Get IRS 1042-S Form

Navigating the complexities of tax documentation is essential for individuals and organizations involved in international financial transactions. Among the various forms the Internal Revenue Service (IRS) mandates, the IRS 1042-S form stands out due to its specific purpose and the audience it serves. Primarily, it is designed for foreigners who receive certain types of income from U.S. sources, which could range from salaries and wages to scholarships and fellowship grants. This form plays a pivotal role in ensuring compliance with the tax withholding and reporting requirements set by the U.S. tax authorities. It provides a detailed account of the income paid to these individuals and any taxes withheld from their payments. By accurately filling out and submitting the IRS 1042-S form, both the payers and the recipients can navigate the tax landscape more effectively, avoiding potential penalties while ensuring that the correct tax amounts are reported and paid. Understanding the nuances of this form is crucial for anyone involved in managing or receiving international payments subject to U.S. taxation.

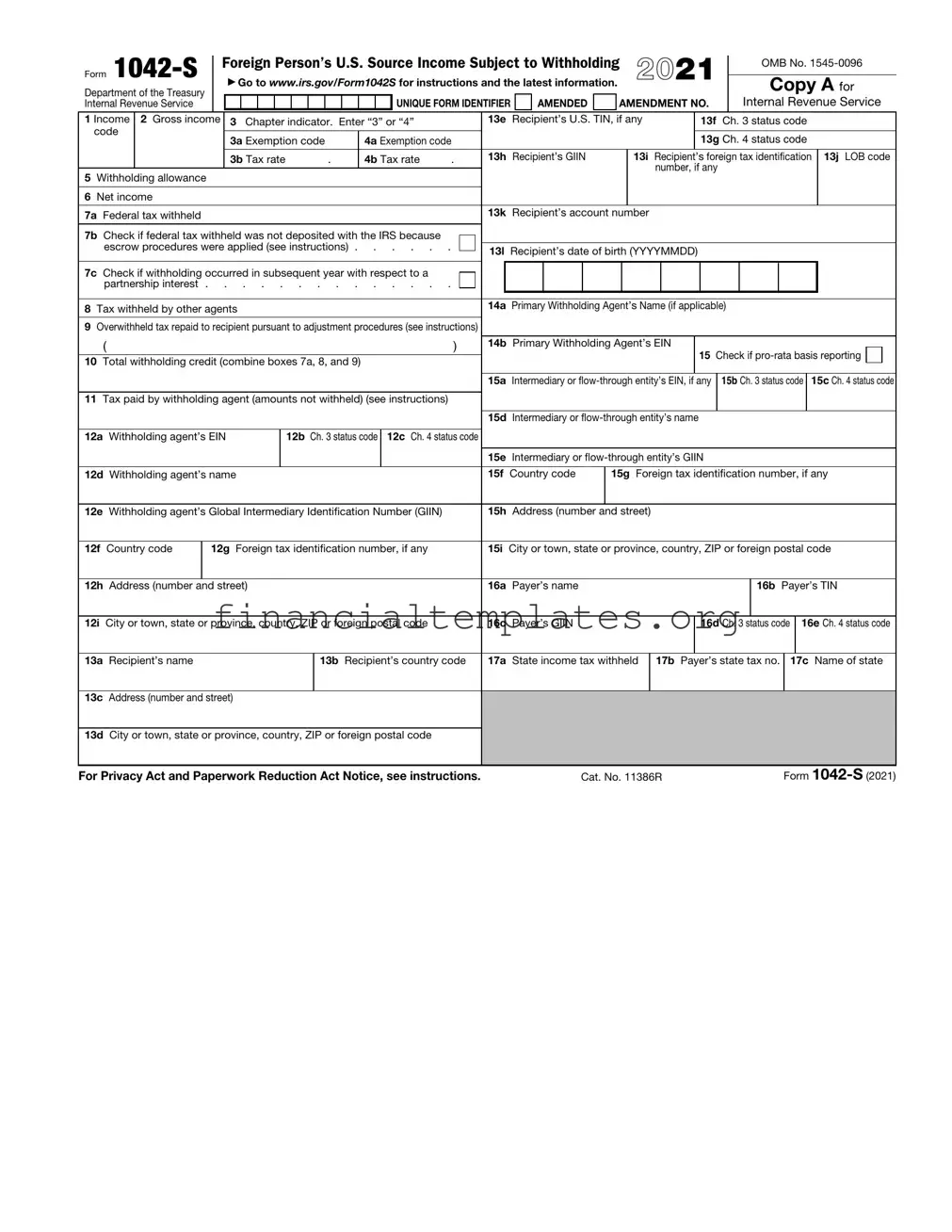

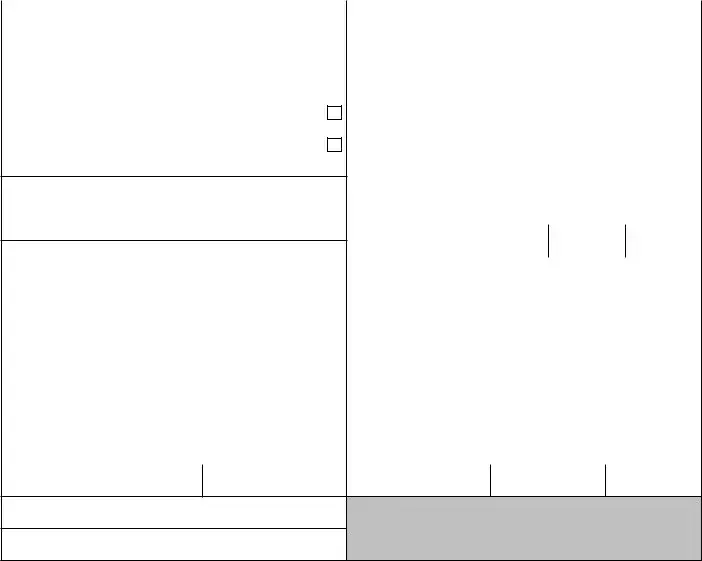

IRS 1042-S Example

|

|

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2021 |

|

|

OMB No. |

|||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy A for |

|||||||||

Form |

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

AMENDED |

|

|

AMENDMENT NO. |

|

|

Internal Revenue Service |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1 Income |

