Get Irs 12203 Form

When individuals find themselves disagreeing with proposed adjustments or changes made by the Internal Revenue Service (IRS) that amount to $25,000 or less for a particular tax year, the Form 12203, Request for Appeals Review, serves as a critical tool in challenging these decisions. This form is an avenue for taxpayers to formally request a review by the IRS Independent Office of Appeals, an entity distinctly separate from the office that initially proposed the adjustments. Completion and submission of this form is a step towards potentially avoiding the need for expensive and time-consuming court trials, as it prompts an informal conference where taxpayers can present their case. It’s significant that individuals understand the form’s sections, including taxpayer identification, periods, and specific items in disagreement, clearly articulating their reasons for the disagreement. The appeal process is not only a right but an opportunity for taxpayers to ensure fairness and accuracy in their tax assessments and responsibilities. Additionally, it is crucial to note the provision allowing for representation by an attorney, certified public accountant, or an enrolled agent, enhancing the support available to taxpayers during the appeals process. The importance of understanding and appropriately utilizing Form 12203 cannot be overstated, as it offers a pathway to rectify discrepancies and ensure that one's tax obligations are just and accurately represented.

Irs 12203 Example

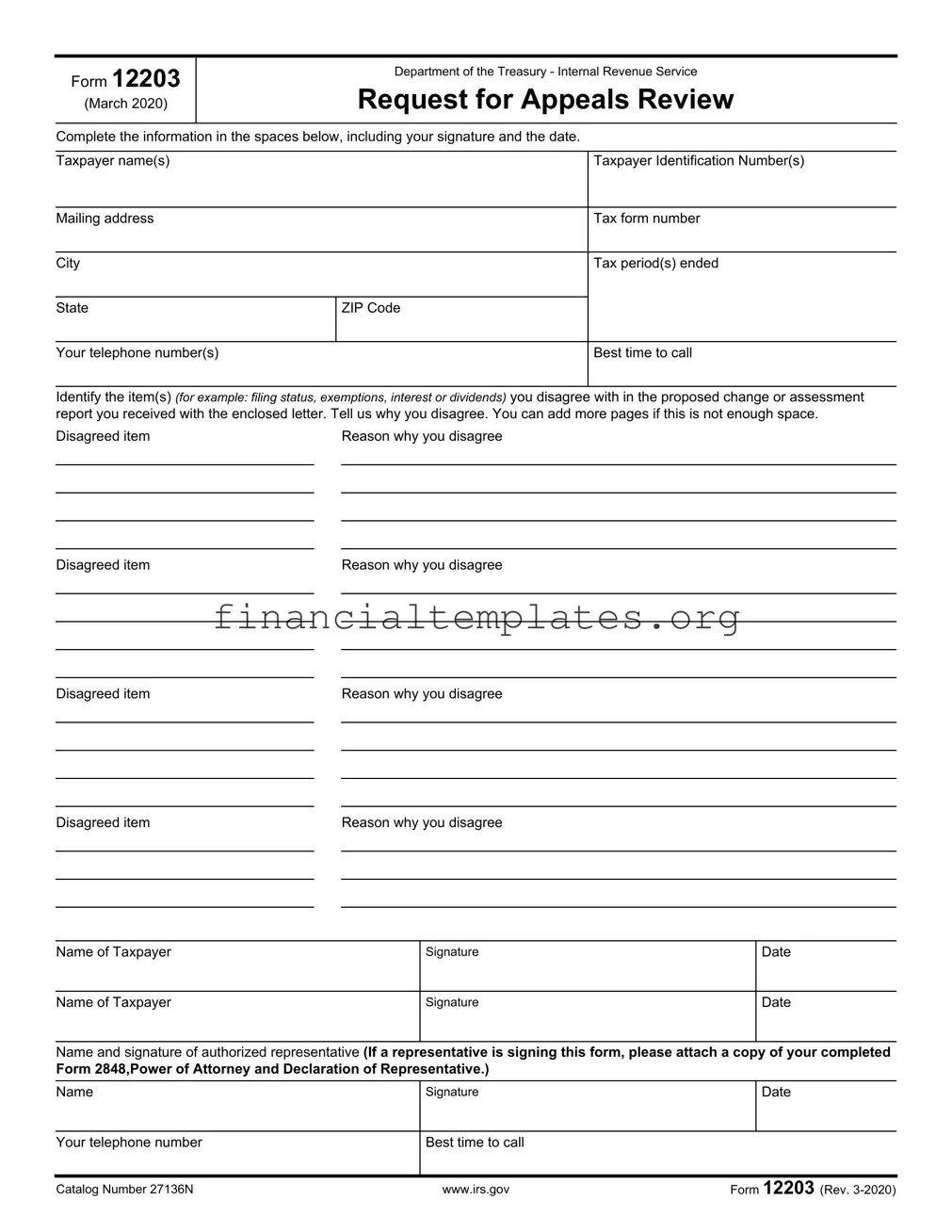

Form 12203

(March 2020)

Department of the Treasury - Internal Revenue Service

Request for Appeals Review

Complete the information in the spaces below, including your signature and the date.

