Get IRS 13614-C Form

Navigating the intricacies of tax preparation can be a daunting task, especially for those who are less familiar with the process. This is where the IRS 13614-C form plays a crucial role, serving as a vital tool designed to streamline the tax preparation process for individuals seeking assistance through the Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs. The form, essentially a questionnaire, aids in ensuring that volunteers have all the necessary information to accurately prepare an individual's tax return. It covers a range of topics, from personal information to income, deductions, and credits, ensuring that no stone is left unturned in the quest to maximize one’s refund or minimize the amount owed. Moreover, the IRS 13614-C form acts as a conversation starter, prompting discussions on various tax-related matters that might otherwise be overlooked. This approach not only facilitates a smoother tax preparation process but also educates individuals about their tax situations, fostering a more informed taxpayer base.

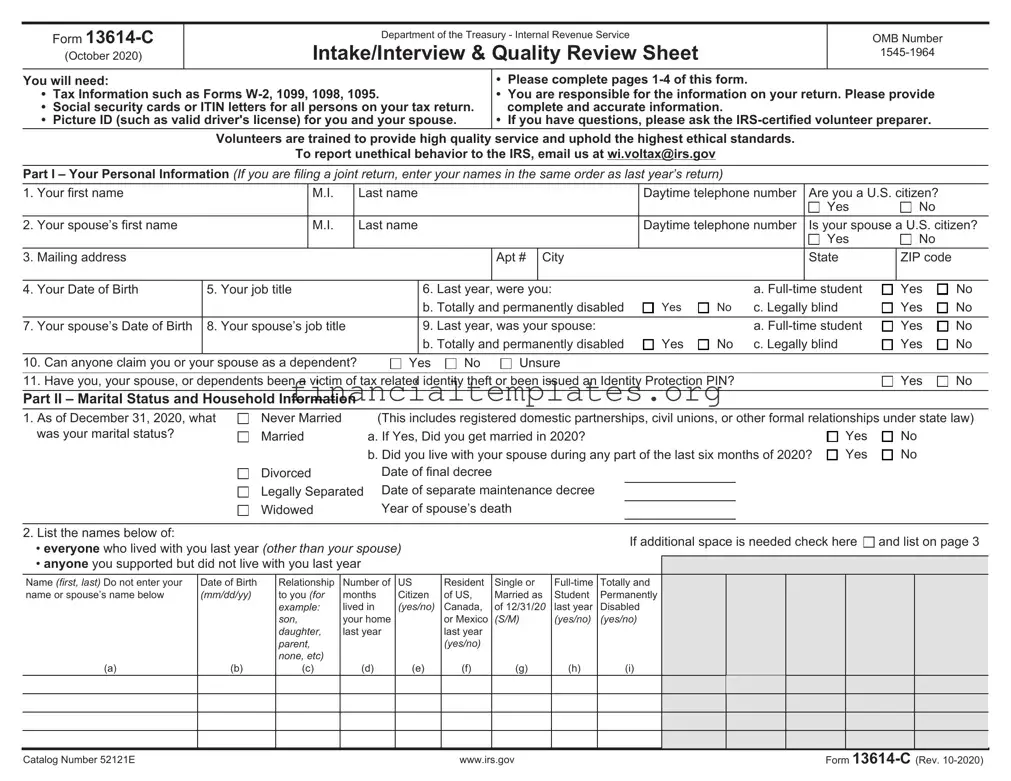

IRS 13614-C Example

Form

(October 2021)

Department of the Treasury - Internal Revenue Service

Intake/Interview & Quality Review Sheet

OMB Number

You will need:

• Tax Information such as Forms

• Social security cards or ITIN letters for all persons on your tax return.

• Picture ID (such as valid driver's license) for you and your spouse.

•Please complete pages

•You are responsible for the information on your return. Please provide complete and accurate information.

•If you have questions, please ask the

Volunteers are trained to provide high quality service and uphold the highest ethical standards.

