Get Iowa Income Tax Form

Navigating through the intricacies of tax forms can be a daunting task, especially when dealing with state-specific documents like the Iowa Income Tax Form, officially known as the 2020 IA 1040. This comprehensive form serves as the foundation for Iowa residents to report their annual income, determining the amount of state income tax owed. At its core, the form requires detailed personal information, including Social Security numbers and addresses. It walks filers through various steps, beginning with the basics of filling out names and SSNs, moving onto choosing the correct filing status, which could significantly impact the calculation of taxes. These statuses range from single and married filing jointly, to head of household and qualifying widow(er) with a dependent child, each with its nuances and specific benefits. The form meticulously guides taxpayers through claiming exemptions, reporting income from a wide array of sources like wages, dividends, and business income, and then allows for deductions to adjust income. Next, it focuses on calculating taxable income, applying federal taxes and qualified deductions, and finally, addressing tax credits and contributions, ensuring every aspect of an individual's financial situation is accounted for. Adjustments to income, tax deductions, and nonrefundable and refundable credits are meticulously cataloged, reflecting the filer's financial activities throughout the fiscal year. This form also underscores the importance of accurate record-keeping and adherence to deadlines, emblematic of the fiscal responsibility expected from every taxpayer.

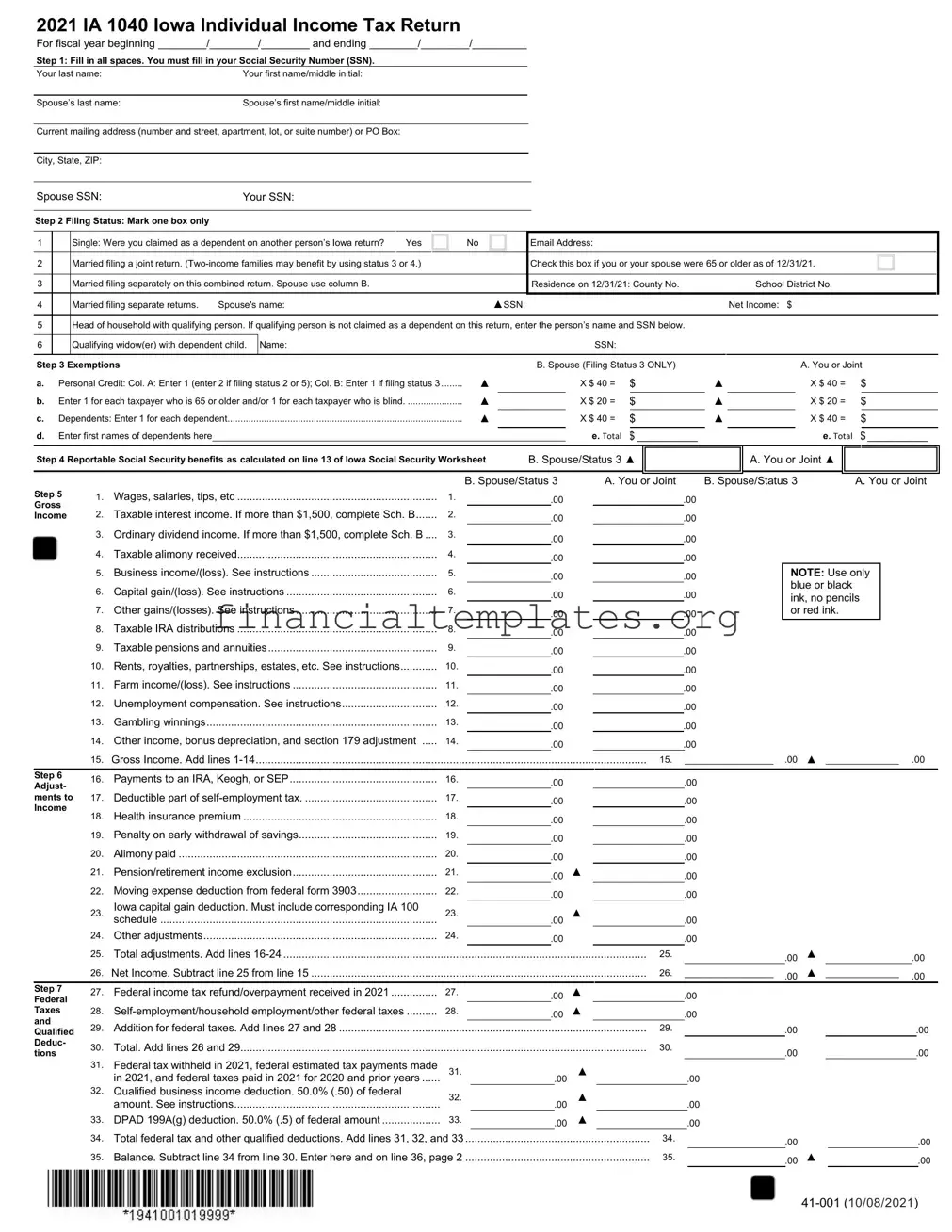

Iowa Income Tax Example

2021 IA 1040 Iowa Individual Income Tax Return

For fiscal year beginning ________/________/________ and ending ________/________/_________