Taxpayer name(s) |

Taxpayer Identification Number(s) |

Mailing address

Tax form number

City

Tax period(s) ended

State

ZIP Code

Your telephone number(s)

Best time to call

Identify the item(s) (for example: filing status, exemptions, interest or dividends) you disagree with in the proposed change or assessment report you received with the enclosed letter. Tell us why you disagree. You can add more pages if this is not enough space.

Disagreed item |

|

Reason why you disagree |

|

|

|

|

|

|

|

|

|

|

|

|

Disagreed item

Disagreed item

Disagreed item

Reason why you disagree

Reason why you disagree

Reason why you disagree

Name of Taxpayer |

Signature |

Date |

|

|

|

Name of Taxpayer |

Signature |

Date |

|

|

|

Name and signature of authorized representative (If a representative is signing this form, please attach a copy of your completed

Form 2848,Power of Attorney and Declaration of Representative.)

Name |

Signature |

Date |

|

|

|

Your telephone number |

Best time to call |

|

|

|

|

Catalog Number 27136N |

www.irs.gov |

Form 12203 (Rev. |

Purpose of this form: You can use this form to request a review in the Internal Revenue Service Independent Office of Appeals when you receive Internal Revenue Service (IRS) proposed adjustments or other changes of $25,000 or less to a tax year questioned in the IRS letter you received with this form.

When you take no action and your case involves income taxes, we will send you a formal Notice of Deficiency and bill for the amount you owe. The Notice of Deficiency allows you to go to the Tax Court and tells you the procedure to follow.

When you don't agree with the IRS proposed adjustments or changes and you have submitted all supporting information, explanations, or documents, you may:

(1)discuss the IRS findings with the person identified (or their supervisor) in the heading on the IRS letter that provided you this information; and if you can't reach agreement,

(2)appeal your case by requesting an Appeals Review.

If you want to request an Appeals Review, complete this form and return it in the envelope provided to the address in the heading of the IRS letter.

The IRS Independent Office of Appeals is independent of the IRS office proposing the action you disagree with. Appeals conferences are conducted in an informal manner. Most differences are settled in these conferences without expensive and time consuming court trials. Appeals will independently consider the reason(s) you disagree, except for moral, religious, political, constitutional, conscientious objection, or similar grounds.

You can represent yourself in Appeals. If you want to be represented by another person, the person you choose must be an attorney, a certified public accountant, or an enrolled agent authorized to practice before the IRS. If you plan to have your representative talk to us without you, we need a signed copy of a completed power of attorney (Form 2848, Power of Attorney and Declaration of Representative).

If you don't reach an agreement in Appeals, the Appeals office will send you a Notice of Deficiency. After you receive the Notice of Deficiency, you may take your case to the United States Tax Court before paying the amount due as shown on the Notice of Deficiency. If you want to proceed in the United States Court of Federal Claims or your United States District Court, see Publication 5, Your Appeal Rights and How to Prepare a Protest if You Disagree, for more information.

You can get more information about your appeal rights by visiting the IRS Internet Web Site at http://www.irs.gov or the Appeals Web Site at http://www.irs.gov/appeals. You also can order blank tax forms, schedules, instructions and publications by calling

PRIVACY ACT STATEMENT

Under the Privacy Act of 1974, we must tell you that our legal right to ask for information is Internal Revenue Code Sections 6001, 6011, 6012(a) and their regulations. They say that you must furnish us with records or statements for any tax for which you are liable, including the withholding of taxes by your employer. We ask for information to carry out the Internal Revenue laws of the United States, and you are required to give us this information. We may give the

information to the Department of Justice for civil and criminal litigation, other federal agencies, states, cities, and the District of Columbia for use in administering their tax laws. If you don't provide this information, or provide fraudulent information, the law provides that you may be charged penalties and, in certain cases, you

may be subject to criminal prosecution. We may also have to disallow the exemptions, exclusions, credits, deductions, or adjustments shown on the tax return. This could make your tax higher or delay any refund. Interest may also be charged.

