Get IRS 1099-B Form

The financial transactions individuals engage in throughout the year, especially those involving the sale or exchange of stocks, bonds, commodities, and various securities, have significant implications when tax season rolls around. Navigating this complex landscape is made somewhat more manageable with the help of the IRS 1099-B form, a document specifically designed to report gains and losses from these transactions to both the taxpayer and the Internal Revenue Service (IRS). Brokers and mutual fund companies typically issue this form by the end of February, detailing each transaction's date, sale price, and cost basis, thereby assisting in distinguishing between short-term and long-term capital gains or losses. The significance of accurately completing and understanding the nuances of the 1099-B cannot be understated, as it directly influences one’s tax liabilities and potential refund amounts. Furthermore, it serves a key role in maintaining compliance with federal tax laws, helping individuals avoid possible penalties for underreporting income or erroneously claiming losses. With financial markets becoming increasingly accessible to the average person, the 1099-B form has become an essential tool in the taxpayer’s arsenal for accurately reporting investment income and ensuring that all financial moves are accurately reflected during tax season.

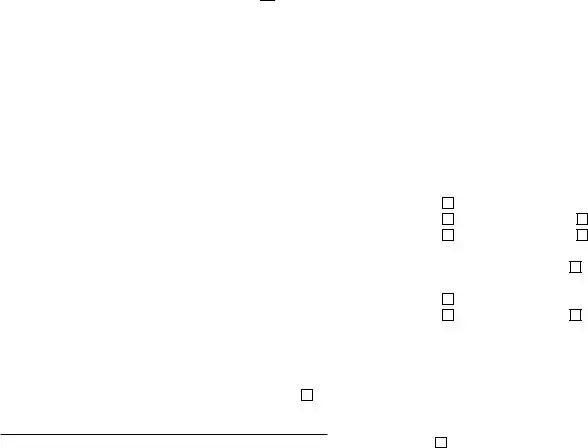

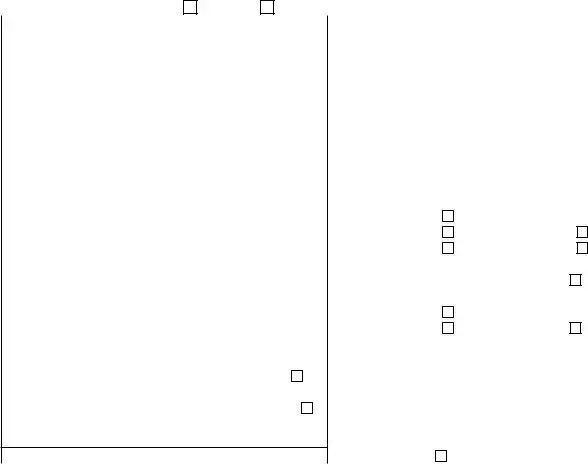

IRS 1099-B Example

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

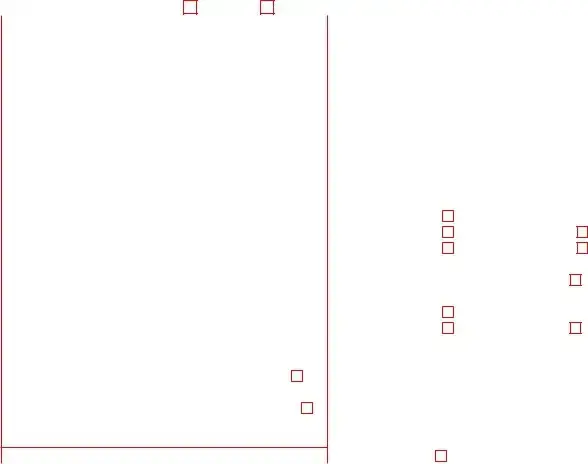

7979 |

VOID |

CORRECTED |

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP Applicable checkbox on Form 8949 |

OMB No. |

Proceeds From |

|||

or foreign postal code, and telephone no. |

|

|

|

2022 |

Broker and |

|

|

|

|

||

|

|

|

Barter Exchange |

||

|

|

|

|

Form |

Transactions |

|

|

|

|

|

|

1a Description of property (Example: 100 sh. XYZ Co.)

|

|

|

|

|

|

|

1b Date acquired |

1c Date sold or disposed |

|

|

|

|

|

|

|

|

|

|

Copy A |

PAYER’S TIN |

|

RECIPIENT’S TIN |

|

1d Proceeds |

1e Cost or other basis |

||||

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

1f Accrued market discount |

1g Wash sale loss disallowed |

For |

|

|

|

|

|

|

$ |

$ |

Internal Revenue |

|

|

|

|

|

|

|

|

|

|

Service Center |

RECIPIENT’S name |

|

|

|

|

|

|

2 |

3 Check if proceeds from: |

|

|

|

|

|

|

|

|

Collectibles |

File with Form 1096. |

|

|

|

|

|

|

|

|

Ordinary |

QOF |

|

Street address (including apt. no.) |

|

|

|

|

|

4 Federal income tax withheld |

5 Check if noncovered |

|

|

|

|

|

|

|

|

$ |

security |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

6 Reported to IRS: |

7 Check if loss is not allowed |

For Privacy Act |

|

|

|

|

|

|

|

|

based on amount in 1d |

and Paperwork |

City or town, state or province, country, and ZIP or foreign postal code |

|

Gross proceeds |

|||||||

|

|

||||||||

|

|

|

|

|

|

|

Net proceeds |

|

Reduction Act |

|

|

|

|

|

|

|

|

Notice, see the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 Profit or (loss) realized in |

