Get IRS 1099-DIV Form

When diving into the realm of investments and dividends, taxpayers encounter various forms that are pivotal for reporting their income accurately to the Internal Revenue Service (IRS). Among these, the IRS 1099-DIV form stands out as an essential document designed to report the dividends and distributions received over the tax year. This form plays a crucial role in ensuring individuals properly account for income from stocks or mutual funds, potentially affecting their tax liabilities. Beyond merely reporting ordinary dividends, the form also covers qualified dividends, which are subject to lower tax rates under certain conditions, total capital gains distributions, and any federal income tax withheld. Whether you're a seasoned investor or new to the scene, understanding the nuances of the 1099-DIV form is indispensable for a smooth tax filing experience, helping to navigate through the complexities of investment income with ease.

IRS 1099-DIV Example

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

9191 |

|

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1a Total ordinary dividends |

OMB No. |

|

|

|

|

|||||||||

or foreign postal code, and telephone no. |

|

|

|

|

|

Form |

|

|

|

|

|||||

|

|

|

|

|

|

$ |

|

|

|

Dividends and |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

|

|

Distributions |

|||

|

|

|

|

|

|

1b Qualified dividends |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

For calendar year |

|

|

|

|

||

|

|

|

|

|

|

$ |

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a Total capital gain distr. |

2b Unrecap. Sec. 1250 gain |

|

|

Copy A |

|||||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

For |

PAYER’S TIN |

|

|

RECIPIENT’S TIN |

|

2c Section 1202 gain |

2d Collectibles (28%) gain |

|

|

Internal Revenue |

||||||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

Service Center |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

2e Section 897 ordinary dividends |

2f Section 897 capital gain |

|

|

File with Form 1096. |

|||||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

RECIPIENT’S name |

|

|

|

|

|

3 |

Nondividend distributions |

4 Federal income tax withheld |

|

For Privacy Act |

|||||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Paperwork |

||

|

|

|

|

|

|

5 |

Section 199A dividends |

6 Investment expenses |

|

|

|||||

|

|

|

|

|

|

|

|

Reduction Act |

|||||||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Notice, see the |

||||||

|

|

|

|

|

|

7 |

Foreign tax paid |

8 Foreign country or U.S. possession |

|

||||||

|

|

|

|

|

|

|

current General |

||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Instructions for |

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

Certain |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

9 |

Cash liquidation distributions |

10 Noncash liquidation distributions |

|

Information |

|||||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

Returns. |

|

|

|

|

|

11 FATCA filing |

12 |

13 Specified private activity |

|

|

|

|||||

|

|

|

|

|

requirement |

|

|

|

bond interest dividends |

|

|

|

|||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

|

2nd TIN not. |

14 State |

15 State identification no. |

16 State tax withheld |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Form |

Cat. No. 14415N |

|

www.irs.gov/Form1099DIV |

Department of the Treasury - Internal Revenue Service |

|||||||||||

Do Not Cut or |

Separate |

Forms on |

This Page |

|

— |

Do Not Cut |

or Separate Forms |

on This Page |

|||||||

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1a Total ordinary dividends |

OMB No. |

|

|

|

|||||||

or foreign postal code, and telephone no. |

|

|

|

|

Form |

|

|

|

||||

|

|

|

$ |

|

|

|

Dividends and |

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

(Rev. January 2022) |

|

|

Distributions |

||||

|

|

|

1b Qualified dividends |

|

|

|||||||

|

|

|

|

|

|

For calendar year |

|

|

|

|||

|

|

|

$ |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a Total capital gain distr. |

