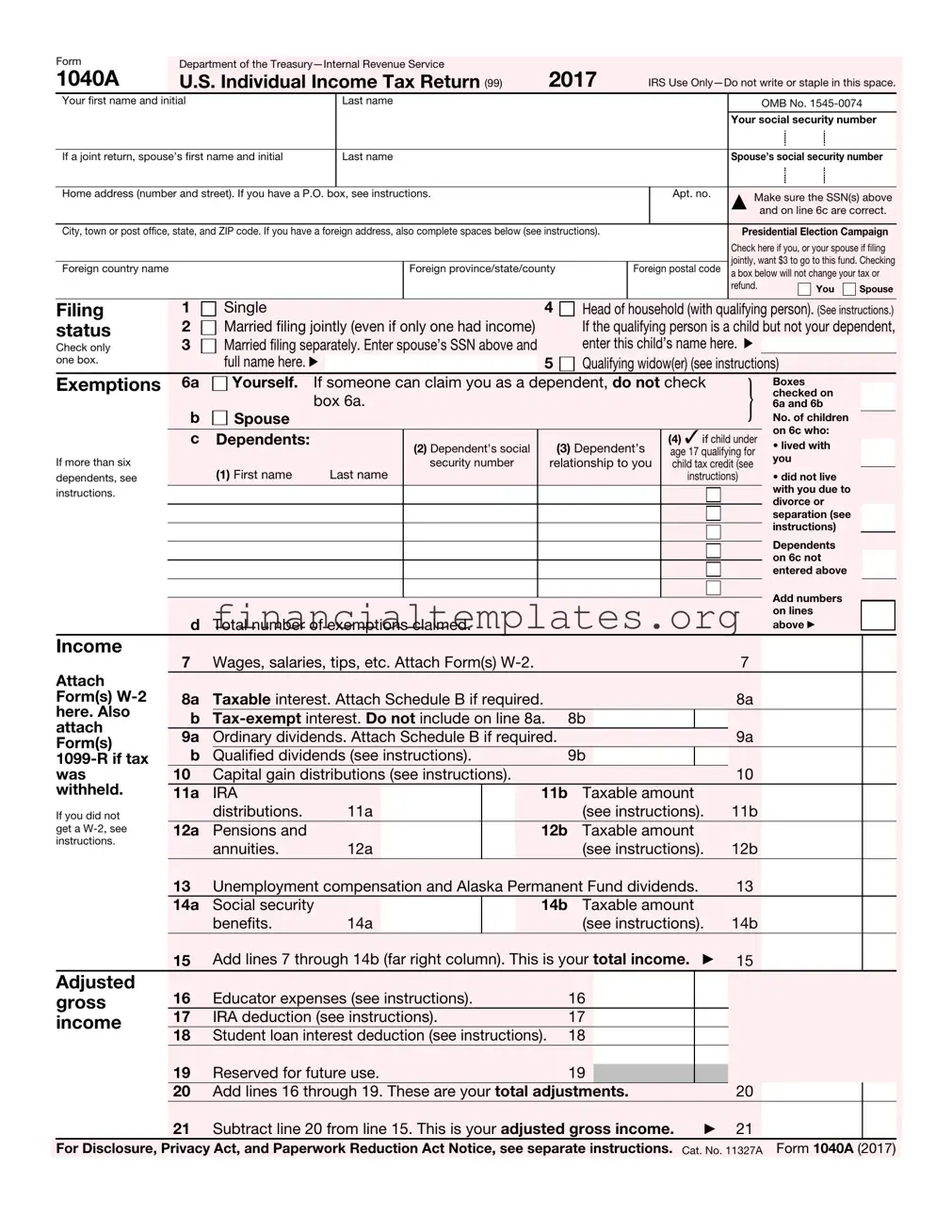

Get Irs 1040A Form

Understanding the intricacies of tax forms can often feel daunting, especially when it comes to specific entries that impact the calculation of your taxable income, such as those involving Social Security benefits on the IRS Form 1040A. The sections covering lines 14a and 14b require a detailed look because they focus on how to determine the portion of Social Security benefits that is subject to taxation. Starting with entries on other parts of the form, taxpayers are guided to calculate half of their Social Security benefits and then combine this with other sources of income to see how it stacks up against predetermined thresholds. This process is crucial for individuals who are navigating their tax responsibilities under various filing statuses, including those married filing jointly or separately, single, or head of household. Furthermore, the form offers direction for specific scenarios, such as living apart from a spouse during the tax year. The worksheet embedded within the form, alongside references to Exception details and the possibility of applying adjustments for lump-sum benefit payments received in previous years, adds layers of consideration to ensure taxpayers accurately report their income and potentially reduce their taxable amount. Navigating these lines on Form 1040A becomes an essential task for those looking to comply with tax laws accurately, providing a window into the broader complexities of managing Social Security benefits in the context of federal income taxes. This introduction aims to unfold the layers surrounding lines 14a and 14b of Form 1040A, breaking down the requisite steps and considerations for taxpayers seeking to understand and accurately report their taxable Social Security benefits.

Irs 1040A Example

|

Form 1040A — Lines 14a and 14b |

|

Social Security Benefits Worksheet — Lines 14a and 14b |

Keep for Your Records |

|

|

|

|

Before you begin: √ Complete Form 1040A, lines 16 and 17, if they apply to you. |

|

|

√If you are married filing separately and you lived apart from your spouse for all of 2005, enter “D” to the right of the word “benefits” on line 14a.