9 Unrealized profit or (loss) on |

|

|

|

|

|

|

|

|

2022 General |

||

|

|

|

|

|

|

|

2022 on closed contracts |

open |

|

Account number (see instructions) |

|

|

|

2nd TIN not. |

$ |

$ |

Instructions for |

||

|

|

|

|

|

|

Certain |

|||

CUSIP number |

|

|

|

FATCA filing |

|

10 Unrealized profit or (loss) on |

11 Aggregate profit or (loss) |

Information |

|

|

|

|

|

requirement |

|

open |

on contracts |

Returns. |

|

|

|

|

|

|

$ |

$ |

|

||

14 State name |

15 State identification no. |

16 State tax withheld |

|

|

|||||

|

|

|

$ |

|

|

|

12 Check if basis reported to |

13 Bartering |

|

|

|

|

$ |

|

|

|

IRS |

$ |

|

|

|

|

|

|

|

|

|

||

Form |

|

Cat. No. 14411V |

|

www.irs.gov/Form1099B |

Department of the Treasury - Internal Revenue Service |

||||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

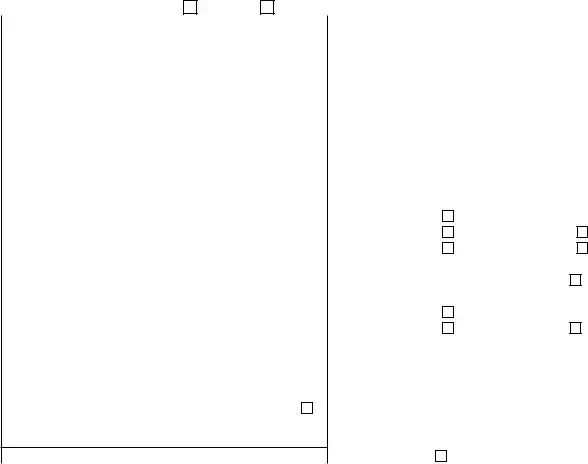

VOID |

CORRECTED |

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP Applicable checkbox on Form 8949 |

OMB No. |

Proceeds From |

||

or foreign postal code, and telephone no. |

|

|

2022 |

Broker and |

|

|

|

||

|

|

Barter Exchange |

||

|

|

|

Form |

Transactions |

|

|

|

|

|

1a Description of property (Example: 100 sh. XYZ Co.)

|

|

|

|

|

|

1b Date acquired |

1c Date sold or disposed |

|

|

|

|

|

|

|

|

|

Copy 1 |

PAYER’S TIN |

|

RECIPIENT’S TIN |

1d Proceeds |

1e Cost or other basis |

||||

|

|

|

|

|

|

$ |

$ |

For State Tax |

|

|

|

|

|

|

1f Accrued market discount |

1g Wash sale loss disallowed |

Department |

|

|

|

|

|

|

$ |

$ |

|

RECIPIENT’S name |

|

|

|

|

|

2 |

3 If checked, proceeds from: |

|

|

|

|

|

|

|

Collectibles |

|

|

|

|

|

|

|

|

Ordinary |

QOF |

|

Street address (including apt. no.) |

4 Federal income tax withheld |

5 If checked, noncovered |

|

|||||

|

|

|

|

|

|

$ |

security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Reported to IRS: |

7 If checked, loss is not allowed |

|

|

|

|

|

|

|

|

based on amount in 1d |

|

City or town, state or province, country, and ZIP or foreign postal code |

Gross proceeds |

|

||||||

|

|

|||||||

|

|

|

|

|

|

Net proceeds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 Profit or (loss) realized in |

9 Unrealized profit or (loss) on |

|

|

|

|

|

|

|

2022 on closed contracts |

open |

|

Account number (see instructions) |

|

|||||||

|

|

|

||||||

|

|

|

|

|

|

$ |

$ |

|

CUSIP number |

|

|

|

FATCA filing |

10 Unrealized profit or (loss) on |

11 Aggregate profit or (loss) |

|

|

|

|

|

|

requirement |

open |

on contracts |

|

|

|

|

|

|

|

$ |

$ |

|

|

14 State name |

15 State identification no. |

16 State tax withheld |

|

|||||

|

|

|

$ |

|

|

12 If checked, basis reported |

13 Bartering |

|

|

|

|

$ |

|

|

to IRS |

$ |

|

|

|

|

|

|

|

|||

Form |

|

|

|

|

|

www.irs.gov/Form1099B |

Department of the Treasury - Internal Revenue Service |

|

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP |

Applicable checkbox on Form 8949 |

OMB No. |

Proceeds From |

||||||

or foreign postal code, and telephone no. |

|

|

2022 |

Broker and |

|||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Barter Exchange |

||

|

|

|

|

|

|

|

Form |

Transactions |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

1a Description of property (Example: 100 sh. XYZ Co.) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1b Date acquired |

