Get IRS 12153 Form

Dealing with tax issues can often feel like navigating through a labyrinth, where each turn introduces a new challenge. At the heart of resolving disputes with the IRS is a critical tool: the IRS 12153 form. This form serves as a request for a Collection Due Process (CDP) or Equivalent Hearing with the IRS. It's paramount for individuals facing tax liens or levies as it opens the door to dispute the IRS's claim before any collection actions proceed. With its ability to halt collection efforts temporarily, the form provides taxpayers a vital chance to present their case, whether it's questioning the amount owed, the collection process itself, or proposing alternative solutions like installment plans. Understanding the intricacies of the form, from when and how to file it, to navigating the subsequent hearing process, is crucial for anyone looking to challenge the IRS effectively. This form is not just paperwork; it's a lifeline for those under the strain of tax disputes, offering a structured path to potentially resolve conflicts with one of the most formidable agencies.

IRS 12153 Example

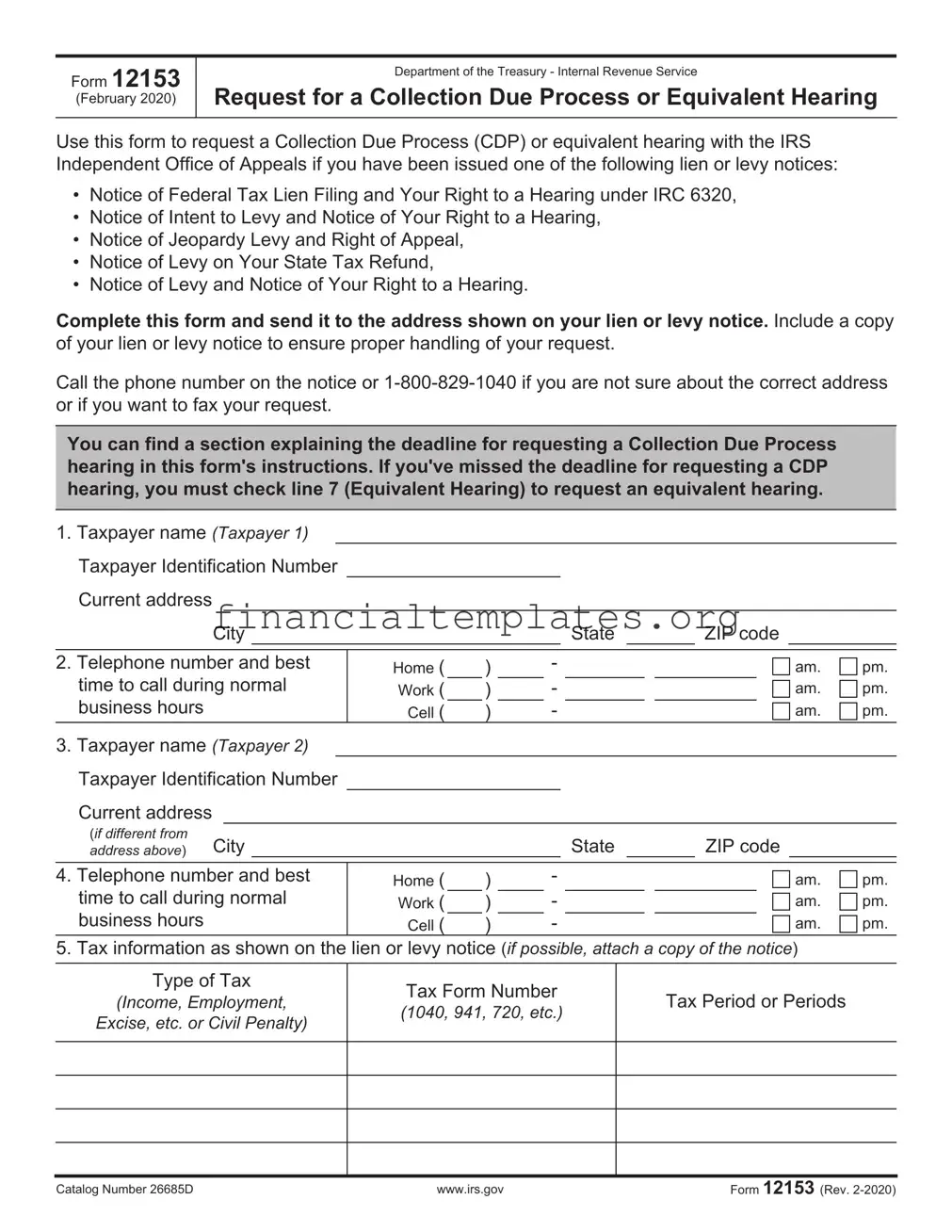

Form 12153

(February 2020)

