Get Income Tax Return Form

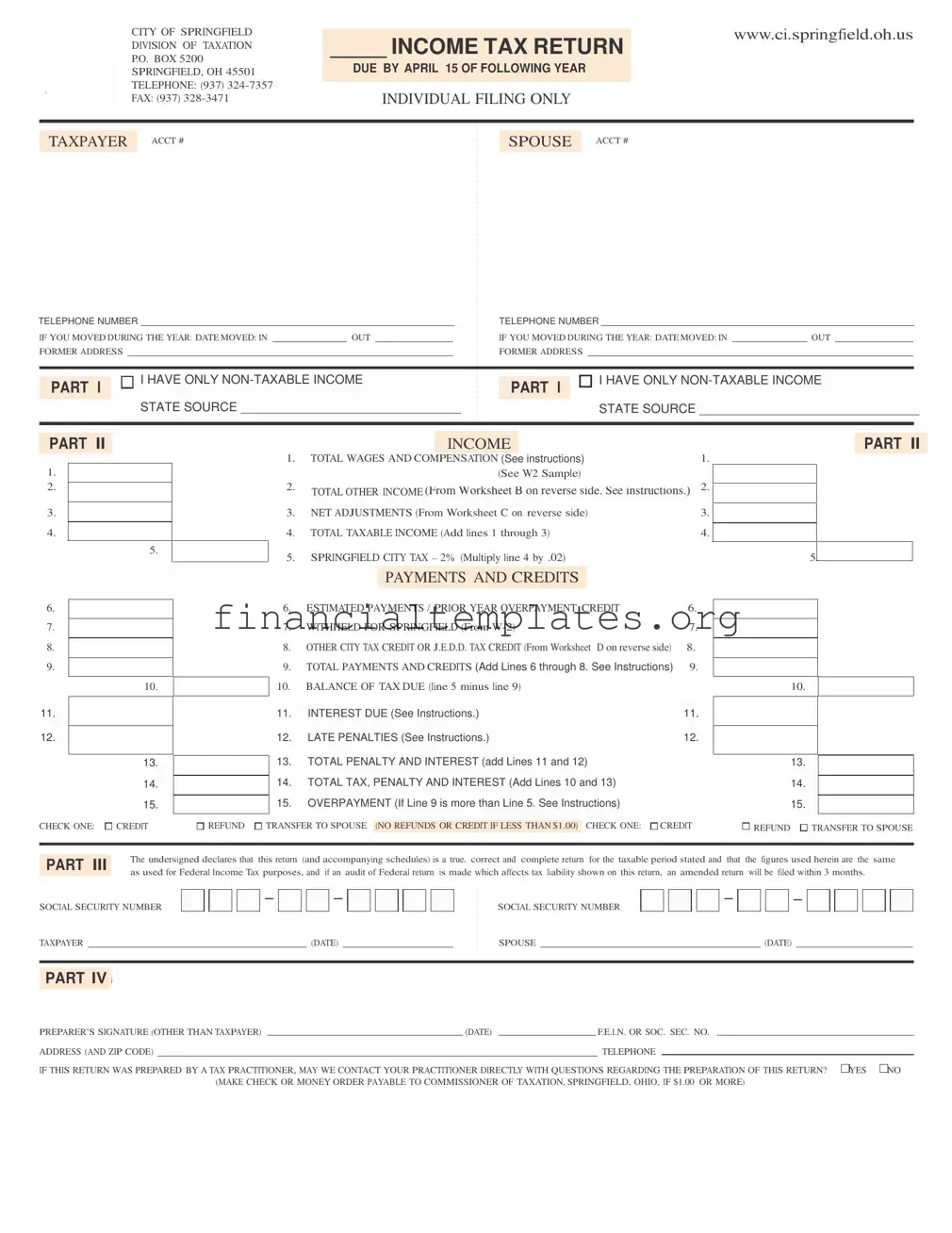

The Income Tax Return form, a pivotal document for taxpayers within the City of Springfield, demands precise attention to detail and adherence to a set timetable, with a due date set for April 15 of the following year. Tailored for individual filing, it encompasses a broad spectrum of information, including taxpayer and spouse account numbers, contact details, and prior address if relocation occurred within the tax year. The form is meticulously structured into parts, wherein Part I addresses non-taxable income scenarios, guiding users on whether filing is necessary based on the nature of their income. Part II dives into the intricate details of taxable income calculation, requiring taxpayers to record wages, compensation, adjustments, and other pertinent financial data to ascertain the total taxable income and subsequently, the city tax owed. Essential segments dedicated to payments and credits further refine the taxpayer's obligation, acknowledging estimated payments, withheld amounts, and applicable credits, which culminate in a clear picture of the balance due or overpayment to be refunded or transferred. Moreover, the form facilitates transparency and accountability, urging filers to affirm the accuracy and completeness of their submission, contingent on consistency with federal income tax filings, and to promptly amend their return should an audit alter their federal tax liability. Accompanying worksheets and documentation requirements underscore the necessity for detailed record-keeping, allowing for the calculation of income adjustments and tax credits for payments to other jurisdictions. This comprehensive structure not only aids in the systematic reporting and payment of taxes but also underscores the civic duty of individuals to contribute to the funding of public services and infrastructure within Springfield.

Income Tax Return Example