1c Date sold or disposed |

|

||

|

|

|

|

|

|

|

|

Copy B |

|

PAYER’S TIN |

|

RECIPIENT’S TIN |

1d Proceeds |

1e Cost or other basis |

|||||

|

|

|

|

|

$ |

$ |

|

For Recipient |

|

|

|

|

|

|

1f Accrued market discount |

1g Wash sale loss disallowed |

|

||

|

|

|

|

|

$ |

$ |

|

|

|

RECIPIENT’S name |

|

|

|

|

2 |

3 If checked, proceeds from: |

|

||

|

|

|

|

|

Collectibles |

|

|||

|

|

|

|

|

Ordinary |

QOF |

|

This is important tax |

|

Street address (including apt. no.) |

4 Federal income tax withheld |

5 If checked, noncovered |

information and is |

||||||

|

|

|

|

|

$ |

security |

being furnished to |

||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

the IRS. If you are |

|

|

|

|

|

|

6 Reported to IRS: |

7 If checked, loss is not allowed |

|||

|

|

|

|

|

required to file a |

||||

|

|

|

|

|

|

based on amount in 1d |

|||

City or town, state or province, country, and ZIP or foreign postal code |

Gross proceeds |

||||||||

return, a negligence |

|||||||||

|

|

||||||||

|

|

|

|

|

Net proceeds |

|

|

penalty or other |

|

|

|

|

|

|

8 Profit or (loss) realized in |

9 Unrealized profit or (loss) on |

sanction may be |

||

|

|

|

|

|

2022 on closed contracts |

open |

imposed on you if |

||

Account number (see instructions) |

|||||||||

|

|

|

this income is |

||||||

|

|

|

|

|

$ |

$ |

|

||

|

|

|

|

|

|

taxable and the IRS |

|||

CUSIP number |

|

|

|

FATCA filing |

10 Unrealized profit or (loss) on |

11 Aggregate profit or (loss) |

determines that it |

||

|

|

|

|

requirement |

open |

on contracts |

has not been |

||

|

|

|

|

|

$ |

$ |

|

reported. |

|

14 State name |

15 State identification no. |

16 State tax withheld |

|

||||||

|

|

||||||||

|

|

|

$ |

|

12 If checked, basis reported |

13 Bartering |

|

||

|

|

|

$ |

|

to IRS |

$ |

|

|

|

|

|

|

|

|

|

||||

Form |

|

(Keep for your records) |

www.irs.gov/Form1099B |

Department of the Treasury - Internal Revenue Service |

|||||

Instructions for Recipient

Brokers and barter exchanges must report proceeds from (and in some cases, basis for) transactions to you and the IRS on Form

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN)). However, the issuer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to distinguish your account.

CUSIP number. Shows the CUSIP (Committee on Uniform Security Identification Procedures) number or other applicable identifying number.

FATCA filing requirement. If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. You may also have a filing requirement. See the Instructions for Form 8938.

Applicable checkbox on Form 8949. Indicates where to report this transaction on Form 8949 and Schedule D (Form 1040), and which checkbox is applicable. See the instructions for your Schedule D (Form 1040) and/or Form 8949.

Box 1a. Shows a brief description of the item or service for which amounts are being reported. For regulated futures contracts and forward contracts, “RFC” or other appropriate description may be shown. For Section 1256 option contracts, “Section 1256 option” or other appropriate description may be shown. For a corporation that had a reportable change in control or capital structure, this box may show the class of stock as C (common), P (preferred), or O (other).

Box 1b. This box may be blank if box 5 is checked or if the securities sold were acquired on a variety of dates. For short sales, the date shown is the date you acquired the security delivered to close the short sale.

Box 1c. Shows the trade date of the sale or exchange. For short sales, the date shown is the date the security was delivered to close the short sale. For aggregate reporting in boxes 8 through 11, no entry will be present.

Box 1d. Shows the cash proceeds, reduced by any commissions or transfer taxes related to the sale, for transactions involving stocks, debt, commodities, forward contracts,

Box 1e. Shows the cost or other basis of securities sold. If the securities were acquired through the exercise of a noncompensatory option granted or acquired on or after January 1, 2014, the basis has been adjusted to reflect your option premium. If the securities were acquired through the exercise of a noncompensatory option granted or acquired before January 1, 2014, your broker is permitted, but not required, to adjust the basis to reflect your option premium. If the securities were acquired through the exercise of a compensatory option, the basis has not been adjusted to include any amount related to the option that was reported to you on a Form

(Continued on the back of Copy 2.)

