Get Irs 11652 Form

Facing the task of proving income and expenses on Schedule C can seem daunting for many small business owners. The IRS Form 11652 serves as a critical tool designed to streamline this process, ensuring that individuals can meet their tax obligations with confidence. Issued by the Department of the Treasury - Internal Revenue Service, this form is a comprehensive questionnaire that outlines the essential records needed to substantiate the entries on Schedule C, which accounts for profits or losses from a business. It underscores the importance of keeping adequate records by enumerating specific types of documentation that taxpayers should provide, such as business licenses, advertisement receipts, and bank statements, among others. Additionally, it covers aspects like how to report various forms of income, not strictly limited to traditional forms like 1099-MISC, 1099-NEC, or 1099-K, but also any income not included on these forms. Failure to complete the questionnaire thoroughly and attach required supporting documents can lead to delays in the examination of one's tax return and the determination of tax liability. It’s more than a form; it’s a guide to navigating the complexities of tax reporting for business owners, aimed at making the process as smooth and straightforward as possible. To further aid in compliance and understanding, the IRS provides links to publications such as the Tax Guide for Small Business and Starting a Business and Keeping Records, available for download or upon request, illustrating the agency's commitment to assisting taxpayers in fulfilling their responsibilities.

Irs 11652 Example

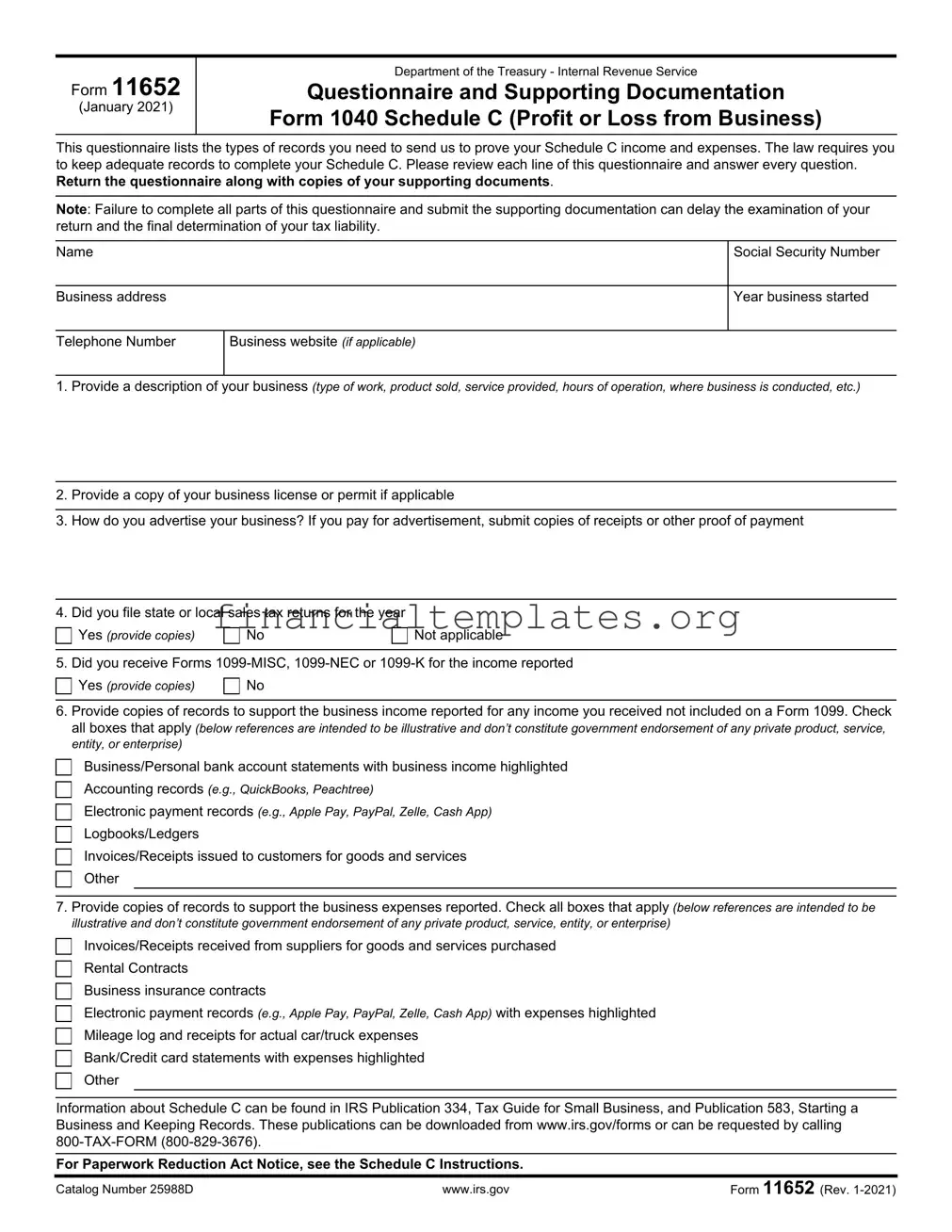

Form 11652

(January 2021)

Department of the Treasury - Internal Revenue Service

Questionnaire and Supporting Documentation

Form 1040 Schedule C (Profit or Loss from Business)

This questionnaire lists the types of records you need to send us to prove your Schedule C income and expenses. The law requires you to keep adequate records to complete your Schedule C. Please review each line of this questionnaire and answer every question. Return the questionnaire along with copies of your supporting documents.

Note: Failure to complete all parts of this questionnaire and submit the supporting documentation can delay the examination of your return and the final determination of your tax liability.

Name

Business address

Social Security Number

Year business started

Telephone Number

Business website (if applicable)

1.Provide a description of your business (type of work, product sold, service provided, hours of operation, where business is conducted, etc.)

2.Provide a copy of your business license or permit if applicable

3.How do you advertise your business? If you pay for advertisement, submit copies of receipts or other proof of payment

4. Did you file state or local sales tax returns for the year

Yes (provide copies) |

No |

Not applicable

