Get IRS 1095-C Form

Every year, as tax season approaches, individuals and employers navigate the complex landscape of tax forms and regulations. Among these, the IRS 1095-C form stands out for its role in reporting health insurance coverage information by employers. This document serves not just as a compliance requirement under the Affordable Care Act (ACA) but also as a vital piece of information for employees understanding their health insurance coverage for the year. It outlines the months of coverage and the type of coverage provided, making it indispensable for both filing taxes accurately and making informed decisions about healthcare. The responsibility of issuing the 1095-C falls on the shoulders of employers with 50 or more full-time employees, underlining its significance in the nexus of employment, healthcare, and taxation. Navigating its complexities can be daunting, but understanding its purpose and the information it conveys is crucial for both employers managing their obligations and employees planning their healthcare and tax strategies.

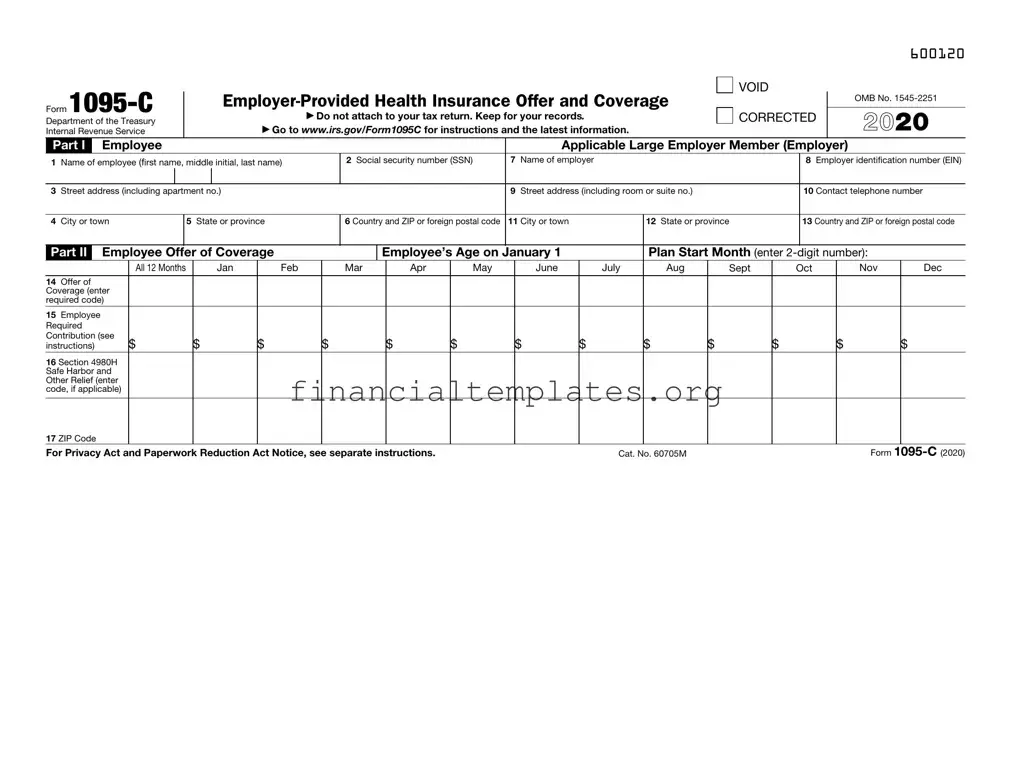

IRS 1095-C Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

600120 |

Form |

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

VOID |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

OMB No. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Department of the Treasury |

