Get IRS 1041 Form

Amid the complexities of the United States tax system, the IRS 1041 form stands as a pivotal document for fiduciaries and administrators, navigating the intricacies of trust and estate taxation. This form not only embodies the federal government's approach to taxing the income accumulated by estates and trusts but also serves as a testament to the broader principles underpinning tax obligations for entities beyond individual and corporate taxpayers. By requiring detailed reporting on the income, deductions, and credits of trusts and estates, the IRS 1041 encapsulates both the fiduciary responsibility to beneficiaries and the adherence to federal tax laws. Given its significance, understanding the major aspects of this form is quintessential for those entrusted with managing these entities, including the nuances of what constitutes taxable income within this context, the eligible deductions that can mitigate tax liability, and the specific credits that may be available. As such, the form is more than a mere procedural requirement; it is a crucial instrument that balances the fiscal responsibilities of estates and trusts with their obligations to both beneficiaries and the Internal Revenue Service, reflecting a broader dialogue about fairness, responsibility, and the distribution of wealth under the auspices of U.S. tax law.

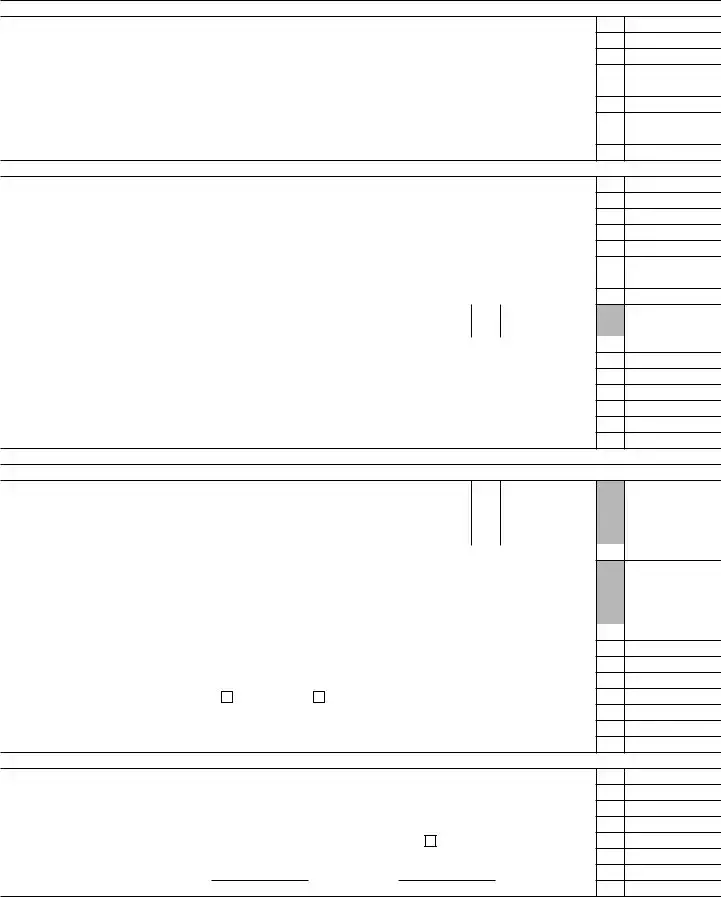

IRS 1041 Example

Form

1041 |

Department of the |

U.S. Income Tax Return for Estates and Trusts |

|

▶ Go to www.irs.gov/Form1041 for instructions and the latest information. |

2021

OMB No.

