Get IRS 1095-A Form

As taxpayers navigate the complexities of health insurance coverage and tax obligations, the IRS 1095-A form emerges as a critical document, bridging the information gap between health insurance marketplaces and the tax reporting process. This form, formally titled the Health Insurance Marketplace Statement, serves a pivotal role for individuals who have obtained health insurance through a marketplace, providing essential data that is instrumental in preparing their tax returns. The 1095-A form details information about the health insurance policy, including the policy start and end dates, the monthly premiums paid, and the advance payments of the premium tax credit, if any, that were received. These details not only facilitate the accurate calculation of the premium tax credit eligibility, aimed at making health insurance more affordable but also ensure compliance with the tax provisions related to healthcare coverage mandated by law. Understanding the nuances of how this form impacts the tax filing process is vital for taxpayers seeking to optimize their tax outcomes and avoid potential penalties for non-compliance. As such, the 1095-A form stands as a cornerstone document that supports individuals in reconciling their health insurance benefits with their tax responsibilities, underscoring the intertwined nature of healthcare coverage and tax law.

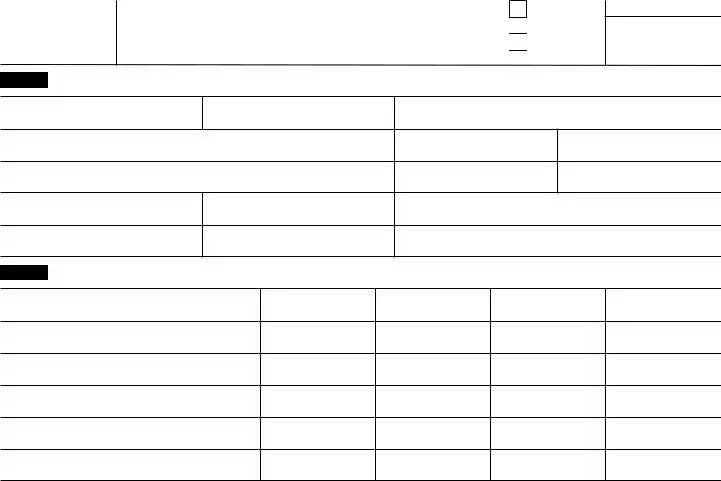

IRS 1095-A Example

CAUTION: NOT FOR FILING

Form

Health Insurance Marketplaces use Form

Form

Department of the Treasury Internal Revenue Service

Health Insurance Marketplace Statement

Do not attach to your tax return. Keep for your records.

Go to www.irs.gov/Form1095A for instructions and the latest information.

Go to www.irs.gov/Form1095A for instructions and the latest information.

VOID

CORRECTED

OMB No.

2020

Part I Recipient Information

1Marketplace identifier

2

3Policy issuer’s name

4Recipient’s name

5Recipient’s SSN

6Recipient’s date of birth

7Recipient’s spouse’s name

8Recipient’s spouse’s SSN

9Recipient’s spouse’s date of birth

10Policy start date

11Policy termination date

12Street address (including apartment no.)

13City or town

14State or province

15Country and ZIP or foreign postal code

Part II Covered Individuals

A. Covered individual name

B. Covered individual SSN

C. Covered individual

date of birth

D. Coverage start date

E. Coverage termination date

16

17

18

19

20

Part III Coverage Information

|

Month |

A. Monthly enrollment premiums |

B. Monthly second lowest cost silver |

C. Monthly advance payment of |

|

|

plan (SLCSP) premium |

premium tax credit |

|

|

|

|

||

|

|

|

|

|

21 |

January |

|

|

|

22 |

February |

|

|

|

23 |

March |

|

|

|

24 |

April |

|

|

|

25 |

May |

|

|

|

26 |

June |

|

|

|

27 |

July |

|

|

|

28 |

August |

|

|

|

29 |

September |

|

|

|

30 |

October |

|

|

|

31 |

November |

|

|

|

32 |

December |

|

|

|

33 |

Annual Totals |

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 60703Q |

Form |

Form |

Page 2 |

Instructions for Recipient

You received this Form

Form 8962 and file it with your tax return (Form 1040, Form

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), including the premium tax credit, see

VOID box. If the “VOID” box is checked at the top of the form, you previously received a Form

CORRECTED box. If the “CORRECTED” box is checked at the top of the form, use the information on this Form

Part I. Recipient Information, lines

Line 1. This line identifies the state where you enrolled in coverage through the Marketplace.

