Get IRS 1023-EZ Form

Embarking on the journey of establishing a nonprofit organization brings with it a maze of paperwork and legal requirements, with one of the most critical steps being the attainment of tax-exempt status from the Internal Revenue Service (IRS). At the heart of this process lies the IRS 1023-EZ form, a streamlined version of its lengthier counterpart, designed to simplify the road to tax exemption for smaller charities. Launched as an initiative to make the exemption process less daunting, the 1023-EZ form reduces the time and effort required by smaller entities seeking recognition as 501(c)(3) organizations. While it offers a quicker route to obtaining tax-exempt status, the form still necessitates a clear understanding of eligibility criteria, as not all organizations will qualify for this expedited process. Furthermore, the implications of the form's submissions, including potential limits on fundraising and the necessity for accurate financial disclosures, are pivotal aspects that applicants must navigate carefully. Despite these challenges, the 1023-EZ form represents a significant step forward in encouraging the growth of the nonprofit sector by easing the initial barriers to entry for many aspiring charities.

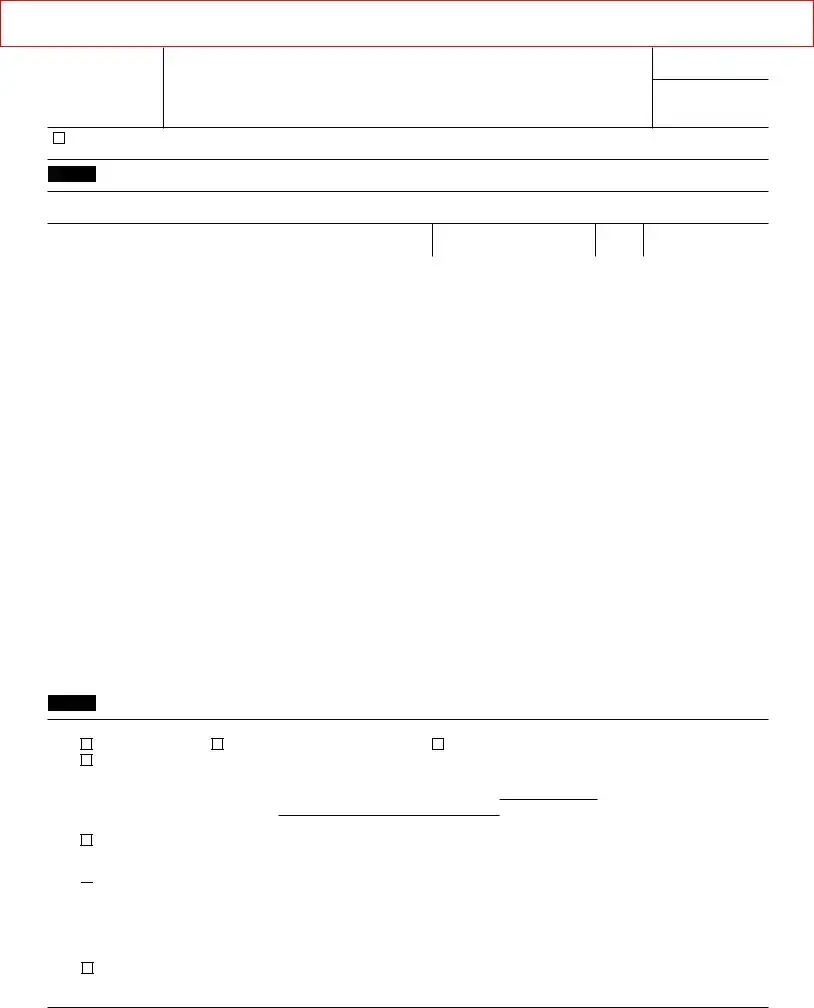

IRS 1023-EZ Example

You must complete the Form

Go to www.irs.gov/form1023ez for additional filing information.

Form

(June 2014)

Department of the Treasury Internal Revenue Service

Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

Do not enter social security numbers on this form as it may be made public.

Information about Form

OMB No.

Note: If exempt status is approved, this application will be open for public inspection.

