Get Inheritance Tax Form

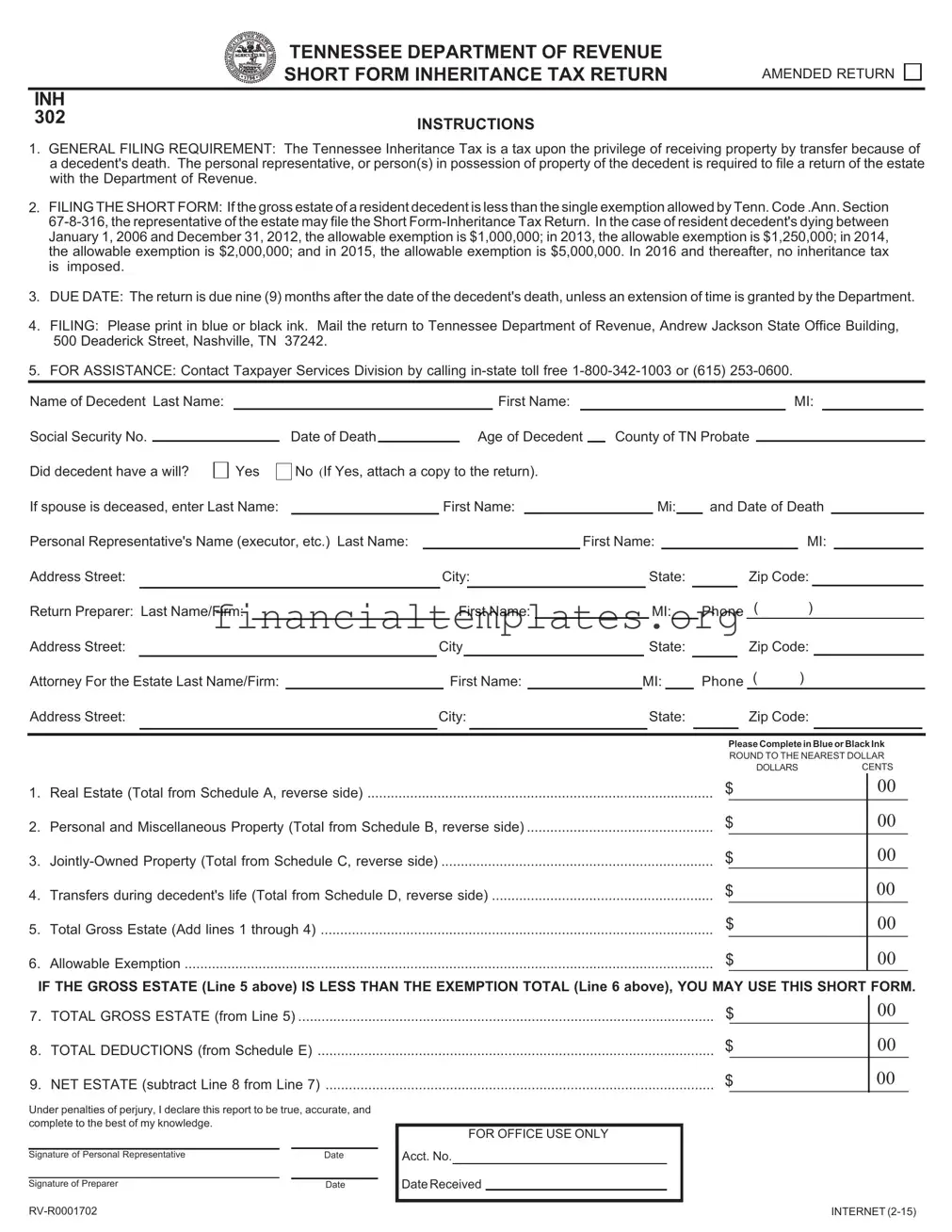

The Inheritance Tax Form, specifically the Short Form Inheritance Tax Return (INH 302) amends a crucial aspect of tax obligations for those handling estates in Tennessee. Administered by the Tennessee Department of Revenue, this form encapsulates the process and requirements involved in reporting a decedent's estate for tax purposes. Initially addressing the general filing requirement, it highlights the tax imposed on the privilege of receiving property due to someone's death, outlining the responsibility of the estate's personal representative or possessor to file this return. Particularly interesting is the shifting landscape of exemption limits over the years, climaxing in 2016 with the abolition of the inheritance tax, thereby reflecting changes in policy. Further, filing details encourage accuracy and timeliness, with a due date set for nine months after the decedent’s death and provisions for extensions under specific circumstances. Instructions for completing the form include the recommendation to use blue or black ink for clarity and detail the submission address, underscoring the Department of Revenue’s commitment to facilitating a smooth filing process. Additionally, it provides resources for assistance, ensuring representatives can seek guidance through designated phone numbers. This introductory coverage into the form's structure and content lays the groundwork for understanding the procedural necessities and legal nuances tied to estate and inheritance tax filing in Tennessee.

Inheritance Tax Example

|

TENNESSEE DEPARTMENT OF REVENUE |

|

|

SHORT FORM INHERITANCE TAX RETURN |

AMENDED RETURN |

|

|

|

INH |

|

|

302 |

INSTRUCTIONS |

|

|

|

1.GENERAL FILING REQUIREMENT: The Tennessee Inheritance Tax is a tax upon the privilege of receiving property by transfer because of a decedent's death. The personal representative, or person(s) in possession of property of the decedent is required to file a return of the estate with the Department of Revenue.

2.FILING THE SHORT FORM: If the gross estate of a resident decedent is less than the single exemption allowed by Tenn. Code .Ann. Section

3.DUE DATE: The return is due nine (9) months after the date of the decedent's death, unless an extension of time is granted by the Department.

4.FILING: Please print in blue or black ink. Mail the return to Tennessee Department of Revenue, Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, TN 37242.

5.FOR ASSISTANCE: Contact Taxpayer Services Division by calling

Name of Decedent Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MI: |

|

|

||||||||||||