To report unethical behavior to the IRS, email us at wi.voltax@irs.gov

Part I – Your Personal Information (If you are filing a joint return, enter your names in the same order as last year’s return)

1. |

Your first name |

|

M.I. |

|

Last name |

|

|

|

Best contact number |

Are you a U.S. citizen? |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

2. |

Your spouse’s first name |

|

M.I. |

|

Last name |

|

|

|

Best contact number |

Is your spouse a U.S. citizen? |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

3. |

Mailing address |

|

|

|

|

|

|

Apt # |

City |

|

|

|

State |

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4. |

Your Date of Birth |

5. Your job title |

|

6. Last year, |

were you: |

|

|

a. |

Yes |

No |

|||||

|

|

|

|

|

|

b. Totally and permanently disabled |

Yes |

No |

c. Legally blind |

Yes |

No |

||||

7. |

Your spouse’s Date of Birth |

8. Your spouse’s job title |

|

9. Last year, was your spouse: |

|

|

a. |

Yes |

No |

||||||

|

|

|

|

|

|

b. Totally and permanently disabled |

Yes |

No |

c. Legally blind |

Yes |

No |

||||

10. Can anyone claim you or your spouse as a dependent? |

Yes |

No |

Unsure |

|

|

|

|

|

|

||||||

11. Have you, your spouse, or dependents been a victim of tax related identity theft or been issued an Identity Protection PIN? |

|

|

Yes |

No |

|||||||||||

12.Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service)

Part II – Marital Status and Household Information

1.As of December 31, 2021, what was your marital status?

Never Married Married

Divorced

Legally Separated

Widowed

(This includes registered domestic partnerships, civil unions, or other formal relationships under state law)

a. If Yes, Did you get married in 2021? |

Yes |

No |

||

b. Did you live with your spouse during any part of the last six months of 2021? |

Yes |

No |

||

Date of final decree |

|

|

||

Date of separate maintenance decree |

|

|

|

|

|

|

|

||

Year of spouse’s death |

|

|

|

|

|

|

|

||

2. List the names below of: |

|

|

|

|

|

|

|

If additional space is needed check here |

and list on page 3 |

||||||

• everyone who lived with you last year (other than your spouse) |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

• anyone you supported but did not live with you last year |

|

|

|

|

|

|

To be completed by a Certified Volunteer Preparer |

||||||||

Name (first, last) Do not enter your |

Date of Birth |

Relationship |

Number of |

US |

Resident |

Single or |

Totally and |

Is this |

Did this |

Did this |

Did the |

Did the |

|||

name or spouse’s name below |

(mm/dd/yy) |

to you (for |

months |

Citizen |

of US, |

Married as |

Student |

Permanently |

person a |

person |

person |

taxpayer(s) |

taxpayer(s) |

||

|

|

example: |

lived in |

(yes/no) |

Canada, |

of 12/31/21 |

last year |

Disabled |

qualifying |

provide |

have less |

provide more |

pay more than |

||

|

|

son, |

your home |

|

or Mexico |

(S/M) |

(yes/no) |

(yes/no) |

child/relative |

more than |

than $4,300 |

than 50% of |

half the cost of |

||

|

|

daughter, |

last year |

|

last year |

|

|

|

|

of any other |

50% of his/ |

of income? |

support for |

maintaining a |

|

|

|

parent, |

|

|

(yes/no) |

|

|

|

|

person? |

her own |

(yes,no,n/a) |

this person? |

home for this |

|

(a) |

(b) |

none, etc) |

(d) |

(e) |

(f) |

(g) |

(h) |

(i) |

(yes/no) |

support? |

|

(yes/no/n/a) |

person? |

||

(c) |

|

(yes,no,n/a) |

|

|

|

(yes/no) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Catalog Number 52121E |

www.irs.gov |

Form |

Page 2

Check appropriate box for each question in each section

Yes |

No |

Unsure |

Part III – Income – Last Year, Did You (or Your Spouse) Receive |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

1. |

(B) Wages or Salary? (Form |

|

|

|

|||||

|

|

|

2. |

(A) Tip Income? |

|

|

|

|

|

|

|

|

|

|

|

3. |

(B) Scholarships? (Forms |

|

|

|

|

|

|

|

|

|

|

|

4. |

(B) Interest/Dividends from: checking/savings accounts, bonds, CDs, brokerage? (Forms |

|

|

||||||

|

|

|

5. |

(B) Refund of state/local income taxes? (Form |

|

|

|

|

|

|

|

|

|

|

|

6. |

(B) Alimony income or separate maintenance payments? |

|

|

|

|

|

|

|

|

|

|

|

7. |

(A) |

|

|||||||

|

|

|

8. |

(A) Cash/check/virtual currency payments, or other property or services for any work performed not reported on Forms |