|

|

|

|

|

Do not attach to your tax return. Keep for your records. |

|

|

CORRECTED |

|

2021 |

|||||||||||||

Internal Revenue Service |

|

|

|

▶ Go to www.irs.gov/Form1095C for instructions and the latest information. |

|

|

|

|

|

|

||||||||||||||

Part I |

|

Employee |

|

|

|

|

|

|

|

|

|

|

Applicable Large Employer Member (Employer) |

|

|

|||||||||

1 |

Name of employee (first name, middle initial, last name) |

|

|

2 Social security number (SSN) |

7 Name of employer |

|

|

|

|

8 Employer identification number (EIN) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3 |

Street address (including apartment no.) |

|

|

|

|

|

|

9 Street address (including room or suite no.) |

|

|

|

10 Contact telephone number |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

4 |

City or town |

|

|

|

5 State or province |

|

|

6 Country and ZIP or foreign postal code |

11 City or town |

12 State or province |

|

13 Country and ZIP or foreign postal code |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Part II |

Employee Offer of Coverage |

|

|

|

Employee’s Age on January 1 |

|

Plan Start Month (enter |

|

||||||||||||||||

|

|

|

|

All 12 Months |

|

Jan |

Feb |

|

|

Mar |

Apr |

May |

June |

July |

Aug |

|

Sept |

Oct |

Nov |

Dec |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

Offer of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coverage (enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

required code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

15 |

Employee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Contribution (see |

$ |

|

|

$ |

|

$ |

|

$ |

|

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|

$ |

|||||

instructions) |

|

|

|

|

|

|

|

|||||||||||||||||

16 Section 4980H Safe Harbor and Other Relief (enter code, if applicable)

17 ZIP Code |

|

Form |

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 60705M |

600220

Form |

Page 2 |

Instructions for Recipient

You are receiving this Form

In addition, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as family members), enrolled in your employer’s health plan and that plan is a type of plan referred to as a

If your employer provided you or a family member health coverage through an insured health plan or in another manner, you may receive information about the coverage separately on Form

Employers are required to furnish Form

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), including the individual shared responsibility provisions, the premium tax credit, and the employer shared responsibility provisions, visit www.irs.gov/ACA or call the IRS Healthcare Hotline for ACA questions

Part I. Employee

Lines

Line 2. This is your social security number (SSN). For your protection, this form may show only the last four digits of your SSN. However, the employer is required to report your complete SSN to the IRS.

Part I. Applicable Large Employer Member (Employer)

Lines

Line 10. This line includes a telephone number for the person whom you may call if you have questions about the information reported on the form or to report errors in the information on the form and ask that they be corrected.

Part II. Employer Offer of Coverage, Lines

Line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. (If you received an offer of coverage through a multiemployer plan due to your membership in a union, that offer may not be shown on line 14.) The information on line 14 relates to eligibility for coverage subsidized by the premium tax credit for you, your spouse, and dependent(s). For more information about the premium tax credit, see Pub. 974.

1A. Minimum essential coverage providing minimum value offered to you with an employee required contribution for

1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to your spouse or dependent(s).

1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) but NOT your spouse.

1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your spouse but NOT your dependent(s).

1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) and spouse.

1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your spouse or dependent(s), or you, your spouse, and dependent(s).

1G. You were NOT a

1H. No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum essential coverage).

1I. Reserved for future use.

1J. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage NOT offered to your dependent(s).

1K. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage offered to your dependent(s).

1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using employee’s primary residence ZIP code.

1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s primary residence ZIP code.

1N. Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s primary residence ZIP code.

1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe harbor.

1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site ZIP code affordability safe harbor.

1Q. Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP code affordability safe harbor.

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents.

1S. Individual coverage HRA offered to an individual who was not a

1T. Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee’s primary residence ZIP code.

1U. Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site ZIP code affordability safe harbor.

1V. Reserved for future use.

1W. Reserved for future use.

1X. Reserved for future use.

1Y. Reserved for future use.

1Z. Reserved for future use.