Line 2. This line is the policy number assigned by the Marketplace to identify the policy in which you enrolled. If you are completing Part IV of Form 8962, enter this number on line 30, 31, 32, or 33, box a.

Line 3. This is the name of the insurance company that issued your policy.

Line 4. You are the recipient because you are the person the Marketplace identified at enrollment who is expected to file a tax return and who, if qualified, would take the premium tax credit for the year of coverage.

Line 5. This is your social security number. For your protection, this form may show only the last four digits. However, the Marketplace has reported your complete social security number to the IRS.

Line 6. A date of birth will be entered if there is no social security number on line 5.

Lines 7, 8, and 9. Information about your spouse will be entered only if advance credit payments were made for your coverage. The date of birth will be entered on line 9 only if line 8 is blank.

Lines 10 and 11. These are the starting and ending dates of the policy.

Lines 12 through 15. Your address is entered on these lines.

Part II. Covered Individuals, lines

If advance credit payments are made, the only individuals listed on Form

If advance credit payments are made and you certify that one or more enrolled individuals aren’t individuals who would be in your tax family for the year of coverage, your Form

If advance credit payments weren’t made and you didn’t identify at enrollment the individuals who would be in your tax family for the year of coverage, Form

If there are more than 5 individuals covered by a policy, you will receive one or more additional Forms

Part III. Coverage Information, lines

Column A. This column is the monthly premiums for the plan in which you or family members were enrolled, including premiums that you paid and premiums that were paid through advance payments of the premium tax credit. If you or a family member enrolled in a separate dental plan with pediatric benefits, this column includes the portion of the dental plan premiums for the pediatric benefits. If your plan covered benefits that aren’t essential health benefits, such as adult dental or vision benefits, the amount in this column will be reduced by the premiums for the nonessential benefits. If the policy was terminated by your insurance company due to nonpayment of premiums for one or more months, then a

Column B. This column is the monthly premium for the second lowest cost silver plan (SLCSP) that the Marketplace has determined applies to members of your family enrolled in the coverage. The applicable SLCSP premium is used to compute your monthly advance credit payments and the premium tax credit you take on your return. See the instructions for Form 8962, Part II, on how to use the information in this column or how to complete Form 8962 if there is no information entered. If the policy was terminated by your insurance company due to nonpayment of premiums for one or more months, then a

Column C. This column is the monthly amount of advance credit payments that were made to your insurance company on your behalf to pay for all or part of the premiums for your coverage. If this is the only column in Part III that is filled in with an amount other than zero for a month, it means your policy was terminated by your insurance company due to nonpayment of premiums, and you aren’t entitled to take the premium tax credit for that month when you file your tax return. You still must reconcile the entire advance payment that was paid on your behalf for that month using Form 8962. No information will be entered in this column if no advance credit payments were made.

Lines

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 1095-A | This form is used to provide information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace. |

| Importance for Tax Filers | Form 1095-A is essential for tax filers as it helps them determine if they're eligible for premium tax credits or if they have to pay back any credit received. |

| Issuance of Form 1095-A | The Health Insurance Marketplace sends this form to individuals who have purchased health coverage through the Marketplace. |

| Information Included | The form includes details such as the type of health coverage obtained, the premiums paid, and any subsidy applied. |

| Impact on Tax Returns | Information from Form 1095-A is used to fill out Form 8962, Premium Tax Credit (PTC), which is part of the tax return process. |

| Deadline for Receipt | Typically, Form 1095-A is sent to individuals by January 31 following the coverage year. |

| State-Specific Forms | Some states running their own health insurance exchanges may provide a state-specific version of Form 1095-A, governed by state law. |

| Correction Process | If there are errors on Form 1095-A, individuals can contact the Marketplace from which they purchased their plan to get a corrected form. |