5. Did you receive Forms

Yes (provide copies)

No

6.Provide copies of records to support the business income reported for any income you received not included on a Form 1099. Check all boxes that apply (below references are intended to be illustrative and don’t constitute government endorsement of any private product, service, entity, or enterprise)

Business/Personal bank account statements with business income highlighted

Accounting records (e.g., QuickBooks, Peachtree)

Electronic payment records (e.g., Apple Pay, PayPal, Zelle, Cash App)

Logbooks/Ledgers

Invoices/Receipts issued to customers for goods and services

Other

7.Provide copies of records to support the business expenses reported. Check all boxes that apply (below references are intended to be illustrative and don’t constitute government endorsement of any private product, service, entity, or enterprise)

Invoices/Receipts received from suppliers for goods and services purchased

Rental Contracts

Business insurance contracts

Electronic payment records (e.g., Apple Pay, PayPal, Zelle, Cash App) with expenses highlighted

Mileage log and receipts for actual car/truck expenses

Bank/Credit card statements with expenses highlighted

Other

Information about Schedule C can be found in IRS Publication 334, Tax Guide for Small Business, and Publication 583, Starting a Business and Keeping Records. These publications can be downloaded from www.irs.gov/forms or can be requested by calling

For Paperwork Reduction Act Notice, see the Schedule C Instructions.

Catalog Number 25988D |

www.irs.gov |

Form 11652 (Rev. |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 11652 | This form is a questionnaire and supporting documentation for Form 1040 Schedule C, detailing the types of records needed to prove Schedule C income and expenses. |

| Record Keeping Requirement | The law mandates adequate record keeping to complete Schedule C, as emphasized in the form instructions. |

| Impact of Incomplete Submission | Failure to complete all parts of this questionnaire and submit the required supporting documentation can delay the examination of your return and the final determination of your tax liability. |

| Supporting Publications | Relevant guidance can be found in IRS Publication 334 (Tax Guide for Small Business) and Publication 583 (Starting a Business and Keeping Records), both available on the IRS website or through direct request. |

Guide to Writing Irs 11652

Filling out the IRS Form 11652 is a straightforward process that requires attention to detail. This form is designed to validate the income and expenses you've reported on your Schedule C (Profit or Loss from Business) form. It's important to accurately complete this questionnaire and provide all requested documentation to avoid delays in the examination of your return and the final determination of your tax liability. Below are the step-by-step instructions to guide you through filling out the form.