2b Unrecap. Sec. 1250 gain |

|

Copy 1 |

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

For State Tax |

PAYER’S TIN |

RECIPIENT’S TIN |

|

2c Section 1202 gain |

2d Collectibles (28%) gain |

|

Department |

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

2e Section 897 ordinary dividends |

2f |

Section 897 capital gain |

|

|

|||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

3 |

Nondividend distributions |

4 Federal income tax withheld |

|

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

5 |

Section 199A dividends |

6 |

Investment expenses |

|

|

||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

7 |

Foreign tax paid |

8 Foreign country or U.S. possession |

|

||||||

|

|

$ |

|

|

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|||

|

|

|

9 |

Cash liquidation distributions |

10 |

Noncash liquidation distributions |

|

|||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

11 FATCA filing |

12 |

13 Specified private activity |

|

|

||||||

|

|

requirement |

|

|

|

|

bond interest dividends |

|

|

|||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

14 State |

15 State identification no. |

16 State tax withheld |

|

|

|||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Form |

|

www.irs.gov/Form1099DIV |

Department of the Treasury - Internal Revenue Service |

|||||||||

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP |

1a Total ordinary dividends |

OMB No. |

|

|

||||||||

or foreign postal code, and telephone no. |

|

|

|

Form |

|

|

||||||

|

|

|

$ |

|

|

|

Dividends and |

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

(Rev. January 2022) |

|

Distributions |

|||||

|

|

|

1b Qualified dividends |

|

||||||||

|

|

|

|

|

|

For calendar year |

|

|

||||

|

|

|

$ |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a Total capital gain distr. |

2b Unrecap. Sec. 1250 gain |

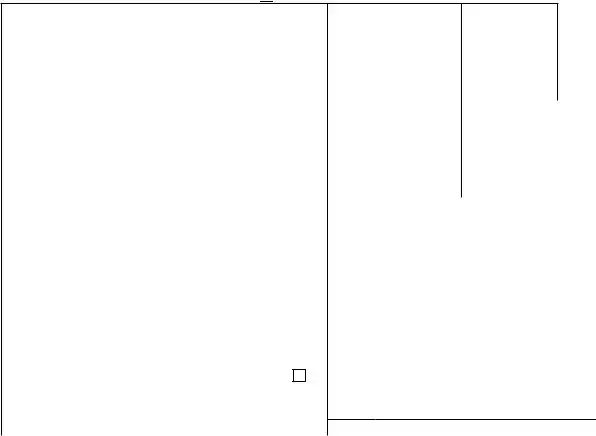

Copy B |

|||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

For Recipient |

|||

PAYER’S TIN |

RECIPIENT’S TIN |

2c Section 1202 gain |

2d |

Collectibles (28%) gain |

||||||||

|

||||||||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

2e Section 897 ordinary dividends |

2f |

Section 897 capital gain |

|

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

3 |

Nondividend distributions |

4 Federal income tax withheld |

This is important tax |

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

information and is |

|||

|

|

|

5 |

Section 199A dividends |

6 |

Investment expenses |

being furnished to |

|||||

|

|

|

$ |

|

|

$ |

|

|

|

|

the IRS. If you are |

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

required to file a |

||||

|

|

|

7 |

Foreign tax paid |

8 |

Foreign country or U.S. possession |

return, a negligence |

|||||

|

|

|

|

|

|

|

|

|

|

|

penalty or other |

|

|

|

|

$ |

|

|

|

|

|

|

|

sanction may be |

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

imposed on you if |

||||

|

|

|

|

|

|

|

|

|

|

|

this income is taxable |

|

|

|

|

9 |

Cash liquidation distributions |

10 |

Noncash liquidation distributions |

||||||

|

|

|

and the IRS |

|||||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

determines that it has |

|||

|

|

|

|

|

|

|

|

|

|

|

not been reported. |

|

|

|

11 FATCA filing |

12 |

13 |

Specified private activity |

|||||||

|

|

|

||||||||||

|

|

requirement |

|

|

|

|

bond interest dividends |

|

||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

14 State |

15 State identification no. |

16 State tax withheld |

|

||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Form |

(keep for your records) |

|

www.irs.gov/Form1099DIV |

Department of the Treasury - Internal Revenue Service |

||||||||

Instructions for Recipient

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to distinguish your account.