2 Gross income |

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

||||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

|

|

13i Recipient’s foreign tax identification |

13j LOB code |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

|||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 11386R |

Form |

Form |

|

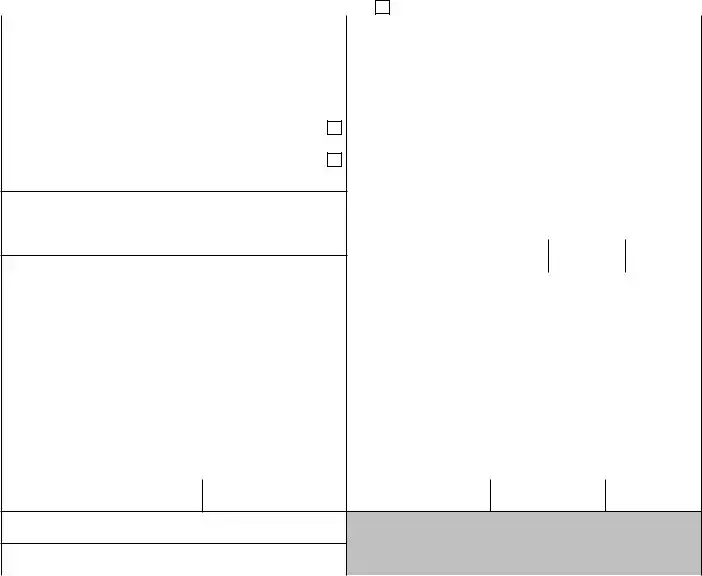

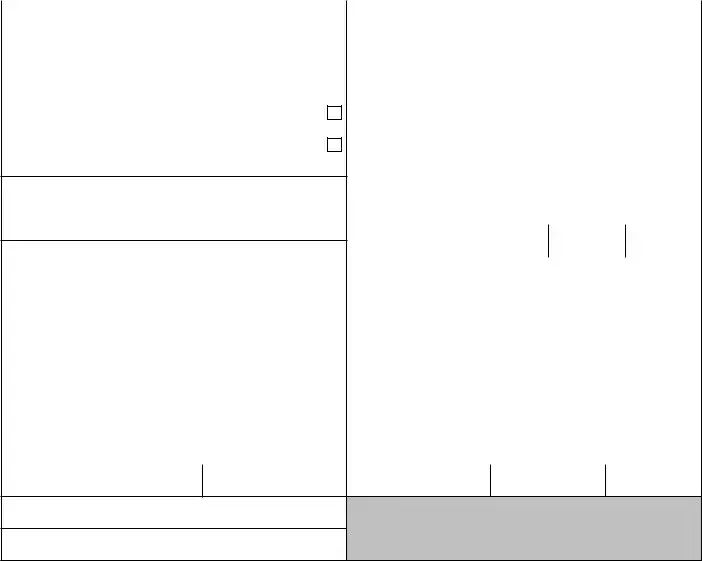

Foreign Person’s U.S. Source Income Subject to Withholding |

2021 |

|

|

OMB No. |

|||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

|

Copy B |

||||||||||||||||||||||||||||

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

AMENDED |

|

|

|

AMENDMENT NO. |

|

|

for Recipient |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 Income |

2 Gross income |

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

|||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

13i Recipient’s foreign tax identification |

13j LOB code |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

(keep for your records) |

Form |

U.S. Income Tax Filing Requirements

Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with U.S. income, including income that is effectively connected with the conduct of a trade or business in the United States, must file a U.S. income tax return. However, no return is required to be filed by a nonresident alien individual, nonresident alien fiduciary, or foreign corporation if such person was not engaged in a trade or business in the United States at any time during the tax year and if the tax liability of such person was fully satisfied by the withholding of U.S. tax at the source. Corporations file Form

En règle générale, tout étranger

àIRS.gov et dans toutes les ambassades et tous les consulats des

Por regla general, todo extranjero no residente, todo organismo fideicomisario extranjero no residente y toda sociedad anónima extranjera que reciba ingresos en los Estados Unidos, incluyendo ingresos relacionados con la conducción de un negocio o comercio dentro de los Estados Unidos, deberá presentar una declaración estadounidense de impuestos sobre el ingreso. Sin embargo, no se requiere declaración alguna a un individuo extranjero, una sociedad anónima extranjera u organismo fideicomisario extranjero no residente, si tal persona no ha efectuado comercio o negocio en los Estados Unidos durante el año fiscal y si la responsabilidad con los impuestos de tal persona ha sido satisfecha plenamente mediante retención del impuesto de los Estados Unidos en la fuente. Las sociedades anónimas envían el Formulario

Im allgemeinen muss jede ausländische Einzelperson, jeder ausländische Bevollmächtigte und jede ausländische Gesellschaft mit Einkommen in den Vereinigten Staaten, einschliesslich des Einkommens, welches direkt mit der Ausübung von Handel oder Gewerbe innerhalb der Staaten verbunden ist, eine Einkommensteuererklärung der Vereinigten Staaten abgeben. Eine Erklärung, muss jedoch nicht von Ausländern, ausländischen Bevollmächtigten oder ausländischen Gesellschaften in den Vereinigten Staaten eingereicht werden, falls eine solche Person während des Steuerjahres kein Gewerbe oder Handel in den Vereinigten Staaten ausgeübt hat und die Steuerschuld durch Einbehaltung der Steuern der Vereinigten Staaten durch die Einkommensquelle abgegolten ist. Gesellschaften reichen den Vordruck

Explanation of Codes

Box 1. Income Code.

Code |

Types of Income |

01Interest paid by U.S.

