Get Irs 1042 T Form

The Form 1042-T, officially designated as the Annual Summary and Transmittal of Forms 1042-S, serves a crucial function within the realm of tax documentation for the Internal Revenue Service. It's primarily utilized by withholding agents to compile and submit multiple instances of Form 1042-S, which detail the U.S. source income subject to withholding of foreign persons. Each aspect of the form, from indicating whether the submission is original or amended, to specifying the type of income and whether certain deductions apply, plays a vital role in ensuring accurate reporting and compliance with U.S. tax laws. Withholding agents must meticulously report gross income and federal tax withheld, distinguishing between Chapter 4 and Chapter 3 withholdings, and must do so by a specified deadline to avoid penalties. This form can only be used for paper submissions, highlighting an important consideration for those reporting in this manner as opposed to electronically. Importantly, the form also contains provisions for partnerships reporting foreign partners' shares of undistributed income, adding another layer of complexity. Given these details, it's clear that Form 1042-T is more than just a simple document; it's a critical tool for managing the nuances of tax reporting for foreign income in the United States.

Irs 1042 T Example

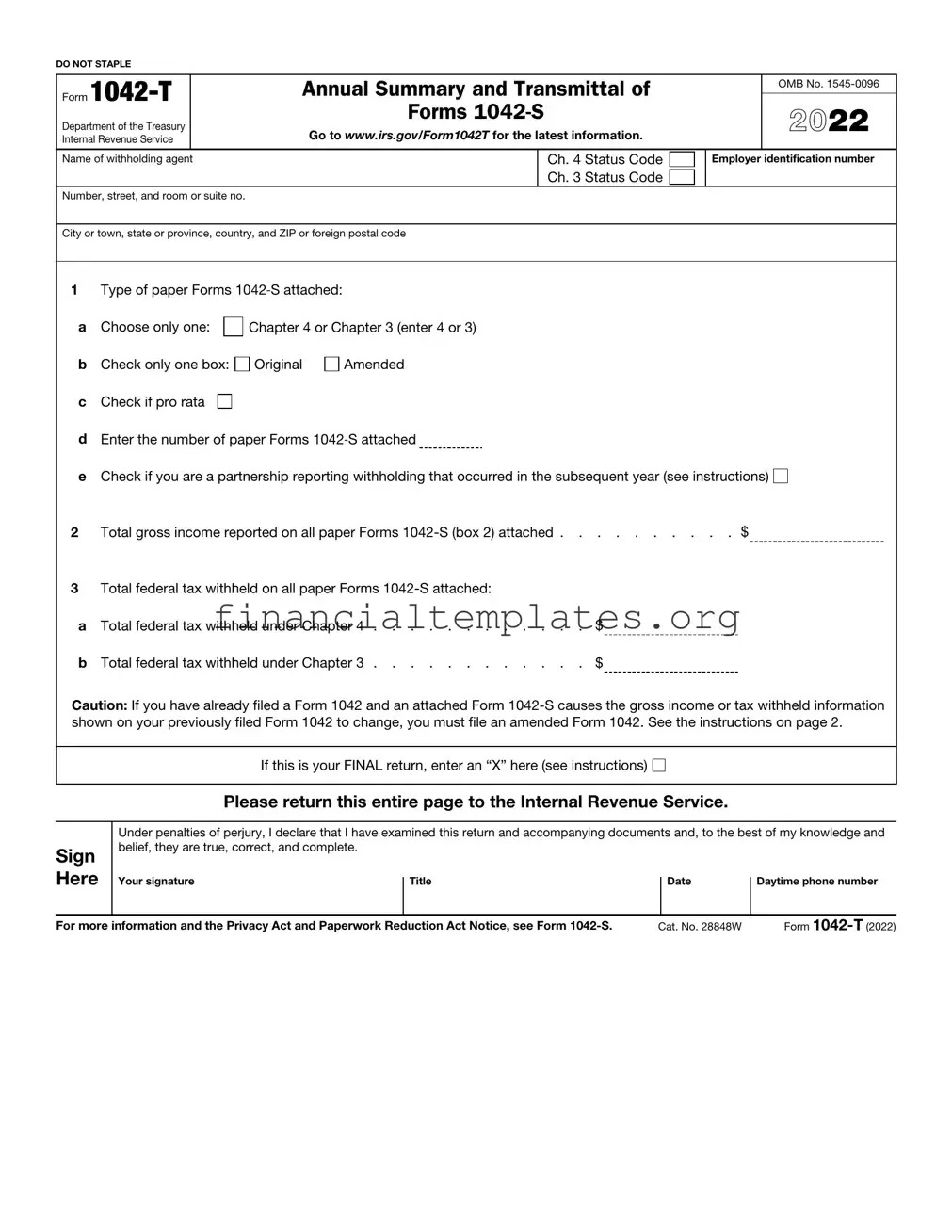

DO NOT STAPLE

Form |

|

Annual Summary and Transmittal of |

|

OMB No. |

|

|

|

|

|||

|

|

|

|||

Department of the Treasury |

|

Forms |

|

2022 |

|

Internal Revenue Service |

|

Go to www.irs.gov/Form1042T for the latest information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of withholding agent |

|

Ch. 4 Status Code |

Employer identification number |

||

|

|

|

Ch. 3 Status Code |

|

|

Number, street, and room or suite no. |

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code

1Type of paper Forms 1042‐S attached:

a Choose only one:

bCheck only one box:

cCheck if pro rata

Chapter 4 or Chapter 3 (enter 4 or 3)

Original |

Amended |

dEnter the number of paper Forms 1042‐S attached

e Check if you are a partnership reporting withholding that occurred in the subsequent year (see instructions)

2 Total gross income reported on all paper Forms

3Total federal tax withheld on all paper Forms

a Total federal tax withheld under Chapter 4 . . . . . . . . . . . . $

bTotal federal tax withheld under Chapter 3 . . . . . . . . . . . . $

Caution: If you have already filed a Form 1042 and an attached Form

If this is your FINAL return, enter an “X” here (see instructions)

