Get Irs 12256 Form

The Internal Revenue Service (IRS) Form 12256, otherwise known as the Withdrawal of Request for Collection Due Process (CDP) or Equivalent Hearing, plays a crucial role in the realm of tax administration and taxpayer rights. Crafted as a means for taxpayers to formally rescind their previous requests for a hearing concerning tax collection actions, this document signifies a taxpayer's decision to forego the appeal process under specific conditions. This may occur when the taxpayer has reached an amicable resolution with the IRS or has determined that a hearing with the Independent Office of Appeals is no longer necessary. By completing this form, individuals and entities essentially waive their right to challenge the tax collection process through the Appeals office, affecting their ability to seek judicial review in Tax Court based on the Appeals' final determination. Furthermore, the form touches on significant procedural aspects such as the suspension of levy actions and the statute of limitations on collection periods, which are discontinued once the form is filed. It's noteworthy that, even with the withdrawal of a CDP hearing request, taxpayers do not relinquish all appeal rights, as they may still have the option to pursue other appeal avenues like the Collection Appeals Program (CAP). As an instrument of tax administration, Form 12256 encapsulates the complex interplay between taxpayer rights and obligations, the administrative frameworks governing tax disputes, and the nuanced choices taxpayers face when navigating the tax collection and appeals processes.