||||||||

|

|

|

9. |

(A) Income (or loss) from the sale or exchange of Stocks, Bonds, Virtual Currency or Real Estate? (including your home) (Forms |

||||||||

|

|

|

10. (B) Disability income? (such as payments from insurance, or workers compensation) (Forms |

|

|

|||||||

|

|

|

11. (A) Retirement income or payments from Pensions. Annuities, and or IRA? (Form |

|

|

|

||||||

|

|

|

12. (B) Unemployment Compensation? (Form 1099G) |

|

|

|

|

|

|

|

||

|

|

|

13. (B) Social Security or Railroad Retirement Benefits? (Forms |

|

|

|

||||||

|

|

|

14. (M) Income (or loss) from Rental Property? |

|

|

|

|

|

|

|

||

|

|

|

15. (B) Other income? (gambling, lottery, prizes, awards, jury duty, virtual currency, Sch |

|

||||||||

Yes |

No |

Unsure |

Part IV – Expenses – Last Year, Did You (or Your Spouse) Pay |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

1. |

(B) Alimony or separate maintenance payments? If yes, do you have the recipient’s SSN? |

Yes |

No |

|

|||||

|

|

|

2. |

Contributions or repayments to a retirement account? |

IRA (A) |

401K (B) |

Roth IRA (B) |

Other |

||||

|

|

|

3. |

(B) College or post secondary educational expenses for yourself, spouse or dependents? (Form |

|

|

||||||

|

|

|

4. |

Any of the following? |

(A) Medical & Dental (including insurance premiums) |

(A) Mortgage Interest (Form 1098) |

||||||

|

|

|

|

|

(A) Taxes (State, Real Estate, Personal Property, Sales) |

(B) Charitable Contributions |

||||||

|

|

|

5. |

(B) Child or dependent care expenses such as daycare? |

|

|

|

|

|

|

|

|

|

|

|

6. |

(B) For supplies used as an eligible educator such as a teacher, teacher’s aide, counselor, etc.? |

|

|

|

|||||

|

|

|

7. |

(A) Expenses related to |

|

|

|

|||||

|

|

|

8. |

(B) Student loan interest? (Form |

|

|

|

|

|

|

|

|

Yes |

No |

Unsure |

Part V – Life Events – Last Year, Did You (or Your Spouse) |

|

|

|

|

|

|

|

||

1. (A) Have a Health Savings Account? (Forms

2. (A) Have credit card, student loan or mortgage debt cancelled/forgiven by a lender or have a home foreclosure? (Forms

3. (A) Adopt a child?

4. (B) Have Earned Income Credit, Child Tax Credit or American Opportunity Credit disallowed in a prior year? If yes, for which tax year?

5. (A) Purchase and install

6. (A) Receive the First Time Homebuyers Credit in 2008?

7. (B) Make estimated tax payments or apply last year’s refund to this year’s tax? If so how much?

8. (A) File a federal return last year containing a “capital loss carryover” on Form 1040 Schedule D?

9. (A) Have health coverage through the Marketplace (Exchange)? [Provide Form

11. (B) Receive Advanced Child Tax Credit payments?

Catalog Number 52121E |

www.irs.gov |

Form |

|

|

|

|

|

|

|

Page 3 |

Additional Information and Questions Related to the Preparation of Your Return |

|

|

|

|

|||

1. |

Would you like to receive written communications from the IRS in a language other than English? |

Yes |

No |

If yes, which language? |

|||

2. |

Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) |

|

|

|

|

||

|

Check here if you, or your spouse if filing jointly, want $3 to go to this fund |

You |

Spouse |

|

|

|

|

3. |

If you are due a refund, would you like: |

a. Direct deposit |

b. To purchase U.S. Savings Bonds |

c. To split your refund between different accounts |

|||

|

Yes |

No |

Yes |

|

No |

Yes |

No |

4. |

If you have a balance due, would you like to make a payment directly from your bank account? |

Yes |

No |

|

|||

5. |

Did you live in an area that was declared a Federal disaster area? |

Yes |

No |

If yes, where? |

|

|

|

6. |

Did you, or your spouse if filing jointly, receive a letter from the IRS? |

Yes |

|

No |

|

|

|

Many free tax preparation sites operate by receiving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding . Your answer will be used only for statistical purposes. These questions are optional.