Check this box to attest that you have completed the Form

Part I Identification of Applicant

1a Full Name of Organization

bAddress (number, street, and room/suite). If a P.O. box, see instructions.

cCity

dState

eZip Code + 4

2 |

Employer Identification Number |

3 Month Tax Year Ends (MM) |

4 Person to Contact if More Information is Needed |

|

|

|

|

|

|

5 |

Contact Telephone Number |

|

6 Fax Number (optional) |

7 User Fee Submitted |

|

|

|

|

|

8List the names, titles, and mailing addresses of your officers, directors, and/or trustees. (If you have more than five, see instructions.)

First Name: |

Last Name: |

Title: |

|

|

|

|

|

Street Address: |

City: |

State: |

Zip Code + 4: |

|

|

|

|

First Name: |

Last Name: |

Title: |

|

|

|

|

|

Street Address: |

City: |

State: |

Zip Code + 4: |

|

|

|

|

First Name: |

Last Name: |

Title: |

|

|

|

|

|

Street Address: |

City: |

State: |

Zip Code + 4: |

|

|

|

|

First Name: |

Last Name: |

Title: |

|

|

|

|

|

Street Address: |

City: |

State: |

Zip Code + 4: |

|

|

|

|

First Name: |

Last Nam : |

Title: |

|

|

|

|

|

Street Address: |

City: |

State: |

Zip Code + 4: |

|

|

|

|

9 a Organization's Website (if available): |

|

|

|

|

|

|

|

b Organization's Email (optional): |

|

|

|

|

|

|

|

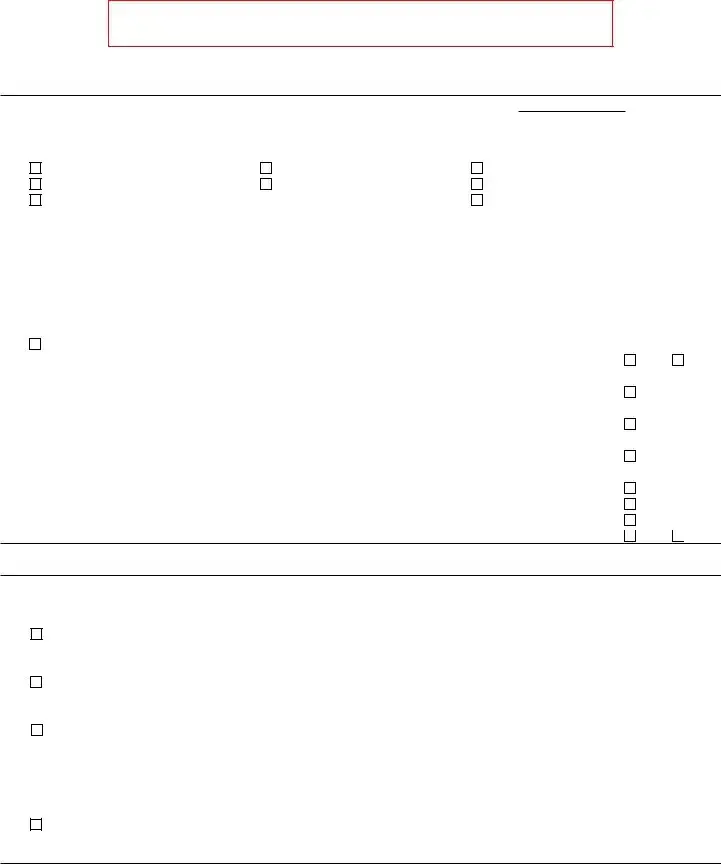

Part II Organizational Structure

1To file this form, you must be a corporation, an unincorporated association, or a trust. Check the box for the type of organization.

|

Corporation |

Unincorporated association |

Trust |

2 |

Check this box to attest that you have the organizing document necessary for the organizational structure indicated above. |

||

(See the instructions for an explanation of necessary organizing documents.)

3Date incorporated if a corporation, or formed if other than a corporation (MMDDYYYY):

4State of incorporation or other formation:

5Section 501(c)(3) requires that your organizing document must limit your purposes to one or more exempt purposes within section 501(c)(3).

Check this box to attest that your organizing document contains this limitation.

6Section 50 (c)(3) requires that your organizing document must not expressly empower you to engage, otherwise than as an insubstantial part of your activities, in activities that in themselves are not in furtherance of one or more exempt purposes.