√Be sure you have read the Exception on page 28 to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable.

1. |

. .Enter the total amount from box 5 of all your Forms |

1. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

2. |

|

Enter |

.2 |

|

|

|

|||

3. |

|

. . . . . .Enter the total of the amounts from Form 1040A, lines 7, 8a, 9a, 10, 11b, 12b, and 13 . |

. . . . . . . . . . . ..3. |

|

|

|

|||

4. |

|

. . . . . .Enter the amount, if any, from Form 1040A, line 8b |

. . . . . . . . . . . ..4. |

|

|

|

|||

5. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 2, 3, and 4 |

. . . . . . . . . . . ..5. |

|

|

|

||||

6. |

. . . . . . . . . . . . . . . . . . . . .Enter the total of the amounts from Form 1040A, lines 16 and 17 |

. . . . . . . . . . . ..6. |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

7.Is the amount on line 6 less than the amount on line 5?

|

|

|

No. |

STOP |

None of your social security benefits are taxable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

|

|

Yes. Subtract line 6 from line 5 |

}. |

. . . . . . . . . . . . . . 7. |

|

|

|

|||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

8. |

If you are: |

|

|

|

|

|

|

|

|||

|

|

|

• Married filing jointly, enter $32,000. |

|

|

|

|

|

|||

|

|

|

• Single, head of household, qualifying widow(er), or married filing separately and |

|

|

|

|

|

|||

|

|

|

you lived apart from your spouse for all of 2005, enter $25,000. |

. . . . . . . . . . . . . . 8. |

|

|

|

||||

|

|

|

• Married filing separately and you lived with your spouse at any time in 2005, skip |

|

|

|

|

|

|||

|

|

|

lines 8 through 15; multiply line 7 by 85% (.85) and enter the result on line 16. |

|

|

|

|

|

|||

|

|

|

Then go to line 17. |

|

|

|

|

|

|||

9. Is the amount on line 8 less than the amount on line 7? |

|

|

|

|

|

|

|||||

|

|

|

No. |

STOP |

None of your social security benefits are taxable. You do not have to enter any amount on line |

|

|

|

|||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

14a or 14b of Form 1040A. But if you are married filing separately and you lived apart from |