Step 1: Fill in all spaces. You must fill in your Social Security Number (SSN). |

|

Your last name: |

Your first name/middle initial: |

|

|

Spouse’s last name: |

Spouse’s first name/middle initial: |

|

|

Current mailing address (number and street, apartment, lot, or suite number) or PO Box: |

|

|

|

City, State, ZIP: |

|

Spouse SSN: |

Your SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 2 Filing Status: Mark one box only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Single: Were you claimed as a dependent on another person’s Iowa return? |

Yes |

|

No |

|

|

Email Address: |

|

|

|

||

|

|

|

|

|

|

|

|

|||||

2 |

Married filing a joint return. |

|

|

|

|

Check this box if you or your spouse were 65 or older as of 12/31/21. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Married filing separately on this combined return. Spouse use column B. |

|

|

|

|

|

|

Residence on 12/31/21: County No. |

School District No. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Married filing separate returns. |

Spouse's name: |

|

|

|

▲SSN: |

|

|

Net Income: $ |

|||

5Head of household with qualifying person. If qualifying person is not claimed as a dependent on this return, enter the person’s name and SSN below.

6 |

Qualifying widow(er) with dependent child. |

Name: |

|

|

|

|

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Step 3 Exemptions |

|

|

B. Spouse (Filing Status 3 ONLY) |

|

|

|

|

|

|

A. You or Joint |

|

||||||||||||||||

a. Personal Credit: Col. A: Enter 1 (enter 2 if filing status 2 or 5); Col. B: Enter 1 if filing status 3. |

....... |

▲ |

|

|

X $ 40 = |

$ |

|

|

|

▲ |

|

|

|

X $ 40 = |

|

$ |

|

|

|||||||||

b. Enter 1 for each taxpayer who is 65 or older and/or 1 for each taxpayer who is blind |

▲ |

|

|

X $ 20 = |

$ |

|

|

|

▲ |

|

|

|

X $ 20 = |

|

$ |

|

|

||||||||||

c. Dependents: Enter 1 for each dependent |

▲ |

|

|

X $ 40 = |

$ |

|

|

|

▲ |

|

|

|

X $ 40 = |

|

$ |

|

|

||||||||||

d. Enter first names of dependents here |

|

|

|

|

|

e. TOTAL |

$ __________ |

|

|

|

|

|

e. TOTAL |

$ __________ |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Step 4 Reportable Social Security benefits as calculated on line 13 of Iowa Social Security Worksheet |

B. Spouse/Status 3 ▲ |

|

|

|

|

A. You or Joint ▲ |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

B. Spouse/Status 3 |

|

A. You or Joint |

B. Spouse/Status 3 |

|

|

|

A. You or Joint |

||||||||||||||

Step 5 |

|

1. |

Wages, salaries, tips, etc |

1. |

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Gross |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

2. |

Taxable interest income. If more than $1,500, complete Sch. B |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income |

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

3. |

Ordinary dividend income. If more than $1,500, complete Sch. B |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

4. |

Taxable alimony received |

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

5. |

Business income/(loss). See instructions |

5. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

NOTE: Use only |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

blue or black |

|

|

|

|

|||||||

|

|

6. |

Capital gain/(loss). See instructions |

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

ink, no pencils |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Other gains/(losses). See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

7. |

7. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

or red ink. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

8. |

Taxable IRA distributions |

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

9. |

Taxable pensions and annuities |

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

10. |

Rents, royalties, partnerships, estates, etc. See instructions |

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

11. |

Farm income/(loss). See instructions |

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

12. |

Unemployment compensation. See instructions |

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

13. |

Gambling winnings |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

14. |

Other income, bonus depreciation, and section 179 adjustment |

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Gross Income. Add lines |

|

|

|

|

|

|

|

|

|

▲ ______________ |

|

|||||||||||||

|

|

15. |

|

|

|

|

|

15. |

_________________ |

.00 |

.00 |

||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 6 |

|

16. |

Payments to an IRA, Keogh, or SEP |

16. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

Adjust- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ments to |

17. |

. ...........................................Deductible part of |

17. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

18. |

Health insurance premium |

18. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

19. |

.............................................Penalty on early withdrawal of savings |

19. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

20. |

Alimony paid |

20. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

21. |

Pension/retirement income exclusion |

21. |

|

|

.00 |

▲ |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

22. |

..........................Moving expense deduction from federal form 3903 |

22. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

23. |

Iowa capital gain deduction. Must include corresponding IA 100 |

23. |

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

schedule |

|

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

24. |

Other adjustments |

24. |

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

25. |

......................................................................................................................Total adjustments. Add lines |

|

|

|

|

|

25. |

|

|

|

|

.00 |

▲ |

|

|

|

|

.00 |

|||||||

|

|

26. |

Net Income. Subtract line 25 from line 15 |

|

|

|

|

|

26. |

_________________ |

.00 |

▲ ______________ |

.00 |

||||||||||||||

Step 7

Federal

Taxes and Qualified Deduc- tions

27. |

Federal income tax refund/overpayment received in 2021 |

27. |

|

.00 |

▲ |

|

.00 |

||||

28. |

28. |

.00 |

▲ |

.00 |

|||||||

29. |

Addition for federal taxes. Add lines 27 and 28 |

|

|

|

|

|

29. |

|

|

||

30. |

Total. Add lines 26 and 29 |

|

|

|

|

|

30. |

|

|

||

31. |

Federal tax withheld in 2021, federal estimated tax payments made |

31. |

|

|

|

|

▲ |

|

|

|

|

|

in 2021, and federal taxes paid in 2021 for 2020 and prior years |

.00 |

.00 |

||||||||

|

|

||||||||||

32. |

Qualified business income deduction. 50.0% (.50) of federal |

32. |

|

|

|

|

▲ |

|

|

|

|

|

amount. See instructions |

|

|

.00 |

|

|

.00 |

||||

|

|

||||||||||

33. |

DPAD 199A(g) deduction. 50.0% (.5) of federal amount |

33. |

|

|

.00 |

▲ |

|

|

.00 |

||

34. |

............................................................Total federal tax and other qualified deductions. Add lines 31, 32, and 33 |