7. |

Would you say you can carry on a conversation in English, both understanding & speaking? |

Very well |

Well |

Not well |

Not at all |

Prefer not to answer |

|

8. |

Would you say you can read a newspaper or book in English? |

Very well |

Well |

Not well |

Not at all |

Prefer not to answer |

|

9. |

Do you or any member of your household have a disability? |

Yes |

No |

Prefer not to answer |

|

|

|

10. |

Are you or your spouse a Veteran from the U.S. Armed Forces? |

|

Yes |

No |

Prefer not to answer |

|

|||

11. |

Your race? |

|

|

|

|

|

|

|

|

|

American Indian or Alaska Native |

Asian |

Black or African American |

Native Hawaiian or other Pacific Islander |

White |

Prefer not to answer |

|||

12. |

Your spouse’s race? |

|

|

|

|

|

|

|

|

|

American Indian or Alaska Native |

Asian |

Black or African American |

Native Hawaiian or other Pacific Islander |

White |

Prefer not to answer |

|||

|

No spouse |

|

|

|

|

|

|

|

|

13. |

Your ethnicity? |

Hispanic or Latino |

Not Hispanic or Latino |

Prefer not to answer |

|

|

|||

14. |

Your spouse’s ethnicity? |

Hispanic or Latino |

Not Hispanic or Latino |

Prefer not to answer |

No spouse |

|

|||

Additional comments

Privacy Act and Paperwork Reduction Act Notice

The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory. Our legal right to ask for information is 5 U.S.C. 301. We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS volunteer income tax preparation and outreach programs. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return preparation sites or outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers. Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs. The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is

Catalog Number 52121E |

www.irs.gov |

Form |

Form 15080

(October 2021)

Department of the Treasury - Internal Revenue Service

Consent to Disclose Tax Return Information to

VITA/TCE Tax Preparation Sites

Federal Disclosure:

Federal law requires this consent form be provided to you. Unless authorized by law, we cannot disclose your tax return information to third parties for purposes other than the preparation and filing of your tax return without your consent. If you consent to the disclosure of your tax return information, Federal law may not protect your tax return information from further use or distribution.

You are not required to complete this form to engage our tax return preparation services. If we obtain your signature on this form by conditioning our tax return preparation services on your consent, your consent will not be valid. If you agree to the disclosure of your tax return information, your consent is valid for the amount of time that you specify. If you do not specify the duration of your consent, your consent is valid for one year from the date of signature.

Terms:

Global Carry Forward of data allows TaxSlayer LLC, the provider of the VITA/TCE tax software, to make your tax return information available to ANY volunteer site participating in the IRS's VITA/TCE program that you select to prepare a tax return in the next filing season. This means you will be able to visit any volunteer site using TaxSlayer next year and have your tax return populate with your current year data, regardless of where you filed your tax return this year. This consent is valid through November 30, 2023.

The tax return information that will be disclosed includes, but is not limited to, demographic, financial and other personally identifiable information, about you, your tax return and your sources of income, which was input into the tax preparation software for the purpose of preparing your tax return. This information includes your name, address, date of birth, phone number, SSN, filing status, occupation, employer's name and address, and the amounts and sources of income, deductions and credits that were claimed on, or contained within, your tax return. The tax return information that will be disclosed also includes the name, SSN, date of birth, and relationship of any dependents that were claimed on your tax return.

You do not need to provide consent for the VITA/TCE partner preparing your tax return this year. Global Carry Forward will assist you only if you visit a different VITA or TCE partner next year that uses TaxSlayer.

Limitation on the Duration of Consent: I/we, the taxpayer, do not wish to limit the duration of the consent of the disclosure of tax return information to a date earlier than presented above (November 30, 2023). If I/we wish to limit the duration of the consent of the disclosure to an earlier date, I/we will deny consent.

Limitation on the Scope of Disclosure: I/we, the taxpayer, do not wish to limit the scope of the disclosure of tax return information further than presented above. If I/we wish to limit the scope of the disclosure of tax return information further than presented above, I/we will deny consent.

Consent:

I/we, the taxpayer, have read the above information.

I/we hereby consent to the disclosure of tax return information described in the Global Carry Forward terms above and allow the tax return preparer to enter a PIN in the tax preparation software on my behalf to verify that I/we consent to the terms of this disclosure.

