a copy of a police report or a Federal Trade Commission Identity Theft Report, if available. Lack of documentation can hinder the investigation.

Writing outside the provided fields or using unclear handwriting. This can make it difficult for IRS officials to process your form accurately.

Forgetting to include a statement regarding the tax year affected by the identity theft. Specifying the tax year(s) involved helps the IRS direct its efforts appropriately.

Not using the most current version of the form. The IRS updates forms regularly, and using an outdated version can cause delays.

Failure to notify the IRS if your situation changes. For example, if the issue is resolved or you discover additional fraudulent activity, you should promptly update the IRS.

Ignoring IRS communications for additional information. If the IRS requests more details or documentation, responding promptly is crucial for moving forward.

Avoiding these mistakes can help streamline the process of resolving tax-related identity theft. When in doubt, seeking assistance from a professional can be beneficial.

Documents used along the form

When dealing with identity theft, particularly regarding tax issues, the IRS Form 14039, Identity Theft Affidavit, becomes crucial. However, to effectively manage and resolve these situations, several other forms and documents often accompany Form 14039. It's important for individuals to be familiar with these documents to ensure a comprehensive approach to addressing and rectifying identity theft issues.

- Form 1040: This is the U.S. Individual Income Tax Return. It's critical for documenting one's yearly income, deductions, and credits. Victims of identity theft may need to file this form to correct any fraudulent tax return filed by identity thieves.

- Form 8822: Known as the Change of Address form, it allows taxpayers to notify the IRS of a change in mailing address. Following identity theft, ensuring the IRS has your correct address is vital to receive pertinent notifications and correspondences.

- Form 4506-T: The Request for Transcript of Tax Return form is used to request tax return transcripts, tax account information, W-2 information, and 1099 information. This can be critical for individuals to obtain records to prove their case of tax-related identity theft.

- Form 56: Notice Concerning Fiduciary Relationship. When dealing with the tax matters of an identity theft victim, a third-party may need to fill out this form to be recognized by the IRS as acting on behalf of the victim.

- Form 2848: The Power of Attorney and Declaration of Representative form provides authorization for an individual, such as a tax attorney or accountant, to represent a taxpayer before the IRS, offering valuable assistance in resolving identity theft issues.

- Police Report: While not an IRS form, filing a police report is a critical step in documenting the identity theft. It may be required by the IRS or other entities to validate the identity theft claim.

- Identity Theft Affidavit (from credit bureaus): Similar to IRS Form 14039, many credit bureaus have their own form or affidavit for reporting identity theft. These documents are crucial for disputing fraudulent accounts or transactions with creditors and credit agencies.

In summary, while the IRS Form 14039 is central to reporting tax-related identity theft, a combination of additional forms and documentation significantly strengthens an individual's case. Promptly and accurately handling these forms not only aids in the resolution process but also helps in the restoration of one's financial and legal standing following identity theft. Support from tax professionals and legal advisors is often beneficial in navigating these complex situations.

Similar forms

The IRS Form 14039, titled "Identity Theft Affidavit," is specifically designed for taxpayers to report instances of identity theft that have affected their tax records. This form plays a crucial role in protecting individuals' financial and personal information. There are several other documents, similar in function or purpose, used across different contexts to safeguard personal information or rectify issues arising from its misuse.

Firstly, the FTC Identity Theft Affidavit is a document closely related to IRS Form 14039. Victims of identity theft use this affidavit to dispute unauthorized accounts or transactions with creditors. Like the IRS form, it serves as a standardized way for individuals to report and document fraudulent activities involving their personal information, helping to resolve unauthorized financial transactions.

Another document with similarities to IRS Form 14039 is the Credit Bureau Dispute Letter. When inaccuracies appear on a credit report due to fraud or error, individuals send this letter to credit reporting agencies. It parallels the IRS form in its purpose to correct false information, although focused specifically on credit reports rather than tax records.

The Social Security Administration (SSA) Fraud Reporting Form also shares functions with the IRS 14039. It's used to report instances where a Social Security Number has been misused. Like the IRS form, it is critical for protecting individuals' social security benefits and preventing fraudulent claims.

The DMV Identity Theft Report is another document used to report and rectify identity theft issues, specifically related to driver’s licenses and vehicle registrations. Its purpose aligns with the IRS 14039 in helping individuals clear their name and record concerning unauthorized activities.

A Bank Fraud Complaint Form is employed when unauthorized transactions are made on bank accounts or credit cards. Similar to the IRS form, it aids in reporting financial fraud to the respective financial institution, aiming to recover lost funds and securing one's financial accounts.

The Passport Identity Theft Form, used by the U.S. Department of State, helps victims of passport-related identity theft. This form, akin to the IRS 14039, is crucial for preventing fraudulent international travel or identity verification activities.

The Medicare Identity Theft Report is specifically for instances where an individual’s Medicare ID or benefits have been compromised. It shares the objective with the IRS form of deterring fraudulent claims and correcting records to ensure rightful access to benefits.

Lastly, the Cybercrime Complaint Form, often utilized in situations involving online fraud or identity theft, addresses issues within the digital domain. It reflects the intention of the IRS Form 14039 by providing a means to report and document fraudulent activity affecting one's digital presence or online accounts.

These documents, while serving different sectors—financing, credit reporting, healthcare, online security, and more—echo the core purpose of the IRS Form 14039. They provide structured ways for individuals to navigate the aftermath of identity theft, safeguarding their rights, finances, and personal records against fraudulent use.

