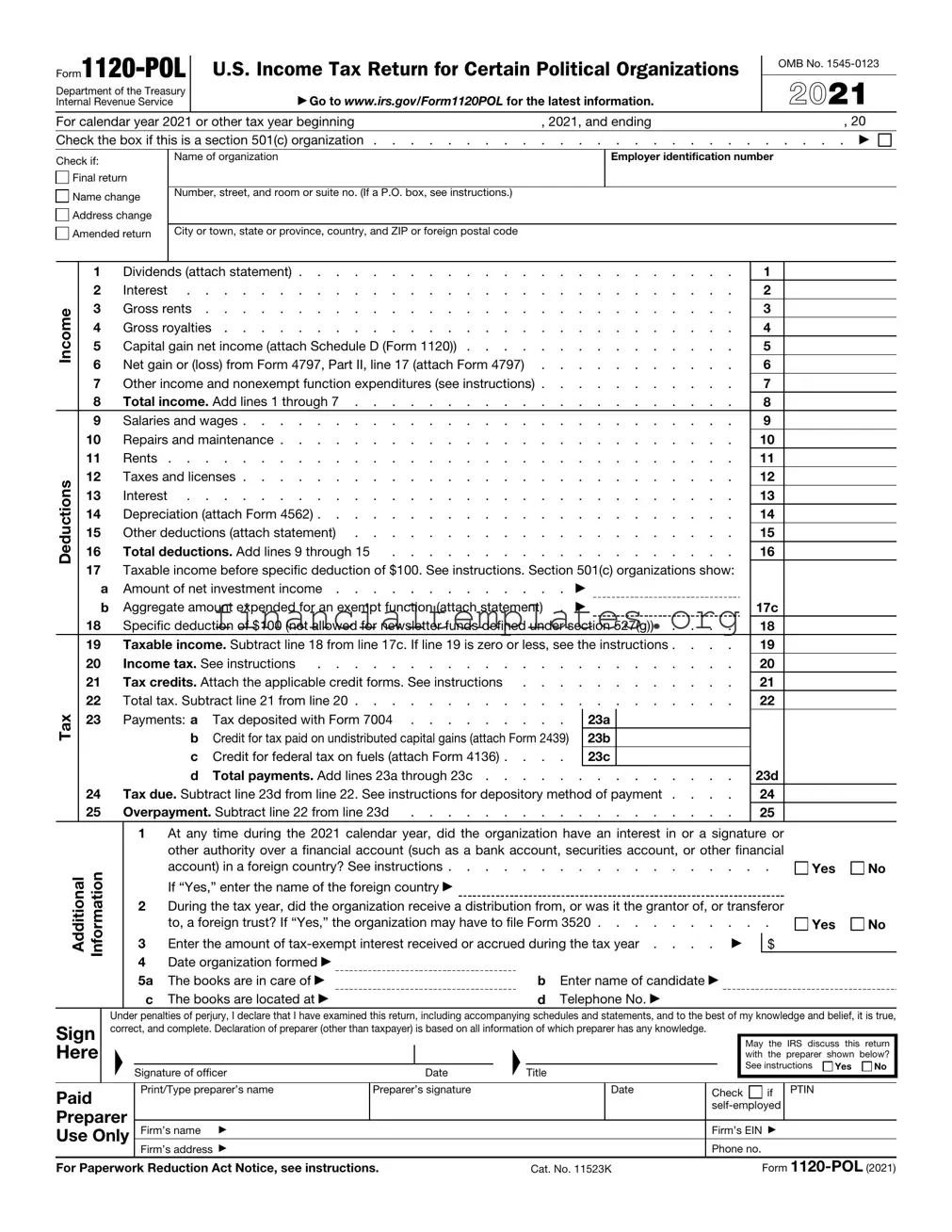

Get Irs 1120 Pol Form

The IRS 1120-POL form plays a crucial role for certain political organizations and exempt organizations under section 501(c) in the realm of tax reporting and compliance. Mandated by the Department of the Treasury and adhering to the guidelines set by the Internal Revenue Service, the form is utilized to report the political organization taxable income and calculate the income tax liability in accordance with section 527. Organizations find it imperative to fill out this form if they have any taxable income to report for the year. The form encompasses various aspects including income sources such as dividends, interest, and capital gains, alongside deductions on expenses like salaries, wages, and repairs. It also makes provisions for specific deductions, accounting for tax credits, and outlines the process for adjusting taxable incomes before specific deductions. Moreover, it highlights the necessity of including additional information pertaining to any financial accounts or interests in foreign countries, thus ensuring thorough financial reporting. Entities required to file this form include political organizations that might not necessarily be tax-exempt and exempt organizations treated as having political organization taxable income under specific conditions. It is imperative to note the significance of filing this form accurately and timely to avoid potential penalties for non-compliance and ensure the organization’s good standing in terms of its tax obligations.

Irs 1120 Pol Example

U.S. Income Tax Return for Certain Political Organizations |

|

OMB No. |

|||||

|

|

||||||

|

2021 |

||||||

Department of the Treasury |

▶ Go to www.irs.gov/Form1120POL for the latest information. |

|

|||||

Internal Revenue Service |

|

|

|||||

For calendar year 2021 or other tax year beginning |

, 2021, and ending |

, 20 |

|||||

Check the box if this is a section 501(c) organization |

. . . . ▶ |

||||||

Check if: |

|

Name of organization |

|

Employer identification number |

|

||

|

|

|

|

|

|

|

|

Final return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name change |

|

Number, street, and room or suite no. (If a P.O. box, see instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Address change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended return |