CITY OF SPRINGFIELD DIVISION OF TAXATION P.O. BOX 5200 SPRINGFIELD, OH 45501 TELEPHONE: (937)

______ INCOME TAX RETURN

DUE BY APRIL 15 OF FOLLOWING YEAR

INDIVIDUAL FILING ONLY

www.ci.springfield.oh.us

TAXPAYER |

ACCT # |

SPOUSE |

ACCT # |

|

|

|

|

TELEPHONEPHONE NUMBERr |

|

|

|

|

|

|

TELEPHONELEPHONE NUMBERr |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

IF YOU MOVED DURING THE YEAR: DATE MOVED: IN |

|

OUT |

|

IF YOU MOVED DURING THE YEAR: DATE MOVED: IN |

|

OUT |

|||||||

FORMER ADDRESS |

|

|

|

|

|

FORMER ADDRESS |

|

|

|

|

|||

PART I

I HAVE ONLY

I AM NOT REQUIRED TO FILE |

SEE INSTRUCTIONS |

STASTATEREASONSOURCE

PART I

I HAVE ONLY

|

|

SEE INSTRUCTIONS |

I AM NOT REQUIRED TO FILE |

||

STASTATEREASONSOURCE

PART II

1.

2.

3.

4.

5.

|

|

INCOME |

|

|

|

|

|

PART II |

|

1. |

TOTAL WAGES AND COMPENSATION (See instructions) |

|

1. |

|

|

|

|

||

|

|

(See W2 Sample) |

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

TOTAL OTHER INCOME((FrorommWWorksheet BtonB onreversreversside,e sideNot. |

.) |

2. |

|

|

|

|

|||

|

|

|

|

||||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

3. |

NET ADJUSTMENTS (From Worksheet C on reverse side) |

|

3. |

|

|

|

|

||

4. |

TOTAL TAXABLE INCOME (Add lines 1 through 3) |

|

4. |

|

|

|

|

||

5. |

SPRINGFIELD CITY TAX 2% (Multiply line 4 by .02) |

|

5. |

|

|

|

|||

|

|

|

|

||||||

PAYMENTS AND CREDITS

6.

7.

8.

9.

10.

11.

11.

12.

12.

13.

13.14.

145.

156.

CHECK ONE:

CREDIT

CREDIT

REFUND

6. |

ESTIMATED PAYMENTS / PRIOR YEAR OVERPAYMENT CREDIT |

6. |

|

|

|

|

|

||||

7. |

WITHHELD FOR SPRINGFIELD (From |

7. |

|

|

|

|

|

||||

|

|

|

|

|

|||||||

8. |

OTHER CITY TAX CREDIT OR J.E.D.D. TAX CREDIT (From Worksheet D on reverse side) |

8. |

|

|

|

|

|

||||

|

|

|

|

|

|||||||

|

TOTAL PAYMENTS AND CREDITS |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