Primary taxpayer printed name and signature

Date

Secondary taxpayer printed name and signature

Date

If you believe your tax return information has been disclosed or used improperly in a manner unauthorized by law or without your permission, you may contact the Treasury Inspector General for Tax Administration (TIGTA) by telephone at

Catalog Number 39573K |

www.irs.gov |

Form 15080 |

Previously identified as Form 15080

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 13614-C form is used as an intake and interview sheet to assist taxpayers in preparing their federal income tax returns accurately. |

| Language Availability | This form is available in multiple languages to ensure comprehension and accessibility for diverse taxpayers. |

| Required for VITA/TCE Programs | Volunteers in the VITA/TCE programs use it to help taxpayers gather necessary information for tax preparation services. |

| Update Frequency | The form is revised yearly to reflect the most current tax laws and filing requirements, ensuring taxpayers get accurate guidance. |

Guide to Writing IRS 13614-C

Filling out the IRS 13614-C form is crucial for correctly accessing tax-related services through the Volunteer Income Tax Assistance (VITA) or the Tax Counseling for the Elderly (TCE) programs. This form helps preparers gather necessary information about your tax situation. While it may seem complex at first glance, breaking down the process into clear, manageable steps can simplify it. Below are the steps to properly complete the form.

- Start with your personal information. Fill out your name, social security number, occupation, and the tax year at the top of the form. Ensure all personal details are accurate to avoid issues with your tax return.

- Answer the basic questions. Section 1 includes yes/no questions related to your tax filing status, dependents, income, deductions, and credits. Answer these questions truthfully to the best of your knowledge.

- Detail your income. In Section 2, list all sources of income for the tax year. This may include wages, unemployment income, interest income, and any other earnings. Attach supporting documents like W-2s or 1099 forms whenever available.

- Review deductions and credits. Sections 3 and 4 ask about specific deductions and credits like education costs, charitable donations, or retirement contributions. If applicable, mark the correct boxes and provide detailed amounts.

- Consider health insurance coverage. Indicate whether you had health insurance for the entire year, part of the year, or none at all. This information is crucial for determining any possible health care tax credits or penalties.

- Address any miscellaneous issues. Sections 6 through the end of the form cover a variety of other topics, including household employment, prior state refunds, and any notices received from the IRS. Fill this section out to the best of your ability.

- Sign and date the form. Your signature is required to authorize the VITA/TCE volunteer to prepare your return based on the information you provided. Also, include the preparer’s information, if someone else helped you fill out the form.

Once the form is fully completed, the next steps include submitting it to a VITA or TCE volunteer and providing any additional documentation they may require to process your tax return. The volunteer will review the form with you, ask any follow-up questions needed to ensure accuracy, and then proceed with preparing your return. Remember, it's vital to provide comprehensive and accurate information to facilitate a smooth tax preparation process.

Understanding IRS 13614-C

-

What is the IRS 13614-C form?

The IRS 13614-C form, also known as the Intake/Interview & Quality Review Sheet, is a vital document used during the tax preparation process for individuals seeking assistance through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. It helps ensure taxpayer information is accurately captured and tax returns are prepared correctly.

-

Who needs to complete the IRS 13614-C form?

Individuals seeking free tax help from VITA or TCE sites are required to complete the IRS 13614-C form. This form helps the volunteer preparers gather all necessary information to prepare an accurate tax return.

-

What information is required on the IRS 13614-C form?

The form requires a variety of information, including personal identification details, income statements, information on expenses that may be deductible, and details on tax credits the taxpayer may be eligible for. Completeness and accuracy are crucial to ensure proper tax return preparation.

-

How do I obtain an IRS 13614-C form?

The form can be downloaded directly from the IRS website. Additionally, it can typically be found at VITA or TCE program sites, where volunteers can also assist in filling it out.

-

Is there a deadline for submitting the IRS 13614-C form?

Since the form is used as part of the tax preparation process at VITA or TCE sites, it should be completed and submitted during the tax filing season and before the federal tax return deadline, typically April 15. Extensions for tax filing do not apply to this form, as it is part of the preparation process.

-

Can I file the IRS 13614-C form online?

The IRS 13614-C form is not typically filed independently or online. It is used in-person at VITA or TCE sites to facilitate the conversation between the taxpayer and the volunteer preparer. Thus, it serves as a comprehensive checklist rather than a form submitted to the IRS.

-

What if I make a mistake on the IRS 13614-C form?

If a mistake is found on the form, it is important to notify the volunteer tax preparer immediately so that corrections can be made before the tax return is filed. The goal is to ensure the accuracy of your tax return, and correcting errors early in the process is essential.

