Get Insolvency Irs Form

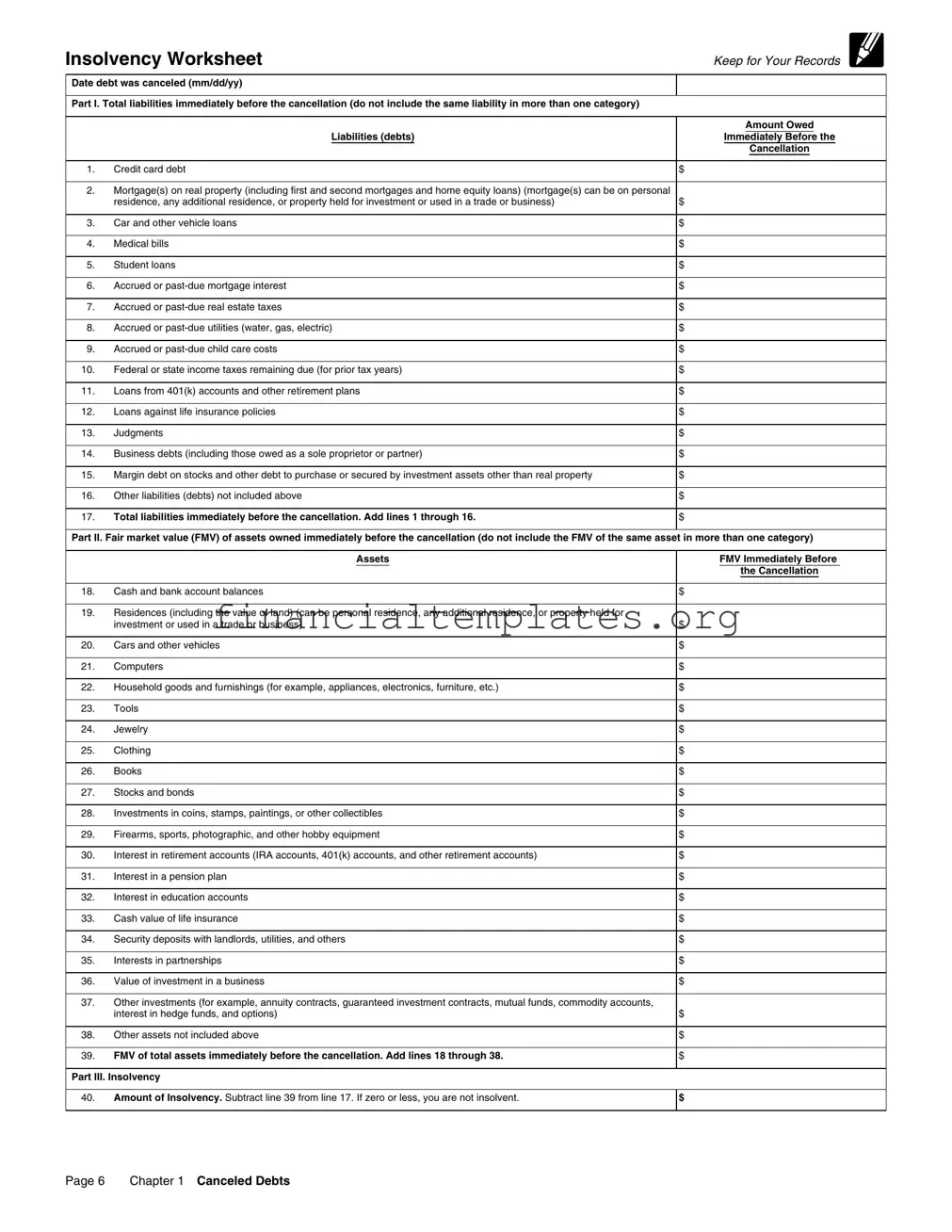

Navigating financial distress can be challenging, especially when faced with the prospect of dealing with canceled debts. The IRS provides a tool for individuals in these situations through the Insolvency Worksheet, a critical form that serves to assess one's fiscal health immediately before the cancellation of a debt. This form comprehensively categorizes and lists liabilities and assets, providing a clear framework for understanding the scope of one’s financial obligations and the value of their holdings. Liabilities are segmented into various categories including credit card debt, mortgages on real property, car and other vehicle loans, and more, each with a designated space to record the amount owed. Similarly, the fair market value (FMV) of assets owned is detailed across subdivisions, ranging from cash and bank balances to personal property and investment interests. The culmination of this form's Part I and Part II allows for the calculation of insolvency in Part III, determining whether one’s financial liabilities exceed their assets at the time debt was canceled. This determination plays a pivotal role in the context of tax obligations, offering a benchmark for whether canceled debt will be recognized as taxable income. As such, the Insolvency Worksheet not only aids individuals in taking stock of their financial standing but also in navigating the complexities of tax implications associated with debt cancellation.

