Get IRS 1040-X Form

Filing taxes can sometimes feel overwhelming, and even the most diligent taxpayer might discover errors or omissions after they've submitted their return. The IRS understands that mistakes happen, which is why the 1040-X form plays a crucial role in the tax filing process. Designed as an amendment form, it allows individuals to correct previously filed tax returns, ensuring they can update their income, deductions, or credits accurately. This adjustment can result in either additional tax owed or a refund due to the filer. It’s essential for taxpayers to know that the IRS sets a time frame for filing this form, generally within three years after the date the original return was filed, or within two years after the date the tax was paid, whichever is later. By using the 1040-X form, taxpayers can rectify errors, from simple miscalculations to more significant oversights, ensuring their tax records accurately reflect their financial situation. This process not only helps in aligning with federal tax obligations but also in potentially safeguarding against future complications with the IRS.

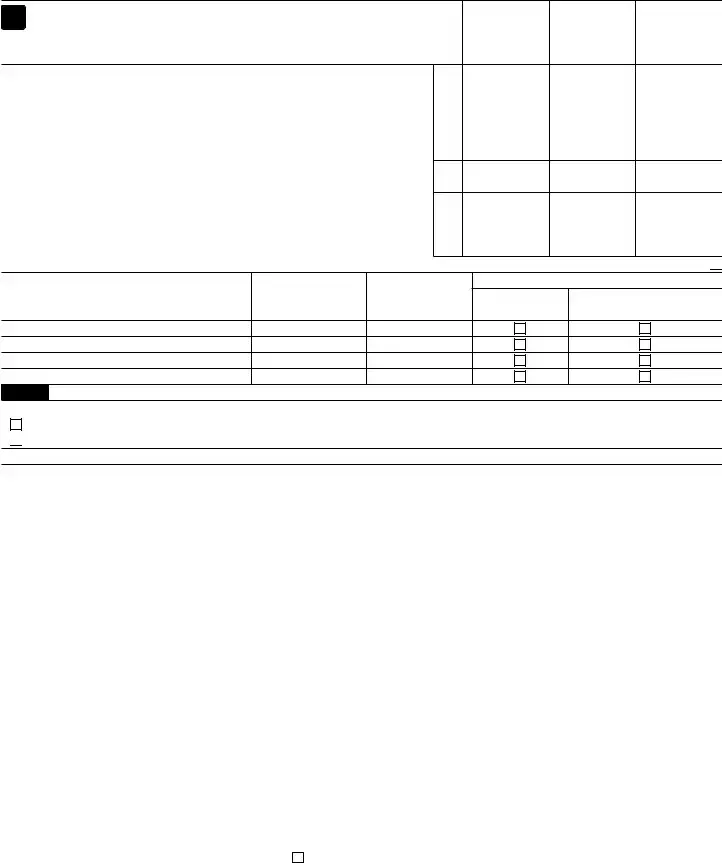

IRS 1040-X Example

Form |

|

|

Department of the |

|

|

|||

|

Amended U.S. Individual Income Tax Return |

|

OMB No. |

|||||

|

|

▶ Use this revision to amend 2019 or later tax returns. |

|

|

||||

(Rev. July 2021) |

|

▶ Go to www.irs.gov/Form1040X for instructions and the latest information. |

|

|

||||

This return is for calendar year (enter year) |

or fiscal year (enter month and year ended) |

|

|

|||||

Your first name and middle initial |

|

|

Last name |

|

|

Your social security number |

||

|

|

|

|

|

|

|||

If joint return, spouse’s first name and middle initial |

|

Last name |

|

|

Spouse’s social security number |

|||

|

|

|

|

|

||||

Current home address (number and street). If you have a P.O. box, see instructions. |

Apt. no. |

|

Your phone number |

|||||

|

|

|

|

|

||||

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below. See instructions. |

|

|

||||||

Foreign country name

Foreign province/state/county

Foreign postal code

Amended return filing status. You must check one box even if you are not changing your filing status. Caution: In general, you can’t change your filing status from married filing jointly to married filing separately after the return due date.

