Get IRS 12277 Form

When individuals find themselves grappling with a federal tax lien, a cloud seems to hang over their financial future. It's not uncommon for this situation to feel overwhelming, rendering dreams of owning a home or securing a loan seemingly unattainable. However, not all hope is lost, thanks to a specific process offered by the Internal Revenue Service (IRS). The IRS Form 12277, often referred to as the Application for Withdrawal of Filed Notice of Federal Tax Lien, serves as a critical tool in this regard. This document allows taxpayers to request the removal of a public Notice of Federal Tax Lien from their records, thus potentially improving their credit scores and opening up new financial opportunities. It's a form that bridges the daunting gap between financial distress and recovery, serving as a beacon of hope for those aiming to rectify their tax situations and rebuild their financial health. Understanding the intricacies of this form, from eligibility criteria to the detailed process involved in its submission, is essential for anyone seeking to navigate the challenging waters of federal tax liens.

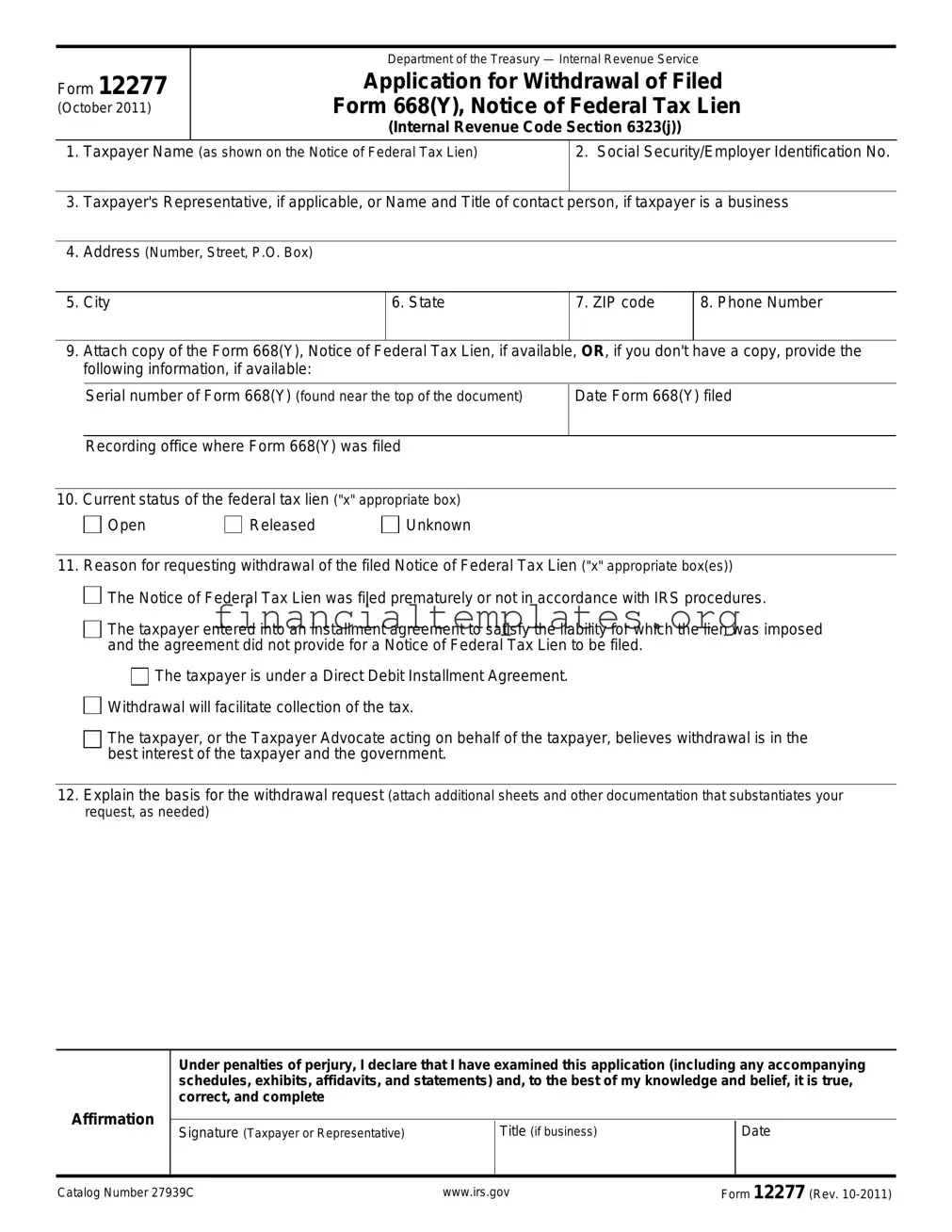

IRS 12277 Example

Form 12277

(October 2011)

