Get IRS 1040-V Form

Navigating the complexities of tax payments can often be a daunting task for many taxpayers, particularly when it comes to making sure that their payments are processed efficiently and accurately by the Internal Revenue Service (IRS). This is where the IRS 1040-V form plays a crucial role. Designed as a payment voucher, it accompanies your tax payment, serving as a tool to facilitate the processing of payments and ensure they are credited correctly to one's account. The form is used by individuals who are making a payment alongside their tax return but choose not to do so electronically. While the idea of filling out yet another document may seem tedious, the 1040-V form is relatively straightforward. It includes the taxpayer's name, social security number, the amount of payment, and other essential information that ties the payment to the tax return, thereby streamlining the process for both the taxpayer and the IRS. Ensuring correct and timely processing of tax payments is integral to avoiding potential late fees or penalties, making understanding and utilizing the IRS 1040-V form a valuable part of managing one's personal finances.

IRS 1040-V Example

2021 Form

Department of the Treasury

Internal Revenue Service

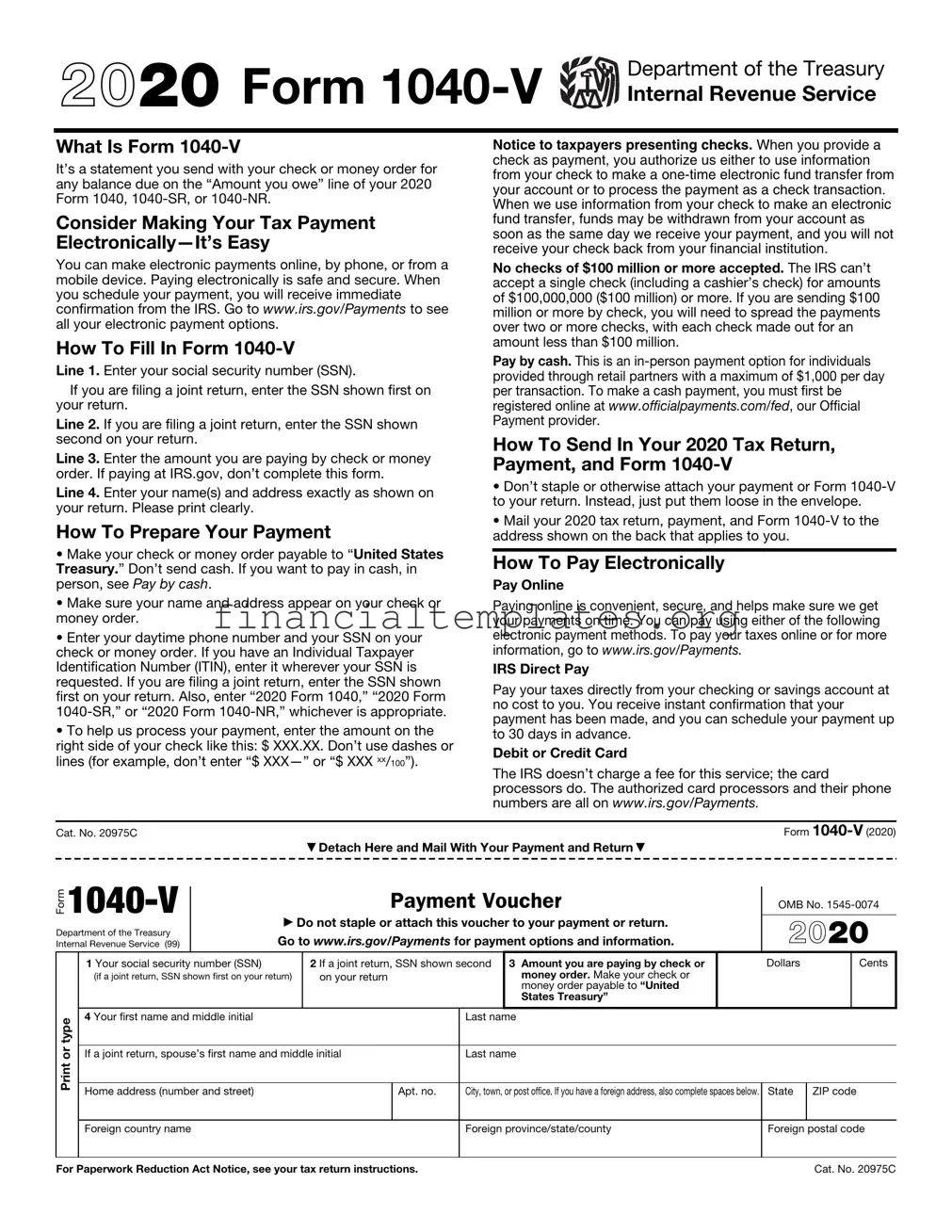

What Is Form

It’s a statement you send with your check or money order for any balance due on the “Amount you owe” line of your 2021 Form 1040,

Consider Making Your Tax Payment

You can make electronic payments online, by phone, or from a mobile device. Paying electronically is safe and secure. When you schedule your payment, you will receive immediate confirmation from the IRS. Go to www.irs.gov/Payments to see all your electronic payment options.

How To Fill in Form

Line 1. Enter your social security number (SSN).

If you are filing a joint return, enter the SSN shown first on your return.

Line 2. If you are filing a joint return, enter the SSN shown second on your return.

Line 3. Enter the amount you are paying by check or money order. If paying online at www.irs.gov/Payments, don’t complete this form.

Line 4. Enter your name(s) and address exactly as shown on your return. Please print clearly.

How To Prepare Your Payment

•Make your check or money order payable to “United States Treasury.” Don’t send cash. If you want to pay in cash, in person, see Pay by cash, later.

•Make sure your name and address appear on your check or money order.

•Enter your daytime phone number and your SSN on your check or money order. If you have an Individual Taxpayer Identification Number (ITIN), enter it wherever your SSN is requested. If you are filing a joint return, enter the SSN shown first on your return. Also, enter “2021 Form 1040,” “2021 Form