02Interest paid on real property mortgages

03Interest paid to controlling foreign corporations

04Interest paid by foreign corporations

05Interest on

|

22 |

Interest paid on deposit with a foreign branch of a domestic |

|

Interest |

30 |

corporation or partnership |

|

Original issue discount (OID) |

|||

|

29 |

Deposit interest |

|

|

31 |

||

|

33 |

Substitute |

|

|

51 |

Interest paid on certain actively traded or publicly offered |

|

|

|

securities1 |

|

|

54 |

Substitute |

|

|

|

or publicly offered securities1 |

|

Dividend |

06 |

Dividends paid by U.S. |

|

07 |

Dividends qualifying for direct dividend rate |

||

|

|||

|

08 |

Dividends paid by foreign corporations |

|

34 |

Substitute |

|

40 |

Other dividend equivalents under IRC section 871(m) |

Dividend |

|

(formerly 871(l)) |

52 |

securities1 |

|

|

Dividends paid on certain actively traded or publicly offered |

|

|

53 |

Substitute |

|

|

publicly offered securities1 |

|

09 |

Capital gains |

|

10 |

Industrial royalties |

|

11 |

Motion picture or television copyright royalties |

|

12 |

Other royalties (for example, copyright, software, |

|

|

broadcasting, endorsement payments) |

Other |

13 |

Royalties paid on certain publicly offered securities1 |

14 |

Real property income and natural resources royalties |

|

|

15 |

Pensions, annuities, alimony, and/or insurance premiums |

|

16 |

Scholarship or fellowship grants |

|

17 |

Compensation for independent personal services2 |

|

18 |

Compensation for dependent personal services2 |

|

19 |

Compensation for teaching2 |

See back of Copy C for additional codes

1This code should only be used if the income paid is described in Regulations section

2If compensation that otherwise would be covered under Income Codes 17 through 20 is directly attributable to the recipient’s occupation as an artist or athlete, use Income Code 42 or 43 instead.

Form |

|

|

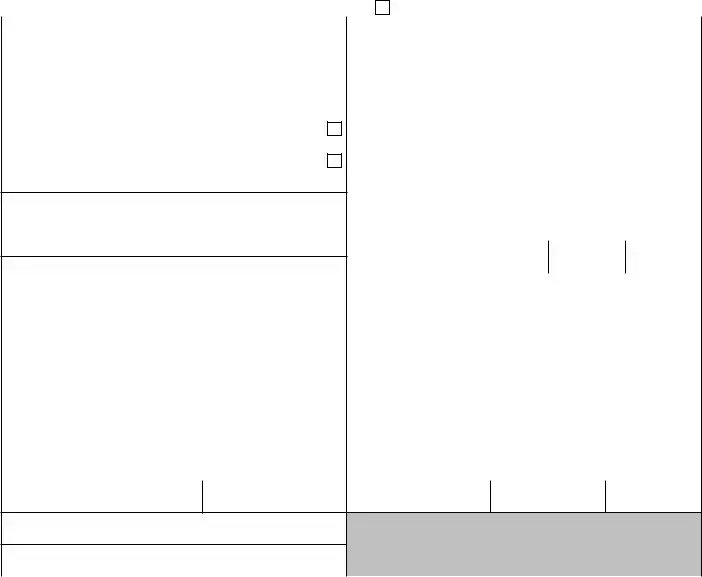

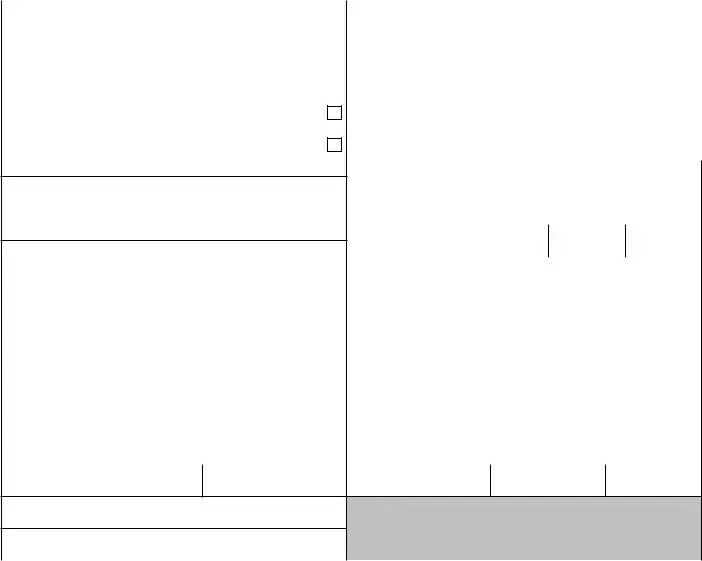

Foreign Person’s U.S. Source Income Subject to Withholding |

2021 |

|

|

OMB No. |

|||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

Copy C for Recipient |

||||||||||||||||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

|

|

AMENDED |

|

|

|

AMENDMENT NO. |

|

Attach to any Federal tax return you file |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 Income |

