Get IRS 1099-SA Form

When it comes to managing your health savings accounts (HSAs), flexible spending accounts (FSAs), or medical savings accounts (MSAs), understanding the IRS 1099-SA form is crucial. This important document reports the distributions you've taken from these accounts over the tax year. If you've used your HSA, FSA, or MSA funds for qualifying medical expenses, the IRS 1099-SA plays a key role in ensuring these expenditures are properly accounted for come tax time. Not only does it help in keeping your finances in order, but it also ensures you comply with tax regulations, potentially saving you from unnecessary penalties. The form is sent out by the trustees or administrators of these accounts, making it an essential piece of the puzzle for individuals navigating their health-related finances throughout the year.

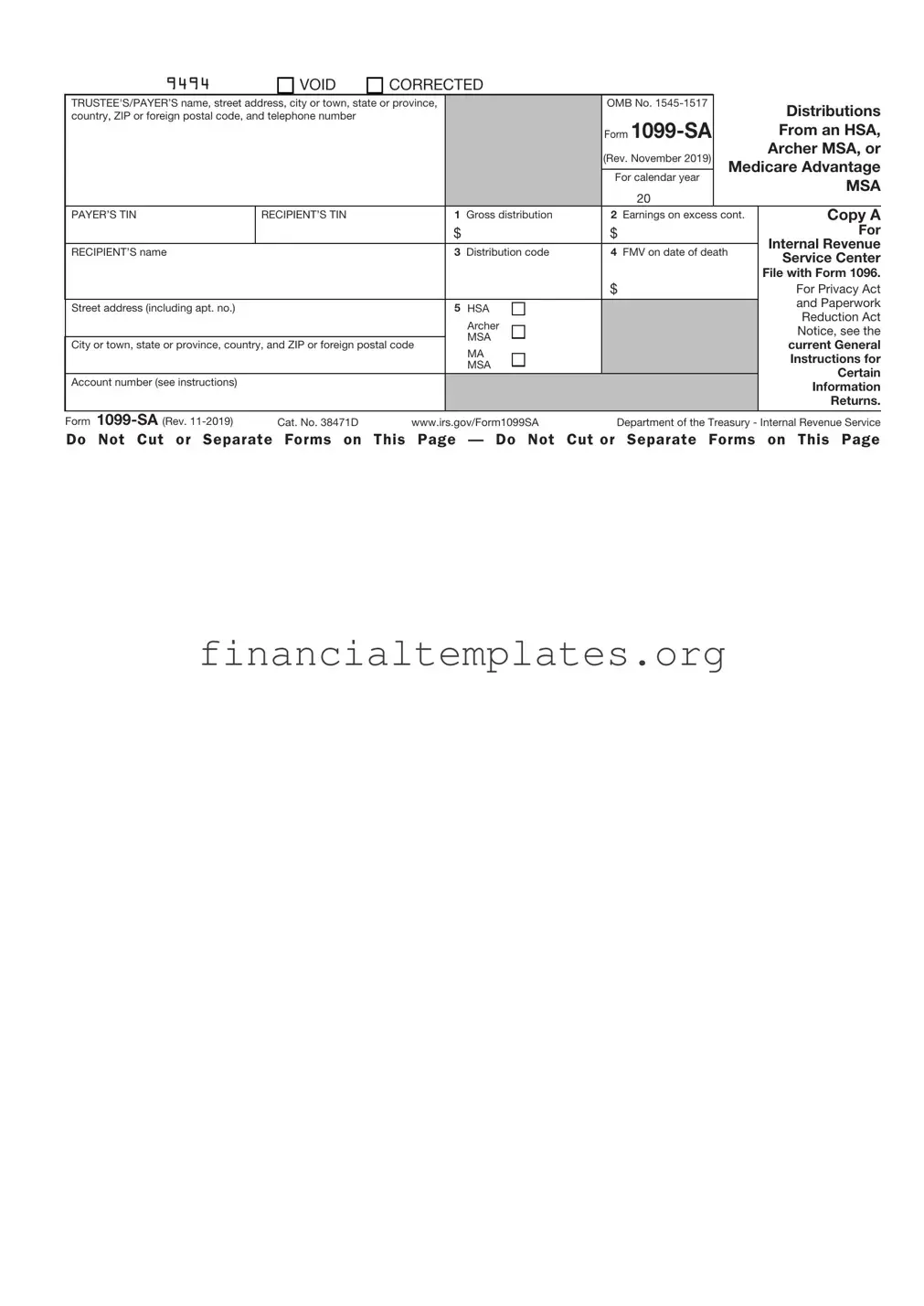

IRS 1099-SA Example

9494

VOID

CORRECTED

TRUSTEE'S/PAYER’S name, street address, city or town, state or province, |

|

|

|

OMB No. |

|

|

Distributions |

||

country, ZIP or foreign postal code, and telephone number |

|

|

|

|

Form |

|

|

||

|

|

|

|

|

|

|

|

From an HSA, |

|

|

|

|

|

|

|

(Rev. November 2019) |

|

|

Archer MSA, or |

|

|

|

|

|

|

|

Medicare Advantage |

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

For calendar year |

|

||

|

|

|

|

|

|

|

|

MSA |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

1 Gross distribution |

|

2 Earnings on excess cont. |

Copy A |

|||

|

|

|

$ |

|

|

$ |

|

|

For |

|

|

|

|

|

|

|

|

|

Internal Revenue |

RECIPIENT’S name |

|

|

3 Distribution code |

|

4 FMV on date of death |

|

|||

|

|

|

|

Service Center |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File with Form 1096. |

|

|

|

|

|

|

$ |

|

|

For Privacy Act |

|

|

|

|

|

|

|

|

|

and Paperwork |

Street address (including apt. no.) |

|

|

5 |

HSA |

|

|

|

|

|

|

|

|

|

|

|

Reduction Act |

|||