Catalog Number 27136N |

www.irs.gov |

Form 12203 (Rev. |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Form 12203 is used to request a review by the IRS Independent Office of Appeals following proposed adjustments or changes to a taxpayer's account of $25,000 or less for a specific tax year. |

| Appeals Process | If a taxpayer disagrees with IRS proposed adjustments, they may first discuss findings with the IRS officer or supervisor. If no agreement is reached, the taxpayer can then request an Appeals Review using Form 12203. |

| Representation | A taxpayer can represent themselves in the Appeals process or choose to be represented by an authorized individual such as an attorney, certified public accountant, or enrolled agent. |

| Subsequent Actions | Should the Appeals process not result in an agreement, the Appeals office will issue a Notice of Deficiency, allowing the taxpayer to take the case to the United States Tax Court before the payment of the disputed amount is required. |

| Privacy Act Statement | This statement outlines the IRS’s legal authority to request information (Internal Revenue Code Sections 6001, 6011, 6012(a)), the purpose of information collection, and the possible disclosure of this information to other entities for tax administration, civil, or criminal litigation. |

Guide to Writing Irs 12203

After receiving a notice from the IRS outlining proposed adjustments or changes to your tax account, and finding yourself in disagreement with these proposals, you have the option to request an Appeals Review by using Form 12203. This form is your gateway to have your case reviewed by the IRS Independent Office of Appeals, a neutral body separate from the IRS office that made the initial findings. Filling out Form 12203 properly is crucial to proceed with your appeal. Here are clear, step-by-step instructions to ensure you complete the form accurately and thoroughly.

- Start by writing the exact name(s) as it appears on your tax documents in the "Taxpayer name(s)" section.

- Next, enter your Taxpayer Identification Number(s), which could be your Social Security Number or Employer Identification Number.

- Provide your full mailing address, including the city, state, and ZIP Code, to ensure you receive all correspondence without delay.

- Fill in the "Tax form number" field with the number of the form you used when filing the tax return in question.

- List the "Tax period(s) ended" to specify the year(s) the disagreement concerns.

- Include your telephone number(s) and indicate the best time to call, facilitating easy communication.

- Under the section asking to identify and explain your disagreement with the IRS's proposed changes or adjustments, clearly describe each item you disagree with. Specify the filing status, exemptions, interest, dividends or any other relevant item that was part of the proposed change or assessment you received.

- For each item you listed, provide a thorough explanation of why you disagree with the IRS's findings. Be as detailed as possible. Attach additional pages if the space provided is not sufficient.

- After detailing the disagreed items and reasons, sign and date the form. If you are representing another taxpayer, make sure to attach a completed Form 2848, Power of Attorney, to authenticate your authority to sign.

- If a representative is completing this form on behalf of a taxpayer, the representative must also provide their name, signature, telephone number, and indicate the best time to call.

Once you have completed Form 12203, carefully review all the information you have provided to ensure accuracy. Then, send the form back using the envelope provided with the IRS letter, or to the address indicated in the heading of that letter. By taking these steps, you are actively engaging in the process to have your case reviewed by an impartial body, potentially leading to a resolution without the need for court intervention. Remember, the goal of the appeals process is to settle differences in an informal setting, keeping the procedure as straightforward as possible for taxpayers.

Understanding Irs 12203

What is the purpose of the IRS Form 12203?

IRS Form 12203, also known as "Request for Appeals Review," is designed for taxpayers who want to contest the IRS's proposed adjustments or changes to their tax returns that are $25,000 or less for a particular tax year. This form is used to formally request a review by the Independent Office of Appeals within the IRS, offering an opportunity to settle disputes without the need for court trials.

When should you file a Form 12203?

Form 12203 should be filed after receiving a letter from the IRS that proposes adjustments or changes to your taxes that you disagree with. Before filing this form, you must have already provided all supporting information, explanations, or documents to the IRS and been unable to reach an agreement with the IRS personnel or their supervisor mentioned in the letter.

What information is needed to complete Form 12203?

To complete Form 12203, provide your name(s), Taxpayer Identification Number(s), mailing address, tax form number, tax period(s) in question, and telephone number with the best time to call. Additionally, clearly identify each item you disagree with as mentioned in the IRS letter and explain your reasons for disagreement. You may attach more pages if necessary. If you are represented by someone else, include their name, signature, and the date, accompanied by a completed Form 2848 (Power of Attorney and Declaration of Representative).

