Get IRS 1040-SR Form

Filing taxes can often seem complicated, especially as we age and our financial situations evolve. Fortunately, the IRS has introduced the 1040-SR form, a version of the tax return form specifically designed for seniors aged 65 and older. This adjustment aims to simplify the filing process, providing a more readable format with a larger font size and a clearer presentation of income sources relevant to retirees, such as Social Security benefits, pensions, and IRA distributions. Not only does it make tax season less daunting for older citizens, but it also ensures that they can take advantage of the specific credits and deductions to which they are entitled without having to navigate through the more complex standard 1040 form. The introduction of the 1040-SR form reflects the IRS's commitment to making tax filing accessible and understandable for seniors, helping them to maintain financial independence and security.

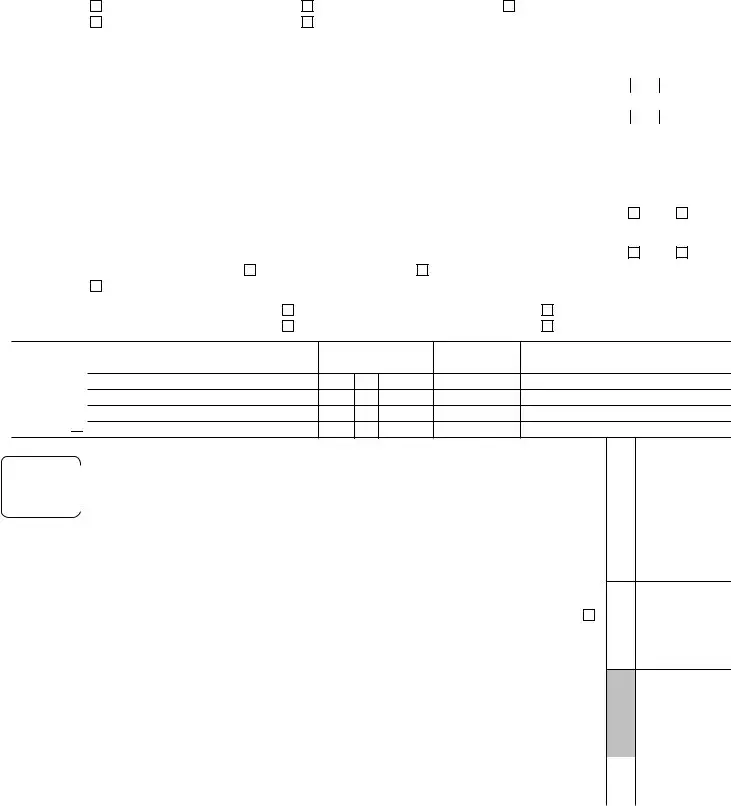

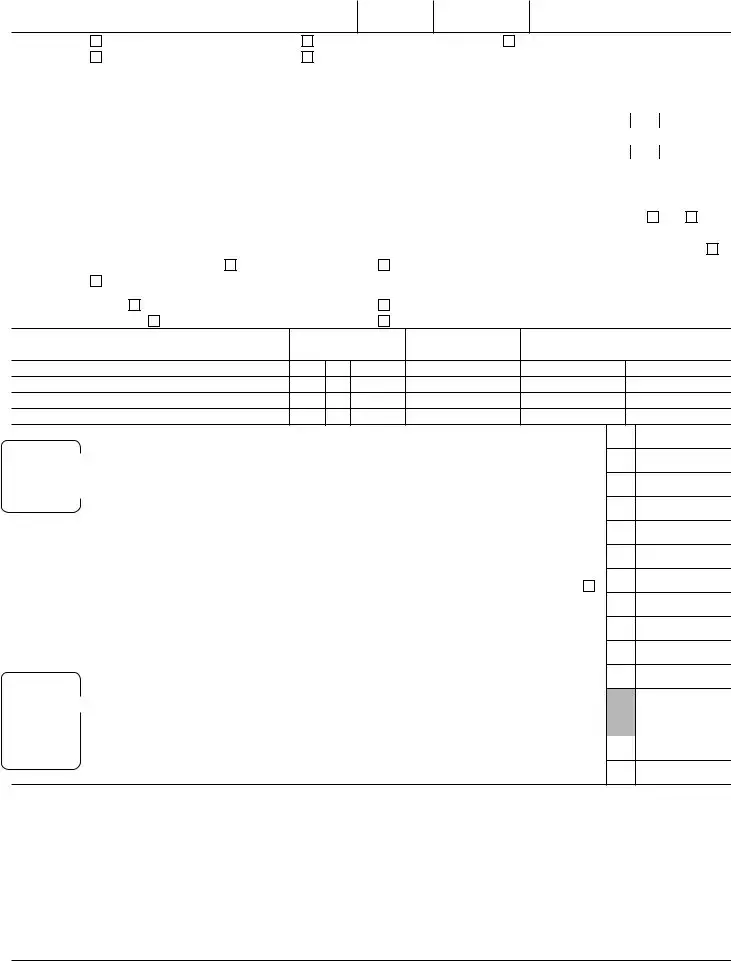

IRS 1040-SR Example

Form |

(99) |

2021 |

OMB No. |

IRS Use |

||||||||||||

|

|

Department of the |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Filing |

Single |

|

|

Married filing jointly |

|

|

Married filing separately (MFS) |

||||||||

|

Status |

Head of household (HOH) |

|

Qualifying widow(er) (QW) |

|

|

|

|

|

|

|

|||||

|

Check only |

If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child’s |

||||||||||||||

|

name if the qualifying person is a child but not your dependent ▶ |

|

|

|

|

|

|

|

||||||||

|

one box. |

|

|

|

|

|

|

|

||||||||

|

Your first name and middle initial |

|

Last name |

|

|

|

|

|

|

|

Your social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

If joint return, spouse’s first name and middle initial |