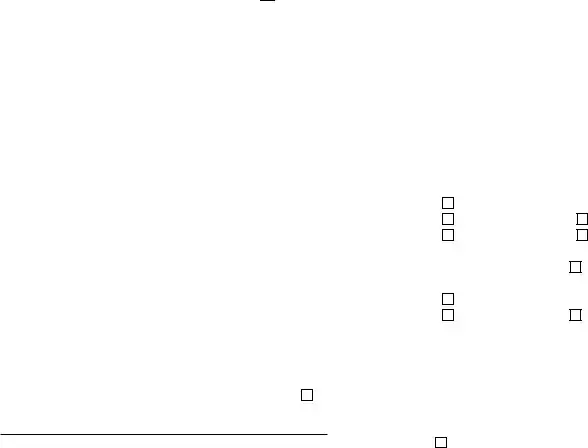

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP |

Applicable checkbox on Form 8949 |

OMB No. |

Proceeds From |

|||||

or foreign postal code, and telephone no. |

|

|

2022 |

Broker and |

||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Barter Exchange |

|

|

|

|

|

|

|

|

Form |

Transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a Description of property (Example: 100 sh. XYZ Co.) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1b Date acquired |

1c Date sold or disposed |

|

|

|

|

|

|

|

|

|

|

Copy 2 |

PAYER’S TIN |

|

RECIPIENT’S TIN |

1d Proceeds |

1e Cost or other basis |

||||

|

|

|

|

|

$ |

$ |

|

To be filed with |

|

|

|

|

|

1f Accrued market discount |

1g Wash sale loss disallowed |

recipient’s state |

|

|

|

|

|

|

$ |

$ |

|

income tax return, |

|

|

|

|

|

|

|

|

when required. |

RECIPIENT’S name |

|

|

|

|

2 |

3 If checked, proceeds from: |

||

|

|

|

|

|

||||

|

|

|

|

|

Collectibles |

|

||

|

|

|

|

|

Ordinary |

QOF |

|

|

Street address (including apt. no.) |

4 Federal income tax withheld |

5 If checked, noncovered |

|

|||||

|

|

|

|

|

$ |

security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Reported to IRS: |

7 If checked, loss is not allowed |

|

|

|

|

|

|

|

|

based on amount in 1d |

|

|

City or town, state or province, country, and ZIP or foreign postal code |

Gross proceeds |

|

||||||

|

|

|

||||||

|

|

|

|

|

Net proceeds |

|

|

|

|

|

|

|

|

8 Profit or (loss) realized in |

9 Unrealized profit or (loss) on |

|

|

|

|

|

|

|

2022 on closed contracts |

open |

|

|

Account number (see instructions) |

|

|||||||

|

|

|

|

|||||

|

|

|

|

|

$ |

$ |

|

|

CUSIP number |

|

|

|

FATCA filing |

10 Unrealized profit or (loss) on |

11 Aggregate profit or (loss) |

|

|

|

|

|

|

requirement |

open |

on contracts |

|

|

|

|

|

|

$ |

$ |

|

|

|

14 State name |

15 State identification no. |

16 State tax withheld |

|

|

||||

|

|

|

$ |

|

12 If checked, basis reported |

13 Bartering |

|

|

|

|

|

$ |

|

to IRS |

$ |

|

|

|

|

|

|

|

|

|||

Form |

|

|

|

|

www.irs.gov/Form1099B |

Department of the Treasury - Internal Revenue Service |

||

Instructions for Recipient (continued)

Box 1f. Shows the amount of accrued market discount. For details on market discount, see the Schedule D (Form 1040) instructions, the Instructions for Form 8949, and Pub. 550. If box 5 is checked, box 1f may be blank.

Box 1g. Shows the amount of nondeductible loss in a wash sale transaction. For details on wash sales, see the Schedule D (Form 1040) instructions, the Instructions for Form 8949, and Pub. 550. If box 5 is checked, box 1g may be blank.

Box 2. The

Box 3. If checked, proceeds are from a transaction involving collectibles or from a Qualified Opportunity Fund (QOF).

Box 4. Shows backup withholding. Generally, a payer must backup withhold if you did not furnish your TIN to the payer. See Form

Box 5. If checked, the securities sold were noncovered securities and boxes 1b, 1e, 1f, 1g, and 2 may be blank. Generally, a noncovered security means: stock purchased before 2011, stock in most mutual funds purchased before 2012, stock purchased in or transferred to a dividend reinvestment plan before 2012, debt acquired before 2014, options granted or acquired before 2014, and securities futures contracts entered into before 2014.

Box 6. If the exercise of a noncompensatory option resulted in a sale of a security, a checked “Net proceeds” box indicates whether the amount in box 1d was adjusted for option premium.

Box 7. If checked, you cannot take a loss on your tax return based on gross proceeds from a reportable change in control or capital

structure reported in box 1d. See the Form 8949 and Schedule D (Form 1040) instructions. The broker should advise you of any losses on a separate statement.

Regulated Futures Contracts, Foreign Currency Contracts, and Section 1256 Option Contracts (Boxes 8 Through 11)

Box 8. Shows the profit or (loss) realized on regulated futures, foreign currency, or Section 1256 option contracts closed during 2022.

Box 9. Shows any

Box 10. Shows the unrealized profit or (loss) on open contracts held in your account on December 31, 2022. These are considered closed out as of that date. This will become an adjustment reported as unrealized profit or (loss) on open

Box 11. Boxes 8, 9, and 10 are all used to figure the aggregate profit or (loss) on regulated futures, foreign currency, or Section 1256 option contracts for the year. Include this amount on your 2022 Form 6781.