A Check all that apply: |

For calendar year 2021 or fiscal year beginning |

, 2021, and ending |

, 20 |

|

||||||||

|

|

|

|

|

|

|

|

|||||

|

Decedent’s estate |

Name of estate or trust (If a grantor type trust, see the instructions.) |

|

C |

Employer identification number |

|

||||||

|

Simple trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Complex trust |

Name and title of fiduciary |

|

|

D |

Date entity created |

||||||

|

Qualified disability trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

ESBT (S portion only) |

Number, street, and room or suite no. (If a P.O. box, see the instructions.) |

|

E Nonexempt charitable and |

||||||||

|

Grantor type trust |

|

|

|

|

|

trusts, check applicable box(es). |

|||||

|

|

|

|

|

|

See instructions. |

||||||

|

Bankruptcy |

|

|

|

|

|

Described in sec. 4947(a)(1). Check here |

|||||

|

Bankruptcy |

City or town, state or province, country, and ZIP or foreign postal code |

|

|

if not a private foundation . . ▶ |

|||||||

|

Pooled income fund |

|

|

|

|

|

Described in sec. 4947(a)(2) |

|||||

|

|

|

|

|

|

|

|

|

|

|

||

B Number of Schedules |

F Check |

Initial return |

Final return |

Amended return |

|

Net operating loss carryback |

||||||

|

attached (see |

applicable |

Change in trust’s name |

Change in fiduciary |

Change in fiduciary’s name |

Change in fiduciary’s address |

||||||

|

instructions) ▶ |

boxes: |

||||||||||

G Check here if the estate or filing trust made a section 645 election . . |

. . . . . . . ▶ |

Trust TIN ▶ |

|

|

|

|

|

|||||

|

1 |

Interest income |

. . . . . . . |

. . |

|

1 |

|

|

||||

|

2a |

Total ordinary dividends |

. . . . . . . |

. . |

|

2a |

||||||

|

b |

Qualified dividends allocable to: |

(1) Beneficiaries |

(2) Estate or trust |

|

|

|

|

|

|||

Income |

3 |

Business income or (loss). Attach Schedule C (Form 1040) . . . . |

. . . . . . . |

. . |

|

3 |

|

|

||||

4 |

Capital gain or (loss). Attach Schedule D (Form 1041) |

. . . . . . . |

. . |

|

4 |

|

|

|||||

|

|

|

||||||||||

|

5 |

Rents, royalties, partnerships, other estates and trusts, etc. Attach Schedule E (Form 1040) |

. . |

|

5 |

|

|

|||||

|

6 |

Farm income or (loss). Attach Schedule F (Form 1040) |

. . . . . . . |

. . |

|

6 |

|

|

||||

|

7 |

Ordinary gain or (loss). Attach Form 4797 |

. . . . . . . |

. . |

|

7 |

|

|

||||

|

8 |

Other income. List type and amount |

|

|

|

|

|

8 |

|

|

||

|

9 |

Total income. Combine lines 1, 2a, and 3 through 8 |

. . . . . . . |

. ▶ |

9 |

|

|

|||||

|

10 |

Interest. Check if Form 4952 is attached ▶ |

. . . . . . . . |

. . . . . . . |

. . |

|

10 |

|

|

|||

|

11 |

Taxes |

. . . . . . . |

. . |

|

11 |

|

|

||||

|

12 |

Fiduciary fees. If only a portion is deductible under section 67(e), see instructions . . . . |

. . |

|

12 |

|

|

|||||

|

13 |

Charitable deduction (from Schedule A, line 7) |

. . . . . . . |

. . |

13 |

|

|

|||||

14Attorney, accountant, and return preparer fees. If only a portion is deductible under section 67(e),

Deductions |

|

|

|

see instructions |

14 |

|

||||||||||||

17 |

|

|

Adjusted total income or (loss). Subtract line 16 from line 9 |

. . |

. . . |

17 |

|

|

|

|

|

|

||||||

|

15a |

|

Other deductions (attach schedule). See instructions for deductions allowable under section 67(e) |

15a |

|

|||||||||||||

|

|

b |

|

Net operating loss deduction. See instructions |

15b |

|

||||||||||||

|

16 |

|

|

Add lines 10 through 15b |

. . . . . . . . . . . . ▶ |

16 |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

Income distribution deduction (from Schedule B, line 15). Attach Schedules |

18 |

|

||||||||||||

|

19 |

|

|

Estate tax deduction including certain |

19 |

|

||||||||||||

|

20 |

|

|

Qualified business income deduction. Attach Form 8995 or |

20 |

|

||||||||||||

|

21 |

|

|

Exemption |

21 |

|

||||||||||||

|

22 |

|

|

Add lines 18 through 21 |

. . . . . . . . . . . . ▶ |

22 |

|

|||||||||||

Payments |

23 |

|

|

Taxable income. Subtract line 22 from line 17. If a loss, see instructions |

23 |

|

||||||||||||

24 |

|

|

Total tax (from Schedule G, Part I, line 9) |

24 |

|

|||||||||||||

|

|

|

|

|||||||||||||||

|

25 |

|

|

Current year net 965 tax liability paid from Form |

25 |

|

||||||||||||

|

26 |

|

|

Total payments (from Schedule G, Part II, line 19) |

26 |

|

||||||||||||

and |

27 |

|

|

Estimated tax penalty. See instructions |

27 |

|

||||||||||||

28 |

|

|

Tax due. If line 26 is smaller than the total of lines 24, 25, and 27, enter amount owed . . . . |

28 |

|

|||||||||||||

Tax |

29 |

|

|

Overpayment. If line 26 is larger than the total of lines 24, 25, and 27, enter amount overpaid . . |

29 |

|

||||||||||||

30 |

|

|

Amount of line 29 to be: a Credited to 2022 ▶ |

|

; |

b Refunded . . . . . ▶ |

30 |

|

||||||||||

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and |

|||||||||||||||

Sign |

|

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May the IRS discuss this return |

|||

Here |

|

▲ |

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

with the preparer shown below? |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Signature of fiduciary or officer representing fiduciary |