Irs 12256 Example

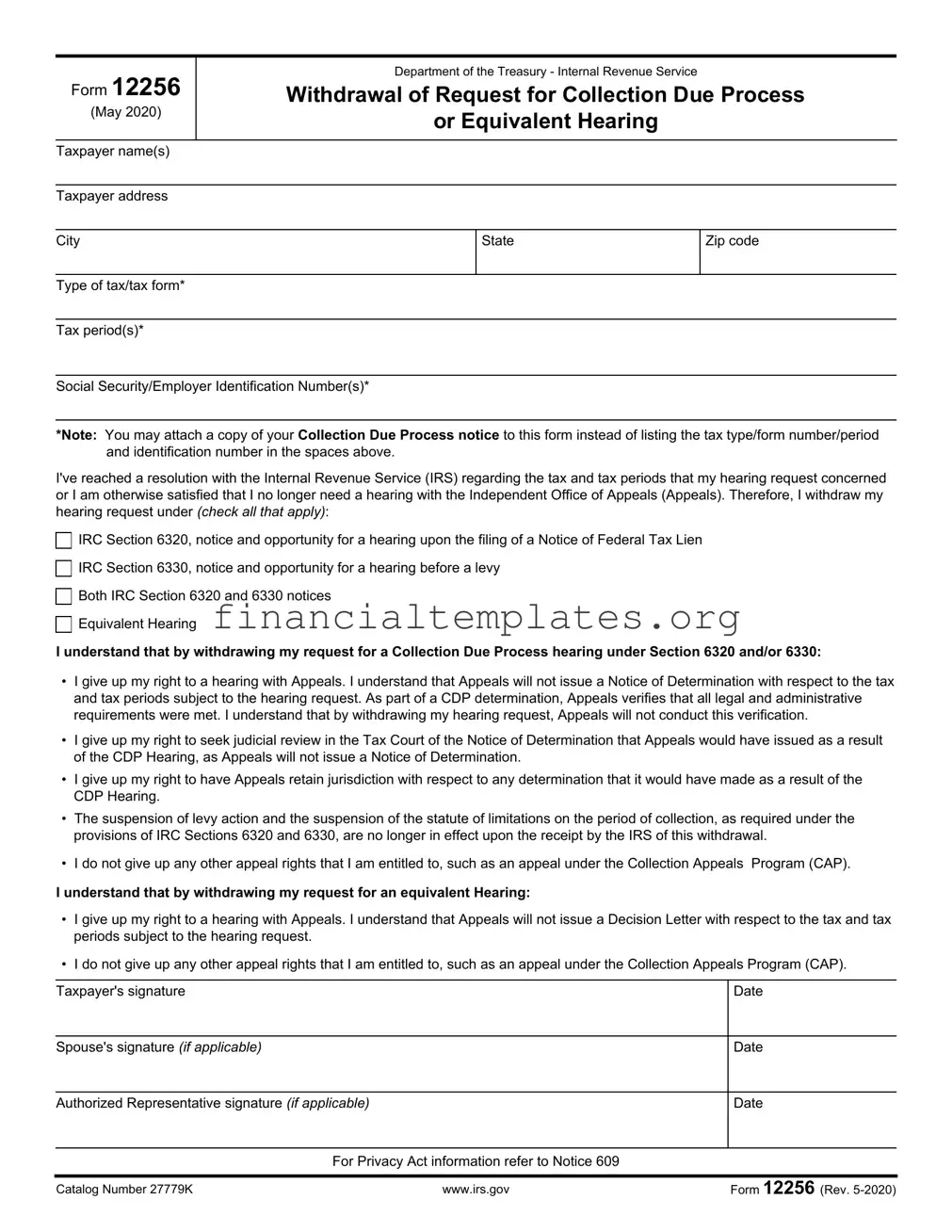

Form 12256 |

Department of the Treasury - Internal Revenue Service |

|

Withdrawal of Request for Collection Due Process |

||

(May 2020) |

||

or Equivalent Hearing |

||

|

||

|

|

|

Taxpayer name(s) |

|

|

|

|

|

Taxpayer address |

|

City

State

Zip code

Type of tax/tax form*

Tax period(s)*

Social Security/Employer Identification Number(s)*

*Note: You may attach a copy of your Collection Due Process notice to this form instead of listing the tax type/form number/period and identification number in the spaces above.

I've reached a resolution with the Internal Revenue Service (IRS) regarding the tax and tax periods that my hearing request concerned or I am otherwise satisfied that I no longer need a hearing with the Independent Office of Appeals (Appeals). Therefore, I withdraw my hearing request under (check all that apply):

IRC Section 6320, notice and opportunity for a hearing upon the filing of a Notice of Federal Tax Lien

IRC Section 6330, notice and opportunity for a hearing before a levy

Both IRC Section 6320 and 6330 notices

Equivalent Hearing

I understand that by withdrawing my request for a Collection Due Process hearing under Section 6320 and/or 6330:

•I give up my right to a hearing with Appeals. I understand that Appeals will not issue a Notice of Determination with respect to the tax and tax periods subject to the hearing request. As part of a CDP determination, Appeals verifies that all legal and administrative requirements were met. I understand that by withdrawing my hearing request, Appeals will not conduct this verification.

•I give up my right to seek judicial review in the Tax Court of the Notice of Determination that Appeals would have issued as a result of the CDP Hearing, as Appeals will not issue a Notice of Determination.

•I give up my right to have Appeals retain jurisdiction with respect to any determination that it would have made as a result of the CDP Hearing.

•The suspension of levy action and the suspension of the statute of limitations on the period of collection, as required under the provisions of IRC Sections 6320 and 6330, are no longer in effect upon the receipt by the IRS of this withdrawal.

•I do not give up any other appeal rights that I am entitled to, such as an appeal under the Collection Appeals Program (CAP).

I understand that by withdrawing my request for an equivalent Hearing:

•I give up my right to a hearing with Appeals. I understand that Appeals will not issue a Decision Letter with respect to the tax and tax periods subject to the hearing request.

•I do not give up any other appeal rights that I am entitled to, such as an appeal under the Collection Appeals Program (CAP).

Taxpayer's signature

Date

Spouse's signature (if applicable)

Date

Authorized Representative signature (if applicable)