Department of the Treasury - Internal Revenue Service

Request for a Collection Due Process or Equivalent Hearing

Use this form to request a Collection Due Process (CDP) or equivalent hearing with the IRS Independent Office of Appeals if you have been issued one of the following lien or levy notices:

•Notice of Federal Tax Lien Filing and Your Right to a Hearing under IRC 6320,

•Notice of Intent to Levy and Notice of Your Right to a Hearing,

•Notice of Jeopardy Levy and Right of Appeal,

•Notice of Levy on Your State Tax Refund,

•Notice of Levy and Notice of Your Right to a Hearing.

Complete this form and send it to the address shown on your lien or levy notice. Include a copy of your lien or levy notice to ensure proper handling of your request.

Call the phone number on the notice or

You can find a section explaining the deadline for requesting a Collection Due Process hearing in this form's instructions. If you've missed the deadline for requesting a CDP hearing, you must check line 7 (Equivalent Hearing) to request an equivalent hearing.

1.Taxpayer name (Taxpayer 1) Taxpayer Identification Number Current address

|

|

City |

|

|

|

|

|

|

State |

|

ZIP code |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Telephone number and best |

Home ( |

) |

- |

|

|

|

|

|

|

|

am. |

pm. |

||||||

|

time to call during normal |

Work ( |

|

) |

|

- |

|

|

|

|

|

|

|

am. |

pm. |

||||

|

business hours |

|

|

|

|

Cell ( |

|

) |

|

- |

|

|

|

|

|

|

|

am. |

pm. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

3. |

Taxpayer name (Taxpayer 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Taxpayer Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Current address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(if different from |

City |

|

|

|

|

|

|

State |

|

ZIP code |

|

|||||||

|

address above) |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Telephone number and best |

Home ( |

) |

- |

|

|

|

|

|

|

|

am. |

pm. |

||||||

|

time to call during normal |

Work ( |

|

) |

|

- |

|

|

|

|

|

|

|

am. |

pm. |

||||

|

business hours |

|

|

|

|

Cell ( |

|

) |

|

- |

|

|

|

|

|

|

|

am. |

pm. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

5. |

Tax information as shown on the |

lien or levy notice (if possible, attach a copy of the notice) |

|

||||||||||||||||

Type of Tax

(Income, Employment,

Excise, etc. or Civil Penalty)

Tax Form Number

(1040, 941, 720, etc.)