Date |

|

|

EIN of fiduciary if a financial institution |

See instructions. Yes No |

||||||||||

Paid |

|

|

Print/Type preparer’s name |

Preparer’s signature |

|

|

|

|

Date |

|

Check |

if |

PTIN |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Firm’s name ▶ |

|

|

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

||||||||

Firm’s address ▶ |

|

|

|

|

|

|

|

|

Phone no. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

|

Cat. No. 11370H |

|

|

|

|

Form 1041 (2021) |

|||||||||

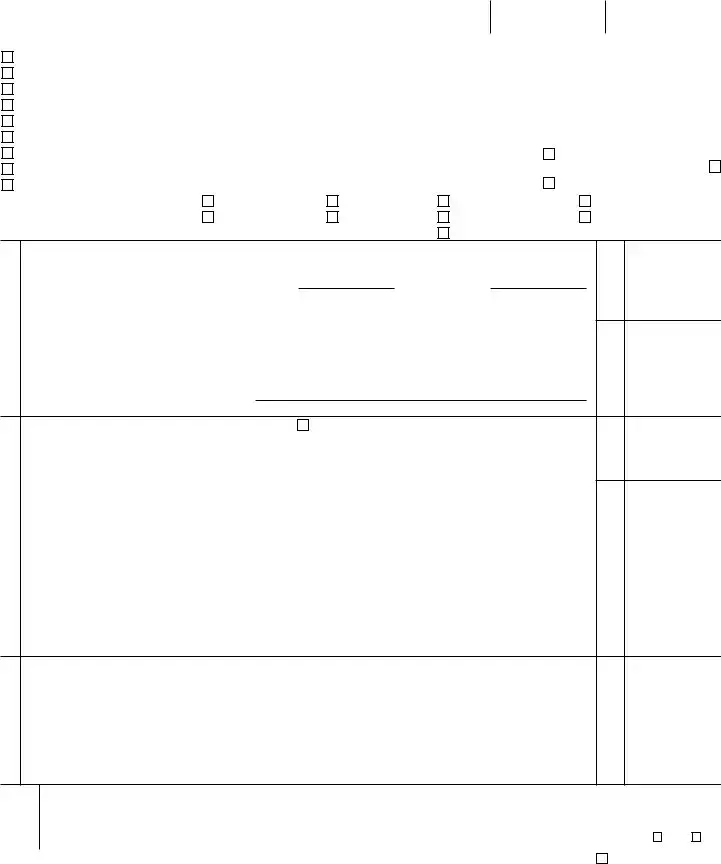

Form 1041 (2021) |

Page 2 |

Schedule A Charitable Deduction. Don’t complete for a simple trust or a pooled income fund.

1Amounts paid or permanently set aside for charitable purposes from gross income. See instructions

2 |

|

3 |

Subtract line 2 from line 1 |

4Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable

purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6Section 1202 exclusion allocable to capital gains paid or permanently set aside for charitable

purposes. See instructions . . . . . . . . . . . . . . . . . . . . . . . . .

7Charitable deduction. Subtract line 6 from line 5. Enter here and on page 1, line 13 . . . . . .

Schedule B Income Distribution Deduction

1

2

3

4

5

6

7

1 |

Adjusted total income. See instructions |

1 |

2 |

Adjusted |

2 |

3 |

Total net gain from Schedule D (Form 1041), line 19, column (1). See instructions |

3 |

4 |

Enter amount from Schedule A, line 4 (minus any allocable section 1202 exclusion) |

4 |

5 |

Capital gains for the tax year included on Schedule A, line 1. See instructions |

5 |

6Enter any gain from page 1, line 4, as a negative number. If page 1, line 4, is a loss, enter the loss as a

|

positive number |

6 |

|

||

7 |

Distributable net income. Combine lines 1 through 6. If zero or less, enter |

7 |

|

||

8 |

If a complex trust, enter accounting income for the tax year as determined |

|

|

|

|

|

under the governing instrument and applicable local law |

8 |

|

|

|

9 |

Income required to be distributed currently |

9 |

|

||

10 |

Other amounts paid, credited, or otherwise required to be distributed |

10 |

|

||

11 |

Total distributions. Add lines 9 and 10. If greater than line 8, see instructions |

11 |

|

||

12 |

Enter the amount of |

12 |

|

||

13 |

Tentative income distribution deduction. Subtract line 12 from line 11 |

13 |

|

||

14 |

Tentative income distribution deduction. Subtract line 2 from line 7. If zero or less, enter |

14 |

|

||

15 |

Income distribution deduction. Enter the smaller of line 13 or line 14 here and on page 1, line 18 . |

15 |

|

||

Schedule G Tax Computation and Payments (see instructions)

