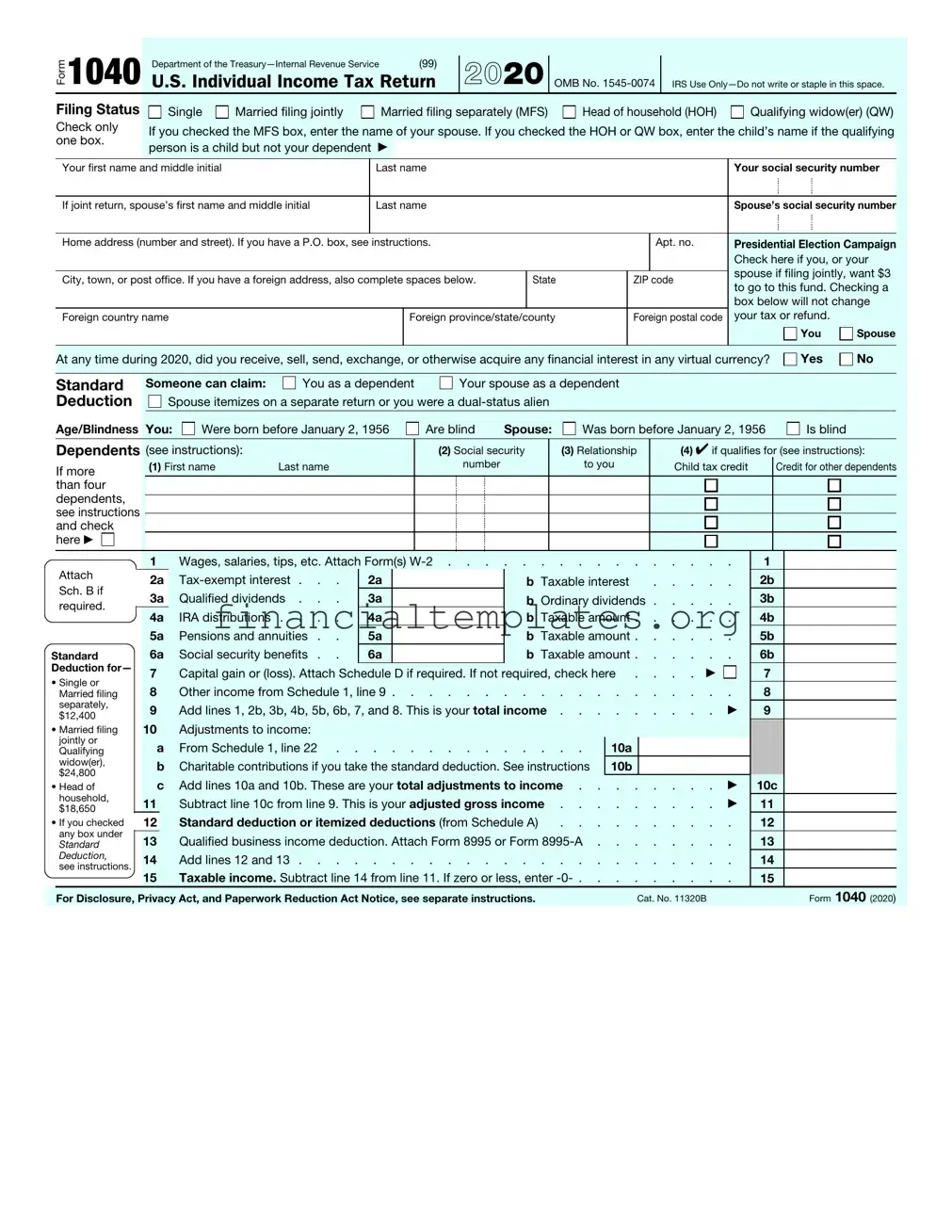

Get IRS 1040 Form

The journey through the tax season is punctuated by a series of important steps, one of the most crucial being the completion of the IRS 1040 form. This document stands as the cornerstone of individual tax filing in the United States, serving a dual purpose as both a report of income and a basis for calculating the amount of tax owed or refund due. Over the years, the form has evolved, adapting to changes in tax law and the needs of taxpayers. It caters to various types of income, deductions, and credits, making it applicable to a wide array of financial situations. Whether you are employed, self-employed, or experiencing changes in your financial landscape, such as buying a home or saving for retirement, understanding the 1040 form is imperative. Its role in the tax filing process cannot be overstated, as it provides the IRS with a detailed snapshot of an individual's financial status, ensuring that the correct amount of tax is paid each year. The completion of this form demands accuracy and a clear understanding of one’s financial activities throughout the tax year, highlighting its significance not only as a tax document but also as a tool for financial planning and management.