|

|

|

|

Archer |

|

|

|

|

|

|

|

|

|

|

|

|

|

Notice, see the |

|

|

|

|

|

MSA |

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

current General |

|||

|

MA |

|

|

|

|

||||

|

|

|

|

|

|

|

|

Instructions for |

|

|

|

|

|

MSA |

|

|

|

|

|

|

|

|

|

|

|

|

|

Certain |

|

Account number (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

|

|

|

|

|

|

Returns. |

Form |

Cat. No. 38471D |

www.irs.gov/Form1099SA |

|

Department of the Treasury - Internal Revenue Service |

|||||

Do Not Cut or Separate Forms on |

This Page |

— Do Not |

Cut or Separate Forms |

on This Page |

|||||

CORRECTED (if checked)

TRUSTEE’S/PAYER’S name, street address, city or town, state or province, |

|

OMB No. |

|

|

Distributions |

|

country, ZIP or foreign postal code, and telephone number |

|

Form |

|

|

||

|

|

|

|

|

From an HSA, |

|

|

|

|

(Rev. November 2019) |

|

|

Archer MSA, or |

|

|

|

|

Medicare Advantage |

||

|

|

|

|

|

||

|

|

|

For calendar year |

|

||

|

|

|

|

|

MSA |

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

1 Gross distribution |

2 Earnings on excess cont. |

Copy B |

||

|

|

$ |

$ |

|

|

For |

RECIPIENT’S name |

|

3 Distribution code |

4 FMV on date of death |

|

Recipient |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

5 HSA |

|

|

|

|

|

|

Archer |

|

|

|

This information |

|

|

MSA |

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

is being furnished |

||

MA |

|

|

|

|||

|

|

|

|

|

to the IRS. |

|

|

|

MSA |

|

|

|

|

|

|

|

|

|

|

|

Account number (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

||

Form |

(keep for your records) |

www.irs.gov/Form1099SA |

Department of the Treasury - Internal Revenue Service |

|||

Instructions for Recipient

Distributions from a health savings account (HSA), Archer medical savings account (MSA), or Medicare Advantage (MA) MSA are reported to you on Form

