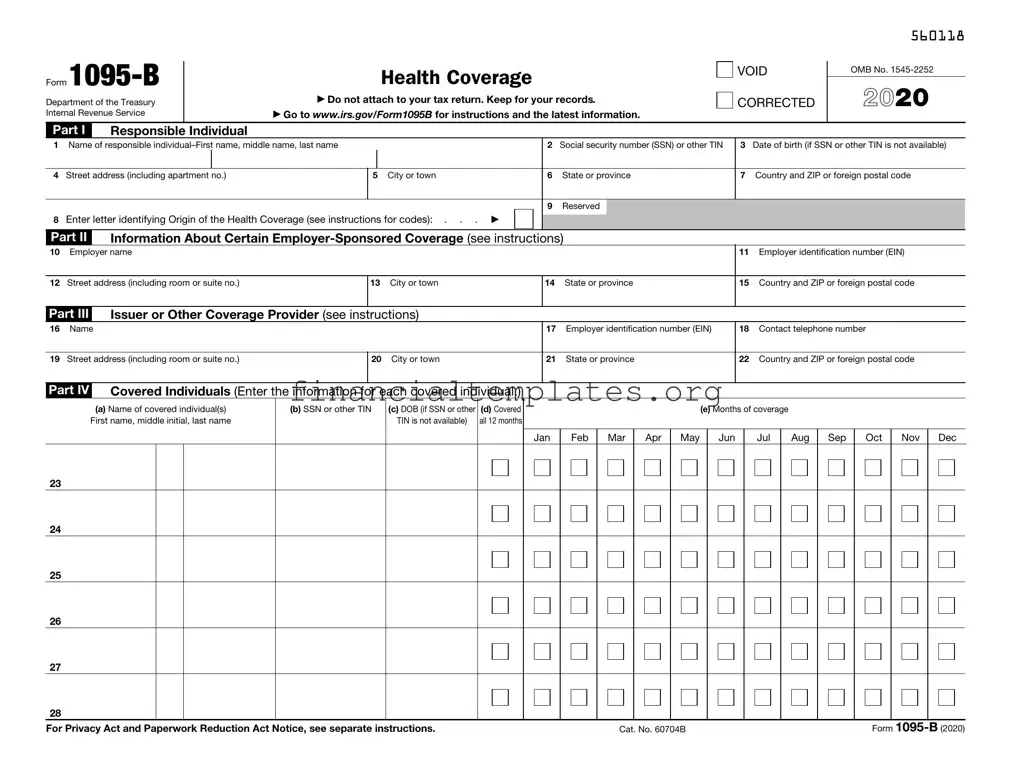

Get IRS 1095-B Form

Navigating the complexities of tax documentation is an annual ritual for many, with the IRS 1095-B form playing a crucial role in this process. This form serves as a testament to an individual's health insurance coverage, essential in the era of the Affordable Care Act (ACA). Its primary function is to verify that a person has met the minimum essential coverage requirements, avoiding potential penalties for lacking insurance. Insurance providers issue it to both the insured and the IRS, creating a seamless pathway of information that supports compliance with healthcare legislation. Understanding the nuances of the 1095-B form can be pivotal for individuals seeking to accurately complete their tax returns. It highlights the months of coverage and the individuals covered, ensuring that taxpayers and the IRS have a clear record of healthcare status throughout the preceding year. As health insurance ties increasingly into tax obligations, the 1095-B form emerges as a key document in bridging healthcare reporting with tax accountability.

