Get IRS 1024 Form

Many organizations seeking recognition of their tax-exempt status find themselves navigating the often complex procedure of filing the right paperwork with the Internal Revenue Service (IRS). Among these crucial documents is the IRS 1024 form, a key piece of the puzzle for certain types of nonprofits, particularly those not covered by the more commonly known 501(c)(3) status under the Internal Revenue Code. The process involves not just filling out the form accurately, but understanding the specific requirements that come along with it, such as the various categories under which an organization might qualify for tax exemption. The IRS scrutinizes these applications to ensure they meet strict criteria, encompassing everything from the organization's structure and operations to its financial arrangements and activities. Successfully navigating this process is essential for these organizations to achieve their goals without the burden of federal income tax, making the journey through the paperwork and regulations a critical step towards their mission.

IRS 1024 Example

The form you are looking for begins on the next page of this file. Before viewing it, please see the important update information below.

New Mailing Address

The mailing address for certain forms have change since the forms were last published. The new mailing address are shown below.

Mailing Address for Forms 1023, 1024,

Internal Revenue Service

TE/GE Stop 31A Team 105

P.O. Box 12192

Covington, KY

Deliveries by private delivery service (PDS) should be made to:

Internal Revenue Service

7940 Kentucky Drive

TE/GE Stop 31A Team 105

Florence, KY 41042

This update supplements these forms’ instructions. Filers should rely on this update for the change described, which will be incorporated into the next revision of the form’s instructions.

This page intentionally left blank.

Form 1024 (Rev. January 2018)

Department of the Treasury Internal Revenue Service

Application for Recognition of Exemption

Under Section 501(a)

Go to www.irs.gov/Form1024 for instructions and the latest information.

OMB No.

If exempt status is approved, this application will be open for public inspection.

Read the instructions for each Part carefully. A User Fee must be attached to this application.

If the required information and appropriate documents are not submitted along with Form 8718 (with payment of the

appropriate user fee), the application may be returned to the organization.

Complete the Procedural Checklist that follows the form.

Part I. Identification of Applicant Must be completed by all applicants; also complete appropriate schedule. Submit only the schedule that applies to your organization. Do not submit blank schedules.

Check the appropriate box below to indicate the section under which the organization is applying:

a

Section

Section

b

Reserved for future use

Reserved for future use

c |

Section |

d

Section

Section

e |

Section |

f |

Section |

g |

Section |

h |

Section |

i |

Section |

|

companies, or like organizations (Schedule G) |

j

Section

Section

k |

Section |

||||

l |

Section |

||||

m |

Section |

||||

n |

Section |

|

|

||

|

|

|

|

||

1a |

Full name of organization (as shown in organizing document) |

2 Employer identification number (EIN) (if |

|||

|

|

|

|

|

none, see Specific Instructions) |

|

|

|

|

||

1b c/o Name (if applicable) |

|

|

3 Name and telephone number of person to be |

||

|

|

|

|

|

contacted if additional information is needed |

|

|

|

|

|

|

1c |

Address (number and street) |

|

Room/Suite |

|

|

|

|

|

|

|

|

1d |

City, town or post office, state, and ZIP + 4. If you have a foreign address, see Specific |

|

|

||

|

Instructions for Part I. |

|

|

|

|

|

|

|

|

( |

) |

1e |

Web site address |

4 Month the annual accounting period ends |

5 Date incorporated or formed |

||

|

|

|

|

|

|

6Did the organization previously apply for recognition of exemption under this Code section or under any other section of the Code? If “Yes,” attach an explanation.

Yes

No

7 Has the organization filed Federal income tax returns or exempt organization information returns? . . . . . . . .

If “Yes,” state the form numbers, years filed, and Internal Revenue office where filed.

Yes

No

8Check the box for the type of organization. ATTACH A CONFORMED COPY OF THE CORRESPONDING ORGANIZING DOCUMENTS TO THE APPLICATION BEFORE MAILING.

a |

Corporation— |

Attach a copy of the Articles of Incorporation (including amendments and restatements) showing approval by the |

|

|

appropriate state official; also attach a copy of the bylaws. |

b |

Trust— |

Attach a copy of the Trust Indenture or Agreement, including all appropriate signatures and dates. |

c |

Association— |

Attach a copy of the Articles of Association, Constitution, or other creating document, with a declaration (see instructions) |

|

|

or other evidence that the organization was formed by adoption of the document by more than one person. Also include a |

|

|

copy of the bylaws. |

If this is a corporation or an unincorporated association that has not yet adopted bylaws, check here . . . . . . . .