|

|

|

|||

|

|

|

|

|

your spouse for all of 2005, enter |

|

|

|

|||

|

|

|

|

|

word “benefits” on line 14a. |

|

|

|

|

|

|

|

|

|

Yes. Subtract line 8 from line 7 |

|

. . . . . . . . . . . . . . 9. |

|

|

|

|||

|

|

|

. . |

|

|

|

|||||

|

|

|

|

|

|

|

|||||

10.Enter: $12,000 if married filing jointly; $9,000 if single, head of household, qualifying widow(er), or married filing

|

separately and you lived apart from your spouse for all of 2005 |

10. |

|

|

||

11. |

Subtract line 10 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .from line 9. If zero or less, enter |

11. |

|

|

|

12. |

Enter the smaller |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .of line 9 or line 10 |

12. |

|

|

|

13. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter |

13. |

|

|

||

14. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter the smaller of line 2 or line 13 |

14. |

|

|

||

15. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Multiply line 11 by 85% (.85). If line 11 is zero, enter |

15. |

|

|

||

16. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 14 and 15 |

16. |

|

|

||

17. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Multiply line 1 by 85% (.85) |

17. |

|

|

||

18. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Taxable social security benefits. Enter the smaller of line 16 or line 17 |

18. |

|

|

||

|

• Enter the amount from line 1 above on Form 1040A, line 14a. |

|

|

|

||

|

• Enter the amount from line 18 above on Form 1040A, line 14b. |

|

|

|

||

TIP |

If any of your benefits are taxable for 2005 and they include a |

|||||

|

|

able to reduce the taxable amount. See Pub. 915 for details. |

|

|

|

|

|

|

|

|

|

|

|

- 29 - |

Need more information or forms? See page 7. |

Document Specifics

| Fact Name | Description |

|---|---|

| Form 1040A Use | For calculating the taxable portion of Social Security benefits. |

| Initial Steps | Complete Form 1040A, lines 16 and 17, if applicable. |

| Special Condition for Married Filing Separately | If living apart from spouse during entire year, mark "D" next to "benefits" on line 14a. |

| Worksheet Purpose | Helps determine if any Social Security benefits are taxable without needing a publication for guidance. |

| Calculation Process | Involves adding half of the Social Security benefits, certain income types from Form 1040A, and adjustments based on marital status and income levels. |

Guide to Writing Irs 1040A

Filing taxes can often seem complicated, but understanding each step you need to take helps streamline the process. When working with the IRS 1040A form, specifically for calculating the taxable portion of Social Security benefits, it's crucial to follow each part of the Social Security Benefits Worksheet meticulously. By carefully entering the correct information and calculations, taxpayers ensure their tax returns are accurate, which can help avoid potential issues with the IRS. Below are the steps to complete lines 14a and 14b on the Form 1040A concerning Social Security benefits.

- Enter the total amount from box 5 of all your Forms SSA-1099 and Forms RRB-1099.

- Enter one-half of the amount from line 1.

- Enter the total of the amounts from Form 1040A, lines 7, 8a, 9a, 10, 11b, 12b, and 13.

- Enter the amount, if any, from Form 1040A, line 8b.

- Add lines 2, 3, and 4.

- Enter the total of the amounts from Form 1040A, lines 16 and 17.

- If the amount on line 6 is less than the amount on line 5, No, STOP. None of your social security benefits are taxable. Yes, subtract line 6 from line 5.

- Depending on your filing status, enter:

Married filing jointly, $32,000.

Single, head of household, qualifying widow(er), or married filing separately (and you lived apart from your spouse for all of 2005), $25,000.

If married filing separately and you lived with your spouse at any time in 2005, multiply line 7 by 85% (.85) and enter the result on line 16. Then go to line 17. - Is the amount on line 8 less than the amount on line 7? If No, STOP. None of your social security benefits are taxable. You do not have to enter any amount on line 14a or 14b of Form 1040A. But if you are married filing separately and you lived apart from your spouse for all of 2005, enter -0- on line 14b. Be sure you entered “D” to the right of the word “benefits” on line 14a. If Yes, subtract line 8 from line 7.

