Get Irs 1095A Form

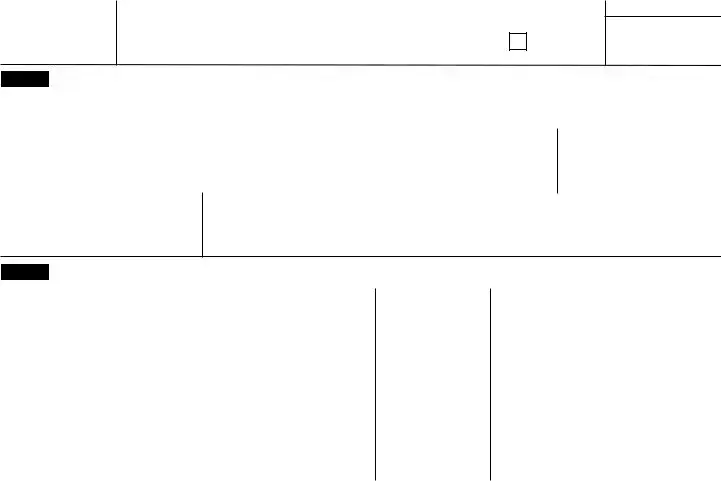

The IRS 1095-A form plays a pivotal role in the interconnected realms of health insurance and tax reporting in the United States, serving as a critical document for individuals who have enrolled in health coverage through the Health Insurance Marketplace. Vital for both taxpayers and the IRS, this form contains information essential for preparing annual tax returns, particularly for those aiming to claim the premium tax credit or reconcile advance credit payments. The detailed breakdown of coverage, including the policy numbers, insurance company details, household members covered, and the periods of coverage, equips taxpayers with the necessary data to navigate the complexities of tax credits related to health insurance. The IRS 1095-A instructs on the different parts encompassing recipient information, coverage details, and household-specific insurance data, making it paramount in ensuring taxpayers accurately report their health insurance status and comply with tax laws. Drafted with caution, the early releases and draft instructions aim to give a heads-up to individuals and professionals, underscoring the importance of waiting for the final versions before filing to avoid errors. The IRS's open call for comments on these drafts further reflects their commitment to refining these forms, making it a clear example of the ongoing dialogue between tax authorities and the citizenry aimed at simplifying tax reporting obligations while adhering to the legislative mandates.

Irs 1095A Example

CAUTION:

This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information as a courtesy. DO NOT FILE DRAFT FORMS. Also, do not rely on draft instructions and publications for filing. We generally do not release drafts of forms until we believe we have incorporated all changes. However, unexpected issues sometimes arise, or legislation is passed, necessitating a change to a draft form. In addition, forms generally are subject to OMB approval before they can be officially released. Drafts of instructions and publications usually have at least some changes before being officially released.

Early releases of draft forms and instructions are at IRS.gov/draftforms. Please note that drafts may remain on IRS.gov even after the final release is posted at IRS.gov/downloadforms, and thus may not be removed until there is a new draft for the subsequent revision. All information about all revisions of all forms, instructions, and publications is at IRS.gov/formspubs.

Almost every form and publication also has its own easily accessible information page on IRS.gov. For example, the Form 1040 page is at IRS.gov/form1040; the Form

If you wish, you can submit comments about draft or final forms, instructions, or publications on the Comment on Tax Forms and Publications page on IRS.gov. We cannot respond to all comments due to the high volume we receive, but we will carefully consider each one. Please note that we may not be able to consider many suggestions until the subsequent revision of the product.

Form

Department of the Treasury Internal Revenue Service

Health Insurance Marketplace Statement

▶ Information about Form |

CORRECTED |

is at www.irs.gov/form1095a. |

|

OMB No.