Single |

Married filing jointly |

Married filing separately (MFS) |

Head of household (HOH) |

Qualifying widow(er) (QW) |

If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying person is a child but not your dependent ▶

Enter on lines 1 through 23, columns A through C, the amounts for the return |

A. Original amount |

B. Net change— |

C. Correct |

|

year entered above. |

reported or as |

amount of increase |

||

previously adjusted |

or (decrease)— |

amount |

||

Use Part III on page 2 to explain any changes. |

||||

(see instructions) |

explain in Part III |

|

Income and Deductions

1Adjusted gross income. If a net operating loss (NOL) carryback is

|

included, check here . . . . . . . . . . . . . . . ▶ |

1 |

|

2 |

Itemized deductions or standard deduction |

2 |

|

3 |

Subtract line 2 from line 1 |

3 |

|

4a |

Reserved for future use |

4a |

|

b |

Qualified business income deduction |

4b |

|

5Taxable income. Subtract line 4b from line 3. If the result is zero or less,

enter |

5 |

Tax Liability

6Tax. Enter method(s) used to figure tax (see instructions):

6

7Nonrefundable credits. If a general business credit carryback is

|

included, check here . . |

. . . . . . . . . . . . . ▶ |

7 |

|

8 |

Subtract line 7 from line 6. |

If the result is zero or less, enter |

8 |

|

9 |

Reserved for future use |

9 |

|

|

10 |

Other taxes |

10 |

|

|

11Total tax. Add lines 8 and 10 . . . . . . . . . . . . . . 11

Payments

12Federal income tax withheld and excess social security and tier 1 RRTA

|

tax withheld. (If changing, see instructions.) |

12 |

|||||

13 |

Estimated tax payments, including amount applied from prior year’s return |

13 |

|||||

14 |

Earned income credit (EIC) |

14 |

|||||

15 |

Refundable credits from: |

Schedule 8812 Form(s) |

2439 |

4136 |

|

||

|

8863 |

8885 |

8962 or |

other (specify): |

|

|

15 |

16Total amount paid with request for extension of time to file, tax paid with original return, and additional

tax paid after return was filed |

16 |

17 Total payments. Add lines 12 through 15, column C, and line 16 |

17 |

Refund or Amount You Owe |

|

|

|

|

|

18 |

Overpayment, if any, as shown on original return or as previously adjusted by the IRS |

18 |

|||

19 |

Subtract line 18 from line 17. (If less than zero, see instructions.) |

19 |

|||

20 |

Amount you owe. If line 11, column C, is more than line 19, enter the difference |

20 |

|||

21 |

If line 11, column C, is less than line 19, enter the difference. This is the amount overpaid on this return |