•To help us process your payment, enter the amount on the right side of your check like this: $ XXX.XX. Don’t use dashes or lines (for example, don’t enter “$

Notice to taxpayers presenting checks. When you provide a check as payment, you authorize us either to use information from your check to make a

No checks of $100 million or more accepted. The IRS can’t accept a single check (including a cashier’s check) for amounts of $100,000,000 ($100 million) or more. If you are sending $100 million or more by check, you will need to spread the payments over two or more checks, with each check made out for an amount less than $100 million.

Pay by cash. This is an

How To Send in Your 2021 Tax Return, Payment, and Form

•Don’t staple or otherwise attach your payment or Form

•Mail your 2021 tax return, payment, and Form

How To Pay Electronically

Pay Online

Paying online is convenient, secure, and helps make sure we get your payments on time. You can pay using either of the following electronic payment methods. To pay your taxes online or for more information, go to www.irs.gov/Payments.

IRS Direct Pay

Pay your taxes directly from your checking or savings account at no cost to you. You receive instant confirmation that your payment has been made, and you can schedule your payment up to 30 days in advance.

Debit or Credit Card

The IRS doesn’t charge a fee for this service; the card processors do. The authorized card processors and their phone numbers are all online at www.irs.gov/Payments.

Cat. No. 20975C

Form

Department of the Treasury Internal Revenue Service (99)

▼ Detach Here and Mail With Your Payment and Return ▼

Payment Voucher

▶ Do not staple or attach this voucher to your payment or return.

▶Go to www.irs.gov/Payments for payment options and information.

Form

OMB No.

2021

|

1 Your social security number (SSN) |

2 If a joint return, SSN shown second |

3 Amount you are paying by check or |

|

||

|

(if a joint return, SSN shown first on your return) |

on your return |

|

money order. Make your check or |

|

|

|

|

|

|

|

money order payable to “United |

|

|

|

|

|

|

States Treasury” |

|

|

|

|

|

|

|

|

or type |

4 Your first name and middle initial |

|

|

Last name |

||

If a joint return, spouse’s first name and middle initial |

Last name |

|||||

Home address (number and street) |

|

Apt. no. |

City, town, or post office. If you have a foreign address, also complete spaces below. |