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

Deductions

Tax

1 |

Dividends (attach statement) |

1 |

2 |

Interest |

2 |

3 |

Gross rents |

3 |

4 |

Gross royalties |

4 |

5 |

Capital gain net income (attach Schedule D (Form 1120)) |

5 |

6 |

Net gain or (loss) from Form 4797, Part II, line 17 (attach Form 4797) |

6 |

7 |

Other income and nonexempt function expenditures (see instructions) |

7 |

8 |

Total income. Add lines 1 through 7 |

8 |

9 |

Salaries and wages |

9 |

10 |

Repairs and maintenance |

10 |

11 |

Rents |

11 |

12 |

Taxes and licenses |

12 |

13 |

Interest |

13 |

14 |

Depreciation (attach Form 4562) |

14 |

15 |

Other deductions (attach statement) |

15 |

16 |

Total deductions. Add lines 9 through 15 |

16 |

17Taxable income before specific deduction of $100. See instructions. Section 501(c) organizations show:

a |

Amount of net investment income |

▶ |

|

|

|||

b |

Aggregate amount expended for an exempt function (attach statement) . |

▶ |

|

17c |

|||

18 |

Specific deduction of $100 (not allowed for newsletter funds defined under section 527(g)) . . . . |

18 |

|||||

19 |

Taxable income. Subtract line 18 from line 17c. If line 19 is zero or less, see the instructions . . . . |

19 |

|||||

20 |

Income tax. See instructions |

. . . . . . . . . |

20 |

||||

21 |

Tax credits. Attach the applicable credit forms. See instructions . . . |

. . . . . . . . . |

21 |

||||

22 |

Total tax. Subtract line 21 from line 20 |

. . . . . . . . . |

22 |

||||

23 |

Payments: a |

Tax deposited with Form 7004 |

|

23a |

|

|

|

|

b Credit for tax paid on undistributed capital gains (attach Form 2439) |

|

23b |

|

|

|

|

|

c |

Credit for federal tax on fuels (attach Form 4136) . . . . |

|

23c |

|

|

|

|

d |

Total payments. Add lines 23a through 23c |

. . . . . . . . . |

|

23d |

||

24 |

Tax due. Subtract line 23d from line 22. See instructions for depository method of payment . . . . |

24 |

|||||

25 |

Overpayment. Subtract line 22 from line 23d |

. . . . . . . . . |

25 |

||||

Additional |

Information |

1At any time during the 2021 calendar year, did the organization have an interest in or a signature or

other authority over a financial account (such as a bank account, securities account, or other financial account) in a foreign country? See instructions . . . . . . . . . . . . . . . . . .

If “Yes,” enter the name of the foreign country ▶

2During the tax year, did the organization receive a distribution from, or was it the grantor of, or transferor

|

to, a foreign trust? If “Yes,” the organization may have to file Form 3520 |

|

3 |

Enter the amount of |

$ |

4Date organization formed ▶

5a |

The books are in care of ▶ |

b |

Enter name of candidate ▶ |

c |

The books are located at ▶ |

d |

Telephone No. ▶ |

Yes

Yes

No

No

Sign Here

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▲ |

|

|

▲ |

|

|

May the IRS discuss this return |

|||

|

|

|

|

with the preparer shown below? |

|||||

|

|

|

|

See instructions |

Yes |

No |

|||

Signature of officer |

Date |

Title |

|||||||

|

|

|

|

||||||

Paid |

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

Check if |

PTIN |

|

|

|

|

|

||

|

|

|

|

|

||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Firm’s EIN ▶ |

|

|

Use Only |

|

|

|

|

||

Firm’s address ▶ |

|

|

|

Phone no. |

|

|

|

|

|

|

|

||

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 11523K |

Form |

||||

Form |

Page 2 |

|

|

Section references are to the Internal Revenue Code unless otherwise noted.

Future developments. For the latest information about developments related to Form

What’s New

Section 965(a) inclusion. Section 965(a) inclusion amounts from Form 965 are not applicable for tax year 2021 and later years. However, if you continue to make installment payments of tax based on a prior year section 965(a) election, continue to attach Form

How To Get Forms and

Publications

Internet. You can access the IRS website 24 hours a day, 7 days a week, at www.irs.gov to:

•Download forms, instructions, and publications;

•Order IRS products online;

•Research your tax questions online;

•Search publications online by topic or keyword;

•View Internal Revenue Bulletins (IRBs) published in recent years; and

•Sign up to receive local and national tax news by email.

Tax forms and publications. Go to www.irs.gov/Forms to view, download, or print all of the forms and publications you may need. You can also download and view popular tax publications and instructions (including the 1040 and 1040- SR instructions) on mobile devices as an eBook at no charge. Or you can go to www.irs.gov/OrderForms to place an order and have forms mailed to you within 10 business days.

Phone Help

If you have questions and/or need help completing Form

General Instructions

Purpose of Form

Political organizations and certain exempt organizations file Form

Who Must File

A political organization, whether or not it is tax exempt, must file Form

An exempt organization that isn’t a political organization must file Form

Political Organizations

A political organization is a party, committee, association, fund (including a separate segregated fund described in section 527(f)(3) set up by a section 501(c) organization), or other organization, organized and operated primarily for the purpose of accepting contributions or making expenditures, or both, to influence the selection, nomination, election, or appointment of any individual to any public office or office in a political organization, or the election of Presidential or Vice Presidential electors. Political organizations include the following.

1.Newsletter fund, if it is a fund established and maintained by an individual who holds, has been elected to, or is a candidate (as defined in section 527(g)(3)) for nomination or election to any federal, state, or local elective public office. The fund must be maintained exclusively for the preparation and circulation of the individual’s newsletter.

2.Separate segregated fund, if it is maintained by a section 501(c) organization (exempt from tax under section 501(a)). For more information, see section 527(f)(3) and Regulations section

Taxable Income

Political organization taxable income (line

19)is the excess of (a) gross income for the tax year (excluding exempt function income (defined later)) over (b) deductions directly connected with the earning of gross income (excluding exempt function income). Taxable income is figured with the following adjustments.