|

|

|

|

34. |

|

|

|||

35. |

Balance. Subtract line 34 from line 30. Enter here and on line 36, page 2 |

|

|

|

|

35. |

|

|

|||

.00.00

.00.00

.00 |

|

|

.00 |

.00 |

▲ |

|

.00 |

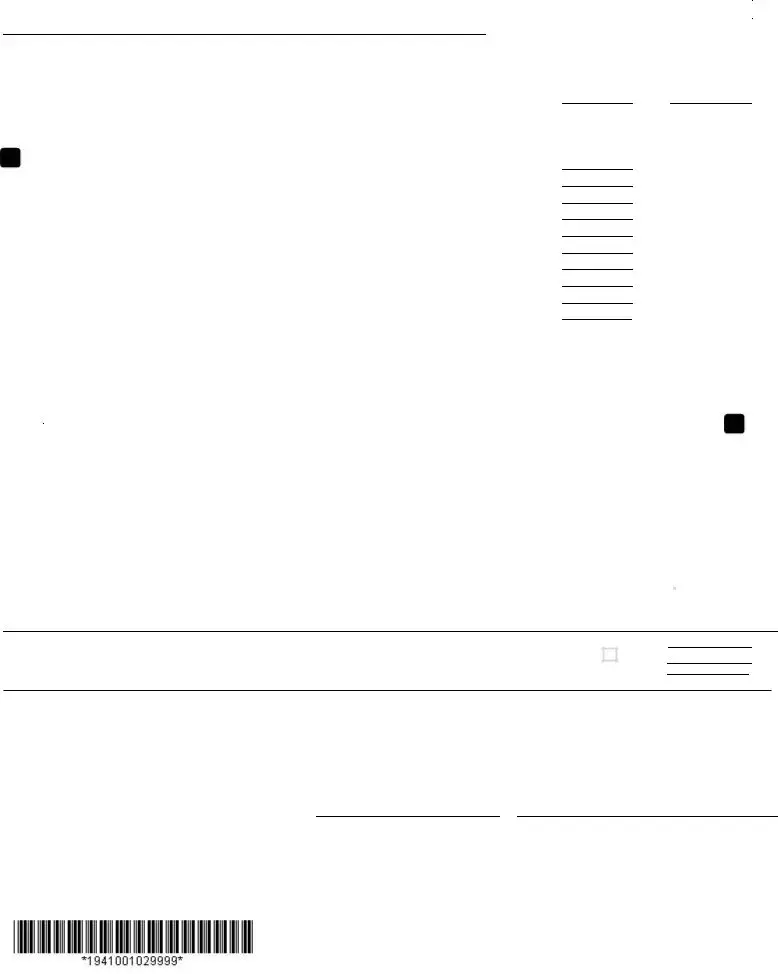

Step 8

Taxable

Income

|

page 2 |

|

B. Spouse/Status 3 |

A. You or Joint |

B. Spouse/Status 3 |

A. You or Joint |

||||||

36. |

BALANCE. From side 1, line 35 |

|

|

|

|

36. |

.00 |

|

.00 |

|||

37. |

Deduction. Check one box ▲ Itemized.(Include IA Schedule A) |

|

Standard |

|

........................................... |

37. |

|

.00 ▲ |

|

|

||

|

|

|

|

|

.00 |

|||||||

38. |

TAXABLE INCOME. SUBTRACT line 37 from line 36 |

|

|

|

|

38. |

|

|||||

|

|

|

|

______________ .00 |

|

________________ .00 |

||||||

|

|

|

|

|

|

|

|

|

||||

Step 9

Tax,

Credits, and Check- off Contri- butions

39. |

Tax from tables or alternate tax |

39. |

|

.00 |

▲ |

.00 |

|

40. |

Iowa |

40. |

|

|

▲ |

|

|

|

.00 |

.00 |

|||||

41. |

Iowa alternative minimum tax. Must include IA 6251 |

41. |

|

|

▲ |

|

|

|

.00 |

.00 |

|||||

42. |

Total tax. ADD lines 39, 40, and 41 |

|

|

|

42. |

|

|

|

|

|

|

|

|

|

|

43. |

Total exemption credit amount(s) from Step 3, side 1 |

43. |

|

.00 |

|

.00 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

44. |

Tuition and textbook credit for dependents |

44. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

45. |

Volunteer firefighter/EMS/reserve peace officer credit |

45. |

|

.00 |

▲ |

.00 |

|

46. |

Total credits. ADD lines 43, 44, and 45 |

|

|

|

46. |

|

|

47. |

BALANCE. SUBTRACT line 46 from line 42. If less than zero, enter zero |

|

|

47. |

|

||

48. |

Credit for nonresident or |

|

|

48. |

|

||

49. |

BALANCE. SUBTRACT line 48 from 47. If less than zero, enter zero |

|

|

|

49. |

|

|

50. |

|

|

|

50. |

|

||

51. |

BALANCE. SUBTRACT line 50 from 49. If less than zero, enter zero |

|

|

|

51. |

|

|

52. |

Other nonrefundable Iowa credits. Must include IA 148 Tax Credits Schedule |

|

|

52. |

|

||

53. |

BALANCE. SUBTRACT line 52 from line 51. If less than zero, enter zero |

|

|

53. |

|

||

54. |

School district surtax or EMS surtax. Take percentage from table; multiply by line 53 |

|

|

54. |

|

||

55. |

Total state and local tax. ADD lines 53 and 54 |

|

|

|

55. |

|

|

56.TOTAL state and local tax before contributions. Combine columns A and B on line 55 and enter here. ..................................................

57.Contributions will reduce your refund or add to the amount you owe. Amounts must be in whole dollars.

.00.00

.00 |

|

|

|

.00 |

|

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

|

.00 |

|

56. |

|

|

|

.00 |

|

|

|

|

|||

|

Fish/Wildlife 57a: ▲ |

|

State Fair 57b: ▲ |

|

|

Firefighters/Veterans 57c: ▲ |

|

|

|

Child Abuse Prevention 57d: ▲ |

|

|

|

Enter here.... |

57. |

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||

|

58. TOTAL STATE AND LOCAL TAX, AND CONTRIBUTIONS. Add line 56 and line 57 and enter here |

|

|

|

|

|

|

58. |

▲ ________________ |

.00 |

|

||||||||||||||||||||||||||||||||||||||||

Step 10 |

59. |

Iowa Fuel Tax Credit. Must include IA 4136 |

|

|

|

|

|

|

|

59. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

60. |

Check One: |

Child and Dependent Care Credit |

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

▲ Early Childhood Development Credit |

|

|

|

|

|

|

60. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

61. |

Iowa earned income tax credit. 15.0% (.15) of federal credit |

61. |

|

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

62. |

Other refundable credits. Include IA 148 Tax Credits Schedule |

62. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

63. |

Iowa income tax withheld |

|

|

|

|

|

|

|

63. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

64. |

Estimated and voucher payments made for tax year 2021 |

64. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

65. |

TOTAL. ADD lines 59 through 64 and enter here |

|

|

|

|

|

|

|

65. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

66. |

......................................................................................................TOTAL CREDITS. ADD columns A and B on line 65 and enter here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66. |