Guide to Writing IRS 1095-A

When navigating the process of completing IRS Form 1095-A, it's important to move forward with a clear understanding of each step, ensuring accuracy for a smooth transition into the next phase. This form is crucial for documenting information about your health insurance marketplace coverage. Completing it accurately is essential for anyone who has enrolled in a health plan through the Marketplace, as it plays a pivotal role in determining your eligibility for certain tax credits and deductions. Here are the steps to fill out the form correctly:

- Start by gathering your necessary documents, including your Health Insurance Marketplace statement and any records of health insurance payments.

- Fill in your personal information in Part I, including your full name, Social Security Number (SSN), and the specifics of your Marketplace plan.

- Proceed to Part II, where you'll need to detail the coverage of each individual in your household, including the start and end dates of their coverage. Enter the name, SSN, and coverage months for each person.

- In Part III, you must report the monthly premium amounts of your health plan. Here, detail the amount of your second lowest cost Silver plan (SLCSP) and the actual premiums paid for the coverage months.

- Review your form for accuracy. Double-check all entered information against your documents to ensure there are no discrepancies.

- Upon completing the form, sign and date it in the designated area. If you had help filling out the form, ensure the preparer also signs and includes their information.

- Finally, follow the instructions on the form for submission. This could include mailing it to the IRS or submitting it electronically, depending on your preference or requirements.

Once your Form 1095-A is correctly filled and submitted, the IRS will use this information to determine your Premium Tax Credit eligibility. Accurate completion and prompt submission are key to optimizing your potential benefits. For any questions or clarification, consulting the Health Insurance Marketplace or a tax professional is advisable.

Understanding IRS 1095-A

-

What is the IRS Form 1095-A?

The IRS Form 1095-A, Health Insurance Marketplace Statement, is a document sent to Americans who buy insurance through the Health Insurance Marketplace. It provides important information about the healthcare coverage purchased, including the type of plan, coverage dates, and any premium tax credits applied. This form is essential for preparing your taxes, as it helps determine whether you're eligible for more tax credits or if you must pay some back.

-

When should I expect to receive my Form 1095-A?

You should receive your Form 1095-A by early February of the year following the coverage year. For instance, for health insurance coverage during 2022, you would receive your Form 1095-A by February 2023. If it’s past this date and you haven’t received it, contact the Health Insurance Marketplace directly to inquire about your form's whereabouts.

-

What should I do if I find mistakes on my Form 1095-A?

If you notice any errors on your Form 1095-A, such as incorrect personal information or coverage details, you should immediately contact the Health Insurance Marketplace. They are responsible for issuing a corrected form. Do not file your tax return with incorrect information, as this could lead to discrepancies and delay your tax return processing.

-

Is the Form 1095-A required for filing taxes?

Yes, the Form 1095-A is essential for filing your federal income taxes if you obtained health insurance through the Marketplace. The information on Form 1095-A is used to fill out Form 8962, Premium Tax Credit (PTC), which is part of your tax return. The PTC form calculates your premium tax credit or determines if you need to pay back any credit you received in advance.

-

Can I file my taxes without Form 1095-A?

You should wait to receive your Form 1095-A before filing your taxes because it contains necessary information for accurately completing your tax return, particularly if you’re expecting to claim or reconcile premium tax credits. Filing without it can lead to errors and possible delays in processing your tax return. If you're concerned about delays, you should contact the Marketplace to request a copy or check if a digital version is available for you online.

Common mistakes

Filling out IRS Form 1095-A, the Health Insurance Marketplace Statement, is a critical step for individuals in accurately reporting their health insurance coverage when filing federal tax returns. However, mistakes can occur during this process, leading to delays or errors in tax filings. Here is an expanded list of common mistakes people make when completing this form:

Not verifying the information: It's essential to check that all personal details and the insurance policy information on the form match your records. Any discrepancy should be addressed before submitting your tax return.