Date

For Privacy Act information refer to Notice 609

Catalog Number 27779K |

www.irs.gov |

Form 12256 (Rev. |

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is named IRS Form 12256. |

| 2 | This form is used to withdraw a request for a Collection Due Process (CDP) or Equivalent Hearing with the IRS. |

| 3 | Form 12256 applies to both sections 6320 and 6330 of the Internal Revenue Code, which deal with notices and hearings upon the filing of a Notice of Federal Tax Lien and notices for hearings before a levy, respectively. |

| 4 | By submitting this form, the taxpayer gives up the right to a hearing with the Appeals Office and any judicial review in Tax Court of the Notice of Determination that would have been issued after such a hearing. |

| 5 | The form allows the taxpayer to state they have reached a resolution with the IRS or they no longer need the hearing for other reasons. |

| 6 | Withdrawing a CDP or Equivalent Hearing request leads to the suspension of levy action and the suspension of the statute of limitations on the collection period being no longer in effect. |

| 7 | IRS Form 12256 includes sections for taxpayer identification, type of tax, tax form number, tax period(s), and requires the taxpayer's and, if applicable, their spouse's or authorized representative's signature. |

Guide to Writing Irs 12256

After coming to an agreement with the IRS or deciding that a Collection Due Process (CDP) or Equivalent Hearing is no longer necessary, taxpayers can use Form 12256 to officially withdraw their request for these hearings. This step signifies the end of a specific process with the IRS related to a notice of lien or levy on taxes. While this withdrawal means you forego the chance for an Appeals hearing or judicial review regarding the dispute covered by the initial request, it does not affect other appeal rights you may have. Here are the steps to accurately fill out the IRS Form 12256:

- Enter the taxpayer's full name(s) in the space provided at the top of the form.

- Fill in the taxpayer address including city, state, and zip code.

- Specify the type of tax and the tax form number that your initial hearing request concerned. For example, you could write "Income Tax" and "Form 1040."

- List the tax period(s) your hearing request involved, such as "2018, 2019."

- Provide your Social Security Number (SSN) or Employer Identification Number (EIN) as relevant. These identifiers are crucial for the IRS to accurately process your withdrawal.

- If applicable, attach a copy of your Collection Due Process notice rather than filling out the tax type/form number/period and identification number. This can simplify the process if the information is detailed and extensive.

- Check the appropriate box(es) to indicate whether your withdrawal pertains to IRC Section 6320 (a notice and opportunity for hearing upon the filing of a Notice of Federal Tax Lien), IRC Section 6330 (a notice and opportunity for hearing before a levy), both, or an Equivalent Hearing.

- Read through the statements carefully to understand what rights and processes your withdrawal affects. This includes giving up your right to an Appeals hearing and any related notice of determination or decision letter from Appeals.

- After understanding the ramifications, sign and date the form in the taxpayer signature area. If this tax matter concerns both you and a spouse, ensure that your spouse also signs and dates the form.

- If an authorized representative has been handling your IRS matters, have them sign and date the form in the designated area for the authorized representative's signature.

Once the IRS Form 12256 is fully completed and signed, it should be submitted to the IRS through the method directed in your CDP or Equivalent Hearing correspondence or as advised by your tax professional. Submitting this form completes your request to withdraw from the hearing process, and you should receive confirmation from the IRS acknowledging your withdrawal.

Understanding Irs 12256

Frequently Asked Questions about IRS Form 12256

IRS Form 12256, titled "Withdrawal of Request for Collection Due Process (CDP) or Equivalent Hearing," serves a specific purpose within the tax dispute resolution process. Here, some of the most commonly asked questions about this form are addressed to help taxpayers understand its use and implications.

What is IRS Form 12256?

IRS Form 12256 is a document used by taxpayers to formally withdraw a previously filed request for a Collection Due Process (CDP) hearing or an equivalent hearing with the Internal Revenue Service (IRS). This form is necessary when a taxpayer has resolved the underlying issue with the IRS or no longer wishes to proceed with the hearing process.

When would I need to use Form 12256?

A taxpayer might need to use Form 12256 after filing a request for a CDP or equivalent hearing if they reach an agreement with the IRS regarding their tax dispute, or if they decide that moving forward with the hearing is no longer necessary or in their best interest. Using this form officially informs the IRS of the taxpayer's decision to withdraw the hearing request.

What are the consequences of withdrawing my hearing request?