9. |

(Add Linesesli 66ththroughough 8)8. See Instructions) |

9. |

|

|

|

|

|

||||

10. |

BALANCE OF TAX DUE (line 5 minus line 9) |

10. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

11. |

|

|

|

|

|

||

|

11. |

INTEREST DUE (See Instructions.) |

|

|

11. |

|

|

|

|

|

|

|

12. |

LATE PENALTY |

|

12. |

|

|

|

|

|

||

|

|

|

|

|

|

||||||

|

12. |

LATE PENALTIES (See Instructions.) |

|

12. |

|

|

|

|

|

||

|

13. |

INTEREST |

|

13. |

|

|

|

|

|

||

|

13. |

TOTAL PENALTY AND INTEREST (add Lines 11 and 12) |

|

|

|

13. |

|

||||

|

14. |

TOTAL PENALTY AND INTEREST (Add Lines 11 through 13) |

|

14. |

|

||||||

|

14. |

10 |

|

|

|

|

|

|

|

||

|

5. |

TOTAL TAX,PENALTYANDINTEREST((AddLLines10 anand1413) |

|

145.. |

|

||||||

|

165.. |

OVERPAYMENTPAYMENT (If(IfLiLinee 9 9exceedsis moreLithane 5)Line 5. See Instructions) |

|

156.. |

|

||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANSFER TO SPOUSE |

(NO REFUNDS OR CREDIT IF LESS THAN $1.00) |

CHECK ONE: |

CREDIT |

2008 |

REFUND |

TRANSFER TO SPOUSE |

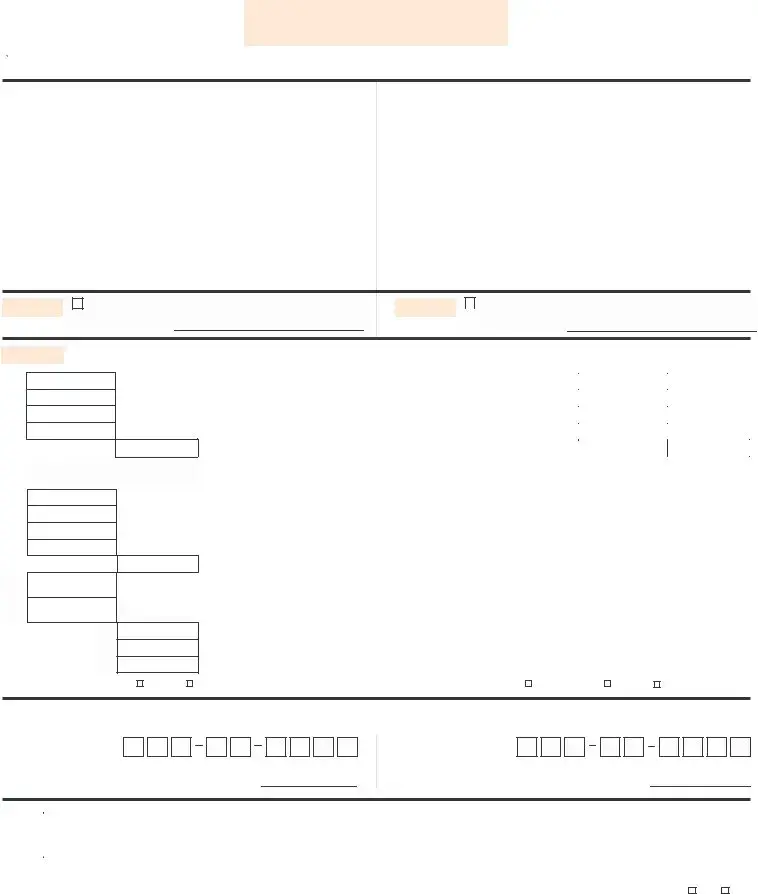

PART III |

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that |

the figures used herein are the same |

|

as used for Federal Income Tax purposes, and if an audit of Federal return is made which affects tax liability shown on this return, an amended return |

will be filed within 3 months. |

||

|

SOCIAL SECURITY NUMBER

TAXPAYER |

|

(DATE) |

SOCIAL SECURITY NUMBER

SPOUSE |

|

(DATE) |

PPARTEPA ER SIVGS |

|

|

|

|

|

|

|

|

|

|

PREPARER S SIGNATURE (OTHER THAN TAXPAYER) |

|

(DATE) |

|

F.E.I.N. OR SOC. SEC. NO. |

|

|

|

|||

ADDRESS (AND ZIP CODE) |

|

|

|

|

TELEPHONE |

|

|

|

|

|

IF THIS RETURN WAS PREPARED BY A TAX PRACTITIONER, MAY WE CONTACT YOUR PRACTITIONER DIRECTLY WITH QUESTIONS REGARDING THE PREPARATION OF THIS RETURN? |