- Enter: $12,000 if married filing jointly; $9,000 if single, head of household, qualifying widow(er), or married filing separately and you lived apart from your spouse for all of 2005.

- Subtract line 10 from line 9. If zero or less, enter -0-.

- Enter the smaller of line 9 or line 10.

- Enter one-half of line 12.

- Enter the smaller of line 2 or line 13.

- Multiply line 11 by 85% (.85). If line 11 is zero, enter -0-.

- Add lines 14 and 15.

- Multiply line 1 by 85% (.85).

- Taxable social security benefits. Enter the smaller of line 16 or line 17.

Upon completing these steps, enter the results in the corresponding sections of Form 1040A: the amount from line 1 above on line 14a and the amount from line 18 above on line 14b. Remember, if any of your benefits are taxable and include a lump-sum benefit payment from an earlier year, you might be able to reduce the taxable amount. For additional information or specific details, referring to IRS Publication 915 can provide further guidance. Always consult the IRS website or a tax professional for the most current information and personal tax advice.

Understanding Irs 1040A

Frequently Asked Questions about the IRS 1040A Form: Social Security Benefits Worksheet

What is the purpose of the Social Security Benefits Worksheet on the IRS 1040A form?

The worksheet is designed to help you determine if any of your social security benefits are taxable and, if so, how much of them you need to include as taxable income on your Form 1040A.How do I know if I need to fill out the Social Security Benefits Worksheet?

If you receive Social Security benefits, you should use the worksheet to see if any of your benefits are taxable. Start by completing lines 16 and 17 on Form 1040A if they apply to you. The worksheet guides you through calculating the taxable portion of your benefits.Can I use the worksheet if I am married filing separately?

Yes, but with conditions. You can use the worksheet if you lived apart from your spouse for the entire tax year. You should enter “D” to the right of the word “benefits” on line 14a. However, if you lived with your spouse at any time during the year, the worksheet’s calculations do not apply in the same way.What initial steps should I take before using the Social Security Benefits Worksheet?

Before starting the worksheet, ensure that you have completed Form 1040A, lines 16 and 17 if they apply to your situation. It’s also important to read the Exception note on page 28 to confirm the worksheet is appropriate for your use instead of directly referring to a publication.How do I calculate the taxable amount of my Social Security benefits?

You will enter the total amount from box 5 of all your Forms SSA-1099 and RRB-1099 on line 1 of the worksheet. The worksheet then takes you through a series of steps that factor in various elements of your income and filing status to calculate the taxable part of your benefits, if any.What should I do if none of my Social Security benefits are taxable?

If, after completing the worksheet, you find that none of your Social Security benefits are taxable, you do not need to report any part of them on lines 14a or 14b of Form 1040A. However, if you are married filing separately and lived apart from your spouse throughout the entire year, you should enter -0- on line 14b and mark “D” next to the benefits on line 14a as instructed.

Common mistakes

Filling out IRS tax forms can be a daunting task, even for simpler forms like the 1040A. Taxpayers often make mistakes that can lead to overpayment of taxes, underpayment, or scrutiny from the IRS. Below are eight common errors to avoid when completing the 1040A form, particularly concerning the Social Security Benefits Worksheet (Lines 14a and 14b).

- Not completing prerequisite lines. Before starting the Social Security Benefits Worksheet, lines 16 and 17 must be completed. Overlooking these steps can lead to inaccuracies in determining taxable social security benefits.

- Incorrectly entering Social Security benefits. Taxpayers sometimes incorrectly enter the total amount from box 5 of all Forms SSA-1099 and RRB-1099 on line 14a without using the worksheet, leading to errors in taxable income calculation.

- Miscalculating one-half of the total benefits. A common error is incorrectly calculating one-half of the social security benefits (line 2 of the worksheet), which forms the basis for further calculations.