IRS 1040 Example

Form

1040

Department of the |

(99) |

U.S. Individual Income Tax Return

2021

OMB No.

IRS Use

Filing Status

Check only one box.

|

Single |

|

Married filing jointly |

|

Married filing separately (MFS) |

|

Head of household (HOH) |

|

Qualifying widow(er) (QW) |

|

|

|

|

|

If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying person is a child but not your dependent ▶

|

Your first name and middle initial |

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

If joint return, spouse’s first name and middle initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s social security number |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Home address (number and street). If you have a P.O. box, see instructions. |

|

|

|

|

|

|

|

|

|

Apt. no. |

Presidential Election Campaign |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you, or your |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

spouse if filing jointly, want $3 |

||||||||||||||

|

City, town, or post office. If you have a foreign address, also complete spaces below. |

|

State |

|

|

|

|

ZIP code |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

to go to this fund. Checking a |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

box below will not change |

||||||||||||||

|

Foreign country name |

|

|

|

|

|

|

|

|

|

|

Foreign province/state/county |

|

|

|

|

Foreign postal code |

your tax or refund. |

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

Spouse |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? |

|

|

|

|

|

|

Yes |

|

|

No |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard |

|

Someone can claim: |

|

|

|

You as a dependent |

|

|

Your spouse as a dependent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Deduction |

|

|

|

|

|

Spouse itemizes on a separate return or you were a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Age/Blindness You: |

|

|

Were born before January 2, 1957 |

|

|

Are blind |

Spouse: |

|

|

Was born before January 2, 1957 |

|

|

|

|

Is blind |

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Dependents (see instructions): |

|

|

|

|

|

|

|

|

|

(2) Social security |

|

(3) Relationship |

(4) ✔ if qualifies for (see instructions): |

||||||||||||||||||||||||||||||||||||||||

|

If more |

|

|

(1) First name |

Last name |

|

|

|

|

|

|

|

number |

|

|

|

|

|

to you |

Child tax credit |

|

|

Credit for other dependents |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

than four |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

dependents, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

and check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

here ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach |

|

|

1 |

|

|

|

|

Wages, salaries, tips, etc. Attach Form(s) |

. |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

2 |

a |

|

|

2a |

|

|

|

|

|

|

|

|

b Taxable interest |

. . . . |

|

|

. |

|

|

2b |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Sch. B if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

3 |

a |

|

|

Qualified dividends . . . |

3a |

|

|

|

|

|

|

|

|

b Ordinary dividends . . . . |

. |

|

|

3b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

4a |

IRA distributions . . . . |

4a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

4b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

5a |

Pensions and annuities . . |

5a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

5b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Standard |

|

|

6a |

Social security benefits . . |

6a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

6b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Deduction for— |

7 |

|

|

|

|

Capital gain or (loss). Attach Schedule D if required. If not required, check here . |

. . . ▶ |

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

• Single or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8 |

|

|

|

|

Other income from Schedule 1, line 10 |

. |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Married filing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

separately, |

9 |

|

|

|

|

Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income |

▶ |

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

$12,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

• Married filing |

10 |

|

|

|

|

Adjustments to income from Schedule 1, line 26 |

. |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

jointly or |

11 |

|

|

|

|

Subtract line 10 from line 9. This is your adjusted gross income |

. . . . . . . . . |

|

|

▶ |

|

11 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

widow(er), |

|

|

|

12 |

a |

|

|

Standard deduction or itemized deductions (from Schedule A) |

. . |

12a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

$25,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

b |

Charitable contributions if you take the standard deduction (see instructions) |

12b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

• Head of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

household, |

|

|

|

c |

Add lines 12a and 12b |

. |

|

|

12c |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

$18,800 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

• If you checked |

13 |

|

|

|

|

Qualified business income deduction from Form 8995 or Form |

. |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

any box under |

14 |

|

|

|

|

Add lines 12c and 13 |

. . . . . . . . . . . . . . . . . . . . . . |

|

|

. |

|

|

14 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Standard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