2014

Part I Recipient Information

1 |

Marketplace identifier |

2 |

3 |

Policy issuer's name |

|

|

|

|

|

|

|

|

|

|

|

4 |

Recipient's name |

|

|

5 |

Recipient's SSN |

6 |

Recipient's date of birth |

|

|

|

|

|

|

|

|

7 |

Recipient's spouse's name |

|

|

8 |

Recipient's spouse's SSN |

9 |

Recipient's spouse's date of birth |

|

DRAFT |

AS OF |

|||||

10 |

Policy start date |

11 |

Policy termination date |

12 |

Street address (including apartment no.) |

||

|

|

|

|

|

|

|

|

13 |

City or town |

14 |

State or province |

15 |

Country and ZIP or foreign postal code |

|

|

|

OCTOBER |

1, 2014 |

|||||

Part II Coverage Household

16 |

|

|

DO |

NOT |

FILE |

|

||||

|

|

A. Covered Individual Name |

B. Covered Individual SSN |

C. Covered Individual |

D. Covered Individual |

E. Covered Individual |

||||

|

|

|

|

|

|

|

Date of Birth |

|

Start Date |

Termination Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Part III |

Household Information |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

|

Month |

|

A. Monthly Premium Amount |

B. Monthly Premium Amount of Second |

C. Monthly Advance Payment of |

||||

|

|

|

|

|

Lowest Cost Silver Plan (SLCSP) |

|

Premium Tax Credit |

|||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

21 |

January |

|

|

|

|

|

|

|

|

|

22 |

February |

|

|

|

|

|

|

|

|

|

23 |

March |

|

|

|

|

|

|

|

|

|

24 |

April |

|

|

|

|

|

|

|

|

|

25 |

May |

|

|

|

|

|

|

|

|

|

26 |

June |

|

|

|

|

|

|

|

|

|

27 |

July |

|

|

|

|

|

|

|

|

|

28 |

August |

|

|

|

|

|

|

|

|

|

29 |

September |

|

|

|

|

|

|

|

|

|

30 |

October |

|

|

|

|

|

|

|

|

|

31 |

November |

|

|

|

|

|

|

|

|

|

32 |

December |

|

|

|

|

|

|

|

|

|

33 |

Annual Totals |

|

|

|

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 60703Q |

Form |

Form |

|

Page 2 |

|

|

|

||

Instructions for Recipient |

number, date of birth (only if no social security number is |

||

entered in column B), and the start and ending dates of |

|||

|

|||

You received this Form |

coverage for each covered individual. |

||

enrolled in health insurance coverage through the Health |

If you or your family members enrolled at the Marketplace in a |

||

Insurance Marketplace. This Form |

|||

policy with one or more individuals who are not your spouse or |

|||

you need to complete Form 8962, Premium Tax Credit (PTC). |

|||

dependent and advance credit payments were made, the |

|||

You must complete Form 8962 and file it with your tax return if |

|||

information reported on Form |

|||

you want to claim the premium tax credit or if you received |

|||

individuals for whom you attested to the Marketplace at |

|||

premium assistance through advance credit payments (whether |

|||

enrollment the intention to claim a personal exemption |

|||

or not you otherwise are required to file a tax return). The |

|||

deduction on your tax return (yourself, spouse, and |

|||

Marketplace has also reported this information to the IRS. If you |

|||

dependents). For example, if you indicated to the Marketplace |

|||

or your family members enrolled at the Marketplace in more |

|||

enrollment that an individual enrolling in the policy is your |

|||

DRAFT atAS OF |

|||

than one qualified health plan policy, you will receive a |

adult child for whom you will not claim a personal exemption |

||

Form |

|||

deduction, that child will receive a separate Form |

|||

|

|||

Part I. Recipient Information, lines |

will not be listed in Part II on your Form |

||

information about you, the insurance company that issued your |

Part II also tells the IRS the months that the individuals |

||

policy, and the Marketplace where you enrolled in the coverage. |

|||

identified are covered by health insurance and therefore have |

|||

Line 1. This line identifies the state where you enrolled in |

|||

satisfied the individual shared responsibility provision. |

|||

OCTOBER |

1, 2014 |

||

coverage through the Marketplace. |

If there are more than 5 individuals covered by a policy you |

||

|

|||

Line 2. The |

will receive one or more additional Forms |

||

the Marketplace uses to identify the policy in which you |

Part II. |

|

|

enrolled. If you are completing Part 4 of Form 8962, enter this |

Part III. Household Information, lines |

||

number on line 30, 31, 32, or 33, box a. |

|||