-

Do I need to bring any documentation when completing the IRS 13614-C form?

Yes, bringing documentation is critical. Taxpayers should bring all necessary tax documents, such as identification, Social Security cards for all persons listed on the tax return, income statements (e.g., W-2, 1099 forms), and information on deductions and credits. This documentation is necessary for accurate completion of both the IRS 13614-C form and the tax return.

-

How does the IRS 13614-C form impact my tax return?

The IRS 13614-C form plays a pivotal role in ensuring the accuracy of your tax return. By providing a thorough overview of your tax situation to the volunteer preparer, it helps identify all relevant tax deductions and credits, ultimately affecting the amount of your refund or tax liability.

-

Where can I get help with completing the IRS 13614-C form?

Assistance with the IRS 13614-C form is available at all VITA and TCE program sites. Trained volunteers are on hand to help taxpayers complete the form accurately and to answer any questions they may have about the tax preparation process.

Common mistakes

The IRS 13614-C form, known as the Intake/Interview & Quality Review Sheet, is crucial for taxpayers seeking assistance through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. While completing this form, several common mistakes can lead to inaccuracies or even delay the processing of one’s tax returns. Here are nine errors to watch out for:

Not fully completing the form: Many people overlook sections or leave them blank believing they are not applicable. Every section should be reviewed and answered to the best of one’s ability to ensure complete processing.

Incorrect Social Security Numbers (SSNs): Entering an incorrect SSN for oneself, a spouse, or a dependent can significantly delay tax return processing and affect tax liabilities and refunds.

Failing to report all income: All sources of income, including wages, salaries, tips, interest, dividends, and any other earnings, must be reported. Forgotten or overlooked income can lead to discrepancies.

Omitting or inaccurately listing dependents: Dependents must be listed correctly to ensure proper calculation of deductions and credits. This includes ensuring that their SSNs are correctly provided.

Inaccurate filing status: Selecting the wrong filing status affects tax liability and returns. Taxpayers often mistake their eligible filing status, which can lead to potential overpayment or underpayment of taxes.

Not providing complete contact information: Accurate contact information is essential for any follow-ups or necessary communications. Missing or incorrect details can lead to delays in processing.

Skipping questions related to health insurance: Questions regarding health insurance are significant due to the possible tax implications. Overlooking these questions can result in inaccuracies on the tax return.

Forgetting to include information about deductible expenses: Taxpayers often miss including details about eligible deductions such as charitable donations, medical expenses, and education costs, potentially losing out on tax savings.

Incorrect use of standard or itemized deductions: Misunderstanding when to itemize deductions versus when to take the standard deduction can affect the tax owed or the refund amount. Each taxpayer's situation varies, and understanding which option benefits them the most is crucial.

When completing the IRS 13614-C form, ensuring accuracy and completeness is vital for the efficient and effective processing of tax returns. Avoiding these common errors can help streamline the tax preparation process, making it less stressful and potentially more beneficial for the taxpayer.

Documents used along the form

When handling tax documents, especially those related to the IRS 13614-C, also known as the Intake/Interview and Quality Review Sheet, clients often need to gather and complete several other forms and documents. These documents are vital for ensuring accurate and thorough tax preparation. Here is a look at some of these critical documents often used alongside the IRS 13614-C form.

- Form W-2, Wage and Tax Statement: This form is crucial for individuals who are employees. It shows their income from wages, tips, and other compensation, along with taxes withheld by their employer.

- Form 1099-MISC, Miscellaneous Income: Independent contractors and freelancers typically use this form. It reports income from services, rentals, prizes, awards, or other non-employee compensation.

- Form 1098, Mortgage Interest Statement: Homeowners with a mortgage will need this document. It outlines the amount of mortgage interest and related expenses paid that could be deductible.

- Form 1095-A, Health Insurance Marketplace Statement: Essential for anyone who purchased health insurance through the Marketplace. It provides information necessary for claiming the premium tax credit.

- Schedule C, Profit or Loss from Business: Used by sole proprietors and single-member LLCs to report business income and expenses. This schedule is critical for calculating the net profit or loss for tax purposes.

- Form 8863, Education Credits: Necessary for students or those claiming a dependent's educational expenses. It's used to claim the American Opportunity Credit and Lifetime Learning Credit.