________________ |

.00 |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Step 11 |

67. |

If line 66 is more than line 58, subtract line 58 from line 66. This is the amount you overpaid |

|

|

|

|

|

|

|

|

|

|

|

|

67. |

▲ |

|

.00 |

|

||||||||||||||||||||||||||||||||

Refund |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68. |

Amount of line 67 to be REFUNDED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFUND |

68. |

▲ |

|

.00 |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

68a. |

Routing number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68b. Type Checking |

|

|

|

|

|

Savings |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

68c. |

Account number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69. |

Amount of line 67 to be applied to your 2022 estimated tax |

69. |

|

|

|

.00 ▲ |

|

|

.00 |

|

|

||

|

|

|

|

|

|

|

|

|

||||||

Step 12 |

70. |

If line 66 is less than line 58, subtract line 66 from line 58. This is the AMOUNT OF TAX YOU OWE |

|

|

70. |

▲ |

||||||||

Pay |

|

|||||||||||||

71. |

Penalty for underpayment of estimated tax from IA 2210, IA 2210S, or IA 2210F. Check if annualized income method is used. ▲ |

|

▲ |

|||||||||||

|

71. |

|||||||||||||

|

72. |

Penalty and interest ▲ 72a. Penalty |

|

.00 |

|

▲ 72b. Interest |

|

.00 ADD. Enter total |

72. |

|

||||

|

73. |

TOTAL AMOUNT DUE. ADD lines 70, 71, and 72. Enter here |

|

|

|

|

|

PAY THIS AMOUNT |

73. |

▲ |

||||

.00

.00

.00

.00

Step 13

SIGN HERE

SIGN HERE

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this return, and, to the best of my knowledge and belief, it is true, correct, and complete.

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your signature |

Date |

Check if deceased |

Date of death |

|

Preparer's signature |

Date |

||

|

|

|

|

|

|

|

||

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's signature |

Date |

Check if deceased |

Date of death |

|

Preparer's PTIN |

Firm's FEIN |

||

Daytime telephone number |

Daytime telephone number |

This return is due May 2nd, 2022. Sign, enclose

PO BOX 9187, Des Moines IA

Document Specifics

| Fact Name | Description |

|---|---|

| Form Type | Iowa Individual Income Tax Return |

| Form Number | IA 1040 |

| Fiscal Year | For fiscal years beginning and ending in 2020 |

| Due Date | April 30, 2021 |

| Required Information | Social Security Number (SSN), Names, Mailing Address, Income Details |

| Filing Status Options | Single, Married filing jointly or separately, Head of household, Qualifying widow(er) |

| Income Sources | Wages, Interest, Dividends, Business Income, Retirement Distributions, and more |

| Deductions and Credits | IRA Contributions, Health Insurance Premiums, Self-Employment Tax, Education Credits, etc. |

| Governing Law | Iowa Code regarding individual income tax |

Guide to Writing Iowa Income Tax

Filling out Iowa's Income Tax form, officially known as IA 1040, is necessary for reporting your income and taxes for the year. The process may seem detailed, but breaking it down step by step simplifies it. You will input personal information, choose your filing status, report incomes and deductions, and calculate what you owe or your refund amount. Following these instructions carefully ensures your tax return is accurate and compliant.

- Begin by entering the fiscal year's start and end dates at the top of the form.

- Step 1: Fill in all required personal details including your Social Security number (SSN), name, spouse’s details (if applicable), and your current mailing address.

- Step 2: Choose your Filing Status by marking only one box that applies to you. Options include Single, Married filing jointly or separately, Head of household, or Qualifying widow(er) with dependent child.

- Step 3: Enter Exemptions information:

- Your or joint exemptions in Column A and, if filing status 3, spouse exemptions in Column B.

- Personal Credits, and credits for being 65 or older or blind.

- List the number of dependents and enter their first names.

- Step 4: Report Social Security benefits as per the instructions on Iowa Social Security Worksheet.

- Step 5: Income:

- Report wages, salaries, tips, interest income, dividends, alimony received, and other specified incomes in the respective lines.

- Remember to use blue or black ink only.

- Step 6: Adjustments to Income:

- Include payments to an IRA, deductible parts of self-employment tax, health insurance premiums, and other adjustments listed.

- Step 7: Calculate Federal Taxes and Qualified Deductions as instructed.

- Step 8: Deduct either your itemized or standard deduction from the balance to find your Taxable Income.

- Step 9: Compute Tax, Credits, and Check-off Contributions by following the form's line-by-line instructions.

- Step 10: List Credits like the Iowa fuel tax credit, child and dependent care credit, and Iowa earned income tax credit, among others specified.

- Step 11: Determine if you have an overpayment (refund) or underpayment. If there's a refund, fill out the direct deposit information or apply it to your next year's estimated tax.