Insolvency Irs Example

Insolvency Worksheet

Keep for Your Records

Date debt was canceled (mm/dd/yy)

Part I. Total liabilities immediately before the cancellation (do not include the same liability in more than one category)

|

Amount Owed |

Liabilities (debts) |

Immediately Before the |

|

Cancellation |

|

|

1. Credit card debt |

$ |

2.Mortgage(s) on real property (including first and second mortgages and home equity loans) (mortgage(s) can be on personal

|

residence, any additional residence, or property held for investment or used in a trade or business) |

$ |

|

|

|

3. |

Car and other vehicle loans |

$ |

|

|

|

4. |

Medical bills |

$ |

|

|

|

5. |

Student loans |

$ |

|

|

|

6. |

Accrued or |

$ |

|

|

|

7. |

Accrued or |

$ |

|

|

|

8. |

Accrued or |

$ |

|

|

|

9. |

Accrued or |

$ |

|

|

|

10. |

Federal or state income taxes remaining due (for prior tax years) |

$ |

|

|

|

11. |

Loans from 401(k) accounts and other retirement plans |

$ |

|

|

|

12. |

Loans against life insurance policies |

$ |

|

|

|

13. |

Judgments |

$ |

|

|

|

14. |

Business debts (including those owed as a sole proprietor or partner) |

$ |

|

|

|

15. |

Margin debt on stocks and other debt to purchase or secured by investment assets other than real property |

$ |

|

|

|

16. |

Other liabilities (debts) not included above |

$ |

|

|

|

17. |

Total liabilities immediately before the cancellation. Add lines 1 through 16. |

$ |

Part II. Fair market value (FMV) of assets owned immediately before the cancellation (do not include the FMV of the same asset in more than one category)

|

Assets |

FMV Immediately Before |

|

|

the Cancellation |

|

|

|

18. |

Cash and bank account balances |

$ |

19.Residences (including the value of land) (can be personal residence, any additional residence, or property held for

|

investment or used in a trade or business) |

$ |

|

|

|

20. |

Cars and other vehicles |

$ |

|

|

|

21. |

Computers |

$ |

|

|

|

22. |

Household goods and furnishings (for example, appliances, electronics, furniture, etc.) |

$ |

|

|

|

23. |

Tools |

$ |

|

|

|

24. |

Jewelry |

$ |

|

|

|

25. |

Clothing |

$ |

|

|

|

26. |

Books |

$ |

|

|

|

27. |

Stocks and bonds |

$ |

|

|

|

28. |

Investments in coins, stamps, paintings, or other collectibles |

$ |

|

|

|

29. |

Firearms, sports, photographic, and other hobby equipment |

$ |

|

|

|

30. |

Interest in retirement accounts (IRA accounts, 401(k) accounts, and other retirement accounts) |

$ |

|

|

|

31. |

Interest in a pension plan |

$ |

|

|

|

32. |

Interest in education accounts |

$ |

|

|

|

33. |

Cash value of life insurance |

$ |

|

|

|

34. |

Security deposits with landlords, utilities, and others |

$ |

|

|

|

35. |

Interests in partnerships |

$ |

|

|

|

36. |

Value of investment in a business |

$ |

37.Other investments (for example, annuity contracts, guaranteed investment contracts, mutual funds, commodity accounts,

|

interest in hedge funds, and options) |

$ |

|

|

|

38. |

Other assets not included above |

$ |

|

|

|

39. |

FMV of total assets immediately before the cancellation. Add lines 18 through 38. |

$ |

Part III. Insolvency

40.Amount of Insolvency. Subtract line 39 from line 17. If zero or less, you are not insolvent.

