Get IRS 1023 Form

Embarking on the journey of establishing a nonprofit organization is both exhilarating and formidable, not least because it paves the way to make a meaningful impact in communities and sectors in need of advocacy and support. A crucial step in this journey involves the daunting task of navigating the tax-exempt status application process with the IRS, specifically through the IRS Form 1023. This form serves as a comprehensive application that organizations must file to obtain 501(c)(3) status, which, once approved, not only exempts the organization from federal income tax but also opens the door to receiving tax-deductible charitable contributions. The IRS scrutinizes these applications thoroughly, requiring detailed information about the organization's structure, governance, financial projections, and the nature of its charitable activities. The complexity of the form can often be a hurdle for many, highlighting the importance of approaching it with a detailed and informed strategy. Securing 501(c)(3) status is a monumental achievement for any nonprofit, unlocking numerous benefits that facilitate its mission towards social good.

IRS 1023 Example

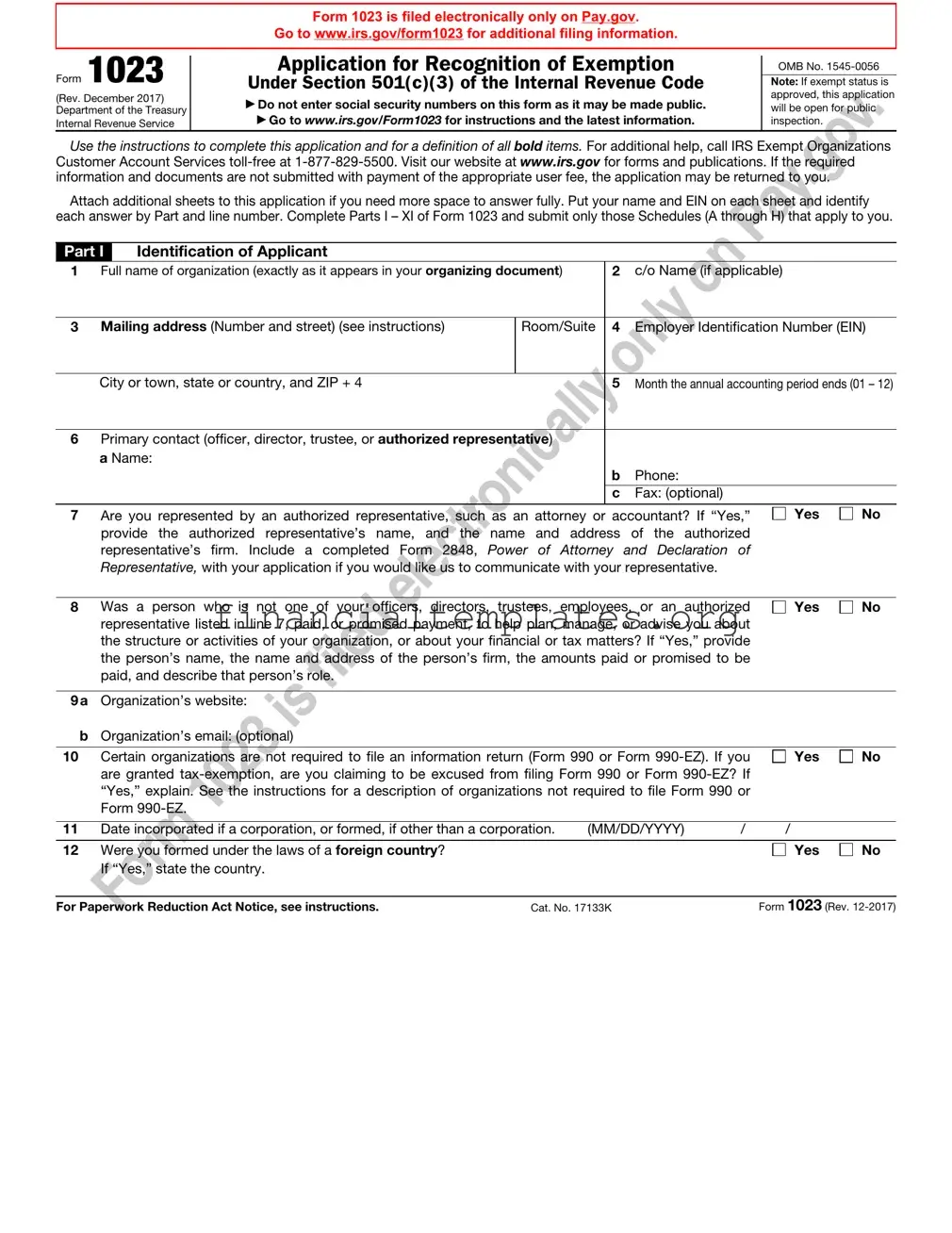

Form 1023 is filed electronically only on Pay.gov.

Go to www.irs.gov/form1023 for additional filing information.

Form 1023

(Rev. December 2017)

Department of the Treasury

Internal Revenue Service

Application for Recognition of Exemption

Under Section 501(c)(3) of the Internal Revenue Code

▶Do not enter social security numbers on this form as it may be made public. ▶ Go to www.irs.gov/Form1023 for instructions and the latest information.

OMB No.

Note: If exempt status is approved, this application will be open for public inspection.

Use the instructions to complete this application and for a definition of all bold items. For additional help, call IRS Exempt Organizations Customer Account Services

Attach additional sheets to this application if you need more space to answer fully. Put your name and EIN on each sheet and identify each answer by Part and line number. Complete Parts I – XI of Form 1023 and submit only those Schedules (A through H) that apply to you.

Part I |

Identification of Applicant |

|

|

|

|

1 |

Full name of organization (exactly as it appears in your organizing document) |

2 |

c/o Name (if applicable) |

||

|

|

|

|

|

|

3 |

Mailing address (Number and street) (see instructions) |

Room/Suite |

4 |

Employer Identification Number (EIN) |

|

|

|

|

|

|

|

|

City or town, state or country, and ZIP + 4 |

|

5 |

Month the annual accounting period ends (01 – 12) |

|

|

|

|

|

||

6 |

Primary contact (officer, director, trustee, or authorized representative) |

|

|

||

|

a Name: |

|

|

|

|

|

|

|

|

b |

Phone: |

|

|

|

|

|

|

|

|

|

|

c |

Fax: (optional) |

7Are you represented by an authorized representative, such as an attorney or accountant? If “Yes,” provide the authorized representative’s name, and the name and address of the authorized representative’s firm. Include a completed Form 2848, Power of Attorney and Declaration of Representative, with your application if you would like us to communicate with your representative.

Yes

No

8Was a person who is not one of your officers, directors, trustees, employees, or an authorized representative listed in line 7, paid, or promised payment, to help plan, manage, or advise you about the structure or activities of your organization, or about your financial or tax matters? If “Yes,” provide the person’s name, the name and address of the person’s firm, the amounts paid or promised to be paid, and describe that person’s role.

Yes

No

9a Organization’s website:

bOrganization’s email: (optional)

10Certain organizations are not required to file an information return (Form 990 or Form