Social Security No. |

|

|

|

|

|

Date of Death |

|

|

|

|

|

|

|

Age of Decedent |

|

|

County of TN Probate |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Did decedent have a will? |

Yes |

|

|

|

No (If Yes, attach a copy to the return). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

If spouse is deceased, enter Last Name: |

|

|

|

|

|

First Name: |

|

|

|

|

|

|

|

|

Mi: |

|

and Date of Death |

|

||||||||||||||||||||||||||||||

Personal Representative's Name (executor, etc.) Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

First Name: |

|

|

|

|

|

|

MI: |

|

|

||||||||||||||||||||||||||

Address Street: |

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

State: |

|

|

Zip Code: |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|||||

Return Preparer: Last Name/Firm: |

|

|

|

|

|

|

|

|

First Name: |

|

|

|

|

|

|

|

MI: |

|

Phone |

|

|

|

|

|

|

|

||||||||||||||||||||||

Address Street: |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State: |

|

|

Zip Code: |

|

||||||||||||||||||||||||||

Attorney For the Estate Last Name/Firm: |

|

|

|

|

|

|

|

First Name: |

|

|

|

|

MI: |

|

Phone |

( |

|

) |

|

|

|

|

|

|

|

|||||||||||||||||||||||

Address Street: |

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

State: |

|

|

Zip Code: |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Complete in Blue or Black Ink |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROUND TO THE NEAREST DOLLAR |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

|

CENTS |

|||

1. |

Real Estate (Total from Schedule A, reverse side) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

00 |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

|||||||||||||||||||||||

2. |

Personal and Miscellaneous Property (Total from Schedule B, reverse side) |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

|||||||||||||||||||||||||||||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||

...................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

||||||||||||||||||||||||

4. |

Transfers during decedent's life (Total from Schedule D, reverse side) |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

|||||||||||||||||||||||||||||||||||

5. |

Total Gross Estate (Add lines 1 through 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

00 |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

|||||||||||||||||||||||

6. |

Allowable Exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

|||||||||||||||

IF THE GROSS ESTATE (Line 5 above) IS LESS THAN THE EXEMPTION TOTAL (Line 6 above), YOU MAY USE THIS SHORT FORM.