Check this box to attest that your organizing document does not expressly empower you to engage, otherwise than as an insubstantial part of your activities, in activities that in themselves are not in furtherance of one or more exempt purposes.

Check this box to attest that your organizing document does not expressly empower you to engage, otherwise than as an insubstantial part of your activities, in activities that in themselves are not in furtherance of one or more exempt purposes.

7Section 501(c)(3) requires that your organizing document must provide that upon dissolution, your remaining assets be used exclusively for secti n 501(c)(3) exempt purposes. Depending on your entity type and the state in which you are formed, this requirement may be satisfied by

peration of state law.

Check this box to attest that your organizing document contains the dissolution provision required under section 501(c)(3) or that you do not need an express dissolution provision in your organizing document because you rely on the operation of state law in the state in which you are formed for your dissolution provision.

For Paperwork Reduction Act Notice, see the instructions. |

Catalog No. 66267N |

Form |

You must complete the Form

Go to www.irs.gov/form1023ez for additional filing information.

Form |

Page 2 |

Part III Your Specific Activities

1Enter the appropriate

2 To qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively to further one or more f the following purposes. By checking the box or boxes below, you attest that you are organized and operated exclusively to further the purp ses indicated. Check all that apply.

Charitable |

Religious |

Educational |

Scientific |

Literary |

Testing for public safety |

To foster national or international amateur sports competition |

Prevention of cruelty to children or animals |

|

3To qualify for exemption as a section 501(c)(3) organization, you must:

•Refrain from supporting or opposing candidates in political campaigns in any way.

•Ensure that your net earnings do not inure in whole or in part to the benefit of private shareholders or individuals (that is, board members, officers, key management employees, or other insiders).

•Not further

•Not be organized or operated for the primary purpose of conducting a trade or business that is not related to y ur exempt purpose(s).

• Not devote more than an insubstantial part of your activities attempting to influence legislation or, if ou made a section 501(h) election, not normally make expenditures in excess of expenditure limitations outlined in section 501(h).

•Not provide

Check this box to attest that you have not conducted and will not conduct activities that violate these prohibitions and restrictions.

4 |

Do you or will you attempt to influence legislation? |

|

Yes |

|

No |

|

(If yes, consider filing Form 5768. See the instructions for more details.) |

|

|

|

|

5 |

Do you or will you pay compensation to any of your officers, directors, or trustees? |

|

Yes |

|

No |

|

|

||||

|

(Refer to the instructions for a definition of compensation.) |

|

|

|

|

6 |

Do you or will you donate funds to or pay expenses for individual(s)? |

|

Yes |

|

No |

|

|

||||

7 |

Do you or will you conduct activities or provide grants or other assistance to individu l(s) or organization(s) outside the |

|

|

|

|

8 |

United States? |

|

Yes |

|

No |

Do you or will you engage in financial transactions (for example, loans, payme ts, rents, etc.) with any of your officers, |

|

|

|

|

|

|

directors, or trustees, or any entities they own or control? |

|

Yes |

|

No |

9 |

Do you or will you have unrelated business gross income of $1,000 or m e during a tax year? |

|

Yes |

|

No |

|

|

||||

10 |

Do you or will you operate bingo or other gaming activities? |

|

Yes |

|

No |

|

|

||||

11 |

Do you or will you provide disaster relief? |

|

Yes |

|

No |

Part IV is designed to classify you as an organization thatelectronicallyis either private foundation or a public charity. Public charity status is a more favorable tax status than private foundation status.

status is a more favorable tax status than private foundation status.

Part IV Foundation Classification

1 If you qualify for public charity status, check the appropriate box (1a – 1c below) and skip to Part V below.

a

Check this box to attest that you normally r c ive at least

b

Check this box to attest that you normally receive more than

c |

Check this box to attest that you are operated for the benefit of a college or university that is owned or operated by a governmental unit. |

|

Sections 509(a)(1) and 170(b)(1)(A)(iv). |

2If you are not described in items 1a – 1c above, you are a private foundation. As a private foundation, you are required by section 508(e) to have specific provisions in your organizing document, unless you rely on the operation of state law in the state in which you were formed to meet these requirements. These specific provisions require that you operate to avoid liability for private foundation excise taxes under sections

Check this box to attest that your organizing document contains the provisions required by section 508(e) or that your organizing document does not need to include the provisions required by section 508(e) because you rely on the operation of state law in your particular state to meet the requirements of section 508(e). (See the instructions for explanation of the section 508(e) requirements.)