information about your insurance coverage that you will need to |

|||

|

|||

|

complete Form 8962 to claim the premium tax credit and |

||

Line 3. This is the nameDOof the insurance companyNOTthat issued |

FILE |

||

your policy. |

reconcile advance credit payments. |

||

Line 4. You are the recipient because you are the person the |

Column A. This column is the monthly premium amount for the |

||

Marketplace identified at enrollment who is expected to file a |

policy in which you enrolled. |

||

tax return and who, if qualified, would claim the premium tax |

Column B. This column is the monthly premium amount for the |

||

credit for the year of coverage. |

|||

second lowest cost silver plan (SLCSP) that the Marketplace |

|||

|

|||

Line 5. This is your social security number. For your protection, |

has determined applies to members of your family enrolled in |

||

this form may show only the last four digits. However, the |

the coverage. The premium for the applicable SLCSP is used to |

||

Marketplace has reported your complete social security number |

compute your monthly advance credit payments and the |

||

to the IRS. |

premium tax credit you claim on your return. If no information is |

||

Line 6. A date of birth will be entered if there is no social |

entered in this column, see the Instructions for Form 8962, Part |

||

2, Premium Tax Credit Claim and Reconciliation of Advance |

|||

security number on line 5. |

|||

Payment of Premium Tax Credit. |

|||

|

|||

Lines 7, 8, and 9. Information about your spouse will be entered |

Column C. This column is the monthly amount of advance |

||

only if advance credit payments were made for your coverage. |

|||

credit payments that were made to your insurance company to |

|||

The date of birth will be entered on line 9 only if line 8 is blank. |

|||

pay for all or part of the premiums for your coverage. No |

|||

|

|||

Lines 10 and 11. These are the start and ending dates of the |

information will be entered in this column if no advance credit |

||

policy. |

payments were made. |

||

Lines 12 through 15. Your address is entered on these lines. |

Lines |

||

Part II. Coverage Household, lines |

columns A, B, and C on lines |

||

|

|

||

information about each individual who is covered under your |

the totals on line 33. Use this information to complete |

|

Form 8962, line 11 or lines |

||

policy. This information includes the name, social security |

||

|

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 1095-A | This form serves as a statement for individuals who have enrolled in health insurance coverage through the Health Insurance Marketplace. It provides essential information needed to file for the Premium Tax Credit (PTC) on tax returns. |

| Components of Form 1095-A | Form 1095-A includes three primary parts: Part I details the recipient's information, Part II outlines coverage household specifics, and Part III provides household information crucial for calculating the Premium Tax Credit. |

| Use for Tax Filing | Recipients of Form 1095-A must use it to complete Form 8962, Premium Tax Credit (PTC), and file it with their tax return if they wish to claim the premium tax credit or received advance credit payments. |

| Reporting to the IRS | Information about an individual's insurance coverage, as detailed on Form 1095-A, is also reported to the IRS by the Health Insurance Marketplace. |

| State Specificity | Line 1 of Part I identifies the state where the coverage was obtained through the Marketplace, indicating that certain aspects of the form may vary by state, governed by specific state laws and regulations where applicable. |

Guide to Writing Irs 1095A

Filling out the IRS Form 1095-A is a crucial step for individuals or families who have enrolled in health insurance through the Health Insurance Marketplace. This form is instrumental in determining eligibility for premium tax credits on your tax return. It's important to accurately complete each part of Form 1095-A to ensure compliance with tax laws and to make the most out of available tax credits. Here are the detailed steps to guide you through each part of the form.

- Part I: Recipient Information

- Line 1: Enter the state where you enrolled in coverage through the Marketplace.

- Line 2: Input the Marketplace-assigned policy number.

- Line 3: Write the name of the insurance company that issued your policy.

- Line 4: Provide the recipient's name (this is typically the primary policy holder).

- Line 5: Enter the recipient's Social Security Number (SSN).