$

Page 6 |

Chapter 1 Canceled Debts |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used to determine if an individual was insolvent immediately before their debt was cancelled. Insolvency occurs when total liabilities exceed total assets. |

| Components of the Form | The form is divided into three parts: Total liabilities immediately before the cancellation, Fair Market Value (FMV) of assets immediately before the cancellation, and the calculation of insolvency. |

| Types of Debt and Assets | It lists specific types of debts and assets, including credit card debt, mortgages, vehicle loans, and student loans for liabilities; and cash, real estate, vehicles, and retirement accounts for assets. |

| Governing Law | This form is governed by federal tax laws as it relates to the IRS and the taxation of cancelled debts. |

Guide to Writing Insolvency Irs

Filling out the Insolvency Worksheet provided by the IRS is an important step for any individual who has recently had debt canceled. This document, while not submitted to the IRS, is a crucial record to maintain for one's files, especially in situations where the canceled debt amount might not be taxable under the insolvency exclusion. Detailed and accurate completion of this form ensures that individuals can accurately determine their insolvency status at the time their debt was canceled.

To fill out the Insolvency Worksheet, follow these steps:

- Under the date debt was canceled, enter the month, day, and year on which your debt was officially canceled.

- In Part I, titled "Total liabilities immediately before the cancellation," list all the amounts owed in each category provided (e.g., credit card debt, mortgage(s) on real property, car and other vehicle loans, etc.), ensuring that no liability is counted more than once. Each liability type from lines 1 to 16 should have the corresponding amount entered next to it.

- After listing all liabilities, calculate the total amount by adding lines 1 through 16 and enter this sum on line 17.

- In Part II, regarding the Fair Market Value (FMV) of assets owned immediately before the cancellation, accurately list the FMV for different asset categories provided from lines 18 to 38 (e.g., cash and bank account balances, residences, cars, and other vehicles, etc.).

- Calculate the FMV of total assets immediately before the debt cancellation by adding lines 18 through 38 and record this total on line 39.

- In Part III, find the Amount of Insolvency on line 40 by subtracting line 39 (FMV of total assets) from line 17 (Total liabilities). If the result is zero or less, it indicates no insolvency.

Completing the Insolvency Worksheet precisely is essential for documenting the financial status at the time of debt cancellation. This not only assists in personal record-keeping but is also fundamental in determining whether any canceled debt may be excluded from taxable income due to insolvency. Remember, the accuracy of this worksheet can significantly impact financial and tax obligations.

Understanding Insolvency Irs

What is an Insolvency IRS Form?

An Insolvency IRS Form, often referred to as the Insolvency Worksheet, is a document that helps individuals determine their financial status right before a debt was forgiven or canceled. This form is not submitted to the IRS but kept for personal records. It requires individuals to list all liabilities and the fair market value of all assets immediately before the cancellation of a debt. The difference between total liabilities and the fair market value of assets will help individuals ascertain if they were insolvent at that time and by how much.

Why is determining insolvency important when a debt is canceled?

Determining insolvency is crucial because, under the U.S. tax code, forgiven or canceled debts are generally treated as income and therefore taxable. However, if a person is insolvent immediately before the cancellation, the amount of canceled debt up to the amount of insolvency may not be taxable. This means that if you were insolvent, you might be able to exclude such canceled debts from your income, thereby reducing your tax liability.

How do I calculate my insolvency using the worksheet?

To calculate insolvency using the worksheet, list all your liabilities and the fair market value of all your assets in the respective sections of the worksheet before the debt was canceled. The liabilities section includes all debts such as credit card debt, mortgages, and student loans. The assets section includes everything you own such as bank accounts, properties, and personal belongings. After you've listed these amounts, subtract the total value of your assets from the total amount of your liabilities. The resulting figure will show your level of insolvency.

Do I need to submit the Insolvency Worksheet to the IRS?

No, the Insolvency Worksheet does not need to be submitted to the IRS. It should be completed and kept with your records. If the IRS needs more information about the exclusion of a canceled debt from your income, this document will be vital in providing proof of your financial situation at the time the debt was forgiven.

What should I do if I was insolvent by a certain amount?

If you find that you were insolvent by a certain amount according to the worksheet, you may qualify to exclude this amount from your income when you file your taxes. It's important to accurately report this on your tax return, specifically on Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness. This form must be filed with your tax return to formally claim the insolvency exclusion.