Tax Period or Periods

Catalog Number 26685D |

www.irs.gov |

Form 12153 (Rev. |

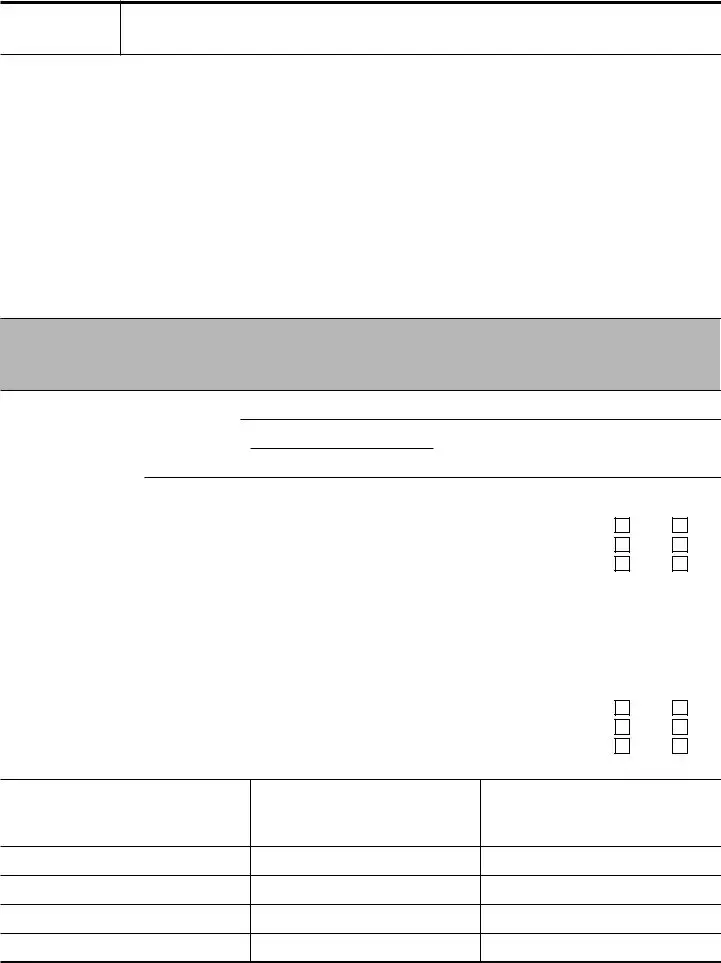

Page 2

6.Basis for hearing request (both boxes can be checked if you have received both a lien and levy notice)

Filed Notice of Federal Tax Lien |

Proposed Levy or Actual Levy |

7.Equivalent Hearing (see the instructions for more information on Equivalent Hearings)

I would like an Equivalent Hearing - I would like a hearing equivalent to a CDP Hearing if my request for a CDP hearing does not meet the requirements for a timely CDP Hearing.

8.Check the most appropriate box for the reason you disagree with the filing of the lien or the levy. See page 4 of this form for examples. You can add more pages if you don't have enough space.

If, during your CDP Hearing, you think you would like to discuss a Collection Alternative to the action proposed by the Collection function it is recommended you submit a completed Form 433A (Individual) and/or Form 433B (Business), as appropriate, with this form. See www.irs.gov for copies of the forms. Generally, the IRS Independent Office of Appeals will ask the Collection Function to review, verify and provide their opinion on any new information you submit. We will share their comments with you and give you the opportunity to respond.

Collection alternative |

Installment Agreement |

Offer in Compromise |

I Cannot Pay Balance |

Lien |

Subordination |

Discharge |

Withdrawal |

Explain |

|

|

|

My spouse is responsible  Innocent Spouse Relief (attach Form 8857, Request for Innocent Spouse

Innocent Spouse Relief (attach Form 8857, Request for Innocent Spouse

Relief, to your request)

Other (for examples, see page 4)

Reason (you must provide a reason for the dispute or your request for a CDP hearing will not be honored. Use as much space as you need to explain the reason for your request. Attach extra pages if necessary)

9. Signatures

I understand the CDP hearing and any subsequent judicial review will suspend the statutory period of limitations for collection action. I also understand my representative or I must sign and date this request before the IRS Independent Office of Appeals can accept it. If you are signing as an officer of a company, add your title (president, secretary, etc.) behind your signature.

SIGN HERE |

Taxpayer 1's signature |

Date

Taxpayer 2's signature (if a joint request, both must sign)

Date

I request my CDP hearing be held with my authorized representative (attach a copy of Form 2848)

Authorized Representative's signature |

Authorized Representative's name |

Telephone number |

|

|

|

IRS Use Only

IRS employee (print) |

Employee telephone number |

IRS received date |

|

|

|

Catalog Number 26685D |

www.irs.gov |

Form 12153 (Rev. |

Page 3

Information You Need To Know When Requesting A Collection Due Process Hearing

What Is the Deadline for Requesting a Timely Collection Due Process (CDP) Hearing?

•Your request for a CDP hearing about a Federal Tax Lien filing must be postmarked by the date indicated in the Notice of Federal Tax Lien Filing and Your Right to a Hearing under IRC 6320 (lien notice).

•Your request for a CDP hearing about a levy must be postmarked within 30 days after the date of the Notice of Intent to Levy and Notice of Your Right to a Hearing (levy notice) or Notice of Your Right to a Hearing After an Actual Levy.

Your timely request for a CDP hearing will prohibit levy action in most cases. A timely request for CDP hearing will also suspend the

You can go to court to appeal the CDP determination the IRS Independent Office of Appeals makes about your disagreement.

What Is an Equivalent Hearing?

If you still want a hearing with the IRS Independent Office of Appeals after the deadline for requesting a timely CDP hearing has passed, you can use this form to request an equivalent hearing. You must check the Equivalent Hearing box on line 7 of the form to request an equivalent hearing. An equivalent hearing request does not prohibit levy or suspend the

•Lien

•Levy

•Your request for a CDP levy hearing, whether timely or Equivalent, does not prohibit the Service from filing a Notice of Federal Tax Lien.

Where Should You File Your CDP or Equivalent Hearing Request?