- Line 6: If the SSN is not available, enter the recipient's date of birth.

- Lines 7-9: If applicable, enter the spouse's name, SSN, and date of birth. If the SSN is not available, only the date of birth is needed.

- Lines 10 and 11: Specify the policy start and termination dates.

- Lines 12-15: Enter the street address, city or town, state or province, country, and ZIP or foreign postal code.

- Part II: Coverage Household

- For each covered individual, enter their name, SSN (or date of birth if SSN is not entered), and the policy start and termination dates.

- Remember, if a policy covers more than five individuals, additional Forms 1095-A are needed to report additional members.

- Part III: Household Information

- Column A: Enter the monthly premium amount for the policy.

- Column B: Enter the monthly premium amount for the second lowest cost silver plan (SLCSP) applicable to you.

- Column C: Input the monthly advance payment of premium tax credit amounts, if any were made to your insurance company.

- Lines 21-33: Detail the monthly and annual totals for columns A, B, and C.

After filling out Form 1095-A, closely review all entered information for accuracy. This form, along with the Form 8962, Premium Tax Credit, should then be filed with your tax return. Accurately completing Form 1095-A is essential for reconciling any advance credit payments received and for claiming the premium tax credit, helping ensure that you only pay the right amount of tax or receive the refund you are entitled to.

Understanding Irs 1095A

What is Form 1095-A?

Form 1095-A is a Health Insurance Marketplace Statement provided by the Marketplace. It includes information about health insurance coverage obtained through the Health Insurance Marketplace. This form is needed to complete Form 8962 and file it with your tax return if you are claiming the premium tax credit or if you received premium assistance through advance credit payments.

Who receives Form 1095-A?

Form 1095-A is sent to individuals or families who enrolled in health insurance coverage through the Health Insurance Marketplace during the tax year. This includes if you, or a family member, were covered by a plan purchased on the Marketplace.

Why is Form 1095-A important?

Form 1095-A is essential for reporting health insurance coverage information on your tax return. It provides the details necessary to claim the premium tax credit or to reconcile any advance payments of the premium tax credit received during the year.

When should I receive my Form 1095-A?

Form 1095-A is typically sent by the Health Insurance Marketplace by January 31st for the previous tax year. If you have not received your form by early February, you should contact the Marketplace directly.

What do I do if there are errors on my Form 1095-A?

If your Form 1095-A has errors – for example, incorrect coverage dates or incorrect monthly premium amounts – you should contact the Health Insurance Marketplace as soon as possible to get a corrected form.

How do I use Form 1095-A to complete Form 8962?

Use the information provided on Form 1095-A to fill out Form 8962, Premium Tax Credit (PTC). Particular attention should be paid to the monthly premium amounts, the premium for the second lowest cost silver plan (SLCSP), and any advance payment of premium tax credit. These figures are used to determine eligibility for the premium tax credit and reconcile any advance payments received.

Can I file my tax return without Form 1095-A?

If you are expecting to receive Form 1095-A, you should wait to file your tax return until you receive it. Filing your tax return without this form, if you received advance payment of the premium tax credit, may delay your refund and could affect the accuracy of your tax return.

Where can I get more information or assistance with Form 1095-A?

For more information or assistance with Form 1095-A, you can visit the official IRS website at www.irs.gov/form1095a. Additionally, for questions specific to your coverage or if you did not receive your form, you should contact the Health Insurance Marketplace through which you purchased your insurance.

Common mistakes

Filling out the IRS Form 1095-A, a Health Insurance Marketplace Statement, is a critical step in managing your health insurance information and ensuring you receive the correct Premium Tax Credit. However, mistakes can happen, leading to delays or inaccuracies in your tax return processing. Here are ten common mistakes individuals make on the IRS Form 1095-A:

Entering incorrect personal information: Details like names, Social Security numbers (SSNs), and dates of birth must match those on file with the Social Security Administration.

Misunderstanding Marketplace identifiers: Each marketplace has a unique identifier that needs to be accurately recorded. Confusion or typos here can create processing issues.