Form

Form

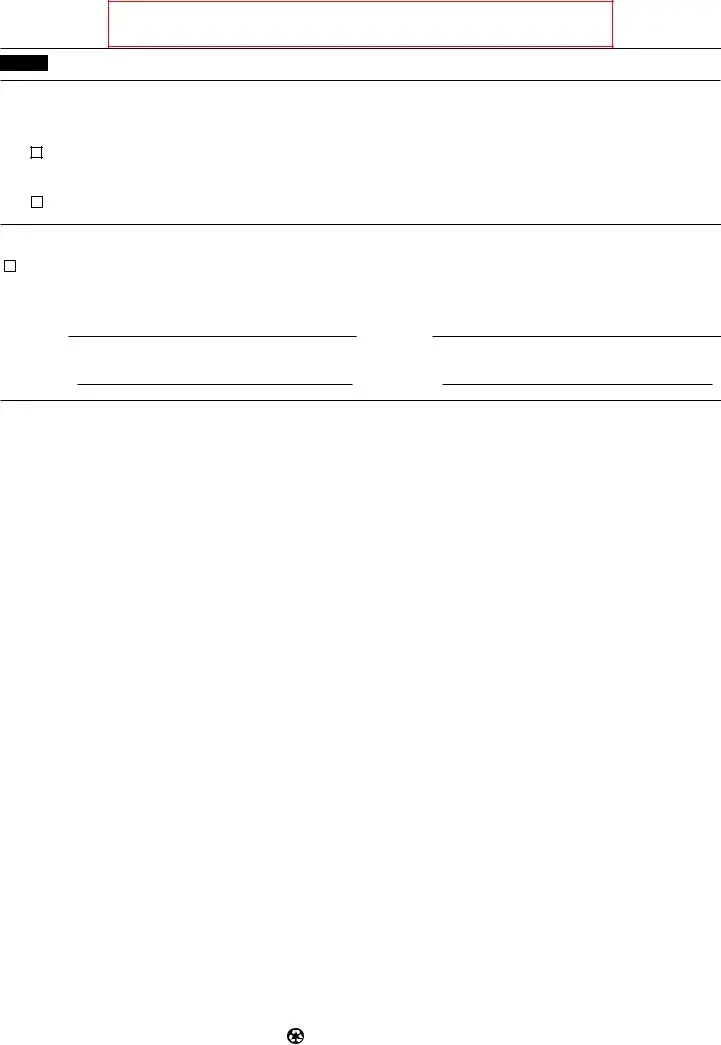

You must complete the Form

Go to www.irs.gov/form1023ez for additional filing information.

Page 3

Part V Reinstatement After Automatic Revocation

Complete this section only if you are applying for reinstatement of exemption after being automatically revoked for failure to file required annual returns or notices for three consecutive years, and you are applying for reinstatement under section 4 or 7 of Revenue Procedure

1

2

Check this box if you are seeking retroactive reinstatement under section 4 of Revenue Procedure

Check this box if you are seeking reinstatement under section 7 of Revenue Procedure

Part VI |

Signature |

|

|

I declare under the penalties of perjury that I am authorized to sign this application on behalf of the above organization and that I have examined this application, and to the best of my knowledge it is true, correct, and complete.

PLEASE SIGN HERE

(Type name of signer)

F(Signature of Officer, Director, Trustee, or other authorized official)

(Type title or authority of signer)

F(Date)

Form

Printed on recycled paper

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 1023-EZ | Designed for smaller organizations to apply for 501(c)(3) tax-exempt status more efficiently. |

| Eligibility Requirements | Organizations with gross receipts of $50,000 or less and assets of $250,000 or less. |

| Form Length | The form is significantly shorter and simpler than the standard Form 1023. |

| Filing Fee | There is a reduced filing fee compared to the standard Form 1023. |

| Processing Time | Applications are typically processed more quickly, often within 2-4 weeks. |

| Online Submission | The form must be submitted online through the IRS website. |

| Limitations | Not all types of organizations are eligible for 1023-EZ; it is important to review the eligibility checklist provided by the IRS. |

| Governing Law | Federal tax law governs the 1023-EZ form, as it is a federal IRS form for organizations seeking exemption under section 501(c)(3). |