An HSA or Archer MSA distribution isn’t taxable if you used it to pay qualified medical expenses of the account holder or eligible family member or you rolled it over. An HSA may be rolled over to another HSA; an Archer MSA may be rolled over to another Archer MSA or an HSA. An MA MSA isn’t taxable if you used it to pay qualified medical expenses of the account holder only. If you didn’t use the distribution from an HSA, Archer MSA, or MA MSA to pay for qualified medical expenses, or in the case of an HSA or Archer MSA, you didn’t roll it over, you must include the distribution in your income (see Form 8853 or Form 8889). Also, you may owe a penalty.

You may repay a mistaken distribution from an HSA no later than April 15 following the first year you knew or should have known the distribution was a mistake, providing the trustee allows the repayment.

For more information, see the Instructions for Form 8853 and the Instructions for Form 8889. Also see Pub. 969.

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer has reported your complete identification number to the IRS.

Spouse beneficiary. If you inherited an Archer MSA or MA MSA because of the death of your spouse, special rules apply. See the Instructions for Form 8853. If you inherited an HSA because of the death of your spouse, see the Instructions for Form 8889.

Estate beneficiary. If the HSA, Archer MSA, or MA MSA account holder dies and the estate is the beneficiary, the fair market value (FMV) of the account on the date of death is includible in the account holder’s gross income. Report the amount on the account holder’s final income tax return.

Nonspouse beneficiary. If you inherited the HSA, Archer MSA, or MA MSA from someone who wasn’t your spouse, you must report as income on your tax return the FMV of the account as of the date of death. Report the FMV on your tax return for the year the account owner died even if you received the distribution from the account in a later year. See the Instructions for Form 8853 or the Instructions for Form 8889. Any earnings on the account after the date of death (box 1 minus box 4 of Form

Account number. May show an account or other unique number the payer assigned to distinguish your account.

Box 1. Shows the amount received this year. The amount may have been a direct payment to the medical service provider or distributed to you.

Box 2. Shows the earnings on any excess contributions you withdrew from an HSA or Archer MSA by the due date of your income tax return. If you withdrew the excess, plus any earnings, by the due date of your income tax return, you must include the earnings in your income in the year you received the distribution even if you used it to pay qualified medical expenses. This amount is included in box 1. Include the earnings on the “Other income” line of your tax return. An excise tax of 6% for each tax year is imposed on you for excess individual and employer contributions that remain in the account. See Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other

Box 3. These codes identify the distribution you received:

Box 4. If the account holder died, shows the FMV of the account on the date of death. Box 5. Shows the type of account that is reported on this Form