1.A specific deduction of $100 is allowed (but not for newsletter funds).

2.The net operating loss deduction isn’t allowed.

3.The

Effect of failure to file Form 8871. Unless excepted (see Other Reports and Returns That May Be Required, later), every political organization, in order to be considered a

Exempt Function and Exempt Function Income

The exempt function of a political organization includes all activities that are related to and support the process of influencing or attempting to influence the selection, nomination, election, or appointment of any individual to any federal, state, or local public office, or office of a political organization, or the election of Presidential or Vice Presidential electors, whether or not the individuals or electors are selected, nominated, elected, or appointed. The term “exempt function” also means the making of expenditures relating to the individual’s office, once selected, nominated, elected, or appointed, but only if the expenditures would be deductible by an individual under section 162(a).

Exempt function income is the total of all amounts received from the following sources (to the extent that they are separately segregated only for use for an exempt function).

•Contributions of money and property.

•Membership dues, fees, or assessments paid by a member of a political party.

•Proceeds from a political fundraising or entertainment event, or from the sale of political campaign materials, if those amounts aren’t received in the active conduct of a trade or business.

•Proceeds from the conduct of a bingo game, as described in section 513(f)(2).

Specified Taxable Income

Newsletter fund. Taxable income of a newsletter fund is figured in the same manner as taxable income of a political organization except that the specific deduction of $100 isn’t allowed.

Exempt organization that isn’t a political organization. Gross income for an exempt organization described in section 501(c) that isn’t a political organization should include the lesser of:

1.The net investment income of the organization for the tax year, or

2.The aggregate amount spent for an exempt function during the tax year either directly or indirectly through another organization.

Net investment income, for this purpose, is the excess of:

1.The gross amount of interest, dividends, rents, and royalties, plus the excess, if any, of gains from the sale or exchange of assets, over the losses from the sale or exchange of assets; over

2.The deductions directly connected with the production of this income.

Taxable income is figured with the adjustments shown in (1), (2), and (3) under Taxable Income, earlier.

Form |

Page 3 |

|

|

Who Must Sign

The return must be signed and dated by:

•The president, vice president, treasurer, assistant treasurer, chief accounting officer; or

•Any other officer (such as tax officer) authorized to sign.

Receivers, trustees, and assignees must also sign and date any return filed on behalf of an organization.

If an employee of the organization completes Form

The paid preparer must complete the required preparer information and:

•Sign the return in the space provided for the preparer’s signature, and

•Give a copy of the return to the taxpayer.

Note: A paid preparer may sign original or amended returns by rubber stamp, mechanical device, or computer software program. Also, facsimile signatures are authorized.

Paid Preparer Authorization

If the organization wants to allow the IRS to discuss its 2021 tax return with the paid preparer who signed it, check the “Yes” box in the signature area of the return. This authorization applies only to the individual whose signature appears in the Paid Preparer Use Only section of the return. It doesn’t apply to the firm, if any, shown in that section.

If the “Yes” box is checked, the organization is authorizing the IRS to call the paid preparer to answer any questions that may arise during the processing of its return. The organization is also authorizing the paid preparer to:

•Give the IRS any information that is missing from its return;

•Call the IRS for information about the processing of its return or the status of any refund or payment(s); and

•Respond to certain IRS notices that the organization may have shared with the preparer about math errors, offsets, and return preparation. The notices won’t be sent to the preparer.

The organization isn’t authorizing the paid preparer to receive any refund check, bind the organization to anything (including any additional tax liability), or otherwise represent it before the IRS. If the organization wants to expand the paid preparer’s authorization, see Pub. 947, Practice Before the IRS and Power of Attorney.

However, the authorization will automatically end no later than the due date (excluding extensions) for filing the 2022 tax return. If you want to revoke the authorization before it ends, see Pub. 947.

When and Where To File

In general, an organization must file Form

If the due date falls on a Saturday, Sunday, or legal holiday, the organization may file on the next business day.

File Form

Department of the Treasury Internal Revenue Service Center Ogden, UT 84201

If the organization’s principal business, office, or agency is located in a foreign country or a U.S. possession, the address for mailing their return should be:

Internal Revenue Service Center P.O. Box 409101

Ogden, UT 84409

Private delivery services. Political organizations can use certain private delivery services (PDS) designated by the IRS to meet the “timely mailing as timely filing” rule for tax returns. Go to www.irs.gov/PDS for the current list of designated services.

The PDS can tell you how to get written proof of the mailing date.

For the IRS mailing address to use if you’re using PDS, go to www.irs.gov/ PDSstreetAddresses.

|

|

▲ |

PDS can’t deliver items to P.O. |

! |

boxes. You must use the U.S. |

Postal Service to mail any item |

|

CAUTION |

to an IRS P.O. box address. |

Extension. File Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, to request an extension of time to file.

Other Reports and Returns That May Be Required

An organization that files Form

1. Form 8871.

Generally, to be tax exempt, a political organization must file this form within 24 hours of the date it is established and within 30 days of any material change in the organization. However, don’t file this form if the organization is:

•An organization that reasonably expects its annual gross receipts to always be less than $25,000,

•A political committee required to report under the Federal Election Campaign Act of 1971 (2 U.S.C. 431 et seq.),

•A political committee of a state or local candidate,

•A state or local committee of a political party, or

•A

2.Form 8872, Political Organization Report of Contributions and Expenditures (periodic reports are required during the calendar year).

Generally, a political organization that files Form 8871 and accepts a contribution or makes an expenditure for an exempt function during the calendar year must file this form. However, this form isn’t required to be filed by an organization excepted from filing Form 8871 (see (1) earlier), or a qualified state or local political organization (QSLPO) (see the Instructions for Form 8871, and Rev. Rul.