Guide to Writing IRS 1023-EZ

Filling out the IRS 1023-EZ form is a crucial step for small tax-exempt organizations aiming to secure their status officially. This streamlined version is designed for eligible organizations seeking recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. It's designed to be simpler and less time-consuming than its longer counterpart, the standard Form 1023. The process can be straightforward if you follow the steps carefully. After completion, your organization moves closer to operating with a tax-exempt status, which can open many doors for funding and operational benefits.

- Begin by accessing the IRS website to download or fill out the form online, ensuring you have the most current version of the 1023-EZ.

- Gather all necessary documentation and information about your organization, including your EIN (Employer Identification Number), a concise statement of your purpose, and financial data.

- Complete the Eligibility Worksheet in the instructions to confirm that your organization qualifies for the 1023-EZ process. If your organization doesn't meet these criteria, you'll need to use the standard Form 1023.

- Fill in the contact information for your organization, including the legal name, mailing address, and website URL if available.

- Provide details about your organization's structure, such as the date of incorporation and the state in which you are incorporated.

- Answer questions related to your specific organizational activities, revenue, and assets. This includes certifying that your projected annual gross receipts will not exceed $50,000 in any of the next 3 years and that your assets are not valued at more than $250,000.

- Read through the attestations section carefully and certify that your organization meets all the conditions listed by signing and dating the form.

- Pay the required fee, which can be submitted electronically through the Pay.gov website. This fee must be paid for your application to be processed.

- Review your form thoroughly to ensure all information is accurate and complete. Incorrect or missing information can delay the process.

- Submit the form electronically through the IRS website. Keep a copy of the completed form and any confirmation or receipt for your records.

Once submitted, the IRS will review your 1023-EZ. The review process can take a few weeks, but once approved, you will receive a letter of determination confirming your tax-exempt status. This letter is crucial for your records and future operations, as it validates your nonprofit's tax-exempt status to donors, grant agencies, and other stakeholders. Congratulations on taking a significant step toward supporting your organization's mission with this tax-exempt status!

Understanding IRS 1023-EZ

-

What is the IRS 1023-EZ form?

The IRS 1023-EZ form, known as the Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is a simplified application used by certain smaller charities seeking tax-exempt status. It is designed to make it easier and faster for small organizations to apply for and receive recognition of their tax-exempt status.

-

Who is eligible to file the IRS 1023-EZ form?

Not all organizations are eligible to file the 1023-EZ form. This form is specifically intended for smaller organizations with gross receipts of $50,000 or less and total assets of $250,000 or less. Additionally, certain types of organizations, such as churches, schools, and hospitals, are not eligible to use this simplified form regardless of size. Organizations should carefully review the eligibility requirements detailed in the form's instructions to determine if they can apply using the 1023-EZ.

-

How does an organization apply for tax-exempt status with the 1023-EZ form?

Organizations that meet the eligibility criteria can apply for tax-exempt status using the 1023-EZ form by submitting their application through the IRS's electronic filing system. The application process involves creating an account in the IRS system, completing the 1023-EZ form by answering a series of questions, and submitting the form along with the appropriate filing fee. It is critical that organizations answer all questions truthfully and accurately to avoid delays or denials.

-

What are the advantages of using the IRS 1023-EZ form?

Reduced paperwork: The 1023-EZ form is significantly shorter and less complex than the standard 1023 form, making it less burdensome for small charities.

Lower filing fee: The cost to file the 1023-EZ is lower than the fee required for the standard 1023 form.

Quicker processing times: The streamlined nature of the form typically results in faster processing by the IRS, allowing organizations to obtain their tax-exempt status more quickly.

-

What is the filing fee for the IRS 1023-EZ form?

The filing fee for the IRS 1023-EZ form is subject to change and should be verified on the IRS website or in the form's instructions. Generally, the fee is significantly less than that required for the full 1023 form. It's important for organizations to ensure they have the most current information before submitting their application.