Box 12. If checked, the basis in box 1e has been reported to the IRS and either the

Box 13. Shows the cash you received, the fair market value of any property or services you received, and the fair market value of any trade credits or scrip credited to your account by a barter exchange. See Pub. 525.

Boxes

Future developments. For the latest information about any developments related to Form

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for

VOID |

CORRECTED |

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP Applicable checkbox on Form 8949 |

OMB No. |

Proceeds From |

||

or foreign postal code, and telephone no. |

|

|

2022 |

Broker and |

|

|

|

||

|

|

Barter Exchange |

||

|

|

|

Form |

Transactions |

|

|

|

|

|

1a Description of property (Example: 100 sh. XYZ Co.)

|

|

|

|

|

|

|

1b Date acquired |

1c Date sold or disposed |

|

|

|

|

|

|

|

|

|

|

|

Copy C |

|

PAYER’S TIN |

|

RECIPIENT’S TIN |

1d Proceeds |

1e Cost or other basis |

||||||

|

|

|

|

|

|

|

$ |

$ |

For Payer |

|

|

|

|

|

|

|

|

1f Accrued market discount |

1g Wash sale loss disallowed |

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

RECIPIENT’S name |

|

|

|

|

|

|

2 |

3 Check if proceeds from: |

|

|

|

|

|

|

|

|

|

Collectibles |

|

||

|

|

|

|

|

|

|

Ordinary |

QOF |

|

|

Street address (including apt. no.) |

|

|

|

|

|

4 Federal income tax withheld |

5 Check if noncovered |

|

||

|

|

|

|

|

|

|

$ |

security |

|

|

|

|

|

|

|

|

|

|

For Privacy Act |

||

|

|

|

|

|

|

|

6 Reported to IRS: |

7 Check if loss is not allowed |

||

|

|

|

|

|

|

|

and Paperwork |

|||

|

|

|

|

|

|

|

|

based on amount in 1d |

||

City or town, state or province, country, and ZIP or foreign postal code |

Gross proceeds |

|||||||||

Reduction Act |

||||||||||

|

||||||||||

|

|

|

|

|

|

|

Net proceeds |

|

Notice, see the |

|

|

|

|

|

|

|

|

8 Profit or (loss) realized in |

9 Unrealized profit or (loss) on |

2022 General |

|

|

|

|

|

|

|

|

2022 on closed contracts |

open |

Instructions for |

|

Account number (see instructions) |

|

|

|

2nd TIN not. |

||||||

|

|

|

|

|

Certain |

|||||

|

|

|

|

|

|

|

$ |

$ |

||

|

|

|

|

|

|

|

Information |

|||

CUSIP number |

|

|

|

FATCA filing |

10 Unrealized profit or (loss) on |

11 Aggregate profit or (loss) |

Returns. |

|||

|

|

|

|

requirement |

open |

on contracts |

|

|||

|

|

|

|

|

$ |

$ |

|

|||

14 State name |

15 State identification no. |

16 State tax withheld |

|

|||||||

|

|

|

$ |

|

|

|

12 Check if basis reported to |

13 Bartering |

|

|

|

|

|

$ |

|

|

|

IRS |

$ |

|

|

|

|

|

|

|

|

|

|

|||

Form |

|

|

|

|

|

|

www.irs.gov/Form1099B |

Department of the Treasury - Internal Revenue Service |

||

Instructions for Payer

To complete Form

•The 2022 General Instructions for Certain Information Returns, and

•The 2022 Instructions for Form

To order these instructions and additional forms, go to www.irs.gov/EmployerForms.

Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website.

Filing and furnishing. For filing and furnishing instructions, including due dates, and requesting filing or furnishing extensions, see the 2022 General Instructions for Certain Information Returns.

Foreign recipient. If the recipient of the proceeds is a nonresident alien, you may have to withhold federal income tax and file Form

Need help? If you have questions about reporting on Form

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 1099-B | Used to report proceeds from broker and barter exchange transactions. |

| Who Must File | Brokers and barter exchanges must file for each person for whom they have sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc. |

| Reporting Requirements | Information about the sales price, date of sale, cost basis, and type of gain or loss must be reported for each transaction. |

| Deadline for Filing | Brokers must send the form to the IRS by February 28th (or March 31st if filing electronically) and to the taxpayer by January 31st. |

| State Reporting | Some states require a copy of the 1099-B for state tax reporting purposes. The need and method vary by state. |

| Exceptions | Certain transactions are exempt from reporting on Form 1099-B, such as sales of noncovered securities acquired before 2011. |

| Electronic Filing | Filers submitting 250 or more Form 1099-Bs must do so electronically through the IRS FIRE system. |

Guide to Writing IRS 1099-B

Filling out the IRS 1099-B form is a crucial step for accurately reporting transactions related to stocks, bonds, commodities, and other securities over the tax year. This form helps individuals and entities document their gains and losses, ensuring compliance with tax laws and potentially optimizing their tax situation. Let's make the process less daunting by breaking it down into clear, manageable steps. By following these guidelines, you can confidently prepare your 1099-B form, paving the way for a smoother tax filing experience.