I declare under the penalties of perjury that I am authorized to sign this application on behalf of the above organization, and that I have examined this application, including the accompanying schedules and attachments, and to the best of my knowledge it is true, correct, and complete.

PLEASE |

F |

|

SIGN |

|

|

HERE |

(Signature) |

For Paperwork Reduction Act Notice, see instructions.

(Type or print name and title or authority of signer) |

(Date) |

Catalog No. 12343K |

Form 1024 (Rev. |

Form 1024 (Rev. |

Page 2 |

Part II. Activities and Operational Information (Must be completed by all applicants)

1Provide a detailed narrative description of all the activities of the

2List the organization’s present and future sources of financial support, beginning with the largest source first.

Form 1024 (Rev.

Form 1024 (Rev. |

Page 3 |

Part II. Activities and Operational Information (continued)

3Give the following information about the organization’s governing body:

a Names, addresses, and titles of officers, directors, trustees, etc.

bAnnual compensation

4If the organization is the outgrowth or continuation of any form of predecessor, state the name of each predecessor, the period during which it was in existence, and the reasons for its termination. Submit copies of all papers by which any transfer of assets was effected.

5If the applicant organization is now, or plans to be, connected in any way with any other organization, describe the other organization and explain the relationship (for example, financial support on a continuing basis; shared facilities or employees; same officers, directors, or trustees).

6If the organization has capital stock issued and outstanding, state: (1) class or classes of the stock; (2) number and par value of the shares;

(3) consideration for which they were issued; and (4) if any dividends have been paid or whether your organization’s creating instrument authorizes dividend payments on any class of capital stock.

7State the qualifications necessary for membership in the organization; the classes of membership (with the number of members in each class); and the voting rights and privileges received. If any group or class of persons is required to join, describe the requirement and explain the relationship between those members and members who join voluntarily. Submit copies of any membership solicitation material. Attach sample copies of all types of membership certificates issued.

8Explain how your organization’s assets will be distributed on dissolution.

Form 1024 (Rev.

Form 1024 (Rev. |

Page 4 |

Part II. Activities and Operational Information (continued)

9Has the organization made or does it plan to make any distribution of its property or surplus funds to shareholders or

members? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” state the full details, including: (1) amounts or value; (2) source of funds or property distributed or to be distributed; and (3) basis of, and authority for, distribution or planned distribution.

Yes

No

10Does, or will, any part of your organization’s receipts represent payments for services performed or to be performed? . If “Yes,” state in detail the amount received and the character of the services performed or to be performed.

Yes

No

11Has the organization made, or does it plan to make, any payments to members or shareholders for services performed or

to be performed? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” state in detail the amount paid, the character of the services, and to whom the payments have been, or will be, made.

Yes

No

12Does the organization have any arrangement to provide insurance for members, their dependents, or others (including

provisions for the payment of sick or death benefits, pensions, or annuities)? . . . . . . . . . . . . .

If “Yes,” describe and explain the arrangement’s eligibility rules and attach a sample copy of each plan document and each type of policy issued.

Yes

No

13Is the organization under the supervisory jurisdiction of any public regulatory body, such as a social welfare agency, etc.? If “Yes,” submit copies of all administrative opinions or court decisions regarding this supervision, as well as copies of applications or requests for the opinions or decisions.

Yes

No

14 Does the organization now lease or does it plan to lease any property? . . . . . . . . . . . . . . .

If “Yes,” explain in detail. Include the amount of rent, a description of the property, and any relationship between the applicant organization and the other party. Also, attach a copy of any rental or lease agreement. (If the organization is a party, as a lessor, to multiple leases of rental real property under similar lease agreements, please attach a single representative copy of the leases.)

Yes

No

15Has the organization spent or does it plan to spend any money attempting to influence the selection, nomination, election,

or appointment of any person to any federal, state, or local public office or to an office in a political organization? . . If “Yes,” explain in detail and list the amounts spent or to be spent in each case.

Yes

No

16 Does the organization publish pamphlets, brochures, newsletters, journals, or similar printed material? . . . . .

If “Yes,” attach a recent copy of each.