|

Last name |

|

|

|

|

|

|

|

Spouse’s social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Home address (number and street). If you have a P.O. box, see instructions. |

|

|

|

|

|

Apt. no. |

Presidential Election Campaign |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you, or your |

||

|

City, town, or post office. If you have a foreign address, also complete spaces below. |

State |

|

ZIP code |

spouse if filing jointly, want |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$3 to go to this fund. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking a box below will |

||

|

Foreign country name |

|

|

Foreign province/state/county |

Foreign postal code |

not change your tax or |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

refund. |

You |

Spouse |

|

|

|

|

|

|

|

||||||||||

|

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any |

|

|

|

||||||||||||

|

financial interest in any virtual currency? |

. . . . . . . . . . . . . |

. . . |

. . . |

. ▶ |

Yes |

No |

|||||||||

|

|

|

|

|

|

|

|

|||||||||

|

Standard |

Someone can claim: |

You as a dependent |

|

Your spouse as a dependent |

|

|

|||||||||

|

Deduction |

Spouse itemizes on a separate return or you were a |

|

|

|

|||||||||||

|

|

You: |

|

|

Were born before January 2, 1957 |

Are blind |

|

|

||||||||

|

|

Age/Blindness { Spouse: |

|

Was born before January 2, 1957 |

Is blind |

|

|

|||||||||

Dependents

(see instructions): (1) First name |

Last name |

If more than four dependents, see instructions and check here ▶

(2)Social security number

(3)Relationship to you

(4)✔ if qualifies for (see instructions):

Child tax credit |

Credit for other dependents |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