File your request by mail at the address on your lien notice or levy notice. You may also fax your request. Call the telephone number on the lien or levy notice to ask for the fax number. Do not send your CDP or equivalent hearing request directly to the IRS Independent Office of Appeals, it must be sent to the address on the lien or levy notice. If you send your request directly to Appeals it may result in your request not being considered a timely request. Depending upon your issue the originating function may contact you in an attempt to resolve the issue(s) raised in your request prior to forwarding your request to Appeals.

Where Can You Get Help?

You can call the telephone number on the lien or levy notice with your questions about requesting a hearing. The contact person listed on the notice or other representative can access your tax information and answer your questions.

In addition, you may qualify for representation by a

If you are experiencing economic harm, the Taxpayer Advocate Service (TAS) may be able to help you resolve your problems with the IRS. TAS cannot extend the time you have to request a CDP or equivalent hearing. See Publication 594, The IRS Collection Process, or visit

You can get copies of tax forms, schedules, instructions, publications, and notices at www.irs.gov, at your local IRS office, or by calling

Catalog Number 26685D |

www.irs.gov |

Form 12153 (Rev. |

Page 4

What Are Examples of Reasons for Requesting a Hearing?

You will have to explain your reason for requesting a hearing when you make your request. Below are examples of reasons for requesting a hearing.

You want a collection alternative— “I would like to propose a different way to pay the money I owe.” Common collection alternatives include:

•Full

•Installment

•Offer in

“I cannot pay my taxes.” Some possible reasons why you cannot pay your taxes are: (1) you have a terminal illness or excessive medical bills; (2) your only source of income is Social Security payments, welfare payments, or unemployment benefit payments; (3) you are unemployed with little or no income; (4) you have reasonable expenses exceeding your income; or (5) you have some other hardship condition. The IRS Independent Office of Appeals may consider freezing collection action until your circumstances improve. Penalty and interest will continue to accrue on the unpaid balance.

You want action taken about the filing of the tax lien against your

When you request lien subordination, you are asking the IRS to make a Federal Tax Lien secondary to a

When you request a lien discharge, you are asking the IRS to remove a Federal Tax Lien from a specific property. For example, you may ask for a discharge of the Federal Tax Lien in order to sell your house if you use all of the sale proceeds to pay your taxes even though the sale proceeds will not fully pay all of the tax you owe.

When you request a lien withdrawal, you are asking the IRS to remove the Notice of Federal Tax Lien (NFTL) information from public records because you believe the NFTL should not have been filed. For example, you may ask for a withdrawal of the filing of the NFTL if you believe the IRS filed the NFTL prematurely or did not follow procedures, or you have entered into an installment agreement and the installment agreement does not provide for the filing of the NFTL. A withdrawal does not remove the lien from your IRS records.

Your spouse is

Other

“I do not believe I should be responsible for penalties.” The IRS Independent Office of Appeals may remove all or part of the penalties if you have a reasonable cause for not paying or not filing on time. See Notice 746, Information About Your Notice, Penalty and Interest for what is reasonable cause for removing penalties.

“I have already paid all or part of my taxes.” You disagree with the amount the IRS says you haven't paid if you think you have not received credit for payments you have already made.

See Publication 594, The IRS Collection Process, for more information on the following topics: Installment Agreements and Offers in Compromise; Lien Subordination, Discharge, and Withdrawal; Innocent Spouse Relief; Temporarily Delay Collection; and belief that tax bill is wrong.

Catalog Number 26685D |

www.irs.gov |

Form 12153 (Rev. |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of IRS Form 12153 | The form is used to request a Collection Due Process (CDP) or Equivalent Hearing with the Internal Revenue Service regarding a levy or lien. |

| Who Needs to File | Individuals or businesses that have received a Notice of Federal Tax Lien or a Notice of Intent to Levy and wish to challenge the IRS's decision. |

| Timeframe for Filing | The form must be filed within 30 days of the date on the notice to request a CDP hearing. An Equivalent Hearing can be requested within one year if the 30-day window is missed. |

| Key Sections to Complete | Identifying information, the type of tax and period, the collection action being disputed, and the reason for disagreeing with the action. |

| Impact of Filing | Filing the form halts collection actions until the hearing is concluded, except under specific circumstances where the collection is under jeopardy. |

| Governing Law | IRS Form 12153 is governed by federal tax law, specifically under the provisions relating to taxpayer rights and the collection process. |

| Outcome Possibilities | The hearing could lead to an agreement with the IRS, placement into a different collection process, or a determination that can be appealed in a U.S. Tax Court. |

Guide to Writing IRS 12153

Filling out the IRS 12153 form is crucial for individuals seeking a Collection Due Process (CDP) or Equivalent Hearing. This form serves as a formal request for a hearing with the Office of Appeals, giving individuals the opportunity to explain their position regarding the tax issue at hand. The completion of this form is the first step in the process to potentially resolve tax disputes. Once submitted, the IRS reviews the request, and the individual will be contacted to schedule the hearing. It's important to provide accurate information to avoid unnecessary delays.