Yes

No

11 |

Date incorporated if a corporation, or formed, if other than a corporation. |

(MM/DD/YYYY) |

/ |

/ |

|

|

12 |

Were you formed under the laws of a foreign country? |

|

|

|

Yes |

No |

|

If “Yes,” state the country. |

|

|

|

|

|

|

|

|

|

|||

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 17133K |

|

Form 1023 (Rev. |

|||

Form 1023 (Rev. |

Name: |

EIN: |

Page 2 |

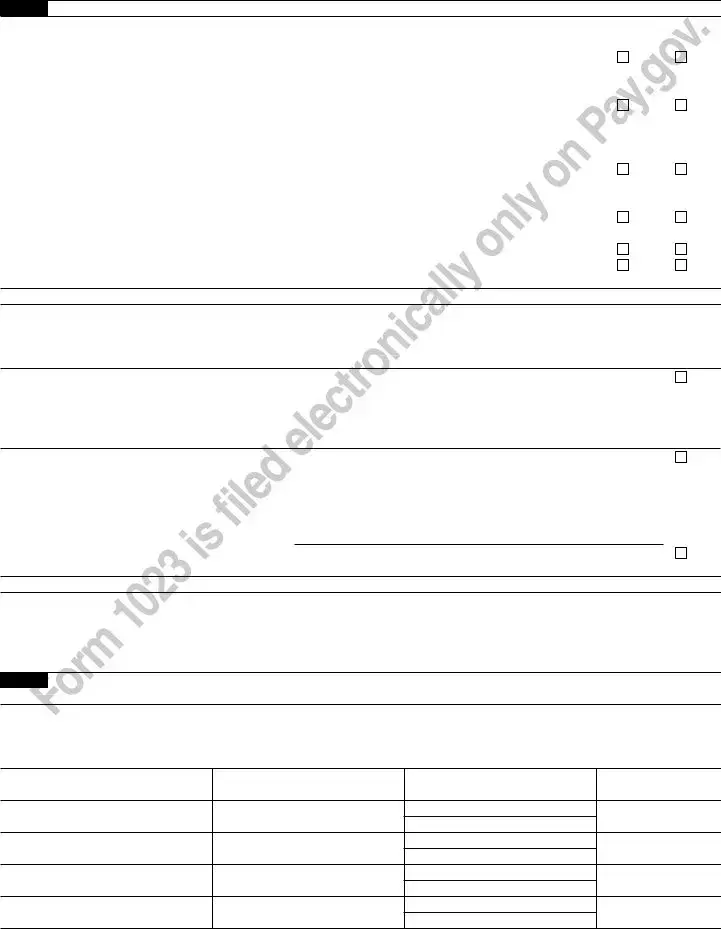

Part II Organizational Structure

You must be a corporation (including a limited liability company), an unincorporated association, or a trust to be tax exempt.

See instructions. DO NOT file this form unless you can check “Yes” on lines 1, 2, 3, or 4.

1 |

Are you a corporation? If “Yes,” attach a copy of your articles of incorporation showing certification of |

Yes |

No |

|

|

|

filing with the appropriate state agency. Include copies of any amendments to your articles and be sure |

|

|

|

|

they also show state filing certification. |

|

|

|

|

|

|

|

2 |

Are you a limited liability company (LLC)? If “Yes,” attach a copy of your articles of organization showing |

Yes |

No |

|

|

|

certification of filing with the appropriate state agency. Also, if you adopted an operating agreement, attach |

|

|

|

|

a copy. Include copies of any amendments to your articles and be sure they show state filing certification. |

|

|

|

|

Refer to the instructions for circumstances when an LLC should not file its own exemption application. |

|

|

|

|

|

|

|

3 |

Are you an unincorporated association? If “Yes,” attach a copy of your articles of association, |

Yes |

No |

|

|

|

constitution, or other similar organizing document that is dated and includes at least two signatures. |

|

|

|

|

Include signed and dated copies of any amendments. |

|

|

|

|

|

|

|

|

4a |

Are you a trust? If “Yes,” attach a signed and dated copy of your trust agreement. Include signed and |

Yes |

No |

|

|

dated copies of any amendments. |

|

|

|

b |

Have you been funded? If “No,” explain how you are formed without anything of value placed in trust. |

Yes |

No |

|

5 |

Have you adopted bylaws? If “Yes,” attach a current copy showing date of adoption. If “No,” explain |

Yes |

No |

|

|

how your officers, directors, or trustees are selected. |

|

|

Part III Required Provisions in Your Organizing Document

The following questions are designed to ensure that when you file this application, your organizing document contains the required provisions to meet the organizational test under section 501(c)(3). Unless you can check the boxes in both lines 1 and 2, your organizing document does not meet the organizational test. DO NOT file this application until you have amended your organizing document. Submit your original and amended organizing documents (showing state filing certification if you are a corporation or an LLC) with your application.

1Section 501(c)(3) requires that your organizing document state your exempt purpose(s), such as charitable, religious, educational, and/or scientific purposes. Check the box to confirm that your organizing document meets this requirement. Describe specifically where your organizing document meets this requirement, such as a reference to a particular article or section in your organizing document. Refer to the instructions for exempt purpose language.

Location of Purpose Clause (Page, Article, and Paragraph):

2 a Section 501(c)(3) requires that upon dissolution of your organization, your remaining assets must be used exclusively for exempt purposes, such as charitable, religious, educational, and/or scientific purposes. Check the box on line 2a to confirm that your organizing document meets this requirement by express provision for the distribution of assets upon dissolution. If you rely on state law for your dissolution provision, do not check the box on line 2a and go to line 2c.

bIf you checked the box on line 2a, specify the location of your dissolution clause (Page, Article, and Paragraph). Do not complete line 2c if you checked box 2a.

c See the instructions for information about the operation of state law in your particular state. Check this box if you rely on operation of state law for your dissolution provision and indicate the state:

Part IV |

Narrative Description of Your Activities |

Using an attachment, describe your past, present, and planned activities in a narrative. If you believe that you have already provided some of this information in response to other parts of this application, you may summarize that information here and refer to the specific parts of the application for supporting details. You may also attach representative copies of newsletters, brochures, or similar documents for supporting details to this narrative. Remember that if this application is approved, it will be open for public inspection. Therefore, your narrative description of activities should be thorough and accurate. Refer to the instructions for information that must be included in your description.

Part V Compensation and Other Financial Arrangements With Your Officers, Directors, Trustees, Employees, and Independent Contractors

1a List the names, titles, and mailing addresses of all of your officers, directors, and trustees. For each person listed, state their total annual compensation, or proposed compensation, for all services to the organization, whether as an officer, employee, or other position. Use actual figures, if available. Enter “none” if no compensation is or will be paid. If additional space is needed, attach a separate sheet. Refer to the instructions for information on what to include as compensation.

Name

Title

Mailing address

Compensation amount (annual actual or estimated)

Form 1023 (Rev.

Form 1023 (Rev. |

Name: |

EIN: |

Page 3 |

|

Part V |

Compensation and Other Financial Arrangements With Your Officers, Directors, Trustees, Employees, |

|||

|

and Independent Contractors (Continued) |

|

|

|

bList the names, titles, and mailing addresses of each of your five highest compensated employees who receive or will receive compensation of more than $50,000 per year. Use the actual figure, if available. Refer to the instructions for information on what to include as compensation. Do not include officers, directors, or trustees listed in line 1a.

Name

Title

Mailing address

Compensation amount (annual actual or estimated)

cList the names, names of businesses, and mailing addresses of your five highest compensated independent contractors that receive or will receive compensation of more than $50,000 per year. Use the actual figure, if available. Refer to the instructions for information on what to include as compensation.

Name

Title

Mailing address

Compensation amount (annual actual or estimated)

The following “Yes” or “No” questions relate to past, present, or planned relationships, transactions, or agreements with your officers, directors, trustees, highest compensated employees, and highest compensated independent contractors listed in lines 1a, 1b, and 1c.

2a |

Are any of your officers, directors, or trustees related to each other through family or business |

Yes |

No |

|

relationships? If “Yes,” identify the individuals and explain the relationship. |

|

|

b |

Do you have a business relationship with any of your officers, directors, or trustees other than through |

Yes |

No |

|

their position as an officer, director, or trustee? If “Yes,” identify the individuals and describe the business |

|

|

|

relationship with each of your officers, directors, or trustees. |

|

|

c |

Are any of your officers, directors, or trustees related to your highest compensated employees or highest |

Yes |

No |

|

compensated independent contractors listed on lines 1b or 1c through family or business relationships? If |

|

|

|

“Yes,” identify the individuals and explain the relationship. |

|

|

|

|

|

|

3 a |

For each of your officers, directors, trustees, highest compensated employees, and highest |

|

|

|

compensated independent contractors listed on lines 1a, 1b, or 1c, attach a list showing their name, |

|

|

|

qualifications, average hours worked, and duties. |

|

|

b |

Do any of your officers, directors, trustees, highest compensated employees, and highest compensated |

Yes |

No |

|

independent contractors listed on lines 1a, 1b, or 1c receive compensation from any other organizations, |

|

|

|

whether tax exempt or taxable, that are related to you through common control? If “Yes,” identify the |

|

|

|

individuals, explain the relationship between you and the other organization, and describe the |

|

|

|

compensation arrangement. |

|

|

4In establishing the compensation for your officers, directors, trustees, highest compensated employees, and highest compensated independent contractors listed on lines 1a, 1b, and 1c, the following practices are recommended, although they are not required to obtain exemption. Answer “Yes” to all the practices you use.

a |

Do you or will the individuals that approve compensation arrangements follow a conflict of interest policy? |

Yes |

No |

b |

Do you or will you approve compensation arrangements in advance of paying compensation? |

Yes |

No |

c |

Do you or will you document in writing the date and terms of approved compensation arrangements? |

Yes |

No |

Form 1023 (Rev.