YES |

NO |

||||||||

|

(MAKE CHECK OR MONEY ORDER PAYABLE TO COMMISSIONER OF TAXATION, SPRINGFIELD, OHIO, IF $1.00 OR MORE) |

|

|

|||||||

PLEASE ATTACH COPIES OF ALL  S, AND APPLICABLE FEDERAL SCHEDULES

S, AND APPLICABLE FEDERAL SCHEDULES

TAXPAYER

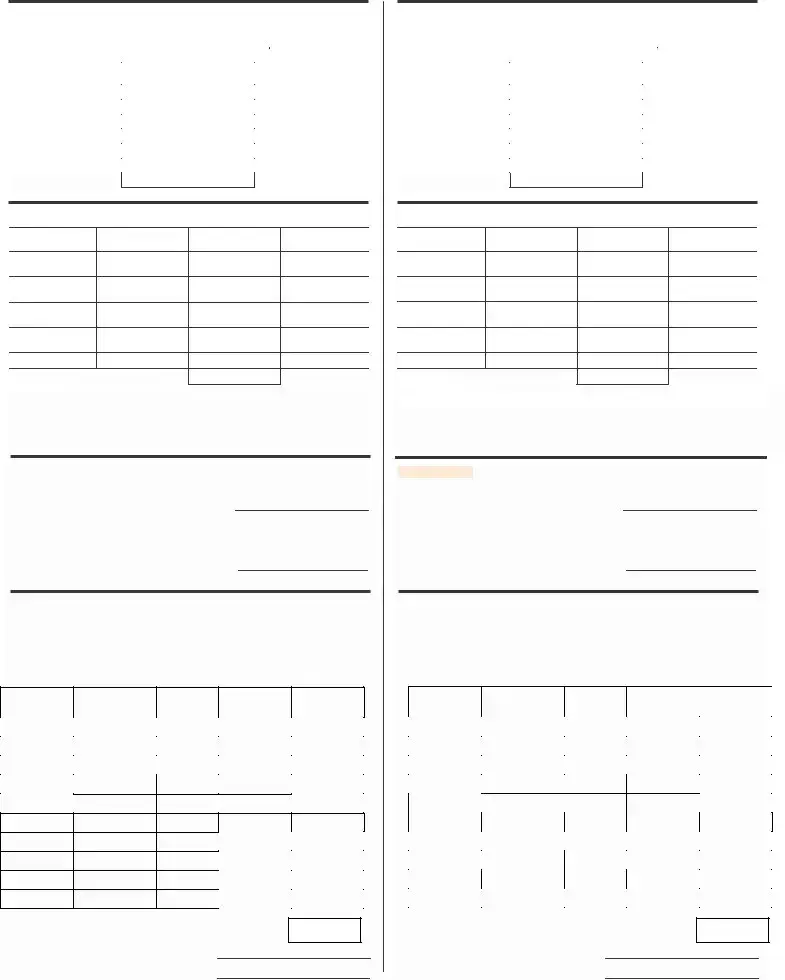

WORKSHEET A - WAGES AND COMPENSATION (From

Location where earned - |

Total wages |

Withheld for |

List separately |

(as shown on |

Springfield |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To Part B,II, Line 1)

WORKSHEET B - OTHER INCOME (From Schedules and Attachments)

SPOUSE

WORKSHEET A - WAGES AND COMPENSATION (From

Location where earned - |

Total wages |

Withheld for |

List separately |

(as shown on |

Springfield |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To Partt B,II Line 1)

WORKSHEET B - OTHER INCOME (From Schedules and Attachments)

TYPE

Proprietorship Income (Schedule C)

Rental Income

(Schedule E)

Partnership Income (Schedule

Farm Income

(Schedule F)

Other Income

LOCATION

(To(Part B,II Line 2)

Net Taxable Gain From Fed. Schedule

Net Taxable Loss From Fed. Schedule

(Not Less Than

TYPE

Proprietorship Income (Schedule C)

Rental Income

(Schedule E)

Partnership Income (Schedule

Farm Income

(Schedule F)

Other Income

LOCATION

(To(Partt B,II Line 2)