Department of the Treasury — Internal Revenue Service

Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien

(Internal Revenue Code Section 6323(j))

1.Taxpayer Name (as shown on the Notice of Federal Tax Lien)

2. Social Security/Employer Identification No.

3.Taxpayer's Representative, if applicable, or Name and Title of contact person, if taxpayer is a business

4.Address (Number, Street, P.O. Box)

5. City

6. State

7. ZIP code

8. Phone Number

9.Attach copy of the Form 668(Y), Notice of Federal Tax Lien, if available, OR, if you don't have a copy, provide the following information, if available:

Serial number of Form 668(Y) (found near the top of the document)

Date Form 668(Y) filed

Recording office where Form 668(Y) was filed

10. Current status of the federal tax lien ("x" appropriate box)

Open

Released

Unknown

11. Reason for requesting withdrawal of the filed Notice of Federal Tax Lien ("x" appropriate box(es))

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The taxpayer entered into an installment agreement to satisfy the liability for which the lien was imposed and the agreement did not provide for a Notice of Federal Tax Lien to be filed.

The taxpayer is under a Direct Debit Installment Agreement.

Withdrawal will facilitate collection of the tax.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.

12.Explain the basis for the withdrawal request (attach additional sheets and other documentation that substantiates your request, as needed)

Affirmation

Under penalties of perjury, I declare that I have examined this application (including any accompanying schedules, exhibits, affidavits, and statements) and, to the best of my knowledge and belief, it is true, correct, and complete

Signature (Taxpayer or Representative) |

Title (if business) |

Date |

|

|

|

Catalog Number 27939C |

www.irs.gov |

Form 12277 (Rev. |

Page 2 of 2

General Instructions

1.Complete the application. If the information you supply is not complete, it may be necessary for the IRS to obtain additional information before making a determination on the application.

Sections 1 and 2: Enter the taxpayer's name and Social Security Number (SSN) or Employer Identification Number (EIN) as shown on the Notice of Federal Tax Lien (NFTL).

Section 3: Enter the name of the person completing the application if it differs from the taxpayer's name in section 1 (for example, taxpayer representative). For business taxpayers, enter the name and title of person making the application. Otherwise, leave blank.

Sections 4 through 8: Enter current contact information of taxpayer or representative.

Section 9: Attach a copy of the NFTL to be withdrawn, if available. If you don't have a copy of the NFTL but have other information about the NFTL, enter that information to assist the IRS in processing your request.

Section 10: Check the box that indicates the current status of the lien.

"Open" means there is still a balance owed with respect to the tax liabilities listed on the NFTL. "Released" means the lien has been satisfied or is no longer enforceable.

"Unknown" means you do not know the current status of the lien.

Section 11: Check the box(es) that best describe the

reason(s) for the withdrawal request. NOTE: If you are requesting a withdrawal of a released NFTL, you generally should check the last box regarding the best interest provision.

Section 12: Provide a detailed explanation of the events or the situation to support your reason(s) for the withdrawal request. Attach additional sheets and supporting documentation, as needed.

Affirmation: Sign and date the application. If you are completing the application for a business taxpayer, enter your title in the business.

2.Mail your application to the IRS office assigned your account. If the account is not assigned or you are uncertain where it is assigned, mail your application to IRS, ATTN: Advisory Group Manager, in the area where you live or is the taxpayer's principal place of business. Use Publication 4235, Advisory Group Addresses, to determine the appropriate office.

3.Your application will be reviewed and, if needed, you may be asked to provide additional information. You will be contacted regarding a determination on your application.

a. If a determination is made to withdraw the NFTL, we will file a Form 10916(c), Withdrawal of Filed Notice of Federal Tax Lien, in the recording office where the original NFTL was filed and provide you a copy of the document for your records.

b. If the determination is made to not withdraw the NFTL, we will notify you and provide information regarding your rights to appeal the decision.