3.Form 990, Return of Organization Exempt From Income Tax, or Form

An exempt political organization must also file one of these forms if its annual gross receipts are $25,000 or more ($100,000 or more for a QSLPO).

The following political organizations aren’t required to file Form 990 or Form

•Any political organization excepted from the requirement to file Form 8871.

•Any caucus or association of state or local officials.

See the instructions for Form 990 or Form

4.Form 8997, Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments.

Use Form 8997 to identify qualified investments held in a qualified opportunity fund at any time during the year. If you held a qualified investment in a qualified opportunity fund at any time during the year, you must file your Form

5.Form 8992, U.S. Shareholder Calculation of Global Intangible

Use Form 8992 to figure the domestic corporation’s GILTI and attach it to Form

Accounting Methods

Figure taxable income using the method of accounting regularly used in keeping the organization’s books and records. Generally, permissible methods include:

•Cash,

•Accrual, or

•Any other method authorized by the Internal Revenue Code.

In all cases, the method used must clearly show taxable income.

Change in accounting method. Generally, the organization may only change the method of accounting used to report taxable income (for income as a whole or for any material item) by getting consent on Form 3115, Application for Change in Accounting Method. For more information, see Pub. 538, Accounting Periods and Methods.

Form |

Page 4 |

|

|

Accounting Period

The organization must figure its taxable income on the basis of a tax year. The tax year is the annual accounting period the organization uses to keep its records and report its income and expenses if that period is a calendar year or a fiscal year. However, an organization that doesn’t keep books or doesn’t have an annual accounting period must use the calendar year as its tax year. A new organization must adopt its tax year by the due date (not including extensions) of its first income tax return.

Change of tax year. After the organization has adopted a tax year, it must get the consent of the IRS to change its tax year by filing Form 1128, Application To Adopt, Change, or Retain a Tax Year. See Regulations section

Rounding Off to Whole Dollars

The organization may round off cents to whole dollars on the return and accompanying schedules. If the organization does round to whole dollars, it must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

If two or more amounts must be added to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.

Federal Tax Deposits Must Be Made by Electronic Funds Transfer

You must use electronic funds transfer to make all federal deposits (such as deposits of estimated tax, employment tax, and excise tax). Generally, electronic fund transfers are made using the Electronic Federal Tax Payment System (EFTPS). If you don’t want to use EFTPS, you can arrange for your tax professional, financial institution, payroll service, or other trusted third party to make deposits on your behalf. Also, you may arrange for your financial institution to submit a

Depositing on time. For deposits made by EFTPS to be on time, you must submit the deposit by 8 p.m. Eastern time the day before the date the deposit is due. If you use a third party to make deposits on its behalf, they may have different cutoff times.

8 p.m. Eastern time the day before the date a deposit is due, you can still make the deposit on time by using the Federal Tax Application (FTA). Before using the same- day payment option, you will need to make arrangements with your financial institution ahead of time. Please check with the financial institution regarding availability, deadlines, and costs. To learn more about making a

Deposits on business days only. If a deposit is required to be made on a day that isn’t a business day, the deposit is considered timely if it is made by the close of the next business day. A business day is any day other than a Saturday, Sunday, or legal holiday. For example, if a deposit is required to be made on a Friday and Friday is a legal holiday, the deposit will be considered timely if it is made by the following Monday (if that Monday is a business day). The term “legal holiday” means any legal holiday in the District of Columbia.

! |

If the organization owes tax |

when it files Form |

|

▲ |

don’t include the payment with |

CAUTION |

the tax return. Instead, use |

|

EFTPS. |

Interest and Penalties

Interest

Interest is charged on taxes paid late even if an extension of time to file is granted. Interest is also charged on penalties imposed for failure to file, negligence, fraud, gross valuation overstatements, and substantial understatement of tax from the due date (including extensions) to the date of payment. The interest charge is figured at a rate determined under section 6621.

Penalties

Penalties may be imposed if the organization is required to file Form

Late filing of return. The organization may be charged a penalty of 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax. The minimum penalty for a return that is more than 60 days late is the smaller of the tax due or $435. If you receive a notice about a penalty after you file this return, reply to the notice with an explanation and we will determine if you meet

Late payment of tax. An organization that doesn’t pay the tax when due may generally have to pay a penalty of ½ of 1% of the unpaid tax for each month or part of

a month the tax isn’t paid, up to a maximum of 25% of the unpaid tax. If you receive a notice about a penalty after you file this return, reply to the notice with an explanation and we will determine if you meet

Other penalties. Other penalties can be imposed for negligence, substantial understatement of tax, and fraud. See sections 6662 and 6663.

Assembling the Return

Attach Form 4136, Credit for Federal Tax Paid on Fuels, after page 1 of Form

Complete every applicable entry space on Form

Specific Instructions

Period covered. File the 2021 return for calendar year 2021 and fiscal years that begin in 2021 and end in 2022. For a fiscal year, fill in the tax year space at the top of the form.

Note: The 2021 Form

•The organization has a tax year of less than 12 months that begins and ends in 2022, and

•The 2022 Form

Address. Include the suite, room, or other unit number after the street address. If the Post Office doesn’t deliver mail to the street address and the organization has a P.O. box, show the box number instead of the street address.

Final return, name change, address change, amended return. If the organization ceases to exist, check the “Final return” box.

If the organization has changed its name since it last filed a return, check the “Name change” box.

If the organization has changed its address since it last filed a return, check the “Address change” box.

Note: If a change in address occurs after the return is filed, the organization should use Form

Form |

Page 5 |

|

|

Amended return. If you are filing an amended Form

•Check the “Amended return” box,

•Complete the entire return,

•Correct the appropriate lines with the new information, and

•Refigure the tax liability.