Part I — Tax Computation

1 |

Tax: |

|

|

|

|

|

a |

Tax on taxable income. See instructions |

|

1a |

|

||

b |

Tax on |

|

1b |

|

||

c |

Alternative minimum tax (from Schedule I (Form 1041), line 54) |

|

1c |

|

||

d |

Total. Add lines 1a through 1c |

. . . . . . . ▶ |

||||

2a |

Foreign tax credit. Attach Form 1116 |

|

2a |

|

||

b |

General business credit. Attach Form 3800 |

|

2b |

|

||

c |

Credit for prior year minimum tax. Attach Form 8801 |

|

2c |

|

||

d |

Bond credits. Attach Form 8912 |

|

2d |

|

||

e |

Total credits. Add lines 2a through 2d |

. . . . . . . ▶ |

||||

3 |

Subtract line 2e from line 1d. If zero or less, enter |

|||||

4 |

Tax on the ESBT portion of the trust (from ESBT Tax Worksheet, line 17). See instructions . . . . |

|||||

5 |

Net investment income tax from Form 8960, line 21 |

|||||

6 |

Recapture taxes. Check if from: |

Form 4255 |

Form 8611 |

|||

7 |

Household employment taxes. Attach Schedule H (Form 1040) |

|||||

8 |

Other taxes and amounts due |

|||||

9Total tax. Add lines 3 through 8. Enter here and on page 1, line 24 . . . . . . . . . . . ▶

Part II — Payments

1d

2e

3

4

5

6

7

8

9

10 |

2021 estimated tax payments and amount applied from 2020 return |

10 |

|

|||

11 |

Estimated tax payments allocated to beneficiaries (from Form |

11 |

|

|||

12 |

Subtract line 11 from line 10 |

12 |

|

|||

13 |

Tax paid with Form 7004. See instructions |

13 |

|

|||

14 |

Federal income tax withheld. If any is from Form(s) 1099, check here ▶ |

. . . . . . . . . |

14 |

|

||

15 |

Current year net 965 tax liability from Form |

15 |

|

|||

16 |

Other payments: a Form 2439 |

; b Form 4136 |

; Total . . |

▶ |

16c |

|

17 |

Credit for qualified sick and family leave wages for leave taken before April 1, 2021 |

17 |

|

|||

18 |

Credit for qualified sick and family leave wages for leave taken after March 31, 2021 |

18 |

|

|||

19 |

Total payments. Add lines 12 through 15 and 16c through 18. Enter here and on page 1, line 26 . |

▶ |

19 |

|

||

Form 1041 (2021)

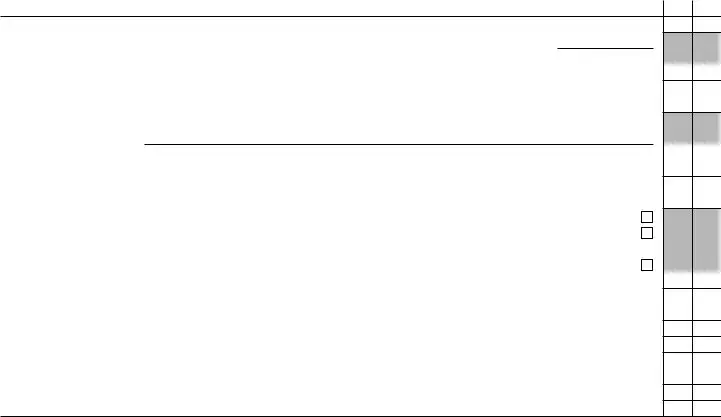

Form 1041 (2021) |

Page 3 |

Other Information |

Yes No |

1Did the estate or trust receive

Enter the amount of

2Did the estate or trust receive all or any part of the earnings (salary, wages, and other compensation) of any

individual by reason of a contract assignment or similar arrangement? . . . . . . . . . . . . . . .

3At any time during calendar year 2021, did the estate or trust have an interest in or a signature or other authority over a bank, securities, or other financial account in a foreign country? . . . . . . . . . . . . . .

See the instructions for exceptions and filing requirements for FinCEN Form 114. If “Yes,” enter the name of the foreign country ▶

4During the tax year, did the estate or trust receive a distribution from, or was it the grantor of, or transferor to, a

foreign trust? If “Yes,” the estate or trust may have to file Form 3520. See instructions . . . . . . . . .

5Did the estate or trust receive, or pay, any qualified residence interest on

the instructions for the required attachment . . . . . . . . . . . . . . . . . . . . . . .