-

How long does it take to receive a determination after filing the 1023-EZ?

The time it takes to receive a determination after submitting the 1023-EZ can vary. Generally, organizations may receive a response within a few weeks to a few months. This timeframe is typically quicker than the processing time for the standard 1023 form, but it can be affected by the completeness of the application, the current workload of the IRS, and whether additional information is required.

Common mistakes

When seeking recognition of tax-exempt status under Section 501(c)(3) of the Internal Revenue Code, many organizations opt to file the IRS Form 1023-EZ. This streamlined form is designed for certain smaller charities to simplify the application process. However, errors in completing this form can lead to delays or rejection. Here are four common mistakes to avoid:

- Not verifying eligibility before applying. One frequent oversight is the failure to ensure that an organization meets all the criteria for using Form 1023-EZ instead of the full Form 1023. The IRS provides a checklist to help organizations determine if they are eligible to use the streamlined form. Skipping this step can lead to the rejection of an application, costing time and resources.

- Incorrect financial information. Accuracy is crucial when providing financial details. Organizations often make errors by underestimating or overestimating their assets or revenue. These discrepancies can raise red flags for the IRS, leading to further scrutiny or a request for additional documentation, which can significantly slow down the approval process.

- Failing to accurately describe the organization’s activities. The form requires a concise description of the organization's mission and activities. A common mistake is not providing enough detail or clarity about how the activities further charitable, educational, religious, or scientific purposes. Vague or incomplete descriptions can result in the IRS requesting more information or clarification, delaying the exemption process.

- Overlooking the necessity for an EIN before applying. Every organization must have an Employer Identification Number (EIN) to apply for 501(c)(3) status, regardless of whether it has employees. Organizations sometimes neglect to obtain an EIN or use an incorrect number, such as a personal Social Security Number. This mistake can lead to the application being rejected or delayed until the correct information is provided.

Avoiding these common errors can streamline the process of applying for 501(c)(3) status, helping organizations more quickly achieve their mission of serving the community. Always double-check eligibility, provide accurate and detailed financial and activity descriptions, and ensure that all necessary identification numbers are correct and specific to the organization.

Documents used along the form

When applying for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code, organizations often use the Internal Revenue Service (IRS) Form 1023-EZ. This streamlined version of the original Form 1023 simplifies the application process for smaller organizations. However, navigating through this process usually involves more than just completing Form 1023-EZ. Several other forms and documents are commonly used, each serving a unique purpose in ensuring an organization's compliance and eligibility for tax-exempt status. Understanding these additional requirements is essential for a smooth and successful application process.

- Articles of Incorporation: This critical document is filed with the state government to legally establish an entity. It includes essential details such as the organization's name, purpose, office address, and information regarding its board of directors. While not a federal IRS document, it's required by many states and provides fundamental information necessary for the 1023-EZ application.

- Bylaws: Bylaws outline the rules and procedures that govern an organization's internal operations. They describe how decisions are made, how officers and board members are chosen, and the frequency of meetings. Though not submitted with Form 1023-EZ, having them is a prerequisite for establishing a solid organizational structure deemed necessary by the IRS for exemption.

- Employer Identification Number (EIN) Confirmation Letter: After an organization obtains its EIN—also known as a Federal Tax Identification Number—from the IRS, it receives a confirmation letter. This document is essential for tax administration purposes and must be referenced or included in the Form 1023-EZ submission.

- Conflict of Interest Policy: A Conflict of Interest Policy is vital for maintaining transparency and ethical operations. It outlines procedures to address situations where a board member’s personal or financial interests might conflict with those of the organization. While submitting this document isn’t strictly necessary with Form 1023-EZ, having it in place is considered good practice and reinforces the integrity of the application.

Successfully applying for 501(c)(3) status involves meticulous preparation and an understanding of all required documents, beyond just the Form 1023-EZ. Organizations are encouraged to gather and prepare these documents carefully to ensure their application is strong and compliant. Seeking expert advice or assistance can also be beneficial in navigating this complex process. Ultimately, being thorough and well-prepared will pave the way for a smoother journey toward achieving tax-exempt status.