Wages, salaries, tips, etc. Attach Form(s) |

1 |

|

|||||

Attach |

|

|

|

|

2a |

|

|

b Taxable interest . . |

2b |

|

|

|

2 |

a |

|

|

|

||||||

Schedule B |

|

|

|

||||||||

3 |

a |

Qualified dividends . . |

3a |

|

|

b Ordinary dividends . |

3b |

|

|||

if required. |

|

|

|

||||||||

|

|

4a |

IRA distributions . . . |

4a |

|

|

b Taxable amount . . |

4b |

|

||

|

|

5a |

Pensions and annuities |

5a |

|

|

b Taxable amount . . |

5b |

|

||

|

|

6a |

Social security benefits . |

6a |

|

|

b Taxable amount . . |

6b |

|

||

|

|

7 |

|

Capital gain or (loss). Attach Schedule D if required. If not required, |

|

|

|||||

|

|

|

|

check here |

. . . . . . . . . . . . . . ▶ |

7 |

|

||||

|

|

8 |

|

Other income from Schedule 1, line 10 |

8 |

|

|||||

|

|

9 |

|

Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income . . ▶ |

9 |

|

|||||

|

|

10 |

|

Adjustments to income from Schedule 1, line 26 |

10 |

|

|||||

|

|

11 |

|

Subtract line 10 from line 9. This is your adjusted gross income . . ▶ |

11 |

|

|||||

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 71930F |

Form |

|||||||||

Form

Standard |

|

|

|

|

|

|

|

|

|

|

12a |

Standard deduction or itemized deductions (from |

|

|

|

||

Deduction |

|

|

|

|

Schedule A) |

12a |

|

|

|

|

|

|

|

|

|||

See Standard |

|

|

|

|

|

|||

|

|

b |

Charitable contributions if you take the standard |

|

|

|

||

Deduction Chart |

|

|

|

|

|

|||

on the last page |

|

|

|

deduction (see instructions) |

12b |

|

|

|

of this form. |

|

|

|

|

|

|

|

|

|

|

c |

Add lines 12a and 12b |

. . . . . . . 12c |

||||

|

|

|

|

|||||

13Qualified business income deduction from Form 8995 or Form

14 Add lines 12c and 13 . . . . . . . . . . . . . . . . . . . . . 14

15Taxable income. Subtract line 14 from line 11. If zero or less, enter

16 Tax (see instructions). Check if any from: |

|

1 Form(s) 8814 2 Form 4972 3 |

. . . . . . . 16 |

17Amount from Schedule 2, line 3 . . . . . . . . . . . . . . . . . 17

18 Add lines 16 and 17 . . . . . . . . . . . . . . . . . . . . . 18

19Nonrefundable child tax credit or credit for other dependents from

Schedule 8812 . . . . . . . . . . . . . . . . . . . . . . . . 19

20Amount from Schedule 3, line 8 . . . . . . . . . . . . . . . . . 20

21 |

Add lines 19 and 20 |

21 |

22 |

Subtract line 21 from line 18. If zero or less, enter |

22 |

23Other taxes, including

24 Add lines 22 and 23. This is your total tax . . . . . . . . . . . ▶ 24

25Federal income tax withheld from:

|

|

|

|

a |

Form(s) |

. . . . |

. |

. |

. . |

|

25a |

|

|

|

||

|

|

|

|

b |

Form(s) 1099 |

. . . . |

. |

. |

. . |

|

25b |

|

|

|

||

|

|

|

|

c |

Other forms (see instructions) . . |

. . . . |

. |

. |

. . |

|

25c |

|

|

|

||

|

|

|

|

d |

Add lines 25a through 25c . . . |

. . . . |

. |

. |

. . |

. . . . . . . . |

|

25d |

||||

|

|

26 |

|

2021 estimated tax payments and amount applied from 2020 return . . |

|

26 |

||||||||||

If you have |

|

|

|

|

|

|

|

|

|

|

|

|

27a |

|

||

|

27 |

a |

Earned income credit (EIC) . . . |

. . . . |

. |

. |

. . |

|

|

|||||||

|

|

|

|

|||||||||||||

a qualifying |

|

|

|

|

||||||||||||

child, attach |

|

|

|

Check here if you were born after January 1, 1998, |

|

|

|

|

|

|||||||

Sch. EIC. |

|

|

|

and before January 2, 2004, and you satisfy all the |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

other requirements for taxpayers who are at least |

|

|

|

|

|

||||||

|

|

|

|

|

age 18 to claim the EIC. See instructions . |

. |

. |

▶ |

|

|

|

|

|

|||

|

|

|

|

b |

Nontaxable combat pay election . |

|

27b |

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Prior year (2019) earned income . |