- Start by gathering all necessary documentation related to your transactions. This includes brokerage statements, trade confirmations, and any other relevant financial records.

- Download the latest version of the IRS 1099-B form from the Internal Revenue Service (IRS) website.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number or Employer Identification Number.

- For each sale or transaction, complete the required information in the form sections:

- Date of the sale or transaction

- Description of the sold property (e.g., shares of XYZ Corporation)

- Quantity sold

- Proceeds from the sale (gross amount)

- Cost or other basis of the sold property

- Adjustments to gain or loss (if applicable)

- If applicable, mark the checkbox for transactions involving collectibles (e.g., art, antiques, metals, gems, stamps, coins) to indicate the appropriate tax rate may apply.

- For short sales, ensure you report the date you acquired the property delivered to close the short sale and the date of the short sale itself.

- If reporting transactions for a customer, include the customer’s name, account number, and other identifying information as required.

- Double-check your entries for accuracy. Confirm that all transactions are reported and that the personal and transactional information matches your financial documents.

- Sign and date the form if you are preparing a physical copy. If filing electronically, verify that your tax software includes the 1099-B form and follow the prompts to review and submit your information.

Once you've completed and reviewed the form for accuracy, you're ready to file it with the IRS, along with any other necessary tax documents. If you're working with a tax professional or using tax software, make sure to provide them with all the information and documentation related to your 1099-B form. Timely and accurate filing of the 1099-B form is essential for meeting tax obligations and avoiding potential penalties. Remember, being meticulous in your documentation and reporting not only helps in complying with tax laws but can assist in optimizing your tax outcomes.

Understanding IRS 1099-B

-

What is a 1099-B form?

The IRS 1099-B form, also known as the "Proceeds from Broker and Barter Exchange Transactions" form, is a document individuals receive from their brokers or barter exchanges. It details the sales or exchanges of stocks, bonds, or other securities that occurred during the tax year. This information is used to report capital gains or losses on your tax return.

-

Who needs to file a 1099-B form?

If you've sold stocks, bonds, options, commodities, or participated in barter exchanges through a broker in the tax year, you'll likely receive a 1099-B form. The responsibility to report these transactions on your tax return, using the information on the 1099-B, falls on you.

-

When should I expect to receive my 1099-B form?

Brokers are required to send out 1099-B forms by January 31st each year for the previous tax year's transactions. However, sometimes there can be a slight delay. If you haven't received yours by mid-February, it's a good idea to contact your broker.

-

What information is included on the 1099-B form?

The form includes details of each sale or exchange, such as the date of sale, the security sold, the number of shares, and the gross proceeds. It may also report cost basis information, which is essential for calculating your capital gain or loss.

-

How do I report information from my 1099-B on my tax return?

You'll use the information on your 1099-B to fill out IRS Form 8949, "Sales and Other Dispositions of Capital Assets." This form organizes your capital gains and losses into short-term and long-term categories. The totals from Form 8949 are then transferred to Schedule D of your tax return.

-

What if I haven't received my 1099-B form?

If you haven't received your 1099-B form by mid-February, first contact your broker. They might offer an electronic copy through their website. Remember, even without the form, you're still responsible for reporting all of your transactions on your tax return. Failure to report can result in penalties.

-

Can I file my taxes without a 1099-B form?

Yes, you can file your taxes without having received a 1099-B form, as long as you report all your transactions. Utilize your own records to accurately report each sale or exchange on Form 8949 and Schedule D. It’s essential to maintain detailed records of all transactions for this reason.

-

How do I handle errors on my 1099-B form?

If you spot an error on your form, contact your broker immediately to issue a corrected form. Mistakes, especially in cost basis reporting, can significantly affect your calculated capital gain or loss. It's crucial to ensure all information is accurate before filing your tax return.

-

Is it possible to get a digital copy of my 1099-B form?

Yes, many brokers now provide the option to access your 1099-B form electronically. This digital copy is considered as official as the paper version. Check your broker's website or contact them directly to see if this option is available to you.

Common mistakes

Filing taxes can be a complex process, especially when it involves reporting the sale of stocks, bonds, commodities, and other types of investments through the IRS 1099-B form. This form is used to report proceeds from broker and barter exchange transactions. Despite the best intentions, many people make mistakes when filling out this form, which can lead to unnecessary stress and potential issues with the IRS. Here are seven common mistakes to watch out for:

Not reporting all transactions: It's crucial to report every sale or exchange, no matter how small. Some may think insignificant transactions can be overlooked, but the IRS requires comprehensive reporting.

Mixing up purchase and sale dates: Getting the dates wrong can significantly affect your tax liability. The purchase date (or acquisition date) and the sale date are essential for calculating capital gains or losses accurately.

Failing to separate short-term and long-term transactions: The tax rates between short-term and long-term capital gains differ. Mixing these up can lead to incorrect tax calculations and potential penalties.

Incorrectly calculating the cost basis: The cost basis is what you paid for the investment, plus any applicable fees or commissions. An incorrect cost basis can lead to incorrect gain or loss calculations.