Similar forms

The IRS 1023-EZ form, a streamlined application for recognizing an organization as tax-exempt under section 501(c)(3) of the Internal Revenue Code, shares similarities with several other documents across different domains. It simplifies the process for small nonprofits, but this notion of streamlining complex applications can be seen in other areas too.

One document similar to the IRS 1023-EZ form is the IRS Form 1040-EZ, which is used for individuals to file their federal income taxes in a simplified manner. Like the 1023-EZ, the 1040-EZ is designed for a specific subset of users who meet certain criteria, aimed at making the tax filing process quicker and less complicated by requiring less information than the standard 1040 form.

The U.S. Small Business Administration's (SBA) Disaster Loan Application also mirrors the IRS 1023-EZ form in its intent to streamline the application process for those in need. Specifically designed for businesses, homeowners, and renters affected by natural disasters, this form facilitates access to financial assistance by simplifying the requirements and steps needed to apply.

The Form I-90, used for renewing or replacing a Green Card, presents another parallel. This form simplifies the process for permanent residents to maintain their status, focusing on efficiently collecting essential information. The streamlined nature of the Form I-90 for a specific target audience closely aligns with the 1023-EZ’s approach to tax-exemption applications.

In the realm of healthcare, the Healthcare Marketplace Application for individuals seeking health insurance offers simplified options much like the 1023-EZ. The Marketplace Application is designed to ease the process of obtaining healthcare coverage by guiding applicants through a tailored path based on their specific circumstances and needs.

The Common Application for college admissions streamlines the process of applying to multiple institutions of higher learning through one platform. Similar to the 1023-EZ, it collects a wide range of information pertinent to its purpose but simplifies submission to various organizations, in this case, colleges and universities.

Another equivalent document is the Electronic System for Travel Authorization (ESTA) application, which simplifies the process for international travelers seeking entry into the United States under the Visa Waiver Program. By providing a shortened form with fewer requirements than a visa application, ESTA makes it quicker and more straightforward for eligible travelers to gain permission to travel to the U.S.

The Simplified Employee Pension (SEP) plan IRS Form 5305-SEP is designed to make it easier for small businesses to set up retirement plans for their employees. Much like the 1023-EZ, this form seeks to remove barriers for certain groups - in this case, small employers - by streamlining the setup process and making it more accessible.

Lastly, the FCC Form 605, Quick-Form Application for Authorization in the Ship, Aircraft, Amateur, Restricted and Commercial Operator, and General Mobile Radio Services, simplifies the licensing process for various communications services. It directly aligns with the 1023-EZ’s philosophy of making governmental processes more accessible, this time in the context of communications licensing.

These documents, each from distinct areas of government and public service, lean on the principle of streamlining complex procedures for specific groups. They offer a simpler, quicker path through bureaucratic processes, mirroring the intention behind the IRS 1023-EZ form’s design to facilitate tax-exempt status applications for eligible small entities.

Dos and Don'ts

Navigating through the IRS 1023-EZ form, the streamlined application for recognizing your organization as a tax-exempt entity, can seem like a daunting task. However, with a little guidance, the process can be smooth sailing. Here are do’s and don’ts to consider that will help ensure your form is complete and your application is successful.

Do's

- Ensure eligibility. Before diving into the paperwork, verify that your organization truly qualifies for tax-exempt status under Section 501(c)(3). The IRS provides clear guidelines on who is eligible to file the 1023-EZ form.

- Have your EIN ready. Your Employer Identification Number (EIN) is crucial for the application. Make sure your organization has one before starting the form. If you don’t have an EIN, you can apply for one online through the IRS website.

- Be concise yet thorough in your description. When explaining your organization's purpose, ensure your description is clear and succinct. This will help the IRS understand your operations and the basis for your tax-exempt status.

- Review the instructions. The IRS provides detailed instructions for the 1023-EZ form. Review them carefully to ensure you understand each section before filling it out.

- Double-check your information. Before submitting, review your application for any errors or omissions. Incorrect or missing information can delay the processing of your form.

- Keep a copy for your records. After you've submitted the form, make sure to keep a copy for your organization's records. It's important to have your submission on file should any questions arise in the future.

Don'ts

- Don’t rush through the form. Take your time to accurately complete each section. Rushing can lead to mistakes that might delay your application or impact your organization's tax-exempt status.