|

27c |

|

|

|

|

|

|

|

|

|

28Refundable child tax credit or additional child tax

|

credit from Schedule 8812 |

|

28 |

|

|

29 |

American opportunity credit from Form 8863, line 8 . |

|

29 |

|

|

30 |

Recovery rebate credit. See instructions |

|

30 |

|

|

31 |

Amount from Schedule 3, line 15 |

|

31 |

|

|

32 |

Add lines 27a and 28 through 31. These are your total other payments |

|

|||

|

and refundable credits |

. . . . . . . ▶ |

|

32 |

|

33 |

Add lines 25d, 26, and 32. These are your total payments . . . . . ▶ |

33 |

|||

Go to www.irs.gov/Form1040SR for instructions and the latest information. |

|

|

|

Form |

|

Form |

|

|

|

|

|

|

|

Page 3 |

|

Refund |

34 |

If line 33 is more than line 24, subtract line 24 from line 33. This is the |

|

||||||

|

|

amount you overpaid . . . |

. . . . . . . . . . . . . . . |

. . . |

34 |

||||

|

35a |

Amount of line 34 you want refunded to you. If Form 8888 is attached, |

|

||||||

|

|

check here |

. . . . . . . . . . . . . . . |

. ▶ |

35a |

||||

Direct deposit? |

▶ b |

Routing number |

|

▶ c Type: |

Checking |

Savings |

|

||

See |

▶ d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

instructions. |

Account number |

|

|

|

|

|

|

|

|

36Amount of line 34 you want applied to your 2022

|

|

estimated tax |

. |

. |

. . |

▶ |

36 |

|

|

|

Amount |

37 |

Amount you owe. Subtract line 33 from line 24. For details on how to |

||||||||

You Owe |

|

pay, see instructions |

. . . . . . . ▶ 37 |

|||||||

|

38 |

Estimated tax penalty (see instructions) . |

. |

. |

. . |

▶ |

|

38 |

|

|

Third Party |

Do you want to allow another person to discuss this return with the IRS? See |

|

|

|

|

|

|

|

|

Designee |

instructions . . |

. . . . . . . . . . . . . . . . . . . ▶ |

Yes. Complete below. |

|

No |

||||

|

Designee’s |

Phone |

Personal identification |

|

|

|

|

|

|

|

name ▶ |

no. ▶ |

number (PIN) |

▶ |

|

|

|

|

|

Sign

Here

Joint return? See instructions. Keep a copy for your records.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

|

Your signature |

Date |

Your occupation |

If the IRS sent you an Identity |

|||||||

▲ |

|

|

Protection PIN, enter it here |

||||||||

|

|

|

|

(see inst.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s signature. If a joint return, both must sign. |

Date |

Spouse’s occupation |

If the IRS sent your spouse an |

|||||||

|

|

|

|

Identity Protection PIN, enter it here |

|||||||

|

|

|

|

(see inst.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone no. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Preparer’s name |

Preparer’s signature |

Date |

PTIN |

|

Check if: |

|

|

|

|

|

|

|

||

Preparer |

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Phone no. |

|

||

Use Only |

|

|

|

|

|||

Firm’s address ▶ |

|

|

|

Firm’s EIN ▶ |

|

||

|

|

|

|

|

|||

Go to www.irs.gov/Form1040SR for instructions and the latest information. |

|

|

Form |

||||

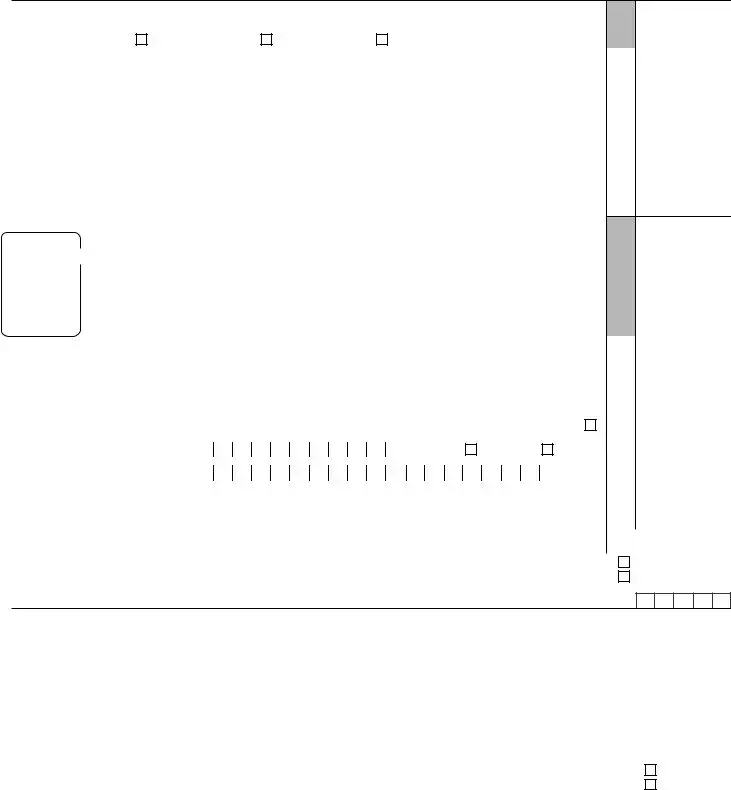

Form

Standard Deduction Chart*

Add the number of boxes checked in the “Age/Blindness” section of Standard Deduction on page 1 . . . . ▶

IF your filing status is. . .

