Get Individual Estimated Tax Payment Form

Navigating tax obligations can often seem daunting, but the Individual Estimated Tax Payment form, commonly referred to as form M14, provides a structured way for individuals to manage their tax payments throughout the year. This form is an essential tool for those who need to pay taxes on income that isn't subject to regular withholding taxes, such as earnings from self-employment, interests, dividends, rents, and alimony. The form’s functionality allows taxpayers to type in their information directly on the screen, ensuring that a personalized scan line is printed on the voucher. This scan line is critical for the accurate crediting of payments to the taxpayer's account, encompassing the tax-year end date and the taxpayer's Social Security number. The instructions emphasize the importance of proper print settings to avoid any mishaps in the processing of the payment voucher. For those who prefer the convenience and immediacy of electronic payment options, the form details steps for online or phone payments, including the necessity for bank information that is not linked to foreign banks. In contrast, those opting to pay via credit or debit card, or by a traditional check, are informed of the applicable procedures and fees. The detailed guidance provided ensures that every taxpayer can select a payment method that suits their preferences while adhering to the requirements for making their estimated tax payments effectively and on time.

Individual Estimated Tax Payment Example

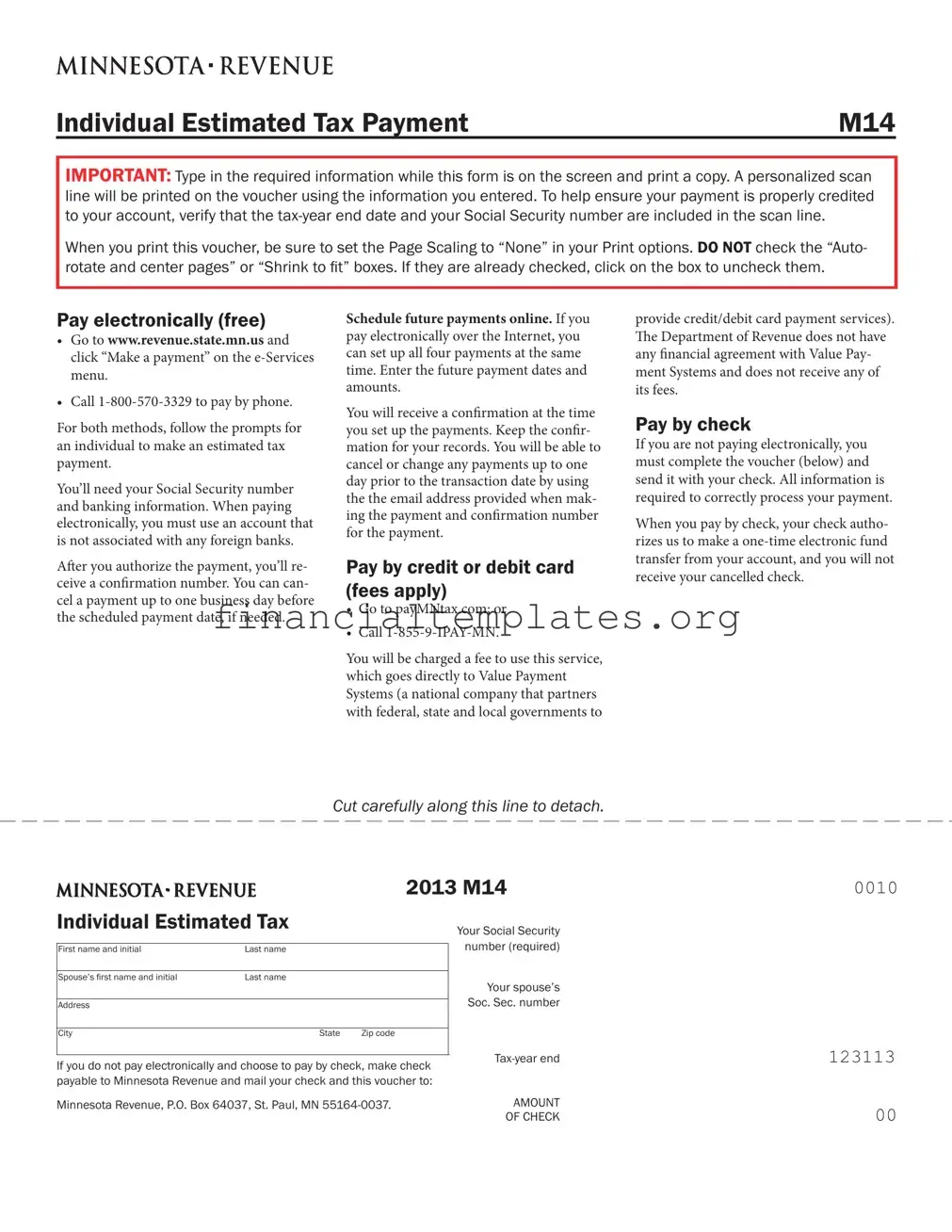

Individual Estimated Tax Payment |

M14 |

IMPORTANT: Type in the required information while this form is on the screen and print a copy. A personalized scan line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited to your account, verify that the

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto- rotate and center pages” or “Shrink to it” boxes. If they are already checked, click on the box to uncheck them.

Pay electronically (free)

•Go to www.revenue.state.mn.us and click “Make a payment” on the e‑Services menu.

•Call 1‑800‑570‑3329 to pay by phone.

For both methods, follow the prompts for an individual to make an estimated tax payment.

You’ll need your Social Security number and banking information. When paying electronically, you must use an account that is not associated with any foreign banks.

Ater you authorize the payment, you’ll re‑ ceive a conirmation number. You can can‑ cel a payment up to one business day before the scheduled payment date, if needed.