|||

|

||||||

|

|

|||||

|

Foreign country name |

|

|

Foreign province/state/county |

||

|

|

|

||||

|

|

|

|

|

|

|

State |

ZIP code |

|

|

Foreign postal code

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 20975C |

Form |

Page 2 |

IF you live in . . . |

THEN use this address to send in your payment . . . |

|

|

Alabama, Florida, Georgia, Louisiana, Mississippi, North |

Internal Revenue Service |

Carolina, South Carolina, Tennessee, Texas |

P.O. Box 1214 |

|

Charlotte, NC |

|

|

Arkansas, Connecticut, Delaware, District of Columbia, Illinois, |

Internal Revenue Service |

Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, |

P.O. Box 931000 |

Minnesota, Missouri, New Hampshire, New Jersey, New York, |

Louisville, KY |

Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, |

|

Wisconsin |

|

|

|

Alaska, Arizona, California, Colorado, Hawaii, Idaho, Kansas, |

Internal Revenue Service |

Michigan, Montana, Nebraska, Nevada, New Mexico, North |

P.O. Box 802501 |

Dakota, Ohio, Oregon, Pennsylvania, South Dakota, Utah, |

Cincinnati, OH |

Washington, Wyoming |

|

|

|

A foreign country, American Samoa, or Puerto Rico (or are |

Internal Revenue Service |

excluding income under Internal Revenue Code 933), or use an APO |

P.O. Box 1303 |

or FPO address, or file Form 2555 or 4563, or are a |

Charlotte, NC |

or nonpermanent resident of Guam or the U.S. Virgin Islands |

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS 1040-V form is a payment voucher used by taxpayers to submit their federal income tax payments. It is not used for filing taxes but rather to ensure that the payment is correctly applied to one's account. |

| Usage | This form accompanies a taxpayer's payment when they choose to mail in their tax payment instead of making it electronically. It helps the IRS process payments more efficiently. |

| Accessibility | The form is available for download on the IRS website and can be printed by individuals needing to make a payment by check or money order. |

| Mailing | Depending on the taxpayer's location, the form and payment are mailed to one of several IRS addresses. These addresses are provided in the instructions for the form and are specific to the taxpayer's state of residence. |

| Preparation | To complete the form, taxpayers need to include their name, address, Social Security number, phone number, and the amount of the payment. The form should be detached along the perforated line and included with the payment in the envelope. |

| Deadline | The payment and 1040-V form must be sent to the IRS by the tax filing deadline, typically April 15, unless an extension has been granted. Failing to meet this deadline could result in penalties and interest. |

| Online Payment Option | Although the 1040-V form is for paper submissions, taxpayers are encouraged to consider making payments online through the IRS Direct Pay system, which provides a faster and secure payment option without the need for a payment voucher. |

Guide to Writing IRS 1040-V

Successfully completing the IRS 1040-V form is a crucial step in ensuring your tax payment is processed accurately and efficiently. This form accompanies your payment for any taxes owed on your federal income tax return. Following a methodical process to fill out this form can significantly streamline your tax payment experience.

- Begin by writing your Social Security Number (SSN) in the space provided. If you are filing jointly, ensure to include the SSN shown first on your tax return.

- Next, fill in the amount of your payment. Ensure this amount matches the total tax owed as indicated on your income tax return. Use dollars and cents to specify the exact amount.

- Now, write your full legal name. If you are filing jointly, include the name of the spouse as it appears on the tax return.

- Then, provide your current address. This includes your street address or rural route. Do not forget to include your apartment or suite number if applicable.

- Continue by adding the city, state, and ZIP code. Ensure the information matches the address on your tax return to prevent any processing delays.

- Finalize by reviewing the form for accuracy. Double-check the details against your tax return to ensure all information has been correctly transferred and is accurate.

Once the IRS 1040-V form is filled out, attach a check or money order for the amount owed to the form. Do not staple or otherwise attach the payment to the form. Mail the form and your payment to the IRS address provided for your geographic location. The address can be found on the IRS website or the instructions for the form. This step ensures that your payment is directed to the appropriate IRS office for processing, thereby avoiding any potential delays or complications with your tax payment.

Understanding IRS 1040-V

When it comes to filing taxes, understanding each form and its purpose can help ensure a smooth process. The IRS Form 1040-V is a payment voucher used with your tax return if you owe money and choose to mail your payment to the IRS. Here are answers to some common questions about this form:

- What is the IRS Form 1040-V?