2 Gross income |

|

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

|||||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

13i Recipient’s foreign tax identification |

13j LOB code |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

|||||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

Form

Explanation of Codes (continued)

|

20 |

Compensation during studying and training2 |

|

|

23 |

Other income |

|

|

24 |

Qualified investment entity (QIE) distributions of capital |

|

|

|

gains |

|

|

25 |

Trust distributions subject to IRC section 1445 |

|

|

26 |

Unsevered growing crops and timber distributions by a trust |

|

|

|

subject to IRC section 1445 |

|

|

27 |

Publicly traded partnership distributions subject to IRC |

|

|

|

section 1446 |

|

|

28 |

Gambling winnings3 |

|

|

32 |

Notional principal contract income4 |

|

Other |

35 |

Substitute |

|

36 |

Capital gains distributions |

||

|

|||

|

37 |

Return of capital |

|

|

38 |

Eligible deferred compensation items subject to IRC section |

|

|

|

877A(d)(1) |

|

|

39 |

Distributions from a nongrantor trust subject to IRC section |

|

|

|

877A(f)(1) |

41Guarantee of indebtedness

42Earnings as an artist or

43Earnings as an artist or

44Specified federal procurement payments

50Income previously reported under escrow procedure6

55Taxable death benefits on life insurance contracts

Boxes 3a and 4a. Exemption Code (applies if the tax rate entered in box 3b or 4b is 00.00).

CodeAuthority for Exemption Chapter 3

01Effectively connected income

02Exempt under IRC7

03Income is not from U.S. sources

04Exempt under tax treaty

05Portfolio interest exempt under IRC

06QI that assumes primary withholding responsibility

07WFP or WFT

08U.S. branch treated as U.S. Person

09Territory FI treated as U.S. Person

10QI represents that income is exempt

11QSL that assumes primary withholding responsibility

12Payee subjected to chapter 4 withholding

22QDD that assumes primary withholding responsibility

23Exempt under section 897(l)

24Exempt under section 892

Chapter 4

13Grandfathered payment

14Effectively connected income

15Payee not subject to chapter 4 withholding

16Excluded nonfinancial payment

17Foreign Entity that assumes primary withholding responsibility

18U.S.

19Exempt from withholding under IGA8

20Dormant account9

21

Boxes 12b, 12c, 13f, 13g, 15b, 15c, 16d, and 16e. Withholding Agent, Recipient, Intermediary, and Payer Chapter 3 and Chapter 4 Status Codes.

Type of Recipient, Withholding Agent, Payer, or Intermediary Code

Chapter 3 Status Codes

03Territory

04Territory

05U.S.

06U.S.

07U.S.

08Partnership other than Withholding Foreign Partnership

09Withholding Foreign Partnership

See back of Copy D for additional codes

2If compensation that otherwise would be covered under Income Codes 17 through 20 is directly attributable to the recipient’s occupation as an artist or athlete, use Income Code 42 or 43 instead.

3Subject to 30% withholding rate unless the recipient is from one of the treaty countries listed under Gambling winnings (Income Code 28) in Pub. 515.

4Use appropriate Interest Income Code for embedded interest in a notional principal contract.

5Income Code 43 should only be used if Letter 4492, Venue Notification, has been issued by the Internal Revenue Service (otherwise, use Income Code 42 for earnings as an artist or athlete). If Income Code 42 or 43 is used, Recipient Code 22 (artist or athlete) should be used instead of Recipient Code 16 (individual), 15 (corporation), or 08 (partnership other than withholding foreign partnership).