- Start by entering your full name, business address, social security number, the year your business started, telephone number, and business website if applicable at the top of the form.

- In the first question, provide a comprehensive description of your business. Include the type of work or products sold, services provided, hours of operation, and the location(s) where the business is conducted.

- For the second question, if you have a business license or permit, submit a copy of it. If this is not applicable to your business, proceed to the next question.

- Answer how you advertise your business in the third question. If you incur costs for advertising, attach copies of receipts or other proof of payment.

- Indicate whether you filed state or local sales tax returns for the year in question 4. Provide copies if you answered yes.

- Question 5 asks if you received Forms 1099-MISC, 1099-NEC, or 1099-K for the income reported. Answer accordingly and provide copies of these forms if applicable.

- For question 6, provide copies of records that support the business income reported. This could include:

- Highlighted business or personal bank account statements.

- Accounting records, such as those from QuickBooks or Peachtree.

- Electronic payment records like Apple Pay, PayPal, Zelle, Cash App.

- Logbooks or ledgers.

- Invoices or receipts issued to customers for goods and services.

- Any other relevant documents.

- Question 7 requires you to provide copies of records to support the business expenses reported. This might involve:

- Invoices or receipts received from suppliers for goods and services purchased.

- Rental contracts.

- Business insurance contracts.

- Electronic payment records with expenses highlighted.

- Mileage log and receipts for actual car/truck expenses.

- Bank or credit card statements with expenses highlighted.

- Other relevant documentation.

- Review your answers and ensure all requested documentation is attached before submitting the form.

After you've completed and reviewed the form for accuracy, return it along with all supporting documentation as instructed by the IRS. This thorough approach ensures you meet legal requirements and aids in the swift examination of your tax return. Remember, keeping detailed and organized records is key to accurately completing your Schedule C and supporting it with the necessary documentation.

Understanding Irs 11652

-

What is Form 11652 and who needs to fill it out?

Form 11652 is a questionnaire and supporting documentation for Schedule C (Profit or Loss from Business) filers. It's designed for individuals who need to prove their business income and expenses to the Internal Revenue Service (IRS). If you've filed a Schedule C with your tax return, you might be asked to complete this form. It helps the IRS verify the details of your business operations, including income, expenses, and other relevant information. Anyone who operates a business as a sole proprietor or single-member LLC and has filed a Schedule C with their tax return should be prepared to fill out this form if requested by the IRS.

-

What sort of documentation is required to accompany Form 11652?

When completing Form 11652, you'll need to provide detailed records supporting both your reported business income and expenses. For income, this could include bank statements highlighting business transactions, accounting records, invoices or receipts issued to customers, and any Forms 1099 received. For expenses, you should include receipts from suppliers, rental contracts, insurance contracts, and highlighted bank or credit card statements showing relevant expenses. Electronic payment records and mileage logs may also be necessary if they relate to your business operations. It's crucial to submit copies of these documents to avoid delays in the examination of your return.

-

What happens if you don't complete Form 11652 or provide the necessary documentation?

Failing to complete all parts of Form 11652 and not submitting the required supporting documentation can lead to delays in the examination of your tax return. This incompletion can potentially affect the final determination of your tax liability. In some cases, it may also result in penalties or further inquiries from the IRS. It's essential to respond to the IRS's request for Form 11652 and accompanying documentation promptly and thoroughly to avoid complications with your tax return processing.

-

Where can you find more information about completing Schedule C and keeping adequate business records?

The IRS provides resources to help taxpayers understand how to properly complete Schedule C and maintain the necessary records for their business. You can find detailed guidance in IRS Publication 334, "Tax Guide for Small Business," and Publication 583, "Starting a Business and Keeping Records." These publications offer valuable information on categorizing income and expenses, recordkeeping requirements, and more. Both publications are available for download at www.irs.gov/forms, or you can request a copy by calling 800-TAX-FORM (800-829-3676).

-

Is there a specific deadline for submitting Form 11652?