Form

VOID

CORRECTED

TRUSTEE’S/PAYER’S name, street address, city or town, state or province, |

|

OMB No. |

|

|

Distributions |

||

country, ZIP or foreign postal code, and telephone number |

|

|

Form |

|

|

||

|

|

|

|

|

|

From an HSA, |

|

|

|

|

|

(Rev. November 2019) |

|

|

Archer MSA, or |

|

|

|

|

|

Medicare Advantage |

||

|

|

|

|

For calendar year |

|

||

|

|

|

|

|

|

MSA |

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

1 Gross distribution |

2 Earnings on excess cont. |

Copy C |

||

|

|

|

$ |

$ |

|

|

For |

RECIPIENT’S name |

|

|

3 Distribution code |

4 FMV on date of death |

|

Trustee/Payer |

|

|

|

|

|

$ |

|

|

For Privacy Act |

|

|

|

|

|

|

and Paperwork |

|

Street address (including apt. no.) |

|

|

5 HSA |

|

|

|

Reduction Act |

|

|

|

Archer |

|

|

|

Notice, see the |

|

|

|

|

|

|

current General |

|

City or town, state or province, country, and ZIP or foreign postal code |

MSA |

|

|

|

|||

MA |

|

|

|

Instructions for |

|||

|

|

|

|

|

|

Certain |

|

|

|

|

MSA |

|

|

|

|

Account number (see instructions) |

|

|

|

|

|

|

Information |

|

|

|

|

|

|

Returns. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Form |

|

www.irs.gov/Form1099SA |

Department of the Treasury - Internal Revenue Service |

||||

Instructions for Trustee/Payer

To complete Form

•The current General Instructions for Certain Information Returns, and

•The current Instructions for Forms

To get or to order these instructions, go to www.irs.gov/Form1099SA.

Filing and furnishing. For filing and furnishing instructions, including due dates, and to request filing or furnishing extensions, see the current General Instructions for Certain Information Returns.

To file electronically, you must have software that generates a file according to the specifications in Pub. 1220.

Need help? If you have questions about reporting on Form

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS 1099-SA form is used to report distributions from a Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage MSA. |

| 2 | It must be filed for each individual whom distributions were made from the aforementioned accounts during the tax year. |

| 3 | Distributions reported on the 1099-SA include normal distributions, excess contributions returned, and death distributions. |

| 4 | Form 1099-SA does not determine the taxability of the distributions. Account holders use it along with Form 8889 to figure the tax consequences. |

| 5 | The person responsible for filing the 1099-SA is the trustee or custodian of the health savings account, not the account holder. |

| 6 | The deadline to send out 1099-SA forms to the account holder is generally January 31st of the year following the distribution. |

| 7 | Copies of the 1099-SA must also be sent to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. |

| 8 | The IRS does not require a 1099-SA for distributions that are rolled over, meaning they are transferred from one health account to another health account of the same type. |

| 9 | Mistakes on a 1099-SA should be corrected as soon as possible by the issuer. The issuer needs to send a corrected copy to both the IRS and the account holder. |

| 10 | There are no state-specific versions of the 1099-SA form, as it is a federal form used for reporting purposes under the IRS regulations. However, the information reported may still affect state income tax filings. |

Guide to Writing IRS 1099-SA

Filling out the IRS 1099-SA form is a necessary step for individuals who have received distributions from a Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage MSA. This form reports the distributions you've taken from these accounts over the tax year. It's important to report these accurately to avoid potential tax implications. The process can seem intimidating at first, but by following these concise steps, you can complete it with confidence.

- Gather your personal information, including your Social Security Number (SSN) and the SSN of the account holder if different from yours. Also, compile details of the distributions you've received during the year.

- Begin with the top section of the form, entering the payer's name, street address, city, state, country, ZIP code, and telephone number. This information relates to the trustee or custodian of your HSA, Archer MSA, or Medicare Advantage MSA.

- Next, proceed to enter the recipient’s information. This includes the name, address, and taxpayer identification number (TIN), which usually is your Social Security Number.

- In box 1, input the total amount of distributions you received during the year. This amount includes all distributions made from your account, not just those used for medical expenses.

- Box 2 requires a checkmark if the distribution was made after your death. Boxes 3 through 5 are for indicating the type of account the distributions were made from. Check the appropriate box for an HSA, Archer MSA, or Medicare Advantage MSA.

- Box 3, if applicable, asks you to input the amount of earnings on excess contributions. This step is only necessary if it applies to your situation.

- In Box 4, if you've returned excess contributions, enter the total amount of any distributions returned to the account before the tax filing deadline for the year they were distributed. These returns could adjust the taxable amount reported.

- Make sure to review all entered information for accuracy. Mistakes on this form can lead to notices from the IRS and potentially adjust your tax liabilities.

- Finally, after ensuring all the information is correct and complete, sign and date the form if required. Note that not all filers will need to sign the physical form; this is dependent on how it's filed (electronically or through mail).

- Submit the completed form to the IRS by the filing deadline, typically February 28th if filing by paper, or March 31st if filing electronically. Keep a copy for your records.