7. |

TOTAL GROSS ESTATE (from Line 5) |

$ |

00 |

|

|||

8. |

TOTAL DEDUCTIONS (from Schedule E) |

$ |

00 |

_______________________ |

|

||

9. |

NET ESTATE (subtract Line 8 from Line 7) |

$ |

00 |

_______________________ |

|

Under penalties of perjury, I declare this report to be true, accurate, and complete to the best of my knowledge.

Signature of Personal Representative |

|

Date |

|

|

|

Signature of Preparer |

|

Date |

FOR OFFICE USE ONLY

Acct. No.

Date Received

INTERNET |

SCHEDULES

Date of Valuation of assets (check one): Value of assets at date of death

or Value of assets 6 months after date of death

SCHEDULE A - REAL ESTATE

Individually owned and located in Tennessee

Description & Location |

Full Value |

SCHEDULE B - PERSONAL & MISC. PROPERTY

Cash, Notes, Mortgages, Life Insurance, Stocks, Bonds, Annuities, Furnishings,

|

Automobiles, Jewelry, etc. Owned Individually |

Description |

Full Value |

10. TOTAL (enter on front, Line 1)

$

11. TOTAL (enter on front, Line 2)

$

|

SCHEDULE C (PART 1) - JOINTLY OWNED PROPERTY |

|

List property interest held jointly by decedent and spouse |

Description |

Full Value |

12.Total Property Value

13.

$

SCHEDULE C (PART 2) - JOINTLY OWNED PROPERTY

|

List property interests held jointly by decedent and persons other than spouse |

|

|

Description |

% owned by Decedent |

Name of Joint Owner |

Full Value Owned by Decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Total Property Value |

|

|

|

|

|

|

|

|

15. |

Total of lines 13 & 14 (enter on front, Line 3) |

|

$ |

|

|

|

|

|

|

|

|

SCHEDULE D - TRANSFERS DURING DECEDENT'S LIFE |

||

|

|

List all transfers made by decedent within 3 years prior to date of death |

|

|

Description of Transfer |

To Whom (name) |

Date of Gift |

Full Value |

|

16.Total Gifts

17.Gift Tax Paid (enter total of State Gift Tax paid on above gifts)

18. Total of lines 16 & 17 (enter on front, Line 4) |

$ |

SCHEDULE E - DEDUCTIONS

Examples: funeral&burialexpenses,administrativeexpenses(courtcosts,bonds,etc.)professionalfees(attorney,accountant,etc.)taxes(property,individual,etc.),notes

&mortgages due (decedent obligations but only ½ of joint obligations), debts of decedent (unpaid at date of death), bequests (public, charitable, religious, & educational), marital deductions (list all property passing to spouse), etc.

Description |

Amount |

19. TOTAL AMOUNT ALL DEDUCTIONS (enter on front, Line 8)

$

INTERNET

Document Specifics

| Fact Name | Description |

|---|---|

| General Filing Requirement | The Tennessee Inheritance Tax is applied to the privilege of receiving property due to someone's death. It necessitates that a return of the estate is filed by the personal representative or person(s) in possession of the decedent's property. |

| Filing the Short Form | This option is available if the gross estate of a resident decedent is less than the exemption provided by Tennessee Code Ann. Section 67-8-316. The exemption amounts varied from $1,000,000 in 2006 to $5,000,000 in 2015. From 2016 onwards, no inheritance tax is imposed. |

| Due Date | The return is due nine months after the decedent's death. Extensions may be granted by the Department of Revenue. |

| Filing Address | Returns should be mailed to the Tennessee Department of Revenue, located at the Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, TN 37242. |

| Assistance Information | For assistance, you can contact the Taxpayer Services Division by calling in-state toll-free 1-800-342-1003 or (615) 253-0600. |

| Exemption Amounts Over Years | The exemption amounts increased from $1,000,000 in 2006 to $5,000,000 in 2015, with specific amounts set for each year. Starting in 2016, the inheritance tax was abolished. |

| Ink Requirement | The form must be completed in blue or black ink to ensure legibility and proper handling. |

| Governing Law | The governing law for the Tennessee Inheritance Tax is found in Tennessee Code Annotated Section 67-8-316, which outlines the exemptions and requirements for the tax. |

| Value of Assets for Schedules | Valuation of assets can be done as per the date of the decedent's death or six months after the date of death, providing flexibility in tax planning and filing. |