Net Taxable Gain From Fed. Schedule

Net Taxable Loss From Fed. Schedule

(Not Less Than

Losses from schedules or businesses, including multiple partnerships, may not offset gains from other |

|||||

Losses from schedules or businesses, including multiple partnerships, may not offset gains from |

|

||||

or |

|

sole |

farms in the |

of |

indi- |

scheduleschedulbusinessessother |

or businessexcepts exceptproprietorships,ole proprietorshiprentals, reandtals and farms inameth |

namtheofsameth |

|

||

vidual. Net |

may not offset |

|

or |

|

|

same individualosses. Net losses may |

notpersonalffset serviceonalpcompensation,ervice compenwagesation, wages or |

||||

Partnership losses may not offset partnership, sole proprietorship, rental or farm gains. Partnership losses may not offset partnership, sole proprietorship, rental or farm gains.

Jointly owned rental property gains/losses are allocated equally among owners of record, unless Jointly owned rental property gains/losses are allocated equally among owners of record. otherwise indicated.

WORKSHEETT C

with documentation and calculations. Proration of income results in proration of credit.

EMPLOYEE BUSINESS EXPENSE |

$ |

|

|

|

......................EMPLOYEE BUSINESS EXPENSE (e) |

$ |

|

|

|

(See Instructions) |

* |

|

(To Part B, Line 3) |

|

|

|

|

(To Part B,II, Line 3) |

|

|

FEDERAL |

A AND FORM 2106 |

|

|

*MUSTATTACHH BOTH SCHEDULSCHEDULEA AN 2106 |

|

|

||

SEE INSTRUCTIONS FOR DEDUCTION LIMITATIONS. |

|

|

|

|

OTHER ADJUSTMENTS |

$ |

|

|

|

OTHER ADJUSTMENTS |

$ |

(To Part B, Line 3) |

|

|

|

|

|

|

|

(To Part B,II, Liine 3)) Must fully explain, plus support with documentation and calculations. Proration of

income results in proration of credit.

WORKSHEET D - CREDIT FOR OTHER CITY TAX OR JOINT ECONOMIC DEVELOPMENT DISTRICT (JEDD) TAX PAID - SEE INSTRUCTIONS WORKSHEET D - OTHER CITY TAX CREDIT AND JOINT ECONOMIC

DEVELOPMENTOther City CreditDISTRICTAllowed: 1/2TAXofCREDITtax correctly- SEEpaid,INSTRUCTIONSmaximum allowable credit 1% of taxable income earned in other jurisdictions.

Cities orA J.E.D.D. with tax rateB UP TO 2%. |

C |

D |

E |

Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other entity.

|

TAXABLE |

OTHER |

|

2 % of |

LESSER of |

|

L CATION |

TAXABLE INCOME |

|||||

|

|

TAX PAID |

||||

LOCATION |

INCOME |

CITY TAX |

Column B |

Column C or D |

||

|

PAID |

|||||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

ALLOWABLE CREDIT, (To Part B, |

Line 8) |

|

X .5 |

||

|

|

|

||||

|

|

|||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Cities with tax rate GREATER than 2% (i.e. Dayton - 2.25%, Oakwood - 2.5%)

Other City Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other city.

Losses fromm schedulesles or businesses,nesses, iincludingcluding mmultipleltiple ppartnerships,rtnerships, mamay nonot ooffsetset ggainsins ffromom |

other |

|||

or |

sole |

farms in the |

of |

indi- |

scheduleschedulbusinessessother |

or businessexcepts exceptproprietorships,le pr |

prietorshiprentals, reandtals and farms innameth namtheofsameth |

|

|

vidual. Net |

may not offset |

or |

|

|

same individualosses. Net losses may notpersonalffset servicersonalpcompensation,ervice compenwagesation, wages or

Partnership losses may not offset partnership, sole proprietorship, rental or farm gains. Partnership losses may not offset partnership, sole proprietorship, rental or farm gains.

Jointly owned rental property gains/losses are allocated equally among owners of record, unless Jointly owned rental property gains/losses are allocated equally among owners of record. otherwise indicated.

WORKSHEETT C

with documentation and calculations. Proration of income results in proration of credit.