6Use only to report gross income the tax for which is being deposited in the current year because such tax was previously escrowed for chapters 3 and 4 and the withholding agent previously reported the gross income in a prior year and checked the box to report the tax as not deposited under the escrow procedure. See the instructions to this form for further explanation.

7This code should only be used if no other specific chapter 3 exemption code applies.

8Use only to report a U.S. reportable account or nonconsenting U.S. account that is receiving a payment subject to chapter 3 withholding.

9Use only if applying the escrow procedure for dormant accounts under Regulations section

Form |

|

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2021 |

|

|

OMB No. |

|||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

Copy D for Recipient |

||||||||||||||||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

|

|

AMENDED |

|

|

|

AMENDMENT NO. |

|

|

Attach to any state tax return you file |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 Income |

2 Gross income |

|

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

|||||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

13i Recipient’s foreign tax identification |

13j LOB code |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

|||||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

Form

Explanation of Codes (continued)

10Trust other than Withholding Foreign Trust

11Withholding Foreign Trust

12Qualified Intermediary

13Qualified Securities

14Qualified Securities

15Corporation

16Individual

17Estate

18Private Foundation

19International Organization

20Tax Exempt Organization (Section 501(c) entities)

21Unknown Recipient

22Artist or Athlete

23Pension

24Foreign Central Bank of Issue

25Nonqualified Intermediary

26Hybrid entity making Treaty Claim

35Qualified Derivatives Dealer

36Foreign

37Foreign

27Withholding Rate

28Withholding Rate

29PAI Withholding Rate

30PAI Withholding Rate

31Agency Withholding Rate

32Agency Withholding Rate

Chapter 4 Status Codes

01U.S. Withholding

02U.S. Withholding

03Territory

04Territory

05Participating

06Participating

07Registered

08Registered

09Registered

10Certified

11Certified

12Certified

13Certified

14Certified

15Nonparticipating FFI

16

17U.S.

18U.S.

19Passive NFFE identifying Substantial U.S. Owners

20Passive NFFE with no Substantial U.S. Owners

21Publicly Traded NFFE or Affiliate of Publicly Traded NFFE

22Active NFFE

23Individual

24Section 501(c) Entities

25Excepted Territory NFFE

26Excepted

27Exempt Beneficial Owner

28Entity Wholly Owned by Exempt Beneficial Owners

29Unknown Recipient

30Recalcitrant Account Holder

31Nonreporting IGA FFI

32Direct reporting NFFE

33U.S. reportable account

34Nonconsenting U.S. account

35Sponsored direct reporting NFFE

36Excepted

37Undocumented Preexisting Obligation

38U.S.

39Account Holder of Excluded Financial Account11

40Passive NFFE reported by FFI12

41NFFE subject to 1472 withholding

50U.S. Withholding

Pooled Reporting Codes

42Recalcitrant

43Recalcitrant

44Recalcitrant

45Recalcitrant

46Recalcitrant

47Nonparticipating FFI Pool

48U.S. Payees Pool

49

Box 13j. LOB Code (enter the code that best describes the applicable limitation on benefits (LOB) category that qualifies the taxpayer for the requested treaty benefits).

LOB Code |

LOB Treaty Category |

02Government – contracting state/political subdivision/local authority

03Tax exempt pension trust/Pension fund

04Tax exempt/Charitable organization

05Publicly traded corporation

06Subsidiary of publicly traded corporation

07Company that meets the ownership and base erosion test

08Company that meets the derivative benefits test

09Company with an item of income that meets the active trade or business test

10Discretionary determination

11Other

10Codes 27 through 32 should only be used by a QI, QSL, WP, or WT. A QI acting as a QDD may use code 27 or 28.

11This code should only be used if income is paid to an account that is excluded from the definition of financial account under Regulations section

12This code should only be used when the withholding agent has received a certification on the FFI withholding statement of a participating FFI or registered deemed- compliant FFI that maintains the account that the FFI has reported the account held by the passive NFFE as a U.S. account (or U.S. reportable account) under its FATCA requirements. The withholding agent must report the name and GIIN of such FFI in boxes 15d and 15e.

13This code should only be used by a withholding agent that is reporting a payment (or portion of a payment) made to a QI with respect to the QI’s recalcitrant account holders.