6 If this is an estate or a complex trust making the section 663(b) election, check here. See instructions . . ▶

7To make a section 643(e)(3) election, attach Schedule D (Form 1041), and check here. See instructions . . ▶

8If the decedent’s estate has been open for more than 2 years, attach an explanation for the delay in closing the

estate, and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

9 Are any present or future trust beneficiaries skip persons? See instructions . . . . . . . . . . . . .

9 Are any present or future trust beneficiaries skip persons? See instructions . . . . . . . . . . . . .

10Was the trust a specified domestic entity required to file Form 8938 for the tax year (see the Instructions for

Form 8938)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a Did the estate or trust distribute S corporation stock for which it made a section 965(i) election? . . . . . .

bIf “Yes,” did each beneficiary enter into an agreement to be liable for the net tax liability? See instructions . . .

12 Did the estate or trust make a section 965(i) election for S corporation stock held on the last day of the tax year?

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 ESBTs only. Does the ESBT have a nonresident alien grantor? If “Yes,” see instructions . . . . . . . .

14ESBTs only. Did the S portion of the trust claim a qualified business income deduction? If “Yes,” see instructions

Form 1041 (2021)

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS 1041 form is required for reporting the income, deductions, gains, losses, etc., of estates and trusts. |

| 2 | It is also known as the U.S. Income Tax Return for Estates and Trusts. |

| 3 | Filing this form is necessary for any domestic estate with a gross income for the tax year of $600 or more, or a beneficiary who is a nonresident alien. |

| 4 | Estates and trusts must obtain a tax identification number (EIN) to report on the Form 1041, which serves as their identification number for tax purposes. |

| 5 | The due date for filing the Form 1041 is April 15th for calendar year taxpayers. If the estate or trust operates on a fiscal year, the due date is the 15th day of the fourth month following the end of their tax year. |

| 6 | Form 1041 must be filed with the Internal Revenue Service (IRS), and the specific version of the form can vary year by year to accommodate changes in tax law. |

| 7 | Income distributions to beneficiaries are reported on Schedule B of Form 1041 and may impact the beneficiaries' personal tax returns. |

| 8 | State-specific 1041 forms may be required in addition to the federal form. These are governed by the tax laws of each state. |

| 9 | Deductions on Form 1041 can include estate administration expenses, certain charitable contributions, and distributions to beneficiaries, among others. |

Guide to Writing IRS 1041

Filing an IRS 1041 form is a necessary step for the administration of estates and trusts. This document details the income, deductions, and credits of a trust or estate, and determining how to properly complete it is crucial for ensuring these entities are taxed appropriately. The process involves several steps, which will guide individuals through the necessary sections and ensure accurate reporting. By following these instructions, filers can navigate the complexities of tax law and compliance.

- Begin by gathering all necessary documentation, including the estate’s or trust’s identification number (EIN), financial statements, and information on distributions to beneficiaries.

- Download the latest version of the IRS 1041 form from the Internal Revenue Service website to ensure you have the most current guidelines and fields.

- Enter the estate's or trust's name, address, and the Employer Identification Number (EIN) in the designated spaces at the top of the form.

- Check the appropriate box for the tax year and type of entity. Make sure to indicate if the trust is a Simple Trust, Complex Trust, or Decedent’s Estate.

- Fill in the income portion of the form. This involves reporting interest income, dividend income, business income, capital gains, and any other relevant types of income.

- Calculate and document allowable deductions. These can include trustee fees, attorney fees, state income tax, and other administrative expenses directly related to the operation of the estate or trust.

- If applicable, complete the section on distributions to beneficiaries, which details any income that is required to be distributed currently or other amounts paid, credited, or otherwise required to be distributed.

- Determine the estate's or trust's tax liability by applying the appropriate tax rates to the taxable income, and enter this in the "Tax Computation" section.

- Report any payments or credits that have already been made, including estimated tax payments or federal income tax withheld.

- Review the form for accuracy and completeness. Verify all calculations to ensure no errors have been made.

- Sign and date the form. An officer, trustee, or executor must sign the form where indicated, affirming the accuracy of the information provided.

- Submit the form to the IRS by the due date, which is typically April 15th for calendar year filers or the 15th day of the fourth month following the end of the fiscal year for fiscal year filers. If necessary, apply for an extension using Form 7004.

By systematically working through these steps, individuals responsible for filing IRS 1041 forms can do so efficiently and compliantly. Accuracy in completing this form ensures the proper management of tax obligations for estates and trusts, ultimately facilitating their smooth administration and adherence to relevant tax laws.

Understanding IRS 1041

-

What is an IRS 1041 form?

The IRS 1041 form, officially titled the "U.S. Income Tax Return for Estates and Trusts," is a document used by the fiduciary of a domestic estate or trust to report the income, gains, losses, deductions, and credits of the estate or trust. It is also used to distribute the income or loss to beneficiaries.

-

Who needs to file the IRS 1041 form?