- Step 12: If you owe, calculate the total amount due including any penalty for underpayment of estimated tax, penalty, and interest.

- Step 13: Sign and date your return. If filing jointly, ensure your spouse also signs. Include the date of death if filing for a deceased taxpayer. Add the preparer's signature, PTIN, and firm information if applicable.

Once completed, ensure all SSNs are correctly verified, attach all required W-2s, and other requested documents. Review the form to check for accuracy before mailing it to the specified address. Remember, attention to detail now can save you from potential issues later.

Understanding Iowa Income Tax

When navigating the complexities of the Iowa Income Tax form, commonly known as the IA 1040, several questions may arise. Let's delve into some frequently asked queries to clarify the filing process.

- Who needs to file the IA 1040 form?

Residents of Iowa, part-year residents, and non-residents who earned income in Iowa during the tax year must file the IA 1040 form. This includes those who are required to report various types of income, such as wages, salaries, taxable interest, dividends, and more, as outlined in the document.

- Can I file my Iowa tax return separately if I am married?

Absolutely. Married individuals have the option to file their Iowa tax returns jointly or separately. The form provides distinct filing statuses to accommodate different situations: Married filing jointly, married filing separately on a combined return, or married filing separate returns. Selecting the appropriate status depends on the specific financial circumstances and potential tax benefits for each couple.

- What should I do if I realize I've made an error on my filed IA 1040 form?

If an error has been detected on a filed IA 1040 form, an amended return should be submitted to correct the misinformation. This involves filling out the form again accurately and checking the box that indicates it is an amended return to inform the Iowa Department of Revenue of the correction being made.

- What are the deadlines for filing and paying Iowa income tax?

The deadline to file and pay Iowa income tax typically falls on April 30th following the end of the tax year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. It's crucial to adhere to these deadlines to avoid potential late filing or payment penalties.

- How can I claim deductions on my Iowa income tax return?

To claim deductions on an Iowa income tax return, taxpayers must itemize if they believe their total deductions exceed the standard deduction amount. Various deductions such as contributions to an IRA, health insurance premiums, and the deductible part of self-employment tax should be detailed in the adjustments section of the IA 1040 form.

- Is it necessary to include documentation when filing the IA 1040 form?

Yes, when filing the IA 1040 form, including all necessary documentation is crucial. This includes W-2 forms, 1099 forms, and any schedules or additional forms supporting the income, credits, or deductions claimed on the tax return. Proper documentation ensures the accuracy of the return and may expedite the processing time by the Iowa Department of Revenue.

Common mistakes

Not filling in all the required blanks, particularly overlooking the Social Security number (SSN), is a common mistake. Every field must be completed to avoid processing delays or errors in identification.

Choosing the incorrect filing status can lead to overpayment or underpayment of taxes. It's crucial to understand the differences between single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child to select the appropriate one.

Failure to accurately report income, including wages, salaries, tips, and other incomes like dividends or business earnings, can result in penalties. All sources of income must be accurately reported.

Skipping or inaccurately filling out deductions and credits, such as the personal credit, dependent deductions, or retirement income exclusion, could result in losing out on potential tax benefits.

Using the wrong color ink. The form specifies that only blue or black ink is acceptable; using any other color can cause issues with processing the document.

Incorrectly calculating exemptions, a critical step particularly for those filing with dependents, can alter the total tax liability or refund amount. Each exemption, including oneself, spouse and dependents, must be correctly claimed.

Forgetting to include necessary schedules or additional forms, such as the Iowa Capital Gain Deduction form or the out-of-state tax credit form, can lead to incomplete filings and potential for audit or reassessment.

Neglecting to check eligibility for specific tax credits such as the Iowa earned income tax credit, volunteer firefighter and reserve peace officer credit, or credits for educational expenses, means potentially leaving money on the table.

Overlooking the signature and date lines at the end of the form compromises the validity of the return. Both the taxpayer and the spouse (if filing jointly) need to sign and date the form to certify that the information is complete and accurate.

Documents used along the form

When filing the Iowa Income Tax Form, several other documents and forms often play a critical role in ensuring the accuracy and completeness of one's tax return. These supplementary documents serve various purposes, from reporting additional types of income to claiming specific deductions or credits. Understanding each document's purpose helps taxpayers comply with Iowa's tax laws while potentially maximizing their refunds or minimizing the amount owed.

- Schedule B – This schedule is used for reporting interest and ordinary dividends when these exceed a certain threshold. It helps detail the sources and amounts of income received from these investments.

- Iowa Schedule A – Similar to the federal Schedule A, this form is for itemizing deductions such as medical expenses, state and local taxes paid, and mortgage interest. This form is crucial for taxpayers who opt to itemize deductions instead of taking the standard deduction.