Omitting reinvested dividends: Reinvested dividends increase the cost basis of the investment. Not accounting for them can result in reporting a higher gain than what actually occurred.

Overlooking wash sale rules: The IRS prohibits claiming a loss on a security sold in a wash sale. Failing to adjust for this can lead to inaccuracies in reported losses.

Entering incorrect taxpayer information: Simple errors like misspelling a name or entering the wrong Social Security number can delay processing and may lead to notices from the IRS.

To avoid these mistakes, carefully review each transaction, consider consulting with a tax professional, and ensure that the information matches your records and those of your brokerage. Accuracy is key to a smooth tax filing process.

Documents used along the form

When you're dealing with the IRS 1099-B form, it's typically because you're reporting sales or exchanges of securities, such as stocks, bonds, and other investment instruments. Handling this form already introduces a level of complexity to your tax filing process. However, you're likely to encounter several other documents that play a crucial role in accurately reporting your investment activity and ensuring compliance with tax laws. Understanding these documents and their purposes can significantly streamline your tax preparation and filing process.

- Schedule D (Form 1040 or 1040-SR): This form is essential for reporting the capital gains or losses from your investments that you've sold or exchanged over the tax year. It works hand-in-hand with Form 1099-B, helping you calculate your total capital gains or losses.

- Form 8949: Before you can complete Schedule D, you may need to fill out Form 8949 if you have a significant number of transactions. This form lists all your transaction details individually, including sales price, cost basis, and type of gain or loss. It helps in organizing your transactions, making it easier to transfer the sum totals to Schedule D.

- Form 1099-DIV: If you've received dividends or distributions from your investments, this form is a must-have. It reports the dividends and distributions you've received over the tax year, which may also need to be reported on your tax return, depending on your circumstances.

- Form 1099-INT: Similar to Form 1099-DIV, this document is used to report interest income from your investments, such as that from bonds or interest-bearing accounts. This information will help you complete your tax return accurately.

- Form 1099-MISC: For those who have earned income beyond interest or dividends from their investments, like royalties or certain types of rents, Form 1099-MISC captures this information. Understanding how to report this income correctly is crucial for your tax filing.

Navigating through these forms might seem daunting initially, but recognizing their relevance and how they interlink with your 1099-B form can demystify the process. Each document serves a unique purpose, contributing a piece to the puzzle of your financial and investment activity over the year. Armed with this knowledge, you can approach your tax filing with confidence, ensuring that every investment move made throughout the year is correctly documented and reported to the IRS.

Similar forms

The IRS 1099-DIV form shares similarities with the 1099-B form in that it reports income from investments, but instead of reporting sales and redemptions of securities, the 1099-DIV form is focused on dividends and distributions received throughout the tax year. Both forms are essential for investors when preparing their tax returns, providing critical information required for accurately reporting investment income and calculating potential tax liabilities on earnings.

Similar to the 1099-B, the IRS 1099-INT form is used to report income, specifically interest income earned from various sources such as savings accounts, interest-bearing checking accounts, and US Savings bonds. Both forms play a crucial role in informing taxpayers about the income they must report on their annual tax returns. While the 1099-B deals with proceeds from broker and barter exchange transactions, the 1099-INT focuses solely on interest income, making both essential for individuals receiving income from investments or savings.

The IRS Schedule D (Form 1040) is intricately connected to the 1099-B form as it is used to summarize capital gains and losses from transactions reported on the 1099-B. Taxpayers use Schedule D to calculate the aggregate capital gains or losses from their investments over the fiscal year, which directly affects their tax obligation. This form requires the detailed information provided by the 1099-B to accurately report the proceeds from sales of stocks, bonds, and other investments.

The IRS 1099-MISC form, although used for a broader range of transactions, shares a purpose with the 1099-B form in reporting various types of income outside of wages, salaries, and tips. It covers areas such as rents, royalties, prizes and awards, and other income payments. While the 1099-B is specific to the sales and redemptions of securities, the 1099-MISC encompasses a wider range of income sources, both contributing important information for the taxpayer's income reporting.

Lastly, the IRS 8949 form works alongside the 1099-B form, serving as a detailed record of individual sales and exchanges of capital assets, including stocks, bonds, and real estate. Taxpayers use Form 8949 to list all their transactions separately, which the 1099-B form has reported throughout the year. This form helps taxpayers compute capital gains or losses, which they then report on Schedule D (Form 1040), showcasing their interconnectedness in reporting investment income and calculating tax implications.

Dos and Don'ts

The IRS 1099-B form is crucial for reporting proceeds from broker and barter exchange transactions. It's essential to approach this document with precision to ensure accurate tax reporting. Here are several key dos and don'ts to consider:

- Do verify your personal information. Ensure your name, address, and taxpayer identification number (TIN) are correct to prevent processing delays or issues with your tax record.

- Do report all transactions. Include all sales and exchanges brokered through your account, as each transaction can impact your tax obligations.

- Do check the classification of your assets. Different rules apply to various asset types, such as stocks, bonds, and commodities. Accurate classification ensures proper tax treatment.