Attach a sheet that explains the reason for the amendments and identifies the lines and amounts being changed on the amended return. Generally, the amended return must be filed within 3 years after the date the original return was due or 3 years after the date the organization filed it, whichever is later.

Employer identification number (EIN). Enter the

The online application process isn’t yet available for organizations with addresses in foreign countries.

If the organization hasn’t received its EIN by the time the return is due, write “Applied for” in the space provided for the EIN. See Pub. 583, Starting a Business and Keeping Records, for details.

Income and deductions. Campaign contributions and other exempt function income are generally not includible in income; likewise, campaign expenditures and other exempt function expenditures aren’t deductible. To be deductible in figuring political organization taxable income, expenses must be directly connected with the production of political organization taxable income. In those cases where expenses are attributable to the production of both exempt function income and political organization taxable income, the expenses should be allocated on a reasonable and consistent basis. Only the portion allocable to the production of political organization taxable income may be deducted. No deduction is allowed for general administrative or indirect expenses.

Line 7. Other income and nonexempt function expenditures. Enter the income from other sources, such as the following.

•Exempt function income that wasn’t properly segregated for exempt functions.

•Income received in the ordinary course of a trade or business.

•Ordinary income from the trade or business activities of a partnership (from Schedule

•Exempt function income (minus any deductions directly connected with the production of that income) taxable under section 527(i)(4) for failure to timely file Form 8871. Include amounts whether or not segregated for use for an exempt function.

Also include on this line:

•Expenditures that were made from exempt function income that weren’t for an exempt function and resulted in direct or indirect financial benefit to the political organization (see Regulations section

•Illegal expenditures.

Attach a schedule listing all income and expenditures included on line 7.

Line 17. Taxable income before specific deduction of $100. Political organizations, newsletter funds, and separate segregated funds figure their tax by subtracting line 16 from line 8 and entering the result on line 17(c).

Exempt organizations (section 501(c)) that aren’t political organizations. Complete lines 17a and 17b if the organization made exempt function expenditures that weren’t from a separate segregated fund. Enter on line 17c the smaller of line 17a or 17b. See Exempt organization that isn’t a political organization, earlier, for an explanation of the amounts to enter on these lines.

Line 19. Taxable income. If the taxable income on line 19 is zero or less, the Form

Line 20. Income tax. The tax rate for

Note: Estimated tax and alternative minimum tax don’t apply to political organizations.

If Form 8978, Partner’s Additional Reporting Year Tax, was filed, attach it to Form

Line 21. Tax credits. The organization may qualify for the following credits.

•Employer credit for paid family and medical leave. See Form 8994, Employer Credit for Paid Family and Medical Leave.

•Foreign tax credit. See Form 1118, Foreign Tax

•Qualified electric vehicle credit (carryforward ONLY). See Form 8834, Qualified Electric Vehicle Credit.

•General business credit (excluding the small employer health insurance premium credit, work opportunity credit, employee retention credit (Form

Enter the total amount of qualified credits on line 21 and attach the applicable credit forms.

If Form 8978 was filed, attach to Form

Line 22. Total tax. If the political organization must recapture any of the qualified electric vehicle credit, include the amount of the recapture in the total for line

22.On the dotted line next to the entry space, write “QEV recapture” and the amount. See Regulations section

What if You Can’t Pay in Full?

If you can’t pay the full amount of tax you owe, you can apply for an installment agreement online.

You can apply for an installment agreement online if:

•You can’t pay the full amount shown on line 24,

•The total amount you owe is $25,000 or less, and

•You can pay the liability in full in 24 months.

To apply using the Online Payment Agreement Application, go to www.irs.gov/OPA.

Under an installment agreement, you can pay what you owe in monthly installments. There are certain conditions you must meet to enter into and maintain an installment agreement, such as paying the liability within 24 months and making all required deposits and timely filing tax returns during the length of the agreement.

If your installment agreement is accepted, you will be charged a fee and you will be subject to penalties and interest on the amount of tax not paid by the due date of the return.

Additional Information

Question 1

Foreign financial accounts. Check the “Yes” box if either (1) or (2) next applies to the organization. Otherwise, check the “No” box.

1.At any time during the 2021 calendar year the organization had a financial interest in or signature or other authority over a bank, securities, or other types of financial accounts in a foreign country; and

•The combined value of the accounts was more than $10,000 at any time during the calendar year; and

•The accounts weren’t with a U.S. military banking facility operated by a U.S. financial institution.

2.The organization owns more than 50% of the stock in any corporation that would answer “Yes” to item (1) above.

See FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), to find out if the organization is considered to have an interest in or signature or other authority over a financial account in a foreign country.

Form |

Page 6 |

|

|

If “Yes” is checked for this question, file FinCEN Form 114 electronically with the Department of the Treasury using FinCEN’s BSA

See www.FINCEN.gov for more information.

Also, if “Yes” is checked for this question, enter the name of the foreign country or countries. Attach a separate sheet if more space is needed.

Question 2

If you checked “Yes” to Question 2, the organization may be required to file Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. For details, see the Instructions for Form 3520.

Note: An owner of a foreign trust must ensure that the trust files an annual information return on Form

Question 3

In the space provided, show any tax- exempt interest income received or accrued. Include any

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for business taxpayers filing this form is approved under OMB control number

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can write to:

Internal Revenue Service Tax Forms and Publications

1111 Constitution Ave. NW,

Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments as we revise our tax products.

Do not send the form to this office. See When and Where To File, earlier.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | U.S. Income Tax Return for Certain Political Organizations |

| Form Number | 1120-POL |

| OMB Number | 1545-0123 |

| Issuing Department | Department of the Treasury - Internal Revenue Service |

| Applicability | Filed by political organizations and certain exempt organizations to report political organization taxable income under section 527 |

| Tax Rate | The tax rate for filers is 21% |

| Filing Requirement | Mandatory if political organization taxable income is present |

| Key Components | Includes sections for income, deductions, tax, credits, and payments |

Guide to Writing Irs 1120 Pol

Filing out the IRS Form 1120-POL is a straightforward process, but it requires attention to detail. This form is used by political organizations and certain exempt organizations to report their income tax liability. To complete this form correctly, follow the systematic steps outlined below. Make sure to gather all necessary documentation related to income, deductions, and credits before starting. This will help streamline the process and ensure accuracy in reporting.