IRS Form 1040-V is a payment voucher used by taxpayers to send checks or money orders for any taxes owed on their Form 1040 series. This form helps the IRS process payments more efficiently and apply the payment to the taxpayer's account correctly.

- Why should I use the IRS Form 1040-V?

Using the IRS Form 1040-V helps ensure that your payment is correctly applied to your tax account as quickly as possible. It also reduces the risk of errors in processing your payment.

- How do I fill out the 1040-V form?

Fill out the form by including your name, address, Social Security number, the amount you are paying, and the tax year for the payment. Attach the voucher to your check or money order, but do not staple or otherwise attach the payment to the voucher.

- Where do I mail my IRS Form 1040-V and payment?

The mailing address for the IRS Form 1040-V and your payment depends on your state of residence and whether you are also sending a tax return. The IRS provides a list of addresses on its website and in the instructions for the form.

- Can I make a payment electronically instead of using Form 1040-V?

Yes, you can make payments electronically through the IRS Direct Pay system, by debit or credit card, or through the Electronic Federal Tax Payment System (EFTPS). These methods do not require Form 1040-V.

- What if I can't pay the full amount I owe with my tax return?

If you cannot pay the full amount, you should still file your return on time and pay as much as you can to minimize interest and penalties. Consider applying for an IRS payment plan for the remaining balance.

- Is there a deadline for sending in IRS Form 1040-V with my payment?

The deadline to send in IRS Form 1040-V with your payment is the tax filing deadline, generally April 15, unless it falls on a weekend or holiday. Then, the deadline is the next business day.

- What happens if I don't use Form 1040-V when I mail my payment?

If you do not use Form 1040-V, the IRS may still process your payment, but it could delay crediting your account. Using Form 1040-V helps ensure proper and timely processing of your payment.

Remember, the IRS Form 1040-V is an essential tool for taxpayers who owe money and choose to pay by check or money order. Following the instructions carefully can help avoid delays in processing your return and payment.

Common mistakes

Filling out the IRS 1040-V form, a critical step in ensuring your tax payment processes correctly, might seem straightforward. Yet, it's surprisingly easy to make mistakes that can lead to delays or even penalties. Here are seven common errors to watch out for:

-

Not using the correct tax year form: Taxpayers often mistakenly use a form from a previous year. The IRS updates forms annually, so it's crucial to use the version for the specific tax year you're paying.

-

Entering the wrong Social Security Number (SSN): A simple typo can cause big problems. Your SSN must match the one on your Social Security card exactly.

-

Miswriting the amount owed: It’s easy to mistype or miswrite the figures, especially if you’re rushing. Double-check the amount you’re submitting matches the amount on your tax return.

-

Incorrect payment method information: If you're paying by check or money order, ensure it's made out correctly and signed. Any discrepancies can cause your payment to be rejected.

-

Forgetting to include the 1040-V form when mailing a payment: Your payment may still get processed without the form, but including it ensures faster and more accurate processing.

-

Not writing your SSN and tax year on your check or money order: If your payment gets separated from the 1040-V form, this information helps the IRS correctly apply your payment.

-

Mailing to the wrong IRS address: The IRS has different addresses based on the state you’re filing from and whether you’re including a payment. Sending your payment to the wrong address can result in delays.

While these mistakes might seem minor, they can have significant repercussions. Taking your time and double-checking your 1040-V form and accompanying payment can save you a headache down the road. Here are a few additional, quick tips to ensure everything goes smoothly:

Always check the IRS website for the most current form and mailing addresses.

Consider paying online through the IRS website for instant confirmation of your payment.

Keep a copy of all submitted forms and correspondences with the IRS, just in case there’s a dispute or misunderstanding later on.

Documents used along the form

When you're dealing with taxes, especially if you owe money to the federal government, it's likely that you'll encounter the IRS 1040-V form. This is a payment voucher you send along with your check or money order for any tax due on your Form 1040. However, it's rarely the only document you'll need to manage your tax affairs. Several other forms and documents often come into play, each serving its unique purpose in the grander schema of tax filing and payment.