21 |

|||

22 |

Amount of line 21 you want refunded to you |

22 |

|||

23 |

Amount of line 21 you want applied to your (enter year): |

estimated tax |

23 |

|

|

|

|

Complete and sign this form on page 2. |

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 11360L |

Form |

Form |

|

|

|

Page 2 |

||

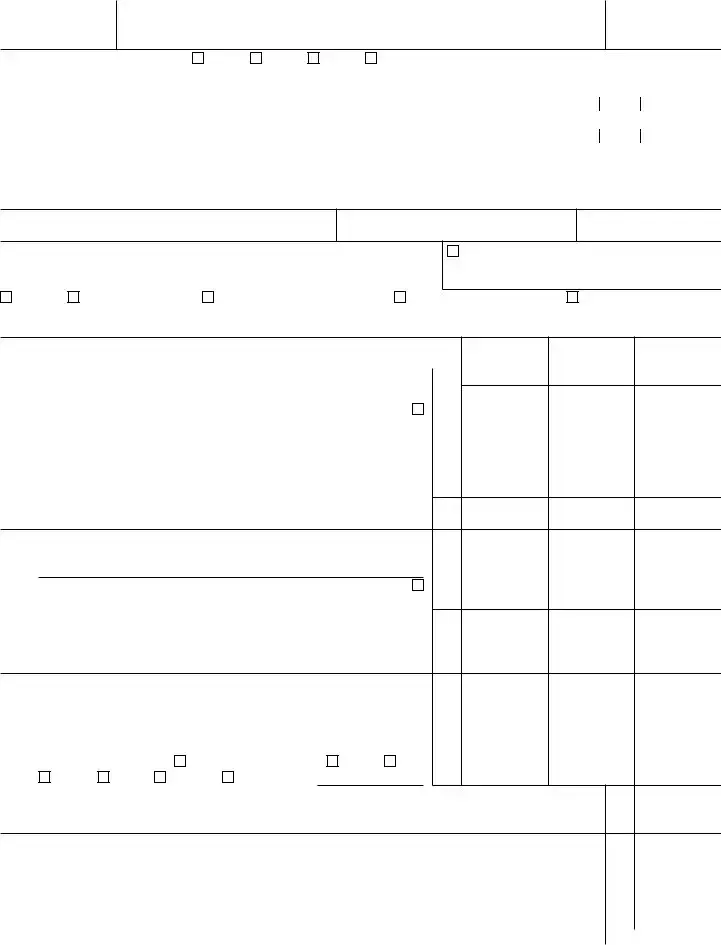

Part I |

Dependents |

|

|

|

|

|

Complete this part to change any information relating to your dependents. |

|

A. Original number |

B. Net change — |

C. Correct |

||

This would include a change in the number of dependents. |

|

of dependents |

amount of increase |

|||

|

reported or as |

number |

||||

Enter the information for the return year entered at the top of page 1. |

|

or (decrease) |

||||

|

previously adjusted |

|

||||

|

|

|

|

|

|

|

24 |

Reserved for future use |

24 |

|

|

|

|

25 |

Your dependent children who lived with you |

25 |

|

|

|

|

26 |

Your dependent children who didn’t live with you due to divorce or |

|

|

|

|

|

|

separation |

26 |

|

|

|

|

27 |

Other dependents |

27 |

|

|

|

|

28 |

Reserved for future use |

28 |

|

|

|

|

29 |

Reserved for future use |

29 |

|

|

|

|

30List ALL dependents (children and others) claimed on this amended return.

Dependents (see instructions): |

|

(b) Social security |

(c) Relationship |

(d) ✓ if qualifies for (see instructions): |

|||

If more |

|

|

Child tax credit |

Credit for other |

|||

(a) First name |

Last name |

number |

to you |

||||

dependents |

|||||||

than four |

|

|

|

||||

|

|

|

|

|

|

||

dependents, |

|

|

|

|

|

|

|

see |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

and check |

|

|

|

|

|

|

|

here ▶ |

|

|

|

|

|

|

|

Part II Presidential Election Campaign Fund (for the return year entered at the top of page 1)

Checking below won’t increase your tax or reduce your refund.

Check here if you didn’t previously want $3 to go to the fund, but now do.

Check here if this is a joint return and your spouse did not previously want $3 to go to the fund, but now does. Part III Explanation of Changes. In the space provided below, tell us why you are filing Form

Check here if this is a joint return and your spouse did not previously want $3 to go to the fund, but now does. Part III Explanation of Changes. In the space provided below, tell us why you are filing Form

▶Attach any supporting documents and new or changed forms and schedules.

Remember to keep a copy of this form for your records.

Under penalties of perjury, I declare that I have filed an original return, and that I have examined this amended return, including accompanying schedules and statements, and to the best of my knowledge and belief, this amended return is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information about which the preparer has any knowledge.

Sign |

▲ |

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

|

|

|

Your signature |

|

|

Date |

|

Your occupation |

|

|

||||

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

Spouse’s signature. If a joint return, both must sign. |

|

Date |

|

Spouse’s occupation |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

|

|

Date |

|

|

Check |

if |

PTIN |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

Preparer |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|

||

Use Only |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s address ▶ |

|

|

|

|

|

|

Phone no. |

|

|

||

|

|

|

|

|

|

|

|

|

|||

For forms and publications, visit www.irs.gov/Forms. |

|

|

|

|

|

|

Form |

||||

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 1040-X | This form is used to amend previously filed Form 1040, 1040-A, 1040-EZ, 1040-NR, or 1040-NR EZ. It allows taxpayers to correct errors and claim a more favorable tax return. |

| Availability for Amendments | Taxpayers generally have up to three years from the date they filed their original tax return or two years from the date the tax was paid, whichever is later, to file Form 1040-X to claim a refund. |

| Electronic Filing | As of the 2019 tax year, the IRS began accepting Form 1040-X filed electronically for certain taxpayers, allowing for faster processing of amendments. |

| Processing Time | The IRS estimates that processing Form 1040-X can take up to 16 weeks from the date of receipt, possibly longer during peak times or for complex corrections. |

| Impact on State Returns | Amending a federal tax return with Form 1040-X may require taxpayers to also amend their state tax returns. Each state has its own set of rules and corresponding forms for state tax amendments. |