Form |

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2021 |

|

|

OMB No. |

|||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

|

Copy E |

||||||||||||||||||||||||||||||

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

|

AMENDED |

|

|

|

AMENDMENT NO. |

|

|

for Withholding Agent |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 Income |

2 Gross income |

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

||||||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h Recipient’s GIIN |

13i Recipient’s foreign tax identification |

13j LOB code |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k Recipient’s account number |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a Primary Withholding Agent’s Name (if applicable) |

|||||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 1042-S form is used to report income paid to foreign persons including non-resident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. |

| Income Types | This form covers various types of income, such as interest, dividends, rents, royalties, and scholarship or fellowship grants. |

| Withholding Requirements | Form 1042-S is used to report amounts paid that are subject to withholding under Chapter 3 of the Internal Revenue Code, which pertains to U.S. source income of foreign persons. |

| Tax Treaties | The form can reflect the application of reduced rates of withholding at source as facilitated by income tax treaties between the U.S. and foreign countries. |

| Filing Entity | U.S. withholding agents, such as individuals, businesses, or institutions, that pay income to foreign persons must file Form 1042-S. |

| Deadlines | Form 1042-S must be filed with the IRS and furnished to the recipient by March 15 following the calendar year in which the income was paid. |

| Electronic Filing | Filers who must submit 250 or more Forms 1042-S must file them electronically through the IRS FIRE (Filing Electronic Returns Electronically) system. |

| Penalties | Failure to file or incorrect filing of Form 1042-S can result in penalties, which may include fines and interest on unpaid taxes. |

| Duplicate Reporting | Income reported on Form 1042-S must not be reported on Form 1099, to avoid duplicate reporting of the same income. |

Guide to Writing IRS 1042-S

Filling out the IRS 1042-S form is a detailed process that involves providing specific information to the Internal Revenue Service regarding payments made to foreign individuals or entities. This task is mandatory for entities that engage in such financial activities. It's essential to approach this form with care to ensure all information is accurate and complete. The following steps are designed to guide you through the process of filling out this form systematically.

- Begin by gathering all necessary documentation related to the payments made to the foreign individuals or entities, including their identifying information and the total amount paid during the fiscal year.

- Enter the payer's information in the top section of the form. This includes the payer's name, address, and the employer identification number (EIN).

- Fill in the recipient’s information. This section requires the name, address, country of citizenship, and the taxpayer identification number (TIN) of the recipient.

- Specify the type of income that was paid to the recipient in the appropriate box. This generally includes but is not limited to, wages, dividends, or scholarship funds.

- Input the total amount of income paid to the foreign individual or entity during the reporting year in the currency in which the payment was made.

- Calculate and enter any tax withheld from the payments. This requires understanding the applicable tax treaty rates or the default rate as prescribed by U.S. tax law.

- If there are any exemptions applied due to treaty benefits, clearly indicate this in the specified area by noting the applicable article and paragraph of the treaty.

- Review the information for accuracy and completeness. Mistakes can lead to compliance issues or delays in processing.

- Sign and date the form at the bottom to certify that the information provided is correct to the best of your knowledge.

- Finally, submit the form to the IRS by the required deadline to avoid penalties. Depending on your situation, the form may be submitted either electronically or in paper form.

Completing the IRS 1042-S form accurately is crucial for compliance with U.S. tax laws concerning payments to foreign entities or individuals. Taking your time to fill out each section carefully, and double-checking your work, can prevent potential issues. Remember, if there's any confusion about how to complete the form or if you need to clarify specific regulations, consulting a tax professional is always a wise decision.

Understanding IRS 1042-S

-

What is a Form 1042-S?

Form 1042-S is a tax document used by the U.S. Internal Revenue Service (IRS) to report certain types of income paid to foreign individuals and entities. This includes, but is not limited to, salaries, dividends, royalties, and scholarship or fellowship grants that come from sources within the United States. The form serves both to report income and any applicable withholdings that might have been taken out for tax purposes.

-

Who needs to file Form 1042-S?