- Form 8822, Change of Address: If there has been a recent move, this form notifies the IRS of the new address to ensure all correspondence and tax documents arrive at the right place.

- Bank Statements and Records of Charitable Donations: Not official IRS forms, but often required to verify deductions such as charitable donations or to reconcile income and expenses.

Gathering these documents is a significant first step in preparing for tax season or any tax-related consultation. It is advisable to consult with a tax professional to ensure that all necessary documents are correctly filled out and submitted for a comprehensive and compliant tax return process.

Similar forms

The IRS Form 1040, often referred to as the U.S. Individual Income Tax Return, shares similarities with the IRS 13614-C form, which is used for the intake/interview and quality review process during tax preparation assistance sessions. Both forms play crucial roles in the federal income tax filing process, gathering essential information about the taxpayer's income, deductions, and credits to determine tax liability or refund eligibility. While the 13614-C form is used as a preliminary checklist to ensure accuracy and completeness of taxpayer information before filing, the Form 1040 serves as the official tax return document submitted to the IRS.

The W-4 form, known as the Employee's Withholding Certificate, is another document related to the IRS 13614-C form in its function of handling taxpayer information, though for a different purpose. The W-4 form is used to determine the amount of federal income tax to withhold from an employee's paycheck, based on their filing status, dependents, and other income. Like the 13614-C, it collects personal and financial information but does so to adjust tax withholding rather than to review tax return accuracy. Both forms are pivotal in ensuring that taxpayers comply with U.S. tax laws and their obligations.

Form 8867, the Paid Preparer's Due Diligence Checklist, operates in a complementary realm to the IRS 13614-C by ensuring that tax professionals adhere to quality and accuracy standards in preparing taxpayer returns. It requires preparers to confirm they have asked clients for all necessary information to claim credits like the Earned Income Tax Credit (EITC), similar to how the 13614-C form ensures taxpayers provide all relevant information for their tax filing through a structured interview process. Both forms aim to increase the accuracy of returns and reduce errors.

The Schedule C (Form 1040) is utilized by sole proprietors and single-member LLCs to report profits or losses from a business, which directly influences the information needed on the IRS 13614-C form during the tax preparation process. Taxpayers engaged in business activities must provide detailed income and expense reports, similar to the comprehensive financial information gathered via form 13614-C. The connection here lies in the necessity of accurately reporting all sources of income and allowable deductions to correctly file one's tax obligations.

Finally, the IRS Form 1099-MISC, used for reporting miscellaneous income, has a connection to the IRS 13614-C form in context but focuses on specific types of income. Contractors, freelancers, and others who receive non-employee compensation need the information from 1099 forms to accurately report their earnings. When preparing to file taxes and completing the IRS 13614-C form, having a detailed record of miscellaneous income is essential to ensure that all earnings are correctly accounted for, much like the comprehensive income capturing role of the 13614-C form.

Dos and Don'ts

The IRS 13614-C form, often referred to as the Intake/Interview & Quality Review Sheet, is critically important for taxpayers seeking assistance through programs such as the Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE). Proper completion of this document is essential for ensuring accuracy in tax preparation. Here are nine key dos and don'ts to follow:

Dos:

- Review the form carefully before filling it out. Understand each section to ensure all applicable parts are completed accurately.

- Gather all necessary documentation before starting. This includes identification, Social Security cards for all family members, and all income statements such as W-2s, 1099s, etc.

- Answer all questions truthfully. Complete honesty is crucial for accurate tax preparation.

- Use the additional information section to note any unusual circumstances or provide extra details about your financial situation that may affect your taxes.

- Review your previous year's tax return. This can provide a helpful reference and ensure consistency where applicable.

- Sign and date the form. Your signature verifies that you have provided accurate information to the best of your knowledge.

- Ask for clarification if needed. Volunteers are there to help, so don’t hesitate to ask questions.

Don'ts:

- Don’t rush through the form. Take your time to ensure that every section is completed accurately.

- Don’t leave any sections blank that apply to you. If a section is not applicable, enter N/A or 0, as appropriate.

- Don’t forget to provide information about health insurance coverage, as this can affect your tax return.

Misconceptions

The IRS Form 13614-C, known as the "Intake/Interview & Quality Review Sheet," is essential for individuals seeking assistance from the Volunteer Income Tax Assistance (VITA) or the Tax Counseling for the Elderly (TCE) programs. Despite its importance, there are several misconceptions about this form that can lead to confusion. Below are eight common misconceptions explained in detail.