Box 1a. Shows total ordinary dividends that are taxable. Include this amount on the “Ordinary dividends” line of Form 1040 or

Box 1b. Shows the portion of the amount in box 1a that may be eligible for reduced capital gains rates. See the Instructions for Form 1040 for how to determine this amount and where to report.

The amount shown may be dividends a corporation paid directly to you as a participant (or beneficiary of a participant) in an employee stock ownership plan (ESOP). Report it as a dividend on your Form 1040 or

Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040). But, if no amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or

Box 2b. Shows the portion of the amount in box 2a that is unrecaptured section 1250 gain from certain depreciable real property. See the Unrecaptured Section 1250 Gain Worksheet in the Instructions for Schedule D (Form 1040).

Box 2c. Shows the portion of the amount in box 2a that is section 1202 gain from certain small business stock that may be subject to an exclusion. See the Schedule D (Form 1040) instructions.

Box 2d. Shows the portion of the amount in box 2a that is 28% rate gain from sales or exchanges of collectibles. If required, use this amount when completing the 28% Rate Gain Worksheet in the Instructions for Schedule D (Form 1040).

Box 2e. Shows the portion of the amount in box 1a that is section 897 gain attributable to disposition of U.S. real property interests (USRPI).

Box 2f. Shows the portion of the amount in box 2a that is section 897 gain attributable to disposition of USRPI.

Note: Boxes 2e and 2f apply only to foreign persons and entities whose income maintains its character when passed through or distributed to its direct or

indirect foreign owners or beneficiaries. It is generally treated as effectively connected to a trade or business within the United States. See the instructions for your tax return.

Box 3. Shows a return of capital. To the extent of your cost (or other basis) in the stock, the distribution reduces your basis and is not taxable. Any amount received in excess of your basis is taxable to you as capital gain. See Pub. 550.

Box 4. Shows backup withholding. A payer must backup withhold on certain payments if you did not give your TIN to the payer. See Form

Box 5. Shows the portion of the amount in box 1a that may be eligible for the 20% qualified business income deduction under section 199A. See the instructions for Form 8995 and Form

Box 6. Shows your share of expenses of a nonpublicly offered RIC, generally a nonpublicly offered mutual fund. This amount is included in box 1a.

Box 7. Shows the foreign tax that you may be able to claim as a deduction or a credit on Form 1040 or

Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7.

Boxes 9 and 10. Show cash and noncash liquidation distributions.

Box 11. If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. You may also have a filing requirement. See the Instructions for Form 8938.

Box 12. Shows

Box 13. Shows

Boxes

Nominees. If this form includes amounts belonging to another person, you are considered a nominee recipient. You must file Form

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1a Total ordinary dividends |

OMB No. |

|

|

|

|||||||

or foreign postal code, and telephone no. |

|

|

|

|

Form |

|

|

|

||||

|

|

|

$ |

|

|

|

Dividends and |

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

(Rev. January 2022) |

|

|

Distributions |

||||

|

|

|

1b Qualified dividends |

|

|

|||||||

|

|

|

|

|

|

For calendar year |

|

|

|

|||

|

|

|

$ |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a Total capital gain distr. |

2b Unrecap. Sec. 1250 gain |

|

Copy 2 |

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

To be filed with |

PAYER’S TIN |

RECIPIENT’S TIN |

|

2c Section 1202 gain |

2d |

Collectibles (28%) gain |

|

||||||

|

|

recipient’s state |

||||||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

income tax return, |

||

|

|

|

2e Section 897 ordinary dividends |

2f |

Section 897 capital gain |

|

when required. |

|||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

3 |

Nondividend distributions |

4 Federal income tax withheld |

|

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

5 |

Section 199A dividends |

6 |

Investment expenses |

|

|

||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

7 |

Foreign tax paid |

8 Foreign country or U.S. possession |

|

||||||

|

|

$ |

|

|

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|||

|

|

|

9 |

Cash liquidation distributions |

10 |

Noncash liquidation distributions |

|

|||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

11 FATCA filing |

12 |

13 Specified private activity |

|

|

||||||

|

|

requirement |

|

|

|

|

bond interest dividends |

|

|

|||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

14 State |

15 State identification no. |

16 State tax withheld |

|

|

|||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Form |

|

www.irs.gov/Form1099DIV |

Department of the Treasury - Internal Revenue Service |

|||||||||

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1a Total ordinary dividends |