Steps to Fill Out IRS Form 12153:

- Begin by entering your personal information, including your full name and Social Security Number (SSN) or Employer Identification Number (EIN). If filing jointly, include your spouse’s name and SSN.

- Provide your current mailing address, including the city, state, and ZIP code, to ensure you receive all correspondence from the IRS.

- Indicate the tax form number related to the disputed tax (for example, Form 1040 for individual income tax) and the tax period(s) in question.

- Specify the type of tax and the amount in dispute, if known. This helps the IRS understand the scope of the disagreement.

- Check the box that corresponds to your reason for requesting the hearing. Options include levy, lien, or other issues such as spousal defense or rejection or termination of an installment agreement.

- If applicable, provide a concise explanation of your issue or dispute in the space provided. This is your opportunity to briefly state your case and why you disagree with the IRS’s action or decision.

- Sign and date the form, certifying that the information provided is accurate to the best of your knowledge. If you’re filing jointly, your spouse must also sign and date the form.

- Review the form for completeness and accuracy. Missing or incorrect information can lead to delays in the processing of your request.

- Mail the completed form to the address provided in your IRS notice. If no address is provided, refer to the IRS website or contact the IRS for guidance on where to send your form.

After submitting the form, expect to receive a written confirmation from the IRS acknowledging receipt of your request. It’s important to keep a copy of your completed form and any correspondence from the IRS for your records. Patience is necessary as the review process can take some time. Be prepared to provide additional information if requested and to actively participate in your scheduled hearing to advocate for your position.

Understanding IRS 12153

-

What is the IRS Form 12153 and who needs to fill it out?

The IRS Form 12153 is a request for a Collection Due Process (CDP) or Equivalent Hearing. It's designed for taxpayers who have received a Notice of Federal Tax Lien Filing or a Notice of Intent to Levy from the IRS. If you disagree with the IRS's decision to levy your property or file a lien against your property, filling out this form allows you to request a hearing to present your case. This form gives taxpayers a chance to discuss with the IRS alternative solutions to resolve their tax liabilities, such as an installment agreement or an offer in compromise.

-

How can someone obtain the IRS Form 12153?

You can obtain IRS Form 12153 from the IRS website by downloading it directly. Additionally, you can request a copy by calling the IRS or visiting a local IRS office. It's important to ensure you are using the most current version of the form to avoid any processing delays.

-

What information is required when filling out Form 12153?

To complete IRS Form 12153, you will need to provide your full name, your Social Security Number (SSN) or Employer Identification Number (EIN), your current address, and the tax period(s) or year(s) in question. Furthermore, you'll need to specify the type of tax and the type of notice you received. It's also necessary to explain why you disagree with the IRS's action and to detail any proposed solutions you might have. Finally, signing and dating the form is crucial for it to be processed.

-

Where should IRS Form 12153 be sent once completed?

The completed IRS Form 12153 should be sent to the IRS office as directed in the notice you received. The specific address can vary depending on the nature of your case and your geographical location. It's crucial to send the form to the correct address to ensure it's processed efficiently and to prevent any delays in scheduling your hearing.

-

What happens after submitting Form 12153?

After submitting Form 12153, the IRS will review your request and determine if you are eligible for a CDP hearing. If eligible, you will receive a notice scheduling your hearing. This process may take some time, depending on the IRS's workload and the complexities involved in your case. At the hearing, you'll have the opportunity to discuss your situation, propose solutions, and challenge the proposed IRS action. If you disagree with the outcome of the CDP hearing, you have the right to appeal the decision in court.

Common mistakes

Filling out the IRS 12153 form, which is the Request for a Collection Due Process or Equivalent Hearing, is a critical step for taxpayers seeking to challenge or appeal certain IRS decisions. Here are ten common mistakes to be aware of:

- Not checking the correct type of tax - Taxpayers often miss selecting the appropriate box for the type of tax under dispute, which can lead to unnecessary delays in processing their request.