Form 11652 does not have a standardized deadline because its submission is typically requested by the IRS as part of an audit or review of your tax return. If you receive a request from the IRS to complete Form 11652, the correspondence will likely specify a deadline by which you should respond and submit the form along with your supporting documents. It's crucial to adhere to this deadline to ensure your tax return's timely and accurate examination. Missing the deadline can result in delays and possibly impact the outcome of the IRS's review of your tax liability.

Common mistakes

Filling out IRS Form 11652 can be a daunting task. The complexity of tax documents often leads to mistakes that can hinder the processing of your paperwork. Let's go through nine common errors people make while completing this form:

Not answering every question: Each question on the form is crucial for substantiating your Schedule C income and expenses. Skipping any question could delay the review of your return.

Failing to provide a detailed business description: The IRS requires a thorough understanding of your business, including the nature of work, products sold, or services provided, and operation hours. Vague descriptions may raise questions about your business operations.

Overlooking the requirement to send copies of your business license or permit: If it's applicable, not including these documents can result in an incomplete submission.

Not submitting proof of advertisements: If you pay for business advertising, the IRS expects receipts or proof of these expenses. Neglecting to include these can affect the verification of your deducted expenses.

Forgetting to include state or local sales tax returns: If you've filed these, you must provide copies. This oversight can lead to problems in corroborating reported income.

Omitting Forms 1099: If you received any Forms 1099-MISC, 1099-NEC, or 1099-K, it's imperative to include copies. Failure to do so might result in a discrepancy in reported income.

Not highlighting business income in bank statements: When submitting bank statements, ensure your business transactions are clearly marked to facilitate the reviewer's task in verifying your income.

Failing to provide support for business expenses: Similar to income, all claimed expenses need backing documents, such as receipts or contracts, for validation.

Ignoring the checklist for supporting records: The form includes a checklist for documents related to both income and expenses. Not checking all applicable boxes or neglecting to submit any of the mentioned records can leave your claims unsubstantiated.

Attention to detail is crucial when completing Form 11652. By avoiding these common mistakes, you can ensure a smoother process in validating your Schedule C, ultimately benefiting your tax return processing and accurate determination of tax liability.

Documents used along the form

When individuals or businesses engage with the Internal Revenue Service (IRS), particularly in matters relating to Schedule C (Profit or Loss from Business) as outlined in Form 11652, several other forms and documents often come into play. These documents are essential for providing a comprehensive overview of a business's financial situation and for substantiating the details reported on tax returns. Understanding these forms and what each represents can streamline the process of completing tax obligations accurately and efficiently.

- Form 1040: This is the U.S. individual income tax return form. It's used by taxpayers to report their annual income to the IRS. It includes information about the taxpayer’s income, tax credits, and deductions.

- Schedule SE (Form 1040): Schedule SE is necessary for anyone who has self-employment income. It's used to calculate the amount of self-employment tax owed to the IRS, which covers the taxpayer's contributions to Social Security and Medicare.

- Form 1099-MISC: This form is used to report miscellaneous income. For individuals operating their own business, it would include payments received for services performed for a trade or business by people not treated as employees, for example, subcontractors.

- Form 1099-NEC: As of the tax year 2020, the IRS reintroduced Form 1099-NEC, "Nonemployee Compensation," for reporting individual service payments of $600 or more during the tax year. This is particularly relevant for freelancers and independent contractors.

- Form 8829: This form is used by taxpayers who use part of their home for business purposes to calculate the deductible expenses for business use of the home. This is relevant for sole proprietors filing a Schedule C.

- Form 4562: Depreciation and Amortization. Individuals completing Schedule C use this form to report the depreciation and amortization of their business assets. It details information on any equipment or property purchased for business use that depreciates in value over time.

Together with Form 11652, these documents create a framework that facilitates the comprehensive and compliant reporting of business income, expenses, and deductions. By accurately completing and submitting these forms, businesses can ensure they meet their tax obligations and potentially minimize their tax liability through legitimate deductions. This process underscores the importance of maintaining good business records, as these documents collectively require detailed financial information that reflects a business's annual operations.

Similar forms

The IRS Form 1040 Schedule C, which Form 11652 directly references, is a foundational document for small business owners and freelancers in the United States. It's used to report the income or loss from a business operated or a profession practiced as a sole proprietor. Similar to the IRS 11652, it requires detailed financial information about the business's operations, including income, expenses, and applicable deductions. Both forms are integral to accurately determining the tax obligations of individuals running their own businesses, with the key difference being that Form 11652 serves as a supplementary questionnaire to ensure the completeness and accuracy of the information reported on Schedule C.