OMB No. |

|

|

|

|||||||

or foreign postal code, and telephone no. |

|

|

|

|

Form |

|

|

|

||||

|

|

|

$ |

|

|

|

Dividends and |

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

(Rev. January 2022) |

|

|

Distributions |

||||

|

|

|

1b Qualified dividends |

|

|

|||||||

|

|

|

|

|

|

For calendar year |

|

|

|

|||

|

|

|

$ |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a Total capital gain distr. |

2b Unrecap. Sec. 1250 gain |

|

Copy C |

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

For Payer |

PAYER’S TIN |

RECIPIENT’S TIN |

|

2c Section 1202 gain |

2d Collectibles (28%) gain |

|

|

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

2e Section 897 ordinary dividends |

2f |

Section 897 capital gain |

|

|

|||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

3 |

Nondividend distributions |

4 Federal income tax withheld |

For Privacy Act |

||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Paperwork |

||

|

|

|

5 |

Section 199A dividends |

6 |

Investment expenses |

|

|||||

|

|

|

|

Reduction Act |

||||||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Notice, see the |

|||

|

|

|

7 |

Foreign tax paid |

8 Foreign country or U.S. possession |

|||||||

|

|

|

current General |

|||||||||

|

|

|

$ |

|

|

|

|

|

|

|

|

Instructions for |

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

Certain |

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

9 |

Cash liquidation distributions |

10 |

Noncash liquidation distributions |

Information |

|||||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

Returns. |

|

|

11 FATCA filing |

12 |

13 Specified private activity |

|

|

||||||

|

|

requirement |

|

|

|

|

bond interest dividends |

|

|

|||

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

2nd TIN not. |

14 State |

15 State identification no. |

16 State tax withheld |

|

|

|||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Form |

|

www.irs.gov/Form1099DIV |

Department of the Treasury - Internal Revenue Service |

|||||||||

Instructions for Payer

To complete Form

•The current General Instructions for Certain Information Returns, and

•The current Instructions for Form

To order these instructions and additional forms, go to www.irs.gov/EmployerForms.

Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website.

Filing and furnishing. For filing and furnishing instructions, including due dates, and to request filing or furnishing extensions, see the current General Instructions for Certain Information Returns.

Foreign dividend recipient. If the recipient of the dividend is a nonresident alien, you may have to withhold federal income tax and file Form

Need help? If you have questions about reporting on Form

Document Specifics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Purpose of Form | The IRS 1099-DIV form is used to report dividends and distributions to taxpayers by corporations and mutual funds. |

| 2 | Recipients | Individuals, trusts, and estates that receive dividends and distributions during the tax year are provided this form. |

| 3 | Reporting Requirements | If dividends and distributions received total over $10, the payer must send out the Form 1099-DIV. |

| 4 | Components of Dividends | The form reports total dividends, qualified dividends, total capital gain distributions, and non-dividend distributions. |

| 5 | Impact on Tax Returns | Income reported on the 1099-DIV form affects the tax liability of the recipient and must be reported on their federal income tax return. |

| 6 | Deadline for Issuance | Payers must furnish Form 1099-DIV to recipients by January 31st of the year following the tax year in which the income was paid. |

| 7 | State Reporting | Some states require a copy of the 1099-DIV for state income tax purposes. The specific requirements vary by state. |

| 8 | Electronic Filing | The IRS encourages electronic filing of Form 1099-DIV, especially for entities submitting 250 or more forms. |

| 9 | Corrections | If incorrect information is reported, a corrected 1099-DIV must be filed with the IRS and furnished to the recipient. |

| 10 | Foreign Account Tax Compliance Act (FATCA) Filing | Form 1099-DIV is used in conjunction with other forms to comply with FATCA requirements by reporting assets held in foreign financial institutions. |