Deduction, |

15 |

|

|

|

|

Taxable income. Subtract line 14 from line 11. If zero or less, enter |

. |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. |

|

|

|

|

Cat. No. 11320B |

|

|

|

|

|

|

|

|

|

Form 1040 (2021) |

||||||||||||||||||||||||||||||||||||||

|

|

Form 1040 (2021) |

Page 2 |

|

16 |

Tax (see instructions). Check if any from Form(s): 1 |

8814 |

2 |

4972 |

|

3 |

|

|

. . |

16 |

|

|||

|

17 |

Amount from Schedule 2, line 3 |

. . . . . . . . |

17 |

|

||||||||||

|

18 |

Add lines 16 and 17 |

. . . . . . . . |

18 |

|

||||||||||

|

19 |

Nonrefundable child tax credit or credit for other dependents from Schedule 8812 |

19 |

|

|||||||||||

|

20 |

Amount from Schedule 3, line 8 |

. . . . . . . . |

20 |

|

||||||||||

|

21 |

Add lines 19 and 20 |

. . . . . . . . |

21 |

|

||||||||||

|

22 |

Subtract line 21 from line 18. If zero or less, enter |

. . . . . . . . |

22 |

|

||||||||||

|

23 |

Other taxes, including |

. . . . . . . . |

23 |

|

||||||||||

|

24 |

Add lines 22 and 23. This is your total tax |

. . . . . |

. . |

▶ |

24 |

|

||||||||

|

25 |

Federal income tax withheld from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Form(s) |

|

25a |

|

|

|

|

|

|

|||||

|

b |

Form(s) 1099 |

|

25b |

|

|

|

|

|

|

|||||

|

c |

Other forms (see instructions) |

|

25c |

|

|

|

|

|

|

|||||

|

d |

Add lines 25a through 25c |

. . . . . . . . |

25d |

|

||||||||||

If you have a |

26 |

2021 estimated tax payments and amount applied from 2020 return . . |

. . . . . . . . |

26 |

|

||||||||||

27a |

Earned income credit (EIC) |

|

27a |

|

|

|

|

|

|

||||||

qualifying child, |

|

|

|

|

|

|

|

||||||||

attach Sch. EIC. |

|

Check here if you were born after January 1, 1998, and before |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

January 2, 2004, and you satisfy all the other requirements for |

|

|

|

|

|

|

|

|

|

||||

|

|

taxpayers who are at least age 18, to claim the EIC. See instructions ▶ |

|

|

|

|

|

|

|

|

|

||||

|

b |

Nontaxable combat pay election . . . . |

27b |

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Prior year (2019) earned income . . . . |

27c |

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

Refundable child tax credit or additional child tax credit from Schedule 8812 |

|

28 |

|

|

|

|

|

|

|||||

|

29 |

American opportunity credit from Form 8863, line 8 |

|

29 |

|

|

|

|

|

|

|||||

|

30 |

Recovery rebate credit. See instructions |

|

30 |

|

|

|

|

|

|

|||||

|

31 |

Amount from Schedule 3, line 15 |

|

31 |

|

|

|

|

|

|

|||||

|

32 |

Add lines 27a and 28 through 31. These are your total other payments and refundable credits |

▶ |

32 |

|

||||||||||

|

33 |

Add lines 25d, 26, and 32. These are your total payments . . . . |

. . . . . |

. . |

▶ |

33 |

|

||||||||

Refund |

34 |

If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid |

|

. . |

34 |

|

|||||||||

35a |

Amount of line 34 you want refunded to you. If Form 8888 is attached, check here . . |