4.At your request, we will notify other interested parties of the withdrawal notice. Your request must be in writing and provide the names and addresses of the credit reporting agencies, financial institutions, and/or creditors that you want notified.

NOTE: Your request serves as our authority to release the notice of withdrawal information to the agencies, financial institutions, or creditors you have identified.

5.If, at a later date, additional copies of the withdrawal notice are needed, you must provide a written request to the Advisory Group Manager. The request must provide:

a.The taxpayer's name, current address, and taxpayer identification number with a brief statement authorizing the additional notifications;.

b.A copy of the notice of withdrawal, if available; and

c.A supplemental list of the names and addresses of any credit reporting agencies, financial institutions, or creditors to notify of the withdrawal of the filed Form 668(Y).

. |

Privacy Act Notice |

We ask for the information on this form to carry out the Internal Revenue laws of the United States. The primary purpose of this form is to apply for withdrawal of a notice of federal tax lien. The information requested on this form is needed to process your application and to determine whether the notice of federal tax lien can be withdrawn. You are not required to apply for a withdrawal; however, if you want the notice of federal tax lien to be withdrawn, you are required to provide the information requested on this form. Sections 6001, 6011, and 6323 of the Internal Revenue Code authorize us to collect this information. Section 6109 requires you to provide the requested identification numbers. Failure to provide this information may delay or prevent processing your application; providing false or fraudulent information may subject you to penalties.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

Catalog Number 27939C |

www.irs.gov |

Form 12277 (Rev. |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose | The IRS Form 12277 is used to request the withdrawal of a filed Notice of Federal Tax Lien after the lien has been satisfied. |

| Applicability | This form is applicable to individuals or entities who have had a federal tax lien filed against them and have since satisfied the lien. |

| Benefit | Filing this form helps in removing the lien notice from the public record, which can improve the individual's credit score and borrowing capability. |

| Sections of the Form | The form includes sections for personal information, details of the tax lien, reason for the request, compliance with filing requirements, and a section for additional information. |

| Requirement for Filing | The lien must be satisfied or paid, and the taxpayer must be in compliance with other tax filing requirements. |

| Governing Law | The process and criteria for the withdrawal of a federal tax lien are governed by federal tax law, specifically mentioned in the Internal Revenue Code (IRC). |

| Filing Process | To file Form 12277, the taxpayer must complete the form and submit it to the IRS office that filed the original Notice of Federal Tax Lien. |

| Outcome of a Successful Filing | If the request is approved, the IRS will issue a Certificate of Withdrawal of Filed Notice of Federal Tax Lien. |

| State-Specific Considerations | While the form and process are federally managed, the impact of the lien withdrawal can vary by state, especially regarding how quickly the public records are updated. |

Guide to Writing IRS 12277

After submitting the IRS Form 12277, the process of removing a lien from your public record begins, which could positively impact your credit score and remove barriers to obtaining future credit. This form essentially asks the IRS to reconsider the lien they've placed due to unpaid taxes, based on the information you provide. Carefully filling out this form is crucial, as it represents the first step toward resolving these financial issues. Here's how to fill out the form correctly:

- Start by providing your personal information, including your full name, social security number (SSN) or employer identification number (EIN), and your detailed contact information (address, city, state, and zip code).

- Under the section titled "Taxpayer Contact Information," ensure to add your phone number and the best time to call. The IRS might need to reach out to you for additional information or clarification.

- In the field marked "Representative’s Name and Address," fill in the details of any individual or entity authorized to represent you in this matter, if applicable. This could be your accountant, attorney, or another person who has your power of attorney.

- Proceed to the "Type of Tax" section, where you must specify the type of tax and the period for which the lien was filed. This could include income tax, employment tax, etc., along with the precise years or quarters in question.

- Fill in the "Tax Form Number," which refers to the specific IRS form associated with your tax debt, such as Form 1040 for individual income taxes.

- In the section titled "Date of Assessment," provide the date the IRS assessed the tax debt. If unsure, this information can be obtained from the IRS.