- Overlooking additional income. Failing to accurately aggregate all additional income (lines 7, 8a, 9a, 10, 11b, 12b, and 13 of Form 1040A) can result in underestimating the extent of taxable social security benefits.

- Misinterpreting the filing status and its impact. Taxpayers sometimes erroneously apply the standard deductions for their marital or filing status, especially the different thresholds for "married filing jointly" and "married filing separately."

- Ignoring the special instruction for those married filing separately. Those who are married filing separately and lived with their spouse at any time during the year often miss applying the correct multiplier (.85) directly to their combined worksheet result—as opposed to using the standard deductions.

- Calculating taxable social security benefits incorrectly. Missteps in subtracting line 6 from line 5, or not properly applying the subsequent calculations, can severely distort the taxable amount of social security benefits.

- Misapplication of the lump-sum payment provision. If taxpayers received a lump-sum social security payment for an earlier year, they might qualify for a tax reduction. However, this is frequently overlooked, leading to unnecessary tax liability.

Acknowledging and addressing these pitfalls can save taxpayers from costly errors and ensure that the process of determining the taxable portion of social security benefits on Form 1040A is as smooth and accurate as possible. When in doubt, consulting the IRS publications or a tax professional can provide clarification and prevent mistakes.

Documents used along the form

Filing taxes can be a complex process, requiring various forms and documents beyond the basic IRS Form 1040A. Understanding these additional documents helps taxpayers ensure they provide complete and accurate information to the IRS. Here's a rundown of other forms and documents often used alongside Form 1040A.

- Form W-2: This is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form 1099-MISC: Used to report income from freelancing, independent contracting, or other self-employment earnings not covered by a W-2.

- Form 1099-INT: Banks and financial institutions issue this form to report interest income of $10 or more during the tax year.

- Form 1099-DIV: This form is used to report dividends and other distributions to investors, typically from stocks or mutual funds.

- Form SSA-1099: Sent by the Social Security Administration, it reports the total social security benefits received, some of which may be taxable.

- Schedule A (Form 1040): For itemizing deductions like mortgage interest, charitable contributions, and medical expenses, exceeding the standard deduction.

- Schedule B (Form 1040A or 1040): Required when the taxpayer has more than $1,500 in interest or dividends, detailing the sources of income.

- Schedule C (Form 1040): Used by self-employed individuals to report profits or losses from a business.

- Schedule EIC (Form 1040A or 1040): Used to claim the Earned Income Credit, a beneficial tax credit for low- to moderate-income individuals and families.

While Form 1040A serves as a crucial part of tax filing for many, incorporating the appropriate additional forms and documents ensures a thorough and accurate tax return. This careful approach can help taxpayers avoid mistakes and maximize potential refunds or credits. Always consult current IRS guidelines or a tax professional when preparing your tax return to ensure compliance with the latest tax laws and requirements.

Similar forms

The IRS Form 1040 is the first document that bears a resemblance to the IRS 1040A form, particularly in the context of reporting taxable income and deductions. Both forms serve as foundational tools for individuals to calculate their annual tax liability. The IRS Form 1040 encompasses a wide range of financial information, including earnings, taxable interest, and deductions, similar to the 1040A form. However, Form 1040 offers more options for deductions and tax credits, making it suitable for more complex tax situations than the streamlined 1040A.

Form 1040EZ represents another document akin to the IRS 1040A, sharing the objective of simplifying the tax filing process for individuals with uncomplicated financial scenarios. Specifically designed for taxpayers with taxable income below a certain threshold, the 1040EZ limits entries to wages, salaries, and tips, akin to parts of the 1040A. Despite its simplicity, the 1040EZ restricts users more than the 1040A, excluding those who wish to claim any deductions or credits other than the standard deduction and earned income credit.