- Don’t guess on details. If you’re unsure about a question, it’s better to research the answer or seek guidance than to guess. Incorrect information can lead to complications with your status.

- Avoid using vague language. Be as specific as possible in your descriptions. Vague or unclear language can make it difficult for the IRS to determine your eligibility.

- Don’t forget to sign the form. An unsigned form is incomplete and will not be processed. Make sure the authorized individual signs the form before submission.

- Don’t overlook the filing fee. There is a fee associated with filing the 1023-EZ. Ensure that your payment information is included and correct to avoid delays.

- Avoid submitting outdated information. If any of your organization’s details have changed since you first decided to apply, make sure the application reflects the most current information.

By keeping these pointers in mind, you can navigate the process of filing the IRS 1023-EZ form with confidence and accuracy, paving the way for your organization’s successful recognition as a tax-exempt entity.

Misconceptions

The IRS 1023-EZ form is designed to simplify the process for small organizations seeking tax-exempt status under Section 501(c)(3). Despite its intention to make the application process more efficient, there are several misconceptions surrounding it. Understanding these misconceptions can help organizations navigate the process more effectively.

All nonprofits can use the 1023-EZ form. This is not the case. The 1023-EZ form is specifically for smaller organizations. These organizations must meet certain criteria, such as expecting to have gross receipts of $50,000 or less in each of the next three years and assets totaling $250,000 or less.

The 1023-EZ process doesn't require detailed information about the organization. While the form is indeed streamlined, it still requires accurate and detailed information about the organization's structure, activities, and finances. Omitting or inaccurately reporting this information can lead to application delays or rejections.

Approval is guaranteed. Even with the simplified form, approval of tax-exempt status is not guaranteed. The IRS reviews each submission for compliance with tax-exempt criteria. Organizations must meet all the requirements to gain approval.

Approval times are always short. While the 1023-EZ process is faster than the standard 1023 application, processing times can vary widely depending on the IRS's current workload and the specifics of the application. Some applications may experience delays.

There's no need to keep detailed records once approved. Even after gaining tax-exempt status, organizations must maintain meticulous records. These records support ongoing compliance with IRS regulations and are essential for annual reporting requirements.

Using the 1023-EZ form limits an organization's credibility. Choosing to file the 1023-EZ form does not affect an organization's credibility. What matters most is adherence to nonprofit best practices, transparency, and commitment to the organization's mission.

Key takeaways

The IRS 1023-EZ form is a streamlined version of the longer IRS 1023 form, designed to make it easier for smaller organizations to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Understanding the key aspects of filling out and using this form can simplify the application process. Below are four essential takeaways for organizations considering utilizing the IRS 1023-EZ form.

- Eligibility Requirements: Not all organizations are eligible to use the IRS 1023-EZ form. To qualify, an organization must have gross receipts of $50,000 or less in each of the next 3 years and assets that do not exceed $250,000. It is crucial to review the eligibility checklist provided in the form's instructions to ensure compliance and proper use of the form.

- Online Submission: The IRS 1023-EZ form must be submitted online through the IRS website. This online process is designed to expedite the review and approval process. Before submitting, organizations should carefully review their application to ensure it is complete and accurate to avoid delays.

- Required Fee: An application fee is required when submitting the IRS 1023-EZ form. This fee is non-refundable, making it critical for organizations to ensure they meet all eligibility criteria before applying. The current fee can be found on the IRS website, as it is subject to change.

- Streamlined Approval Process: Organizations using the IRS 1023-EZ form typically experience a faster approval process compared to the standard IRS 1023 form. While this is a significant advantage, organizations should still be prepared for possible inquiries from the IRS and respond promptly to any requests for additional information.

Proper completion and submission of the IRS 1023-EZ form can significantly ease the path to obtaining tax-exempt status for eligible organizations. By adhering to the guidelines and preparing the necessary documentation in advance, organizations can navigate the application process more smoothly.

Popular PDF Documents

IRS 6781 - It enables taxpayers to transparently report financial market activities, fostering a straightforward relationship with tax authorities.

4506-t Vs 4506-c - It’s a non-invasive method for third parties to verify income without needing to see detailed financial statements or returns.