Please return this entire page to the Internal Revenue Service.

Sign Here

Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete.

Your signature |

Title |

Date |

Daytime phone number |

|

|

|

|

For more information and the Privacy Act and Paperwork Reduction Act Notice, see Form |

Cat. No. 28848W |

Form |

Form |

Page 2 |

|

|

Instructions

Future Developments

For the latest information about developments related to Form

Purpose of Form

Use this form to transmit paper Forms

▲Do not use Form

for the electronic filing requirements for Form

CAUTION

Filing Forms 1042 and

Use of this form to transmit paper Forms

If you have not yet filed a Form 1042 for 2022, you may send in more than one Form

If you have already filed a Form 1042 for 2022 and an attached Form

Where and When To File

File Form

Line Instructions

Identifying information at top of form. The name, address, EIN, and chapter 4 and chapter 3 status codes of the withholding agent named on this form must be the same as those you enter on Forms 1042 and

Line 1. You must file a separate Form 1042‐T for each type of paper Form 1042‐S you are transmitting.

Line 1a. Withholding agents are not permitted to file a single Form 1042‐T to transmit both chapter 4 and chapter 3 amounts. Withholding agents must indicate either chapter 4 or chapter 3 to designate the chapter for which they are filing a given Form 1042‐T. The chapter you designate on this form must be the same as that on all attached Forms 1042‐S. See Chapter indicator in the Form 1042‐S instructions for additional information.

Line 1b. Check either the Original or Amended box (but not both).

Line 1c. Check the box on this line 1c if you are filing pro rata Forms 1042‐S (see the Form 1042‐S instructions).

Line 1e. Check the box on line 1e if you are a partnership reporting withholding that occurred in the subsequent year with respect to a foreign partner’s share of undistributed income for the prior year. The attached Form(s)

As a result of the above rules, there are sixteen possible types of Form 1042‐S that may be transmitted, and each type requires a separate Form 1042‐T.

•Chapter 4, original, pro rata.

•Chapter 4, original, non‐pro rata.

•Chapter 4, amended, pro rata.

•Chapter 4, amended, non‐pro rata.

•Chapter 4, original, pro rata, partnership.

•Chapter 4, original,

•Chapter 4, amended, pro rata, partnership.

•Chapter 4, amended,

•Chapter 3, original, pro rata.

•Chapter 3, original, non‐pro rata.

•Chapter 3, amended, pro rata.

•Chapter 3, amended, non‐pro rata.

•Chapter 3, original, pro rata, partnership.

•Chapter 3, original,

•Chapter 3, amended, pro rata, partnership.