- The "Location Where Filed," requires the information about where the lien was filed, which is typically a county or state office. This helps in identifying the specific lien to be withdrawn.

- The "Balance Due Amount Unpaid or Amount to be Adjusted," section should include the current outstanding amount or any adjustments to be made to the lien.

- In the "Reason(s) for requesting withdrawal," segment, carefully explain why the IRS should reconsider and withdraw the lien. This could be because the debt was paid, the lien was filed in error, or any other valid reason that applies to your situation.

- Conclude by reviewing the form for accuracy, then sign and date it at the bottom. If someone is representing you, they will also need to sign.

Once the form is filled and reviewed for accuracy, it should be mailed to the IRS office that originally issued the lien, or as otherwise directed by the IRS. After your request is submitted, the IRS will review the application and you will receive a notice regarding their decision. If successful, the lien will be withdrawn from public record, often improving your financial standing significantly. Keep a copy of the form and any correspondence for your records.

Understanding IRS 12277

-

What is IRS Form 12277?

IRS Form 12277, also known as the Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien, is used by individuals or businesses to request the removal of a public Notice of Federal Tax Lien from their records. This form essentially asks the IRS to withdraw the lien before it's paid in full, under certain circumstances. Using this form does not eliminate the underlying tax liability.

-

When should IRS Form 12277 be used?

Form 12277 should be used when you wish to have a Notice of Federal Tax Lien removed from your public records. There are several reasons you might do this, including if you entered into a payment agreement and are in compliance, if the lien was filed prematurely or not in accordance with IRS procedures, if it will help you pay your taxes faster, or if withdrawal will be in the best interest of both you and the government.

-

How do I fill out Form 12277?

To fill out Form 12277, you need to provide personal information, including your name, social security number (or EIN for businesses), physical address, and the details of the tax lien you wish the IRS to withdraw. You'll also need to explain why you believe the lien should be withdrawn. It's crucial to provide as much detail and supporting documentation as possible to justify your request.

-

Where do I send my completed Form 12277?

The completed Form 12277 should be sent to the IRS office that filed the lien. If you're unsure which office that is, you can find the appropriate address on the IRS website or by contacting the IRS directly through their customer service number. Ensure you keep a copy of the form and any accompanying documents for your records.

-

What happens after I submit Form 12277?

After you submit Form 12277, the IRS will review your request. This process can take some time, depending on the complexity of your case and the IRS's current workload. If the IRS approves your request, they will file a Certificate of Withdrawal, notifying credit reporting agencies and lifting the public Notice of Federal Tax Lien. If your request is denied, you will be notified and given reasons for the decision.

-

Is there a fee to file Form 12277?

No, there is no fee to file Form 12277. The IRS does not charge taxpayers to request a withdrawal of a Notice of Federal Tax Lien. However, this does not eliminate any underlying tax liability, which must still be addressed according to the terms agreed upon with the IRS.

-

Can filing Form 12277 affect my credit score?

Yes, filing Form 12277 and having a tax lien withdrawn can positively impact your credit score. A Notice of Federal Tax Lien can significantly damage your credit rating. Having it withdrawn removes the public record of the lien, which can improve your credit score, though the specific impact will vary depending on your overall credit history.

-

What are the chances my request on Form 12277 will be approved?

The approval of your request on Form 12277 depends on several factors, including your compliance with other tax filings and payments, the reasons for your request, and your adherence to IRS guidelines. Providing a detailed explanation and supporting documentation can increase the likelihood of approval. However, each case is unique, and decisions are made on an individual basis.

-

What should I do if my request is denied?

If your Form 12277 request is denied, review the IRS's reasons for denial carefully. You may address any issues and reapply, or you can explore other tax relief options, such as an Offer in Compromise or an installment agreement, depending on your situation. Consulting a tax professional for guidance on your next steps can also be beneficial.

-

Can I file Form 12277 electronically?

As of the last update, the IRS does not accept Form 12277 filings electronically. You must fill out the form and mail it to the appropriate IRS office. Always check the IRS website for the most current information on filing procedures, as policies and practices can change.