Guide to Writing IRS 1040-X

After submitting a federal tax return, individuals sometimes need to make changes to their filed information. These changes could include correcting income amounts, changing filing status, or claiming additional deductions or credits not previously claimed. To make such adjustments, the IRS Form 1040-X is used. This form allows taxpayers to correct errors and ensure their tax information accurately reflects their financial situation for the year in question. Knowing how to properly complete this form is important to facilitate the amendment process. Here are the steps to follow:

- Obtain the most current version of IRS Form 1040-X from the IRS website.

- Before you begin, gather all necessary documents, including your originally filed Form 1040, any other forms or schedules that will be affected by your amendment, and any new documentation that supports your changes.

- Read the instructions for IRS Form 1040-X carefully. The instructions include information on when and where to file, which can be specific to your situation.

- On Form 1040-X, enter your personal information, including your name, address, and Social Security number. If you’re filing a joint amendment, include your spouse’s information as well.

- Check the box at the top of the form to indicate which tax year you are amending. If amending a return for a year not listed, write the year in the space provided.

- In Column A, enter the amounts from your original return. If you previously amended this return or are correcting an IRS adjustment, enter the adjusted amounts.

- In Column B, specify the increases or decreases to the figures you reported on your original return. Provide a detailed explanation of each change in Part III of the form.

- Calculate the corrected amounts and enter them in Column C.

- Fill out Part III of Form 1040-X to provide a clear explanation of the changes. Be thorough in this section to avoid processing delays.

- If you’re claiming additional refunds, understand that processing can take up to 16 weeks. If you owe tax as a result of the amendment, include the payment to avoid interest and penalties.

- Review your amended return for accuracy. Double-check your calculations and the completeness of all necessary attachments.

- Once you’ve completed the form and attached all required documentation, mail your Form 1040-X to the IRS. The mailing address depends on your location and is provided in the form instructions.

After your amended return is filed, expect some waiting time. Processing Form 1040-X can take up to 16 weeks, and the IRS will mail a notice of receipt once they begin processing your form. To check the status of your amended return, you can use the IRS’s “Where's My Amended Return?” tool available on their website. This process, while it could take some time, is essential for ensuring your tax records accurately represent your financial activity for the year in question. Remember, taking the time to amend your return correctly can help avoid potential issues with the IRS in the future.

Understanding IRS 1040-X

-

What is the IRS 1040-X form used for?

The IRS 1040-X form is a crucial document for individuals who need to amend a previously filed federal income tax return. Whether you've discovered an error, omitted information, or experienced changes in your tax situation after filing, the 1040-X form allows you to make corrections. It's essential for ensuring your tax obligations are accurate and up to date.

-

When should I file a 1040-X form?

You should consider filing the 1040-X form if you find mistakes in your tax return or if there have been changes to your income, deductions, or tax credits after you've already submitted your return. Generally, to claim a refund, you must file a 1040-X within three years after the date you originally filed your return or within two years after the date you paid the tax, whichever is later. However, for specific situations, it's wise to consult the IRS guidelines or seek professional advice to understand the best timing for your circumstances.

-

How do I file the IRS 1040-X form?

Fill out the 1040-X form, ensuring you correctly report the original figures and the changes. You'll need to explain why you're making these amendments.

Attach any documents that support your changes, such as W-2s, 1099s, or schedules that have been altered or need to be added.

Review the form and supporting documents for accuracy before submission. You can file your 1040-X form electronically through tax software or mail it to the IRS. If you owe additional tax, it's important to pay as soon as possible to avoid potential penalties and interest.

-

How long does it take for a 1040-X to be processed?

The processing time for a 1040-X form can vary depending on the complexity of your amendment, how you filed it, and the IRS's current workload. Generally, if you file electronically, you can expect processing to take up to 16 weeks. Mail-in forms may take longer, usually around 6 months. It's a good idea to check the status of your amended return through the IRS website's "Where's My Amended Return?" tool.