. |

▶ |

|

35a |

|

|||||||||

|

|

|

|||||||||||||

Direct deposit? |

▶ b |

Routing number |

|

▶ c Type: |

|

|

Checking |

|

Savings |

|

|

||||

See instructions. |

▶ d |

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

Amount of line 34 you want applied to your 2022 estimated tax . |

. |

▶ |

|

36 |

|

|

|

|

|

|

|||

Amount |

37 |

Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions |

|

. |

▶ |

37 |

|

||||||||

You Owe |

38 |

Estimated tax penalty (see instructions) . . . |

. . . . . |

. |

▶ |

|

38 |

|

|

|

|

|

|

||

Third Party |

Do |

you want to allow another person to discuss this return with the IRS? See |

|

|

|

|

|

|

|||||||

Designee |

instructions |

. . . . . . . . . . . . . . . . . . . |

. |

▶ |

Yes. Complete below. |

No |

|||||||||

|

Designee’s |

|

Phone |

|

|

|

|

|

Personal identification |

|

|||||

|

name ▶ |

|

no. ▶ |

|

|

|

|

|

number (PIN) ▶ |

|

|

||||

Sign

Here

Joint return? See instructions. Keep a copy for your records.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature |

Date |

Your occupation |

If the IRS sent you an Identity |

||||||

|

|

|

Protection PIN, enter it here |

||||||

|

|

|

(see inst.) ▶ |

|

|

|

|

|

|

Spouse’s signature. If a joint return, both must sign. |

Date |

Spouse’s occupation |

If the IRS sent your spouse an |

||||||

▲ |

|

|

Identity Protection PIN, enter it here |

||||||

|

|

|

(see inst.) ▶ |

|

|

|

|

|

|

Phone no. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Preparer’s name |

Preparer’s signature |

Date |

PTIN |

|

Check if: |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Phone no. |

|

|

|

|

|

|

|

Use Only |

|

|

|

|

|

|

|

|

|

||

|

|

Firm’s address ▶ |

|

|

|

Firm’s EIN |

▶ |

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

Go to www.irs.gov/Form1040 for instructions and the latest information. |

|

|

|

|

|

Form 1040 (2021) |

|||||

Document Specifics

| Fact | Description |

|---|---|

| Form Name | IRS 1040 Form |

| Purpose | Used to file an annual income tax return. |

| Applicable To | All U.S. taxpayers filing an individual income tax return. |

| Variations | Includes 1040-SR for seniors; 1040-NR for non-residents. |

| Deadline | Typically April 15 of every year, unless extended. |

| Governing Law | Federal tax law as mandated by the Internal Revenue Code. |

Guide to Writing IRS 1040

Filling out the IRS 1040 form is a necessary step for individuals to report their annual income along with deductions and credits to calculate their tax due or refund for the year. This process requires attention to detail to ensure that all the information provided is accurate and complete. The following steps are designed to guide individuals through this process smoothly. By following them, you can complete your 1040 form with confidence.

- Gather all necessary documents, including your Social Security Number, W-2 forms from employers, 1099 forms if you're self-employed, and records of any deductions or credits.

- Start by filling in your personal information at the top of the form, including your name, address, Social Security Number, and filing status. Check the appropriate box for your filing status.

- Enter your total income details in the Income section. This includes wages, salaries, taxable interest, dividends, and any other income. Use your W-2 and 1099 forms to report income accurately.

- Calculate and enter your adjusted gross income (AGI) by making allowable deductions from your total income. Common adjustments include contributions to retirement accounts, student loan interest, and classroom expenses.

- Determine your standard deduction or itemized deductions and input the total in the Deductions section. Your choice here will depend on which option lowers your tax bill the most.

- If applicable, claim any tax credits for which you are eligible. These could include education credits, child tax credits, and residential energy credits.

- Calculate your taxable income by subtracting deductions and credits from your AGI. Refer to the IRS tax tables to determine your tax based on your taxable income.

- Report any tax payments you have already made throughout the year, including federal income tax withheld (found on your W-2 or 1099) and estimated tax payments.

- If necessary, calculate the amount owed to the IRS or your expected refund. Subtract the total tax paid from the tax you owe.