Guide to Writing IRS 1099-DIV

Filing the IRS 1099-DIV form is crucial for accurately reporting the dividends and distributions received from investments. It's a straightforward process that helps ensure compliance with tax obligations. This form captures the dividends received during the tax year, including ordinary dividends, qualified dividends, total capital gain distributions, federal income tax withheld, foreign taxes paid, and section 1202 gains. Once filled out properly, this form provides the Internal Revenue Service (IRS) with necessary details on the income investors earned from dividends and distributions, which aids in the appropriate taxation of that income. The following steps will guide through filling out the form accurately.

- Gather essential information: Before starting, collect all necessary documents such as brokerage statements or dividend statements that detail the amount of dividends paid during the tax year.

- Enter payer’s information: At the top of the form, fill in the payer’s (or your company’s) name, address, and telephone number, and also the payer’s federal identification number.

- Enter recipient’s information: Below the payer’s information, input the recipient’s name, address, and taxpayer identification number (TIN), usually a social security number (SSN) or employer identification number (EIN).

- Report dividends and distributions: In boxes 1a and 1b, enter the total ordinary dividends and the total qualified dividends, respectively. These amounts often come from dividends on stock investments or mutual funds.

- Detail capital gain distributions: In box 2a, report the total capital gain distributions. This amount represents profits from the sale of investments in a portfolio.

- Fill in additional tax items: If applicable, input any federal income tax withheld in box 4, foreign taxes paid in box 6, and section 1202 gains in box 2d. These fields capture specific tax considerations related to dividends and distributions.

- Review and sign: Once all information is accurately recorded, review the form for completeness and accuracy. If everything is correct, sign and date the form.

- Submit the form: Finally, mail the completed form to the IRS, and provide a copy to the recipient of the dividends for their records.

Accurate completion and timely submission of the IRS 1099-DIV form are essential steps in fulfilling tax responsibilities. This process not only assists in ensuring that the correct taxes are paid but also helps individuals to keep track of their investment income throughout the year. By carefully following these steps, one can efficiently manage tax obligations associated with dividends and distributions, avoiding any potential issues with the IRS.

Understanding IRS 1099-DIV

-

What is a 1099-DIV form, and who needs to file it?

The IRS Form 1099-DIV is a document that U.S. financial institutions and other entities use to report dividends and other distributions to taxpayers and to the IRS. This form is necessary for individuals who receive dividends or distributions from investments they own, such as stocks or mutual funds, that amount to $10 or more in a year. Furthermore, if you've received dividends on insurance policies if they are considered taxable, the form is required. This information is crucial for completing your tax return accurately, as it affects your income and taxation levels.

-

What information is included on the 1099-DIV form?

The 1099-DIV form captures a variety of information, crucial for both taxpayers and the IRS. It includes:

- The total dividends and distributions you have received over the year.

- Qualified dividends that are subject to capital gains rates, which could be lower than ordinary income tax rates.

- Any federal income tax withheld, if applicable, which can help reduce your overall tax liability.

- Investments that yielded dividends in foreign countries and the taxes paid to those countries.

- Details regarding capital gain distributions, which are the result of the mutual fund's sale of stocks or other assets.

- Any non-dividend distributions, which are not considered taxable income and reduce your cost basis in the investment.

This comprehensive breakdown aids in understanding how dividends impact your tax obligations.

-

What should I do if I don't receive a 1099-DIV form but I had dividends?