- IA 6251 – The Iowa Alternative Minimum Tax form is required for those taxpayers subject to the state's alternative minimum tax, ensuring that individuals and corporations with substantial exemptions or deductions pay a minimum amount of tax.

- IA 126 – This document is for nonresidents or part-year residents of Iowa to calculate the amount of their income that is taxable by Iowa. It is crucial for ensuring that these taxpayers only pay tax on their Iowa-source income.

- IA 130 – The Out-of-State Tax Credit form allows taxpayers to claim a credit for taxes paid to another state. This form helps to prevent double taxation of the same income by Iowa and another state.

- IA 100 – This form is used to calculate the Iowa capital gain deduction. Taxpayers who have sold assets for a gain may qualify for this deduction, reducing their taxable income.

- IA 148 Tax Credits Schedule – This comprehensive schedule is used to claim various Iowa tax credits. It includes nonrefundable, refundable, and carryforward credits, ranging from adoption to venture capital investment tax credits.

- IA 4136 – For individuals who qualify, this form is utilized to claim the Iowa fuel tax credit. It's pertinent for taxpayers in certain businesses, such as farming, where there's significant fuel consumption not subject to the state fuel tax.

Each document and form associated with the Iowa Income Tax Form plays a unique role in the tax filing process. By providing detailed information about income, taxes paid, and eligible credits and deductions, these forms help taxpayers accurately report their financial activities and potentially improve their tax outcomes. Understanding the function and requirements of each form ensures compliance with tax laws and facilitates a smoother filing process.

Similar forms

The Iowa Income Tax Form shares similarities with the Federal Income Tax Return (Form 1040) in structure and purpose. Both forms are designed to calculate individual income tax liability based on earned income, allowable deductions, and applicable credits. Each form requires taxpayers to report earnings from various sources, such as wages, salaries, and dividends, and to calculate tax owed after accounting for specific adjustments to income, deductions, and credits. This parallel structure facilitates consistency in taxpayer reporting practices across state and federal tax systems.

State income tax forms from other U.S. states, such as the California Form 540, are also akin to the Iowa Income Tax Form. While specific tax rates and credits may differ due to variances in state tax laws, the overall format of reporting income, deductions, exemptions, and credits remains consistent. This similarity aids in standardizing the process for taxpayers who may need to file income tax returns in multiple states, ensuring a foundational level of familiarity across different state tax forms.

The W-2 Form, issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck, is directly related to sections of the Iowa Income Tax Form that require income information. Taxpayers use the information from Form W-2 to complete portions of the income section on their tax returns. This direct use of information emphasizes the W-2’s role as a pivotal document for accurately reporting wage-related income on both state and federal tax forms.

Schedule C (Profit or Loss from Business) is a federal form used by sole proprietors to report business income and expenses. The information from Schedule C directly impacts sections of the Iowa Income Tax Form relating to business income or loss, demonstrating functional similarity in the treatment of business operations across tax documents. Entrepreneurs and independent contractors rely on this interconnection to accurately report their business financials within their broader tax obligations.

The Iowa Capital Gain Deduction form (IA 100) is a supplementary document specifically designed to calculate deductions related to capital gains. Taxpayers must fill out this form when they have capital gains that qualify for special treatment under Iowa tax law. The necessity to include or reference this form for certain deductions on the Iowa Income Tax Form illustrates the intricacies within state taxation systems that allow for specific types of income to be taxed differently, akin to adjustments and specific deductions on the federal level.

Schedule A (Itemized Deductions) from the federal tax filing process shares functionality with portions of the Iowa Income Tax Form that allow for itemized deductions. If taxpayers elect to itemize deductions rather than take the standard deduction, they do so with the expectation of lowering their taxable income by detailing allowable expenses. This parallel between federal and state forms provides taxpayers the flexibility to optimize their tax outcomes through detailed accounting of deductible expenses.

The IA 126 Form for nonresident and part-year resident credit is specifically designed for individuals who may have tax liabilities in more than one state or who moved into or out of Iowa during the tax year. This form mirrors the complexities seen in multi-state tax situations on a federal level, where taxpayers must apportion income and understand reciprocal agreements between states. It exemplifies the necessity for specific forms that address unique taxpayer circumstances, ensuring fair treatment in tax liabilities.

Finally, the 1040-ES (Estimated Tax for Individuals) form, while used for federal tax payments on income not subject to withholding, has its counterpart in practices surrounding estimated tax payments that might be necessary for the Iowa Income Tax Form. Taxpayers with income not subject to regular withholding, such as earnings from self-employment, interest, dividends, and capital gains, must anticipate their tax liability and may need to make quarterly estimated tax payments to both the IRS and state tax authority, such as Iowa, to avoid underpayment penalties.