The form needs to be filed by the fiduciary of a domestic estate with gross income for the tax year of $600 or more, or when a beneficiary is a nonresident alien. Trusts that are required to distribute income currently or that have a beneficiary who is either a nonresident alien or are receiving credits or deductions for the tax year must also file this form.

-

When is the deadline to file form 1041?

The deadline to file form 1041 is typically the 15th day of the fourth month following the end of the estate’s or trust’s tax year. For most filers, this date falls on April 15th. However, if the estate or trust operates on a fiscal year rather than a calendar year, the filing date will be adjusted accordingly.

-

What information do I need to fill out form 1041?

To complete form 1041, you will need the estate’s or trust’s identification number, the total income received during the year, information on distributions to beneficiaries, and details of any expenses or deductions claimed. This includes income from all sources, deductions for administration expenses, and information regarding the beneficiaries.

-

How do I obtain an IRS 1041 form?

You can obtain the IRS 1041 form online directly from the IRS website. The form can be downloaded and printed for manual completion, or it can be filled out using tax software that supports the form. Additionally, tax professionals and some libraries also provide access to these forms.

-

Can the IRS 1041 form be e-filed?

Yes, the IRS 1041 form can be e-filed. This is a convenient option for many filers and is supported by various tax preparation software programs. E-filing can help ensure quicker processing of the form and potentially faster response times from the IRS.

-

Are there penalties for filing form 1041 late?

If form 1041 is filed after the due date (including extensions) without reasonable cause, the estate or trust may be subject to a penalty. The penalty is usually a percentage of the unpaid tax required to be reported. Additional penalties may apply for failing to pay the tax owed by the due date.

-

Can I request an extension to file form 1041?

Yes, an extension to file form 1041 can be requested using Form 7004, titled “Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.” This extension allows for an additional six months to file. However, it's important to note that this extension does not grant additional time to pay any taxes owed.

-

How do distributions to beneficiaries affect form 1041?

Distributions to beneficiaries must be reported on form 1041. These distributions reduce the taxable income of the estate or trust and are considered taxable income to the beneficiaries. Specific instructions on how to report these distributions are included in the form's instructions. The character of the income (such as capital gains, dividends, etc.) is maintained as it passes through to the beneficiaries.

Common mistakes

Filling out the IRS 1041 form, which is essential for reporting income, deductions, and gains of estates and trusts, can often be a complicated process. Mistakes in this process can lead to delays, audits, and additional taxes. Being aware of common errors can help ensure that the form is completed accurately and efficiently.

Not obtaining a Tax Identification Number (TIN) for the estate or trust. Before filing Form 1041, it is critical to secure a TIN, as using the decedent's Social Security Number is a common mistake.

Failing to report all income. All income received by the estate or trust must be reported. This includes interest, dividends, and any other income types. Omitting any source of income can lead to inaccuracies and potential penalties.

Incorrect deduction claims. It's pivotal to understand which expenses are deductible. For example, personal expenses of the beneficiaries cannot be deducted. Misinterpreting these rules can significantly impact the tax liabilities.

Not properly allocating income between the estate or trust and the beneficiaries. The allocation of income to beneficiaries on Schedule K-1 must be accurate to ensure correct reporting and taxation at both levels.

Miscalculating DNI (Distributable Net Income). The DNI determines how much of the income is taxable to the estate or trust and how much is taxable to the beneficiaries. Errors in calculating DNI can lead to under or overpayment of taxes.

Missing the filing deadline. The deadline for filing Form 1041 is generally the 15th day of the fourth month after the end of the estate or trust's tax year. Late filings can incur penalties and interest charges.

It is essential to pay meticulous attention to detail when preparing and filing IRS Form 1041 to avoid these pitfalls. Consider seeking professional guidance to navigate the complexities of estate and trust taxation, ensuring compliance with IRS regulations and avoiding unnecessary financial or legal repercussions.

Documents used along the form

When an individual is responsible for handling a deceased person's estate or a trust, they typically need to become familiar with a variety of forms and documents, one of the most important being the IRS Form 1041. This form, U.S. Income Tax Return for Estates and Trusts, is crucial for reporting the income, deductions, and gains of estates and trusts. However, its completion often necessitates gathering and preparing additional documents that support or supplement the information provided. Here are some of the other forms and documents commonly used in conjunction with Form 1041.

- Schedule K-1 (Form 1041) - This form is used to report a beneficiary's share of estate or trust income, deductions, and credits to the IRS. It's necessary for beneficiaries to accurately file their personal tax returns.

- Form W-9 - Request for Taxpayer Identification Number and Certification. Trustees might need this form to report interest, dividends, or other types of income on investments owned by the estate or trust.