If you've had dividends or other qualifying distributions but haven't received a Form 1099-DIV, you're still responsible for reporting all of your income on your tax return. First, contact the institution or company that should have issued the form. There may have been an error or oversight in sending out your form. If you're unable to obtain the form in time for tax filing, use your account statements or other records to report the income as accurately as possible on your tax return. Always keep detailed records of your investments and their earnings to ensure compliance and to simplify this process.

-

How does the 1099-DIV form affect my tax obligations?

The dividends and distributions reported on Form 1099-DIV are considered income by the IRS and must be included on your tax return. Depending on the type of dividends received, they may be taxed at different rates:

- Ordinary dividends are taxed at your normal income tax rate.

- Qualified dividends benefit from being taxed at the lower long-term capital gains tax rates.

Reporting these accurately can significantly impact your taxable income and the taxes owed. Be mindful of any deductions or credits you're eligible for, which could offset some of the tax implications of your dividend income. Additionally, the tax withheld as indicated on your 1099-DIV can reduce the amount you owe when filing your return.

Common mistakes

Filling out the IRS 1099-DIV form, which is used to report dividends and distributions to taxpayers and the IRS, requires attention to detail and an understanding of the form's requirements. Mistakes in this process can lead to audits, penalties, or delayed tax refunds. Here are four common errors to avoid:

Incorrect or Omitted Taxpayer Identification Number (TIN): Every 1099-DIV form must include the correct taxpayer identification number, usually the recipient's Social Security Number (SSN) or, in some cases, an Employer Identification Number (EIN). An incorrect or missing TIN can lead to mismatches in the IRS system, delaying the processing of your tax return or causing unnecessary IRS notices.

Failure to Report All Income: Taxpayers sometimes receive multiple 1099-DIV forms from various sources. Every dividend or distribution, no matter how small, must be reported on your tax return. Overlooking or intentionally omitting dividends can attract IRS scrutiny and may result in interest and penalties.

Misunderstanding Box 1a and 1b: Box 1a on the 1099-DIV form reports the total amount of ordinary dividends, while Box 1b reports the portion of Box 1a that is qualified dividends. Mixing these up can affect tax calculations, as qualified dividends are taxed at a lower rate than ordinary income. Accurately reporting these amounts ensures you're taking advantage of potential tax savings.

Ignoring State Tax Requirements: While the 1099-DIV form is a federal document, the information it contains may also be relevant for state tax returns. Some taxpayers overlook the need to report their dividend income on state tax returns, possibly leading to state tax liabilities. Being mindful of state tax laws and requirements ensures compliance on both federal and state levels.

Avoiding these common pitfalls can smooth the path of your tax reporting process, minimizing errors and the potential for unwanted attention from the IRS. Always double-check your forms and consult with a tax professional if you're unsure about your tax obligations.

Documents used along the form

When preparing tax documents, especially those related to investment income, the IRS 1099-DIV form plays a crucial role. This form is just one piece of the puzzle in understanding your tax obligations and potential refunds. Alongside the 1099-DIV, several other forms and documents are often used to provide a complete picture of an individual's financial standing. Each document serves a unique purpose in ensuring that your tax filings are accurate and comprehensive.

- Form 1040: This is the standard IRS form that individuals use to file their annual income tax returns. It serves as the main form where you report your total income for the year, and it helps to determine the amount of taxes owed or the refund due.

- Schedule B (Form 1040): This schedule is used to list interest and ordinary dividends over a certain amount. It's particularly relevant for individuals who receive a 1099-DIV, as it helps detail the source and amount of income reported.

- Form 1099-INT: This form reports interest income. Similar to the 1099-DIV, it’s issued by banks and other financial institutions. For anyone with investments, it's common to receive both 1099-DIV and 1099-INT forms.

- Form 1099-B: This form reports capital gains and losses from transactions of brokered or bartered exchanges. If you sold any stocks, bonds, or mutual funds, the 1099-B provides necessary details for your tax records.