By withdrawing your request for a CDP or equivalent hearing, you forfeit the right to have the hearing itself, the issuance of a Notice of Determination or Decision Letter by Appeals, and the possibility of seeking judicial review of Appeals' decision. However, the suspension of levy actions and the suspension of the statute of limitations on collection that were in place while the hearing request was pending are lifted. Importantly, withdrawing a hearing request does not affect any other appeal rights under different procedures like the Collection Appeals Program (CAP).

How do I fill out and submit Form 12256?

To complete Form 12256, you must provide your name(s), address, the type of tax and tax form number, tax period(s), and your Social Security or Employer Identification Number(s). You can also attach a copy of your CDP notice instead of filling out the tax information. Once completed, the form needs to be signed by the taxpayer, their spouse (if applicable), and their authorized representative (if applicable), before being submitted to the address provided by the IRS for this purpose.

Can I appeal after withdrawing my request for a hearing?

Withdrawing your request for a CDP or equivalent hearing with Form 12256 ends the specific appeal process for that hearing. Nevertheless, it does not preclude you from utilizing other appeal rights you may have, such as appealing under the Collection Appeals Program (CAP) for other or ongoing issues.

Is there a deadline for submitting Form 12256?

While there is no specific deadline for submitting Form 12256, it should be submitted as soon as you decide to withdraw your hearing request to prevent unnecessary processing and to ensure that the IRS takes no further collection action under the assumption that a hearing is pending. Prompt submission is advisable.

Where can I find more information about Form 12256 or get help with filling it out?

For more information about Form 12256 or for assistance with completing it, you can visit the official IRS website (www.irs.gov) or consult with a tax professional who can offer personalized advice and guidance based on your specific situation.

Common mistakes

When individuals fill out the IRS Form 12256, Withdrawal of Request for Collection Due Process or Equivalent Hearing, common mistakes can lead to delays or complications in their case handling. Awareness and avoidance of these errors can streamline the process.

Not including taxpayer identification numbers: The form requires individuals to provide their Social Security Number (SSN) or Employer Identification Number (EIN). Forgetting to include these crucial details can result in processing delays.

Incomplete tax type/tax form and period information: Taxpayers must clearly indicate the type of tax, the tax form number, and the specific tax periods involved. Attaching a copy of the Collection Due Process notice, as allowed, can be an alternative but often gets overlooked.

Failing to check the applicable sections: The form offers the option to withdraw requests under IRC Section 6320, 6330, both, or request an equivalent hearing. Individuals sometimes miss marking the appropriate box, causing confusion about which rights they are waiving.

Omitting signatures: The taxpayer, and if applicable, their spouse or authorized representative, must sign the form. Unsigned forms are not processed, which stalls the withdrawal request.

Overlooking the Privacy Act information: The Privacy Act information, referred to Notice 609, provides essential details about data usage. Ignoring this section can result in missed understanding about rights and protections.

Errors in taxpayer name(s) and address: Incorrectly filled or outdated information in the taxpayer name(s) and address sections can lead to miscommunication or misdirection of correspondence.

These mistakes are not just procedural but could significantly affect a taxpayer's rights and the outcomes of their interactions with the Internal Revenue Service. Proper completion and understanding of the IRS Form 12256 are essential steps in the process.

Documents used along the form

When engaging with the Internal Revenue Service (IRS), particularly in scenarios involving the resolution of tax disputes or clarification of tax obligations, individuals and entities might find themselves navigating a complex array of forms and documents beyond the Form 12256, "Withdrawal of Request for Collection Due Process (CDP) or Equivalent Hearing". This form itself is pivotal for taxpayers choosing to withdraw their request for a hearing concerning the collection processes of the IRS, aiming to achieve a resolution or when they find that a hearing is no longer necessary. Understanding the ecosystem of forms that could accompany or follow Form 12256 can provide clarity and assist in managing one's tax affairs more efficiently.

- Form 2848, Power of Attorney and Declaration of Representative: Enables a taxpayer to authorize an individual, typically with the requisite credentials, to represent them before the IRS, providing the said representative with the ability to receive and inspect confidential tax information.