After submitting the IRS 1099-SA form, the process doesn't end there. It's important to use the information from the form to accurately complete your tax return. Specifically, you may need to fill out Form 8889 for HSA distributions or provide relevant information if you have an Archer MSA or Medicare Advantage MSA. This ensures your distributions are reported correctly and you pay the correct amount of taxes, if any are due. Staying organized and keeping thorough records can help simplify this process each year.

Understanding IRS 1099-SA

-

What is a 1099-SA form?

The 1099-SA form is a tax document issued by the IRS. It is used to report distributions made from a Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage MSA (MA MSA) during the tax year. This form helps individuals report these distributions on their tax returns.

-

Who should receive a 1099-SA form?

Individuals who have taken distributions from their HSA, Archer MSA, or Medicare Advantage MSA during the tax year will receive a 1099-SA form from the financial institution that manages their account. It's important to review this document carefully, as it needs to be reported on your tax return if you have taken distributions.

-

What information is reported on the 1099-SA?

The 1099-SA form reports the total amount of distributions taken from your account during the tax year. It will outline the gross distribution amount, the distribution code indicating the type (e.g., normal, excess, disability), and whether any portion of the distribution was used for qualified medical expenses. Accurate reporting is crucial to ensure proper tax handling of these distributions.

-

How does the 1099-SA affect my tax return?

Distributions reported on the 1099-SA must be included on your tax return. The tax implications depend on whether the distributions were used for qualified medical expenses. Distributions not used for qualified medical expenses may be taxable and subject to additional penalties. It's essential to use the information on your 1099-SA, along with Form 8889, to report these amounts correctly on your tax return.

-

Where do I report the information from my 1099-SA on my tax return?

The information from your 1099-SA should be reported on Form 8889, which is then included with your Form 1040 tax return. Form 8889 helps calculate the taxable portion of your distributions, if any, and determines whether you owe any additional taxes or penalties on the distributions.

-

Can I still contribute to my HSA or MSA after receiving a 1099-SA?

Yes, receiving a 1099-SA does not affect your eligibility to contribute to your HSA or MSA. However, you must still meet the other eligibility requirements for making contributions to these accounts. Knowing your contribution limits and staying within those guidelines is essential throughout the contribution year.

-

What happens if I use the funds for non-qualified expenses?

If you use funds from your HSA or MSA for non-qualified expenses, the distribution amount will be considered taxable income and may also be subject to an additional 20% penalty. It is crucial to keep receipts and records of how distributions are spent to prove they were used for qualified medical expenses.

-

What should I do if I didn't receive a 1099-SA but took distributions?

If you took distributions from your HSA or MSA and did not receive a 1099-SA, you should first contact the financial institution that manages your account. They can provide you with the necessary form or correct any issue that prevented its delivery. It's important to report all distributions on your tax return, even if you did not receive a 1099-SA.

-

Is there a deadline for the financial institution to send out the 1099-SA?

Yes, financial institutions are required to send out the 1099-SA forms by January 31st of the year following the tax year in which the distributions were made. If you have not received your form by mid-February, contacting the institution directly is a good idea to ensure it's on its way.

-

Can I access my 1099-SA form online?

Many financial institutions offer the option to access your 1099-SA form online through their customer portal. This can be a convenient way to receive your form, especially if mail delivery is slow or unreliable. Check with your institution to see if they offer electronic delivery and how you can access your documents online.

Common mistakes

Filling out the IRS 1099-SA form, which reports distributions from a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA, can be tricky. People often make mistakes that can lead to complications, potential penalties, or incorrect tax liabilities. Recognizing and avoiding these common errors is crucial.

-

Not reporting all distributions: Some individuals mistakenly report only the distributions they used for medical expenses, overlooking others. It's essential to report all distributions, regardless of their use, to ensure accurate tax reporting.

-

Confusing distributions with contributions: A common mistake is mixing up distributions with contributions on the form. Distributions are amounts you take out of your account, while contributions are amounts you put in. This mix-up can significantly affect your tax calculations.