- Check the appropriate box at the top of the form to indicate if this is a return for a section 501(c) organization.

- Under "Check if," mark any applicable boxes that apply, such as "Final return," "Name change," or "Address change."

- Fill in the "Name of organization" and "Employer identification number."

- Input the organization’s full address, including "Number, street, and room or suite no." If applicable, choose a P.O. box according to the instructions.

- Enter income details:

- Line 1: Dividends.

- Line 2: Interest.

- Line 3: Gross rents.

- Line 4: Gross royalties.

- Line 5: Capital gain net income.

- Line 6: Net gain or (loss) from Form 4797, Part II.

- Line 7: Other income and nonexempt function expenditures.

- Line 8: Total income, sum of lines 1 through 7.

- Enter deduction amounts:

- Line 9: Salaries and wages.

- Line 10: Repairs and maintenance.

- Line 11: Rents.

- Line 12: Taxes and licenses.

- Line 13: Interest.

- Line 14: Depreciation.

- Line 15: Other deductions.

- Line 16: Total deductions, sum of lines 9 through 15.

- If applicable, for section 501(c) organizations, fill in:

- Line 17a: Amount of net investment income.

- Line 17b: Aggregate amount expended for an exempt function.

- Enter specific deduction information on line 18.

- Calculate and input taxable income on line 19.

- Compute income tax on line 20.

- If applicable, calculate and input tax credits on line 21.

- Figure out total tax on line 22.

- Detail payments on lines 23a to 23d, including any tax deposited with Form 7004, credits for tax paid on undistributed capital gains, and credits for federal tax on fuels.

- Determine and enter either tax due on line 24 or overpayment on line 25.

- Complete the "Additional Information" section, questions 1 through 5, as applicable.

- Sign and date the form. Ensure an officer of the organization signs in the designated area. If prepared by someone other than an employee of the organization, the paid preparer must complete the "Paid Preparer Use Only" box.

- Check "Yes" or "No" to authorize the IRS to discuss the return with the preparer, if applicable.

After completing all sections, review the form for accuracy. Be sure to attach any required schedules or statements, such as Schedule D for capital gains and losses or Form 4562 for depreciation. Once the review is complete, mail the form to the appropriate IRS address, depending on the organization's location and specific instructions for filing. Remember, timely filing is crucial to avoid any potential penalties or interest charges.

Understanding Irs 1120 Pol

Who needs to file the IRS 1120-POL form?

Political organizations, regardless of their tax-exempt status, must file the IRS 1120-POL form if they have any political organization taxable income. Additionally, exempt organizations that aren’t considered political organizations but are treated as having political organization taxable income under section 527(f)(1) are also required to file this form.

What income is considered taxable on the IRS 1120-POL form?

For political organizations, taxable income includes all gross income (excluding exempt function income) over the deductions directly connected with the production of gross income. This calculation is adjusted by a specific deduction of $100, disallows net operating loss deductions, dividends-received deductions, and other special deductions for corporations.

What are the filing deadlines for the IRS 1120-POL form?

Generally, the form must be filed by the 15th day of the 4th month following the end of the organization's tax year. If this date falls on a weekend or legal holiday, the deadline is extended to the next business day. Forms should be sent to the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201, unless the organization operates in a foreign country or U.S. possession.

Can you file an amended IRS 1120-POL form?

Yes, organizations can file an amended IRS 1120-POL form. To do so, check the "Amended return" box, complete the entire form with the corrected information, and attach an explanation sheet detailing the reasons and changes made. This must generally be done within 3 years from the original filing deadline or 3 years after the original form was filed, whichever is later.

What should be done if an organization changes its address or name?

If an organization changes its address or name since the last filed return, it should check the respective "Address change" or "Name change" box on the form. For address changes occurring after the return is filed, use Form 8822-B to notify the IRS.

Are there penalties for filing or paying late?

Organizations may face penalties for not filing the IRS 1120-POL form on time or for failing to pay any taxes due by the deadline. The late filing penalty is 5% of the unpaid taxes for each month or part of a month the return is late, up to a maximum of 25%. The minimum penalty for returns over 60 days late is either the total tax due or $435, whichever is smaller. Late payment of taxes incurs a penalty of 0.5% per month on the unpaid tax, up to a maximum of 25%.

Common mistakes

-

One common mistake when completing the IRS 1120-POL form is not checking the correct boxes at the top of the form, particularly whether it is a final return, a name change, an address change, or an amended return. These boxes provide crucial information about the status of the organization and any changes that may have occurred. Failing to mark the appropriate box can lead to misunderstandings and processing delays.

-

Omitting or inaccurately reporting income on lines 1 through 7 under the Income section is another frequent mistake. It's essential to diligently report all forms of income, such as dividends, interest, gross rents, and other incomes. Misreporting or omitting income can attract unwelcome attention from the IRS and potentially lead to audits or penalties.

-

Incorrectly filling out the deductions section, particularly lines 9 through 15, is also a common error. Organizations must ensure that all deductions like salaries, wages, repairs, maintenance, and taxes are accurately reported. Deductions should be fully documented and directly connected to the organization's taxable income to avoid potential issues.

-

Failing to complete the Additional Information section accurately, specifically questions regarding foreign financial accounts and foreign trusts, can be problematic. This oversight can lead to compliance issues, especially if the organization fails to disclose foreign financial interests or transactions, as required by the IRS.