- Form 8960: For individuals subject to the Net Investment Income Tax, this form calculates the taxes due on investment income, including dividends, interest, and capital gains.

- Broker Statements: While not a formal IRS document, broker statements are essential for verifying the information on your 1099 forms. They provide detailed information about transactions within your investment accounts throughout the year.

These documents collectively ensure that individuals can accurately report their income and calculate their tax liabilities. Handling these forms can be daunting, but they are fundamental tools for managing your financial life. Seeking advice from tax professionals or using dependable tax preparation software can help simplify this process, ensuring that all information is both accurate and complete.

Similar forms

The IRS 1099-INT form closely resembles the 1099-DIV form, as both pertain to income that is not from employment. While the 1099-DIV form captures dividends and distributions from investments, the 1099-INT focuses on interest income. This interest could be from bank accounts, savings accounts, or investments that pay interest, showing the IRS the amount of interest an individual has earned during the year outside their regular salary or wages.

Another document similar to the 1099-DIV form is the 1099-MISC form. This form is used to report miscellaneous income that does not fit the standard categories of salary or wages. Examples of income reported on a 1099-MISC include rents, payments to independent contractors, prizes, and awards. Although the types of income reported are different, both the 1099-DIV and 1099-MISC forms serve the same function of reporting extra income to the IRS for tax purposes.

The 1099-B form, used for reporting sales and exchanges of securities, also shares similarities with the 1099-DIV form. The 1099-B form tracks the capital gains or losses that result from transactions of stocks, bonds, or other securities throughout the year. While the 1099-DIV form focuses on income received as dividends from investments, the 1099-B form deals with the outcome of selling those investments, thereby complementing each other in the spectrum of investment income reporting.

Finally, the 1099-R form, intended for reporting distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc., parallels the 1099-DIV form in its focus on non-employment income. Both forms are crucial for individuals receiving income from sources other than a paycheck, allowing the IRS to assess taxes on these varied income streams appropriately. The 1099-R specifically highlights the distribution aspect of retirement and investment plans, which is a significant source of income for retirees, similar to how dividends are for investors.

Dos and Don'ts

Filling out an IRS 1099-DIV form, which is used to report dividends and distributions, can be straightforward if you follow these essential dos and don'ts:

- Do ensure you have all the necessary information before you start, including total dividends and distributions received during the tax year.

- Do double-check the taxpayer identification numbers (TINs), including your social security number or employer identification number, to ensure they are correct.

- Do accurately report each type of dividend or distribution in the appropriate box, as they are taxed at different rates.

- Do use the IRS's electronic filing system if you are required to file a large number of forms; this is quicker and can reduce errors.

- Don't overlook the importance of reporting exempt-interest dividends from mutual funds, as these must be reported even though they are not taxable.

- Don't forget to distribute the correct copies of the 1099-DIV to the recipient and the IRS; keep one for your records as well.

- Don't disregard the deadlines for filing the 1099-DIV form with the IRS and for sending it to the payee — late filing can result in penalties.

- Don't hesitate to seek professional advice if you're uncertain about how to report specific dividends or distributions, to avoid potential errors and penalties.

Misconceptions

The IRS 1099-DIV form is a document that United States taxpayers receive from banks and financial institutions to report dividends and distributions from investments. However, there are several misconceptions about this form that can cause confusion. Understanding these common myths can help taxpayers file more accurately and avoid potential pitfalls.

- Misconception #1: All dividends are taxed the same. Dividends are not one-size-fits-all when it comes to taxation. Qualified dividends are taxed at the more favorable capital gains rates, whereas ordinary dividends are taxed as ordinary income. The distinction is crucial for understanding your tax obligations accurately.

- Misconception #2: If I reinvest my dividends, I don't have to report them. Whether you take your dividends as cash or reinvest them in additional shares, the IRS requires that all dividends received be reported on your tax return. Reinvestment does not exempt you from reporting or taxation.