-

Incorrectly categorizing expenses: When distributions are used for eligible medical expenses, they're tax-free. However, people often categorize expenses incorrectly, either claiming ineligible expenses as qualified or failing to claim eligible expenses, thus misreporting their taxable income.

-

Failing to keep receipts: The IRS may require proof of medical expenses if your return is audited. Not keeping receipts for medical expenses paid with HSA or MSA distributions is a mistake that can lead to challenges in verifying these expenses were qualified.

-

Entering incorrect information due to form updates: Tax forms, including the 1099-SA, can change from year to year. Using an outdated form as a reference may result in entering information in the wrong sections or missing new requirements.

To avoid these mistakes, individuals should carefully review their 1099-SA forms, ensure they understand the differences between distributions and contributions, categorize expenses correctly, keep accurate records of all medical expenses, and use the most current form available from the IRS. When in doubt, consulting with a tax professional can help clarify any confusion and ensure the form is filled out correctly.

Documents used along the form

When dealing with the IRS 1099-SA form, individuals primarily focus on distributions from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), or Medicare Advantage MSAs. This form is crucial for reporting purposes, particularly during tax season, to ensure that distributions are accounted for accurately. However, it is rarely the only document involved in the reporting process. Several other forms and documents often accompany the IRS 1099-SA to provide a full picture of an individual's health-related expenditures and savings account activities over the tax year.

- Form 1040: The standard IRS form used by individuals to file their annual income tax returns. This form helps taxpayers calculate their total taxable income, deductions, and credits to determine their tax liability or refund.

- Form 8889: Specifically designed for Health Savings Accounts, this form is crucial for anyone who has made contributions to, or withdrawals from, an HSA. It helps calculate contributions, distributions, and the tax on those distributions if they're not used for qualified medical expenses.

- Schedule A (Form 1040): This schedule is used to itemize deductions, including qualified medical and dental expenses not covered by health insurance or reimbursed by another health plan.

- Form 8853: Required for Archer MSA or Long-Term Care insurance contracts, this form reports contributions, distributions, and such to these accounts or plans.

- Form 1099-MISC: Used to report miscellaneous income, this form could be related if you have received payments due to healthcare services provided, including payments from HSAs, under certain conditions.

- Form 5329: Required if you have excess contributions to HSAs, Archer MSAs, or other tax-favored accounts, this form calculates additional taxes due.

- W-2: The form used by employers to report employee income and taxes withheld. Box 12 may include codes that indicate contributions to an employee's HSA, which must align with your 1099-SA and Form 8889 filings.

- Records of Qualified Medical Expenses: While not a formal IRS form, keeping detailed records of all medical expenses paid out of an HSA or MSA is necessary. These records, including receipts and statements, are essential if your distributions or deductions are ever questioned.

Understanding and accurately completing these documents in conjunction with the IRS 1099-SA form are vital for managing Health Savings Accounts, Archer Medical Savings Accounts, and Medicare Advantage MSA contributions and distributions. Such diligence ensures compliance with tax laws, maximizing benefits, and minimizing unnecessary tax liabilities. Each document serves a specific purpose in the broader context of an individual's tax and healthcare financial planning, highlighting the interconnected nature of finance and personal health management in the tax process.

Similar forms

The IRS Form 1099-SA, which reports distributions from a health savings account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA, has characteristics similar to other IRS documents, designed to report various types of income, transactions, or financial distributions. These similarities often lie in their function of reporting to both the taxpayer and the IRS specific financial activities that may affect an individual's tax liabilities and responsibilities.

One such document is the IRS 1099-MISC form, utilized for reporting miscellaneous income such as rent, royalties, or non-employee compensation. Like the 1099-SA, the 1099-MISC serves a crucial role in ensuring individuals report and pay taxes on various types of income not covered by traditional employment. Both forms contribute to a transparent financial system where different income streams are accurately reported to the IRS.