- Double-check all information for accuracy. Mistakes or omissions can delay processing and affect your tax liability or refund amount.

- Sign and date the form. If filing jointly, make sure both spouses sign.

- Choose your filing method: electronically through the IRS e-file system or by mailing a printed copy to the IRS. Follow the instructions for your chosen method to submit your form.

Completing the IRS 1040 form accurately is crucial for complying with tax regulations and ensuring that you pay no more tax than necessary. Keep copies of your filled-out 1040 form and all supporting documents for your records. If you encounter difficulties, consider seeking help from a tax professional or utilizing IRS resources. Remember, tax laws and form requirements can change, so always use the most current form available from the IRS website.

Understanding IRS 1040

-

What is the IRS 1040 form?

The IRS 1040 form, central to the process of annual income tax filing in the United States, serves as a vehicle through which individuals report their yearly income. This document not only lays the groundwork for calculating tax owed to the federal government but also determines any refund due to the taxpayer. It accommodates various types of income, deductions, and credits, making it applicable to a wide array of tax situations.

-

Who needs to file the IRS 1040 form?

Generally, filing this form is necessary for all individuals who earn income over a certain threshold within the United States. This encompasses citizens, residents, and some non-resident aliens. The obligation to file is influenced by several factors including age, filing status, and the type and amount of income received. For a complete set of criteria, referring to the latest IRS guidelines is recommended.

-

How do I know which version of the 1040 form to use?

While the standard IRS 1040 form is apt for the vast majority of taxpayers, other versions exist for specific circumstances. For instance, the 1040-SR is designed for seniors, featuring a larger font size and a focus on retirement income. Choosing the correct version typically depends on personal or financial situations unique to each taxpayer. Guidance from the IRS or a tax professional can help in selecting the appropriate form.

-

What kinds of income need to be reported on the 1040 form?

Income reported on the 1040 form can be varied, extending to earnings from employment, investments, business operations, and certain forms of government payments, among others. It is crucial to disclose all sources of income, irrespective of whether they were subject to federal withholding, to ensure accurate tax liability assessment and to avoid penalties.

-

Can I claim deductions on the 1040 form?

Yes, the 1040 form provides opportunities to lower taxable income through various deductions. Taxpayers can elect to itemize deductions or opt for the standard deduction, depending on which yields greater tax savings. Common deductions include charitable donations, medical expenses exceeding a certain portion of income, and interest paid on a home mortgage.

-

What are tax credits, and how do they work with the 1040 form?

Tax credits, unlike deductions, reduce the amount of tax owed on a dollar-for-dollar basis. The IRS 1040 form allows taxpayers to claim multiple credits, including those for education expenses, childcare costs, and energy-efficient home improvements. Each credit has specific eligibility requirements and can have a significant impact on the overall tax obligation.

-

When is the deadline to file the IRS 1040 form?

The regular deadline for filing the IRS 1040 form typically falls on April 15th of each year. However, if this date lands on a weekend or a public holiday, the deadline is then pushed to the next business day. It's important to note that extensions are available, allowing taxpayers extra time until October 15th to file, although any taxes owed are still due by the original April deadline to avoid penalties.

-

Can the IRS 1040 form be filed electronically?

Absolutely. The IRS encourages electronic filing (e-filing) of the 1040 form due to its efficiency and accuracy. Most taxpayers qualify for free or low-cost e-filing options, making this method both convenient and accessible. Filing electronically also results in faster processing times, meaning any refunds owed are delivered more promptly.

-

What should I do if I make a mistake on my 1040 form?

If an error is discovered on a previously filed 1040 form, amending the return is possible through Form 1040-X. This corrected form should be submitted as soon as the mistake is recognized to adjust income, deductions, or credits inaccurately reported. While amendments can typically be filed within three years from the original filing date, acting swiftly ensures any additional taxes owed are minimized, along with potential penalties.