Guide to Writing Inheritance Tax

Filling out an Inheritance Tax form is an important step in managing the affairs of a loved one who has passed away. This document is used to report the value of the estate left behind and to calculate any taxes due. The process may seem daunting at first, but following a step-by-step guide can simplify the task. The objective is to ensure you accurately complete the form, thus ensuring compliance with the legal requirements. It's worth noting that the rules and exemptions may vary, so it's important to pay close attention to details such as the allowable exemption amounts for different years. Once completed, the form must be submitted to the designated department within the stipulated time frame to avoid any penalties.

- Begin by gathering all necessary information about the decedent's estate, including details of all assets and their values.

- Fill in the "Name of Decedent" section with the last name, first name, and middle initial of the person who has passed away, along with their Social Security Number and date of death.

- If the decedent had a will, mark "Yes" in the appropriate section and attach a copy of the will to the return.

- Enter information regarding the Personal Representative of the estate, including their name and contact details.

- In the "Return Preparer" section, fill in the details of the person who prepared the form, if it wasn't filled out by the Personal Representative.

- The "Attorney For the Estate" section should include the name and contact information of the estate's attorney, if applicable.

- Proceed to fill in the financial details of the estate in the required sections:

- Real Estate (Total from Schedule A)

- Personal and Miscellaneous Property (Total from Schedule B)

- Jointly-Owned Property (Total from Schedule C)

- Transfers during decedent's life (Total from Schedule D)

- Calculate the Total Gross Estate by adding the values from lines 1 through 4.

- Write down the Allowable Exemption based on the year of the decedent's death, referring to the instructions for the correct amount.

- If the Gross Estate is less than the Exemption Total, proceed to use this Short Form. Otherwise, consult the relevant instructions for next steps.

- Compute the Total Deductions from Schedule E and the Net Estate by subtracting the Total Deductions from the Total Gross Estate.

- Confirm the accuracy of all information entered and sign the form as the Personal Representative. If someone prepared the form on behalf of the Personal Representative, both parties must sign and date the form.

- Mail the completed form to the Tennessee Department of Revenue at the address provided in the instructions, ensuring it's sent well before the due date to avoid any penalties.

Upon submitting the Inheritance Tax form, the Department of Revenue will review the submission and notify you of any further requirements or provide confirmation of acceptance. This step is crucial in the estate settlement process and helps ensure all tax obligations are met according to the law. Be sure to keep copies of all documents submitted for your records and future reference.

Understanding Inheritance Tax

-

Who needs to file the Inheritance Tax Return form in Tennessee, and are there any exceptions?

The personal representative of the estate, or anyone in possession of the decedent's property, is required to file an inheritance tax return with the Tennessee Department of Revenue. However, there are exemptions based on the value of the estate and the dates of the decedent's passing. Specifically, if the gross estate of a resident decedent is less than the single exemption amount provided by Tennessee law, the short form can be filed. These exemption amounts changed over the years; from 2006 to 2012, it was $1,000,000, in 2013, $1,250,000, in 2014, $2,000,000, and in 2015, $5,000,000. Starting from 2016 onwards, no inheritance tax is imposed.

-

What is the due date for filing the Tennessee Inheritance Tax Return?

The Inheritance Tax Return must be filed within nine months following the decedent's death. If necessary, it's possible to request an extension of time to file from the Department of Revenue. This extension provides additional time to gather the necessary information and complete the filing accurately.

-

How should the Inheritance Tax Return be submitted, and what ink color should be used?