Another related document is the IRS 1099-INT form. This form is used to report interest income from banks and other financial institutions. Similar to the 1099-SA, the 1099-INT informs the IRS of additional income that could affect the taxpayer’s total taxable income. Both documents play a pivotal role in capturing income from financial growth or distributions, underscoring their importance in the tax reporting ecosystem.

The IRS 1099-DIV form, which reports dividends and distributions from investments, shares a purposeful resemblance to the 1099-SA. Both forms are essential for individuals to report earnings received, whether those earnings are from savings account distributions or stock dividends. This connection underlines the broad spectrum of what is considered taxable income and the IRS's interest in these distributions.

The IRS 5500 series, which reports on employee benefit plans, while more complex, shares a conceptual connection with the 1099-SA. Both types of documents are involved in reporting on benefits or distributions that have tax implications for the recipient. The detailed reporting is crucial for maintaining the compliance and transparency of financial accounts associated with benefits and savings.

Similarly, the IRS Form 1099-R, used for reporting distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc., aligns with the 1099-SA's objective. Both forms are instrumental in ensuring that distributions potentially impacting a taxpayer’s income are accounted for during tax calculations. This underlines the IRS's commitment to capturing a comprehensive view of an individual's taxable income.

The IRS Form 529, which reports contributions and distributions related to educational savings accounts, also parallels the 1099-SA. Although focusing on educational financing, both forms track distributions from accounts intended for specific purposes and have implications for the taxpayer's financial statements and tax responsibilities.

IRS Form 1099-G, which is used for reporting government payments like state tax refunds and unemployment compensation, somewhat mirrors the 1099-SA. Both documents ensure that payments received from government or government-affiliated programs are reported. This similarity highlights the wide array of income sources that can affect taxation, from government refunds to health savings account distributions.

Lastly, the IRS Schedule K-1, which reports income from partnerships, S-corporations, and other pass-through entities, shares with the 1099-SA the theme of reporting income that may not be subject to regular wage-based withholding. Both documents play critical roles in tracking income from specific and perhaps less common sources, ensuring a thorough accounting of taxable income.

In sum, the IRS 1099-SA form is but one part of a larger framework designed by the IRS to monitor and tax a broad spectrum of income sources. From investment dividends to retirement distributions, these documents collectively help paint a full picture of an individual's income landscape, ensuring accurate tax reporting and compliance.

Dos and Don'ts

Filling out the IRS 1099-SA form, which reports distributions from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), or Medicare Advantage MSAs, requires careful attention to detail. Here are some essential tips to ensure accuracy and compliance.

- Do double-check the taxpayer identification number (TIN) to ensure it matches the one on file with the IRS.

- Do verify the accuracy of the distribution amount reported. This figure should reflect the total of all distributions made during the tax year.

- Do indicate the correct distribution code in box 3. This code identifies the reason for the distribution, such as medical expenses or death of the account beneficiary.

- Do use the correct form version. The IRS updates forms periodically, so it's crucial to use the most recent version available on the IRS website.

- Do file electronically if you are required to file 250 or more forms to improve processing efficiency and accuracy.

- Don't overlook the deadline for filing the 1099-SA form, which is typically the end of February (if filing by paper) or the end of March (if filing electronically) following the tax year in which the distributions were made.

- Don't forget to provide a copy of the 1099-SA to the account holder by January 31 following the tax year in which the distributions were made.

- Don't report distributions for HSAs, Archer MSAs, and Medicare Advantage MSAs on the same form. Each account type requires a separate form.

- Don't disregard the importance of maintaining accurate records of all distributions and corresponding documentation, should the IRS require verification.

By following these guidelines, you can ensure the 1099-SA form is filled out correctly, thereby avoiding potential issues with the IRS. Always consult the IRS instructions for the 1099-SA form or a tax professional if you have specific questions related to your situation.