Can you represent yourself when filing Form 12203?

Yes, you can choose to represent yourself during the Appeals process. Alternatively, if you prefer to have representation, you may be represented by an attorney, a certified public accountant, or an enrolled agent authorized to practice before the IRS. If your representative will communicate with the IRS on your behalf without you being present, a signed and completed Form 2848 is required.

How do you submit Form 12203?

Submit Form 12203 by mailing it to the address provided in the header of the IRS letter that accompanied the form. Ensure that all required information and signatures are included to avoid processing delays.

What happens after you send in Form 12203?

Once submitted, the Independent Office of Appeals will review your case. This office functions independently of the IRS office that proposed the initial changes. The Appeals Office will consider your reasons for disagreement (excluding issues based on moral, religious, political, constitutional, and similar grounds) and work towards resolving the dispute. If an agreement cannot be reached, the Appeals Office will issue a Notice of Deficiency, providing the opportunity to take the case to the United States Tax Court before any payment is due.

What are your options if you disagree with the Appeals Office decision?

If you disagree with the decision made by the Appeals Office, upon receiving a Notice of Deficiency, you have the option to challenge the decision in the United States Tax Court before making any payment on the disputed amount. For disputes wishing to be heard in the United States Court of Federal Claims or your United States District Court, refer to Publication 5 for further details on preparing a protest.

Where can you get more information about your appeal rights or other IRS forms?

For more details on your appeal rights or to access other IRS forms, schedules, instructions, and publications, visit the IRS website at http://www.irs.gov or the Appeals web page directly at http://www.irs.gov/appeals. Information can also be requested by calling 1-800-829-3676. For IRS Tax Fax Services, the direct line is (703) 487-4160.

Common mistakes

Filling out IRS Form 12203, also known as the Request for Appeals Review, requires attention to detail and an understanding of the process. Sadly, many people make errors that could affect the outcome of their appeal. Here are six common mistakes to avoid:

Not providing detailed reasons for the disagreement: It is crucial to clearly explain why you disagree with each proposed change or assessment. Vague explanations or overlooking this step can lead to your appeal being overlooked or denied.

Omitting relevant information: Each field in the form asks for specific information, such as taxpayer identification numbers and tax period(s) ended. Missing data can lead to delays or the inability of the IRS to properly process your request.

Failure to sign the form: An unsigned form is considered invalid and will not be processed. Both the taxpayer and the authorized representative (if applicable) must sign the form.

Using incorrect or outdated forms: The IRS periodically updates its forms. Submitting an outdated version of Form 12203 can result in delays or require re-submission.

Not attaching necessary documentation: If a representative is signing the form on behalf of the taxpayer, a completed Form 2848 (Power of Attorney and Declaration of Representative) must be attached. Failure to include necessary documentation can stall the appeals process.

Ignoring required fields: Every field on the form should be completed unless specified otherwise. Skipping fields because they seem irrelevant can lead to an incomplete form submission and potential processing issues.

Understanding and avoiding these common mistakes can greatly improve the chances of a successful appeal. It's also advisable to review the form carefully and ensure all information is accurate and complete before submission.

Documents used along the form

When dealing with the IRS and the complexities of tax disputes, it's crucial to have a comprehensive understanding of the documents and forms that might be involved in the process. The IRS Form 12203, a Request for Appeals Review, serves as a stepping stone for taxpayers who disagree with proposed changes to their taxes and seek an independent review. However, this form doesn't stand alone in the battle for a fair tax assessment. A spectrum of other forms and documents often accompany Form 12203 to ensure a well-rounded and thorough appeals process.

- Form 2848, Power of Attorney and Declaration of Representative: This form allows taxpayers to authorize an individual (such as an attorney, CPA, or enrolled agent) to represent them before the IRS, making it essential if the taxpayer won't be representing themselves.

- Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals: This document might be necessary when proving financial hardship or when setting up a payment plan with the IRS.

- Form 656, Offer in Compromise: Used when the taxpayer wishes to settle their tax debt for less than the full amount owed, this form is crucial for negotiating tax debt resolutions.

- Form 8857, Request for Innocent Spouse Relief: If seeking relief from joint tax liabilities due to actions of the other spouse, this form is submitted to make such a request.