The return should be printed out and filled in using either blue or black ink for clarity. Once completed, it must be mailed to the Tennessee Department of Revenue at the specified address in Nashville, TN. This requirement helps ensure the document is legible and processed efficiently by the Revenue Department.

-

Where can assistance be found if there are questions or issues filling out the Inheritance Tax Return form?

For any inquiries or need for further assistance, the Taxpayer Services Division of the Tennessee Department of Revenue is available. They can be reached via an in-state toll-free number or another number provided for general inquiries. This service is valuable for clarifications or addressing any uncertainties during the completion of the inheritance tax return.

Common mistakes

When preparing an Inheritance Tax form, individuals often navigate through complex instructions and financial details, aiming to fulfill their obligations accurately. However, common mistakes can arise during this process, complicating the fulfillment of these duties. Below are seven mistakes frequently encountered:

Failing to thoroughly understand the eligibility for using the Short Form Inheritance Tax Return, resulting in the use of an incorrect form. The short form is specifically designated for estates that fall beneath a certain exemption threshold, which has varied over years, as detailed in the Inheritance Tax form instructions.

Inaccurately calculating the total value of the estate's gross assets. This includes real estate, personal and miscellaneous property, jointly-owned property, and transfers during the decedent’s life. Proper appraisal and valuation of these assets are crucial for an accurate submission.

Omitting or incorrectly reporting transfers made by the decedent within three years prior to death. Schedule D requires precise details about such transfers, including the recipient and the value at the time of the gift, which are often overlooked or undervalued.

Not fully documenting deductions that could reduce the taxable value of the estate, as outlined in Schedule E. This includes funeral and burial expenses, administrative expenses, debts, and taxes owed by the decedent, which are sometimes not meticulously accounted for.

Misunderstanding the valuation date for estate assets. Estate assets can be valued either at the date of the decedent's death or six months thereafter. This selection can significantly impact the estate's valuation and, consequently, the inheritance tax calculation.

Overlooking the requirement to attach a copy of the decedent’s will if one existed. This omission can delay the processing of the return, as the will may designate various bequests and directives important for accurate tax calculation.

Failing to round dollar amounts to the nearest dollar as instructed. This might seem minor, but accuracy in these details can affect the overall calculation and presentation of the tax return.

Addressing these mistakes requires attention to detail and an in-depth understanding of the requirements set forth by the Tennessee Department of Revenue. Individuals are encouraged to seek assistance when necessary and to review their forms carefully before submission to ensure compliance and accuracy.

Documents used along the form

When navigating through the intricacies of managing a deceased person's estate, the Tennessee Department of Revenue's Inheritance Tax form is crucial but often not the sole document needed in the process. Alongside it, several other forms and documents are commonly utilized to ensure a thorough and compliant execution of the decedent's estate management and tax obligations. Understanding these documents can ease the burden during a challenging time.

- Will: This legal document outlines the decedent's wishes regarding the distribution of their assets and the care of any minor children. It is crucial for determining the rightful heirs and the distribution of the estate according to the decedent's wishes.

- Death Certificate: This official document serves as proof of death. It is required by financial institutions, government agencies, and courts to verify the decedent's death and proceed with the administration of the estate.

- Trust Documents: If the decedent established any trusts, these documents delineate the terms, trustees, and beneficiaries of those trusts. Trusts may be used to manage and distribute assets outside of the probate process.

- Life Insurance Policies: These policies provide beneficiary information and the amount to be disbursed upon the decedent's death. Life insurance proceeds are typically not subject to probate and can provide immediate funds to beneficiaries.

- Bank and Investment Account Statements: These statements are essential for understanding the full scope of the decedent's assets. They help in valuing the estate and determining the distribution of assets.

- Property Deeds: Real estate deeds are necessary to establish ownership of properties. They are needed to transfer property titles to the heirs or to sell the property as part of the estate settlement.

Each document serves a specific purpose in the broader context of estate management and inheritance tax filing. By meticulously gathering and managing these documents, personal representatives can navigate the estate settlement process more effectively, ensuring compliance with legal requirements and honoring the decedent's wishes. This underscores the importance of thorough preparation and understanding of all required documentation in managing the affairs of a deceased loved one's estate.