IRS 1095-B Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

560118 |

||||

Form |

|

|

|

|

|

Health Coverage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VOID |

|

|

|

|

|

OMB No. |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|||||||||||||||||||||

Department of the Treasury |

|

|

|

▶ Do not attach to your tax return. Keep for your records. |

|

|

|

|

|

|

|

CORRECTED |

|

|

|

|

||||||||||||||||||||||||||||||||||||

Internal Revenue Service |

|

|

▶ Go to www.irs.gov/Form1095B for instructions and the latest information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Part I |

Responsible |

Individual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1 Name of responsible |

|

|

|

|

|

|

2 |

Social security number (SSN) or other TIN |

3 Date of birth (if SSN or other TIN is not available) |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4 Street address (including apartment no.) |

|

|

5 |

City or town |

|

|

|

|

|

6 |

State or province |

|

|

|

|

|

|

|

7 Country and ZIP or foreign postal code |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Enter letter identifying Origin of the Health Coverage (see instructions for codes): . . . |

▶ |

|

|

|

9 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Part II |

Information About Certain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

10 |

Employer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 Employer identification number (EIN) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

12 Street address (including room or suite no.) |

|

|

13 |

City or town |

|

|

|

|

|

14 |

State or province |

|

|

|

|

|

|

|

15 Country and ZIP or foreign postal code |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Part III |

Issuer or Other Coverage Provider (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

16 |

Name |

|

|

|

|

|

|

|

|

|

|

17 |

Employer identification number (EIN) |

18 Contact telephone number |

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

19 Street address (including room or suite no.) |

|

|

20 |

City or town |

|

|

|

|

|

21 |

State or province |

|

|

|

|

|

|

|

22 Country and ZIP or foreign postal code |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Part IV |

Covered Individuals (Enter the information for each covered individual.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

(a) Name of covered individual(s) |

|

(b) SSN or other TIN |

(c) DOB (if SSN or other |

(d) Covered |

|

|

|

|

|

|

|

|

|

|

|

|

(e) Months of coverage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

First name, middle initial, last name |

|

|

|

|

TIN is not available) |

all 12 months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan |

|

Feb |

Mar |

|

Apr |

May |

Jun |

|

|

Jul |

|

Aug |

|

Sep |

|

|

Oct |

|

Nov |

Dec |

||||||||||||||||

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

Cat. No. 60704B |

|

|

|

|

|

|

|

|

|

|

|

|

Form |

1095- |

B (2021) |

||||||||||||||||||||||||

560220

Form |

Page 2 |

Instructions for Recipient

This Form

Before 2019, individuals who did not have minimum essential coverage and did not qualify for an exemption from this requirement could be liable for the individual shared responsibility payment. Beginning in 2019, individuals will not be responsible for the individual shared responsibility payment because the payment amount is reduced to $0. However, if individuals in your tax family are eligible for certain types of minimum essential coverage, you may not be eligible for the premium tax credit. For more information on the premium tax credit, see Pub. 974, Premium Tax Credit (PTC).

Providers of minimum essential coverage are required to furnish TIP only one Form

reported on that form. As the recipient of this Form

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), including the individual shared responsibility provisions, and the premium tax credit, see www.irs.gov/ACA or call the IRS Healthcare Hotline for ACA questions

Part I. Responsible Individual, lines

Lines 2 and 3. Line 2 reports your social security number (SSN) or other taxpayer identification number (TIN), if applicable. For your protection, this form may show only the last four digits. However, the coverage provider is required to report your complete SSN or other TIN, if applicable, to the IRS. Your date of birth will be entered on line 3 only if line 2 is blank.

Line 8. This is the code for the type of coverage in which you or other covered individuals were enrolled. Only one letter will be entered on this line.

A. Small Business Health Options Program (SHOP) B.

C.

E. Multiemployer plan

F. Other designated minimum essential coverage

G. Individual coverage health reimbursement arrangement (HRA)

If you or another family member received health insurance TIP coverage through a Health Insurance Marketplace (also known as

an Exchange), that coverage will generally be reported on a Form

Line 9. Reserved.