Common mistakes

Filing an amended tax return using the IRS 1040-X form can be a complex process, fraught with potential pitfalls. Individuals often make critical errors that could affect their tax situation. Understanding these mistakes is essential to ensure the amendment process is handled correctly. Here's a detailed look at ten common mistakes:

Not Waiting for the Original Return to Be Processed: Taxpayers should wait until their original return is fully processed before submitting an amendment. Filing a 1040-X form too early can lead to processing delays and confusion at the IRS.

Overlooking Additional Documents: Failing to attach necessary documentation or schedules that support the changes made on the 1040-X can result in processing delays and possible denial of the amendment.

Incorrectly Reporting Changes: When making amendments, individuals sometimes incorrectly report the changes to their income, deductions, or credits. It’s crucial to clearly itemize and explain each change to avoid potential issues with the IRS.

Missing Signatures: An unsigned 1040-X form is not valid. Both spouses must sign the amended return if they are filing jointly. This oversight can lead to the rejection of the amendment.

Choosing the Wrong Tax Year: Taxpayers occasionally fill out the form for the wrong tax year. It's important to ensure that the correct tax year is marked on the 1040-X to avoid confusion and processing delays.

Not Checking the IRS Instructions: The IRS frequently updates its instructions for tax forms. Failing to review the most current instructions for the 1040-X can lead to errors in how the form is completed and submitted.

Incorrect Math Calculations: Arithmetic errors are common when recalculating the tax liability. These mistakes can affect the outcome of the amendment, potentially leading to an incorrect refund or balance due.

Failing to Pay Due Taxes: If the amendment results in additional tax owed, taxpayers sometimes forget to submit the required payment with their 1040-X. This oversight can lead to penalties and interest on the unpaid amount.

Using the Wrong Filing Status: Changes in personal circumstances may affect filing status. Amending a return without adjusting the filing status accordingly can cause issues with the IRS.

Not Explaining the Changes: The IRS requires a clear explanation for each change made on the 1040-X. Neglecting to provide a detailed explanation can delay processing and may require further correspondence with the IRS.

Amending a tax return requires careful attention to detail. By avoiding these common mistakes, taxpayers can ensure their 1040-X submissions are processed efficiently and accurately, reducing the likelihood of further issues with the IRS.

Documents used along the form

When amending a previously filed tax return, individuals often utilize the IRS 1040-X form. This form is crucial for making corrections or changes to an income tax return that has already been processed. However, the 1040-X form is just one part of the documentation needed in certain circumstances. Various other forms and documents are frequently required to support the changes made on the 1040-X. Below is a list of some of these documents, each serving a specific purpose in the amendment process.

- W-2 forms: These are wage and tax statements from employers that provide evidence of the income earned and taxes withheld. They are essential when the amendment affects reported income or withholding amounts.

- 1099 forms: These include various types of income outside of wages, such as independent contractor income (1099-NEC), interest and dividends (1099-INT and 1099-DIV), and others that may need to be corrected or updated.

- Schedule A: Used for itemizing deductions instead of taking the standard deduction. If an amendment involves changes to deductions, a revised Schedule A may need to be attached.

- Schedule C: For self-employed individuals, this form reports business income and expenses. A revised Schedule C may be necessary if the amendment affects business earnings or deductions.

- Schedule D: Used to report capital gains or losses from the sale of assets. Corrections to investment income or losses are reported with an updated Schedule D.

- Schedule E: Reports income or losses from rental property, royalties, partnerships, S corporations, estates, and trusts. It's required if adjustments are made to these types of income.

- Form 8962: Used to reconcile or claim the Premium Tax Credit for individuals who purchase health insurance through the marketplace. Adjustments to income or family size could necessitate a revised Form 8962.

The above documents are commonly associated with the filing of an amended tax return using the IRS 1040-X form. Each document supports the modification by providing detailed and specific information related to the taxpayer’s income, deductions, or credits. When preparing to amend a tax return, gathering and reviewing all related documents is essential to ensure accuracy and compliance with IRS requirements.