Yes

No

Form 1024 (Rev.

Form 1024 (Rev. |

Page 5 |

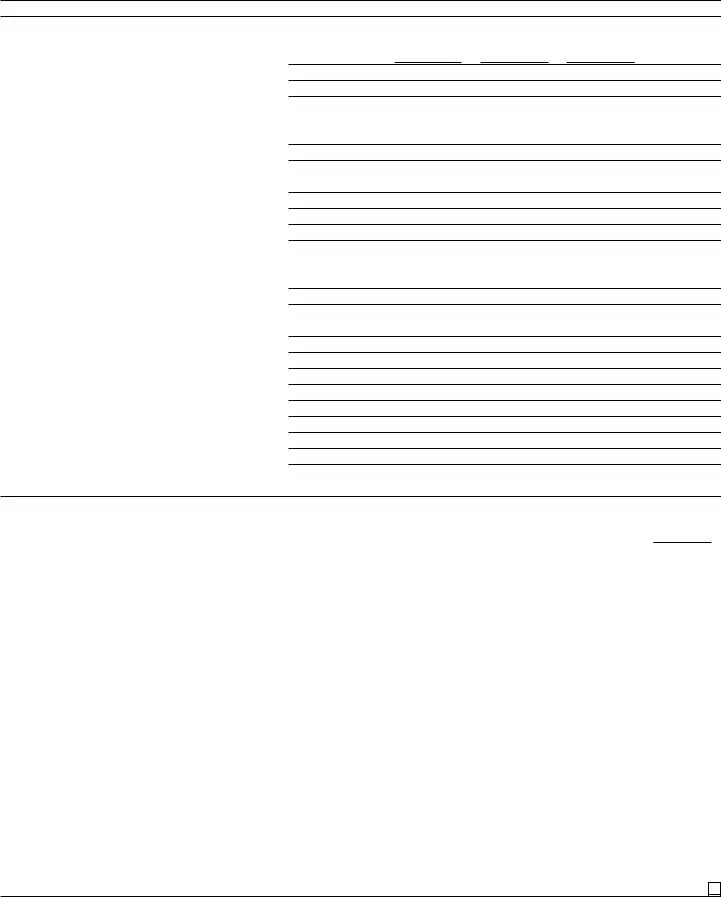

Part III. Financial Data (Must be completed by all applicants) |

|

Complete the financial statements for the current year and for each of the 3 years immediately before it. If in existence less than 4 years, complete the statements for each year in existence. If in existence less than 1 year, also provide proposed budgets for the 2 years following the current year.

A. Statement of Revenue and Expenses

|

Revenue |

1 |

Gross dues and assessments of members . . . |

2 |

Gross contributions, gifts, etc |

3Gross amounts derived from activities related to the organization’s exempt purpose (attach schedule)

(Include related cost of sales on line 9.) . . . .

4Gross amounts from unrelated business activities (attach schedule)

5 Gain from sale of assets, excluding inventory items

|

(attach schedule) |

. . . . . . . . . . |

6 |

Investment income (see instructions) |

|

7 |

Other revenue (attach schedule) |

|

8Total revenue (add lines 1 through 7) . . . . .

Expenses

9Expenses attributable to activities related to the organization’s exempt purposes . . . . . .

10Expenses attributable to unrelated business activities

11Contributions, gifts, grants, and similar amounts paid

(attach schedule) |

. . . . . . . . . . |

12Disbursements to or for the benefit of members (attach schedule)

13Compensation of officers, directors, and trustees (attach schedule)

14 |

Other salaries and wages |

|

15 |

Interest |

|

16 |

Occupancy |

|

17 |

Depreciation and depletion |

. . . . . . . |

18 |

Other expenses (attach schedule) |

|

19Total expenses (add lines 9 through 18) . . . .

20Excess of revenue over expenses (line 8 minus

line 19) . . . . . . . . . . . . .