Can all types of canceled debts be excluded from income based on insolvency?

Most types of canceled debts can be excluded based on insolvency, but there are exceptions. For example, debts discharged through bankruptcy, certain qualified farm debts, and certain real property business debts may have different rules. Additionally, while insolvency can allow for the exclusion of some personal, credit, and possibly business debts, it does not apply to all types of canceled debts. It's advisable to consult with a tax professional to understand which of your canceled debts may qualify for this exclusion.

Common mistakes

Not accurately listing all liabilities and assets: People often overlook or mistakenly omit certain debts or assets which can lead to an inaccurate representation of their financial situation. It is important to carefully review all financial documents and consider all sources of debts and assets.

Double counting liabilities or assets: Some individuals may mistakenly include the same liability or asset in multiple categories. This error can skew the calculation of insolvency, falsely inflating or deflating the total figure.

Underestimating the fair market value (FMV) of assets: Owners might not assess their assets' value accurately. Assets like real estate or vehicles should be evaluated based on current market conditions, not just purchase prices or sentimental value.

Incorrectly adding the totals of liabilities and assets: Mathematical errors can significantly affect the outcome of the form. Simple addition mistakes or overlooking certain line items can lead to an incorrect calculation of insolvency.

Leaving sections blank: Some individuals might skip parts of the form, either because they think those sections don't apply to them or due to oversight. Every section must be reviewed and filled out as applicable to ensure a complete and accurate portrayal of the financial situation.

Not keeping accurate records: For both liabilities and assets, it's critical to keep detailed records. These records are necessary for verifying the amounts entered on the form and may be required by the IRS for substantiation purposes.

Ignoring accrued expenses: People often forget to include accrued or past-due expenses, such as mortgage interest, real estate taxes, and utilities. These liabilities play a crucial role in determining the extent of insolvency and should not be overlooked.

Common misunderstandings include:

Omitting recent debts or assets acquired just before the cancellation of the debt, which could lead to an incomplete snapshot of one's financial standing.

Failure to recognize the importance of accuracy in every part of the form, which underlines the fact that both understating and overstating values can have legal and financial implications.

Misinterpreting the applicability of certain types of debts and assets, such as mistakenly excluding retirement accounts or life insurance from the assets list due to misunderstandings about their relevance or impact.

Documents used along the form

When dealing with debt cancellation and insolvency, it’s important to have a comprehensive understanding of all necessary documents. The Insolvency IRS Form, with its detailed breakdown of liabilities and assets, is a crucial document for illustrating an individual's financial status at the time of debt cancellation. However, to fully navigate the process, additional forms and documents are often required to provide a thorough financial overview and ensure compliance with tax laws.

- Form 1040 (U.S. Individual Income Tax Return): This form is the standard federal income tax form used to report an individual’s annual earnings, including income, deductions, and tax credits.

- Form 982 (Reduction of Tax Attributes Due to Discharge of Indebtedness): Required for taxpayers who need to reduce their tax attributes due to the discharge of indebtedness, especially in the context of insolvency.

- Form 1099-C (Cancellation of Debt): Issued by the creditor, this form reports the amount of canceled debt that may need to be reported as income on a tax return.

- Bank Statements: Useful for verifying cash and bank account balances listed on the Insolvency Worksheet.

- Property Appraisals: Official appraisals can establish the fair market value (FMV) of properties, crucial for accurately completing the assets section of the Insolvency Worksheet.

- Vehicle Registration and Blue Book Value Reports: These documents help determine the FMV of cars and other vehicles owned.

- Statements of Retirement or Brokerage Accounts: Provide verification for stocks, bonds, and retirement account values listed as assets.

- Life Insurance Policies: Documentation is needed for any life insurance cash value that may count as an asset.

- Loan and Credit Card Statements: Detailed statements are essential to confirm the amounts listed under liabilities in the Insolvency Worksheet.

- Invoice Statements for Major Assets: Receipts or invoices for valuable personal property, such as jewelry or computers, can support their listed FMV.