Single

Married filing jointly

Qualifying widow(er)

Head of household

Married filing separately**

AND the number of |

THEN your standard |

boxes checked is. . . |

deduction is. . . |

1 |

$14,250 |

2 |

15,950 |

1 |

$26,450 |

2 |

27,800 |

3 |

29,150 |

4 |

30,500 |

1 |

$26,450 |

2 |

27,800 |

1 |

$20,500 |

2 |

22,200 |

1 |

$13,900 |

2 |

15,250 |

3 |

16,600 |

4 |

17,950 |

*Don’t use this chart if someone can claim you (or your spouse if filing jointly) as a dependent, your spouse itemizes on a separate return, or you were a

**You can check the boxes for your spouse if your filing status is married filing separately and your spouse had no income, isn’t filing a return, and can’t be claimed as a dependent on another person’s return.

Go to www.irs.gov/Form1040SR for instructions and the latest information. |

Form |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS 1040-SR form is specifically designed for taxpayers aged 65 or older. |

| 2 | It was introduced in the tax year 2019 as part of the Bipartisan Budget Act of 2018. |

| 3 | The form allows for a higher standard deduction for senior citizens. |

| 4 | 1040-SR includes a chart to help calculate the taxpayer's standard deduction quickly. |

| 5 | The layout and questions are similar to the regular 1040 form but have a larger font size for easier reading. |

| 6 | There is no income limit for filing the 1040-SR form. |

| 7 | Senior taxpayers can report income from wages, salaries, tips, IRAs, pensions, and annuities on this form. |

| 8 | It can be filed regardless of whether the standard deduction or itemized deductions are chosen. |

| 9 | e-Filing options are available for the 1040-SR, making it convenient to submit online. |

| 10 | Couples who are both 65 or older and filing jointly can both benefit from the higher standard deduction on a single 1040-SR. |

Guide to Writing IRS 1040-SR

Filling out the IRS 1040-SR form is a necessary process for individuals who meet the criteria for its use, primarily aimed at seniors who prefer a form with larger print and a simpler layout. This task doesn't have to be daunting. By following a series of clear steps, individuals can complete the form accurately and ensure that all required information is provided. This guide will walk you through each part of the form, one step at a time.

- Gather all necessary documentation, including Social Security numbers, W-2 forms, 1099 forms, and any records of taxable income.

- Start with your personal information. Enter your full name, mailing address, and Social Security number in the designated areas at the top of the form.

- If you're filing jointly, also include your spouse's name and Social Security number.

- Check the appropriate box for your filing status: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Enter your age and, if applicable, your spouse's age, as well as whether you are blind. This information may affect your standard deduction.

- List dependents, if any, including their names, Social Security numbers, relationships to you, and whether they qualify for the child tax credit or the credit for other dependents.

- Fill in the income section by reporting wages, salaries, tips (Form W-2), and any other income sources such as Social Security benefits, distributions from pensions, annuities, or IRAs. Consult the form's instructions for more detailed guidance on each type of income to be reported.

- Calculate your adjusted gross income (AGI) by following the form's guidelines on specific deductions you're eligible to claim, such as educator expenses or student loan interest.

- Apply the standard deduction or itemize deductions if it benefits you more. Remember, the 1040-SR form allows for a higher standard deduction for taxpayers over 65.

- Compute the tax amount based on your taxable income using the IRS provided tax tables or the Tax Computation Worksheet.

- Subtract any credits you're eligible for, including the earned income credit, child tax credit, or education credits. These credits can directly reduce your tax liability.

- Report any federal income tax withheld from your W-2 and 1099 forms. Add these to compute your total payments and refundable credits.

- Calculate your tax due or refund owed by comparing your total tax liability with your payments and credits. If your payments exceed your liability, you're due a refund.

- Sign and date the form. If you're filing jointly, your spouse must also sign.