Dos and Don'ts

When completing the Iowa Income Tax Form, there are several important steps you should follow to ensure the process goes smoothly and accurately. Here are four recommendations on what you should do:

- Double-check your Social Security Number (SSN) and that of your spouse if filing jointly, to ensure all information is correct.

- Choose the correct filing status that matches your situation. This decision can impact your tax calculation, so it's important to select the option that best fits your circumstances.

- Accurately report all sources of income, including wages, salaries, interest, dividends, and any other taxable income you may have received during the year.

- Sign and date your return. Make sure to also include all required documents, such as W-2s or 1099s, when you mail your return.

Equally important are the things you should avoid doing when filling out the Iowa Income Tax Form:

- Do not leave any spaces blank. If a section does not apply to you, fill it with a "0" or "N/A" to indicate it has been reviewed but is not applicable.

- Avoid using pencils or red ink when completing your form. Use only blue or black ink to ensure legibility and to comply with processing requirements.

- Do not guess or estimate figures. Use your actual financial documents and statements to report income and deductions accurately.

- Lastly, avoid waiting until the last minute to file your return. Meet the filing deadline to avoid potential penalties for late submission.

Following these guidelines will help ensure that your Iowa Income Tax Form is filled out correctly and efficiently, leading to a smoother processing of your tax return.

Misconceptions

Understanding the nuances of tax forms can feel daunting, and the Iowa Income Tax form is no exception. To help demystify the process, here's a look at common misconceptions about the IA 1040 Iowa Individual Income Tax Return form:

- Only traditional families benefit from filing jointly. This is not true. Various configurations, including two-income families, can sometimes benefit more from filing separately, depending on their specific financial situations.

- All income types are taxed the same way. Different income types, such as wages, investments, and business earnings, may be subject to taxation in varied ways. Some might be eligible for deductions or exemptions.

- Using pencils or red ink is acceptable. The IA 1040 form stipulates that only blue or black ink should be used for filling out the form to ensure clarity and legibility for processing.

- All social security benefits are tax-free. While social security benefits do receive favorable tax treatment, the taxable amount depends on additional income sources and may not be fully exempt.

- Filing a tax return is unnecessary if you don't owe any tax. Filing may still be required based on income, age, and filing status. Additionally, filing can result in receiving a refund due to withholdings or credits.

- The standard deduction is always the best choice. Itemizing deductions could be more beneficial for some taxpayers, especially if they have significant medical expenses, mortgage interest, or charitable contributions.

- Tax credits and deductions are the same. Tax credits reduce the amount of tax you owe, dollar-for-dollar, whereas deductions reduce the amount of income subject to tax.

- All taxpayers are eligible for the same adjustments and deductions. Some adjustments and deductions are only available to taxpayers in specific situations, such as self-employed individuals or those with certain types of moving expenses.

Understanding these misconceptions and the intricacies of the Iowa Income Tax form can help taxpayers navigate the filing process more smoothly and potentially save money. Always consult with a tax professional or refer to the latest tax laws and guidelines when preparing your tax return.

Key takeaways

Filling out your Iowa Income Tax form correctly is crucial to avoid errors that might delay your refund or even result in owing additional tax. Here are key takeaways to help you through this process:

- Ensure all personal information is accurate, including your Social Security number (SSN) and address. Making a mistake here could delay the processing of your return.

- Choose your filing status carefully. Your marital status and whether you have dependents can affect which box you check. This choice impacts your taxable income calculation and potential deductions.

- Report all sources of income, including wages, tips, interest, and any earnings from self-employment or investments, accurately on the form. Don't forget to include additional income like alimony received, business income, or capital gains.

- Deductions and credits can significantly lower your tax liability. Review possible IRA contributions, health insurance premiums, or self-employment taxes that could be deducted. Also, consider applicable credits such as for education expenses or retirement savings.

- Remember to include information about any tax already paid, including federal tax withheld and estimated tax payments. This might lead to a deduction in the total tax amount owed or even a refund.

- Double-check your math and entries before submitting the form. Mistakes can delay the processing of your return or lead to unnecessary audits or corrections.

Once completed, review the form for accuracy, sign it, and ensure to mail it by the due date along with any required documentation to avoid penalties. Proper preparation and understanding of the Iowa Income Tax form can make filing your taxes a smoother and possibly more beneficial process.

Popular PDF Documents

T1098 - Assists lenders in making informed decisions based on the financial stability of a borrower's business.

Tax Form 1040 - It simplifies the process of claiming additional tax credits, ensuring you pay only what you owe.