Schedule future payments online. If you pay electronically over the Internet, you can set up all four payments at the same time. Enter the future payment dates and amounts.

You will receive a conirmation at the time you set up the payments. Keep the conir‑ mation for your records. You will be able to cancel or change any payments up to one day prior to the transaction date by using the the email address provided when mak‑ ing the payment and conirmation number for the payment.

Pay by credit or debit card (fees apply)

•Go to payMNtax.com; or

•Call 1‑855‑9‑IPAY‑MN.

You will be charged a fee to use this service, which goes directly to Value Payment Systems (a national company that partners with federal, state and local governments to

provide credit/debit card payment services). he Department of Revenue does not have any inancial agreement with Value Pay‑ ment Systems and does not receive any of its fees.

Pay by check

If you are not paying electronically, you must complete the voucher (below) and send it with your check. All information is required to correctly process your payment.

When you pay by check, your check autho‑ rizes us to make a one‑time electronic fund transfer from your account, and you will not receive your cancelled check.

Cut carefully along this line to detach.

|

|

2013 M14 |

||

Individual Estimated Tax |

|

|

Your Social Security |

|

|

|

|

|

|

|

|

|

|

number (required) |

First name and initial |

Last name |

|

||

|

|

|

|

|

Spouse’s irst name and initial |

Last name |

|

|

Your spouse’s |

|

|

|

|

|

|

|

|

|

Soc. Sec. number |

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip code |

|

|

|

|

|

|

|

If you do not pay electronically and choose to pay by check, make check |

|

|||

|

|

|||

payable to Minnesota Revenue and mail your check and this voucher to: |

|

|

||

0010

123113

Minnesota Revenue, P.O. Box 64037, St. Paul, MN |

AMOUNT |

00 |

|

OF CHECK |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Use | The Individual Estimated Tax Payment M14 form is used for making estimated tax payments to the state of Minnesota. |

| Electronic Payment Options | Payments can be made electronically through the official state website or by phone, with the requirement of having a bank account not associated with foreign banks. |

| Credit or Debit Card Payments | Payment through credit or debit card is supported via payMNtax.com or a designated phone number, subject to service fees paid directly to Value Payment Systems. |

| Check Payment Instructions | If not paying electronically, a filled-out voucher from the M14 form must be sent along with a check to a specified address for Minnesota Revenue. |