(Continued on page 4)

600320

Form |

Page 3 |

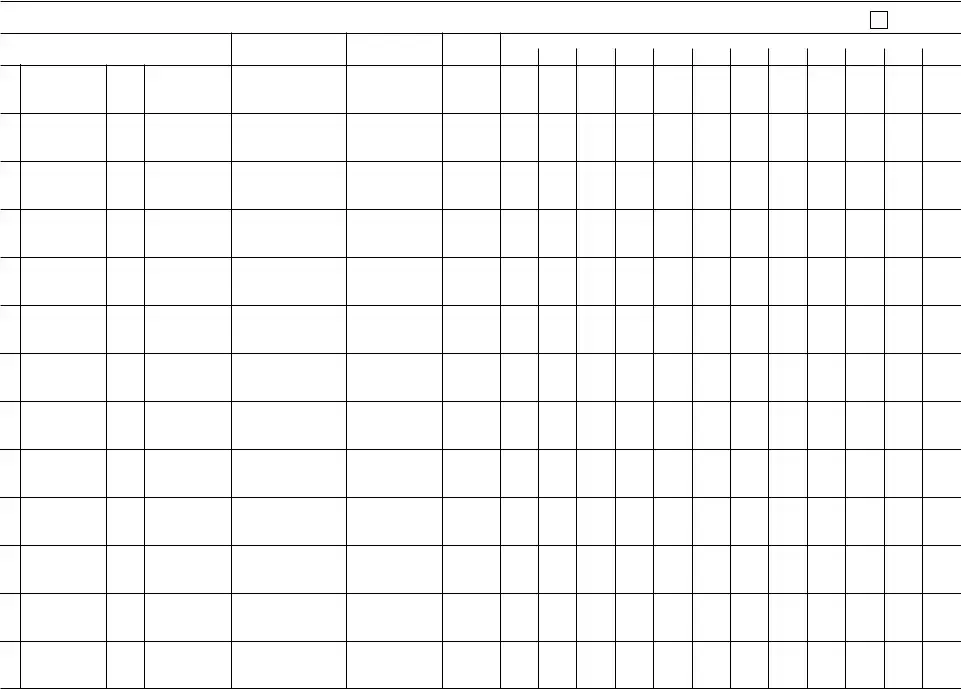

Part III Covered Individuals

If Employer provided

18

19

20

21

22

23

24

25

26

27

28

29

30

(a) Name of covered individual(s) |

(b) SSN or other TIN (c) DOB (if SSN or other |

(d) Covered |

|

|

|

|

|

|

|

|

(e) Months of coverage |

|

|

|

|

|

|

||||||||||||

First name, middle initial, last name |

TIN is not available) |

all 12 months |

|

Jan |

Feb |

Mar |

Apr |

May June July |

Aug Sept |

Oct |

Nov |

Dec |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form

600420

Form |

Page 4 |

Instructions for Recipient (continued)

Line 15. This line reports the employee required contribution, which is the monthly cost to you for the lowest cost

Line 16. This code provides the IRS information to administer the employer shared responsibility provisions. Other than a code 2C, which reflects your enrollment in your employer’s coverage, none of this information affects your eligibility for the premium tax credit. For more information about the employer shared responsibility provisions, visit IRS.gov.

Line 17. This line reports the applicable ZIP code your employer used for determining affordability if you were offered an individual coverage HRA. If code 1L, 1M, 1N, or 1T was used on line 14, this will be your primary residence location. If code 1O, 1P, 1Q, or 1U was used on line 14, this will be your primary employment site. For more information about individual coverage HRAs, visit IRS.gov.

Part III. Covered Individuals, Lines

Part III reports the name, SSN (or TIN for covered individuals other than the employee listed in Part I), and coverage information about each individual (including any