The Schedule B (Form 1040A or 1040), Interest and Ordinary Dividends, mirrors the 1040A insofar as it addresses specific types of income, namely interest and dividends. This schedule supplements the 1040A by providing a detailed framework to report additional sources of income, essentially enhancing the 1040A's functionality for taxpayers with investments. Similar to the 1040A’s straightforward approach, Schedule B guides taxpayers in summarizing their interest and dividends in a clear, structured manner.

Form SSA-1099, Social Security Benefit Statement, significantly parallels the IRS 1040A, especially regarding the calculation and reporting of social security benefits. Both documents engage with the intricacies of social security income, determining the taxable portion of these benefits. Taxpayers receiving social security benefits must reference their Form SSA-1099 when completing lines 14a and 14b of the 1040A, evidencing the interconnectedness of these forms in managing social security income taxation.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), shares similarities with the IRS 1040A through its focus on tax benefits related to personal investments, in this case, educational expenses. The 1040A allows taxpayers to claim certain education credits directly on the form, much like Form 8863, which is dedicated solely to calculating and claiming these credits. Both forms play crucial roles in facilitating the financial support of taxpayers’ educational pursuits, directly impacting their taxable income.

Finally, Publication 915, Social Security and Equivalent Railroad Retirement Benefits, complements the IRS 1040A form closely. While not a form, this publication provides the detailed guidelines required to accurately calculate the taxable portion of social security benefits, as briefly outlined in the 1040A's instructions. Taxpayers often turn to Publication 915 for a deeper understanding of how to complete relevant sections of the 1040A, making it an essential resource for those navigating the complexities of social security benefit taxation.

Dos and Don'ts

When filling out the IRS 1040A form, particularly with regard to reporting Social Security benefits on lines 14a and 14b, accuracy and attention to detail are paramount. Follow these carefully selected dos and don'ts to ensure a smooth filing process:

- Do gather all necessary documents beforehand, including all your Forms SSA-1099 and RRB-1099 for accurate reporting of Social Security benefits.

- Do thoroughly read the instructions provided by the IRS, especially the Exception notes on page 28, to see if you could use the Worksheet instead of additional publications to figure out taxable benefits.

- Do carefully calculate one-half of the total amount from box 5 of all your Forms SSA-1099 and Forms RRB-1099, as this will be crucial for later steps in the worksheet.

- Do ensure accuracy when adding up the amounts from Form 1040A, lines 7, 8a, 9a, 10, 11b, 12b, and 13, as these figures play a significant role in determining the taxability of your benefits.

- Do NOT rush through filling out the form; take your time to ensure every detail is correct, particularly the calculations that determine if your benefits are taxable.

- Do NOT overlook the significance of correctly reporting the amount if you are married filing separately and lived apart from your spouse for all of the tax year. This distinction is crucial for accurate completion of lines 14a and 14b.

- Do NOT ignore the tip regarding lump-sum benefit payments for earlier years. If this situation applies to you, consult Pub. 915 for potentially reducing the taxable amount.

- Do NOT hesitate to seek professional advice or assistance if you find the form or calculations confusing. Misreporting can lead to errors that might trigger an audit or result in additional taxes or penalties.

Adhering to these dos and don'ts can help ensure that the process of filling out the IRS 1040A form, specifically with regards to reporting Social Security benefits, is done accurately and efficiently, reducing the likelihood of complications with your tax return.

Misconceptions

There are many misconceptions surrounding the IRS Form 1040A, particularly regarding social security benefits and their tax implications. Here’s a list of ten common misunderstandings and the truths behind them.

- Only Form 1040 is required for reporting Social Security Benefits. False. Social Security benefits are reported on lines 14a and 14b of Form 1040A, which includes a worksheet specifically for this purpose.

- All Social Security benefits are taxable. Not always true. The taxability of benefits depends on additional income and the total calculated on the Social Security Benefits Worksheet.