- Misconception #3: The 1099-DIV form is only for individual investors. The 1099-DIV form is not exclusive to individuals. Entities such as trusts and estates that earn dividends also receive this form. It's about the income, not the recipient's tax classification.

- Misconception #4: You only need to report domestic dividends. U.S. tax laws require the reporting of all income, including dividends from foreign investments. The source of the dividend income does not exempt it from being reported to the IRS.

- Misconception #5: It's optional to file the 1099-DIV with your tax return. If you receive a 1099-DIV, the IRS also gets a copy. Therefore, it's essential to report any amounts listed on the 1099-DIV on your tax return. Failure to do so can lead to discrepancies and prompt IRS inquiries.

- Misconception #6: The 1099-DIV form covers all forms of investment income. The 1099-DIV form is specifically for reporting dividends and certain types of distributions. Other investment income, such as interest earned or capital gains, is reported on different forms, such as 1099-INT and 1099-B, respectively.

A common thread through these misconceptions is the vital importance of understanding the distinct rules and requirements for different types of investment income. Accurate reporting ensures compliance with tax obligations and helps taxpayers avoid unnecessary complications. Seeking the guidance of a knowledgeable professional can provide clarity and confidence in navigating these matters.

Key takeaways

The IRS 1099-DIV form is a crucial document for individuals who receive dividend income throughout the fiscal year. Understanding the essentials of how to properly fill out and utilize this form can help manage tax obligations effectively. Here are key takeaways to ensure compliance and optimization of your tax responsibilities.

- Identification of Dividend Types: The 1099-DIV form categorizes dividends into ordinary dividends and qualified dividends, each with different tax implications. Ordinary dividends are taxed as ordinary income, while qualified dividends benefit from lower tax rates, similar to long-term capital gains.

- Reporting Threshold: If you receive more than $10 in dividends from any one entity during the tax year, you should expect to receive a 1099-DIV form. Entities are required to send out these forms to shareholders who meet or surpass this threshold.

- Deadline Awareness: The deadline for companies to issue 1099-DIV forms is typically January 31st following the end of the tax year. As a recipient, be on the lookout for this form to arrive via mail or electronically around this time-frame to ensure timely tax filing.

- Consolidation for Multiple Accounts: If you have dividends coming from various sources, you might receive multiple 1099-DIV forms. It’s essential to consolidate information from all these forms accurately when reporting dividend income on your tax return.

- Foreign Accounts and Tax Treaties: For dividends received from foreign entities, additional reporting requirements may apply, and tax treaty benefits might reduce the amount of tax owed on these dividends. It’s important to understand how to report these accurately on the 1099-DIV and other relevant forms.

- State Tax Implications: Besides federal taxes, your dividend income may also be subject to state taxes. Be sure to understand your state’s requirements for reporting dividend income, as it may impact your overall tax liability.

- Reinvestment Plans: If dividends are automatically reinvested in additional shares or units, these reinvested amounts are still reportable and taxable income for the year they were received. It’s a common misconception that reinvested dividends don’t count as taxable income.

- Amending Returns: If you receive a corrected 1099-DIV form after you’ve already filed your taxes, you may need to amend your return. Careful review of all 1099-DIV forms when they arrive can save the hassle of amending tax returns later on.

In navigating the complexities of dividend income reporting, the key lies in staying organized, understanding the applicable tax laws, and considering the timing and nature of dividends received. Proper handling of the 1099-DIV form can lead to a smoother tax filing process and potentially more favorable tax outcomes.

Popular PDF Documents

Airsev Application For Employment - Additional space requirement for any section indicates the form's comprehensive nature, allowing candidates to provide extensive details about their qualifications and experience.

Formulario 1028 - The BIR’s detailed process for the tax-exempt certification of cooperatives signals a supportive regulatory environment, crucial for the sector’s growth and its pivotal role in the economy.