- Review the form for accuracy, completeness, and any mathematical errors. Incorrect or missing information can result in processing delays.

- Finally, submit the form to the IRS by the designated deadline, either electronically using IRS e-file or by mailing it to the address provided in the form's instructions.

Completing the IRS 1040-SR form meticulously ensures that all necessary tax information is reported. This not only maintains compliance with tax regulations but can also maximize potential refunds or minimize liabilities. As tax laws and personal circumstances vary, individuals may also consider consulting a tax professional for personalized advice and guidance.

Understanding IRS 1040-SR

- What is the IRS 1040-SR form?

The IRS 1040-SR form is a version of the tax return form designed specifically for taxpayers aged 65 and older. Its primary goal is to make it easier for senior citizens to read and fill out their tax returns, thanks to its larger print and a more straightforward layout than the standard 1040 form. This form allows seniors to report their income, including any from investments, Social Security, and retirement plans, and to calculate their tax or refund owed to them by the IRS.

- Who is eligible to use the 1040-SR form?

Eligibility for the 1040-SR form is primarily based on age. If you are 65 years or older by the end of the tax year you are filing for, you can use this form. There are no special income restrictions or requirements; therefore, as long as you meet the age criterion, you can choose the 1040-SR regardless of your financial situation. This includes both individual filers and married couples, provided at least one spouse meets the age requirement.

- Are there any differences between the 1040 and 1040-SR forms in terms of filing options?

No, there are no differences in the filing options for the 1040 and 1040-SR forms. Both forms allow taxpayers to choose from the same filing statuses such as Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child. Additionally, both forms can be filed electronically or by mail, providing flexibility based on the taxpayer's preference. The main distinctions lie in the layout and readability, with the 1040-SR being tailored to older taxpayers.

- How can I obtain the 1040-SR form?

You can easily obtain the 1040-SR form through several methods:

- Downloading it from the official IRS website.

- Requesting a physical copy by mail from the IRS.

- Picking up a copy at a local IRS office or at some libraries and post offices during tax season.

Common mistakes

Filling out the IRS 1040-SR form, a version of the tax form designed for seniors aged 65 and older, can be tricky. It's easy to make mistakes if you're not careful. Here are ten common errors people often make:

Not checking the right filing status: Your filing status can affect your tax rates and deductions. Make sure you choose the correct one that applies to your situation.

Entering incorrect Social Security numbers: A simple mistake like transposing numbers can cause big problems. Double-check every Social Security number on the form to ensure they're correct.

Forgetting to include all sources of income: You might have income from different sources, such as pensions, investments, or part-time work. Make sure to report all of it.

Miscalculating deductions and credits: It's important to understand what deductions and credits you're eligible for. Incorrect calculations can lead to owing more tax or getting a smaller refund.

Omitting information about dependents: If you support others financially, you may be able to claim them as dependents. Leaving out dependent information can miss out on valuable tax benefits.

Not claiming the standard deduction: The 1040-SR form has a higher standard deduction amount for seniors. Failing to take advantage of this can result in paying more tax than necessary.

Signing in the wrong area: Your signature validates the form. Make sure you sign in the designated spot. Unsigned or incorrectly signed forms will be returned.

Forgetting to attach required documents: Depending on your situation, you may need to attach additional forms or schedules. Forgetting these can delay processing.

Using the wrong tax year's form: Tax laws and forms can change from year to year. Always use the form for the correct tax year.

Not keeping a copy for personal records: After you've sent in your form, having a personal copy is crucial for reference or in case the IRS has questions.

Avoiding these mistakes can help ensure that your tax return is processed smoothly and efficiently. Double-checking your form before submission can save you time and potential headaches later on.

Documents used along the form

Filing taxes can be a complex process, especially for those who may not be familiar with all the necessary documents. The IRS 1040-SR form, designed for seniors over 65, is just one piece of the tax filing puzzle. Alongside this form, several other documents often play crucial roles in ensuring that individuals can accurately declare their income, claim deductions, and understand their tax liabilities. Here, we outline five key forms and documents commonly used with the IRS 1040-SR form to provide a clearer picture of the tax filing process.

- Schedule 1 (Form 1040): This form is used to report additional income that isn’t directly listed on the 1040 or 1040-SR forms, such as business income, alimony, and unemployment compensation. It's also where deductions such as educator expenses and student loan interest are declared.