Common mistakes

Filling out the IRS 1040 form, the cornerstone document for individual federal income tax returns in the United States, can be a daunting task. Every year, many people inadvertently make mistakes that can lead to delays in processing their returns, result in paying more tax than necessary, or, worse, trigger an IRS audit. Awareness of common errors can help filers avoid these pitfalls and ensure a smoother tax return process. Here are seven mistakes often made on the IRS 1040 form:

Incorrect Social Security Numbers (SSNs): One of the most common mistakes is entering incorrect SSNs for oneself, spouse, or dependents. This error can lead to rejected e-filed returns or delayed processing of paper returns. Each SSN should be double-checked for accuracy against the Social Security card.

Filing Status Errors: Choosing the wrong filing status can affect tax liability and eligibility for certain credits and deductions. Taxpayers often mistakenly select the wrong status, such as 'Head of Household' instead of 'Single', or 'Married Filing Jointly' instead of 'Married Filing Separately'.

Mathematical Mistakes: Even simple addition or subtraction errors can significantly alter your tax return. With the IRS checking every return, any mathematical discrepancy will be uncovered. Using tax software can help mitigate this issue, but manual double-checks are advisable.

Missing or Incorrect Income Reporting: All sources of income, including wages, dividends, and freelance income, must be reported. Forgetting to include income from a W-2, 1099, or other income statements can lead to audits and penalties.

Overlooking Tax Credits or Deductions: Many taxpayers miss out on valuable tax credits and deductions simply because they aren't aware of them. Education credits, Earned Income Tax Credit, and deductions for charitable contributions are commonly overlooked.

Direct Deposit Details: For those opting for direct deposit refunds, entering incorrect banking information can delay refunds significantly. It's essential to double-check routing and account numbers.

Forgetting to Sign and Date: An unsigned tax return is like an unsigned check – it's not valid. Both spouses must sign if filing jointly. For electronic filings, a Personal Identification Number (PIN) is used as an electronic signature.

Avoiding these mistakes can help ensure that the tax return process is as smooth and error-free as possible. It's always beneficial to consult with a tax professional or use reputable tax preparation software to help navigate the complexities of tax filing.

Documents used along the form

When it comes to filing an income tax return with the IRS, the 1040 form is just the starting point for many taxpayers. This core document, which collects information about your income, deductions, and credits to determine the amount of tax you owe or the refund you are entitled to, often requires additional forms and documents to provide a full picture of your financial situation. Understanding these supplementary documents can help ensure you file your taxes accurately and take advantage of all the deductions and credits available to you.

- Schedule A (Form 1040): This form is used for itemizing deductions as opposed to taking the standard deduction. Taxpayers can list expenses such as medical and dental, taxes paid, interest paid, gifts to charity, casualty and theft losses, job expenses, and certain miscellaneous deductions.

- Schedule D (Form 1040): For reporting capital gains and losses from the sale or exchange of capital assets. This includes stocks, bonds, and real estate, and it helps calculate the tax owed or loss that can be factored into your taxable income.

- Schedule EIC (Form 1040): This document is specifically for filers claiming the Earned Income Credit (EIC), a benefit for working people with low to moderate income. It requires information about your qualifying children or, if you don't have children, information that verifies your eligibility for the credit based on income.

- Form 8949: Used to list all sales and exchanges of capital assets, including stocks, bonds, and real estate. This form is necessary for detailing each transaction before transferring the summary to Schedule D. It is pivotal for ensuring accurate capital gains or losses calculation.

Filing taxes can be a complex process, involving multiple forms and documents. Besides the main 1040 form, many people will also need to fill out one or more of the additional forms listed above. The key is to understand which forms apply to your situation. Properly completing these can help you accurately report your financial activities and possibly reduce the amount of tax you owe or increase your refund. Always consider seeking the advice of a tax professional if you have questions or need guidance on your tax situation.

Similar forms

The IRS 1040 form is a crucial document for filing individual federal income tax returns in the United States, detailing an individual's financial income and taxes due. Similar documents, though serving different jurisdictions or purposes, share this foundational concept of reporting income and determining tax obligations. Each document, in its essence, serves as a bridge between the taxpayer and the taxing authority, ensuring the fair assessment and collection of taxes.