- Form 1099 - Various types of Form 1099 are used to report different types of income the trust or estate might have received, such as interest (Form 1099-INT), dividends (Form 1099-DIV), and proceeds from broker and barter exchange transactions (Form 1099-B).

- Form 1040 - U.S. Individual Income Tax Return. The final personal income tax return of the decedent is often required to settle any outstanding taxes owed before the assets are distributed among the heirs or beneficiaries.

- Form 706 - United States Estate (and Generation-Skipping Transfer) Tax Return. This form is used to report the estate's value and calculate the estate tax due to the federal government. It's necessary for estates that exceed the exemption threshold established by law.

- Form 8971 - Information Regarding Beneficiaries Acquiring Property from a Decedent. This form and its accompanying Schedule A are used to report the value of property that a beneficiary acquires from an estate, which is crucial for determining the property's basis for future tax implications.

- Form 56 - Notice Concerning Fiduciary Relationship. This form is used to notify the IRS of the creation or termination of a fiduciary relationship, granting or revoking authority to act on behalf of the estate or trust.

These documents each play a pivotal role in ensuring that estates and trusts comply with federal tax laws, effectively manage their reporting and tax obligations, and provide clear records for beneficiaries. The complexity of tax filing for estates and trusts underscores the importance of careful preparation, thorough documentation, and, often, professional guidance.

Similar forms

The IRS 1041 form, essential for reporting income, deductions, and other financial information for estates and trusts, shares similarities with several other tax forms. One such form is the IRS 1040, known as the U.S. Individual Income Tax Return. It's used by individuals to report their yearly income, deductions, and credits. Both forms are integral to the tax filing process, facilitating accurate tax liability calculations for different entities. The 1041 and the 1040 forms alike require detailed financial information, providing a structured method for taxpayers to calculate taxes owed or refunds due.

Another related document is the IRS 1065, which serves as the U.S. Return of Partnership Income. This form is utilized by domestic partnerships to report the income, gains, losses, deductions, and credits from their operations. Similar to the 1041, the 1065 form demands comprehensive information about the entity’s financial activities throughout the tax year. Both forms share the objective of ensuring that entities report their income accurately and pay any taxes owed, thus maintaining transparency in the entity’s tax obligations.

The IRS Form 1120, or the U.S. Corporation Income Tax Return, is also akin to the 1041. It is specifically designed for corporations to disclose their income, gains, losses, deductions, and credits. Like the 1041, the 1120 form plays a crucial role in the tax filing process by helping corporations determine their tax liability. Despite the different types of entities they serve, both forms ensure that the IRS receives detailed and accurate information about an entity’s financial status, which is vital for the correct assessment of taxes.

Form 990, which is the Return of Organization Exempt from Income Tax, bears resemblance to Form 1041 in its purpose of reporting. Nonprofit organizations utilize the 990 form to provide information about their income, expenses, and operational activities. Though the recipients of these forms differ — with 1041 targeting estates and trusts and 990 focusing on nonprofit organizations — both documents emphasize transparency and accountability in financial reporting, ensuring these entities comply with federal regulations regarding their tax responsibilities.

Last but not least, the IRS Form 5500, Annual Return/Report of Employee Benefit Plan, shares commonality with the 1041 form. The 5500 is required for pension and welfare benefit plans to report their financial conditions, investments, and operations. Although the 5500 caters to employee benefit plans and the 1041 to estates and trusts, both forms are instrumental in providing the IRS with detailed information pertaining to the financial aspects of the filing entities. This information is crucial for compliance with federal tax laws and for ensuring the financial integrity of the entities involved.

Dos and Don'ts

Filling out the IRS 1041 form, which is used for reporting the income, deductions, gains, losses, and other financial activities of estates and trusts, requires careful attention to detail. Follow these guidelines to ensure accuracy and compliance with tax regulations.

- Do double-check taxpayer identification numbers. Accurate identification numbers are crucial for all parties involved, including the estate, trust, and beneficiaries.

- Do report all income accurately. This includes interest, dividends, and any other income the estate or trust has received. Underreporting can lead to penalties and audits.

- Do take advantage of deductions and credits. Be sure to claim any applicable deductions for administration expenses, charitable contributions, and distributions to beneficiaries to reduce the taxable income.

- Do keep thorough records. Documentation of income, deductions, distributions, and credits is essential for accurate filing and responding to any IRS queries.

- Don’t overlook state filing requirements. In addition to the federal IRS 1041 form, be aware of any state-specific filing requirements for estates and trusts.

- Don’t guess on values. Use exact numbers whenever possible. Estimates can lead to inaccuracies and potential issues with the IRS.

- Don’t forget to sign and date the form. An unsigned form is considered invalid and can cause delays in processing.

- Don’t ignore filing deadlines. Submitting the IRS 1041 form by the deadline is crucial to avoid penalties and interest for late filing.