- Form 1040: This is the base form used by individuals to file their annual income tax return with the IRS. You report your income, deductions, credits, and calculate the tax you owe or the refund you should receive here.

- Form W-2: Issued by employers, this form reports an employee's annual wages and taxes withheld from their paycheck. It's a vital document for accurately filling out your 1040 because it shows how much you've already paid toward your tax liability.

- Form 1099: Various types of 1099 forms are used to report income other than wages, such as freelance or contract work (1099-MISC), interest and dividends (1099-INT, 1099-DIV), and distributions from pensions, annuities, retirement plans, etc. (1099-R).

- Schedule A: Attached to your Form 1040, Schedule A is used if you choose to itemize deductions instead of taking the standard deduction. It can help you lower your tax bill by itemizing things like charitable donations, medical expenses, and mortgage interest.

- Schedule C: For those who are self-employed or are sole proprietors of a business, Schedule C is used to report your income or loss from the business. It accounts for both your revenue and your expenses, offering a clear picture of your business’s net profit or loss.

- Schedule SE: Self-employment tax is covered by this form. It calculates the tax owed on net earnings from self-employment, taking into account both Social Security and Medicare contributions, which is especially important for those who work for themselves or have freelance income.

Managing taxes can be a complex process that requires careful attention to detail and sometimes, a multitude of forms and documents. The IRS 1040-V form is just one piece of the puzzle. By understanding and correctly utilizing the related forms mentioned above, taxpayers can navigate their tax obligations more effectively, ensuring that their financial responsibilities to the government are met accurately and on time.

Similar forms

The IRS 1040-V form, a payment voucher used when submitting a federal tax payment, shares similarities with several other financial documents, each facilitating specific types of transactions or submissions. One such document is the IRS 1040-ES, used for estimated tax payments by individuals. Both of these forms serve to accompany payments sent to the IRS, yet the 1040-ES is specifically designed for taxpayers who need to pay their taxes on a quarterly basis, such as freelancers or independent contractors, rather than lump-sum annual payments.

Another analogous document is the IRS Form 4868, which is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. Much like the 1040-V, it plays a role in the tax submission process, but instead of accompanying a payment, it requests additional time for filing a return. Both forms ensure taxpayers remain compliant with IRS regulations, one through payment and the other through procedural extension.

Similarly, the IRS Form 8822, Change of Address, and the 1040-V, although serving very different purposes, share the methodology of informing the IRS about important updates. While the 1040-V is tied to payments, Form 8822 advises the IRS of a taxpayer’s new address, ensuring communications and documents reach the taxpayer. This aspect of administrative communication with the IRS is critical for the timely and accurate processing of personal information and financial transactions.

The State tax payment voucher, which varies by state, is akin to the federal IRS 1040-V form in its purpose and use. State vouchers are used when taxpayers submit their state tax payments by mail. Both types of vouchers serve as a means for the tax authorities (federal or state) to correctly allocate and credit the taxpayer's payment to their account, emphasizing the importance of accurate record-keeping and payment processing at different levels of government.

Form W-2, Wage and Tax Statement, though primarily a document employers send to their employees and the IRS to report annual wages and taxes withheld, shares the broader theme of tax responsibility and documentation with the IRS 1040-V. Both are integral to the tax filing process, with the W-2 providing the information necessary to complete tax returns and the 1040-V facilitating the actual payment of any taxes owed based on those returns.

Lastly, the IRS Form 1099-MISC, used to report miscellaneous income, parallels the 1040-V in its role in the tax reporting and payment landscape. Independent contractors and freelancers often deal with the 1099-MISC to report their earnings. While fundamentally different in purpose, both the 1099-MISC and the 1040-V are crucial for accurate tax reporting and financial accountability, ensuring taxpayers meet their obligations in diverse income situations.

Dos and Don'ts

Filling out the IRS 1040-V form, which is the payment voucher for your Federal Income Tax, is a crucial step in ensuring your taxes are processed efficiently and correctly. Here are some guidelines to follow to avoid common mistakes and ensure a smooth transaction with the IRS.

- Do:

- Make sure your personal information is accurate. Double-check your social security number and address to ensure they match the information on your tax return.