Misconceptions

When it comes to the IRS 1099-SA form, several misconceptions often lead to confusion. This form is essential for individuals using Health Savings Accounts (HSAs), Medical Savings Accounts (MSAs), or Medicare Advantage MSAs. Here, we will dispel some of the common myths surrounding this form to ensure you have the accurate information you need.

- Only Withdrawals for Non-Qualified Medical Expenses Need to Be Reported: Many believe that the 1099-SA form only needs to cover withdrawals for non-qualified expenses. However, this form reports all withdrawals, regardless of their purpose. It's up to you to differentiate between qualified and non-qualified medical expenses when filing your taxes.

- The Form Is Only for the IRS: While it's true that the 1099-SA form is a federal document, it isn't solely for the IRS. You should also use this form to accurately report your HSA, MSA, or Medicare Advantage MSA withdrawals on your tax return. It’s important to understand how these figures influence your tax obligations.

- Employers Issue 1099-SA Forms: A common misunderstanding is that employers who offer HSAs or MSAs are responsible for issuing the 1099-SA forms. In reality, the financial institution that manages your HSA or MSA issues this form, not your employer.

- You Don’t Need to Report If You Didn’t Withdraw: Some people think if they didn't make any withdrawals from their HSA or MSA in a given year, they don’t have to worry about the 1099-SA. While you might not receive a 1099-SA form if there were no withdrawals, it’s essential to keep track of your account activity throughout the year. This ensures accuracy in your tax records and preparedness for any audits or inquiries.

- Filing a 1099-SA Means You'll Owe More Taxes: There's a misconception that filing a 1099-SA automatically means paying more in taxes. This isn’t necessarily true. The purpose of the form is to report distributions from your HSA or MSA. If these distributions were used for qualified medical expenses, they are generally tax-free. It's the use of the funds, not the act of reporting them, that determines your tax liability.

Understanding these misconceptions about the IRS 1099-SA form can help streamline your tax preparation process and ensure you're complying with tax laws without undue stress. Always consult with a tax professional for guidance tailored to your specific situation.

Key takeaways

The IRS 1099-SA form is crucial for individuals using Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), or Medicare Advantage MSAs. Understanding how to accurately fill out and utilize this form is essential for reporting purposes. Here are key takeaways to consider when dealing with the 1099-SA form:

- The purpose of the IRS 1099-SA form is to report distributions from HSAs, Archer MSAs, or Medicare Advantage MSAs over the tax year. Accurately reporting these distributions is critical to ensure compliance with tax laws and avoid potential penalties.

- The form should include all distributions made from your account during the fiscal year. This encompasses medical expenses, premiums, and any other qualified expenditures. Each distribution type impacts your taxable income differently, so correctly classifying each withdrawal is critical.

- Filling out the form requires attention to detail, including the taxable amount of distributions and your personal identifying information. If distributions were used exclusively for qualified medical expenses, they are generally not taxable. However, it’s essential to maintain records and receipts to substantiate these expenses in case of an IRS inquiry.

- It is also important to understand that receiving a 1099-SA form does not automatically imply that you owe taxes on the distributions. The tax implications of your distributions depend on whether those funds were used for qualified medical expenses. This distinction emphasizes the importance of keeping detailed records throughout the year.

Responsibly managing your HSA, Archer MSA, or Medicare Advantage MSA, and understanding the nuances of the 1099-SA form, plays a pivotal role in maximizing the benefits of these accounts while ensuring compliance with tax laws. As always, consulting with a tax professional can provide personalized guidance tailored to your specific situation.

Popular PDF Documents

Transfer Taxes Illinois - Filing the PTAX-203 form is a mandatory step for nearly all real estate transfers in Illinois, ensuring legal adherence.

¥7,200 - With Form 7200, the IRS provides a mechanism for immediate financial relief to businesses impacted by the coronavirus pandemic.

W-9s - The W-9S form plays a significant role in the tax preparation process for students, helping them to accurately report educational expenses and financial aid on their tax returns.