Part II. Information About Certain

Part III. Issuer or Other Coverage Provider, lines

Part IV. Covered Individuals, lines

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

560318 |

|||||

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 |

||||||

Name of responsible |

|

|

|

|

|

|

|

Social security number (SSN) or other TIN |

Date of birth (if SSN or other TIN is not available) |

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part IV |

Covered Individuals — Continuation Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(a) Name of covered individual(s) |

(b) SSN or other TIN |

|

(c) DOB (if SSN or other |

(d) Covered |

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) Months of coverage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

First name, middle initial, last name |

|

|

TIN is not available) |

all 12 months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

Jan |

|

Feb |

|

Mar |

|

Apr |

May |

|

|

Jun |

|

|

Jul |

|

Aug |

|

Sep |

|

Oct |

|

Nov |

|

|

Dec |

||||||||||||||

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

1095- |

B (2021) |

||||||

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 1095-B form is designed to provide information about an individual's health coverage to both the taxpayer and the IRS, including details about who was covered and when. |

| Issuers | Insurance providers, including health insurance companies, government-sponsored programs like Medicare, and small employers that provide self-insured health coverage, are responsible for issuing Form 1095-B. |

| Recipient Requirements | Individuals who were enrolled in a qualifying health plan are meant to receive a 1095-B form from their provider for their tax records and to verify the fulfillment of the Affordable Care Act's coverage mandate. |

| Submission Deadline | Typically, the form must be sent to individuals by January 31 of the year following the coverage year to ensure they have the information required for their tax returns. |

| State-Specific Variants | Some states may have their own versions of the 1095-B form or additional reporting requirements due to state-specific healthcare laws. In these instances, the governing state law will dictate the specifics of the form’s use and deadlines. |

Guide to Writing IRS 1095-B

Once you have decided to tackle the task of filling out the IRS 1095-B form, it is important to approach the process with a detailed and organized mindset. This document is crucial for reporting information to the IRS about individuals' health insurance coverage. Given its importance in ensuring compliance with health insurance coverage requirements, accurately completing this form is paramount. Below, you will find a structured guide designed to assist you in filling out the 1095-B form step by step.

- Begin by gathering all necessary documentation that pertains to the health coverage. This includes policy numbers, the dates coverage was in effect, and personal information for all individuals covered under the policy.

- Locate the correct form version for the tax year you are reporting. The IRS website offers downloadable versions of forms for each tax year.

- Fill in the “Responsible Individual” section. This part requires the personal information of the person who is the primary holder of the insurance policy. Make sure to include full name, Social Security Number (or TIN), and address.

- Next, proceed to the “Employer-Sponsored Coverage” section if applicable. If the insurance was provided through an employer, fill in the employer’s name, EIN, and contact information.

- In the section labeled “Issuer or Other Coverage Provider”, input the details of the insurance company or entity that provided the health coverage. This includes their name, EIN, and address.

- Detailed information about each individual covered under the policy during the calendar year must be entered in the “Covered Individuals” section. Include full names, SSNs or TINs, and the dates of coverage for each person.

- Review the completed form thoroughly. Ensure all information is accurate and that no required fields have been missed. Accuracy is crucial to avoid potential issues with the IRS.

- Sign and date the form once you are certain that all information is correct. The signature certifies that the information provided is true and accurate to the best of your knowledge.

- Lastly, refer to the IRS instructions for Form 1095-B to determine the appropriate filing method. Whether submitting by mail or electronically, ensure that you follow the IRS guidelines to avoid processing delays.

Upon completing and submitting the IRS 1095-B form, it's pivotal to keep a copy for your records. This document serves as proof of insurance coverage and may be needed for future reference, especially if any discrepancies arise with the IRS. Additionally, being organized and retaining copies of important tax documents can significantly simplify any potential future inquiries or tax-related procedures.

Understanding IRS 1095-B

-

What is the IRS 1095-B form and who needs it?

The IRS 1095-B form is a document that reports certain information to the IRS and to taxpayers about individuals who are covered by minimum essential health coverage. This coverage is typically through insurance providers outside of the Health Insurance Marketplace, including through small employers or government-sponsored programs like Medicare or Medicaid. People need this form to verify on their tax returns that they, and any dependents, had health insurance coverage during the previous year, which helps in complying with the Affordable Care Act's mandates for coverage.

-

How do I get my IRS 1095-B form?