One analogous document is the IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts. This form is used by fiduciaries to report the income, deductions, gains, losses, and tax liability of estates and trusts. Similar to the 1040, it ensures that income generated by these entities is appropriately taxed, playing a crucial role in the taxation of non-individual entities. Both forms require the calculation of taxable income and the application of relevant tax rates to determine the amount of tax owed.

Another document is the Schedule C attached to the IRS Form 1040, used by sole proprietors to report profits or losses from their business activities. While technically a part of the overall 1040 submission for those who are self-employed, the Schedule C demands detailed reporting of business income and expenses, akin to the broader income and deduction reporting on the 1040 form itself. Both documents ensure the accurate reporting of income and the fair calculation of taxable income and tax dues.

The IRS 1120 form, used by corporations to file their income tax returns, shares similarities with the 1040 form as well. It requires corporations to detail their income, losses, deductions, and credits to determine their federal tax liability. Like the 1040, the 1120 is fundamental in making sure that entities contribute their fair share to public coffers, based on their income levels.

The W-2 form, issued by employers, is utilized by employees to report wages, tips, and other compensation to the IRS when filing their 1040 forms. The W-2 is a precursor to the 1040, providing essential information that feeds into the tax return process. Both documents are integral to the accurate reporting and taxation of employment income.

Similarly, the 1099-MISC form, which freelancers and independent contractors receive, mirrors the function of the W-2 but for non-employee compensation. It's used by the recipient in conjunction with the IRS 1040 form to report self-employment income. Both the 1099-MISC and the 1040 facilitate the fair taxation of all forms of income, ensuring that everyone pays their due share.

On the international scene, the U.S. Form 1040-NR serves non-resident aliens in reporting their U.S.-sourced income. Much like the standard 1040 form used by residents, the 1040-NR ensures that income earned within the U.S. by individuals who do not live in the country is subjected to appropriate taxation.

In the Canadian context, the T1 General form performs a similar function to the IRS 1040 form, being used by individuals to file their personal income tax and benefit return. Though it caters to the Canadian revenue system, its fundamental purpose of reporting income, calculating deductions, and establishing tax owed parallels that of the IRS 1040.

Lastly, the UK’s Self Assessment tax return is Britain’s counterpart to the IRS 1040, required from individuals who have received income that is not automatically taxed at source. Like the 1040, it demands a comprehensive account of an individual’s income and deductions over the tax year, determining the amount of tax to be paid directly to the government. It embodies the same principles of fair taxation based on individual earnings.

Through these comparisons, it is evident that while tax forms may vary by jurisdiction or specific taxpayer circumstances, their core function of income reporting for the purpose of tax calculation is a universal aspect of tax administration worldwide.

Dos and Don'ts

Filing your IRS 1040 form can be a straightforward process when you know what to do and what to avoid. Here's a helpful guide with essential dos and don'ts to ensure your tax filing goes smoothly.

Do:

- Review the entire form before starting to understand the required information.

- Gather all necessary documents, such as W-2s, 1099s, and documentation for any deductions or credits you plan to claim.

- Use the IRS's official instructions or consult a tax professional if you're unsure about any part of the form.

- Double-check your Social Security Number and ensure it matches the name on your Social Security card.

- Report all of your income, including wages, interest, dividends, and any other sources, to avoid issues with the IRS.

- Claim all deductions and credits you're eligible for to reduce your taxable income or increase your refund.

- Use direct deposit for your refund to get it faster and minimize the risk of a lost check.

- Keep a copy of your filed tax return and all relevant documentation for at least three years in case of an audit.

- Consider filing electronically to reduce errors and speed up the processing time.

- File by the deadline, or request an extension if you need more time to prepare your return accurately.

Don't:

- Rush through filling out the form, which can lead to mistakes or missed opportunities for deductions and credits.

- Guess on figures or information. If you're unsure, look it up or seek professional advice.

- Overlook the importance of signing and dating your return. An unsigned return is like an unfiled return.

- Forget to include your payment if you owe taxes. Not paying by the deadline can result in penalties and interest.

- Assume the IRS already knows about all your income or deductions. It's your responsibility to report them accurately.