Omission of Policy Numbers: Every policy has a distinct number assigned by the Marketplace, and it's crucial for identifying your coverage.

Listing incorrect policy issuer's name or misspelling it. It's important to ensure this matches the official name as discrepancies can complicate records.

Skipping coverage dates: The policy start and end dates determine eligibility periods for the Premium Tax Credit; thus, they must be accurately reported.

Improperly listing covered individuals, especially in complex family situations or when there's shared custody, could lead to reporting errors.

Neglecting to include complete address details: Full and accurate addresses including zip codes are necessary for correspondence and proper processing of your form.

Inaccurate entry of premium amounts or misunderstanding the columns for Monthly Premium, SLCSP (Second Lowest Cost Silver Plan), and Advance Payment of Premium Tax Credit can lead to financial discrepancies in your credit calculation.

Failing to report or incorrectly reporting the Advanced Premium Tax Credit (APTC) amounts could lead to owing money back to the government or claiming less credit than eligible.

Misunderstanding instructions: Not thoroughly reading or misunderstanding the form’s instructions can lead to various mistakes, from minor to critical.

Making sure to avoid these common errors can save time and prevent potential issues with your tax return. It's always recommended to review your form carefully and consult with a professional if you encounter any doubts during the process.

Documents used along the form

When dealing with the IRS Form 1095-A, a key document for individuals who have enrolled in a health insurance plan through the Marketplace, it’s important to navigate the tax season with ease and efficiency. This form is pivotal for understanding the health coverage acquired and for determining the premium tax credits that can be claimed. To streamline the process and ensure all pertinent information is reported correctly, several other forms and documents often accompany the IRS Form 1095-A. Knowing these documents can significantly enhance one's tax filing experience.

- Form 8962, Premium Tax Credit (PTC): This form is crucial for individuals who have received a 1095-A. It is used to calculate the premium tax credit and reconcile any advance payment of the premium tax credit. The information from Form 1095-A feeds directly into Form 8962, making it essential for those claiming or reconciling their premium tax credits.

- Form 1040, U.S. Individual Income Tax Return: Essentially the cornerstone of personal tax filing, this form is where one reports their annual income, deductions, and credits. The information from Form 8962 is reported on Form 1040, integrating the premium tax credit into one's overall tax picture.

- Schedule 2 (Form 1040), Tax: This schedule is used for additional taxes, including the alternative minimum tax or taxes on unearned income by children. For individuals reconciling premium tax credits, any excess advance payment of premium tax credit will be reported on this schedule, which then carries to Form 1040.

- Form 1095-B, Health Coverage: Provided by insurance companies or the health coverage provider, this form serves as proof of health insurance for the covered individuals and their dependents. Though not directly used in the calculation of the premium tax credit, it provides information verifying coverage that might need to be confirmed when filing taxes.

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage: This form is issued by employers offering health insurance coverage to show the offer and coverage status for their employees. For individuals receiving a Form 1095-A, a Form 1095-C might also be necessary to determine the affordability and minimum essential coverage requirements that affect eligibility for the premium tax credit.

Gathering these documents ahead of time can make the process of filing taxes smoother and more accurate. Each plays a critical role in painting the full picture of an individual's health coverage and its impact on their taxes. Understanding how they all fit together helps to ensure that benefits are maximized and that the tax filing is as beneficial as possible. Armed with the right documents, including the crucial Form 1095-A, navigating the tax landscape can be a far less daunting task.

Similar forms

The IRS 1095-A form shares similarities with the Form 1040, commonly known as the U.S. Individual Income Tax Return. Both forms play crucial roles in the taxpayer's annual filing process. The Form 1040 serves as the foundation for personal income tax filing, requiring detailed income, deduction, and credit information. Similarly, the 1095-A provides essential data for taxpayers who need to reconcile or claim the Premium Tax Credit (PTC), directly impacting the computation of tax obligations or refunds on the Form 1040.