For most individuals, the 1095-B form will be mailed to them by their health coverage provider. This includes private insurance providers, employers who provide health plans, and entities that administer government-sponsored health plans. Typically, forms should arrive by the end of January each year for the previous year's coverage. If you haven't received your form or if you've misplaced it, contact your insurance provider directly to request a duplicate. You can also access it online if your provider offers a digital copy through their member services portal.

-

Do I need to attach the 1095-B form to my tax return?

No, you are not required to attach Form 1095-B to your tax return. However, it serves as an important document for your records, confirming that you met the health coverage requirements for the year. When you fill out your tax return, you will indicate whether or not you had health insurance for all or parts of the previous year, but you do not need to send proof of this with your return. Retain the form with your tax documents in case of future inquiries from the IRS about your health coverage status.

-

What should I do if there are errors on my 1095-B form?

If you identify any discrepancies or errors on your Form 1095-B, such as incorrect personal information or coverage details, you should promptly contact your insurance provider to request a correction. It's crucial to ensure that all the information on the form accurately reflects your coverage status, as it affects your compliance with health insurance mandates and may impact your tax obligations or refunds. Your insurance provider will then issue a corrected form that you should keep for your records.

Common mistakes

Filling out IRS forms can be a complex process, with the IRS 1095-B form being no exception. This form is essential for reporting certain types of health insurance coverage to the IRS. Unfortunately, mistakes can happen. Here are five common errors people make when completing the IRS 1095-B form:

-

Not verifying personal information. People often fill in their personal details such as name, social security number, and address without double-checking for accuracy. Errors in this basic information can lead to processing delays or the form being returned.

-

Incorrect coverage dates. It’s important to accurately report the months during which each family member was covered under the insurance policy. Misreporting these dates can cause confusion or suggest a lack of coverage, possibly impacting eligibility for other benefits.

-

Forgetting to list dependents. Sometimes, individuals forget to list all dependents who were covered by the insurance plan. This omission can lead to inaccuracies in the coverage information reported to the IRS.

-

Mixing up the form versions. The IRS updates its forms regularly, and using an outdated version of the 1095-B form can result in processing errors. Always ensure you're using the most current version available on the IRS website.

-

Failing to send the form to the correct place. While the 1095-B form is completed by the insurance provider, individuals who need to correct information must send their adjustments to the right department. Sending it to the wrong address can lead to unnecessary delays.

By being mindful of these common mistakes, individuals can help ensure their IRS 1095-B forms are accurately processed without avoidable delays. When in doubt, consulting with a professional can provide clarity and peace of mind.

Documents used along the form

When it comes to healthcare reporting, the IRS 1095-B form plays a pivotal role in the life of taxpayers, helping them provide proof of health insurance coverage. This form is part of a broader group of documents that individuals may need to gather during the tax season. Understanding the landscape of these forms can simplify the process, ensuring that taxpayers are both compliant and maximizing their potential benefits. Below is a list of five forms and documents often used in conjunction with the IRS 1095-B form, each serving its unique purpose in the tax filing puzzle.

- IRS 1095-A: This document is essential for individuals who purchased health insurance through the Marketplace. It provides detailed information about the coverage, including monthly premiums, which is crucial for calculating the premium tax credit.

- IRS 1095-C: Employed individuals who receive health insurance through their employer might need this form. It outlines the coverage offered and whether it meets the minimum value standard set by the Affordable Care Act.

- IRS 1040: The backbone of tax season, this form is where individuals report their annual income, deductions, and credits. Information from 1095 forms is crucial in filling out certain sections related to health care information and tax credits.

- Form 8962: For those who are claiming or reconciling premium tax credits, this form is indispensable. It uses information from IRS 1095-A to determine the amount of credit you're eligible for versus what you have already received.

- Form 8965: This form is relevant for individuals seeking an exemption from the health care coverage mandate. While the individual mandate penalty has been reduced to $0 at the federal level since 2019, some states still require health insurance coverage or an exemption form.