Similar forms

The IRS 1040-X form, used for amending previously filed tax returns, bears resemblance to several other documents, both within and outside the realm of tax filings. One such document is the IRS 1040 form itself, which individuals use to file their annual income tax returns. The 1040 form serves as the original submission, while the 1040-X is used to correct any errors or report changes after the original form has been filed. Both forms are integral to managing one’s personal federal income tax obligations, with the primary difference being their timing and purpose in the tax reporting process.

Another document similar to the IRS 1040-X form is the 1040-ES form, which is used for estimating future tax payments. While the 1040-ES helps individuals calculate and pay estimated taxes quarterly, the 1040-X is used post-factum to adjust any discrepancies on previous returns. Both forms involve a close examination of one’s income and deductions, albeit with different objectives – one is forward-looking, and the other corrects the past.

The W-2 form, issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck, also shares similarities with the 1040-X. While primarily serving different functions, both documents are crucial for accurately reporting and correcting personal income information. The 1040-X may require information from W-2 forms if the amendment involves changes to income or tax withholding figures.

Form 4868, which is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, shares a focus on tax deadlines with the 1040-X. Though one extends the filing deadline and the other amends a filed return, both recognize the need for adjustments within the tax filing process, accommodating circumstances that prevent on-time or accurate submissions on the first attempt.

Akin to the 1040-X, the Schedule A (Form 1040) document is used for itemizing deductions that taxpayers want to claim, such as mortgage interest, state tax payments, or charitable contributions. When filing an amended return with a 1040-X, changes to itemized deductions initially reported on Schedule A may be necessary, making these documents closely linked in the tax amendment process.

The IRS Form 8822, Change of Address, though administratively different, shares the concept of updating previously submitted information with the 1040-X form. While the 8822 form specifically relates to updates in a taxpayer's address, the 1040-X encompasses a broader range of amendments, including income, deductions, and credits, reflecting the dynamic nature of an individual’s fiscal situation.

Form 1099, which encompasses various types such as the 1099-MISC for freelancers or the 1099-INT for interest income, is essential for reporting income outside of traditional employment. Amendments made with a 1040-X often rely on accurate information from 1099 forms, especially if the original tax return omitted or inaccurately reported additional income sources. Thus, both play pivotal roles in ensuring the comprehensiveness and accuracy of reported earnings.

Similar to the 1040-X, the Form 8938, Statement of Specified Foreign Financial Assets, involves disclosing additional financial details that could affect tax obligations. Individuals might need to amend their tax return via Form 1040-X if previously unreported or misreported foreign assets need to be corrected, underscoring the interconnectedness of various reporting obligations.

State tax amendment forms, which vary by U.S. state, are the state-level counterparts to the federal 1040-X form. While the specifics can differ according to state tax laws, the purpose aligns closely with the 1040-X – to correct or update previously submitted state tax returns. Just as the 1040-X ensures federal tax compliance, these state forms maintain accuracy in state tax obligations.

Last but not least, the IRS Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, shares the premise of flexibility in filing like the 1040-X but for businesses. While the 7004 provides businesses extra time to file their returns, the 1040-X offers individuals the opportunity to correct inaccuracies post-submission, highlighting a shared recognition of the complexities in tax reporting and the need for amendments.

Dos and Don'ts

When filling out the IRS 1040-X form, understanding the dos and don'ts is crucial. This amended U.S. individual income tax return allows you to correct errors and make adjustments to a previously filed 1040 form. To ensure accuracy and compliance, here are some recommended practices:

Do:

- Double-check your information from the original tax return to ensure you accurately report what needs to be amended.

- Explain the reason for your amendment in the section provided, detailing the changes made.

- Attach any documentation that supports your amendment, such as W-2s or 1099s, if your amendment changes your income level.

- Wait for confirmation of your original tax return before submitting the 1040-X form if you've recently filed your taxes.

Don't:

- Forget to sign and date the form. An unsigned form is not valid and will not be processed.

- Assume the IRS owes you a larger refund without carefully recalculating your tax liability based on the changes made.

- Ignore the specific instructions for each line that you are amending. Correctly fill out only the sections that apply to your amendment.

- Delay the filing beyond the IRS’s time frame for amendments, which is typically within three years from the date you filed your original return or two years from the date you paid the tax, whichever is later.

Misconceptions

When it comes to amending a tax return using the IRS 1040-X form, several misconceptions can lead to confusion and mistakes. Understanding what these misconceptions are and the truth behind them is crucial for accurately handling tax amendments.