Form 1023 (Rev. |

Name: |

EIN: |

Page 4 |

|

Part V |

Compensation and Other Financial Arrangements With Your Officers, Directors, Trustees, Employees, |

|||

|

and Independent Contractors (Continued) |

|

|

|

dDo you or will you record in writing the decision made by each individual who decided or voted on compensation arrangements?

eDo you or will you approve compensation arrangements based on information about compensation paid by similarly situated taxable or

Yes |

No |

Yes |

No |

f Do you or will you record in writing both the information on which you relied to base your decision and its |

Yes |

No |

source? |

|

|

gIf you answered “No” to any item on lines 4a through 4f, describe how you set compensation that is reasonable for your officers, directors, trustees, highest compensated employees, and highest compensated independent contractors listed in Part V, lines 1a, 1b, and 1c.

5a Have you adopted a conflict of interest policy consistent with the sample conflict of interest policy in |

Yes |

No |

Appendix A to the instructions? If “Yes,” provide a copy of the policy and explain how the policy has |

|

|

been adopted, such as by resolution of your governing board. If “No,” answer lines 5b and 5c. |

|

|

bWhat procedures will you follow to assure that persons who have a conflict of interest will not have influence over you for setting their own compensation?

cWhat procedures will you follow to assure that persons who have a conflict of interest will not have influence over you regarding business deals with themselves?

Note: A conflict of interest policy is recommended though it is not required to obtain exemption. Hospitals, see Schedule C, Section I, line 14.

6a |

Do you or will you compensate any of your officers, directors, trustees, highest compensated employees, and highest |

Yes |

No |

|

compensated independent contractors listed in lines 1a, 1b, or 1c through |

|

|

|

bonuses or |

|

|

|

amounts are determined, who is eligible for such arrangements, whether you place a limitation on total compensation, |

|

|

|

and how you determine or will determine that you pay no more than reasonable compensation for services. Refer to |

|

|

|

the instructions for Part V, lines 1a, 1b, and 1c, for information on what to include as compensation. |

|

|

b |

Do you or will you compensate any of your employees, other than your officers, directors, trustees, or your |

Yes |

No |

|

five highest compensated employees who receive or will receive compensation of more than $50,000 per |

|

|

|

year, through |

|

|

|

describe all |

|

|

|

is or will be eligible for such arrangements, whether you place or will place a limitation on total compensation, |

|

|

|

and how you determine or will determine that you pay no more than reasonable compensation for services. |

|

|

|

Refer to the instructions for Part V, lines 1a, 1b, and 1c, for information on what to include as compensation. |

|

|

|

|

|

|

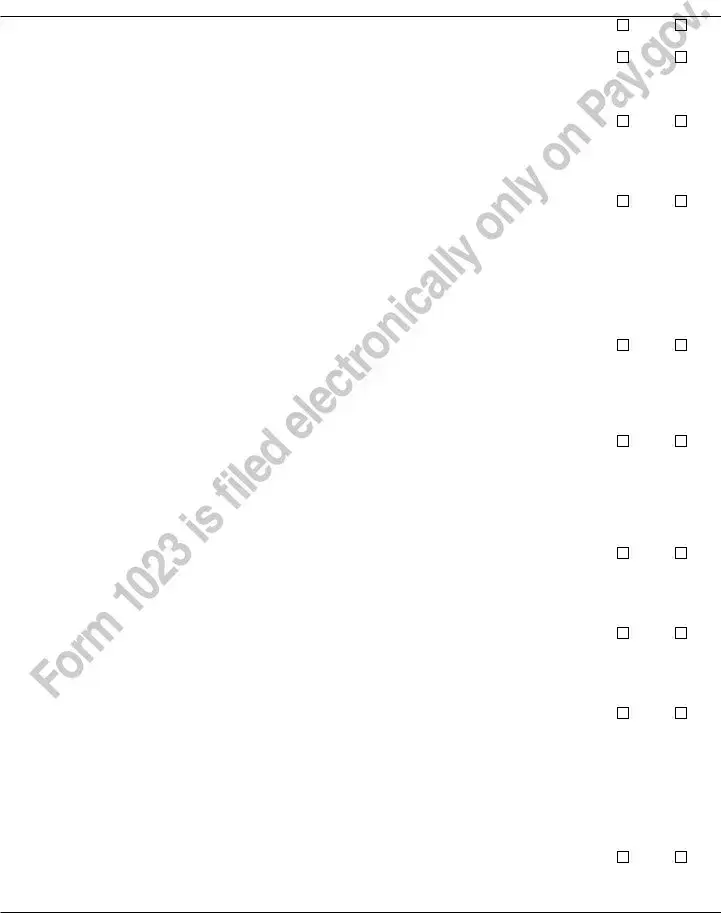

7a |

Do you or will you purchase any goods, services, or assets from any of your officers, directors, trustees, highest |

Yes |

No |

|

compensated employees, or highest compensated independent contractors listed in lines 1a, 1b, or 1c? If “Yes,” |

|

|

|

describe any such purchase that you made or intend to make, from whom you make or will make such purchases, how |

|

|

|

the terms are or will be negotiated at arm’s length, and explain how you determine or will determine that you pay no |

|

|

|

more than fair market value. Attach copies of any written contracts or other agreements relating to such purchases. |

|

|

b |

Do you or will you sell any goods, services, or assets to any of your officers, directors, trustees, highest |

Yes |

No |

|

compensated employees, or highest compensated independent contractors listed in lines 1a, 1b, or 1c? If “Yes,” |

|

|

|

describe any such sales that you made or intend to make, to whom you make or will make such sales, how the |

|

|

|

terms are or will be negotiated at arm’s length, and explain how you determine or will determine you are or will be |

|

|

|

paid at least fair market value. Attach copies of any written contracts or other agreements relating to such sales. |

|

|

|

|

|

|

8a |

Do you or will you have any leases, contracts, loans, or other agreements with your officers, directors, |

Yes |

No |

|

trustees, highest compensated employees, or highest compensated independent contractors listed in |

|

|

lines 1a, 1b, or 1c? If “Yes,” provide the information requested in lines 8b through 8f.

bDescribe any written or oral arrangements that you made or intend to make.

cIdentify with whom you have or will have such arrangements.

dExplain how the terms are or will be negotiated at arm’s length.

eExplain how you determine you pay no more than fair market value or you are paid at least fair market value. f Attach copies of any signed leases, contracts, loans, or other agreements relating to such arrangements.

9a Do you or will you have any leases, contracts, loans, or other agreements with any organization in which |

Yes |

No |

any of your officers, directors, or trustees are also officers, directors, or trustees, or in which any individual officer, director, or trustee owns more than a 35% interest? If “Yes,” provide the information requested in lines 9b through 9f.

Form 1023 (Rev.

Form 1023 (Rev. |

Name: |

EIN: |

Page 5 |

|

Part V |

Compensation and Other Financial Arrangements With Your Officers, Directors, Trustees, |

|

||

|

Employees, and Independent Contractors (Continued) |

|

|

|

bDescribe any written or oral arrangements you made or intend to make.

cIdentify with whom you have or will have such arrangements.

dExplain how the terms are or will be negotiated at arm’s length.

eExplain how you determine or will determine you pay no more than fair market value or that you are paid at least fair market value.

fAttach a copy of any signed leases, contracts, loans, or other agreements relating to such arrangements.

Part VI |

Your Members and Other Individuals and Organizations That Receive Benefits From You |

The following “Yes” or “No” questions relate to goods, services, and funds you provide to individuals and organizations as part of your activities. Your answers should pertain to past, present, and planned activities. See instructions.

1 a In carrying out your exempt purposes, do you provide goods, services, or funds to individuals? If “Yes,” describe each program that provides goods, services, or funds to individuals.

bIn carrying out your exempt purposes, do you provide goods, services, or funds to organizations? If “Yes,” describe each program that provides goods, services, or funds to organizations.