Common mistakes

Filling out the IRS 12277 Form, which is used to request the withdrawal of a Federal Tax Lien, requires attention to detail and a clear understanding of the instructions. Mistakes can delay the process, or worse, result in the rejection of the request. Here are some of the common errors people make when completing this form:

Not providing complete information: All required fields must be filled in accurately. Leaving sections blank or providing incomplete responses can lead to unnecessary delays.

Incorrect taxpayer identification numbers: It is crucial to double-check the taxpayer identification number (TIN), such as the Social Security Number (SSN) or Employer Identification Number (EIN), to ensure it matches IRS records.

Failure to justify the request: The form requires a detailed explanation of why the lien should be withdrawn. Simply stating a desire for withdrawal without a solid reason is insufficient.

Lack of supporting documentation: Depending on the circumstances, attaching relevant documents to support the request is necessary. Failure to include these can hinder the IRS’s ability to assess the situation accurately.

Signing and dating errors: The IRS 12277 Form must be signed and dated correctly. An oversight in this area can render the document invalid.

Using outdated forms: The IRS updates its forms periodically. Using an outdated version of Form 12277 can lead to processing delays or rejection.

When filling out the form, it’s advisable to:

Read the instructions carefully: Understand each section and what is required before starting to fill out the form.

Review the form before submission: Check for any mistakes, incomplete sections, or missing attachments.

Keep a copy: Always keep a copy of the completed form and any documents sent to the IRS for personal records.

Approaching the form with diligence and ensuring all information is complete and accurate can significantly improve the chances of a successful Federal Tax Lien withdrawal request.

Documents used along the form

When dealing with tax-related matters, particularly focusing on the IRS 12277 form, which is used to request the withdrawal of a federal tax lien, it's crucial to understand the associated paperwork that often accompanies this form. This understanding can streamline the process, making it smoother and more efficient for everyone involved. Below is a portrait of other forms and documents frequently used in tandem with the IRS 12277 form, aimed at providing a clearer path through the sometimes complex terrain of tax resolution.

- IRS Form 668(Y)(c) - Notice of Federal Tax Lien: This document is the formal notification from the IRS that a lien has been filed against your property. It’s essential to understand the details within this notice as it outlines what the IRS claims is owed.

- IRS Form 433-A or IRS Form 433-B - Collection Information Statements for Wage Earners, Self-Employed Individuals, or Businesses: These forms provide the IRS with detailed information about an individual's or business's financial situation. They are crucial for negotiating payment plans or proving financial hardship.

- IRS Form 668(Z) - Release of Federal Tax Lien: After the lien is paid off or other arrangements are made that satisfy the debt to the IRS's satisfaction, this form officially releases the lien, clearing the public record.

- IRS Form 8821 - Tax Information Authorization: This form authorizes someone else to access or discuss your tax information with the IRS. It's particularly useful if you're working with a tax professional who needs to understand all aspects of your case.

- IRS Form 2848 - Power of Attorney and Declaration of Representative: Similar to Form 8821, this document grants a tax professional the authority to represent you before the IRS, allowing them to make decisions and undertake actions on your behalf.

- Proof of Payment or Financial Arrangement: While not a formal IRS form, providing documentation of any payments made toward the debt or agreements for future payments can be crucial when requesting lien withdrawal under the IRS 12277 form.

Together, these forms and documents play a pivotal role in navigating through the process of managing and ultimately resolving tax liens. By understanding and properly utilizing these tools, individuals and businesses can more effectively communicate with the IRS to address and resolve their tax issues.

Similar forms

The IRS Form 656, also known as the Offer in Compromise (OIC), shares a key similarity with Form 12277 in that both aim to alleviate taxpayer burden. While Form 656 focuses on allowing taxpayers to settle their debt for less than the full amount owed when they can't pay their full tax liability, or doing so creates a financial hardship, Form 12277 is used to request the withdrawal of a federal tax lien. Both forms serve to help taxpayers in distress, though they address different aspects of tax relief and resolution.

The IRS Form 433-A, the Collection Information Statement for Wage Earners and Self-Employed Individuals, parallels Form 12277 in its use for financial assessment. The Form 433-A is crucial for determining an individual’s ability to pay back taxes, similar to how Form 12277 evaluates the appropriateness of lifting a lien based on current financial situations. Both are essential tools in negotiating with the IRS regarding one's tax liabilities and resolving outstanding obligations.