- Failing to specify the tax period - It's essential to clearly indicate the specific tax period or periods in question. Vague or missing information can complicate the appeal process.

- Using an outdated form - The IRS updates its forms regularly. Submitting an outdated version of form 12153 may result in the request being rejected.

- Omitting contact information - Detailed and current contact information is crucial to ensure that the IRS can reach the taxpayer for any clarifications or updates regarding their case.

- Not stating a reason for the request - A taxpayer must specify the reason for their hearing request. Failing to do so can lead to the application being considered incomplete.

- Skipping the representation section - If taxpayers are being represented by a third party, they must fill this part accurately. Incorrect representation information can impede communication.

- Missing signatures and dates - The form is not valid without the taxpayer's signature and the date signed. This simple oversight is a common mistake.

- Not providing supporting documentation - While not always mandatory, attaching relevant supporting documents can significantly strengthen the taxpayer's case.

- Ignoring deadlines - There are strict deadlines for when this form can be submitted in relation to the IRS's notice of intent to levy. Missing these deadlines can forfeit the right to a hearing.

- Failing to make copies - Taxpayers should always keep a copy of the submitted form and any attached documents for their records. Not having a copy can complicate matters if the IRS claims they never received the original submission.

It's essential for taxpayers to carefully review all sections of the IRS 12153 form and ensure accuracy to avoid these common pitfalls. By paying attention to detail and following the instructions closely, taxpayers can effectively navigate the process of requesting a Collection Due Process hearing.

Documents used along the form

The IRS Form 12153, Request for a Collection Due Process or Equivalent Hearing, is a pivotal document for taxpayers seeking relief or to contest the IRS's decision to levy or place a lien on their assets. This form is often the foundation for dialogues between the taxpayer and the IRS, aiming to resolve disputes over tax liabilities in a manner equitable to both parties. In conjunction with Form 12153, several other forms and documents are frequently used to ensure a comprehensive approach to addressing tax issues. Each document plays a unique role in the process, from substantiating the taxpayer's financial situation to formalizing agreements with the IRS.

- Form 433-A (OIC) - Collection Information Statement for Wage Earners and Self-Employed Individuals: This form provides the IRS with detailed information about the taxpayer's financial situation. It is essential for those seeking to set up payment plans or offer in compromise.

- Form 433-B (OIC) - Collection Information Statement for Businesses: Similar to Form 433-A but tailored for businesses, offering the IRS insight into the business's finances to facilitate tax resolution strategies.

- Form 2848 - Power of Attorney and Declaration of Representative: This authorizes a designated individual, such as an attorney or CPA, to represent the taxpayer in dealings with the IRS, allowing for more nuanced negotiations and advocacy on behalf of the taxpayer.

- Form 656 - Offer in Compromise: A form used by taxpayers to propose a settlement to the IRS that is less than the full amount owed, based on doubt as to liability, doubt as to collectibility, effective tax administration, or a combination of these.

- Form 9465 - Installment Agreement Request: For taxpayers unable to pay their tax debt immediately, this form requests a payment plan that fits their financial situation, allowing them to pay over time.

- Form 8379 - Injured Spouse Allocation: This form can be necessary when a tax refund expected by a married taxpayer filing jointly is applied to a past-due obligation of the other spouse. It allows the "injured" spouse to claim their portion of the refund.

- Form 8857 - Request for Innocent Spouse Relief: Offers relief by separating the tax liabilities, interest, and penalties from a spouse or former spouse if it is found to be unfair to hold one liable for the tax obligations recorded on a joint return.

- Form 4506-T - Request for Transcript of Tax Return: Used to request a transcript of previously filed tax returns, which is often necessary for preparing accurate financial statements and applications.

- Form 1040-X - Amended U.S. Individual Income Tax Return: For taxpayers who need to amend their tax returns after discovering errors or missing information, this form is crucial for correcting such mistakes and potentially affecting the outcome of tax disputes.

- Notice of Federal Tax Lien - A document the IRS files with local or state authorities to alert creditors that the government has a legal right to a taxpayer's property. While not a form, it is a critical document related to the process initiated by Form 12153.