- Form 9465, Installment Agreement Request: This form is useful for individuals who cannot pay their tax debt in full and wish to make monthly installment payments. It is often used in conjunction with the withdrawal of a CDP to ensure that there is a structured plan for tax repayment.

- Form 433-F, Collection Information Statement: Provides the IRS with information about the taxpayer's financial situation. It is used to assess how a taxpayer can fulfill their tax obligations, often in situations leading to or following the withdrawal of a CDP hearing request.

- Form 656, Offer in Compromise: Allows taxpayers to settle their tax debt for less than the full amount owed if they meet certain criteria. This form might be part of the documentation if the taxpayer has reached a resolution via an offer in compromise thereby withdrawing the CDP request.

- Form 12153, Request for a Collection Due Process or Equivalent Hearing: The initial form filed by taxpayers to request a CDP or equivalent hearing before withdrawing it with Form 12256, if they reach an agreement or for other reasons.

- Form 843, Claim for Refund and Request for Abatement: This may be used to request a refund of penalties, interest, fees, or additions to tax if the taxpayer believes they were assessed in error. It could be relevant in instances where resolving a dispute leads to the withdrawal of a CDP request.

- Notice CP92 or CP242: These IRS notices indicate the intent to levy a taxpayer’s state tax refund or an intent to levy property for unpaid tax, respectively. Receiving either notice could precede the filing of Form 12256 if the taxpayer chooses to withdraw their CDP request after making arrangements to address the looming levy.

The fabric of IRS documentation and procedural forms is intricate, designed to cover a broad spectrum of taxpayer scenarios and issues. Form 12256 represents a critical juncture in the taxpayer's journey, serving as a formal step back from a previously requested CDP hearing. Whether because a resolution has been reached, conditions have changed, or for other strategic reasons, the withdrawal with Form 12256 often leads to engaging with, or the completion of, other IRS forms and documents as outlined. Efficient navigation through these processes requires a good understanding of each document's purpose and how they interlink, ultimately paving the way for smoother interactions with the IRS and the fulfillment of tax obligations.

Similar forms

The IRS Form 12153, Request for a Collection Due Process or Equivalent Hearing, is closely related to Form 12256 in its purpose and use. Form 12153 is the document taxpayers submit to request a hearing with the IRS Appeals Office regarding a notice of federal tax lien or levy. It's the initial step in contesting the IRS's lien or levy actions, while Form 12256 represents the withdrawal of such a request, essentially the opposite action. Both forms facilitate taxpayer interaction with the IRS's collection due process, yet each serves distinct procedural milestones.

Form 2848, Power of Attorney and Declaration of Representative, shares a procedural connection with Form 12256, particularly in instances where a taxpayer opts to have a representative withdraw a Collection Due Process request on their behalf. The Power of Attorney form authorizes individuals to represent taxpayers before the IRS, encompassing activities from submitting forms to speaking on behalf of the taxpayer. When a taxpayer's authorized representative completes Form 12256, it often follows that a Form 2848 was previously submitted to establish that representation legally.

IRS Form 656, Offer in Compromise, and Form 12256 are connected through the resolution of tax liabilities. Form 656 is used by taxpayers to propose a settlement to the IRS, paying less than the full amount owed. Taxpayers who have submitted Form 656 may later find themselves filling out Form 12256 to withdraw a Collection Due Process or Equivalent Hearing request if they reach an agreement with the IRS through the Offer in Compromise process, thereby resolving their tax issues.

IRS Form 9465, Installment Agreement Request, is relevant to those considering Form 12256 as it also relates to resolving tax liabilities but through a different mechanism. When taxpayers arrange to pay their debts over time with an installment agreement, they may decide to withdraw their Collection Due Process Hearing request using Form 12256, especially if the installment agreement sufficiently addresses their situation, making the need for a hearing moot.

IRS Form 9423, Collection Appeal Request, provides an alternative appeals process for taxpayers who disagree with certain collection actions. Unlike the Collection Due Process (CDP) hearing requested via Form 12153 and withdrawn via Form 12256, the Collection Appeals Program (CAP) allows for a different avenue of IRS dispute resolution. Taxpayers might opt to withdraw their CDP request if they choose to pursue their case through the CAP instead, suggesting a strategic decision in navigating IRS processes.