(a) Current Tax Year |

3 Prior Tax Years or Proposed Budget for Next 2 Years |

|||

From |

|

|

|

|

|

|

(b) |

(c) |

(d) |

To |

||||

|

|

|

|

|

(e)Total

B. Balance Sheet (at the end of the period shown)

|

|

|

Current Tax Year |

|

|

|

Assets |

as of |

|

1 |

Cash |

1 |

|

|

2 |

Accounts receivable, net |

2 |

|

|

3 |

Inventories |

3 |

|

|

4 |

Bonds and notes receivable (attach schedule) |

4 |

|

|

5 |

Corporate stocks (attach schedule) |

5 |

|

|

6 |

Mortgage loans (attach schedule) |

6 |

|

|

7 |

Other investments (attach schedule) |

7 |

|

|

8 |

Depreciable and depletable assets (attach schedule) |

8 |

|

|

9 |

Land |

9 |

|

|

10 |

Other assets (attach schedule) |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

10 |

|

11 |

Total assets |

11 |

|

|

12 |

|

Liabilities |

12 |

|

Accounts payable |

|

|||

13 |

Contributions, gifts, grants, etc., payable |

13 |

|

|

14 |

Mortgages and notes payable (attach schedule) |

14 |

|

|

15 |

Other liabilities (attach schedule) |

15 |

|

|

16 |

Total liabilities |

16 |

|

|

17 |

|

Fund Balances or Net Assets |

17 |

|

Total fund balances or net assets |

|

|||

18 |

Total liabilities and fund balances or net assets (add line 16 and line 17) |

18 |

|

|

If there has been any substantial change in any aspect of the organization’s financial activities since the end of the period shown above, check the box and attach a detailed explanation . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 1024 (Rev.

Page 6

Yes

No

Yes

No

Yes |

No |

If “Yes,” give the reasons for not filing this application within the

If “No,” answer question 4.

4If you answer “No” to question 3, your organization’s qualification as a section 501(c)(9) or 501(c)(17) organization can be recognized only from the date this application is filed. Therefore, does the organization want us to consider its application as a request for recognition of exemption as a section 501(c)(9) or 501(c)(17) organization from the date the application is received and not retroactively to the date the organization was created or formed? . . . . . . . . . . . .

Yes

No

Form 1024 (Rev.

Form 1024 (Rev. |

Page 7 |

Schedule A Organizations described in section 501(c)(2) or 501(c)(25)

1State the complete name, address, and EIN of each organization for which title to property is held and the number and type of the applicant organization’s stock held by each organization.

2If the annual excess of revenue over expenses has not been or will not be turned over to the organization for which title to property is held, state the purpose for which the excess is or will be retained by the title holding organization.

3In the case of a corporation described in section 501(c)(2), state the purpose of the organization for which title to property is held (as shown in its governing instrument) and the Code sections under which it is classified as exempt from tax. If the organization has received a determination or ruling letter recognizing it as exempt from taxation, please attach a copy of the letter.

4In the case of a corporation or trust described in section 501(c)(25), state the basis whereby each shareholder is described in section 501(c)(25)(C). For each organization described that has received a determination or ruling letter recognizing that organization as exempt from taxation, please attach a copy of the letter.

5With respect to the activities of the organization.

a Is any rent received attributable to personal property leased with real property? . . . . . . . . . . . .

If “Yes,” what percentage of the total rent, as reported on the financial statements in Part III, is attributable to personal property?

bWill the organization receive income which is incidentally derived from the holding of real property, such as income

from operation of a parking lot or from vending machines? . . . . . . . . . . . . . . . . . .

If “Yes,” what percentage of the organization’s gross income, as reported on the financial statements in Part III, is incidentally derived from the holding of real property?

cWill the organization receive income other than rent from real property or personal property leased with real property or income which is incidentally derived from the holding of real property? . . . . . . . . . . . . . .

If “Yes,” describe the source of the income.

Yes

Yes

Yes

No

No

No

Instructions

Line

Line

Line

describes the organization (as shown in its IRS determination letter).

Line

1.A qualified pension,

2.A government plan;

3.An organization described in section 501(c)(3); or

4.An organization described in section 501(c)(25).

Form 1024 (Rev.

Form 1024 (Rev. |

Page 8 |

This page left blank intentionally.