Gathering these documents in addition to completing the Insolvency IRS Form provides a comprehensive financial snapshot necessary for managing the implications of debt cancellation. Accurately prepared and submitted forms, supported by well-documented financial records, can significantly streamline the process and help ensure that taxpayers comply with relevant tax regulations while protecting their financial well-being.

Similar forms

The Form 1040, U.S. Individual Income Tax Return, bears a resemblance to the Insolvency IRS form because it also requires taxpayers to declare various types of income, deductions, and credits. Much like how the insolvency form calculates a taxpayer's financial status by comparing liabilities and assets, Form 1040 assesses an individual's tax liability based on their annual income and allowable deductions, influencing their tax standing with the Internal Revenue Service.

The Schedule C (Form 1040), Profit or Loss from Business, is similar to the insolvency form in that it also deals with assessing financial health, albeit from a business perspective. Schedule C requires the declaration of income and expenses related to business activities, which directly affects the taxpayer's overall financial position, much like the insolvency form's aim to establish a person's financial situation by listing personal liabilities and assets.

The Schedule D (Form 1040), Capital Gains and Losses, shares commonalities with the insolvency form, particularly in the way it addresses the financial implications of investments. While the insolvency form includes assessments of investments such as stocks, bonds, and other securities, Schedule D is specifically designed to report gains or losses from such investments, impacting the taxpayer's financial situation.

The Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness, directly relates to the insolvency form as it is used when a taxpayer excludes canceled debt from income due to insolvency or other exclusions. This form helps taxpayers reduce certain tax attributes and adjust basis in assets, paralleling the insolvency form's goal of evaluating financial condition in light of debt cancellation.

The Estate Tax Return (Form 706) parallels the Insolvency IRS Form in its approach to valuing assets and liabilities, but within the context of an individual's estate following their death. Both forms require detailed listings of values, though for different purposes: estate tax liability versus determining insolvency status.

The Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, is conceptually similar to the insolvency form because both require the individual to provide comprehensive details about their financial situation. This includes income, living expenses, assets, and liabilities, aimed at assessing ability to pay tax debt or negotiate payment plans.

The Bankruptcy Forms, used when filing for bankruptcy protection, have a notable similarity with the insolvency form, focusing on a thorough declaration of the debtor’s assets, liabilities, income, and expenses. This comprehensive financial snapshot is crucial for both determining insolvency and guiding the bankruptcy process to manage and discharge debts.

The Form 656, Offer in Compromise, shares a common goal with the insolvency form in that it is designed to help individuals settle tax debts for less than the full amount owed based on an inability to pay. Both forms take into account the taxpayer's financial situation, including assets and liabilities, to evaluate the viability of reducing debt obligations.

The Statement of Financial Affairs for Individuals Filing for Bankruptcy requires debtors to list all significant financial actions, income sources, and properties, akin to the detailed asset and liability listings on the insolvency worksheet. This parallels the need in both documents to provide a comprehensive view of an individual's financial standing to assess their capacity to meet debt obligations.

Lastly, the Annual Information Return of Foreign Trust with a U.S. Owner (Form 3520-A) indirectly relates to the insolvency form by requiring detailed information on trust assets, which could influence a U.S. owner's financial position and potentially their insolvency status. Although focused on foreign trusts, the underlying principle of disclosing assets to evaluate financial health aligns with the purpose of the insolvency form.

Dos and Don'ts

When approaching the process of filling out the Insolvency IRS form, it is critical to understand what actions will facilitate an accurate and compliant submission as well as what mistakes to avoid. Below, find essential do's and don'ts to guide you through the completion of this form.

Do:- Verify all the required documents and information you have: Before starting, ensure you possess all the necessary financial documents. This preliminary step will help streamline the process, avoiding the hassle of searching for documents midway through.

- Thoroughly list all liabilities and assets: Accuracy is key. Include every debt and asset as of the date immediately before the debt cancellation. Overlooking an item can lead to an incorrect calculation of insolvency.

- Use precise amounts for liabilities and assets: Estimate values as accurately as possible. For assets, this means current fair market value, not the purchase price or an inflated figure.

- Keep copies of your calculations and documents: After filling out the form, securing a copy for your records is crucial. This will assist in future references or in case the IRS requires more information.

- Seek professional advice if unsure: Whenever uncertainties arise, consulting with a tax professional can provide clarity and prevent errors that might complicate your tax situation.