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of Form 1095-C | It is used by employers to report health insurance coverage offered to their employees under the Affordable Care Act. |

| Who Must File | Applicable Large Employers (ALEs), typically those with 50 or more full-time employees, including full-time equivalents. |

| Recipient of Form 1095-C | Every employee of an ALE who is eligible for insurance coverage, regardless of whether they actually enrolled in the coverage. |

| Deadline for Employers | Employers must furnish Form 1095-C to employees by January 31 following the reported tax year. |

| IRS Filing Deadline | Employers must file the forms with the IRS by February 28 if filing on paper, or March 31 if filing electronically, of the year following the reported tax year. |

| Electronic Filing Requirement | Employers with 250 or more forms to file must file them electronically with the IRS. |

| Parts of Form 1095-C | The form consists of three parts: Part I reports information about the employee and employer; Part II reports information about the health coverage offered; Part III reports information about the covered individuals, if the employer sponsors a self-insured plan. |

| State-Specific Forms | Some states may require their own version of health coverage reporting in addition to the federal requirements. For example, California and New Jersey have their own state-specific health insurance mandate that requires additional reporting. |

| Governing Laws for State-Specific Forms | The state-specific requirements are governed by individual state laws, such as the California Health and Safety Code and the New Jersey Health Insurance Market Preservation Act. |

Guide to Writing IRS 1095-C

Filling out the IRS 1095-C form is a crucial step for employers subject to the Affordable Care Act (ACA) provisions, requiring them to report information about health insurance coverage offered to full-time employees. This process can seem complex due to the specific information and precision required. However, breaking it down into manageable steps can help employers ensure they comply with reporting requirements efficiently. The following steps are designed to guide employers through the process of completing the 1095-C form, from gathering necessary information to submitting the form to the IRS.

- Gather all necessary information, including employer identification number (EIN), the names, social security numbers, and addresses of all full-time employees, and details about the health coverage offered by month.

- Download the latest version of Form 1095-C from the IRS website to ensure you are using the most current form.

- Complete Part I of the form with the employer’s information, including the name, EIN, and contact information.

- Fill out Part II, lines 14-16, for each full-time employee. This section requires information on the offer of coverage, including the type of health insurance offered, if any, and the employee's share of the lowest cost monthly premium.

- In Part III, if applicable, list any covered individuals, including the name, social security number, and the months of coverage for each person. This section is only required if the employer sponsors a self-insured plan.

- Review the form carefully to ensure all information is accurate and complete. Pay special attention to social security numbers and dates to prevent any processing delays or penalties.

- Prepare a transmittal Form 1094-C, which must be filed with Form 1095-C. Form 1094-C serves as a cover sheet summarizing the employer’s total number of 1095-Cs and providing additional information about the employer.

- Submit the completed Form 1095-C and the transmittal Form 1094-C to the IRS by the required deadline. The deadlines are typically February 28 if filing by paper (or March 31 if filing electronically) of the year following the reported year.

- Provide copies of the completed Form 1095-C to each full-time employee listed on the form by January 31 of the year following the reported year, ensuring they have the necessary information to file their personal income tax returns.

Completing and submitting the IRS 1095-C form is a significant step in complying with the ACA's employer mandate. By following these steps closely, employers can accurately report healthcare coverage information to both the IRS and their employees. It’s important to start this process early to accommodate any unforeseen delays or the need for corrections, thereby avoiding potential penalties for late or incorrect filings.

Understanding IRS 1095-C

-

What is the IRS 1095-C form and who needs to file it?

The IRS 1095-C form, known as the Employer-Provided Health Insurance Offer and Coverage form, is a document that certain employers are required to file. Specifically, it's for employers with 50 or more full-time or equivalent employees. These large employers must send the form to both the IRS and the individuals they cover to report information about the health insurance coverage offered to their full-time employees. This aids individuals in understanding their health insurance coverage for the year and assists in the preparation of their own tax returns.

-

How does the 1095-C form relate to individual tax returns?

The information on the 1095-C form is essential for individuals when preparing their tax returns, particularly if they want to determine their eligibility for a premium tax credit. Although it is not needed to attach the form to their tax return, individuals should keep Form 1095-C with their tax records. It serves as proof of the health insurance coverage offered to them by their employer and can help in resolving any tax-related discrepancies regarding health coverage.

-

What should an employee do if they have not received their 1095-C form?