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 1024 is used by organizations to apply for recognition of exemption under Section 501(a). |

| 2 | This form specifically caters to organizations seeking recognition under sections other than 501(c)(3). |

| 3 | Organizations filing this form may include those exempt under 501(c)(4) (social welfare organizations), 501(c)(6) (business leagues), and more. |

| 4 | Filing this form is a mandatory step for organizations that need a formal determination of their tax-exempt status from the IRS. |

| 5 | The IRS charges a fee for processing Form 1024, which must be paid upon submission of the form. |

| 6 | Once approved, the organization is eligible to receive tax-deductible contributions in accordance with their exemption status. |

| 7 | The form requires detailed information about the organization’s structure, purposes, governance policies, and financial data. |

| 8 | The IRS recommends using the electronic filing system, though paper submissions are still accepted. |

| 9 | The processing time for Form 1024 can vary, ranging from a few months to over a year, depending on the complexity of the application and IRS workload. |

| 10 | Form 1024-A is a related form that specifically simplifies the application process for 501(c)(4) organizations. |

Guide to Writing IRS 1024

After thoroughly preparing and organizing your relevant organizational documents, the next crucial step involves completing the IRS Form 1024. This complex form requires careful attention to detail and accuracy to ensure a successful submission. Designed for certain types of nonprofits seeking tax-exempt status, filling it out correctly forms the backbone of your organization's application. Here's a step-by-step guide to help you navigate through the form with ease, ensuring every section is correctly filled out to represent your organization accurately.

- Start by downloading the latest version of the IRS Form 1024 from the official IRS website to ensure you have the most current form.

- Enter your organization's legal name, as it appears in your creating documents, at the top of the form.

- Provide your Employer Identification Number (EIN) in the designated space. Ensure this number is accurate, as it's essential for your organization's identification.

- Detail the primary address where your organization conducts its operations. Include a mailing address if it differs from the primary address.

- Fill in the date of incorporation and the state in which your organization was legally formed. This information must match your official documents.

- Identify the specific section under which you are applying for tax-exempt status. This requires a clear understanding of your organization's purpose and activities.

- Describe your organization's activities in detail, providing a comprehensive overview of its mission, the population it serves, and the services it provides.

- Include financial data, such as revenue and expenses, for the current and past years. This section might require assistance from a financial professional to ensure accuracy.

- Review the form for any attachments or additional schedules required based on your answers. Ensure all necessary additional information is attached before proceeding.

- Sign and date the form. An officer or authorized representative of the organization must sign the IRS Form 1024 to validate its accuracy and completeness.

- Mail the completed form and any necessary attachments to the address provided in the form's instructions. Keep a copy for your organization's records.

Completing IRS Form 1024 is a significant step toward achieving tax-exempt status for your organization. It requires a detailed examination of your organization's activities, financial information, and legal standing. Therefore, gather all necessary information and consult with legal or financial advisors as needed to ensure that your submission accurately reflects your organization's purpose and operations.

Understanding IRS 1024

-

What is the purpose of the IRS 1024 form?

The IRS 1024 form is a document used by organizations seeking recognition of exemption from federal income tax under sections other than 501(c)(3) of the Internal Revenue Code. This includes various types of organizations such as social clubs, labor organizations, and veterans' organizations, among others. By completing and submitting this form, an organization can obtain a status that often exempts it from federal income taxes and may also make it eligible for certain other benefits, such as postal discounts.

-

Who needs to file the IRS 1024 form?

Not all organizations are required to file the IRS 1024 form. It is specifically designed for organizations seeking tax-exempt status under sections of the IRS codes other than 501(c)(3), which includes charitable organizations. Some common examples of entities that might need to file this form include those seeking exemption under 501(c)(4) (social welfare organizations), 501(c)(6) (business leagues, chambers of commerce), or 501(c)(7) (social clubs). It's important to review the IRS guidelines or consult a tax professional to understand if your organization should file a 1024 form.

-

What information is required on the IRS 1024 form?

Filling out the IRS 1024 form requires detailed information about your organization. This includes the organization's name, address, and Employer Identification Number (EIN), as well as a detailed statement of its purpose and activities. You will also need to provide information about your organization's governing body and operating structure, financial data, and any bylaws or articles of association. Completeness and accuracy are crucial, as this information will be used to determine your organization's eligibility for tax-exempt status.

-

How do you file the IRS 1024 form, and what is the filing fee?

The IRS 1024 form can be filed either electronically through the IRS website or mailed in paper form to the IRS. Filing electronically is generally faster and allows for easier tracking of your application's status. The filing fee for the IRS 1024 form varies depending on your organization's gross receipts. Smaller organizations with lower gross receipts will pay a lower fee, while larger organizations with higher gross receipts will face a higher fee. It's important to check the latest IRS fee schedule to determine the exact amount your organization needs to pay.