Yes |

No |

Yes |

No |

2 |

Do any of your programs limit the provision of goods, services, or funds to a specific individual or group |

Yes |

No |

|

|

of specific individuals? For example, answer “Yes,” if goods, services, or funds are provided only for a |

|

|

|

|

particular individual, your members, individuals who work for a particular employer, or graduates of a |

|

|

|

|

particular school. If “Yes,” explain the limitation and how recipients are selected for each program. |

|

|

|

|

|

|

|

|

3 |

Do any individuals who receive goods, services, or funds through your programs have a family or |

Yes |

No |

|

|

business relationship with any officer, director, trustee, or with any of your highest compensated |

|

|

|

|

employees or highest compensated independent contractors listed in Part V, lines 1a, 1b, and 1c? If |

|

|

|

|

“Yes,” explain how these related individuals are eligible for goods, services, or funds. |

|

|

|

|

|

|

|

|

Part VII |

Your History |

|

|

|

The following “Yes” or “No” questions relate to your history. See instructions.

1 |

Are you a successor to another organization? Answer “Yes,” if you have taken or will take over the |

Yes |

No |

||

|

|

activities of another organization; you took over 25% or more of the fair market value of the net assets of |

|

|

|

|

|

another organization; or you were established upon the conversion of an organization from |

|

|

|

|

|

nonprofit status. If “Yes,” complete Schedule G. |

|

|

|

|

|

|

|

||

|

2 |

Are you submitting this application more than 27 months after the end of the month in which you were |

Yes |

No |

|

|

|

legally formed? If “Yes,” complete Schedule E. |

|

|

|

|

|

|

|

|

|

|

Part VIII |

Your Specific Activities |

|

|

|

The following “Yes” or “No” questions relate to specific activities that you may conduct. Check the appropriate box. Your answers should pertain to past, present, and planned activities. See instructions.

1 Do you support or oppose candidates in political campaigns in any way? If “Yes,” explain. |

Yes |

No |

|

2 a |

Do you attempt to influence legislation? If “Yes,” explain how you attempt to influence legislation and |

Yes |

No |

|

complete line 2b. If “No,” go to line 3a. |

|

|

b |

Have you made or are you making an election to have your legislative activities measured by |

Yes |

No |

|

expenditures by filing Form 5768? If “Yes,” attach a copy of the Form 5768 that was already filed or |

|

|

|

attach a completed Form 5768 that you are filing with this application. If “No,” describe whether your |

|

|

|

attempts to influence legislation are a substantial part of your activities. Include the time and money |

|

|

|

spent on your attempts to influence legislation as compared to your total activities. |

|

|

3a Do you or will you operate bingo or gaming activities? If “Yes,” describe who conducts them, and list all revenue received or expected to be received and expenses paid or expected to be paid in operating these activities. Revenue and expenses should be provided for the time periods specified in Part IX, Financial Data.

bDo you or will you enter into contracts or other agreements with individuals or organizations to conduct bingo or gaming for you? If “Yes,” describe any written or oral arrangements that you made or intend to make, identify with whom you have or will have such arrangements, explain how the terms are or will be negotiated at arm’s length, and explain how you determine or will determine you pay no more than fair market value or you will be paid at least fair market value. Attach copies or any written contracts or other agreements relating to such arrangements.

cList the states and local jurisdictions, including Indian Reservations, in which you conduct or will conduct gaming or bingo.

Yes |

No |

Yes |

No |

Form 1023 (Rev.

Form 1023 (Rev. |

Name: |

EIN: |

|

Page 6 |

|

Part VIII |

Your Specific Activities (Continued) |

|

|

|

|

4 a Do |

you or will you undertake fundraising? If “Yes,” check all the fundraising programs you do or will |

Yes |

No |

||

conduct. See instructions. |

|

|

|

||

|

mail solicitations |

|

phone solicitations |

|

|

|

email solicitations |

|

accept donations on your website |

|

|

|

personal solicitations |

receive donations from another organization’s website |

|

||

|

vehicle, boat, plane, or similar donations |

government grant solicitations |

|

|

|

|

foundation grant solicitations |

Other |

|

|

|

Attach a description of each fundraising program.

b Do you or will you have written or oral contracts with any individuals or organizations to raise funds for |

Yes |

No |

you? If “Yes,” describe these activities. Include all revenue and expenses from these activities and state |

|

|

who conducts them. Revenue and expenses should be provided for the time periods specified in Part IX, |

|

|

Financial Data. Also, attach a copy of any contracts or agreements. |

|

|

c Do you or will you engage in fundraising activities for other organizations? If “Yes,” describe these |

Yes |

No |

arrangements. Include a description of the organizations for which you raise funds and attach copies of |

|

|

all contracts or agreements. |

|

|

dList all states and local jurisdictions in which you conduct fundraising. For each state or local jurisdiction listed, specify whether you fundraise for your own organization, you fundraise for another organization, or another organization fundraises for you.

e |

Do you or will you maintain separate accounts for any contributor under which the contributor has the |

Yes |

No |

|

right to advise on the use or distribution of funds? Answer “Yes” if the donor may provide advice on the |

|

|

|

types of investments, distributions from the types of investments, or the distribution from the donor’s |

|

|

|

contribution account. If “Yes,” describe this program, including the type of advice that may be provided |

|

|

|

and submit copies of any written materials provided to donors. |

|

|

|

|

|

|

5 |

Are you affiliated with a governmental unit? If “Yes,” explain. |

Yes |

No |

6a |

Do you or will you engage in economic development? If “Yes,” describe your program. |

Yes |

No |

bDescribe in full who benefits from your economic development activities and how the activities promote exempt purposes.

7a |

Do or will persons other than your employees or volunteers develop your facilities? If “Yes,” describe |

Yes |

No |

|

each facility, the role of the developer, and any business or family relationship(s) between the developer |

|

|

|

and your officers, directors, or trustees. |

|

|

b |

Do or will persons other than your employees or volunteers manage your activities or facilities? If “Yes,” |

Yes |

No |

|

describe each activity and facility, the role of the manager, and any business or family relationship(s) |

|

|

|

between the manager and your officers, directors, or trustees. |

|

|

cIf there is a business or family relationship between any manager or developer and your officers, directors, or trustees, identify the individuals, explain the relationship, describe how contracts are negotiated at arm’s length so that you pay no more than fair market value, and submit a copy of any contracts or other agreements.

8 Do you or will you enter into joint ventures, including partnerships or limited liability companies |

Yes |

No |

treated as partnerships, in which you share profits and losses with partners other than section 501(c)(3) |

|

|

organizations? If “Yes,” describe the activities of these joint ventures in which you participate. |

|

|

9a Are you applying for exemption as a childcare organization under section 501(k)? If “Yes,” answer lines 9b through 9d. If “No,” go to line 10.

bDo you provide childcare so that parents or caretakers of children you care for can be gainfully employed (see instructions)? If “No,” explain how you qualify as a childcare organization described in section 501(k).

Yes |

No |

Yes |

No |

cOf the children for whom you provide childcare, are 85% or more of them cared for by you to enable their parents or caretakers to be gainfully employed (see instructions)? If “No,” explain how you qualify as a childcare organization described in section 501(k).

dAre your services available to the general public? If “No,” describe the specific group of people for whom your activities are available. Also, see the instructions and explain how you qualify as a childcare organization described in section 501(k).

Yes |

No |

Yes |

No |

10 Do you or will you publish, own, or have rights in music, literature, tapes, artworks, choreography, |

Yes |

No |

scientific discoveries, or other intellectual property? If “Yes,” explain. Describe who owns or will own any copyrights, patents, or trademarks, whether fees are or will be charged, how the fees are determined, and how any items are or will be produced, distributed, and marketed.

Form 1023 (Rev.