- Underestimate the significance of debts or overestimate assets: This can lead to inaccurate determination of your insolvency status, potentially affecting the tax implications of your canceled debt.

- Include the same liability or asset in more than one category: Duplicate entries can distort your financial picture, leading to incorrect outcomes on the form.

- Ignore minor debts or assets: Every financial detail counts. Minor debts or assets, when combined, may significantly impact your insolvency calculation.

- Postpone completing the form: Procrastination can lead to rushed decisions and mistakes. Start the process early to allow ample time for accurate completion and verification.

- Disregard IRS instructions and guidelines: The IRS provides specific instructions for each part of the form. Failing to follow these can result in errors. Always refer to the latest instructions provided by the IRS.

Misconceptions

When it comes to understanding the IRS Insolvency form, several misconceptions often cloud the concept of insolvency and its impact on tax obligations. Here's a look at five common misunderstandings:

- Misconception 1: If you're insolvent, you automatically don't owe taxes on forgiven debts. This is only partially true. While insolvency can exclude you from paying taxes on canceled debts up to the amount by which you are insolvent, it doesn't blanketly remove all tax obligations. The IRS requires you to calculate your insolvency immediately before the debt was forgiven and report it accurately.

- Misconception 2: All debts are treated equally in the Insolvency Worksheet. While the worksheet does list various types of debts, not all are necessarily treated the same for tax purposes. For example, student loans might have different considerations given specific forgiveness programs or circumstances under tax law.

- Misconception 3: The fair market value (FMV) of your assets is always equal to what you paid for them. This is not the case. FMV is based on what the asset could currently sell for, not its purchase price or what it's insured for. This is a crucial distinction when filling out the assets section of the insolvency worksheet.

- Misconception 4: You only need to include large assets and debts. Every asset and liability counts when determining insolvency. Overlooking or disregarding smaller items can lead to inaccurate calculations and potential issues with the IRS. This includes everything from household goods to minimal balances in bank accounts.

- Misconception 5: The Insolvency Worksheet needs to be filed with your tax return. The worksheet itself doesn't need to be filed with your tax return but maintaining accurate records and calculations is essential if the IRS requires proof of your insolvency claim. Keeping the worksheet for your records ensures you're prepared for such inquiries.

Navigating insolvency and its implications for canceled debt can be complex. Understanding these misconceptions can help clarify the process, ensuring individuals are better prepared to accurately report their financial status and understand their tax responsibilities. It's always recommended to consult with a tax professional to understand fully how insolvency might impact your specific situation.

Key takeaways

Filling out the Insolvency IRS Form requires attention to detail and an understanding of one's financial situation. Here are eight key takeaways to guide individuals through the process:

- The date of debt cancellation is crucial as it marks the specific point in time when calculating insolvency.

- Total liabilities must include all debts up to the date of cancellation, ensuring nothing is omitted or duplicated across different categories.

- Debts are categorized broadly, from credit card debt to more specific liabilities such as accrued child care costs or judgments, offering a comprehensive overview of what constitutes a liability.

- Mortgages and loans on properties are distinguished by their use, such as personal residence, investment, or business use, affecting their treatment on the form.

- The section on assets similarly enumerates various categories, including everything from cash and bank accounts to the value of business investments, clarifying what needs to be considered when assessing asset value.

- It's essential to accurately assess the fair market value (FMV) of each asset listed, as this will directly impact the calculation of insolvency.

- The calculation of insolvency itself hinges on subtracting the total FMV of assets from the total liabilities immediately before the cancellation of debt, determining whether an individual is insolvent.

- If the calculated insolvency amount is zero or less, the individual is not considered insolvent according to this specific measure.

Correctly completing the Insolvency IRS Form can help individuals understand their financial status and obligations related to canceled debts. It's a detailed process that underscores the importance of accurately reporting all liabilities and assets to assess one's insolvency accurately.

Popular PDF Documents

Income Tax Exemption - Signifies the importance of understanding the distinctions between places of abode that qualify and do not qualify under the exemption criteria.

Sale of Donated Property Within 3 Years - The form requires detailed information about the donated item, the sale amount, and the charity’s use of the proceeds.

Federal Form 8822 - For individuals looking to ensure continuity in their tax affairs, submitting Form 8822 after moving is an essential step.