•Chapter 3, amended,

Each type must be transmitted with a separate Form

Line 2. Enter the total of the gross income amounts shown on the Forms

Line 3. Enter the total of the federal tax withheld amounts shown on all Forms

Final return. If you will not be required to file additional Forms

Paperwork Reduction Act Notice. The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 12 minutes.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 1042-T | Used to transmit paper Forms 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, to the Internal Revenue Service. |

| Filing Requirement | A separate Form 1042-T is needed to transmit each type of Form 1042-S. It should not be used if submitting Forms 1042-S electronically. |

| Deadline for Filing | Form 1042-T must be filed with the Ogden Service Center by March 15, 2022. |

| Amendments and Final Return | If Form 1042-S changes the gross income or tax withheld info on a previously filed Form 1042, an amended Form 1042 must be filed. Mark “X” in the final return box if no additional Forms 1042-S will be filed for the year. |

Guide to Writing Irs 1042 T

Once the IRS 1042-T form is thoroughly filled out, it signifies the completion of a critical step in the process of reporting and summarizing U.S. source income subjected to withholding for foreign persons. The next steps involve collecting and organizing any accompanying documents, ensuring they align with the information provided on the 1042-T form. It's crucial to confirm that all data on the 1042-S forms is accurate and matches the summary reported. After a final review to ensure completeness and accuracy, the packet—comprising the 1042-T form and all the 1042-S forms—is ready to be submitted to the Internal Revenue Service by the specified deadline. This submission marks a significant responsibility in compliance with U.S. tax law, facilitating accurate tax reporting for foreign individuals and entities.

- Start by entering the name of the withholding agent at the top of the form.

- Specify the Ch. 4 and Ch. 3 Status Codes applicable to the withholding agent.

- Fill in the Employer Identification Number (EIN) in the designated space.

- Provide the complete address including the number, street, room or suite no., city or town, state or province, country, and ZIP or foreign postal code.

- In line 1a, indicate the type of paper Forms 1042-S attached by choosing either Chapter 4 or Chapter 3 (enter 4 or 3).

- For line 1b, check the appropriate box to denote whether the forms being submitted are Original or Amended.

- If submitting pro rata forms, check the box in line 1c.

- In the space provided in line 1d, enter the total number of paper Forms 1042-S attached.

- Check the box on line 1e if you are a partnership reporting withholding that occurred in the subsequent year.

- On line 2, enter the total gross income reported on all paper Forms 1042-S attached.

- For line 3, fill in the total federal tax withheld on all Forms 1042-S attached, dividing the amounts into those withheld under Chapter 4 (line 3a) and those withheld under Chapter 3 (line 3b).

- If this filing represents your final return for the filing year, place an “X” in the box indicating "FINAL return".

- Sign and date the form at the bottom, providing your title and daytime phone number for any follow-up communication that may be required.

After completing these steps, the form along with all necessary documents should be sent to the Ogden Service Center by the deadline mentioned on the form. Ensure all documents are not folded and are properly organized to prevent any processing delays. This careful preparation and submission reaffirm the commitment to accurate and compliant tax reporting for incomes sourced from the U.S. to foreign persons.

Understanding Irs 1042 T

What is the purpose of IRS Form 1042-T?

IRS Form 1042-T is used to transmit paper Forms 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, to the Internal Revenue Service (IRS). Each type of Form 1042-S requires a separate Form 1042-T for submission.

Should I use Form 1042-T for electronic submissions of Form 1042-S?

No, Form 1042-T should not be used if you are submitting Forms 1042-S electronically. There are specific electronic filing requirements for Form 1042-S which do not involve the use of Form 1042-T.

How does filing Form 1042-T affect my obligation to file Form 1042?

Filing Form 1042-T to transmit paper Forms 1042-S does not eliminate or alter your obligation to file Form 1042, the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. If necessary, multiple Form 1042-T submissions can be made before filing Form 1042.

Where and when should Form 1042-T be filed?

Form 1042-T, along with Copy A of the paper Forms 1042-S being transmitted, should be filed with the Ogden Service Center at P.O. Box 409101, Ogden, UT 84409. The filing deadline is March 15, 2022. It's recommended to send the forms in a flat mailing to avoid folding.

What should I do if filing an amended Form 1042-S affects the information on a previously filed Form 1042?

If filing an amended Form 1042-S changes the gross income or tax withheld information previously reported on your Form 1042, you must file an amended Form 1042 to reflect these changes.

Can I file a single Form 1042-T for both Chapter 4 and Chapter 3 amounts?