-

How long does it take to receive a decision on an IRS 1024 form application?

The processing time for an IRS 1024 form can vary widely based on several factors, including the complexity of your application, the completeness of the information provided, and the IRS's current work volume. Generally, applicants can expect to wait several months for a decision. However, it could take longer if the IRS has questions or requests additional information. Keeping a detailed record of your submission and any correspondence with the IRS can help manage expectations and follow up as necessary.

Common mistakes

-

Not reading the instructions carefully before starting to fill out the form results in common errors, such as incorrect or missing information. The IRS provides a detailed instruction manual which should be reviewed thoroughly.

-

Entering incorrect organization information, including the wrong EIN (Employer Identification Number), name, or address, is a mistake. It's crucial to double-check these details for accuracy.

-

Failing to specify the exact type of tax-exempt status being applied for. The IRS 1024 form is used by various types of organizations seeking different exemptions; specifying the wrong type can lead to unnecessary delays.

-

Omitting signatures and dates at the end of the form. An unsigned form is incomplete and will be returned or not processed until properly signed.

-

Not attaching the required schedules or supporting documents that are relevant to the organization's exemption application. Every application must be accompanied by appropriate documentation for the IRS to make a determination.

-

Incorrectly calculating fees or not including the correct payment amount for processing the application. The fee structure can vary, so it’s important to verify the current required amount.

-

Overlooking the need to fill out certain parts of the form that specifically apply to the organization's exemption status. Each section should be reviewed to ensure completion.

-

Using outdated versions of the form. The IRS periodically updates its forms, so using the most current version is necessary to prevent the submission from being rejected.

-

Assuming a non-profit automatically qualifies without providing detailed information about activities, governance, and finances. Detailed explanations help the IRS understand the organization’s operations and basis for tax-exempt status.

Documents used along the form

When organizations apply for tax-exempt status under sections other than 501(c)(3) of the Internal Revenue Code, they often use the IRS 1024 form. However, this is just one piece of the puzzle. To complete the application process successfully or manage tax-exempt operations, several other forms and documents may be needed. Here's a look at some of the most commonly required additional forms and documents.

- IRS Form 2848, Power of Attorney and Declaration of Representative: This form is used by organizations to authorize an individual, such as an attorney or accountant, to represent them before the IRS. It grants the representative the power to receive confidential information and make decisions on behalf of the organization.

- IRS Form 5768, Election/Revocation of Election by an Eligible Section 501(c)(4) Organization to Make Expenditures to Influence Legislation: This form is specifically for 501(c)(4) organizations that want to elect or revoke an election to make expenditures to influence legislation.

- IRS Form 8821, Tax Information Authorization: This form allows organizations to authorize individuals or entities to review their tax records. It's often used in conjunction with Form 2848 but doesn't grant power of attorney.

- IRS Form 990 Series: This series of forms is required for tax-exempt organizations to provide the IRS with annual financial information. The specific form used (e.g., 990, 990-EZ, 990-N) depends on the organization's size and type.

- Articles of Incorporation: Most organizations need to file articles of incorporation with their state's secretary of state to establish themselves as legal entities. This document outlines the organization's purpose, structure, and operational guidelines.

- Bylaws: Bylaws are internal documents that govern how an organization operates. They cover rules on meetings, elections of directors or officers, and other organizational procedures.

- Conflict of Interest Policy: This is a policy that outlines how an organization will handle conflicts of interest. The IRS often reviews this document to ensure that the organization has measures in place to identify and manage conflicts.

- Budgets and Financial Statements: During the application process, and often during annual filings, organizations may need to provide budgets or financial statements. These documents offer insights into the organization's financial health and operational efficiency.

Having the right documentation ready can streamline the application process for tax-exempt status and aid in maintaining compliance with IRS regulations. Each document plays a critical role in establishing the organization's credibility and accountability. Organizations should carefully complete and gather these documents, consulting with legal or tax professionals as needed to ensure accuracy and compliance.

Similar forms

The IRS Form 1024 is utilized by organizations seeking tax-exempt status under certain sections of the Internal Revenue Code other than 501(c)(3). This form bears similarities to the IRS Form 1023, which is designed specifically for charities, religious, educational, scientific, and literary organizations that seek exemption under section 501(c)(3). Both forms require detailed information about the organization's purpose, activities, governance, and financial structure to determine eligibility for tax-exempt status. However, they cater to different sections of non-profit entities.