Together, these documents form a toolkit that taxpayers and their representatives can use to navigate the complexities of resolving tax liabilities. Each document serves to provide essential information, propose solutions, or establish representative authority in discussions with the IRS. Proper understanding and management of these forms can significantly affect the outcome of tax disputes, offering pathways to resolution that consider the taxpayer's financial reality and legal rights.

Similar forms

The IRS 12153 form is a Request for a Collection Due Process or Equivalent Hearing, used when a taxpayer disagrees with the IRS over certain collection actions. Similar to this form, the IRS Form 843, Claim for Refund and Request for Abatement, allows taxpayers to request a refund or ask for an abatement of certain taxes, penalties, fees, or interest. Both forms are used by taxpayers to challenge or adjust tax liabilities, but while the IRS 12153 is specific to collection actions, Form 843 is broader, covering refunds and abatements for reasons beyond collections.

Another document akin to the IRS 12153 form is the Form 656, Offer in Compromise. This form enables taxpayers to settle their tax debt for less than the full amount owed if they can prove paying the full debt would cause financial hardship. Both forms offer solutions for individuals struggling with tax obligations, but while the 12153 form requests a hearing to contest collection actions, the Form 656 proposes a financial settlement to resolve tax debt.

The IRS Form 9465, Installment Agreement Request, shares similarities with the IRS 12153 form as well. Taxpayers use Form 9465 to request a monthly payment plan for paying off their tax debt over time. While both forms provide taxpayers means to manage or contest their tax liabilities, Form 9465 is specifically for setting up payment plans, whereas the 12153 form is for disputing collection actions before they commence.

Form 12277, Application for Withdrawal of Filed Notice of Federal Tax Lien, resembles the IRS 12153 form in that it offers taxpayers a way to address liens placed on their property due to tax debts. Both forms are part of the process to mitigate the impacts of tax collection actions. However, while the 12153 form is for requesting a hearing to object to such collection efforts, Form 12277 is specifically for removing a public record of a tax lien.

The Collection Information Statement for Wage Earners and Self-Employed Individuals, using Form 433-A, is another document similar to the IRS 12153 form. It is utilized by the IRS to gather financial information from taxpayers to determine their ability to pay tax debt. Both documents are integral to resolving tax debt situations, but Form 433-A is focused on assessing financial status, whereas the 12153 form pertains to the legal right to contest or question collection attempts.

The IRS Form 2848, Power of Attorney and Declaration of Representative, while serving a different core purpose, is similar to the IRS 12153 form in its procedural aspect. It allows taxpayers to authorize an individual, such as a lawyer or accountant, to represent them in dealings with the IRS, including collection issues that might be contested via the 12153 form. Both forms are essential for navigating tax disputes, but Form 2848 deals with representation in general IRS matters, not just collection hearings.

The Innocent Spouse Relief Request, facilitated through Form 8857, shares a connection with the IRS 12153 form by providing taxpayers a means to seek relief from joint tax liabilities under certain conditions. While both forms deal with alleviating burdensome tax situations, Form 8857 is specifically for requesting relief from liabilities arising from joint tax filings when it would be unfair to hold both spouses responsible.

Lastly, the Application for Extension of Time for Payment of Tax Due to Undue Hardship, using Form 1127, parallels the IRS 12153 form. This document allows taxpayers to request an extension on paying taxes if they can demonstrate paying on time would cause undue hardship. Both the 12153 and Form 1127 are utilized to manage financial strain from tax obligations, but Form 1127 specifically addresses payment extensions, while the 12153 form focuses on contesting collection actions.

Dos and Don'ts

When filling out the IRS 12153 form, it's important to pay attention to detail and follow the guidelines correctly. This form is a request for a Collection Due Process hearing, and it's crucial to fill it out accurately to ensure your rights are protected. Below are five things you should do and five things you should avoid doing when completing this form:

Things You Should Do:

- Read all instructions provided with the form carefully to understand the requirements and process.

- Use black ink for clarity and to ensure the form is legible after faxing or photocopying.

- Provide complete and accurate information for every section to avoid delays in the processing of your request.

- Sign and date the form to certify that the information provided is true and correct to the best of your knowledge.

- Retain a copy of the completed form and all related documents for your records and future reference.

Things You Shouldn't Do:

- Don't leave any required fields blank. If a section does not apply, mark it as "N/A" (not applicable) instead.

- Don't use pencil or any ink color other than black as it may not be legible or acceptable.

- Don't provide false or misleading information, as this could result in penalties or legal action.

- Don't forget to include any necessary documentation that supports your position or request.