IRS Form 8379, Injured Spouse Allocation, although primarily related to allocating tax obligations between spouses, intersects indirectly with Form 12256 situations. A taxpayer who has filed Form 8379 due to concerns about their tax refund being applied to a spouse's debt might initially request a Collection Due Process hearing to contest a levy affecting their refund. However, upon resolution of the injured spouse claim, they might then withdraw the hearing request using Form 12256 if the issue becomes moot.

Form 433-F, Collection Information Statement, is utilized by taxpayers to provide the IRS with financial information necessary to determine payment options for outstanding taxes, similar to Form 656 or 9465 processes. Taxpayers who have entered into negotiations with the IRS about their debt by submitting Form 433-F may concurrently opt to withdraw a previously requested Collection Due Process hearing using Form 12256, particularly if they are nearing a resolution about their payment options or if the form aids in securing an installment agreement or offer in compromise.

Form 668(Y), Notice of Federal Tax Lien, is directly connected with the need for or withdrawal of a Collection Due Process hearing. This form represents the action taken by the IRS to claim a legal right to the taxpayer's property for unpaid tax debts, which might prompt the taxpayer to request a hearing by filing Form 12153. Conversely, Form 12256 allows a taxpayer to withdraw such a request, possibly because of a resolution achieved with the IRS regarding the lien, rendering the request for a hearing unnecessary.

Dos and Don'ts

When you're dealing with the IRS Form 12256, it's important to proceed with care. Here are key do's and don'ts to help guide you through the process.

Do's:

- Read the form carefully before you start filling it out. Make sure you understand what is being asked and how it pertains to your situation.

- Include all the required information: your name, address, type of tax, tax form number, tax period(s), and your Social Security or Employer Identification Number(s). Missing information can delay the process.

- Consider attaching a copy of your Collection Due Process notice if it makes filling out the form easier or helps clarify the information you're providing.

- Sign and date the form. If applicable, make sure your spouse and/or authorized representative also signs and dates the form. An unsigned form is not valid.

Don'ts:

- Don’t rush through the form without fully understanding the ramifications of withdrawing your request for a Collection Due Process hearing. This decision has significant implications, including giving up certain rights.

- Avoid leaving sections blank that apply to your situation. Every piece of requested information is important for the IRS to accurately process your form.

- Don’t neglect the privacy act information. It's important to be aware of how your personal information is used. Refer to Notice 609 for more details.

- Refrain from skipping the checkboxes that specify under which section(s) you are withdrawing your request (IRC Section 6320, 6330, both, or equivalent hearing). This clarity is crucial for the IRS to understand your intent.

Misconceptions

Only taxpayers in dispute with the IRS need Form 12256: It's a common belief that Form 12256, Withdrawal of Request for Collection Due Process (CDP) or Equivalent Hearing, is only for those locked in a bitter dispute with the IRS. However, this form is also used by taxpayers who have reached a resolution or believe they no longer require a hearing. Its purpose goes beyond disputes, serving as a formal way to communicate that a hearing under IRC Section 6320 or 6330 is no longer necessary.

Withdrawing a CDP request admits guilt: Some people think that if you withdraw your request for a Collection Due Process hearing, you are admitting to being in the wrong. This isn't the case. Withdrawing a request simply means that you've reached a resolution with the IRS, or for whatever reason, you've decided that the hearing is no longer needed. It's not an admission of guilt or wrongdoing.

Filing Form 12256 waives all appeal rights: There's a misconception that by filing Form 12256, taxpayers forfeit all their rights to appeal. In truth, while it does waive the right to the specific hearing requested and any subsequent judicial review specific to that hearing's determination, it does not strip taxpayers of other appeal rights, such as those under the Collection Appeals Program (CAP).

You can't file Form 12256 after reaching a resolution with the IRS: This misunderstanding could leave some taxpayers feeling trapped into proceeding with hearings they no longer need. In reality, even after reaching an agreement with the IRS, taxpayers can—and should—submit Form 12256 to formally withdraw their hearing request. This action confirms the resolution and eliminates the need for a potentially unnecessary hearing.