Missing monthly premium amounts: Individuals often skip entering the monthly premium amounts or enter inaccurate figures. This information is crucial for calculating possible premium tax credits.

Incorrect coverage dates: Failing to correctly list the start and end dates of the insurance coverage can lead to issues with the IRS verifying your insurance status for the tax year.

Overlooking the policy number: Each form has a unique policy number that should be accurately reported. Omitting or inaccurately reporting this number can cause confusion.

Misunderstanding the column labels: The form contains several columns that represent different types of payments or credits. Misinterpreting these can result in incorrect calculations.

Failing to report all family members: If the policy covered multiple family members, it's crucial to ensure each person is correctly listed on the form.

Ignoring the second lowest cost Silver Plan (SLCSP) column: The SLCSP premium is vital for determining the amount of the premium tax credit. Not entering this information correctly can affect the credit calculation.

Entering the wrong year's information: Using the form for the incorrect tax year or inputting details from the wrong year's health coverage can have significant repercussions on tax filings.

Forgetting to attach Form 8962: If you're eligible for the premium tax credit, Form 8962 must be filed with your tax return. Failing to include this form can delay processing.

Omitting the form altogether: Sometimes, individuals forget or choose not to include Form 1095-A with their tax filings. This omission can lead to the IRS requesting additional information, potentially delaying refunds.

Understanding and avoiding these common mistakes can make the tax filing process smoother and help ensure that individuals accurately report their health insurance coverage.

Documents used along the form

When you're handling the IRS 1095-A form, it's often part of a bigger picture, especially during tax season. This form is crucial for individuals who've received health insurance coverage through a government marketplace. Yet, it's rarely the only document you'll need. Understanding other forms and documents that are commonly used alongside the IRS 1095-A can simplify your tax preparation process. Let's explore some of these key documents.

- IRS Form 8962, Premium Tax Credit (PTC) – This form is essential for anyone who needs to reconcile, or compare, their premium tax credit. If you received a subsidy to help cover your health insurance costs, this form helps you figure out if you got the right amount. You'll need information from your 1095-A to fill it out.

- IRS Form 1040, U.S. Individual Income Tax Return – The main form used to file personal income taxes in the U.S. It gathers information about your income, deductions, and credits to determine how much tax you owe or how much of a refund you're due. Details from the 1095-A are necessary to complete certain sections related to healthcare coverage or deductions.

- IRS Form 1095-B, Health Coverage – Provided by insurance companies to individuals who have health coverage outside of the marketplace. It's a record that you had health insurance and could be needed if you're asked to prove you met the healthcare coverage requirements.

- IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage – Employers with 50 or more full-time employees provide this form. It details the insurance offered to you and whether you accepted it. While you don't need to send this form to the IRS when you file, it's crucial to have it on hand as evidence of your insurance status.

- State-specific Health Insurance Forms – Some states might have additional forms or requirements for health insurance reporting. While not applicable to everyone, it's important to check if your state has any special documentation that goes along with the federal forms.

Ensuring you have all the necessary documents prepared alongside the IRS 1095-A can make the tax filing process smoother and more straightforward. Take the time to gather and review each relevant document to avoid any hiccups with your tax return. Remember, getting organized early can save you a headache later.

Similar forms

The IRS 1095-B form shares similarities with the 1095-A as it also provides information about an individual’s health insurance coverage. While the 1095-A form is used for those who purchase insurance through the marketplace, the 1095-B is issued by insurance providers to individuals who obtain coverage outside of the marketplace. Both forms are used to report health insurance information to the IRS and to prove that the individual had health coverage to avoid penalties for not having insurance.

The IRS 1095-C form is another document closely related to the 1095-A. It is provided by employers to employees who receive health insurance coverage under an employer-sponsored plan. Like the 1095-A, the 1095-C form is used to report to the IRS that an individual had health insurance during the year. This form is particularly relevant for large employers complying with the Affordable Care Act requirements to offer health insurance to their employees.