If an employee hasn't received their 1095-C form by the time they are ready to file their tax return, they should first contact their employer to request a copy. Employees don't need to wait for their 1095-C form to file their tax returns, but they should keep any health insurance statements or other documentation as proof of coverage. They can use these documents to complete their tax returns and then confirm the information when the 1095-C form arrives.

-

Are there any exceptions to who must receive a 1095-C form?

Yes, there are exceptions. Generally, employees of large employers (those with 50 or more full-time equivalent employees) will receive a 1095-C form. However, part-time employees, retirees, and employees not covered by the employer's health plan might not receive a 1095-C form. It's also worth noting that employees of small businesses, those with fewer than 50 full-time equivalent employees, might not receive a 1095-C form but instead could receive a different form, such as the 1095-B, depending on their coverage provider.

Common mistakes

When completing the IRS 1095-C form, individuals often make errors that can complicate their tax situation or delay processing. Understanding these common mistakes can help in avoiding potential issues. Here are eight frequent errors observed:

-

Not verifying personal information: Individuals sometimes fail to double-check their Social Security Number (SSN), name, address, and other personal details. This can lead to processing delays or mismatches in tax records.

-

Incorrectly reporting coverage information: It's crucial to accurately report the months during which you and any dependents were covered by a qualifying health plan. Misreporting can affect eligibility for certain tax credits or benefits.

-

Omitting dependent information: Dependents must be included if they were covered under your insurance plan. Forgetting to add a dependent can lead to inaccuracies in your tax reporting.

-

Failure to update life changes: Life events such as marriage, divorce, or the birth of a child can affect health coverage. Not updating these changes on the form can result in incorrect information being filed.

-

Misunderstanding Plan Start Month: The plan start month box is often overlooked or filled out incorrectly. This detail is significant for understanding when coverage began, especially for newly initiated plans within the tax year.

-

Using incorrect versions of the form: Individuals sometimes use outdated versions of the form, which may not have the current tax year's requirements. Always use the most recent version published by the IRS.

-

Not seeking assistance when needed: The 1095-C form can be complex, and seeking help from a tax professional or using IRS resources can prevent mistakes. People often attempt to complete the form without understanding all the instructions fully.

-

Overlooking the necessity to submit the form: Some individuals are unaware that they need to attach Form 1095-C when they file their tax return, especially if they are claiming or reporting certain health insurance-related credits or deductions.

Avoiding these mistakes is crucial for accurate and timely tax filing. It is always recommended that individuals review their forms carefully and consult with professionals if there is any confusion or uncertainty regarding the completion and submission of IRS 1095-C.

Documents used along the form

Throughout the tax season, individuals and employers navigate a variety of forms to ensure compliance with healthcare coverage reporting requirements under the Affordable Care Act. One key piece of documentation in this process is the IRS 1095-C form, utilized by large employers to report information about health insurance coverage offered to their employees. Alongside the 1095-C, several other forms and documents often come into play, each serving its specific purpose in the broader landscape of healthcare reporting and tax compliance. Understanding these documents can greatly streamline the filing process.

- IRS Form 1094-C: This form acts as a cover sheet for the 1095-C forms being submitted to the IRS by employers. It provides a summary to the IRS about the offer of healthcare coverage and employees’ acceptance.

- IRS Form 1095-B: Issued by insurance providers, it reports individuals covered by minimum essential coverage, thereby supporting the taxpayers' compliance with the individual mandate.

- IRS Form 1094-B: Similar to Form 1094-C, this serves as a transmittal form for the 1095-B forms sent to the IRS by insurers and other coverage providers.

- IRS Form 1040: The U.S. individual income tax return form is often accompanied by information from Forms 1095 to substantiate healthcare coverage or claim exemptions and tax credits related to healthcare.

- W-2 Form: While primarily used to report wages and taxes withheld, the W-2 can also show the value of the employer-sponsored health coverage to both employees and the IRS.