Form 1023 (Rev. |

Name: |

EIN: |

|

Page 7 |

||

Part VIII |

Your Specific Activities (Continued) |

|

|

|

||

11 |

Do you or will you accept contributions of: real property; conservation easements; closely held |

Yes |

No |

|||

|

securities; intellectual property such as patents, trademarks, and copyrights; works of music or art; |

|

|

|||

|

licenses; royalties; automobiles, boats, planes, or other vehicles; or collectibles of any type? If “Yes,” |

|

|

|||

|

describe each type of contribution, any conditions imposed by the donor on the contribution, and any |

|

|

|||

|

agreements with the donor regarding the contribution. |

|

|

|

||

12 a |

Do you or will you operate in a foreign country or countries? If “Yes,” answer lines 12b through 12d. If |

Yes |

No |

|||

|

“No,” go to line 13a. |

|

|

|

|

|

b |

Name the foreign countries and regions within the countries in which you operate. |

|

|

|

||

c |

Describe your operations in each country and region in which you operate. |

|

|

|

||

d |

Describe how your operations in each country and region further your exempt purposes. |

|

|

|

||

|

|

|

|

|||

13a |

Do you or will you make grants, loans, or other distributions to organization(s)? If “Yes,” answer lines 13b |

Yes |

No |

|||

|

through 13g. If “No,” go to line 14a. |

|

|

|

||

bDescribe how your grants, loans, or other distributions to organizations further your exempt purposes.

c Do you have written contracts with each of these organizations? If “Yes,” attach a copy of each contract. |

Yes |

No |

dIdentify each recipient organization and any relationship between you and the recipient organization.

eDescribe the records you keep with respect to the grants, loans, or other distributions you make.

fDescribe your selection process, including whether you do any of the following.

(i) |

Do you require an application form? If “Yes,” attach a copy of the form. |

Yes |

No |

(ii) |

Do you require a grant proposal? If “Yes,” describe whether the grant proposal specifies your |

Yes |

No |

|

responsibilities and those of the grantee, obligates the grantee to use the grant funds only for the |

|

|

|

purposes for which the grant was made, provides for periodic written reports concerning the use of |

|

|

|

grant funds, requires a final written report and an accounting of how grant funds were used, and |

|

|

|

acknowledges your authority to withhold and/or recover grant funds in case such funds are, or appear |

|

|

|

to be, misused. |

|

|

gDescribe your procedures for oversight of distributions that assure you the resources are used to further your exempt purposes, including whether you require periodic and final reports on the use of resources.

14 a Do you or will you make grants, loans, or other distributions to foreign organizations? If “Yes,” answer lines 14b through 14f. If “No,” go to line 15.

bProvide the name of each foreign organization, the country and regions within a country in which each foreign organization operates, and describe any relationship you have with each foreign organization.

cDoes any foreign organization listed in line 14b accept contributions earmarked for a specific country or specific organization? If “Yes,” list all earmarked organizations or countries.

dDo your contributors know that you have ultimate authority to use contributions made to you at your discretion for purposes consistent with your exempt purposes? If “Yes,” describe how you relay this information to contributors.

eDo you or will you make

fDo you or will you use any additional procedures to ensure that your distributions to foreign organizations are used in furtherance of your exempt purposes? If “Yes,” describe these procedures, including site visits by your employees or compliance checks by impartial experts, to verify that grant funds are being used appropriately.

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Form 1023 (Rev.

|

Form 1023 (Rev. |

Name: |

EIN: |

|

Page 8 |

||

|

Part VIII |

Your Specific Activities (Continued) |

|

|

|

||

15 |

Do you have a close connection with any organizations? If “Yes,” explain. |

|

Yes |

No |

|||

|

16 |

Are you applying for exemption as a cooperative hospital service organization under section 501(e)? If |

Yes |

No |

|||

|

|

“Yes,” explain. |

|

|

|

|

|

|

|

|

|

|

|||

17 |

Are you applying for exemption as a cooperative service organization of operating educational |

Yes |

No |

||||

|

|

organizations under section 501(f)? If “Yes,” explain. |

|

|

|

||

|

|

|

|

||||

|

18 |

Are you applying for exemption as a charitable risk pool under section 501(n)? If “Yes,” explain. |

Yes |

No |

|||

|

19 |

Do you or will you operate a school? If “Yes,” complete Schedule B. Answer “Yes,” whether you operate |

Yes |

No |

|||

|

|

a school as your main function or as a secondary activity. |

|

|

|

||

|

|

|

|

||||

|

20 |

Is your main function to provide hospital or medical care? If “Yes,” complete Schedule C. |

Yes |

No |

|||

|

21 |

Do you or will you provide |

Yes |

No |

|||

|

|

complete Schedule F. |

|

|

|

|

|

|

|

|

|

|

|||

22 |

Do you or will you provide scholarships, fellowships, educational loans, or other educational grants to |

Yes |

No |

||||

|

|

individuals, including grants for travel, study, or other similar purposes? If “Yes,” complete |

Schedule H. |

|

|

||

Note: Private foundations may use Schedule H to request advance approval of individual grant procedures.

Form 1023 (Rev.

Form 1023 (Rev. |

Name: |

EIN: |

Page 9 |

|

Part IX |

Financial Data |

|

|

|

For purposes of this schedule, years in existence refer to completed tax years.

1.If in existence less than 5 years, complete the statement for each year in existence and provide projections of your likely revenues and expenses based on a reasonable and good faith estimate of your future finances for a total of:

a.Three years of financial information if you have not completed one tax year, or

b.Four years of financial information if you have completed one tax year. See instructions.

2.If in existence 5 or more years, complete the schedule for the most recent 5 tax years. You will need to provide a separate statement that includes information about the most recent 5 tax years because the data table in Part IX has not been updated to provide for a 5th year. See instructions.