Navigating through tax season requires a comprehensive understanding of how different documents interact to paint a complete picture of an individual's tax situation. From proving health insurance coverage with IRS 1095-B to calculating premium tax credits with Form 8962, each document plays a critical role. While the landscape may seem daunting at first, a methodical approach to gathering and understanding these forms can significantly ease the process, ensuring compliance and optimizing potential tax benefits.

Similar forms

The IRS 1095-B form is similar to the IRS 1095-A form in that both are part of the reporting requirements under the Affordable Care Act (ACA). While the 1095-B form is typically issued by insurance providers and certain employers to report an individual's health coverage, the 1095-A form is sent out by Health Insurance Marketplaces. The purpose of the 1095-A form is to detail the insurance coverage obtained through the Marketplace, including the premium amounts, any premium tax credits received, and the periods of coverage. This similarity lies in their common goal of documenting health coverage to comply with tax laws and to help individuals file their taxes accurately.

Another related document is the IRS 1095-C form. Similar to the 1095-B form, it is concerned with health insurance coverage but is specifically used by large employers to report the health insurance coverage offered to their employees. This form is key under the employer mandate of the ACA, which requires large employers to offer affordable and adequate health insurance to their full-time employees or face penalties. Both the 1095-B and 1095-C forms serve the dual purpose of providing necessary information for individual tax compliance and enforcing the provisions of the ACA related to employer and insurer reporting.

The W-2 form is also akin to the IRS 1095-B form in terms of its function in the context of tax reporting. While the W-2 form documents an employee's annual wages and the amount of taxes withheld from their paycheck, the 1095-B provides details about an individual’s health insurance coverage. Both forms are indispensable for individuals when filing their federal income tax returns, each serving to report different aspects of an individual's financial and healthcare-related information necessary for calculating tax liability and eligibility for health insurance subsidies.

Form 1040, the U.S. Individual Income Tax Return, is fundamentally connected to the IRS 1095-B form, as health coverage information can impact the computation of the premium tax credit and the individual shared responsibility payment on this form. While the 1095-B form itself is used to verify that an individual had health insurance and thereby complied with the ACA’s coverage mandate, the information it contains may need to be reported on Form 1040, especially if someone is claiming the premium tax credit or reporting a health care sharing ministry membership.

Form 8962, Premium Tax Credit (PTC), is directly related to 1095 forms, as it is used to calculate the amount of premium tax credit an individual is eligible for based on the insurance coverage reported by forms like 1095-A and reconciles this with any advance payments of the premium tax credit. Although the 1095-B form does not directly report information used in the premium tax credit calculation, it substantiates health coverage compliance, which can indirectly affect eligibility for the tax credit. Therefore, both documents are components of the overarching process of managing and reconciling health insurance-related tax credits.

Lastly, the IRS 8965, Health Coverage Exemptions form, shares a connection with the 1095-B form. This form is used to report any exemptions from the ACA’s health insurance coverage requirement. For individuals who did not maintain coverage throughout the year and are not claiming an exemption, the 1095-B form provides the necessary proof of insurance for the months they were covered. Thus, both forms are instrumental to taxpayers in addressing the coverage requirement under the ACA, either by proving compliance or claiming an exemption.

Dos and Don'ts

Filing the IRS 1095-B form, which provides information about an individual's health coverage, requires attention to detail and accuracy. Below are key dos and don'ts to consider during this process:

Things You Should Do

- Review Personal Information: Ensure all personal information, including Social Security numbers and dates of birth for you and any dependents, is accurate and matches the records.

- Verify Coverage Dates: Accurately report the months of health coverage for each individual listed on the form to avoid discrepancies.

- Use Official Documentation: Refer to official health coverage documents as a basis for filling out the form, ensuring that all details align with these records.

- Keep a Copy for Your Records: After submitting the form, keep a copy in your personal records for reference in case of any queries from the IRS or for future tax purposes.

Things You Shouldn't Do

- Estimate Information: Avoid guessing or estimating dates and other details. Inaccuracies can lead to issues with your tax filing or health coverage status.