- It's only for low-income individuals. While the VITA and TCE programs primarily serve people with lower incomes, disabilities, and the elderly, the IRS Form 13614-C itself is a tool used in the process of getting tax help and is relevant to ensuring the accuracy and completeness of the tax assistance provided. The form is used to facilitate the conversation between the taxpayer and the volunteer, making sure all necessary information is covered.

- You need to fill it out every year. Yes, this is required annually. It's a common misconception that once you've completed the form, you won't need to do it again for future tax years. The information on the form, including your income, deductions, and personal circumstances, can change from year to year, necessitating a fresh form each tax season.

- It's complicated and time-consuming. While the form is thorough, it is designed to be user-friendly. Its purpose is to guide the interview process between the taxpayer and the volunteer, ensuring that no important information is missed. The form helps streamline the tax preparation process by organizing the information needed.

- The form substitutes for tax preparation software. This is a misconception. The IRS Form 13614-C is an intake form used to gather necessary information. It does not replace the tax preparation process or software used to file taxes. It’s a tool to facilitate accurate and efficient tax preparation by volunteers.

- It's only useful for VITA/TCE volunteers. While the form is specifically designed for use in the VITA and TCE programs, it can serve as a helpful checklist for anyone preparing taxes, offering a comprehensive overview of the types of information and documents that are necessary for accurate tax filing.

- You can't get help filling it out. Actually, the volunteers at VITA and TCE sites are trained to assist taxpayers in filling out the IRS Form 13614-C as part of the tax preparation process. The form is meant to be completed with a volunteer's help, rather than on your own, to ensure all information is accurately captured.

- It asks for unnecessary personal information. Every question on the IRS Form 13614-C is designed to ensure the tax return is complete and accurate. Questions about personal and financial circumstances are critical for claiming eligible tax credits and deductions. The form follows strict privacy and confidentiality rules to protect personal information.

- Filing out Form 13614-C means you're more likely to get audited. There is no evidence to suggest that using Form 13614-C increases your chances of an IRS audit. The form is a tool to ensure that your tax return is complete and accurately reflects your financial situation, which can actually help prevent issues that might lead to an audit.

Key takeaways

When dealing with the IRS 13614-C form, commonly known as the Intake/Interview & Quality Review Sheet, there are several key points to keep in mind. This document plays a crucial role in ensuring that taxpayers receive accurate and thorough assistance from the Volunteer Income Tax Assistance (VITA) or the Tax Counseling for the Elderly (TCE) programs. Below are four essential takeaways related to the completion and utilization of the form:

- Accuracy is crucial: It’s important for taxpayers to fill out the form with the most accurate and up-to-date information available. This ensures that volunteers can provide the correct assistance and prepare the tax return accurately. Misinformation or omitted details can lead to errors that may affect the taxpayer’s obligations or returns.

- Comprehensive completion: The IRS 13614-C form is designed to cover a wide range of financial situations and tax-related questions. Taxpayers should complete every section that applies to their situation. Skipping sections or providing incomplete answers may result in an incomplete understanding of the taxpayer’s financial picture, potentially missing out on important tax benefits or deductions.

- Updated annually: The form is updated each year to reflect changes in tax law and filing requirements. Taxpayers should ensure they are using the most current version of the form to account for any new tax rules or adjustments. This helps prevent the submission of outdated information and ensures compliance with the latest tax codes.

- Essential for quality review: The form also serves as a tool for quality review in the VITA/TCE programs. Both the volunteer preparer and the quality reviewer use the completed form to verify that all tax information has been accurately accounted for and that the prepared tax return aligns with the taxpayer’s information. This dual-check system helps minimize errors and ensures the accuracy of the tax return.

Understanding and accurately completing the IRS 13614-C form is essential for taxpayers seeking assistance through VITA or TCE programs. This form not only guides the tax preparation process but also ensures that taxpayers are compliant with current tax laws and receive all applicable tax benefits. Taxpayers are encouraged to approach the completion of this form with diligence and attention to detail.

Popular PDF Documents

Metlife Dog Insurance - A declaration section for the policyholder to affirm that the claimed treatments were recommended by their veterinarian.

Nevada Sales Tax Return - Email submission of the completed form is an option but requires saving and attaching the form to the email.

1099-int From Bank - Recipients of the 1099-INT form should consult with a tax professional if they have questions about reporting interest income.