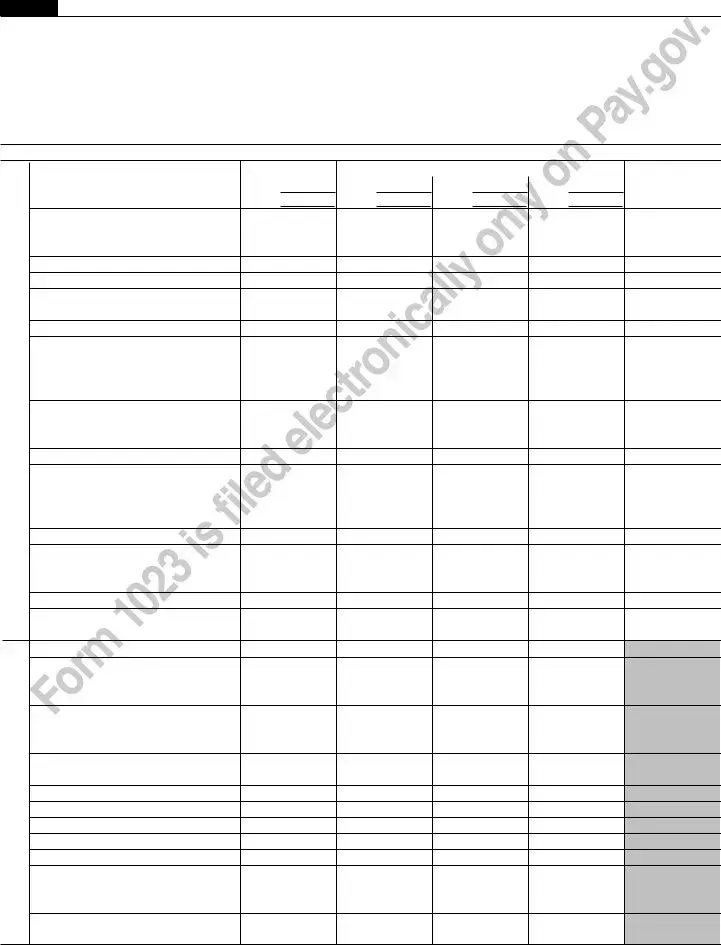

A.Statement of Revenues and Expenses

Revenues

Expenses

Type of revenue or expense |

Current tax year |

|

3 prior tax years or 2 succeeding tax years |

|

|

|

|

|

|

|

|

|

(a) From |

(b) From |

(c) From |

(d) From |

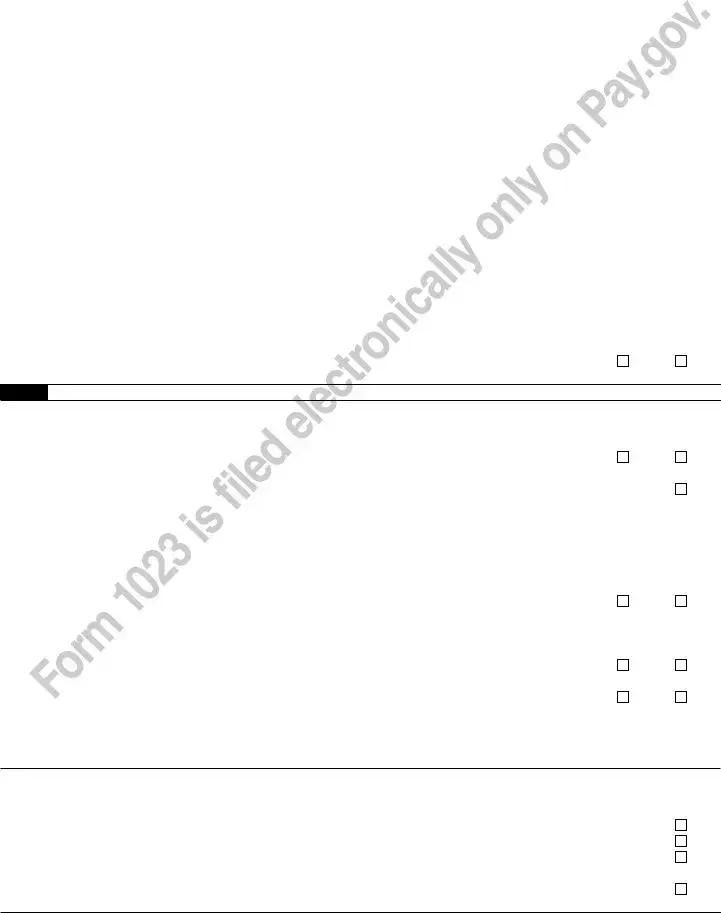

(e) Provide Total for |

|

To |

To |

To |

To |

(a) through (d) |

1Gifts, grants, and contributions received (do not include unusual grants)

2Membership fees received

3Gross investment income

4Net unrelated business income

5Taxes levied for your benefit

6Value of services or facilities furnished by a governmental unit without charge (not including the value of services generally furnished to the public without charge)

7Any revenue not otherwise listed above or in lines

8Total of lines 1 through 7

9Gross receipts from admissions, merchandise sold or services performed, or furnishing of facilities in any activity that is related to your exempt purposes (attach itemized list)

10Total of lines 8 and 9

11Net gain or loss on sale of capital assets (attach schedule and see instructions)

12Unusual grants

13Total Revenue

Add lines 10 through 12

14 Fundraising expenses

15Contributions, gifts, grants, and similar amounts paid out (attach an itemized list)

16Disbursements to or for the benefit of members (attach an itemized list)

17Compensation of officers, directors, and trustees

18 Other salaries and wages

19 Interest expense

20 Occupancy (rent, utilities, etc.)

21 Depreciation and depletion

22 Professional fees

23Any expense not otherwise classified, such as program services (attach itemized list)

24Total Expenses

Add lines 14 through 23

Form 1023 (Rev.

|

Form 1023 (Rev. |

Name: |

EIN: |

|

|

Page 10 |

||

|

Part IX |

Financial Data (Continued) |

|

|

|

|

||

|

|

|

|

B. Balance Sheet (for your most recently completed tax year) |

|

|

Year End: |

|

|

|

|

|

Assets |

|

|

(Whole dollars) |

|

1 |

Cash |

1 |

|

|

||||

2 |

Accounts receivable, net |

2 |

|

|

||||

3 |

Inventories |

3 |

|

|

||||

4 |

Bonds and notes receivable (attach an itemized list) |

4 |

|

|

||||

5 |

Corporate stocks (attach an itemized list) |

5 |

|

|

||||

6 |

Loans receivable (attach an itemized list) |

6 |

|

|

||||

7 |

Other investments (attach an itemized list) |

7 |

|

|

||||

8 |

Depreciable and depletable assets (attach an itemized list) |

8 |

|

|

||||

9 |

Land |

9 |

|

|

||||

10 |

Other assets (attach an itemized list) |

10 |

|

|

||||

11 |

Total Assets (add lines 1 through 10) |

11 |

|

|

||||

|

|

|

|

Liabilities |

|

|

|

|

12 |

Accounts payable |

12 |

|

|

||||

13 |

Contributions, gifts, grants, etc. payable |

13 |

|

|

||||

14 |

Mortgages and notes payable (attach an itemized list) |

14 |

|

|

||||

15 |

Other liabilities (attach an itemized list) |

15 |

|

|

||||

16 |

Total Liabilities (add lines 12 through 15) |

16 |

|

|

||||

|

|

|

|

Fund Balances or Net Assets |

|

|

|

|

17 |

Total fund balances or net assets |

17 |

|

|

||||

18 |

Total Liabilities and Fund Balances or Net Assets (add lines 16 and 17) |

18 |

|

|

||||

|

19 |

Have there been any substantial changes in your assets or liabilities since the end of the period |

|

Yes |

No |

|||

|

|

shown above? If “Yes,” explain. |

|

|

|

|

||

Part X Public Charity Status

Part X is designed to classify you as an organization that is either a private foundation or a public charity. Public charity status is a more favorable tax status than private foundation status. If you are a private foundation, Part X is designed to further determine whether you are a private operating foundation. See instructions.

|

1 a |

Are you a private foundation? If “Yes,” go to line 1b. If “No,” go to line 5 and proceed as instructed. If you |

Yes |

No |

|

|

are unsure, see the instructions. |

|

|

|

b |

As a private foundation, section 508(e) requires special provisions in your organizing document in |

|

|

|

|

addition to those that apply to all organizations described in section 501(c)(3). Check the box to confirm |

|

|

|

|

that your organizing document meets this requirement, whether by express provision or by reliance on |

|

|

|

|

operation of state law. Attach a statement that describes specifically where your organizing document |

|

|

|

|

meets this requirement, such as a reference to a particular article or section in your organizing document |

|

|

|

|

or by operation of state law. See the instructions, including Appendix B, for information about the special |

|

|

|

|

provisions that need to be contained in your organizing document. Go to line 2. |

|

|

|

|

|

|

|

|

2 |

Are you a private operating foundation? To be a private operating foundation you must engage directly in |

Yes |

No |

|

|

the active conduct of charitable, religious, educational, and similar activities, as opposed to indirectly |

|

|

|

|

carrying out these activities by providing grants to individuals or other organizations. If “Yes,” go to line 3. |

|

|

|

|

If “No,” go to the signature section of Part XI. |

|

|

|

|

|

|

|

3 |

Have you existed for one or more years? If “Yes,” attach financial information showing that you are a |

Yes |

No |

|

|

|

private operating foundation; go to the signature section of Part XI. If “No,” continue to line 4. |

|

|

|

|

|

|

|

|

4 |

Have you attached either (1) an affidavit or opinion of counsel, (including a written affidavit or opinion |

Yes |

No |

|

|

from a certified public accountant or accounting firm with expertise regarding this tax law matter), that |

|

|

|

|

sets forth facts concerning your operations and support to demonstrate that you are likely to satisfy the |

|

|

|

|

requirements to be classified as a private operating foundation; or (2) a statement describing your |

|

|

|

|

proposed operations as a private operating foundation? |

|

|

5If you answered “No” to line 1a, indicate the type of public charity status you are requesting by checking one of the choices below. You may check only one box.

The organization is not a private foundation because it is:

a 509(a)(1) and

c509(a)(1) and

d

Form 1023 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 1023 is used by nonprofit organizations to apply for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. |

| Who Must File | O rganizations seeking tax-exempt status under section 501(c)(3) must file the IRS Form 1023. This includes charities, religious organizations, educational institutions, and other types of nonprofit entities. |

| Form Versions | There are two versions of the form: the standard Form 1023 and the Form 1023-EZ, which is a streamlined version for smaller organizations that meet certain criteria. |

| Filing Fee | The filing fee for Form 1023 varies. The fee for Form 1023-EZ is lower than the standard Form 1023. Fees are subject to change, so it's important to check the latest information on the IRS website. |

| Processing Time | Processing times for Form 1023 can vary significantly, ranging from a few months to over a year, depending on the complexity of the application and the current backlog at the IRS. |

| Electronic Filing | As of recent updates, the IRS accepts Form 1023 submissions electronically, which can help reduce processing times. |

| Required Attachments | Form 1023 requires various attachments, including organizational documents like Articles of Incorporation, bylaws, and detailed narratives of the organization’s activities. |

| Governing Law | Form 1023 is governed by federal law, specifically Section 501(c)(3) of the Internal Revenue Code. There are no state-specific versions of Form 1023, but organizations must ensure they comply with state and local laws relating to charitable organizations. |

| Public Inspection | Approved Form 1023 applications are subject to public inspection, meaning that once granted, the status and application documents of a 501(c)(3) organization can be reviewed by the public. |

Guide to Writing IRS 1023

Applying for tax-exempt status in the United States requires careful attention to detail, particularly when filling out the IRS Form 1023. This form is essential for organizations seeking recognition as a 501(c)(3) tax-exempt entity. Completing it accurately ensures the Internal Revenue Service (IRS) has all the necessary information to process the application successfully. The following steps provide a clear guide to navigate through the form, making the task less daunting for applicants.