Form 12256 only applies to personal tax disputes: While personal tax issues are commonly associated with CDP hearings, Form 12256 is not exclusively for individual taxpayers. Businesses addressing tax disputes or issues can also use this form to withdraw their request for a CDP or equivalent hearing, whether the matter involves employee identification numbers or other tax-related concerns.

The form suspends collection and statute limitations indefinitely: A dangerous assumption is that once filed, Form 12256 indefinitely suspends collection actions and the statute of limitations on collections. The truth is, withdrawing a CDP request actually ends these suspensions, signaling the IRS that it may proceed with collection actions and adhere to the standard statute limitations for the tax periods involved.

There's no need to inform the IRS if you change your mind: Some taxpayers mistakenly believe that if they decide not to pursue the CDP hearing, there's no need to formally inform the IRS. However, submitting Form 12256 is crucial as it officially communicates your intention to withdraw the request, ensuring that the IRS doesn't continue with the hearing process in anticipation of your participation.

Any taxpayer or their representative can sign Form 12256: A common misconception is that anyone related to the taxpayer can sign off on this form. In reality, only the taxpayer, their spouse (if applicable), and any authorized representative with a valid power of attorney can sign Form 12256. This requirement ensures that the request to withdraw is authorized and legitimate.

Key takeaways

When dealing with the Internal Revenue Service (IRS), especially in matters that involve disputes or collections, understanding the paperwork involved is crucial. The IRS Form 12256 is a specific document used to withdraw a previously filed request for a Collection Due Process (CDP) or equivalent hearing. Here are some key takeaways about this form and its implications:

- Filing a Withdrawal: By submitting Form 12256, taxpayers complete the process for formally withdrawing their request for either a Collection Due Process hearing or an equivalent hearing with the IRS's Independent Office of Appeals. This step is taken typically when an agreement has been reached or the taxpayer no longer needs the hearing.

- Required Information: To fill out the form properly, the taxpayer must provide their name(s), address, type of tax and tax form number, tax period(s), and their Social Security or Employer Identification Number(s). Alternatively, attaching a copy of the Collection Due Process notice received can substitute for listing these details directly on the form.

- Waiving Rights: It’s crucial to understand that withdrawing a hearing request means giving up specific rights. This includes the right to a hearing with the Appeals office, the right to seek judicial review in the Tax Court regarding the Notice of Determination, and the right to have Appeals make or retain any determinations regarding the case.

- Impact on Levy Actions and Statute of Limitations: Withdrawing a request stops the suspension of levy actions and the suspension of the statute of limitations on collection periods, which are protections normally in place while awaiting a CDP hearing.

- Preservation of Other Appeal Rights: Despite the withdrawal, taxpayers do not forfeit all appeal rights. They can still pursue appeals under different procedures, such as the Collection Appeals Program (CAP), offering alternative means to resolve disputes with the IRS.

- Completing the Process: For a withdrawal to be officially recognized, the form must be duly signed by the taxpayer, and if applicable, by the spouse and an authorized representative. The date of these signatures is essential for establishing when the withdrawal becomes effective.

It’s important for taxpayers to carefully consider the implications of withdrawing their request for a CDP or equivalent hearing. Once the IRS receives Form 12256, certain protections cease, and the agency proceeds based on the assumption that the matter is resolved or that the taxpayer will seek alternative solutions. Therefore, before submitting this form, it might be beneficial for taxpayers to consult with a tax advisor or legal professional to fully understand their situation and ensure this is the best course of action.

Popular PDF Documents

How to Pay Form 4549 Online - An official notice from the IRS detailing the results of an audit, including any adjustments to your tax return.

IRS 656-B - Successful offers lead to a binding agreement for payment, releasing taxpayers from further liability.

Do Military Pay Taxes While Deployed - Explore free tax preparation services offered by the Fort Leavenworth Tax Center, tailored for military personnel and their families.