- Ignore Instructions: Failing to read and follow the specific instructions provided for each part of the form can result in errors or incomplete submissions.

- Omit Individuals: Do not leave out any individuals who were covered under your health plan during the reporting year, even if only for part of the year.

- Postpone Submission: Delaying the completion and submission of the IRS 1095-B form can lead to penalties or complications with your tax return. Adhere to the deadline provided by the IRS.

Misconceptions

The IRS 1095-B form is crucial for taxpayers to understand, yet there are several misconceptions that often lead to confusion. Below are five common misconceptions explained to help clarify what the 1095-B form entails.

- It's only for people who bought insurance through the marketplace. This is a misconception. The 1095-B form is actually provided to individuals who receive health insurance through providers outside of the Health Insurance Marketplace. This includes coverage through an employer, government-sponsored programs like Medicare, Medicaid, CHIP, and other sources not purchased through the Marketplace.

- You don’t need it to file taxes. While it’s true that you're not required to attach the 1095-B form to your tax return, it serves as proof of health insurance coverage for the year. Keeping it for your records is important as it verifies that you met the health coverage requirement and can help avoid penalties.

- If you don't receive it, you're not covered. Not receiving a 1095-B form does not necessarily mean you weren’t covered. There may be delays or issues in distribution, especially if your coverage or personal details changed during the year. It's best to contact your insurance provider if you expected to receive a form and did not.

- All information on the form is correct. While one would hope so, errors can occur. It's crucial to review your 1095-B form carefully for any inaccuracies in your personal information or coverage dates. If you find errors, contact the issuer immediately to correct them. Accurate information ensures your tax return is processed smoothly.

- Everyone should receive a 1095-B form. Not everyone will receive a 1095-B form. For instance, those who are covered exclusively through the Health Insurance Marketplace will receive a 1095-A form instead. Additionally, there are certain exemptions for small employers and others that might not provide a 1095-B. Understanding the criteria for who should receive this form can clear up confusion and prevent unnecessary concern.

Key takeaways

The IRS 1095-B form is an important document for both individuals and insurance providers, detailing health insurance coverage information. It plays a crucial role during tax season, ensuring compliance with the health care law. Understanding its purpose and requirements can significantly streamline the tax filing process. Here are seven key takeaways about filling out and using the IRS 1095-B form:

- Identification of Coverage: The form 1095-B is used primarily to verify that an individual has minimum essential coverage. This is crucial for meeting the requirements of the Affordable Care Act (ACA).

- Who Sends It: It's typically issued by insurance providers, including insurance companies, government-sponsored programs, and employers that provide self-insured health coverage directly to employees.

- Reporting Deadline: Providers are required to send out the form to the individual by March 2nd of the year following the reported coverage year. For instance, for coverage in 2022, the form should be received by March 2, 2023.

- What to Do Upon Receiving It: Individuals should keep Form 1095-B for their personal records. Although it's not directly submitted to the IRS with the tax return, the information may be needed to respond to IRS queries or for verifying on the tax return that the individual had health coverage.

- Information Included: The form details the type of health coverage you had, the months of coverage, and the individuals covered under the plan.

- Potential Penalties: While the individual mandate penalty for not having health insurance has been set to $0 at the federal level since 2019, some states have their own health insurance mandates. Not having coverage or not maintaining necessary documents like Form 1095-B could result in penalties at the state level.

- Correction Process: If there are any errors on the form received, it's vital to contact the issuer immediately to correct the information. Errors could range from personal information inaccuracies to incorrect coverage dates.

Understanding and managing the IRS 1095-B form effectively ensures compliance with health care law requirements, ultimately aiding in a smoother tax filing process. Whether you're an individual taxpayer or managing benefits for an organization, keeping abreast of the form's requirements and deadlines is essential.

Popular PDF Documents

What Is Form 4562 - Form 4562 enables businesses to claim deductions for the depreciation of property.

How Long Does an Eviction Take - Highlights a court's ruling against tenants who have not paid their rent.