The IRS Form 1099 Series, including Forms 1099-MISC, 1099-NEC, and 1099-K mentioned in the IRS 11652, are also related documents. These forms are used to report various types of income apart from wages, salaries, and tips. Specifically, they pertain to independent contractors, freelancers, and other non-employees to report payments for services performed. The IRS 11652 requests copies of these forms as part of its documentation requirement, demonstrating its role in substantiating the income declared on Schedule C with verifiable third-party reports.

IRS Publication 334, the Tax Guide for Small Business, is a comprehensive resource for individuals who operate as sole proprietors. It dovetails with the purpose of Form 11652 by offering detailed guidance on tax responsibilities, including how to document income and expenses accurately. This publication supports the questionnaire by providing the foundational knowledge required to understand why each piece of information or documentation is necessary, underlining the importance of thorough record-keeping as highlighted in Form 11652.

IRS Publication 583, Starting a Business and Keeping Records, is another document akin to Form 11652. It focuses on the initial stages of setting up a business and the crucial aspect of maintaining accurate records right from the start. The alignment with Form 11652 lies in its emphasis on record-keeping practices, which are necessary for fulfilling the documentation requirements listed in the questionnaire. Both documents serve to reinforce the IRS’s expectation that businesses will maintain complete and organized financial records.

The IRS Form 8829, Expenses for Business Use of Your Home, shares similarities with Form 11652 in that it too requires detailed information about the expenses associated with maintaining a business. While Form 8829 is specific to home office deductions, including calculations for depreciation and indirect expenses, it also necessitates thorough documentation and record-keeping, akin to the comprehensive approach demanded by Form 11652 for substantiating business expenses.

The IRS Form 4562, Depreciation and Amortization, is related to IRS 11652 through its focus on reporting the depreciation of property used in a business, another factor in determining the profit or loss from business operations reported on Schedule C. This form requires detailed records and calculations to substantiate depreciation claims, paralleling the meticulous documentation and support demanded by Form 11652 for various aspects of business operations.

Finally, the IRS Schedule SE (Form 1040), Self-Employment Tax, is indirectly connected to Form 11652 through its role in calculating the self-employment tax of individuals who report income on Schedule C. The income and loss figures established with the aid of Form 11652 directly influence the self-employment tax obligations determined by Schedule SE, underscoring the interconnectedness of these documents in the broader context of tax reporting and compliance for individuals running their own businesses.

Dos and Don'ts

Filling out IRS Form 11652 correctly is crucial for ensuring your Schedule C (Profit or Loss from Business) is accurately processed without unnecessary delays. Here are key do's and don'ts to keep in mind:

Do:

- Read the instructions carefully before you start filling out the form. This helps you understand what documents you need and how to accurately provide the requested information.

- Gather all necessary documents in advance, such as business licenses, receipts, bank statements, and any 1099 forms you received. This will make the process smoother and ensure you don't miss anything important.

- Answer every question on the questionnaire. If a question does not apply to you, make sure to mark it as "Not applicable" instead of leaving it blank.

- Highlight business transactions on your bank and electronic payment records as specified. This makes it easier for the IRS to verify your income and expenses.

- Provide clear copies of all supporting documents. Ensure that copies are legible and that no crucial information is cut off or blurred.

- Check your work before submitting. Verify that you have answered all questions and included all necessary documentation.

Don't:

- Ignore the instructions on the form. Failing to follow guidelines could result in errors that delay the processing of your Schedule C.

- Submit original documents. Always send copies, as submitted documents will not be returned to you.

- Forget to sign and date the questionnaire. An unsigned form may be considered incomplete and can delay the examination process.

- Overlook any income or expenses. Ensure that all financial activity related to your business is accurately reported.

- Estimate figures. Provide precise numbers based on your records to avoid questions or audits down the line.

- Wait until the last minute to fill out the form. Allow yourself enough time to thoroughly complete the questionnaire and gather the necessary documents.