Guide to Writing Individual Estimated Tax Payment

When it's time to handle estimated taxes, ensuring your payments are accurately and timely processed is crucial. Whether you're an individual making these payments on your own behalf or on behalf of a spouse or a dependent, filling out the Individual Estimated Tax Payment form correctly guides the payment process, avoiding potential hiccups. The form acts as a direct link between your payment and your tax account, helping to ensure that your payment is credited accurately. It is also designed to accommodate various payment methods, including electronic payments, which can streamline the process for you. Here is a step-by-step guide on how to fill out the Individual Estimated Tax Payment form, with options for both electronic and check payments.

- Type in the required information directly on the form on your screen before printing. This includes your social security number, name, address, and the tax-year end date.

- Adjust the Print options. Set the Page Scaling to “None” and ensure that "Auto-rotate and center pages" and "Shrink to fit" boxes are unchecked. If they are checked, click on the boxes to remove the checkmarks.

- If paying electronically:

- Visit www.revenue.state.mn.us, click “Make a payment” on the e-Services menu, or call 1-800-570-3329 to pay by phone.

- Follow the prompts designated for individuals making an estimated tax payment. Have your social security number and banking information ready. Remember, the account must not be associated with any foreign banks.

- After authorizing the payment, note down the confirmation number provided. This is crucial for record-keeping or if you need to cancel the payment.

- To schedule future payments online, enter the dates and amounts for all intended payments. Make sure to keep the confirmation for your records.

- If paying by credit or debit card:

- Visit payMNtax.com or call 1-855-9-IPAY-MN.

- Note, service fees apply for this payment method. These charges are collected by the payment processor, not the Department of Revenue.

- If paying by check:

- Complete the voucher part of the form with all the required information. This includes your Social Security number, name, address, and the amount of the check.

- Make the check payable to Minnesota Revenue and mail it along with the voucher to Minnesota Revenue, P.O. Box 64037, St. Paul, MN 55164-0037.

- Note that by paying with a check, you authorize a one-time electronic funds transfer, and you will not receive your canceled check back.

Paying your estimated taxes doesn’t have to be a complicated process. By following these straightforward steps, you can ensure your payment is processed promptly and linked accurately to your tax account. Whether you're more comfortable paying electronically or sticking to traditional methods like checks, the key is ensuring the information you provide is complete and accurate. Timely and correctly filling out the Individual Estimated Tax Payment form is an important part of managing your taxes effectively.

Understanding Individual Estimated Tax Payment

Frequently Asked Questions About the Individual Estimated Tax Payment Form

- What is the Individual Estimated Tax Payment Form?

It's a form used to make estimated tax payments if you are not having enough tax withheld from your income, such as earnings from self-employment, interest, dividends, alimony, rental income, etc. It ensures you comply with tax payment rules and avoid potential penalties for underpayment.

- How do I fill out the Information on the form correctly?

Type in the required information while the form is on your screen and then print a copy. Ensure you do not scale the print size by setting the Page Scaling to “None” in your Print options. The tax-year end date and your Social Security number must be included for the payment to be properly credited.

- Can I pay my estimated taxes electronically?

Yes, you can pay electronically either by visiting the website provided or by calling the toll-free number. You'll need your Social Security number and bank information that's not linked to foreign banks. Upon authorization, you'll receive a confirmation number, and you can cancel the payment up to one business day before the scheduled date.

- Is it possible to schedule future payments online?

Yes, when paying electronically via the internet, you can set up all your payments at once, specifying future payment dates and amounts. A confirmation will be provided for your records, and modifications or cancellations can be made up to one day before the transaction date using the provided email address and confirmation number.

- Are there fees for paying with a credit or debit card?

Yes, when you pay using a credit or debit card through the designated website or phone number, a processing fee is charged by Value Payment Systems. This fee is not collected by the Department of Revenue, as there is no financial agreement between the two entities.