Dos and Don'ts

When dealing with the IRS 14039 form, which is intended to alert the Internal Revenue Service (IRS) of potential identity theft, accuracy and diligence are crucial. To assist in this process, here’s a guide on what you should and shouldn't do:

Do's:Immediately report any suspected identity theft to the IRS.

Fill out the form completely, ensuring no sections are skipped.

Provide a clear explanation of the identity theft issue, including any evidence or documentation to support your claim.

Include your contact information accurately to enable the IRS to reach you if further information is needed.

Attach a copy of your police report or a Federal Trade Commission Identity Theft Report if available.

Use secure means to send the form, such as certified mail, to ensure it reaches the IRS safely.

Keep a copy of the form and any correspondence for your records.

Monitor your credit report regularly for any unauthorized activity.

Contact the IRS Identity Protection Specialized Unit if you have any questions or need further assistance.

Be patient, as resolving identity theft issues can take some time.

Provide false or inaccurate information, as this can lead to further complications.

Forget to sign and date the form, as an unsigned form will not be processed.

Ignore IRS notices regarding your tax records or suspected fraud; respond promptly.

Share your personal information on the phone, through the mail, or online unless you are sure of the recipient's identity.

Dispose of any documentation related to your identity theft case or the IRS form carelessly; shred any sensitive documents.

Delay in reporting any compromised Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to the IRS.

Assume identity theft is a one-time issue; continue to monitor your accounts and credit report regularly.

Use unofficial websites to download the IRS 14039 form; always go through the official IRS website.

Attempt to resolve complex identity theft scenarios on your own; seek professional legal advice when necessary.

Forgetting to follow up with the IRS if you do not receive a response within the expected timeframe.

Misconceptions

The IRS 14039 form, known as the Identity Theft Affidavit, is often misunderstood. Below are ten common misconceptions about this form, aiming to dispel myths and offer clarity.

Filing Form 14039 is required for all tax issues. Many believe that this form is a standard step for any tax problem, but it's specifically designed for individuals who believe they're victims of tax-related identity theft. It's not for general tax issues or inquiries.

It guarantees immediate resolution. While filing this form is an important step in resolving identity theft issues, it doesn't always lead to an instant fix. The IRS needs time to investigate and resolve the matter.

You can only file Form 14039 if you've experienced fraud. Actually, this form can also be filed as a precautionary measure if you suspect you might be at risk of tax-related identity theft, even if you haven't yet been directly affected.

The form is complicated and requires legal assistance. Though it deals with serious matters, Form 14039 is designed to be filled out by individuals without the need for legal representation. Instructions are provided to guide you through the process.

It should be filed annually as a preventative measure. Filing this form is a reactive step, not a preventative one. It's unnecessary to file it annually unless you have new concerns or incidents of identity theft.

Online filing is available for Form 14039. Currently, the form must be printed, completed by hand or electronically and then mailed or faxed to the IRS, as there isn't an option to file it online.

All family members must file separate forms. In cases where your entire family is affected by identity theft, a separate form for each family member is usually unnecessary. Exceptions might apply, so reading the instructions carefully or consulting the IRS can provide specific guidance.

Form 14039 is only for those who owe taxes. This is a common misunderstanding. The form is for anyone who suspects their identity has been compromised in relation to their tax records, regardless of their tax situation.

Once you file, the IRS will monitor your accounts moving forward. While filing this form alerts the IRS to potential or actual identity theft, it does not enroll you in any continuous monitoring service. The IRS may flag your account for closer scrutiny, but ongoing vigilance is recommended.

Form 14039 also serves as a report to other credit and identity theft agencies. Filing this form is specific to the IRS and does not extend to other institutions. It's vital to also contact credit bureaus and other relevant agencies if you're a victim of identity theft.

Understanding the correct use and expectations of the IRS Form 14039 can significantly help in navigating tax-related identity theft issues efficiently. When in doubt, contacting the IRS directly or consulting a tax professional can provide personalized guidance.

Key takeaways

Filling out the IRS 14039 form, also known as the Identity Theft Affidavit, is a crucial step for individuals who suspect or have confirmed that their personal information has been used fraudulently to file taxes. Here are five key takeaways about this form:

- The purpose of the IRS 14039 form is to alert the IRS about potential identity theft. This enables the agency to take necessary actions to secure your tax records.

- You should complete this form if you receive a notification from the IRS indicating a suspicious tax filing under your Social Security number or if you suspect or know that someone has used your information to file taxes.

- Accuracy is critical when filling out the form. Provide complete and precise information, including your Social Security number, the tax year affected, and any evidence of the fraud, to ensure the IRS can effectively process your case.

- Upon completion, the form can either be mailed or faxed to the IRS, depending on the instructions provided in the correspondence you received from the IRS or as outlined on the IRS’s official website. It's important to verify the correct submission method to avoid delays.

- After submitting the form, be prepared for a longer processing time for your tax return. The IRS takes additional steps to verify your identity and the legitimacy of your tax filing, which can extend the processing period.

Being proactive and promptly submitting the IRA 14039 form if you suspect identity theft is vital for protecting your tax records and ensuring your financial integrity.

Popular PDF Documents

Rc66 Form - Determine if you qualify to transfer a Veterans Exemption from one property to another within New York State.

Inua Jamii Loans - Clear directives on the application's submission and the requisite follow-up processes are provided to streamline communication.