No, withholding agents must file separate Form 1042-T submissions for Chapter 4 and Chapter 3 amounts. This means choosing and indicating specifically whether you are filing under Chapter 4 or Chapter 3 for each Form 1042-T.

What information is needed at the top of Form 1042-T?

The top of Form 1042-T requires identifying information such as the name, address, Employer Identification Number (EIN), and both Chapter 4 and Chapter 3 status codes of the withholding agent. This information must match what is entered on Forms 1042 and 1042-S.

What types of Form 1042-S can be transmitted with a Form 1042-T?

There are sixteen possible types of Form 1042‐S that may be transmitted, each requiring a separate Form 1042‐T. These types vary based on whether they are original or amended, pro rata or non-pro rata, and whether they involve Chapter 4 or Chapter 3, including specific provisions for partnerships.

What should I do if this is my final return?

If you will not be required to file additional Forms 1042-S, including amended forms for the tax year in question (either on paper or electronically), you should enter an “X” in the FINAL return box on Form 1042-T.

Common mistakes

Filling out IRS forms accurately and completely is crucial for compliance with tax laws. The IRS Form 1042-T, which serves as an annual summary and transmittal document for Forms 1042-S, is no exception. Unfortunately, it's easy to make errors on this form that can lead to delays or complications. Here are six common mistakes people make:

-

Failing to file a separate Form 1042-T for each type of Form 1042-S: Some individuals attempt to bundle different types of Forms 1042-S under a single Form 1042-T. The IRS requires a separate Form 1042-T for each specific type of Form 1042-S, as detailed in the instructions.

-

Mixing Chapter 4 and Chapter 3 amounts on a single form: The form explicitly asks filers to choose between Chapter 4 or Chapter 3 amounts for reporting. Combining these distinct categories in a single submission contradicts the form’s directives and can lead to processing errors.

-

Incorrectly marking the Original or Amended box: It's imperative to indicate correctly whether the form is an original submission or amends a previously filed report. This distinction ensures that the IRS handles the form appropriately, and failing to check the correct box can lead to confusion or incorrect processing.

-

Skipping the pro rata box when required: If you are filing pro rata Forms 1042-S, the related box on line 1c must be checked. This oversight might result in misinterpretation of the submitted forms.

-

Overlooking partnership reporting requirements: Partnerships with withholding obligations for a subsequent year must indicate this by checking the box on line 1e. Neglecting to do so could misrepresent the nature of the income and withholding reported.

-

Submitting incomplete or inaccurate gross income and federal tax withheld totals: Errors in reporting the total gross income and federal tax withheld, as required on lines 2 and 3, can significantly impact the form’s correctness. These figures must match the totals from all attached Forms 1042-S.

Avoiding these mistakes not only facilitates a smoother interaction with the IRS but also helps ensure compliance with U.S. tax laws. When preparing the IRS Form 1042-T, thoroughness, accuracy, and adherence to the specific requirements laid out in the form's instructions are essential.

Documents used along the form

When managing U.S. sourced income subject to withholding for foreign persons, professionals rely on IRS Form 1042-T. This form plays a crucial role in summarizing and transmitting Forms 1042-S, which detail such income. However, successfully navigating these requirements often involves more than just Form 1042-T. A suite of additional forms and documents typically come into play, each serving a unique yet interconnected role in the reporting process.

- Form 1042: Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This form is used by withholding agents to report the total amount of U.S. sourced income paid to foreign persons and the total tax withheld. It’s a critical form that summarizes the year's withholding and serves as a companion piece to both the Forms 1042-T and 1042-S.

- Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding. This document details the specific amounts of income paid to each foreign person and the tax withheld. It is the primary form that must be provided both to the IRS and to the income recipient, providing detailed information on each transaction covered under this withholding requirement.

- Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). Entities use this form to certify the foreign status of a beneficial owner for U.S. tax withholding purposes. It is a way for foreign individuals to claim tax treaty benefits or exemptions from withholding as applicable.

- Form W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). Similar to the W-8BEN, this form is tailored for entities and allows foreign companies to claim exemptions or benefits under tax treaties.

- Form 8804: Annual Return for Partnership Withholding Tax (Section 1446). This form is filed by partnerships that earn income effectively connected with a U.S. trade or business and that is allocable to foreign partners. It ties back to the withholding reportable on Form 1042-S for partnerships.

- Form W-9: Request for Taxpayer Identification Number and Certification. Though primarily used domestically, Form W-9 may be relevant in situations where a status determination needs to be made between a U.S. and foreign person status, affecting the need for Forms 1042-S and 1042-T.