Misconceptions

There are several misconceptions surrounding the IRS Form 11652, which can lead to confusion for taxpayers. This form is essential for individuals filing Schedule C (Profit or Loss from Business) as part of their tax return. Understanding these misconceptions can help ensure compliance and accuracy when dealing with the IRS.

Misconception 1: Form 11652 is optional for Schedule C filers. This is incorrect. If requested by the IRS, completing Form 11652 and providing the requested documentation is mandatory to verify the income and expenses reported on Schedule C.

Misconception 2: Only physical records are acceptable for documentation. The IRS accepts both physical and electronic records as proof of income and expenses. This includes bank statements, electronic payment records, and digital logbooks, among others.

Misconception 3: Personal bank account statements are irrelevant to Form 11652. If personal bank accounts are used for business transactions, statements highlighting these transactions are necessary to support business income and expense claims.

Misconception 4: Filing Form 11652 extends the deadline for filing your tax return. Submitting this form does not grant an extension for filing your tax return. It is part of the examination process to validate information on your filed return.

Misconception 5: Businesses without a physical address do not need to complete Form 11652. Even if a business is conducted online or from a home office, completing this form upon request is necessary, including the description of the business and how it operates.

Misconception 6: Receipts are the only form of acceptable documentation for expenses. While receipts are primary documents for supporting expenses, other forms like bank/credit card statements, rental contracts, and electronic payment records are also acceptable.

Misconception 7: Only income reported on Forms 1099 needs to be verified. Taxpayers must report and provide documentation for all business income, not just that which is reported on Forms 1099-MISC, 1099-NEC, or 1099-K.

Misconception 8: Detailed records are not necessary if expenses are estimated. The IRS requires detailed records to support all expense claims, not just estimates. This includes mileage logs for vehicle use and detailed ledgers or accounting software data for other expenses.

Misconception 9: The information provided on Form 11652 influences the initial tax return filing. The information on Form 11652 is used to verify the accuracy of a tax return during an examination. It does not alter the filing requirements or the initial information presented in the tax return.

Understanding these misconceptions helps taxpayers correctly prepare and submit IRS Form 11652, ensuring that the information on Schedule C is accurately represented and properly documented. This can aid in a smoother examination process and potentially avoid complications with tax liabilities.

Key takeaways

When filling out and using the IRS 11652 form, understanding the required documentation and information is crucial for ensuring accuracy and compliance. Here are key takeaways to help guide you through the process:

- Complete the questionnaire thoroughly. Every question on the form needs to be answered to avoid delays in the examination of your return and the final determination of your tax liability.

- Record Keeping is mandatory. Law mandates record-keeping to substantiate your Schedule C income and expenses. This form helps identify the types of records necessary to support your tax return.

- Providing copies of important documents is essential. Along with the completed questionnaire, include copies of documents supporting both income and expenses. Originals should be retained for your records.

- Highlight business income and expenses. For clarity and ease of examination, highlight business-related transactions on bank account statements, electronic payment records, and credit card statements.

- Specific details about your business are required. Include a comprehensive description of your business, including the type of work, products sold, services provided, business hours, and operation locations.

- Submit proof of business advertising and licenses. If applicable, copies of business licenses or permits, along with evidence of advertisement expenses (receipts or proof of payment), will be required.

- Ensure all forms of income are reported. If you received income not included on Forms 1099-MISC, 1099-NEC, or 1099-K, provide detailed records supporting the income reported. This includes bank statements, accounting records, or any other relevant documentation.

- Accuracy in reporting expenses is critical. Support for business expenses reported must be comprehensive and may include invoices, receipts, rental contracts, insurance contracts, and mileage logs among others.

Lastly, for additional guidance on Schedule C and record-keeping, IRS Publication 334, Tax Guide for Small Business, and Publication 583, Starting a Business and Keeping Records, offer valuable information and are available for download from the IRS website.

Popular PDF Documents

New York Sales Tax Due Dates - The form includes special sections for reporting sales of specific items like vapor products, subject to different tax rates.

Tax POA Form 21-002-13 - A necessary provision for taxpayers who require assistance from tax professionals to optimize their tax strategies and compliance.

Dlstfd - The loan sequence and first disbursement dates are provided, giving a complete history of your loan disbursements.