- Married individuals who file separately always have their Social Security benefits taxed. This only applies if they lived with their spouse at any time during the year. Those who lived apart for the entire year have different guidelines.

- There is no need to complete any form if Social Security benefits are not taxable. Incorrect. Even if benefits are not taxable, Form 1040A requires an entry on lines 14a or 14b, ensuring proper documentation.

- Form 1040A simplifies the process so much that additional instructions or publications are unnecessary. While Form 1040A does simplify the process, consulting the Exception on page 28 or additional publications like Pub. 915 can provide crucial guidance for certain situations, like lump-sum benefit payments for earlier years.

- The calculations for Social Security benefits taxation are straightforward and involve minimal steps. The calculation process, as detailed from steps 1 through 18 on the worksheet, involves several considerations including total income, marital status, and specific deductions and adjustments.

- If your benefits are not taxable, you don't have to enter any amount on lines 14a or 14b. Incorrect. Proper documentation requires an entry, sometimes "-0-", to specify the non-taxable status of benefits.

- Everyone uses the same threshold to determine the taxable amount of Social Security benefits. The thresholds vary based on filing status, such as married filing jointly or separately, or single filers, impacting the taxable portion of Social Security benefits.

- Lump-sum payments for previous years are always fully taxable. Not necessarily. Special rules may allow reducing the taxable amount of these lump-sum payments, emphasizing the need to refer to specific IRS publications for guidance.

- Once you determine some of your Social Security benefits are taxable, the calculation method is the same regardless of your marital status. False. Married individuals filing separately who lived with their spouse at any time during the year are subject to different calculation rules.

Understanding the specifics of Form 1040A, especially regarding Social Security benefits, helps in accurately reporting and potentially reducing the taxable amount of these benefits. Always refer to the latest IRS guidelines and publications for the most accurate and applicable instructions.

Key takeaways

When it comes to understanding and filling out the IRS 1040A form, specifically related to the Social Security Benefits Worksheet for lines 14a and 14b, individuals may find several key points helpful. These insights aim to make the process clearer and more straightforward.

Begin by completing lines 16 and 17: Before diving into the worksheet, make sure lines 16 and 17 on Form 1040A are filled out if they apply to your situation. This step is crucial for accurately calculating any taxable social security benefits.

Marital status matters: If you're married but filing separately and lived apart from your spouse throughout the entire tax year, you should mark "D" next to the word "benefits" on line 14a. This designation can impact the calculation of taxable benefits.

Check if your social security benefits are taxable: The IRS provides exceptions and a specific worksheet to help you determine if any of your social security benefits are taxable. Review the exception guidelines on page 28 of the form instructions to determine if you can use this simplified process.

Calculating taxable social security benefits: The worksheet guides you through several calculations, incorporating half of your social security income, your total income, and any adjustments. These calculations help ascertain if, and how much of, your social security benefits are taxable.

Understanding the threshold amounts: Depending on your filing status (such as married filing jointly, single, or head of household), there are specific base amounts that determine the taxability of your social security benefits. Knowing these amounts can help you anticipate whether your benefits will be taxable.

Potential for reducing taxable amount: If any of your social security benefits for the tax year include a lump-sum payment for an earlier year, there may be a possibility to reduce the taxable amount. Referencing Publication 915 can provide further details and guidance on this topic.

To ensure accurate filing, individuals are encouraged to gather all necessary documents, carefully review the instructions provided by the IRS, and consider seeking guidance from tax professionals if complex scenarios arise. The goal is to accurately report income and fulfill tax obligations while taking advantage of any available tax benefits or deductions.

Popular PDF Documents

What Is a Pay Off Letter - Get a clear path to owning your home outright. Use the Loan Payoff Request form today.

Schedule M1 - Special sections are devoted to adjustments unique to Minnesota, such as state tax refunds and other subtractions to income.

Sba 1201 Loan Forgiveness - Designed for ease of use, with a format that guides employers through each step of the loan payment process.