Form W-2, the Wage and Tax Statement, is another document closely related to the 1095-A. Employers use Form W-2 to report an employee's annual wages and the amount of taxes withheld from their paycheck. Like the 1095-A, the W-2 is an integral component of the tax filing process, providing necessary information that affects tax liability and eligibility for certain tax credits, including the Premium Tax Credit calculated using information from the 1095-A for individuals with marketplace insurance.

The Form W-4, Employee's Withholding Certificate, also intersects with the information needs served by the 1095-A. While the W-4 is used by employees to determine the amount of federal income tax to withhold from their pay, the 1095-A supplies details relevant for those who may adjust their withholdings based on eligibility for the PTC. Both forms contribute to ensuring the taxpayer’s obligations are accurately met, reflecting how tax credits and deductions influence overall tax strategy.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), like the 1095-A, offers taxpayers the means to claim specific tax benefits. Form 8863 deals with education credits, while the 1095-A focuses on the Premium Tax Credit. Both require taxpayers to supply detailed information about eligible expenses or premiums paid, showcasing the tailored approach the IRS takes to awarding benefits based on personal investments in education and health insurance.

Schedule A (Form 1040), an itemized deductions form, parallels the 1095-A in its role of providing taxpayers with the opportunity to reduce taxable income. Schedule A itemizes allowable deductions such as medical expenses, state and local taxes, and charitable contributions, whereas the 1095-A aids in claiming the Premium Tax Credit, a direct reduction in tax owed for those who qualify based on health insurance premiums paid through the Marketplace.

Another related document is the General Instructions for Certain Information Returns, embodying a collection of forms including the 1099 series. These instructions cover various forms used to report different types of non-employment income. Like those instructions, the 1095-A instructions support taxpayers in accurately reporting health insurance information critical to calculating the Premium Tax Credit, underscoring the varied types of guidance the IRS provides to ensure compliance across different aspects of tax reporting.

Publication 17, Your Federal Income Tax (For Individuals), is an all-encompassing guide that elaborates on the kinds of information found in the 1095-A and its relevance to individual tax situations. It serves as a resource for understanding how different pieces of one's financial picture, such as health insurance purchased through the Marketplace (reported on 1095-A), interact with broader tax filing obligations and opportunities, much like the purpose-specific guidance given through 1095-A instructions.

Dos and Don'ts

When filling out the IRS 1095-A form, there are pivotal steps you should follow and mistakes you must avoid. Here's a guide to help you navigate this task more confidently:

Do:

Ensure that all personal information is accurate. This includes your full name, social security number, address, and the details of any dependents. Accuracy is crucial for the IRS to process your forms without delays.

Double-check the policy details. Verify the policy start and end dates, the policy number provided by the Marketplace, and the policy issuer's name. Incorrect information here could lead to complications with your tax returns.

Report the correct coverage information for each month. This is essential for determining your eligibility for the premium tax credit.

Review the amounts reported in Part III concerning your premiums, the Second Lowest Cost Silver Plan (SLCSP), and any advance payment of the premium tax credit. These figures impact your tax obligations and potential refunds.

File the form with your tax return if you're claiming the premium tax credit, ensuring that both documents are consistent with each other.

Don't:

File draft forms. Draft versions of the form are provided for informational purposes only and should not be filed with your tax return.

Overlook the instructions for adjusting premium amounts or advance payment amounts if changes occur during the year. Circumstances such as a change in income or family size could affect these numbers.

Forget to file Form 8962, the Premium Tax Credit form, if you received advance payment of the premium tax credit or are claiming the credit. The information from Form 1095-A will be needed to complete Form 8962 accurately.

Ignore any errors or discrepancies. If you notice mistakes, contact the Health Insurance Marketplace as soon as possible to get a corrected Form 1095-A.

Assume the form doesn't apply to you if you didn't get a form but were enrolled in a qualifying health plan through the Marketplace. In such cases, reach out to the Marketplace to obtain your form.

Misconceptions

Understanding the IRS Form 1095-A can be confusing, and there are several misconceptions about what it means for taxpayers. Here, we'll clear up seven common misunderstandings:

It's not necessary to wait for Form 1095-A to file taxes: This is incorrect. If you received health insurance through the Marketplace, this form is crucial for completing your tax return accurately, particularly if you're claiming the Premium Tax Credit or reconciling advance payments of the premium tax credit.