Another document similar to the IRS Form 1024 is IRS Form 1024-A, specifically designed for 501(c)(4) organizations, such as civic leagues and social welfare organizations. Like Form 1024, Form 1024-A requires information on the organization's operations, finances, and compliance with special conditions relevant to their tax-exempt status. Both forms serve the purpose of establishing an organization's eligibility for tax exemption, albeit under different subsections.

Form 990, the Return of Organization Exempt from Income Tax, shares characteristics with Form 1024, as it is an annual reporting return that certain tax-exempt organizations must file with the IRS. It details the organization's income, expenses, and adherence to tax-exempt purposes. Although Form 990 is for ongoing compliance rather than obtaining tax-exempt status, both documents ensure that organizations fulfill IRS requirements for non-profit operations.

The IRS Form SS-4, Application for Employer Identification Number (EIN), while not directly for tax-exempt status, is a necessary step for most organizations before filing Form 1024. It requires basic information about the entity to secure an EIN, needed for tax filings and operational purposes. Organizations often must complete Form SS-4 as a prerequisite to applying for tax-exempt status with Form 1024, linking the documents in the preparation process.

Form 8940, Request for Miscellaneous Determination, also parallels Form 1024 in certain aspects. This form is used by tax-exempt organizations to request specific determinations from the IRS about their tax status, such as classification changes or confirmation of public charity status. While it is used post-exemption, it closely relates to Form 1024 in its aim to clarify or alter the organization's standing with the IRS based on its operational or financial changes.

The Application for Recognition of Exemption under Section 501(a) or Section 521 of the Internal Revenue Code, using a different, less common form, requires organizations to provide comprehensive details about their operations, financials, and organizational structure, akin to the requirements in Form 1024. This parallels the exhaustive disclosure necessary for the IRS to grant or recognize tax-exempt status, ensuring that only qualified entities benefit from such status.

Lastly, Form 8868, Application for Extension of Time to File an Exempt Organization Return, indirectly aligns with Form 1024 regarding timeline management for tax-exempt organizations. While Form 8868 is used to request more time to file the annual information returns (such as Form 990), it underscores the ongoing compliance effort required from organizations that were granted exemption, potentially through the Form 1024 process. This connection highlights the continuum of responsibility from exemption application to annual reporting.

Each of these documents, while serving distinct purposes, integrates into the broader schema of tax-exempt organization documentation and compliance. The relationship between Form 1024 and these various forms underscores the multifaceted process of attaining and maintaining tax-exempt status in the United States, emphasizing both initial qualification and ongoing adherence to IRS standards.

Dos and Don'ts

Filing the IRS Form 1024—Application for Recognition of Exemption under Section 501(a), can seem daunting. However, with careful attention and an understanding of what is expected, organizations can navigate this process more smoothly. Below are nine tips to help ensure that your application is accurately completed and efficiently processed.

- Do: Carefully read the instructions before beginning. The IRS provides detailed guidance that can answer many of your questions upfront and prevent common mistakes.

- Do: Ensure your organization's documents, like the Articles of Incorporation, are consistent with the 501(a) requirements. This alignment is crucial for proving that your organization meets the necessary exemption criteria.

- Do: Include a detailed description of your organization's activities. Clarity and specificity about what your organization does, and how it plans to do it, are key to the IRS's understanding and approval of your exemption status.

- Don't: Leave any sections incomplete. If a section does not apply, make sure to indicate this by writing "N/A" (not applicable). Incomplete forms can lead to delays or even rejection.

- Do: Provide accurate financial data. Accurately projecting your finances for the next few years demonstrates your organization's sustainability and fiscal responsibility.

- Do: Keep copies of everything you submit. Having a record of your submission can help in future discussions with the IRS or if your application is misplaced.

- Don't: Rush through the application. Mistakes can delay the processing of your form or affect your organization's ability to be approved for tax-exempt status.

- Don't: Hesitate to seek professional help. If certain sections of the form are confusing or if you're unsure about your organization's eligibility, consulting with a professional experienced in tax law or nonprofit status can be invaluable.

- Don't: Forget to sign and date the form. An unsigned application is incomplete and will be returned, delaying the exemption process.