- Publication 5, Your Appeal Rights and How to Prepare a Protest if You Disagree: Provides detailed information on the appeals process and how to prepare for it, making it a critical resource for understanding one’s rights and the necessary steps for a successful appeal.

- Form 1040, U.S. Individual Income Tax Return: While not directly part of the appeals process, the original tax return(s) in question are often referenced throughout the dispute.

- Form 4564, Information Document Request: The IRS may issue this form to request additional information from the taxpayer to support their case during the review process.

- Notice of Deficiency: Not a form but a document sent by the IRS indicating the proposed changes to a taxpayer's return and the amount owed. This notice is what often triggers the decision to file a Form 12203.

- Form 9423, Collection Appeal Request: If the dispute involves collection actions taken by the IRS, this form can be used to request an appeal of actions such as liens, levies, or seizures.

Navigating the tax appeals process can be daunting, filled with specific procedures and a variety of forms and documents. Understanding each document's purpose and how they interrelate can provide a strategic advantage in resolving tax disputes. The ultimate goal is to ensure that all taxpayers can confidently engage with the IRS, armed with the knowledge and tools needed to secure a fair and just assessment of their tax obligations.

Similar forms

The Form 2848, Power of Attorney and Declaration of Representative, is analogous to the IRS 12203 form in its requirement for taxpayer representation. Form 2848 is employed when taxpayers need to authorize an individual, such as an attorney, Certified Public Accountant (CPA), or enrolled agent, to represent them before the IRS. This similarity lies in the authorization process, where both forms necessitate a formal declaration of representation, albeit for different contexts. Form 12203 allows for an appeal process, whereas Form 2848 specifies who can communicate with the IRS on the taxpayer’s behalf.

Another related document is the Notice of Deficiency, a formal declaration issued by the IRS to inform a taxpayer about the discrepancy in their tax return and the intention to assess additional taxes. While not a form that taxpayers fill out, the Notice of Deficiency is closely tied to Form 12203's function, serving as a pivotal document that can prompt taxpayers to seek an Appeals Review via Form 12203 to contest the IRS's findings. Both documents are integral steps in the dispute resolution process between taxpayers and the IRS.

The Publication 5, "Your Appeal Rights and How to Prepare a Protest if You Disagree," shares a purposeful connection with Form 12203. It guides taxpayers on how to appeal against IRS decisions, offering detailed instructions and procedures much like those summarized in Form 12203. While Publication 5 serves as an informational guide to enlighten taxpayers about their rights and the appeals process, Form 12203 is the practical application of these rights, allowing taxpayers to formally request an Appeals Review.

The U.S. Tax Court Petition Form is another document that comes into play for taxpayers who decide to contest an IRS decision judicially. After receiving a Notice of Deficiency and failing to reach an agreement through the Appeals process facilitated by Form 12203, taxpayers may take their case to the U.S. Tax Court. This progression illustrates a direct relationship between Form 12203’s appeals process and the subsequent legal avenue available to taxpayers, emphasizing the judicial steps following administrative appeal efforts.

Form 1040, U.S. Individual Income Tax Return, while primarily for filing annual income tax returns, is indirectly related to Form 12203 through its potential to trigger the dispute process. Discrepancies or audits stemming from information reported on Form 1040 can lead to the issuance of proposed changes by the IRS, which in turn, may necessitate the use of Form 12203 to request an appeal. This connection underscores how initial tax filing activities can subsequently intertwine with the appeals process detailed in Form 12203.

Dos and Don'ts

When filling out the IRS Form 12203, it's crucial to approach it with attention to detail and a clear understanding of what is required. Below are guidelines that can substantially increase the likelihood of a favorable outcome.

Things You Should Do:

- Review All Documentation: Before you begin filling out the form, ensure you have all relevant tax documents and the IRS letter proposing adjustments at hand. This helps in providing accurate information and supporting your disagreement effectively.

- Clearly Identify Disagreed Items: Clearly specify which items you are disputing from the IRS's proposed changes. Being specific helps the IRS understand exactly what your appeal is about.

- Provide Detailed Explanations: For each item you disagree with, offer a detailed reason why. The more information you give about why you think the proposed change is incorrect, the better the IRS can understand your perspective.

- Include Additional Documentation: If you have further evidence or documents that support your case, don't hesitate to include them. Additional pages or documentation can be crucial in making your case stronger.

Things You Shouldn't Do:

- Delay Submitting Your Form: It's important to return the completed form promptly. Waiting too long can result in the IRS moving forward with the proposed changes, leaving you with fewer options to appeal.