- How can I pay by check?

If you opt not to pay electronically, complete the voucher part of the form and send it with your check to the specified address. Note that paying by check authorizes a one-time electronic funds transfer, and you won’t receive your canceled check back.

- What happens if I don’t set the Page Scaling correctly when I print the form?

Incorrect page scaling may lead to improperly formatted submissions, which can delay or misdirect the processing of your estimated tax payment. Ensure the “Auto- rotate and center pages” and “Shrink to fit” options are unchecked before printing.

- Why do I need to include my Social Security number?

Your Social Security number is essential for ensuring your payment is accurately applied to your account. It acts as a unique identifier for your tax records and payments.

- What should I do if I need to cancel an electronic payment?

If you need to cancel an electronic payment, you can do so up to one business day before the scheduled payment date. Use the confirmation number and the email address provided during the setup process to cancel the payment.

Common mistakes

-

Not typing in the required information while the form is on the screen, leading to a lack of a personalized scan line that is crucial for the payment process. This scan line includes the tax-year end date and the individual's Social Security number, which are essential for ensuring the payment is credited to the correct account.

-

Forgetting to set the Page Scaling to “None” in the Print options. This mistake can cause the printed form to not match the original document's specifications, potentially causing issues with processing the form.

-

Checking the “Auto-rotate and center pages” or “Shrink to fit” boxes in the print options. This action can alter the layout or size of the printed form, leading to scanning and processing errors.

-

Paying with an account associated with foreign banks when making electronic payments, which is not allowed. This can lead to the payment being rejected.

-

Failure to keep the confirmation number and email address used when making an electronic payment. This information is critical for canceling or changing payments if necessary.

-

Not using the official payment platforms or phone numbers listed, potentially leading to scams or incorrect payment processing. It is important to use the website provided and the official phone number for making payments.

-

Entering incorrect banking information when making electronic payments, which can result in payment failure or delays.

-

Omitting or incorrectly filling in the Social Security numbers for both the taxpayer and the spouse if applicable. This mistake can lead to misdirected payments or processing delays.

-

Failing to complete all required fields in the voucher when choosing to pay by check. Each field is necessary for the payment to be processed correctly.

-

Paying by check but neglecting to attach the completed voucher with the check. The voucher contains important information that matches the payment to the taxpayer's account.

By avoiding these mistakes, taxpayers can ensure their estimated tax payments are processed smoothly and accurately, without unnecessary delays or issues.

Documents used along the form

Filing taxes involves a meticulous process requiring various forms and documents, not just to comply with regulations but also to ensure accuracy and timeliness in submissions. For individuals making estimated tax payments, the Individual Estimated Tax Payment form is a starting point, but often, several other documents play a crucial role in ensuring a complete and compliant tax filing process. Understanding each of these documents will streamline tax preparation and minimize errors.

- Form 1040-ES, Estimated Tax for Individuals: This form is used to calculate and pay estimated taxes on income not subject to withholding, including earnings from self-employment, interest, dividends, rents, alimony, etc.

- Form W-2, Wage and Tax Statement: Employers provide this form to employees, showing the amount of wages received and taxes withheld for the year. It's essential for individuals who have taxes withheld from their salaries or wages.

- Form 1099-MISC, Miscellaneous Income: This document reports income received as an independent contractor or freelancer. It's crucial for accurately reporting earnings that aren't covered by traditional employment.

- Form 1099-INT, Interest Income: This form reports interest income earned throughout the year. It's necessary for taxpayers who have interest-earning accounts in banks or investments.

- Form 1099-DIV, Dividends and Distributions: This is used to report dividends and other distributions received on stocks or mutual funds, a key document for investors to accurately report their investment income.

- Schedule C, Profit or Loss from Business: Used by sole proprietors to report the income or loss of a business they operated or a profession they practiced as a sole proprietor. It details the income earned and expenses incurred in the business.