- Ignore IRS notices after filing. If you receive a notice, respond promptly to avoid additional issues.

- File a paper return if you can avoid it. Electronic filing has many advantages, including being faster and more secure.

- Miss out on claiming tax credits or deductions because you're unfamiliar with them. Doing a bit of research can save money.

- Mix personal and business expenses if you're self-employed. Keep these separate to accurately report your income and expenses.

- Wait until the last minute to start your taxes. Rushing can lead to errors, missed deductions, and unnecessary stress.

Misconceptions

The Internal Revenue Service (IRS) Form 1040 is an essential document for many taxpayers in the United States, designed to report income and calculate federal taxes owed. However, several misconceptions surround this form, which can lead to confusion and errors when filing taxes. Here are five common misconceptions about the IRS 1040 form.

- Only Employees Need to File Form 1040: Many people believe that Form 1040 is solely for individuals earning income through traditional employment. However, the truth is that this form is necessary for all taxpayers who receive income over a certain threshold, regardless of the source. This includes self-employment income, interest, dividends, and even income from gig economy activities.

- Filing Form 1040 Automatically Triggers an Audit: Another common misconception is the fear that filing a Form 1040 will increase the chances of being audited by the IRS. However, audits are typically triggered by inconsistencies or red flags in the data reported, not by the mere act of filing. Ensuring accurate and truthful reporting is the best way to minimize the risk of an audit.

- The Form 1040 Must Be Filed by April 15: While April 15 is widely recognized as Tax Day in the United States, there are exceptions to this filing deadline. If April 15 falls on a weekend or a legal holiday, the deadline is pushed to the next business day. Additionally, taxpayers living outside the United States or those serving in the military in combat zones are granted additional time to file.

- E-Filing is Less Secure Than Paper Filing: With the rise in digital services, some taxpayers remain wary about the security of electronically filing (e-filing) their Form 1040. In reality, e-filing is considered highly secure, employing advanced encryption technologies to protect sensitive information. Furthermore, the IRS encourages e-filing due to its efficiency and lower error rate compared to paper filing.

- Form 1040 Is the Same for Everyone: Lastly, it is a misconception that there is only one standard Form 1040 that all taxpayers must use. The IRS provides different versions of the form, such as the 1040-SR for senior citizens, to accommodate various taxpayer situations. Additionally, the IRS frequently updates the form and its schedules to reflect tax law changes, meaning taxpayers need to ensure they are using the most current version appropriate for their situation.

Understanding these misconceptions about the IRS Form 1040 can help taxpayers approach their tax preparation with more confidence and accuracy, potentially reducing the stress associated with tax season.

Key takeaways

The IRS Form 1040 is the standard federal income tax form used to report an individual's gross income. Here are key takeaways to ensure its correct use and completion:

Understand the Different Versions: Form 1040 has several versions, including 1040-SR for senior taxpayers. It's essential to choose the one that fits your tax situation best.

Gather Necessary Documentation: Before filling out Form 1040, collect all required documentation, including W-2s from employers, 1099 forms if you're self-employed or have other sources of income, and records of any tax deductions or credits you plan to claim.

Report All Income: Carefully report all forms of income, not just wages or salary. This includes self-employment income, interest, dividends, and any other sources. Failing to report income can result in penalties.

Deductions and Credits: Familiarize yourself with the standard deduction and itemized deductions to determine which is more beneficial for your tax situation. Additionally, understand the qualifications for any tax credits you claim, as they can directly reduce your tax liability.

Sign and Date Your Form: An often overlooked but crucial step is signing and dating your tax return. An unsigned tax return is considered invalid by the IRS.

Consider Filing Electronically: Filing electronically is secure, faster, and ensures fewer errors compared to paper filing. It also provides confirmation once the IRS receives your tax return.

Popular PDF Documents

What Is a 2439 Tax Form - The form serves as a record of the capital gains distribution that was not directly paid out to shareholders.

Proof of Payment Letter - A clear format for indicating preferred updates and corrections to planholder records, with separate fields for current and new information.

1040 X - It also facilitates the process of adjusting tax benefits that impact the overall tax calculation, potentially affecting refund amounts.