- Omit Signature and Date: Failing to sign or date the form can lead to it being returned to you unprocessed. Make sure both the taxpayer's and, if applicable, the authorized representative's signatures and dates are included.

- Ignore the Power of Attorney Attachment If Applicable: If you're being represented by someone, forgetting to attach Form 2848, Power of Attorney and Declaration of Representative, can result in unnecessary delays or complications in your appeal.

- Include Irrelevant Arguments: While it's crucial to explain why you disagree with the IRS's findings, avoid including emotional, speculative, or irrelevant reasons. Focus solely on factual and relevant arguments to strengthen your appeal.

Misconceptions

Many misconceptions exist about IRS Form 12203, also known as the Request for Appeals Review. Here are seven common ones explained:

Form 12203 is used to initiate a tax refund. This is incorrect. The form is actually used to request an appeals review if you disagree with the IRS proposed adjustments or other changes to your tax return that are $25,000 or less for a specific tax year.

Anyone can fill out Form 12203 on behalf of the taxpayer. This isn't true. Only the taxpayer, or their authorized representative who has a completed Form 2848 (Power of Attorney and Declaration of Representative), can submit this form.

You must agree with the IRS's findings before submitting Form 12203. This statement is incorrect. In fact, this form is specifically for taxpayers who disagree with the IRS's proposed adjustments or changes and have already submitted all supporting information, documents, or explanations.

Filing Form 12203 will automatically lead to a court trial. This is a misconception. The purpose of the form is to request an appeals review, which is a step taken to avoid court trials. Most disputes are resolved during these informal appeals conferences.

The IRS Independent Office of Appeals is part of the office proposing the action. Actually, the IRS Independent Office of Appeals is independent of any IRS office that is proposing adjustments or changes. Their reviews are conducted in an unbiased manner.

Filing Form 12203 costs money. This belief is false. There is no fee to submit a request for an Appeals Review.

The form can only be sent by mail. This is not accurate. While the form along with any supporting documents is commonly sent through the mail in the provided envelope, taxpayers should verify the most current submission methods by contacting the IRS or checking the IRS website, as electronic submission options may be available.

It's crucial for taxpayers to understand the correct use and process of Form 12203 to effectively navigate their rights and options when dealing with the IRS.

Key takeaways

When you disagree with an IRS proposed adjustment or other changes related to your taxes, Form 12203 enables you to request a review by the Independent Office of Appeals. The form serves as a structured avenue for taxpayers to formally contest IRS determinations that they believe are incorrect, without immediately resorting to legal action. Here are eight critical takeaways you need to know:

- The form is specifically designed for disputes involving IRS proposed adjustments or changes of $25,000 or less for a given tax year.

- Before considering an appeals review, it's suggested that taxpayers first attempt to resolve their issues directly with the IRS representative or their supervisor who issued the adjustments.

- If an agreement cannot be reached directly with the IRS, submitting Form 12203 initiates the appeals process, engaging the Independent Office of Appeals, which operates separately from the office that made the initial adjustment proposal.

- Appeals conferences, where disputes are reviewed, are conducted informally, aiming to resolve disagreements without the need for costly and lengthy court trials.

- It's important for taxpayers to accurately complete all sections of the form, providing detailed reasons for their disagreement with the IRS's proposed adjustments. This includes specifying the items disputed and why.

- If a taxpayer chooses to be represented by someone else during the appeals process, the representative must be an attorney, a certified public accountant, or an enrolled agent who is authorized to practice before the IRS. In such cases, a completed Form 2848, Power of Attorney and Declaration of Representative, must accompany Form 12203.

- In situations where no resolution is found through the appeals process, the Appeals Office will issue a Notice of Deficiency. Taxpayers then have the option to take their case to the United States Tax Court before the amount due is paid.

- Additional information about the appeal process and taxpayer rights can be found on the IRS’s official website or by consulting IRS Publication 5, which offers guidance on how to prepare a protest if you disagree with an IRS decision.

Understanding your rights and the available procedures for contesting IRS decisions is paramount in ensuring fair tax administration. Form 12203 provides a formal pathway for taxpayers to appeal IRS determinations, aiming for a resolution that is just and reasonable without resorting to litigation.

Popular PDF Documents

Schedule B 941 Form 2023 - Used to adjust contributions to social security and Medicare for both employer and employee.

Lancaster County Tax Collection Bureau - A clear layout for reporting income, deductions, and tax liability simplifies the filing process, making it easier for residents to comply with tax obligations.