- Schedule SE, Self-Employment Tax: This form calculates the self-employment tax owed by individuals who earn income as freelancers, independent contractors, or sole proprietors. It accompanies the main tax return and addresses Social Security and Medicare contributions.

Gathering these forms and documents before filing taxes can significantly reduce stress and uncertainty. Each plays a pivotal role in not just calculating the taxes owed or refund due but also in substantiating the income and deductions reported on one's tax return. Ensuring that these documents are accurate and complete is fundamental to a seamless tax filing experience.

Similar forms

The 1040-ES form, used for calculating and submitting estimated taxes by individuals, closely resembles the structure and purpose of the Individual Estimated Tax Payment form. Both forms facilitate the payment of taxes that are not automatically deducted from wages or salaries, such as earnings from self-employment, interest, dividends, and rentals. They share the necessity for taxpayers to accurately estimate their due tax amounts for the year, divide this estimate into quarterly payments, and include personal identification information to ensure the payments are credited appropriately to their accounts.

The W-9 form, Request for Taxpayer Identification Number and Certification, also shares similarities with the Individual Estimated Tax Payment form, although it serves a different primary function. The W-9 is typically used by freelancers and contractors to provide their tax identification numbers (such as Social Security numbers) to entities that will pay them. This is analogous to the requirement on the Individual Estimated Tax Payment form for taxpayers to provide their Social Security numbers to ensure that their payments are matched to the correct account. Both forms are crucial in the management and reporting of taxable income.

Another form with similarities is the State Tax Withholding Form, which varies by state, like the Minnesota Revenue form mentioned. This form is used by employees to determine the amount of state tax to be withheld from their paychecks. While it directly pertains to withholding rather than estimated tax payments, it similarly requires individuals to estimate their tax liabilities based on earnings and personal exemptions, akin to estimating payments on the Individual Estimated Tax Payment form. Both forms require detailed personal information to apply the correct tax rates and ensure accurate accounting of individuals' tax obligations.

Lastly, the Direct Pay Permit for electronic payments parallels the payment options detailed in the Individual Estimated Tax Payment instructions, particularly for those opting to pay taxes electronically. This permit, often used for various tax payments including income and property taxes, allows taxpayers to transfer funds directly from their bank accounts to pay their taxes. The process mirrors the electronic payment option for estimated taxes where taxpayers authorize electronic transfers, ensuring payments are credited to their accounts. Both methods emphasize the convenience and efficiency of modern electronic payment systems in managing tax obligations.

Dos and Don'ts

When filling out the Individual Estimated Tax Payment form, it’s essential to pay attention to detail to ensure your payment is processed smoothly and accurately. Below are lists of things you should and shouldn't do:

Should Do:- Verify your personal information: Ensure your Social Security number and the tax-year end date are correctly filled out. These are crucial for your payment to be properly credited.

- Use correct payment settings when printing: Set the Page Scaling to “None” to make sure the personalized scan line prints correctly. This helps the tax authority process your form accurately.

- Consider paying electronically: Electronic payments are convenient and reduce the risk of errors. You can pay via the state’s website or by phone, using your banking information not associated with foreign banks.

- Keep your payment confirmation: Whether you pay online or by phone, save your payment confirmation number. It’s proof of payment and necessary if you need to cancel or modify the payment.

- Set up future payments: To avoid missing any payments, schedule all four quarterly payments at once if you’re paying electronically. It saves time and ensures consistency.

- Do not ignore print settings: Avoid selecting “Auto-rotate and center pages” or “Shrink to it” options as they can alter the layout, potentially causing issues with processing your payment.

- Do not use foreign bank accounts for electronic payments: When paying electronically, use a bank account that is not associated with any foreign banks to comply with regulations.

- Avoid late modifications to electronic payments: Remember that changes or cancellations of scheduled payments need to be done at least one business day before the transaction is processed.

- Do not disregard the voucher if paying by check: Complete the voucher accurately and send it along with your check. This facilitates correct processing of your payment.

- Avoid sending incomplete forms: Ensure all required fields are filled accurately. Incomplete forms can delay processing and could potentially result in penalties.