- Don’t hesitate to seek professional help. If you’re unsure about any aspects of the IRS 1041 form, consulting with a tax professional can provide guidance and peace of mind.

By following these dos and don'ts, you can navigate the complexities of the IRS 1041 form more confidently and ensure compliance with tax obligations.

Misconceptions

When it comes to understanding IRS forms, confusion often arises, especially with Form 1041, which deals with the income tax return for estates and trusts. Let's clarify some common misconceptions to help better navigate through the requirements and implications of this form.

- Misconception 1: Form 1041 is only for estates of deceased individuals.

This is not entirely accurate. While it’s true that Form 1041 is used for estates, it is also required for trusts, including those that are operational during the grantor's lifetime, not just for the deceased's estates.

- Misconception 2: All trusts and estates must file a Form 1041.

Not all trusts and estates are required to file Form 1041. There are specific income thresholds and other criteria that determine the necessity of filing. For example, if an estate or trust's annual gross income is less than $600, it generally does not need to file this form.

- Misconception 3: Beneficiaries always pay the taxes on income distributed to them.

While it's true that beneficiaries may be liable for taxes on the income they receive, the trust or estate may also pay taxes on any income that is not distributed. The specific tax responsibilities depend on the terms of the trust or estate and the distributions made throughout the year.

- Misconception 4: Filing Form 1041 is the same as filing a personal income tax return.

Filing Form 1041 for an estate or trust involves unique considerations compared to personal income tax returns. The form accounts for income, deductions, and allocations to beneficiaries differently than personal taxes, requiring careful attention to the specifics of estate and trust income reporting.

- Misconception 5: The filing deadline for Form 1041 is April 15th.

Actually, the deadline for filing Form 1041 is not April 15th but rather April 15th of the year following the entity's tax year. If the estate or trust operates on a calendar year, the filing deadline is indeed April 15th. However, for a fiscal year estate or trust, the deadline is the 15th day of the fourth month following the close of their tax year.

- Misconception 6: The IRS does not audit Form 1041 filings.

Just like personal and business tax returns, Form 1041 can be audited by the IRS. It's crucial for trustees and executors to maintain accurate records and documentation for income, deductions, and distributions to prepare for the possibility of an audit.

Key takeaways

Filling out an IRS 1041 form, which pertains to income tax for estates and trusts, can seem daunting at first. Yet, with the right insights, it becomes a manageable task. This form plays a crucial role in ensuring that these entities comply with U.S. tax laws. Below are essential takeaways to help guide individuals and fiduciaries through the process.

- Determine the necessity: Before diving into the paperwork, it's critical to ascertain whether the estate or trust in question is required to file a Form 1041. This involves understanding the income thresholds and the type of entity you're dealing with.

- Understanding the form: IRS Form 1041 is used to report the income, gains, losses, deductions, and credits of estates and trusts. The form ensures that any income distributed or required to be distributed is properly taxed.

- Gather necessary documentation: Preparation is key. Collect all pertinent financial statements, including income and expense reports, as well as documentation on distributions to beneficiaries.

- Know the deadlines: Timing is everything. Generally, the 1041 form must be filed by April 15th following the year the estate or trust earned income. Extensions are available, but must be requested.

- Deciphering income types: It's important to correctly classify the various types of income received by the estate or trust, as each may be taxed differently.

- Deductions and Credits: Understanding what deductions and credits the estate or trust is eligible for can significantly reduce its tax liability. This includes deductions for administrative expenses and distributions to beneficiaries.

- Reporting Distributions: Form 1041 includes a schedule to specify the income distribution deduction, detailing how much of the income was distributed to beneficiaries.

- Consider the state requirements: Besides the federal IRS 1041 form, some states may require estates or trusts to file separate state income tax returns, each with its own set of rules and deadlines.

- E-filing vs. Paper filing: Weigh the options between e-filing and mailing the form. While e-filing is convenient and faster, ensuring that all data is accurately entered is paramount.

- Seek professional advice: When in doubt, consult a tax professional. The complexities of trust and estate taxation can be navigated more effectively with expert guidance, potentially saving time and money while adhering to all legal requirements.

By keeping these key takeaways in mind, individuals and fiduciaries can approach the IRS 1041 form with confidence. The process underscores the importance of meticulous record-keeping, strict adherence to deadlines, and a thorough understanding of tax obligations, all of which contribute to fulfilling fiscal responsibilities while safeguarding the financial health of the estate or trust.

Popular PDF Documents

IRS 1040-NR - 1040-NR includes instructions on how to calculate and report effectively connected income, vital for determining taxable U.S. income.

IRS 13614-C - Completion of the form ensures a more efficient and effective tax assistance session by preparing both the taxpayer and the volunteer for the appointment.