Form 1095-A is only for people who owe taxes: Not true. Whether or not you owe taxes, if you had a Marketplace plan, you need this form to file your taxes. It provides information about your coverage, which is necessary for determining your eligibility for the Premium Tax Credit.

All family members receive their own Form 1095-A: This misunderstanding can lead to confusion. The truth is that a single form will report coverage for all family members listed on the same policy. However, if family members were enrolled in separate policies, each policyholder would receive a different Form 1095-A.

You don't need Form 1095-A if you didn't change plans during the year: Even if you didn't change your health insurance plan during the year, you still need Form 1095-A to file your taxes if you had Marketplace coverage. It contains vital information about your health coverage regardless of changes or lack thereof.

The information on Form 1095-A doesn't need to be reviewed because it's always accurate: Unfortunately, mistakes can happen. It’s important to review your Form 1095-A carefully for any inaccuracies in coverage dates or the amount of the Premium Tax Credit and report any errors to the Marketplace immediately.

Form 1095-A is only for federal tax purposes and not needed for state taxes: While primarily used for federal tax returns, depending on your state's requirements, information from Form 1095-A might be necessary for completing state taxes as well. It's advisable to check with your state's tax regulations.

If you didn't get a Form 1095-A, you can file without it: If you were enrolled in a Marketplace plan and did not receive your Form 1095-A, you should contact the Marketplace to get a copy before filing your taxes. Filing without it could result in errors in your tax return, potentially affecting your tax refund or the amount of taxes you owe.

Understanding the significance of the information provided on Form 1095-A can help ensure that you complete your tax return accurately and make the most of any eligible Premium Tax Credit. Always ensure that your information is accurate and up to date, and when in doubt, consult the instructions for Form 1095-A or a tax professional.

Key takeaways

Filing your taxes accurately is crucial, and understanding your forms is a big part of that process. The IRS Form 1095-A plays a significant role for those who have enrolled in health insurance through the Health Insurance Marketplace. Here are six key takeaways to ensure you're informed and prepared when dealing with this form:

- Know the purpose: Form 1095-A, the Health Insurance Marketplace Statement, is essential for filing your taxes if you or someone in your family enrolled in coverage through the Marketplace. This form contains information needed to complete Form 8962, Premium Tax Credit (PTC).

- Avoid using draft forms: The IRS cautions against filing draft forms. Always ensure you are using the final, approved version of Form 1095-A for your filing to avoid any processing delays or errors with your tax return.

- Understand the information provided: This form details the insurance company that issued your policy, the coverage dates, and the specifics of the coverage— including monthly premium amounts and any advance payment of the Premium Tax Credit (APTC).

- Reconcile advance credit payments: If you received premium assistance through APTC, you must complete Form 8962 and attach it to your tax return. This step reconciles the amount of APTC paid on your behalf with the Premium Tax Credit you’re eligible for based on your final annual income.

- Report for all covered individuals: Part II of Form 1095-A lists everyone covered under the policy, including their coverage start and end dates. This is important for proving that you and your family members had health insurance coverage, thus meeting the individual shared responsibility requirement.

- Seek further instruction if needed: If certain columns on Form 1095-A are blank or if you have questions about how to use the information on the form to complete Form 8962, detailed instructions are provided by the IRS and can be found on their website. Don’t hesitate to refer to these resources or consult a tax professional if you are uncertain.

Form 1095-A is more than just another piece of paper; it's an integral part of your tax return if you've received health insurance through the Marketplace. By understanding the key aspects of this form, you can ensure that you accurately report your health insurance coverage and any Premium Tax Credit you're eligible to claim or need to reconcile.

Popular PDF Documents

A Taxpayer Who Receives a Schedule K-1 (form 1041) Typically - Detailed instructions accompany the worksheet, guiding users through each step of the tax calculation process.

Where to Report Sale of Land - Loss carryover from previous years can also impact how the current year's transactions are reported on Form 8949.