- Don't submit the form without first reviewing it for errors or omissions to ensure completeness and accuracy.

Misconceptions

Understanding the IRS 12153 form, or the Request for a Collection Due Process or Equivalent Hearing, is crucial for individuals facing certain tax collection actions. However, misconceptions about this form are widespread, often leading to confusion. This clarification seeks to address and correct the most common misunderstandings.

Only for tax professionals: One common misconception is that the IRS 12153 form is solely for use by tax professionals. In reality, any taxpayer with a qualifying tax issue, such as a lien or levy, can and should use this form to request a hearing.

For disputing tax bills: Another misunderstanding is that this form is a way to dispute the amount of tax owed. Although it can be used to discuss collection alternatives and underlying liabilities if certain criteria are met, its primary function is to appeal collection actions.

Leads to immediate tax relief: Some believe that filing Form 12153 results in immediate relief or halts collection actions. While filing the form does often pause collection efforts temporarily, it is not a guarantee of relief and depends on the case's outcome.

Limited to one issue: It's also mistakenly thought that you can only address one tax issue or period on the form. In truth, you can and should include all relevant tax periods and issues for which you're seeking a Collection Due Process hearing.

Guarantees a face-to-face hearing: While the form does allow taxpayers to request a face-to-face hearing, not all requests may be granted. Many cases are resolved through correspondence or over the phone, depending on the complexity and IRS guidelines.

No deadline for submission: A critical misconception is that there is no deadline for submitting Form 12153. Taxpayers must file the form within the timeframe outlined in the IRS's final notice of intent to levy or within one year of the lien filing notice to be eligible for a hearing.

Is a form of tax protest: Some view submitting Form 12153 as a form of tax protest. While it is true that the form allows taxpayers to express their concerns and seek a resolution, it is a formal and recognized procedure within the IRS for resolving specific collection disputes, rather than a general protest of taxes or tax policy.

Clearing up these misconceptions about the IRS 12153 form is essential for taxpayers facing collection actions. Understanding what the form is—and isn't—can help taxpayers navigate their options and potentially avoid costly mistakes.

Key takeaways

The IRS 12153 form is a request for a Collection Due Process (CDP) or Equivalent Hearing with the IRS. This form is an essential tool for taxpayers who are facing tax liens or levies and wish to dispute or seek alternatives for repayment. Here are key takeaways about filling out and using this form:

- Understanding the purpose: The IRS 12153 form is specifically used by taxpayers to request a hearing before a levy is placed on their property or after a Notice of Federal Tax Lien has been filed against them.

- Timing is critical: To qualify for a Collection Due Process hearing, you must submit Form 12153 within the time frame specified in your notice, typically 30 days from the date of the notice.

- Detailed information is essential: When filling out the form, it is crucial to provide detailed and accurate information about yourself, including your name, Social Security Number or Employer Identification Number, and the tax periods involved.

- Specify the reason for your request: Clearly indicate the reason(s) you are requesting the hearing, such as an offer in compromise, installment agreement, or questioning the underlying tax liability.

- Options for an Equivalent Hearing: If you miss the 30-day deadline for a CDP hearing, you may still request an Equivalent Hearing within one year of the date of the notice, but the IRS's collection actions can continue.

- Professional representation is allowed: You have the right to be represented by an attorney, certified public accountant, or other qualified individuals at your hearing.

- Collection actions may be suspended: Filing Form 12153 may suspend the IRS's collection actions until the hearing is completed and a decision is issued.

- Effective communication: After submitting the form, keep all correspondence from the IRS regarding your hearing request. You may need to submit additional information or answer questions from the IRS.

- Appeal rights: If you disagree with the outcome of the Collection Due Process or Equivalent Hearing, you have the right to appeal the decision in the United States Tax Court.

Filling out and submitting IRS Form 12153 is a crucial step for taxpayers looking to manage or dispute collection actions taken by the IRS. It is important to approach this process with care, paying attention to deadlines and providing accurate information to protect your rights and seek the best possible outcome.

Popular PDF Documents

IRS 8960 - The strategic gathering of financial records is essential for accurately completing and filing IRS 8960.

California Stop Payment - Employs statutory backing to reinforce the rights of individuals and companies seeking just compensation for their involvement in construction projects.

Pa Department of Revenue Tax Clearance - The engagement in sales of specific items like soft drinks and diesel fuel within PA attracts targeted tax compliance scrutiny.