The IRS Form 843, Claim for Refund and Request for Abatement, resembles Form 12277 in its role in rectifying tax matters. While Form 843 is used to request a refund or ask for an abatement of certain taxes, penalties, fees, and interest, Form 12277 is specifically aimed at withdrawing a lien. Both forms are integral to addressing disputes or burdens regarding one’s tax responsibilities and seeking a form of relief or correction to one's tax record.

The IRS Form 2848, Power of Attorney and Declaration of Representative, is closely related to Form 12277 in the empowerment it grants. Just as Form 2848 allows individuals to authorize someone else to represent them before the IRS, handling forms like Form 12277 can also be part of such a representative's duties. Both forms are crucial in navigating the complexities of tax issues, especially for those who seek the expertise of a professional to manage their cases.

Similar to IRS Form 12277, the Form 9465, Installment Agreement Request, is another avenue for taxpayers seeking relief. While Form 9465 enables taxpayers to request a monthly payment plan for taxes owed, Form 12277 seeks to remove the lien from public record as a form of relief. Both approaches provide taxpayers with options to manage or mitigate their tax burdens in a more manageable fashion.

IRS Form 8821, Tax Information Authorization, shares a connection to Form 12277 through the theme of authorization. Form 8821 permits individuals or entities to authorize others to access their tax information, which might be necessary when dealing with tax liens and using Form 12277. Both forms facilitate dealing with the IRS by allowing either broader access to information or the ability to address specific tax issues like liens.

The Application for Taxpayer Assistance Order (Form 911) and IRS Form 12277 both serve as critical tools for taxpayers facing significant hardship due to their tax situations. Form 911 seeks assistance from the Taxpayer Advocate Service for those in severe need, potentially including situations where a tax lien has caused undue strain, making the resolution of such matters through Form 12277 a related process. These forms collectively represent recourse for taxpayers in distress.

The IRS Form 14039, Identity Theft Affidavit, while primarily focused on addressing identity theft issues, connects to Form 12277 by its nature of protecting the taxpayer’s interest. Just as Form 14039 alerts the IRS to fraudulent activity potentially affecting one's taxes, Form 12277 serves to rectify the consequences (like a lien) of unsettled tax disputes, which could also stem from identity theft scenarios. Both are pivotal in safeguarding taxpayer rights and resolving issues with the IRS.

Finally, the Request for Transcript of Tax Return, IRS Form 4506-T, bears similarity to Form 12277 by providing essential information that might be needed to resolve tax disputes, including those involving liens. Access to previous tax returns via Form 4506-T can be crucial in proving compliance or rectifying issues that necessitated the use of Form 12277. Both forms aid in clarifying and settling tax matters, making them important in the landscape of tax resolution and documentation.

Dos and Don'ts

Filling out IRS Form 12277, also known as the Application for Withdrawal of Filed Notice of Federal Tax Lien, requires attention to detail and an understanding of the process. This task may seem daunting, but by following a set of dos and don'ts, you can navigate it with confidence. Below are lists designed to guide you in accurately completing this form.

Things You Should Do:

- Thoroughly review the instructions provided by the IRS for completing Form 12277. This ensures you understand each section and its requirements.

- Provide accurate information in every section to avoid delays or rejections. Double-check your tax identification numbers, lien amounts, and dates.

- Clearly explain the reason for your request in the section asking for a detailed explanation. This will help the IRS understand why you believe the lien should be withdrawn.

- Include all necessary documentation that supports your request for withdrawal. This could include proof of payment or a release of lien.

- Contact a tax professional if you're unsure about any part of the form or if your situation is complex. Their expertise can provide guidance and increase the chances of a favorable outcome.

Things You Shouldn't Do:

- Don't leave any required fields blank. If a section does not apply to your situation, it's better to note that it's not applicable rather than just skipping it.

- Don't provide false or misleading information. The IRS takes the accuracy of provided information very seriously, and falsifying information can lead to severe penalties.

- Avoid guessing on dates, amounts, or other specifics. If you're unsure of a detail, it's better to look it up than to guess incorrectly.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Resist the urge to submit without reviewing the entire form for accuracy and completeness. A quick review can catch errors or omitted information that could impact your request.