- Write your check or money order payable to “United States Treasury.” Be as specific as possible to avoid any processing delays.

- Include your social security number, the tax year, and the form number (1040-V) on your payment. This helps the IRS process your payment more efficiently.

- Send your payment and the 1040-V form to the address provided in the instructions for your specific area. It varies, so don't assume last year's address is still correct.

- Don't:

- Staple or otherwise attach your payment to the 1040-V form. They should simply be placed together in the envelope.

- Forget to sign your check. An unsigned check can cause delays or may even be returned to you.

- Ignore the specific mailing instructions. Using the wrong address can delay your payment significantly.

- Send cash. For security and proof of payment, it's always better to use a check or money order.

Following these dos and don'ts can help ensure your payment is processed as quickly and smoothly as possible. Remember, taking care with forms like the 1040-V is an integral part of managing your taxes effectively.

Misconceptions

When it comes to paying taxes, understanding the right forms and procedures is crucial. The IRS 1040-V form, a payment voucher used when mailing your tax payment, often gets misunderstood. Here are seven common misconceptions about the IRS 1040-V form:

The 1040-V is required for all tax payments: It's a common belief that the IRS 1040-V form must accompany all tax payments. In reality, this form is only needed if you're mailing a payment for your tax return. If you pay online or through other means, you don't need to include it.

Using the 1040-V form speeds up processing: Some taxpayers think that including a 1040-V will expedite the processing of their payment. However, the form's primary purpose is to help the IRS correctly apply your payment, not to speed up processing times.

The form is complicated to fill out: The 1040-V form is surprisingly simple. It asks for basic information, including your name, address, Social Security number, and the amount you are paying.

Electronic payments require a 1040-V form: This is incorrect. If you're paying electronically, through the IRS Direct Pay, the Electronic Federal Tax Payment System, or by debit or credit card, there's no need to use the 1040-V form.

It replaces the need for a tax return: Another misconception is that the 1040-V can be used instead of a tax return. In truth, the form is only a payment voucher and must accompany your completed tax return if mailing a payment.

You can't get it online: Many believe that the 1040-V form can't be downloaded and must be obtained from the IRS by mail or in person. This isn't true; the form is readily available on the IRS website for anyone to download.

Paying without the 1040-V leads to penalties: While using the 1040-V form when mailing your payment helps the IRS process it correctly, failing to include it doesn't result in penalties or additional charges. Your payment might just take slightly longer to process.

Understanding the purpose and use of the IRS 1040-V form is important for taxpayers who choose to mail their payments. Dispelling these misconceptions ensures that you follow the correct procedures without any undue stress or worry.

Key takeaways

The IRS 1040-V form is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040, 1040-SR, or 1040-NR. Understanding the correct way to fill out and use this form is essential for ensuring that your payment is processed correctly and in a timely manner. Here are four key takeaways about this process:

- Accuracy is Paramount: When filling out the IRS 1040-V form, make sure all information is accurate and corresponds to the details on your tax return. This includes your name, address, Social Security Number, and the amount you are paying. An error can lead to processing delays or payment misapplication.

- Mailing Instructions: The IRS provides specific mailing addresses for the 1040-V payment form based on the state you live in and whether you are including a payment. It is crucial to use the correct address to avoid any delays in processing your payment. You can find this information on the IRS website or in the instructions for the form.

- Do Not Staple or Attach Your Payment: When sending in your 1040-V form along with your payment, do not staple, tape, or otherwise attach your payment to the form. This can cause issues with the IRS's automated processing equipment. Instead, simply place the form and your check or money order loosely in the envelope.

- Use of the Form is Optional but Recommended: While using the IRS 1040-V payment voucher is optional, it is highly recommended as it helps the IRS process your payment more efficiently. The form notifies the IRS that a payment is included in the envelope and assists in ensuring that your payment is credited to your account promptly.

Popular PDF Documents

Form 8840 Due Date - Filing Form 8840 can be seen as part of a comprehensive approach to managing one's international tax profile and minimizing risks of non-compliance.

Power of Attorney Form Virginia - An official consent allowing a proxy to represent an individual in their tax issues and procedures.

8832 Election - Filing IRS Form 8832 requires careful consideration of the entity's current and future business environment to make an informed decision.