- IRS Form 8962: This form is used to calculate and report the premium tax credit for eligible individuals purchasing insurance through the health insurance marketplace.

- IRS Form 8965: Taxpayers use this form to report any exemptions from the individual shared responsibility payment, which requires individuals to have qualifying health insurance coverage.

- State-Specific Forms: Some states have their own healthcare reporting requirements and forms that work alongside federal forms to ensure residents meet state-specific mandates.

- Employee Benefits Statements: Although not filed with the IRS, these statements are crucial for employees to understand their offered benefits, including healthcare coverage, which can support the information reported on 1095-C forms.

Navigating the complexities of healthcare reporting requires attention to detail and an understanding of how various documents interact with one another. From employer summaries and individual coverage reports to forms calculating tax credits and exemptions, each document plays a crucial role in ensuring both compliance and the maximization of benefits available under the law. Whether managing personal taxes or overseeing an organization’s tax reporting, staying informed about these forms is essential for successful navigation of the healthcare reporting landscape.

Similar forms

The IRS 1095-C form shares similarities with the IRS 1095-A form, which is issued by the Health Insurance Marketplace. Both forms play crucial roles in the reporting of health insurance coverage, complying with the Affordable Care Act's provisions. The 1095-A form primarily serves individuals who purchase health insurance through the Marketplace, detailing the coverage obtained and any advance payment of premium tax credit. Similar to the 1095-C, it aids taxpayers in completing their tax returns by reporting essential health insurance coverage information.

Another document related to the 1095-C form is the IRS 1095-B form, which is distributed by insurance providers outside of the employer-sponsored framework. This form reports to the Internal Revenue Service the months in which individuals were covered by minimum essential coverage, helping to verify the fulfilment of the individual mandate requirement of the Affordable Care Act. Like the 1095-C, the 1095-B ensures that individuals have the necessary documentation to prove their health insurance status during the tax year, although its focus is on coverage through insurers directly rather than through employers.

The W-2 form, while primarily a statement of an employee's annual wages and the amount of taxes withheld, also has sections that overlap with the information reported by the 1095-C form. Specifically, employers can use the W-2 form to report the value of the health insurance coverage they provided to each employee. This inclusion reflects the interconnectedness of employment benefits and tax obligations, illustrating how forms like the W-2 and 1095-C together provide a comprehensive overview of an individual's compensation and benefits for the tax year.

Lastly, the IRS form 8962 intersects with the information provided by the 1095-C, although its primary function differs. Form 8962 is used to calculate the premium tax credit (PTC) and reconcile any advance payment of the PTC. The information on the 1095-C, regarding an individual's health coverage through their employer, can affect the calculation of the credit on Form 8962. Thus, while serving different purposes, both forms are essential in the accurate accounting and reporting of individual health insurance information for tax purposes.

Dos and Don'ts

Filling out the IRS 1095-C form can seem daunting at first. However, with careful attention and a clear understanding of the dos and don'ts, it can become a straightforward process. Below are some essential tips to help ensure that your form is completed accurately and on time.

Do:

- Double-check your information, including Social Security numbers and dates of birth, for accuracy. Any mistake can delay processing.

- Use the official IRS instructions for filling out the form. These guidelines are designed to help you complete the form correctly.

- Report coverage information for each month accurately. Indicating whether employees were offered health insurance for each month is crucial.

- Keep copies of the completed 1095-C form for your records. Having this documentation on hand is important for future reference or in case of an audit.

- Submit the form before the deadline. Late submissions can result in penalties.

Don't:

- Leave fields blank unless instructed. Incomplete forms can be considered incorrect and may lead to having to resubmit.

- Guess on information. If unsure about certain details, it’s better to verify first to avoid providing incorrect information.

- Use correction fluid or tape on the form. Mistakes should be fixed by filling out a new form to ensure clarity and legibility.

- Ignore the form if you're a small employer. Even small employers, under certain conditions, need to provide employees with a 1095-C form.