Together, these forms create a comprehensive framework designed to ensure compliance with U.S. tax laws concerning payments to foreign persons. Each form has a unique role yet interacts with others to provide a full picture of the withholding agent's obligations and actions throughout the tax year. Professionals tasked with these responsibilities must understand not just the purpose of each form but also how they interrelate to ensure thorough and accurate tax reporting and compliance.

Similar forms

The IRS 1042-T form shares similarities with the W-2 Form, commonly recognized for reporting an employee's annual wages and the amount of taxes withheld from their paycheck. Like the 1042-T form, the W-2 is pivotal in ensuring compliance with tax reporting requirements, providing the IRS and the recipient with crucial information about the income earned and taxes withheld over the year. Both forms serve as essential documents for year-end tax reconciliation and filing, although targeting different groups of taxpayers.

Similar to the 1042-T Form, the 1099-MISC Form is employed in reporting income. However, the 1099-MISC focuses on reporting payments made to independent contractors, rents, and other types of income that do not fit the employee-employer paradigm. Both the 1042-T and the 1099-MISC play a vital role in tax reporting by disclosing payments that are subject to income tax withholding, albeit for different categories of recipients and income.

The Form 1042-S, directly associated with the 1042-T, is used alongside it to report U.S. source income paid to foreign persons, including employees, independent contractors, and other recipients. The Form 1042-T acts as a transmittal form for the 1042-S forms, summarizing and sending them to the IRS. This relationship emphasizes the holistic approach to reporting and withholding tax on foreign persons’ income, ensuring that the IRS receives a comprehensive account of taxable activities involving foreign individuals.

The partnership returns form, or Form 1065, shares a connection with the Form 1042-T through its relevance to partnerships reporting income and deductions. The 1042-T, in some instances, is used by partnerships to report withholding that occurred in the subsequent year for a foreign partner's share of undistributed income. This similarity highlights how both forms are essential for accurate reporting of income and withholding taxes, ensuring that partnerships comply with their tax obligations, particularly in international contexts.

The IRS Form 941 is akin to the 1042-T in serving as a quarterly tax report, which employers use to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. While targeting different tax components, both the 941 and 1042-T forms are crucial for the IRS’s tracking of withheld taxes, ensuring that taxpayers’ obligations to the government are met promptly and accurately.

Similar in purpose to the 1042-T, the Form 8865 is used by U.S. persons to report foreign partnerships. In cases where a U.S. partnership engages in foreign transactions or holds interest in a foreign entity, it must report related activities and financial details through the Form 8865, akin to how the 1042-T reports income subject to withholding for foreign individuals. This parallel underscores the importance of transparency and compliance in international financial activities and the role these forms play in maintaining it.

Last but not least, the FATCA Report, or Form 8966, shares objectives with the 1042-T by focusing on reporting under the Foreign Account Tax Compliance Act (FATCA). Both forms are integral to the compliance framework for foreign financial institutions and their involvement with U.S. taxpayers, ensuring that foreign entities report U.S. accounts and that withholding is appropriately managed for U.S. source income paid to non-U.S. persons.

Dos and Don'ts

When filling out the IRS 1042-T form, understanding what actions to take and what to avoid is crucial to ensure the process is handled correctly. Below are curated guidelines to assist in this task:

Do's:

Ensure you choose the correct chapter status by specifying either Chapter 4 or Chapter 3 on line 1a, according to the nature of the payments being reported.

Check the correct box to indicate whether the form is an Original or an Amended submission on line 1b, as this determines how the IRS processes your documents.

Enter the total gross income and total federal tax withheld accurately on lines 2 and 3, respectively, to avoid discrepancies that could lead to penalties or delays.

Send the Form 1042-T and accompanying Forms 1042-S to the Ogden Service Center by the due date, ensuring they are not folded and the package is sent flat for clear scanning and recording.

Don'ts:

Do not staple the documents as this can interfere with the IRS's processing equipment and delay the handling of your submission.

Avoid filing a single Form 1042-T for both Chapter 4 and Chapter 3 amounts; separate submissions are required for each chapter to ensure proper processing.

Do not check both the Original and Amended boxes on line 1b. It's essential to distinguish clearly between an initial filing and a correction to a previous filing.

Do not forget to enter an “X” in the FINAL return box if you will not file additional Forms 1042-S (including amended forms) for the year, as this signals the IRS about the completeness of your submissions.