- Schedule 2 (Form 1040): Schedule 2 is where taxpayers report additional taxes that aren’t included on the standard 1040 or 1040-SR form. This can include alternative minimum tax and excess advance premium tax credit repayment.

- Schedule 3 (Form 1040): This form is important for those looking to claim nonrefundable tax credits, including credits for foreign tax paid, education expenses, and general business credits. It complements the 1040-SR by allowing for these additional credits to be factored into an individual's tax calculation.

- Form 1099-R: Retirees who have started withdrawing from their retirement accounts will likely receive this document from the administrator of the plan. It reports the amount of money distributed over the tax year, which is necessary to fill out the 1040-SR accurately.

- Form SSA-1099: This form is sent to recipients of Social Security benefits and reports the total amount of benefits received during the year. This information is used to determine the taxable portion of SSA benefits to be reported on the 1040-SR form.

Understanding these additional forms and documents is critical for taxpayers using the IRS 1040-SR form, as they ensure that all income is reported and all eligible credits and deductions are claimed. This can potentially lower tax liability or increase the refund for eligible seniors. Each form serves a specific purpose in the greater context of an individual’s financial and tax situation, making it important to pay careful attention to which forms apply to each taxpayer’s unique scenario.

Similar forms

The IRS 1040-SR form, designed specifically for seniors aged 65 and older, shares similarities with several other tax-related documents. Among these, the standard IRS 1040 form is the most closely related. The IRS 1040 form serves as the foundation for filing individual income tax returns in the United States. Like the 1040-SR, it collects information on income, tax deductions, and credits to determine the amount of tax owed or the refund due to the taxpayer. The primary difference is that the 1040-SR is tailored to meet the needs of older adults, featuring a larger font size and a focus on income types more common among retirees, such as Social Security benefits and retirement account distributions.

Similar to the IRS 1040-SR form, the IRS 1040-NR form is designed for a specific group of taxpayers—nonresident aliens engaged in business or trade within the U.S., or those with other U.S. income. The 1040-NR facilitates the reporting of income, deductions, and credits to calculate the tax liability for individuals who do not have U.S. citizenship and do not reside in the U.S. It parallels the 1040-SR in structure, gathering related financial information to assess tax obligations but is tailored to the requirements and tax situations peculiar to nonresident aliens.

The IRS Schedule SE form is another document that, while serving a different primary purpose, shares characteristics with the 1040-SR. Schedule SE is used to calculate the self-employment tax owed by individuals who operate their own businesses or work as independent contractors. While it does not directly correspond to income tax calculations, Schedule SE integrates with the 1040 and 1040-SR forms by contributing to the overall tax picture of an individual. Taxpayers who are self-employed must fill out Schedule SE and attach it to their 1040 or 1040-SR form, making it an integral part of determining their total tax liability.

The IRS 1040-ES form also bears resemblance to the IRS 1040-SR form in purpose and function. The 1040-ES is used for estimated tax payments, which are quarterly payments made by individuals who do not have sufficient taxes withheld from their earnings throughout the year. This can include freelancers, independent contractors, and retirees who do not have taxes withheld from their Social Security benefits or pension distributions. Like the 1040-SR, the 1040-ES addresses the taxpayer's income, but it focuses on estimating the amount of tax that will be due for the current year, rather than reporting the tax owed from the previous year. It is especially relevant for retirees filing a 1040-SR who may need to make estimated payments to avoid underpayment penalties.

Dos and Don'ts

When filling out the IRS 1040-SR form, it's important to pay close attention to ensure accuracy and compliance with tax regulations. Here are key dos and don'ts to consider:

Do:Double-check your personal information, including your Social Security Number, to make sure everything is correct.

Report all income sources accurately, including Social Security benefits, retirement plan distributions, and any other income.

Use the IRS's standard deductions for seniors, if applicable, to potentially reduce your taxable income.

Review the tax credits and deductions specifically available to seniors and claim any for which you are eligible.

Keep copies of all documents and receipts related to your tax return in case you need to reference them later or if you are audited.

Consider using tax software or consulting with a tax professional to ensure your form is filled out correctly.

Overlook additional income, such as interest, dividends, or capital gains, which must be reported on your tax return.

Forget to take required minimum distributions (RMDs) from your retirement accounts, as failing to do so can result in significant penalties.