- Start by downloading the latest version of IRS Form 1023 from the official IRS website. Ensure you have the current form as the IRS updates these forms periodically.

- Gather all required information before beginning the application process. This includes your organization’s legal name, contact information, history, structure, finances, and detailed descriptions of your activities and purpose.

- Complete Part I, providing general information about your organization. This part requires basic details such as the legal name, mailing address, and the Employer Identification Number (EIN).

- In Part II, clarify your organizational structure. You'll indicate whether your organization is a corporation, an association, or a trust, and you must attach a copy of your organizing document, like articles of incorporation.

- Answer questions about your specific activities and operational information in Part III. This section asks for a detailed description of your past, present, and planned activities, helping the IRS understand your purpose and operations.

- Provide detailed financial data in Part IV. This includes income and expense statements for the current year and projections for the next two years. Also, attach a balance sheet if available.

- Part V is about compensation and other financial arrangements with your officers, directors, trustees, employees, and independent contractors. List all individuals or entities that are compensated, directly or indirectly, by the organization.

- Complete the sections regarding your foundation status in Part VI. Your answers will determine under which section of 501(c)(3) your organization qualifies – as a public charity or as a private foundation.

- If applicable, fill out the Schedules A through H, depending on your organization’s activities. Each schedule addresses specific operations such as schools, hospitals, supporting organizations, and others.

- Review the form thoroughly. Ensure all necessary documents are attached and all questions are answered completely and truthfully.

- Sign and date the form. An officer or authorized representative of the organization must sign the form, certifying under penalty of perjury that the information is true, correct, and complete.

- Pay the required application fee, which is based on your organization’s gross receipts. Include your payment details as instructed on the form or in the accompanying instructions.

- Mail the completed form and all attachments to the address provided in the instructions. Keep a copy for your records.

After submitting the form, the IRS may contact you for further information or clarification. The review process can take several months, so patience is essential. Once approved, your organization will receive a letter recognizing your tax-exempt status. This is a significant milestone for any organization, as it not only exempts you from federal income tax but also makes you eligible to receive tax-deductible charitable contributions. Fill out the form carefully and consult with a legal or tax professional if you have any questions or concerns.

Understanding IRS 1023

-

What is the IRS 1023 form used for?

The IRS Form 1023 is utilized by nonprofit organizations seeking to obtain tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form serves as an application that organizations must fill out to prove they meet the necessary criteria. It includes sections for detailing the organization's structure, purpose, governance policies, financial arrangements, and operational activities, all aimed at demonstrating it operates exclusively for exempt purposes such as charitable, religious, educational, or scientific endeavors.

-

Who is required to file the IRS 1023 form?

Not every nonprofit organization needs to file Form 1023. It is specifically designed for organizations seeking 501(c)(3) tax-exempt status. This includes charities, religious groups, educational institutions, and other types of organizations that operate for exempt purposes. Organizations that have gross receipts of $50,000 or less and assets totaling $250,000 or less may choose to file Form 1023-EZ, a streamlined version. However, it is essential for organizations to carefully review the IRS criteria to determine which form aligns with their circumstances.

-

How long does it take for the IRS to process a Form 1023?

Processing times for IRS Form 1023 can vary considerably based on the volume of applications the IRS is handling and the complexity of the submitted forms. On average, it might take anywhere from 3 to 6 months. However, more complex applications or those requiring additional information can extend beyond this timeframe. Organizations seeking expedited processing must provide a compelling reason, such as a significant grant opportunity that requires 501(c)(3) status, although granting expedited review is at the discretion of the IRS.

-

Can the filing fee for the IRS 1023 form be waived?

The IRS charges a filing fee for processing Form 1023, which is non-negotiable and cannot be waived. The fee varies depending on the size and type of the organization. As of the last update, the filing fee for organizations using the standard Form 1023 is significantly higher than the fee for those eligible to use Form 1023-EZ. It's crucial for organizations to ensure the correct amount is included with their submission to avoid delays in the processing of their application.

Common mistakes

When filing the IRS 1023 form, which is essential for organizations seeking tax-exempt status, many people unfortunately encounter pitfalls. While it's crucial to approach this form with great care, there are common mistakes that can lead to delays or even denials of tax-exempt status. Here's what to watch out for:

Not providing detailed narratives of activities: Applicants often fail to comprehensively describe their organization's activities. The IRS requires detailed information about operations to ensure compliance with tax-exempt standards.

Incorrect or incomplete financial data: Filling out the financial statements inaccurately or leaving sections incomplete can raise red flags. It’s important to provide thorough and accurate financial histories and projections.

Forgetting necessary attachments: Many applications are delayed because necessary attachments and supporting documents are not included. These documents may include organizational bylaws, conflict of interest policies, and financial records.

Not specifying the correct exempt purpose: Organizations must clearly identify their exempt purpose according to IRS classifications, such as charitable, religious, educational, etc. A general or misclassified purpose can lead to application rejection.

Application for the wrong type of exemption: With different sections and types of tax exemptions available, it’s easy to apply under the wrong category. This mistake can result in unnecessary complexity and rejection.

Error in organizational structure information: The form requires details about the organizational structure. Mistakes or vague descriptions in this area can cause concerns about compliance with exempt status qualifications.

Overlooking the necessity for specific clauses in the organizing document: IRS stipulations require specific language in an organization's founding documents related to operations, dissolution, and assets. Missing these legal clauses can be a significant oversight.

When preparing your IRS 1023 form, take your time to ensure accuracy and completeness. Double-check your application against these common pitfalls. While the process can be detailed and sometimes daunting, avoiding these mistakes can help smooth the path to gaining and maintaining your tax-exempt status.

Documents used along the form

When organizations apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code using the IRS Form 1023, they often need to submit additional forms and documents to support their application. These supplementary materials not only provide the IRS with the necessary details to assess the eligibility of the organization for tax exemption but also ensure compliance with federal regulations governing charitable organizations. Below is a list of other forms and documents frequently used in conjunction with the IRS Form 1023.

- Articles of Incorporation: This document establishes the existence of an entity in a specific state and includes information such as the organization's name, purpose, office location, and details about its initial directors. It is filed with the state government.

- Bylaws of the Organization: Bylaws outline the internal rules governing the management and operations of the organization. They specify procedures for holding meetings, electing officers and directors, and handling other corporate formalities.

- Conflict of Interest Policy: A conflict of interest policy is necessary to ensure that decisions made by the organization's board and staff are in the organization's best interest and not influenced by personal gain.

- IRS Form 2848, Power of Attorney and Declaration of Representative: This form allows an individual, such as an attorney or accountant, to represent the organization before the IRS, enabling them to receive confidential information and respond to IRS inquiries.

- Financial Statements: Recent financial statements provide the IRS with insight into the organization's financial health and activities. These may include a balance sheet, income statement, and statement of cash flows.

- IRS Form 5768, Election/Revocation of Election by an Eligible Section 501(c)(3) Organization To Make Expenditures To Influence Legislation: This form is used by 501(c)(3) organizations opting to make expenditures to influence legislation within the limits prescribed by law.

- Detailed Narrative of Activities: A written narrative that describes the organization's specific activities, programs, and operations gives the IRS a clear understanding of its purposes and how it intends to achieve its mission.

Together, these documents provide a comprehensive overview of the organization seeking tax-exempt status, ensuring that all legal and regulatory requirements are met. Furnishing complete and accurate information will facilitate the review process and increase the likelihood of obtaining the desired tax-exempt status.