-

Signing and dating the form incorrectly or omitting these altogether in the Sign Here section also ranks high among filing mistakes. The form must be signed and dated by an authorized officer of the organization. An unsigned or undated form can be considered invalid, leading to delays in processing.

It is crucial for organizations to ensure that these common mistakes are avoided to maintain compliance with IRS regulations and to facilitate the smooth processing of their 1120-POL forms.

Documents used along the form

When preparing the IRS Form 1120-POL, which is crucial for certain political organizations to report their income tax liabilities, there are several other forms and documents that organizations might need to use in conjunction. These materials can ensure compliance with IRS requirements and help manage the financial operations of the organization more effectively. Here’s a rundown of some of the key forms often used alongside Form 1120-POL:

- Form 8871: This form is used by political organizations to declare their status under section 527. It's essential for establishing or maintaining tax-exempt status.

- Form 8872: Political organizations use this form to report contributions and expenditures. It's a key document for maintaining transparency about the sources and uses of funds.

- Form 990 or 990-EZ: These forms are used by tax-exempt organizations, including certain political organizations, to provide the IRS with annual financial information. The choice between the forms depends on the size of the organization.

- Form 1120: Though primarily used by corporations to report their income and deductions, some entities using Form 1120-POL might also need to file Form 1120, particularly if they have complex financial structures.

- Form 4797: This form is required for reporting the sale of business property. It might be relevant for political organizations that have engaged in transactions that need to be reported separately.

- Form 4562: For organizations that need to report depreciation and amortization, Form 4562 is essential. It helps calculate the deductions related to the aging or use of property.

- Form 7004: This application for automatic extension of time to file certain business income tax returns can be critical for organizations that need more time to prepare their Form 1120-POL.

- Form 8834: Relevant for entities that qualify for the qualified electric vehicle credit, this form is necessary to claim the credit, even though it's carried forward.

- Form 4136: Organizations that use fuel in their operations may qualify for a credit for federal taxes paid on fuels, claimed using this form.

Each form listed plays a role in ensuring that political organizations meet specific regulatory or operational requirements. Whether it's establishing tax-exempt status, reporting financial activities, or claiming credits, having the right documentation in order is crucial. It’s important that organizations carefully review their activities and seek appropriate forms to stay compliant and maximize their operational efficiencies.

Similar forms

The IRS 1120 form, known as the U.S. Corporation Income Tax Return, shares similarities with the IRS 1120-POL form, which is designated for certain political organizations. Both forms are used by entities to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS), calculate their income tax liability, and outline the payment or refund due. These forms gather comprehensive financial information, enabling the IRS to assess the tax obligations of these entities accurately. While the 1120 form is for corporations, the 1120-POL is specifically tailored for political organizations, adapting the requirements and categories to the unique financial activities related to political contributions and expenditures.

The IRS 990 form, or the Return of Organization Exempt From Income Tax, is another document that intersects in purpose with the 1120-POL form. Both are designed for organizations with specific tax-exempt status under the IRS code, but they cater to different types of entities. Form 990 is broadly used by charitable organizations, non-profits, and other tax-exempt entities to provide the public with financial information, ensuring these organizations' operations align with their tax-exempt purposes. Although the 1120-POL also serves tax-exempt entities—specifically, political organizations—it specifically captures the financial nuances of political contributions and expenditures, reinforcing transparency and accountability within the political financing landscape.

The IRS 1065 form, U.S. Return of Partnership Income, shares commonalities with the 1120-POL form in terms of its structure for reporting income, losses, deductions, and credits. Both forms are essential for entities that must report their financial activities to the IRS, albeit catering to different types of entities—1065 for partnerships and 1120-POL for political organizations. The primary purpose of both documents is to ensure these entities comply with U.S. tax laws by accurately reporting their earnings and financial activities. However, the 1120-POL specifically addresses the unique reporting needs of political entities, focusing on political contributions and spending.

Similar to the 1120-POL, the IRS 1041 form, U.S. Income Tax Return for Estates and Trusts, is designed for a specific entity type and its unique financial activities. While the 1041 form is used by fiduciaries to report the income, deductions, gains, and losses of estates and trusts, the 1120-POL form is catered to political organizations documenting their taxable income and tax liabilities. Both forms play critical roles in their respective domains, ensuring that these entities remain compliant with tax laws and regulations by providing a structured means to report their financial operations to the federal government.

The Schedule C form, Profit or Loss from Business (Sole Proprietorship), while primarily used by individual business owners, parallels the 1120-POL form in its function of detailing the financial aspects of an entity's operations. Both forms require the reporting of income, expenses, and net profit or loss, facilitating the accurate determination of tax obligations. Although Schedule C is tailored for individuals operating sole proprietorships, and the 1120-POL is for political organizations, each form addresses the IRS's need to assess tax liabilities based on the comprehensive financial portrayal of the filing entity's activities.

The IRS Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is akin to the 1120-POL form in its reporting complexity and specificity. Designed for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, Form 5471 collects detailed information about the entity's finances. Like the 1120-POL, which garners specific financial data from political organizations, Form 5471 ensures compliance with U.S. tax laws regarding international operations, highlighting the IRS’s broader mandate to monitor and tax the global activities of U.S. persons and entities.

The Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, bears resemblance to the 1120-POL, as both require detailed financial disclosure for tax purposes. Form 8865 is used by U.S. persons who have an interest in foreign partnerships, necessitating a report of the partnership's income, deductions, gains, and losses to ensure compliance with U.S. tax obligations. This parallels the objective of the 1120-POL, which is focused on capturing the financial activities of political organizations. Both forms are integral to the IRS's efforts to ensure that entities and individuals engaged in specific domains, be they political or international partnerships, accurately report their financial standings for tax assessment.