Miss the deadline for filing your tax return or for requesting an extension, if necessary. Late filing can lead to penalties and interest charges.

Ignore the instructions for the 1040-SR form, which may have specific lines and calculations different from the standard 1040 form.

Attempt to claim deductions or credits for which you are not eligible, as this can lead to an audit or reassessment of your tax obligations.

Discard or lose your documentation before the period for tax document retention has passed, as you may need these documents for future reference or audits.

Misconceptions

Understanding the IRS Form 1040-SR is essential for seniors who are navigating their taxes. However, some misconceptions can lead to confusion. Let's dispel some common misunderstandings:

Only retirees can use the Form 1040-SR. This is a misconception. The form is available to taxpayers aged 65 or older by the end of the tax year, regardless of their employment status. So, whether you're still working, partially retired, or fully retired, if you meet the age requirement, the 1040-SR is an option for you.

The 1040-SR is vastly different from the regular 1040 form. Actually, the 1040-SR is very similar to the standard 1040 form. The primary difference is that the 1040-SR has a larger font size to make it easier to read, and it may include a chart to help calculate the standard deduction, which can be higher for seniors.

Filing with a 1040-SR form automatically gets you more tax breaks. This is not true. The 1040-SR form doesn't provide additional tax breaks just for using it. However, taxpayers aged 65 and older may qualify for a higher standard deduction, which is an option to note on this form.

You must itemize deductions if you use the 1040-SR. This is incorrect. Just like with the standard 1040 form, taxpayers using the 1040-SR have the choice between taking the standard deduction or itemizing deductions. Your decision should be based on which option lowers your taxable income the most.

The 1040-SR can only be filed on paper. Many people believe that the 1040-SR form can only be submitted in paper format. In reality, this form can also be filed electronically, offering seniors the convenience and efficiency of e-filing.

Using the 1040-SR form limits how you can receive your refund. The method of refund is not limited by the type of form you file. Regardless of whether you file using the 1040 or 1040-SR form, you can choose to receive your refund via direct deposit into your bank account or as a paper check.

Key takeaways

The IRS 1040-SR form is a version of the tax form designed specifically for seniors, offering a more readable format with larger text and a simpler layout. Understanding how to correctly fill out and use this form can lead to a smoother tax filing experience. Here are key takeaways to consider:

- The 1040-SR form is available to taxpayers who are age 65 or older by the end of the tax year. It's designed with their needs in mind, providing a clearer, more accessible way to file.

- This form allows seniors to report income from various sources, including wages, salaries, dividends, capital gains, and Social Security benefits, ensuring a comprehensive reporting platform.

- Taxpayers using the 1040-SR form can take a standard deduction or itemize deductions if it leads to a lower tax. The standard deduction amount is higher for seniors, providing more financial relief.

- Instructions for the 1040-SR form include helpful information on tax calculations, credits, and deductions specifically relevant to seniors, guiding them through the process with clarity.

- The form can be filed either electronically or on paper, offering flexibility to seniors based on their personal preference or ease of use.

- Similar to the regular 1040 form, the 1040-SR includes schedules for additional income, deductions, and credits. However, these are only required if they apply to the taxpayer's financial situation.

- Joint filers can use the 1040-SR if at least one spouse meets the age requirement, making it a practical option for married seniors.

- Using the 1040-SR form does not impact the tax calculation rules; the taxation rates, credits, and deductions remain the same as those who file using the standard 1040 form.

- Accessibility features, such as the larger font size and a user-friendly layout, aim to reduce errors and enhance readability for seniors, potentially making the tax filing experience less stressful.

- Seek advice from a tax professional if unsure about how to proceed with the 1040-SR form. Personalized guidance can ensure that taxpayers take full advantage of the benefits and comply with tax laws.

Navigating the tax filing process can be complex, but the introduction of the IRS 1040-SR form is a positive step toward accommodating the unique needs of senior taxpayers, providing them with a tool designed to simplify their tax filing duties.

Popular PDF Documents

Ohio It 4 - Represents an agreement between the purchaser and vendor on the tax status of a purchase.

Credits for Qualifying Children and Other Dependents - Designed to clarify the complex rules surrounding the Additional Child Tax Credit and its eligibility requirements.

Sch F - Demands detailed information on the nature and purpose of foreign activities to ensure compliance and transparency.