Similar forms

The IRS 1023 form, required for organizations seeking tax-exempt status under Section 501(c)(3), shares similarities with the IRS 1024 form. The IRS 1024 form caters to organizations desiring exemption under other sections of 501(c), like social clubs or business leagues. Both require detailed information about organizational structure, activities, and financial records, aiming to determine eligibility for tax-exempt status. However, they cater to different types of organizations, underscoring the IRS's segmented approach to tax exemption.

Similar to the IRS 1023 form, the IRS Form 990 is pivotal for tax-exempt entities. While the 1023 form is for applying for tax-exempt status, Form 990 is an annual return that nonprofits must file to maintain their exemption. Both forms require detailed financial information and descriptions of the organization's activities, ensuring that they adhere to the operational limitations and transparency standards required for tax exemption.

The SS-4 Form, used to apply for an Employer Identification Number (EIN), also shares similarities with the IRS 1023. The EIN is essential for tax administration purposes, just as the 1023 form is necessary for tax exemption qualification. Both are initial steps towards establishing an organization's identity in the IRS's eyes, albeit serving different administrative functions -- one for tax identification and the other for granting tax-exempt status.

The IRS 990-EZ form, a simplified version of the IRS 990 form, and the IRS 1023 share common grounds. The 990-EZ is for small to medium-sized tax-exempt organizations to fulfill their annual reporting requirements. Like the 1023, it demands financial details and governance information but on a less comprehensive scale, tailored for entities with simpler structures and activities. Both ensure accountability and adherence to tax-exempt criteria.

The IRS 8868 form, used for applying for an extension on submitting the 990 forms, parallels the 1023 in its procedural essence. Seeking an extension on reporting deadlines and applying for tax-exempt status are both processes where organizations must communicate with the IRS to comply with regulatory timelines, emphasizing the administrative relationship between the entities and the tax authority.

State-level nonprofit incorporation forms, while varying by state, often mirror the IRS 1023 in their requirements. These forms typically ask for details on the organization's purpose, initial directors, and registered agent, akin to the governance and operational information required on the 1023. This parallel ensures organizations are compliant both federally and at the state level for legal operation and tax purposes.

The Charitable Solicitation Registration forms, required by many states before nonprofits can solicit donations, reflect aspects of the IRS 1023 form. Both sets of documents necessitate information on the organization's finances, governance, and activities. This similar requirement helps safeguard the public and maintain trust in the nonprofit sector by ensuring that only legitimate and accountable organizations raise funds.

The Form 8940, Request for Miscellaneous Determination, used by tax-exempt organizations to request specific determinations about their tax status from the IRS, also shares a common purpose with the 1023 form. Both involve organizations seeking clarification or confirmation on tax-related matters from the IRS to ensure their operations align with statutory requirements, albeit the 8940 covers a broader range of requests beyond initial tax-exempt status.

The Grant Application forms that non-profits often complete to secure funding have elements in common with the IRS 1023. Grant applications require detailed explanations of an organization's mission, programs, and financials — similar to the comprehensive overview required in the 1023. This similarity underscores the importance of transparency and detailed reporting in both securing funding and achieving tax-exempt status.

Dos and Don'ts

Filling out the IRS Form 1023, which organizations use to apply for tax-exempt status under Section 501(c)(3), is a critical step for nonprofits. To make this process as smooth as possible, here are seven do's and don'ts to keep in mind:

- Do gather all necessary documents and information before starting the application. This includes your organization's EIN, bylaws, and financial statements.

- Do read the instructions for each section carefully to ensure compliance with IRS requirements.

- Do provide detailed descriptions of your organization's activities, mission, and programs to clearly demonstrate your eligibility for tax-exempt status.

- Do use the IRS website or consult with a tax professional if you have questions or need clarification on certain parts of the form.

- Don't rush through the application. Accuracy and thoroughness are key to avoiding delays or rejections.

- Don't leave sections incomplete. If a section does not apply to your organization, indicate this with "N/A" (not applicable) instead of leaving it blank.

- Don't forget to sign and date the form. An unsigned form will not be processed by the IRS.

By following these do's and don'ts, you can streamline your IRS Form 1023 application process and help establish your organization's tax-exempt status more efficiently.

Misconceptions

The IRS 1023 form is essential for organizations seeking recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. However, several misconceptions surround the form, leading to confusion and, at times, errors in the filing process. Here's a list intended to clarify some of these misunderstandings:

Only religious organizations need to file it: This is not true. While religious organizations are among those that can file the IRS 1023 for tax-exempt status, it is also required by educational, charitable, scientific, and certain other nonprofit organizations.

It's quick and easy to get approval: The reality is that the process can be quite lengthy. After submitting the form, it can take anywhere from 3 to 12 months (or sometimes longer) for an organization to receive a response, depending on various factors including the completeness of the application and the IRS’s workload.

The form is too complicated for a layperson to complete: While the IRS 1023 form can seem daunting due to its length and the detail required, many resources are available to help. These include instructional guides provided by the IRS and advice from legal professionals with experience in nonprofit law. With the right assistance, most organizations can navigate the process successfully.

Once you submit the form, your work is done: Submitting the form is indeed a significant step, but it's just part of maintaining tax-exempt status. Organizations must continue to comply with federal and state regulations, file annual returns (Form 990 series), and operate in accordance with their stated exempt purposes.

Your application will be denied if you make any mistake: While accuracy is crucial, the IRS does allow for correction of errors. If the IRS needs more information or identifies issues with your application, they will typically send a letter requesting clarification or additional documentation.

Filing fee is always the same: The filing fee for the IRS 1023 form varies depending on the organization's projected gross receipts. Smaller organizations paying a lower fee must complete and file the IRS 1023-EZ, a streamlined version of the form. Therefore, applicants should consult the latest IRS fee schedule.

You don't need to worry about state laws after filing the IRS 1023: This is incorrect. Securing federal tax-exempt status does not automatically exempt your organization from state and local taxes. Most states require separate applications for exemption from income, sales, and property taxes.

All donations received before IRS approval are tax-deductible: Generally, donations received while your IRS Form 1023 application is pending are tax-deductible to the donor, retroactive to the date of your organization’s incorporation. However, if the application is ultimately denied, those donations will not be tax-deductible.

Understanding the facts about the IRS 1023 form helps organizations navigate the application process more effectively and avoid common pitfalls. By dispelling these misconceptions, nonprofits are better positioned to achieve their mission and maintain their tax-exempt status.

Key takeaways

The IRS 1023 form is integral for organizations seeking recognition of their tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Successfully navigating through this document demands close attention to detail and a thorough understanding of what's required. Here are six key takeaways to consider when filling out and using the IRS 1023 form:

- Determine Eligibility: Before diving into the form, ensure your organization qualifies for tax-exempt status. The IRS stipulates that entities must operate exclusively for religious, charitable, scientific, literary, or educational purposes, among other qualifiers.

- Gather Required Information: Completing the 1023 form requires extensive data about your organization, including its legal name, history, financial data, organizational structure, and specific activities. Collecting this information in advance can streamline the filing process.

- Be Detailed in Descriptions: The IRS scrutinizes the nature of your activities to ensure they align with tax-exempt purposes. Provide clear, detailed descriptions of your organization's mission, activities, and programs, highlighting how they fulfill tax-exempt criteria.

- Understand the Financial Section: Accurately reporting past, current, and projected finances is crucial. This section helps the IRS understand how your organization manages its funds and ensures accountability regarding its nonprofit status.

- Use the Checklist: The IRS 1023 form includes a checklist designed to help applicants ensure they've included all required information and attachments. Using this checklist can prevent processing delays caused by incomplete applications.

- Seek Professional Help if Needed: The complexities of the IRS 1023 form can be daunting. Don't hesitate to seek advice from a professional experienced in nonprofit law or a tax advisor familiar with IRS requirements. This can help avoid common pitfalls and strengthen your application.

Filling out the IRS 1023 form carefully and completely is a critical step in securing tax-exempt status for your organization. Understanding these key aspects can help facilitate a smoother application process, allowing you to focus more on your organization’s objectives and less on bureaucratic hurdles.

Popular PDF Documents

IRS 8962 - Correct filing of Form 8962 can enhance your tax return by accurately aligning your insurance premiums and credits.

Does Form 2848 Need to Be Notarized - The Tax POA 2848a is an essential tool for tax planning and consulting, allowing professionals to act efficiently on behalf of their clients.