Misconceptions

Individual Estimated Tax Payments (Form M14) can be surrounded by misconceptions, leading to confusion about its purpose and how to correctly utilize it. Understanding these misconceptions is crucial for ensuring that estimated tax payments are made correctly and efficiently. Let’s explore some of these common misunderstandings:

- Misconception 1: You can only pay your estimated taxes by check or mail. This assumption misses out on the convenience and efficiency of electronic payments. The truth is, taxpayers have the option to pay their estimated taxes electronically through the state revenue website or by phone. This method is not only faster but also minimizes the risk of errors in processing your payment.

- Misconception 2: Electronic payments require an account associated with a domestic bank. While it is necessary to use an account for electronic payments, what is often misunderstood is that this account cannot be associated with any foreign banks. This is to ensure that the electronic payment system functions within the regulatory frameworks governing domestic banking transactions.

- Misconception 3: When you pay by check, you will always receive your canceled check back for your records. The process actually involves a one-time electronic fund transfer from your account when you opt to pay by check. This means that instead of getting your canceled check back, the transaction will be reflected in your account statements, aligning with modern electronic banking practices.

- Misconception 4: The Department of Revenue benefits financially from the fees charged by third-party services for credit or debit card payments. This is incorrect. The fee charged for using a credit or debit card is directed entirely to Value Payment Systems, a partner company that provides the payment service. The Minnesota Department of Revenue does not receive any part of this fee, ensuring that payments are solely for facilitating the electronic transaction.

Understanding these key points helps clarify the process of making individual estimated tax payments and dispels common myths. By encouraging correct payment practices, taxpayers can ensure their contributions are efficiently and correctly processed, aiding in the smooth operation of tax collection services.

Key takeaways

Filling out and using the Individual Estimated Tax Payment form involves a few key steps and options to ensure your payments are processed correctly and efficiently. Here's what you need to know:

- To make your tax payment process seamless, enter all the required information directly on the form as it appears on your screen, and then print a copy. A personalized scan line using the details you input, including the tax-year end date and your Social Security number, will help accurately credit the payment to your account.

- Setting the Page Scaling to “None” and ensuring options like “Auto-rotate and center pages” or “Shrink to fit” are unchecked in your print settings is crucial. This ensures the voucher prints correctly and retains its intended format for processing.

- Choosing to pay electronically is not only convenient but also free. Whether through the state website or over the phone, you will need your Social Security number and banking details for a transaction. However, your bank account must not be linked to any foreign banks. After completing the electronic payment, a confirmation number will be provided for your records. Remember, payments can be easily canceled or changed up to one business day before the scheduled date.

- For those preferring to plan ahead, setting up all your estimated tax payments at once online is possible. This method allows you to specify the dates and amounts for each payment well in advance, with the added comfort of receiving immediate confirmation and the flexibility to adjust or cancel payments as necessary, using the provided confirmation number and email address.

- Alternative payment methods like credit or debit cards are available, although they come with processing fees charged by the payment service provider. It’s important to note that these fees do not benefit the Department of Revenue in any way. If paying by check without using electronic options, completing the voucher accurately is essential for ensuring your payment is processed correctly. Remember, by using a check, you authorize a one-time electronic fund transfer, and the physical check will not be returned.

Familiarizing yourself with these key aspects of the Individual Estimated Tax Payment form can help make the tax payment process smoother and more manageable. Whether preferring electronic payments for their convenience or traditional check methods, understanding the specific requirements and options available ensures your tax obligations are met with minimal hassle.

Popular PDF Documents

Pennsylvania Tax Clearance Certificate - Guidance on the importance of the declaration of no current tax audit investigations against the applicant for a smoother application process.

How to Get Power of Attorney in Nebraska - Provides a proactive approach to tax management, authorizing a representative to act in the principal's best interest.

Nevada Income Tax Return - This document acts as an official record between the business and the Nevada Department of Taxation for sales and use tax liabilities.