Dos and Don'ts

Filing IRS Form 1120-POL, the U.S. Income Tax Return for Certain Political Organizations, requires careful attention to detail and thoroughness to ensure accurate and compliant submissions. Below are ten do's and don'ts to guide you through the process smoothly.

- Do ensure that all the information about the organization, including its name and Employer Identification Number (EIN), is current and accurate.

- Do carefully read the instructions provided by the IRS for the Form 1120-POL to understand all the requirements and how to properly fill in the form.

- Do attach all required schedules and statements, such as Schedule D (Form 1120) for capital gains or losses, and Form 4562 for depreciation if items on the form necessitate these.

- Do verify the calculations for income, deductions, and tax liabilities to minimize errors that could lead to possible audits or penalties.

- Do make use of electronic filing and payment systems for efficiency and to ensure timely submission and payment of any taxes owed.

- Don't forget to sign and date the form. An unsigned tax return is considered invalid and can lead to penalties.

- Don't overlook checking the box for final return, name change, address change, or amended return if any of these apply to your organization for the tax filing period.

- Don't include exempt function income or expenditures in the total income or deductions unless they are correctly related to taxable activities and clearly substantiatable.

- Don't miss the filing deadline. Late filing can result in penalties. The due date is generally the 15th day of the 4th month after the end of the organization's tax year.

- Don't fail to attach a detailed explanation for any amendments if filing an amended return. Include specific references to the lines and amounts that are changing.

Fulfilling all procedural and documentation requirements for Form 1120-POL accurately reflects the political organization's commitment to compliance with IRS rules. By following these dos and don'ts, organizations can avoid common mistakes that might lead to unnecessary scrutiny or financial penalties.

Misconceptions

One common misconception is that Form 1120-POL should be filed only if a political organization or certain exempt organization has taxable income. This is incorrect. The requirement to file Form 1120-POL is not solely based on having taxable income. Rather, a political organization must file if it has any political organization taxable income, and certain exempt organizations that aren't inherently political organizations must file if they are treated as having political organization taxable income under section 527(f)(1).

Another misunderstanding is that contributions to political organizations are taxable and must be reported as income on Form 1120-POL. Contributions and other exempt function income are generally not taxable and, therefore, not included in the income reported on Form 1120-POL. The primary focus of Form 1120-POL is reporting political organization taxable income which excludes exempt function income such as contributions, membership dues, and fundraising proceeds.

There's also a misconception that expenses related to campaign activities or other exempt functions are deductible when calculating taxable income. This is not accurate. Only expenses directly connected with the production of political organization taxable income are deductible. Expenses attributable to campaign activities or other exempt functions, which are not directly connected to generating taxable income, are not deductible.

Some believe that all political organizations, irrespective of their income level, are required to file Form 1120-POL. This is not the case. Small political organizations, specifically those that expect their annual gross receipts to always be less than $25,000, are not required to file Form 1120-POL, unless they have political organization taxable income.

Lastly, there's a misconception that filing Form 1120-POL is the only reporting requirement for political organizations. In reality, political organizations may have several other reporting obligations, such as filing Form 8871 to achieve tax-exempt status under section 527, filing Form 8872 to report contributions and expenditures, and, depending on their activities, perhaps even filing Form 990 or Form 990-EZ if their annual gross receipts are $25,000 or more.

Key takeaways

Understand Who Must File: Any political organization, exempt or not, must file IRS 1120-POL if it has any taxable income. Exempt organizations that aren’t political but are considered to have taxable income under section 527(f)(1) must also file.

Identify Political Organizations: This includes parties, committees, associations, funds, or other groups primarily involved in influencing the selection, nomination, election, or appointment of individuals to public or political office.

Calculate Taxable Income Carefully: Political organization taxable income is determined by subtracting the total deductions from the gross income, excluding exempt function income. Campaign contributions and other exempt function income are generally not included in income, and likewise, expenditures aren’t deductible.

Specific Deductions: A specific deduction of $100 is allowed for political organizations when calculating taxable income, but not for newsletter funds defined under section 527(g).

Exempt Function and Income: Activities related to influencing or attempting to influence the selection or nomination for public office, or the election of Presidential or Vice Presidential electors, are considered "exempt functions." Income from these activities is usually not taxed.

Importance of Timely Filing Form 8871: Filing Form 8871 on time is crucial for an organization to be considered tax-exempt. Failure to do so means including exempt function income in taxable income.

Signatory Requirements: The return must be signed and dated by an authorized officer of the organization.

Filing Deadlines and Place: Generally, Form 1120-POL is due by the 15th day of the fourth month following the end of the organization’s tax year. It should be filed with the Department of the Treasury, Internal Revenue Service Center in Ogden, UT, unless the principal business is outside the U.S. or in a U.S. possession.

Electronic Payment Requirement: All federal tax deposits must be made by electronic funds transfer, generally using the EFTPS system.

Rounding Off to Whole Dollars: You can round off cents to whole dollars on your return and schedules. If you choose to round, do so for all amounts on the return.

Responding to Penalties and Interest: Interest is charged on late payments, and penalties may apply for late filing or failure to file. It's crucial to respond to notices about penalties promptly with an explanation.

Extension Requests: Use Form 7004 to request an extension for filing if necessary.

Accounting Method: The organization's taxable income should be calculated using the accounting method regularly employed in maintaining the organization's books and records.

Additional Forms: Depending on circumstances, political organizations may need to file other forms such as Form 8872, Form 990, or Form 8997 alongside or in place of Form 1120-POL.

Popular PDF Documents

How Long Does an Eviction Take - Final step in legal proceedings allowing a landlord to recover property from non-paying tenants.

IRS 6744 - It acts as a bridge between theoretical tax law knowledge and the practical challenges of preparing real tax returns for the public.

What Is 1040-sr - Designed to simplify the process of determining taxable social security benefits for Form 1040A filers.