Misconceptions

The IRS Form 12277, often associated with tax-related processes, is subject to many misconceptions. Clearing up these misconceptions is crucial for individuals looking to navigate their tax responsibilities effectively.

Only Businesses Can File Form 12277: A common misconception is that IRS Form 12277 is exclusively for businesses. In truth, individuals can also use it to request the withdrawal of a filed Notice of Federal Tax Lien, showing that the lien is no longer necessary for securing the debt.

Form 12277 Will Remove the Tax Debt: Filing Form 12277 does not erase or eliminate the tax debt. It’s intended for requesting the withdrawal of a public Notice of Federal Tax Lien. The underlying tax obligation remains, and the individual or business must still address it through other means.

It's Complicated to Fill Out: While tax forms can often be complex, Form 12277 is relatively straightforward. It requires basic information regarding the taxpayer, the tax debt, and the reason for the lien withdrawal request. Assistance from a tax professional can help, but many people can complete it on their own with careful reading.

Filing It Guarantees Lien Withdrawal: This is not the case. Filing Form 12277 is a request, not a guarantee. The IRS reviews each request individually, considering factors like tax compliance and the status of the tax debt, before making a decision on whether to withdraw the lien.

Form 12277 Only Applies to Federal Liens: While it's true that IRS Form 12277 is used to request the withdrawal of federal tax liens, it's important to understand that similar processes may exist at the state or local level. However, those will use different forms and procedures, not Form 12277.

There's a Fee to File Form 12277: Actually, there is no fee to submit Form 12277 to the IRS. This misbelief might stem from confusing this form with other tax or legal forms that do have associated filing fees.

You Must Hire a Professional to File It: While tax professionals can provide valuable advice and assistance, especially in complex situations, it is not a requirement to hire one to file Form 12277. Individuals have the option to complete and submit the form themselves, although professional guidance can be beneficial in understanding the broader tax implications.

Understanding these misconceptions about IRS Form 12277 can help individuals and businesses better navigate their dealings with tax liens and the IRS. Given the nuances of tax laws, seeking the guidance of a tax professional for individual circumstances is often advisable.

Key takeaways

The IRS Form 12277, also known as the Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien, is a document vital for individuals seeking to have a lien notice removed. Here are key takeaways to understand its filling and use:

- Accuracy is crucial when completing the form. Every detail must be clearly and accurately provided to avoid delays or denial of the application. Misinformation can complicate the process significantly.

- Personal identification is essential. Individuals must provide their full legal name, social security number or employer identification number, and all other personal information exactly as it appears on the tax documents related to the lien.

- Timing matters. Submitting the form as soon as the obligation that led to the lien has been satisfied can accelerate the withdrawal of the notice, reducing its impact on credit and reputation.

- Reasons for withdrawal must be specified. The IRS allows for the withdrawal of a lien if certain conditions are met, such as the lien being filed prematurely or not in accordance with IRS procedures. Understanding and stating the specific reason that applies to your situation is vital.

- Supporting documents are often necessary. When applicable, attaching proof of payments, release of lien, or any other documentation that supports the application can bolster the case for withdrawal.

- Follow up is key. After submitting Form 12277, individuals should keep track of their application's status and be prepared to provide additional information or clarification if contacted by the IRS.

- The IRS response time may vary. While some applications may be processed relatively quickly, others may take longer depending on the complexity of the case and the IRS's current workload. Patience is often required.

- Seek professional advice if needed. Complex tax situations or issues regarding the lien might require the expertise of a tax professional or lawyer. Their guidance can be invaluable in navigating the process.

- Understand the full impact of a lien withdrawal. While withdrawing a lien notice removes the public claim against your assets, it does not eliminate the underlying tax obligation. Ensuring that all tax liabilities are addressed is crucial for preventing future issues.

Effectively managing the removal of a Notice of Federal Tax Lien can restore financial stability and creditworthiness. The IRS Form 12277 is a pivotal tool in this process, requiring attention to detail, persistence, and, when necessary, professional guidance.

Popular PDF Documents

Where's My Application Irs - Through Form 8718, the IRS collects a fee based on your organization's gross receipts, determining your cost of application.

Fire Tcc - Entities that fail to update their TCC information using Form 4419 may face challenges in filing their information returns electronically.