The W-2 form is commonly known for reporting an individual's annual wages and the amount of taxes withheld from their paycheck. Although it focuses more on employment and tax information, it is similar to the 1095-A in that it is a crucial document for tax filing, required by the IRS to ensure individuals report accurate income and tax information.

The 1040 tax return form is the standard form individuals use to file their annual income tax returns with the IRS. It’s similar to the 1095-A as both forms are essential for tax reporting. The 1095-A provides necessary details about health insurance that could affect deductions and credits reported on the 1040, influencing an individual's tax obligations.

The IRS Schedule C is a tax form used by sole proprietors to report profits or losses from their business. This document is similar to the 1095-A in that it affects an individual’s overall tax situation. For instance, the health insurance premiums a sole proprietor pays can be deductible, and having the health coverage information from the 1095-A can help determine those deductions accurately.

The IRS Schedule A is used for itemizing deductions on the 1040 tax return form, including medical and dental expenses. For individuals who purchased marketplace insurance, the 1095-A provides necessary information to calculate the premium tax credit, which can impact the deductions listed on Schedule A, particularly if any refunds are due from or owed to the Healthcare Marketplace.

The Form 8962, Premium Tax Credit (PTC), works directly with the information provided on the 1095-A. Taxpayers use Form 8962 to calculate the premium tax credit they are eligible for based on their income and family size, as well as to reconcile any advance payments of the premium tax credit. The 1095-A form provides the health insurance premium amounts and advance payments received, which are crucial for accurately completing the 8962 form.

The W-9 form is requested by companies and individuals who pay freelancers or contractors to ensure the IRS can match the reported payments with the taxpayer’s income. While different in purpose, the W-9 form is like the 1095-A in that it plays a significant role in the tax reporting process, ensuring individuals report accurate income and receive appropriate deductions.

The SSA-1099 form is issued to individuals who receive Social Security benefits. Like the 1095-A, it is a critical document for tax reporting, providing necessary information to the IRS and the individual for accurately reporting income, which can affect taxation and eligibility for certain tax credits or deductions, including those related to healthcare.

The 1098 form, or Mortgage Interest Statement, is a report from a lender to the borrower indicating the amount of interest paid during the year on a mortgage. This form is critical for homeowners when itemizing deductions on their tax returns. Similarly to the 1095-A, the 1098 affects an individual’s tax liabilities by providing potential deductions, underlining the interconnectedness of various tax documents in managing one’s financial and tax responsibilities effectively.

Dos and Don'ts

When dealing with the IRS 1095-A form, it's crucial to approach the process with care and accuracy. This form is essential for anyone who has enrolled in health insurance through the Marketplace. Here are key dos and don'ts to keep in mind to ensure the process is smooth and error-free.

Do:Double-check the information you receive from the Marketplace. Ensure that details such as your personal information, the premium amounts, and the advance payments of the premium tax credit are correct.

Gather all necessary documents before you start filling out the form. This includes your insurance policy information, social security numbers for all dependents, and details of any advance payments of the premium tax credit.

Use the IRS's instructions for Form 1095-A as a guide. The instructions can help clarify what information goes where and why it's important.

Report any discrepancies to the Marketplace as soon as they are discovered. If there are errors in the information provided on your Form 1095-A, it could impact your tax return.

Keep a copy of the completed Form 1095-A for your records. Having this document can be invaluable if there are questions or issues in the future.

Rush through filling out the form. Taking your time can help you avoid mistakes that could complicate your tax situation.

Ignore errors on your Form 1095-A. If something doesn't look right, it's important to get it corrected before you file your taxes.

Assume the information is correct without verifying it. Even if the form comes directly from the Marketplace, errors can occur.

Forget to include information about your health insurance coverage on your tax return. The IRS requires this information to be reported.