Misconceptions

Understanding the IRS Form 1042-T can sometimes be challenging, leading to some common misconceptions. Here, we aim to clarify these misunderstandings to help ensure that withholding agents accurately fulfill their filing obligations.

Misconception #1: The Form 1042-T can be used for electronic submissions. The Form 1042-T is specifically designed for the transmittal of paper Forms 1042-S. If you are submitting Forms 1042-S electronically, you should not use Form 1042-T, as it is exclusively for paper submissions.

Misconception #2: One Form 1042-T can transmit both Chapter 3 and Chapter 4 forms together. This is incorrect. Withholding agents must file a separate Form 1042-T for each chapter type of Form 1042-S. Selecting either Chapter 3 or Chapter 4 is crucial and they cannot be mixed in a single transmittal.

Misconception #3: Amended Forms 1042-S cannot be submitted after the original Form 1042-T has been filed. If necessary, you can submit amended Forms 1042-S even after the original submission. However, remember that an amended Form 1042 (if previously filed) may also be required if there are changes to the reported amounts.

Misconception #4: The total gross income reported on Form 1042-T includes both Chapters 3 and 4 income types. The total gross income reported should only include the income relevant to the specific chapter (either Chapter 3 or Chapter 4) being transmitted with that particular Form 1042-T.

Misconception #5: There is no deadline for filing the Form 1042-T. The Form 1042-T has a specific filing deadline, usually March 15 of the year following the reported tax year. Ensuring timely submission is important to avoid penalties.

Misconception #6: You only need to enter information for either Chapter 3 or Chapter 4 on Form 1042-T. Actually, withholding agents must indicate specific details for one chapter only, but it's imperative to ensure that all attached Forms 1042-S correspond to the chapter indicated.

Misconception #7: Any corrections to Forms 1042-S should be handled outside of the Form 1042-T process. In reality, if you need to make corrections to previously submitted Forms 1042-S, you must do so by submitting amended forms using the Form 1042-T, adhering to the correct procedures for either Chapter 3 or Chapter 4.

By dispelling these misconceptions, withholding agents can better navigate their responsibilities when dealing with foreign person’s U.S. source income and ensure compliance with IRS requirements.

Key takeaways

When navigating the complexities of IRS Form 1042-T, it is crucial to understand its purpose and requirements to ensure accurate and timely filing. Here are seven key takeaways to guide individuals and entities in completing and utilizing this form effectively:

- Form 1042-T serves as a transmittal form for paper Forms 1042-S, which report U.S. source income subject to withholding for foreign persons. This means it is the vehicle through which multiple Forms 1042-S are submitted to the IRS.

- Electronic submissions of Form 1042-S negate the need for Form 1042-T. Entities filing Forms 1042-S electronically should not use Form 1042-T, highlighting the IRS’s push towards digital submissions.

- Separate filings for each Form 1042-S type are mandatory. The IRS requires a distinct Form 1042-T for each type of Form 1042-S being transmitted, aimed at streamlining processing and ensuring accuracy in reporting.

- Choice between Chapter 3 and Chapter 4 is needed when completing Form 1042-T. This choice dictates the chapter of the IRS code under which withholding is reported, reflecting the specific tax obligations applicable to the income being reported.

- Amendments to previously filed Forms 1042-S can be submitted using Form 1042-T, indicating that corrections or updates to prior submissions are possible and providing a mechanism for maintaining accurate tax records.

- The deadline for submitting Form 1042-T and attached Forms 1042-S is March 15 following the tax year in which the income was paid. Meeting this deadline is essential to avoid penalties and ensure compliance with tax laws.

- Proper identification and matching with Forms 1042 and 1042-S are critical. The information provided on Form 1042-T regarding the withholding agent and types of income must align with the details on Forms 1042 and 1042-S to ensure consistency across submissions.

Understanding and adhering to these guidelines when filing Form 1042-T will facilitate effective reporting of U.S. source income for foreign persons and help entities fulfill their withholding tax obligations accurately and efficiently.

Popular PDF Documents

Form 5020 - An employee was bitten by a dog during a home service visit, causing puncture wounds.

What Is a 8862 Form - Enables taxpayers to present their case to the IRS for the restoration of Earned Income Credit benefits.

Office Depot Nonprofit Discount - Completion of this form is the first step toward obtaining a tax exemption purchasing card for qualifying purchases.