Taking these steps seriously can make the difference between a straightforward approval process and unnecessary complications. Remember, the goal of the IRS Form 1024 is not just to gain tax-exempt status but to start your organization on strong legal and financial footing. Paying attention to these details from the start can save a lot of time and effort down the road.

Misconceptions

Filing for tax-exempt status is a significant step for many organizations. However, misunderstandings about the IRS 1024 form, which is used to apply for recognition of exemption under sections other than 501(c)(3) of the Internal Revenue Code, can complicate the process. Below are nine common misconceptions about this form, clarified to help you navigate your application more smoothly.

- All nonprofit organizations must file Form 1024. This is not true. While many organizations seeking tax-exempt status under sections other than 501(c)(3) use this form, it's not universally required. Some exemptions are automatically granted based on the organization's purpose and operations without needing to file.

- Form 1024 is only for 501(c)(4) organizations. In fact, Form 1024 is used by a variety of organizations to apply for exemption under different sections of the Internal Revenue Code, not just 501(c)(4).

- Approval is guaranteed upon submission. Submitting the form does not guarantee approval. The IRS reviews each application to ensure it meets the specific requirements for tax-exempt status under the relevant code section.

- The form is straightforward and quick to complete. Completing Form 1024 can be time-consuming and complex, requiring detailed information about the organization's structure, activities, and finances.

- Once granted, tax-exempt status is permanent. Not necessarily. Organizations must continue to operate in accordance with the IRS's requirements for their tax-exempt classification. Failure to do so can lead to the revocation of tax-exempt status.

- The filing fee is the same for all organizations. The filing fee varies depending on the organization's average annual gross receipts. Smaller organizations may pay a reduced fee.

- Form 1024 and Form 1023 are interchangeable. This is incorrect. Form 1023 is specifically for organizations seeking exemption under section 501(c)(3), while Form 1024 is for those applying under other sections.

- There's no deadline for filing Form 1024. While there's no specific deadline, it's beneficial to file within 27 months from the end of the month in which the organization was formed to ensure tax-exempt status is applied retroactively to the date of formation.

- Organizations can't operate until the IRS approves the Form 1024. Organizations can operate as tax-exempt from the date of formation if they apply for and ultimately receive tax-exempt status. However, there is a risk if the application is denied.

Clearing up these misconceptions is vital for any organization beginning the journey toward gaining tax-exempt status. Understanding the specifics of IRS Form 1024 can save time and ensure compliance with the stringent requirements set forth by the IRS.

Key takeaways

The IRS 1024 form is a crucial document for organizations seeking to apply for tax-exempt status under certain classifications. Understanding how to properly fill out and use this form can significantly influence the success of an organization's application. Here are seven key takeaways to guide you through this process:

- Determine Eligibility: Before starting the form, ensure your organization is eligible for the tax-exempt status under the sections the form covers. This includes various types of 501(c) organizations, excluding 501(c)(3) entities which use Form 1023.

- Complete All Required Sections: The form is comprehensive and requires detailed information about your organization, including its structure, activities, and financial data. Make sure to complete every section carefully to avoid delays or rejections.

- Provide a Detailed Narrative: Part of the form requires you to describe your organization's activities. This narrative should be detailed, clearly demonstrating how your activities align with the tax-exempt purposes defined by the IRS.

- Gather Necessary Attachments: Depending on your organization's activities, you may need to attach additional documents, such as financial statements or a bylaws copy. Check the form instructions to know what's required for your specific case.

- Review the User Fee: Filing Form 1024 involves a user fee that varies depending on the organization's size and type. Ensure you know the correct amount and include it with your submission to avoid processing delays.

- Consider Online Submission: While paper submissions are accepted, filing Form 1024 online through the IRS's website can expedite the processing time. The IRS encourages online submissions for faster feedback.

- Seek Professional Advice: If you're uncertain about any part of the form or the process, consider consulting with a tax professional or legal advisor who specializes in non-profit organizations. This can ensure your application is correctly completed and increase your chances of approval.

Filling out the IRS 1024 form is a significant step toward achieving tax-exempt status for your organization. Taking the time to understand and accurately complete this form can pave the way for a smoother application process and contribute to your organization's long-term success.

Popular PDF Documents

Federal Form 1310 - IRS Form 1310 is completed when someone is filing a tax return for someone who has passed away.

New Mexico Gross Receipts Tax - Ensure all updated information is accurate to avoid issues with your tax status.