-

Misconception 1: The 1040-X form is only for correcting mistakes that increase a tax refund. In truth, this form is used to make corrections to previously filed tax returns, regardless of whether it increases the refund or results in more taxes owed. It ensures the taxpayer's information is accurate and up to date.

-

Misconception 2: Filing a 1040-X form guarantees a quick resolution. While it's understandable to expect timely updates, the processing time can vary significantly—often taking up to 16 weeks. This duration can extend due to the complexity of the amendment or IRS backlog.

-

Misconception 3: You can file Form 1040-X electronically for any tax year. Initially, the IRS accepted amendments only via paper filing. However, as of the 2019 tax year, electronic filing became an option for certain situations. Despite this, not all amendments qualify for electronic filing, and many must still be submitted through paper.

-

Misconception 4: Amending a tax return is voluntary if you owe more taxes. Filing a 1040-X form is not merely a matter of choice when finding errors that affect how much tax you owe. Taxpayers are legally obligated to correct such mistakes to avoid penalties and interest from accruing on the additional amount owed.

-

Misconception 5: There is no deadline for filing a 1040-X form. Although it might seem like amendments can be made at any time, there are strict deadlines. Typically, you have three years from the date you filed your original return or two years from the date you paid the tax, whichever is later, to file an amended return if it will result in a refund.

-

Misconception 6: You must wait for your original return to be processed before amending. While it's necessary for the IRS to process your original return before accepting an amended one, you don't have to wait to prepare the 1040-X form. Preparing in advance can expedite the process once your initial return is processed.

-

Misconception 7: The IRS will audit returns simply for filing a 1040-X form. There's a common fear that amending a return sends a red flag to the IRS, increasing audit risk. However, amending a return does not inherently increase the odds of an audit. The IRS audits returns based on a variety of factors, and correcting a mistake via the 1040-X form is not a significant one by itself.

Key takeaways

Having to amend a previously filed tax return can feel daunting. The IRS Form 1040-X is designed for this very purpose—to make corrections or add more information to your existing tax return. Here are some key takeaways to guide you through this process with greater ease and confidence.

Check the timing: Amendments have a deadline. You typically have up to three years from the date you filed your original return or two years from the date you paid the tax, whichever is later, to file a 1040-X.

Not for math errors: Don’t worry if you’ve made a math mistake. The IRS usually corrects those on your original return. Use the 1040-X for changes in filing status, income, deductions, or credits.

Prepare in sequence: If you need to amend more than one year, prepare a separate 1040-X for each year and mail them in separate envelopes. Ensuring each form is processed correctly is crucial.

Electronic and paper filing: Recent updates now allow the 1040-X to be filed electronically for some, but not all, tax years. Check the IRS website to see if your tax year qualifies for e-filing.

Documents to include: Attach any forms or schedules affected by your amendment. This supports the changes you are reporting and helps verify your corrections.

Explain your changes: The 1040-X form includes a section for explaining the reason behind the amendments. Clearly state why you are amending your return. This clarity can assist in the processing of your amendment.

State tax returns may be affected: Amending your federal tax return might also mean you need to amend your state return. Check your state’s requirements as each state’s process could be different.

Expect a longer processing time: Amended returns take longer to process than regular returns—expect to wait up to 16 weeks or longer. Check the status of your amendment using the IRS’s ‘Where’s My Amended Return?’ tool.

Receiving a refund: If your amendment results in a refund, you cannot receive those funds by direct deposit. Refunds from amendments are typically issued as a check mailed to the address the IRS has on file.

Getting everything right with the IRS can seem challenging, but understanding the essentials of the 1040-X form can simplify the amendment process. Remember, if you're ever in doubt, seeking advice from a tax professional is a smart way to ensure your tax filings are accurate and complete.

Popular PDF Documents

IRS Schedule K-1 1041 - By detailing information on alternative minimum tax items, the Schedule K-1 ensures beneficiaries are aware of potential tax implications.

Ifta Oregon - Procedure for carriers to declare total Oregon miles driven and assess taxes based on declared vehicle weights.

4952 Instructions - Provides a clear framework for taxpayers to itemize and deduct their investment interest expenses accurately.