- Do use the correct form version. The IRS updates its forms periodically. Always use the most recent version to comply with current tax laws.

- Do keep a copy for your records. Once filed, retain a copy of Form 1099-B and all relevant documentation for at least seven years in case of an audit.

- Don't estimate transaction values. Use exact numbers from your brokerage statements to report proceeds and cost basis, reducing the risk of errors and potential penalties.

- Don't forget to report losses. Losses can offset gains and reduce your taxable income, so including them is both accurate and potentially beneficial.

- Don't ignore instructions for adjustments. Certain transactions require adjustments, such as for wash sales. Carefully read the IRS instructions to properly adjust the reported amounts.

- Don't submit incomplete forms. An incomplete 1099-B form can lead to processing delays, inquiries from the IRS, and possible penalties. Ensure all required fields are filled out before submission.

Misconceptions

The IRS 1099-B form is surrounded by several misconceptions that can lead to confusion. Understanding these can help ensure accurate reporting and compliance with tax obligations.

Only stocks are reported on Form 1099-B. Contrary to common belief, the 1099-B form covers a wider range of transactions. Beyond stocks, it includes sales of mutual funds, bonds, and securities. This form captures any capital gains or losses from these transactions.

Form 1099-B is only for high-value transactions. This misconception might lead some to believe they don't need to report smaller transactions. However, Form 1099-B must be filed for any sale of securities, regardless of the transaction size. All transactions, big or small, are subject to reporting.

If I lose money, I don’t need to report it. Even transactions that result in a loss need to be reported. Reporting losses on your tax return can be beneficial as they may be used to offset other gains or taxable income, subject to IRS rules.

Personal property sold at a loss needs to be reported on 1099-B. The requirement to report on Form 1099-B applies specifically to securities or applicable transactions. Personal property losses are not reported on Form 1099-B, but may need to be reported elsewhere depending on the specific circumstances.

Brokers are responsible for reporting my capital gains tax. While brokers issue Form 1099-B and report transactions to the IRS, the individual taxpayer is ultimately responsible for reporting their income and paying any owed taxes. Taxpayers should verify the information on Form 1099-B and include it in their tax return.

I don’t need to report transactions that aren’t listed on Form 1099-B. Sometimes, not all transactions are reported by brokers on Form 1099-B. However, it is the taxpayer’s responsibility to report all taxable transactions, including those not listed on a Form 1099-B.

Form 1099-B is only necessary if I take cash out. This form is used to report any sale or exchange of securities, regardless of whether the proceeds were taken in cash or reinvested. It's important to report transactions accurately to avoid potential penalties.

Everything on Form 1099-B is accurate and final. Mistakes can happen. It’s essential for taxpayers to review their Form 1099-B for accuracy and consult with a tax professional or their broker to correct any discrepancies before filing.

I only need to file Form 1099-B with the IRS. While the broker sends a copy of Form 1099-B to both the taxpayer and the IRS, the information from the form must be included in the taxpayer's return, typically on Schedule D and Form 8949 if required. Taxpayers should ensure all information is accurately reported on their tax return based on the details provided in Form 1099-B.

Key takeaways

The IRS 1099-B form is a crucial document for individuals who engage in the sale of securities, commodities, and various types of financial transactions within a tax year. Understanding the ins and outs of filling out and using this form can significantly streamline the tax filing process, ensuring accuracy and compliance with IRS requirements. Below are five key takeaways to assist with correctly handling the 1099-B form.

- Identification of Transactions: The form is specifically designed to report gains or losses from the sale or exchange of securities. These could include stocks, bonds, and mutual funds, among others. Each transaction must be detailed, including the date of sale, the purchase date, and the amounts for which the securities were bought and sold.

- Broker Responsibility: Typically, it is the responsibility of the broker or the financial institution that managed the sale of securities to provide both the investor and the IRS with a copy of the 1099-B form. This ensures that the transactions are reported accurately for tax purposes.

- Reporting for Tax Purposes: The information from the 1099-B form is used to fill out Schedule D (Form 1040), which is where capital gains or losses are reported on the tax return. Accuracy in this step is vital as it impacts the calculation of tax liability or refund.

- Understanding Cost Basis: An essential component of the 1099-B form is the cost basis. This is the original value of the security, adjusted for stock splits, dividends, and return of capital distributions. Knowing the correct cost basis is crucial for calculating the gain or loss from a sale accurately.

- Deadlines and Penalties: The IRS mandates that brokers must send out 1099-B forms to investors by February 15 of the year following the sale of securities. It's important for individuals to review these forms promptly upon receipt to ensure all information is accurate and complete to avoid potential penalties for underreporting income.

By keeping these key takeaways in mind, individuals can navigate the complexities of reporting financial transactions on the 1099-B form with greater ease and accuracy. This not only aids in maintaining compliance but also in optimizing one's tax situation.

Popular PDF Documents

When Does Workers' Comp Start Paying Lost Wages - Employers need to specify on Form 45 if the incident took place on the premises and if it resulted in hospitalization or emergency treatment.

1099-div Form 2022 - The IRS mandates electronic filing of the 1099-DIV form by corporations and financial institutions when issuing to a large number of recipients.