Similar forms

Similar to the Inheritance Tax Form, an Estate Tax Return documents the valuation of a deceased individual’s estate to determine any taxes due. The process involves listing all assets, including real estate, personal property, and investments, just like the Inventory section of the Inheritance Tax Form. Both require comprehensive information to accurately assess the financial responsibilities of the estate to the federal or state government, taking into account allowable exemptions and deductions.

The Gift Tax Return is another document that echoes the structure and purpose of the Inheritance Tax Form. This form is used to report the transfer of property or money to another person without receiving full value in return. Similar to the Inheritance Tax Form, it includes valuing assets and calculating exemptions to determine if a tax liability exists. The Gift Tax Return specifically focuses on transfers made during a person’s life, akin to the "Transfers during decedent's life" section on the Inheritance Tax Form.

The Trust Income Tax Return requires trustees to report income, deductions, and credits of a trust. This parallels the Inheritance Tax Form's approach in documenting assets and deductions but within the context of a trust's operations. Like the Inheritance Tax Form, it determines the taxable portion of an entity's income after deductions, noting exemptions and taxable distributions.

The Final Individual Income Tax Return for deceased persons, or Form 1040, shares common principles with the Inheritance Tax Form in its compilation of financial information following someone's death. This return accounts for the last year of income, deductions, and credits of the deceased, similar to the Inheritance Tax Form's accounting of the decedent's assets and deductions at the time of death.

The Personal Representative’s Deed is integral to estate administration, allowing for the transfer of real property from an estate to heirs or buyers. It relates to the Inheritance Tax Form’s need to document and value real estate within the deceased’s estate, as seen in Schedule A of the form. Both documents are pivotal in the lawful distribution and taxation of estate assets.

A Power of Attorney for Finances grants someone the authority to handle financial matters on behalf of another person. It is akin to the Inheritance Tax Form’s aspect where a personal representative or executor handles the deceased's financial responsibilities, including tax obligations. The document facilitates transactions and decisions, mirroring the executor’s role in managing estate tax filings.

The Executor’s/ Administrator's Deed functions similarly to the Personal Representative’s Deed by facilitating the transfer of estate property. It directly correlates with documenting and valuing estate assets on the Inheritance Tax Form, especially in cases where property must be sold to meet financial obligations of the estate, including tax liabilities.

Lastly, the Application for Probate and Administration is akin to the initiation phase represented by filing the Inheritance Tax Form. This application begins the legal process of estate administration, identifying assets, liabilities, and the decedent’s wishes as outlined in their will, paralleled by the tax form’s role in assessing the estate’s tax responsibilities based on its value.

Dos and Don'ts

Filling out an Inheritance Tax Form can be a complex process that requires attention to detail. To ensure accuracy and compliance with legal requirements, here are five dos and don'ts to consider:

Do:

- Verify exemption eligibility : Before starting, confirm if the estate qualifies for an exemption based on the decedent's date of death and the applicable exemption amount for that year. This determines if the short form can be used.

- Gather all necessary documents : Compile a complete inventory of the decedent's assets, including real estate, personal and miscellaneous property, jointly-owned property, and any transfers during the decedent's lifetime.

- Use the correct ink : Fill out the form in blue or black ink as required, to ensure the form is processed correctly and to avoid any delays.

- Round to the nearest dollar : When listing asset values and deductions, ensure amounts are rounded to the nearest dollar to comply with form instructions.

- File on time : Submit the completed form within nine months of the decedent's death or by the extended due date if an extension was granted by the Department of Revenue.

Don't:

- Overlook jointly-owned properties : Carefully list all jointly-owned properties, specifying each owner's share, to accurately determine the estate's value.

- Forget about lifetime transfers : Include all transfers made by the decedent within three years prior to their death, as they may affect the estate's total value.

- Ignore deductions : Accurately listing allowable deductions, such as funeral and burial expenses, can significantly reduce the taxable estate value.