Form 1042-S must be filed by any U.S. entity that makes payments of the types described above to foreign individuals or entities. This can include universities, employers, or financial institutions, among others. The form is required for each recipient of such payments, meaning an entity may need to file multiple forms if it makes payments to more than one foreign individual or entity.

-

What information do I need to complete Form 1042-S?

To complete Form 1042-S, you'll need detailed information about both the payer (usually the U.S. entity making the payment) and the recipient (the foreign individual or entity receiving the payment). This includes the full name and address of each, the recipient's country of tax residence, and their U.S. taxpayer identification number (TIN), if they have one. Additionally, you'll need details of the payments made, including the total amount and the type of income paid. If any withholding was done, this must also be reported on the form.

-

What if I don't have a TIN?

Foreign individuals or entities receiving payment may not always have a U.S. Taxpayer Identification Number (TIN). In such cases, it's essential to make a note of this on Form 1042-S, following the specific instructions provided by the IRS for these situations. Depending on the circumstances, recipients might be encouraged to apply for a TIN to comply with U.S. tax laws and potentially avoid higher withholding rates.

-

When is Form 1042-S due?

Form 1042-S is generally due by March 15th of the year following the payment. If March 15th falls on a weekend or a public holiday, the due date is extended to the next business day. It's crucial to adhere to this deadline to avoid penalties for late filing. Copies of the form also need to be provided to the income recipient by the same date, allowing them to correctly file their tax returns if necessary.

-

How do I file Form 1042-S?

Form 1042-S can be filed electronically or on paper, although the IRS encourages electronic filing for efficiency and security reasons. Filing electronically is mandatory for entities submitting 250 or more forms. The IRS website provides instructions and links for electronic filing. For those who choose or need to file on paper, the forms must be ordered from the IRS, as photocopies are not accepted.

-

What are the penalties for not filing Form 1042-S?

Failure to file Form 1042-S, filing late, or filing an incorrect form can result in penalties. These penalties can vary, potentially including financial fines and interest on any underpaid taxes. The specifics depend on the extent of the delay and the nature of the mistake. The IRS may offer relief from penalties in certain situations if the filer can show that the failure was due to reasonable cause and not willful neglect.

-

Can Form 1042-S be amended?

Yes, if errors are discovered after Form 1042-S has been filed, it is possible, and often necessary, to amend the form. To do this, a new form should be completed with the correct information and marked as "Amended" to distinguish it from the original submission. Detailed instructions on how to properly amend Form 1042-S are available on the IRS website. It's important to correct any mistakes promptly to prevent or minimize penalties.

Common mistakes

Filling out the IRS 1042-S form can be a complex process that requires careful attention to detail. This form is used to report amounts paid to foreign persons, including non-resident aliens, foreign partnerships, and corporations, in the preceding year. Mistakes can lead to delays or incorrect tax withholding and reporting. Here are four common mistakes people make when filling out this form:

-

Incorrect Taxpayer Identification Numbers (TINs): One frequent error is entering incorrect or incomplete Taxpayer Identification Numbers. This can include the Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN) of the recipient. Accurate TINs are crucial for ensuring proper reporting and tax withholding.

-

Failing to Choose the Correct Income Code: The IRS 1042-S form requires the payer to select an income code that best describes the type of payment being reported. This code is essential for determining the tax rate and any exemptions that may apply. Choosing the wrong income code can lead to incorrect withholding and reporting.

-

Not Reporting in U.S. Dollars: All amounts must be reported in U.S. dollars, even if the payment was made in another currency. This requires the payer to convert the payment amount to U.S. dollars using the exchange rate in effect on the date of payment. Failing to report in U.S. dollars can lead to inaccuracies in the reported amounts.

-

Omitting or Misreporting Recipient Information: It is critical to provide detailed and accurate information about the recipient of the payment. This includes the recipient's name, address, and country of citizenship. Incomplete or incorrect recipient information can cause problems with the IRS and may result in the form being rejected.

By avoiding these common mistakes, filers can ensure smoother processing of their IRS 1042-S forms and stay compliant with U.S. tax laws. Whether you are a seasoned tax professional or a first-time filer, paying close attention to these details is key to successful tax reporting for payments to foreign persons.

Documents used along the form