Discard your Form 1095-A after filing your taxes. It's a crucial piece of documentation that you may need to refer back to in the future.

Misconceptions

Understanding the IRS Form 1095-A is crucial for accurately handling your health insurance information during tax season. However, several misconceptions frequently muddy the waters. Here's a clear breakdown to dispel common misunderstandings:

- Only the primary insured needs the 1095-A form. Every individual listed on the insurance plan should use the information from the 1095-A form when filing their taxes, not just the primary insured person.

- If you didn’t have any changes in coverage, you don’t need a new 1095-A form each year. Each year, you'll get a new 1095-A form that reflects your insurance coverage for that year, even if your coverage didn't change.

- The 1095-A form is only for people who don't work. The 1095-A form is actually for anyone who purchased health insurance through the Marketplace, regardless of their employment status.

- You use the 1095-A form to pay your monthly premiums. The 1095-A form is used for tax filing purposes, not for paying monthly premiums. It provides information needed to fill out your tax return if you have Marketplace insurance.

- If you lose your 1095-A form, you can’t file your taxes. If you lose your form, you can access it online through the Health Insurance Marketplace account or request a replacement.

- The IRS doesn't really check your 1095-A information. The IRS closely reviews the information on your 1095-A form to ensure you received the correct amount of premium tax credit.

- Filling out the form is complicated and requires a tax professional. While consulting a tax professional can be helpful, many people are able to accurately report their information from the 1095-A form on their own using tax software or IRS guidance.

- The 1095-A form is irrelevant if you don’t get a refund. This form is essential for all taxpayers who purchased through the Marketplace, as it can affect your refund or the amount of tax you owe, regardless of your refund status.

Dispelling these myths ensures that individuals can approach their tax obligations with confidence, fully understanding the role and implications of the 1095-A form in their tax preparation process.

Key takeaways

The IRS 1095-A form, officially known as the Health Insurance Marketplace Statement, is an essential document for many taxpayers in the United States. It serves a pivotal role during tax season for individuals who have purchased health insurance through the Marketplace. Here are eight key takeaways about filling out and using this form:

- The 1095-A form is sent to you by the Health Insurance Marketplace, not the IRS. If you've purchased health coverage through the Marketplace, expect to receive this document in the mail or electronically, typically by early February each year.

- This form contains important information regarding the health insurance coverage you had, including the start and end dates, the premiums paid, and any advance premium tax credits you received.

- You'll need the information on Form 1095-A to fill out Form 8962, Premium Tax Credit (PTC). This form is crucial for calculating your premium tax credit or determining if you need to repay any credit you received in advance.

- If you received advance payments of the premium tax credit, it's critical to file a federal income tax return, even if you're not otherwise required to file. Failure to do so could result in losing eligibility for future advance payments.

- Check your 1095-A form carefully for inaccuracies. If it contains errors, contact the Marketplace as soon as possible to request a corrected form. Mistakes could affect your tax refund or how much you owe.

- The 1095-A form includes a column for the "second lowest cost Silver plan" (SLCSP), which is used to calculate the premium tax credit. This figure is vital for the accuracy of Form 8962.

- If you're filing your taxes electronically, you won't need to attach Form 1095-A to your tax return. However, it's important to keep it with your tax records in case the IRS has any questions.

- For families with more than one health insurance policy through the Marketplace, each policy will have its own Form 1095-A. You'll need to input information from all forms received into Form 8962 to accurately report your total premium tax credits.

Understanding and accurately completing the IRS 1095-A form is crucial for leveraging the full benefits of the Health Insurance Marketplace and staying compliant with tax laws. Always consult with a tax professional if you're uncertain about how to use the form or its impact on your taxes.

Popular PDF Documents

IRS 4797 - Corporations, partnerships, and sole proprietors use this form to report business asset transactions.

IRS 8919 - The IRS 8919 form is used by workers to report taxes not withheld by their employers on wages.

What Does G Mean on Costco Receipt - Overview of how Costco handles sales tax exemption requests, with emphasis on after-purchase claim submission.