- Skip legal documentation : If the decedent had a will, ensure a copy is attached to the return. This is crucial for the accurate processing of the estate.

- Miss signatures : The form requires signatures from both the personal representative and, if applicable, the return preparer. Missing signatures can lead to the rejection of the form.

Misconceptions

One common misconception is that the inheritance tax form must be filed for all estates, regardless of their size. In reality, the requirement to file is based upon the value of the estate. If the gross estate value is less than the single exemption amount, a Short Form Inheritance Tax Return can be filed instead. This exemption amount has varied over years, showcasing a need to evaluate each estate against the exemption threshold applicable at the time of the decedent's death.

Many people believe that filing an amended inheritance tax return is a complicated process. However, the INH 302 form is designated for this purpose, accommodating corrections or updates to a previously submitted return without an overly complex procedure.

There's a misconception that the inheritance tax applies to the beneficiary's total inheritance. The tax is calculated on the decedent's estate value before distribution, not on the individual amount received by each beneficiary.

It's often thought that jointly-owned property is always exempt from inheritance tax. While the form does have provisions for jointly-owned property, only a portion may be exempt, and this is determined by the deceased's share of the property, highlighting the need to assess the value of jointly-owned assets accurately.

Some assume that all transfers during the decedent's life are excluded from the estate valuation. However, the form requires listing transfers made within three years prior to death, which might affect the estate's valuation for tax purposes.

There is a misconception that there is no deadline for filing the inheritance tax return. In reality, the return is due nine months after the decedent's death, with the possibility of an extension granted by the Department under certain circumstances.

An error often made is thinking that assistance for filling out the form is hard to come by. The Department of Revenue offers help through its Taxpayer Services Division, providing a toll-free number for in-state calls, ensuring that representatives or individuals handling the estate can seek guidance when needed.

Finally, some believe that the value of assets is fixed at the date of the decedent's death. The form allows for the valuation of assets either at the date of death or six months after, offering some flexibility in determining the estate's value for tax purposes.

Key takeaways

Understanding how to properly complete and utilize the Tennessee Inheritance Tax Form, known as INH 302, is crucial for personal representatives managing an estate. Here are key takeaways to navigate this process effectively:

Filing Requirements: The necessity to file the Tennessee Inheritance Tax Return, INH 302, comes into play when managing the property of a deceased person. This requirement is designated for personal representatives or individuals in possession of the decedent's property.

Choosing the Correct Form: Eligibility to file the Short Form Inheritance Tax Return is based on the gross estate value. If the gross estate is under the exemption limit set by Tennessee Code Section 67-8-316, the short form may be used. Exemption limits have varied over the years, reaching $5,000,000 in 2015, with no inheritance tax imposed from 2016 onwards.

Submission Deadline: The Inheritance Tax Return is due nine months following the decedent's death. Extensions can be requested but require approval from the Department of Revenue.

How to File: Accuracy is key. The form should be completed using blue or black ink and mailed to the designated address at the Tennessee Department of Revenue. This ensures clarity and legibility of the information provided.

Getting Help: For those needing assistance or clarification on how to complete the form, contacting the Taxpayer Services Division is recommended. They offer support through both toll-free and direct phone numbers.

Important Sections to Complete: The form includes various schedules to itemize different types of property and assets, such as real estate, personal property, jointly-owned property, and transfers during the decedent's life. Understanding these segments is crucial for accurately reporting the estate's value.

Declaration and Penalties: The signatory, typically the personal representative or estate preparer, certifies the form's accuracy under the penalty of perjury. This underscores the importance of ensuring all information is true, accurate, and complete.

By paying close attention to these key aspects and diligently gathering the necessary information, representatives can more confidently navigate the process of filing a Tennessee Inheritance Tax Return.

Popular PDF Documents

Application for Closing Loan Account - Precondition document submitted to ICICI Bank, clarifying the borrower's intended use of loan funds, ensuring transparency and compliance with legal and bank policies.

Us Sales Tax Exemption - Approval by the Texas Real Estate Commission signifies that the form meets regulatory standards and expectations.