- Forget to inform your employees. They should know when and how they will receive their 1095-C form to avoid confusion and delays in their own filings.

Misconceptions

Understanding the IRS 1095-C form is crucial for both employers and employees as it is tied to healthcare reporting requirements under the Affordable Care Act (ACA). However, there are several misconceptions surrounding this form that can lead to confusion. Below are six common misunderstandings about the 1095-C form, explained to illuminate the reality behind each assumption.

- Misconception #1: Only large companies need to worry about the 1095-C.

Many people believe that the 1095-C form is only a concern for large corporations. However, it applies to all employers with 50 or more full-time employees or equivalents. This includes not just large corporations but also medium-sized businesses and some smaller entities that meet the employee count criteria.

- Misconception #2: If you didn’t get a 1095-C, you don’t have to worry about it when filing taxes.

This assumption can lead to issues with tax filings. Individuals should use the information on the 1095-C form to answer questions about health coverage on their tax return. If the form is not received, it is advised to contact the employer or seek help from a tax professional to ensure compliance and avoid potential penalties.

- Misconception #3: The 1095-C form is identical to the W-2 and serves the same purpose.

While both forms are issued by employers and relevant for tax purposes, their purposes are distinct. The W-2 form reports an employee's annual wages and tax withholdings. Conversely, the 1095-C provides information about health insurance coverage offered and used, which is essential for the ACA's individual mandate compliance.

- Misconception #4: Employees must wait to file their taxes until they receive their 1095-C.

Not necessarily. It's possible to file taxes before receiving the 1095-C form by using other documentation of health insurance coverage for the year. However, it's essential to ensure accurate reporting of coverage to avoid issues with the IRS.

- Misconception #5: The 1095-C form only needs to be filed with the IRS.

While the primary purpose is for IRS reporting by the employer, a copy of the 1095-C form also must be provided to the employee. This enables the employee to know the information reported to the IRS about their health coverage and to use it for their personal tax filings.

- Misconception #6: All parts of the 1095-C must be completed for every employee.

The 1095-C form includes several parts, but not all parts need to be filled out for every employee. Which sections need to be completed depend on the specifics of the employer's offered health insurance and the employee's acceptance and use of the insurance throughout the tax year.

Key takeaways

The IRS 1095-C form is an essential document for both employers and employees, playing a crucial role in compliance with the Affordable Care Act (ACA). Understanding its purpose, how to fill it out properly, and its implications for tax filings can ensure that employers fulfill their reporting responsibilities and employees are well-informed about their health coverage. Here are key takeaways to remember:

- The 1095-C form is primarily for employers with 50 or more full-time employees (including full-time equivalent employees). It documents the health insurance coverage offered to their employees. This documentation is essential for determining whether the employer has met the obligations under the ACA's employer mandate.

- Employees receive this form as evidence of health insurance coverage, which is necessary for completing their individual tax returns. It provides details about the health insurance coverage offered to them and any dependents over the past year.

- It is the employer's responsibility to fill out and deliver the 1095-C form to their employees by the deadline established each year by the IRS. Failure to do so can lead to penalties. Employers also need to send a copy to the IRS.

- When filling out the form, accuracy is paramount. Information such as the offer of coverage, the employee’s share of the monthly premium, and the months during which coverage was available must be correctly reported. This ensures that employees are correctly informed about their coverage and avoids any discrepancies that could affect their tax obligations or eligibility for certain tax provisions.

By keeping these key takeaways in mind, both employers and employees can navigate the complexities of the 1095-C form with more confidence, ensuring compliance with the ACA and smooth processing of tax returns.

Popular PDF Documents

Irs Tax Forms - Stay informed about current electronic filing options to streamline your disaster-related tax returns.

What Is a 1088 - Ensure your business's UIA matters are handled correctly by accurately completing and submitting Form 1488.

4506-t Tax Form - For those going through a divorce, it can expedite the financial disclosure process by providing an official income statement.