EMPLOYEE BUSINESS EXPENSE |

$ |

|

|

|

......................EMPLOYEE BUSINESS EXPENSE (e) |

$ |

|

|

|

(See Instructions) |

* |

|

(To Part B, Line 3) |

|

|

|

|

(To Part B,II, Line 3) |

|

|

FEDERAL |

A AND FORM 2106 |

|

|

*MUSTATTACH BOTH SCHEDULSCHEDULEA AN 2106 |

|

|

||

SEE INSTRUCTIONS FOR DEDUCTION LIMITATIONS. |

|

|

|

|

OTHER ADJUSTMENTS |

$ |

|

|

|

OTHER ADJUSTMENTS |

$ |

(To Part B, Line 3) |

|

|

|

|

|

|

|

(To Part B,II, Liine 3)) Must fully explain, plus support with documentation and calculations. Proration of

income results in proration of credit.

WORKSHEET D - CREDIT FOR OTHER CITY TAX OR JOINT ECONOMIC

DEVELOPMENT DISTRICT (JEDD) TAX PAID - SEE INSTRUCTIONS |

|

|

|

||||||||||

WORKSHEET D - OTHER CITY TAX CREDIT AND JOINT ECONOMIC |

|

|

|

||||||||||

DEVELOPMENTOther City CreditDISTRICTAllowed: 1/2TAXofCREDITtax correctly- SEEpaid,INSTRUCTIONSmaximum allowable credit 1% of |

|

||||||||||||

taxable income earned in other jurisdictions. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Cities orA J.E.D.D. with tax rateB UP TO 2%. |

|

C |

D |

|

|

E |

|

||||||

Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other |

|

entity. |

|

||||||||||

|

|

|

TAXABLE |

|

|

OTHER |

2 % of |

|

|

LESSER of |

|

||

LOCATLOCATIONN |

|

TAXABLECITYNCOMETAX |

TAX |

|

|

||||||||

|

INCOME |

Column B |

|

PAID |

|

||||||||

|

|

|

|

|

PAID |

|

|

Column C or D |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOWABLE CREDIT, |

|

(To Part B, Line 8) |

|

X |

|

.5 |

|

|||

|

|

|

|

|

|

|

|

|

|||||

D- |

2 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cities with tax rate GREATER than 2% (i.e. Dayton - 2.25%, Oakwood - 2.5%) |

Other City Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other city. |

A

LOCATION

B

TAXABLE INCOME

C

OTHER CITY

TAX PAID

D |

E |

|

LESSER of |

2% of Column B |

Column C or D |

|

|

|

|

TOTALTAL

XX ..55

A |

|

|

|

|

B |

|

|

C |

|

|

D |

|

E |

|

|

|

|

|

|

|

OTHER CITY |

|

|

|

|

LESSER of |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCATION |

TAXABLE INCOME |

TAX PAID |

2% of Column B |

|

Column C or D |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTOTALAL

XX ..5

ALLOWABLE CREDIT, (To Part B, Line 8) ALLOWABLE CREDIT, (To Part II, Line 8)

ALLOWABLE CREDIT, (To Part B, Line 8) ALLOWABLE CREDIT, (To Part II, Line 8)

Document Specifics

| Fact Name | Description |

|---|---|

| Form Deadline | The Income Tax Return for the City of Springfield is due by April 15 of the following year. |

| Individual Filing Requirement | This form is intended for individual filing only. |

| Contact Information | For assistance, taxpayers can contact the Division of Taxation at (937) 324-7357 or fax at (937) 328-3471. |

| Income Reporting | Taxpayers must report total wages and compensation, other income, and make necessary adjustments to calculate taxable income. |

| Governing Law | This form is governed by the local tax laws and regulations of Springfield, Ohio. |

Guide to Writing Income Tax Return

Filling out an Income Tax Return form requires careful attention to detail and a thorough understanding of your financial transactions over the past year. This document, especially when pertaining to city taxes such as the City of Springfield Income Tax Return, mandates a step-by-step approach to ensure accuracy and compliance. It's not simply about reporting your earnings but also about understanding various deductions, income sources, and potential credits. This narrative strives to make the process manageable, guiding you through each section to foster a comprehensive and worry-free submission.

- First, gather all necessary documents including W-2 forms, Schedule C, E, F, and K-1 forms if applicable, as well as any records of taxable and non-taxable income received throughout the year.

- Enter your personal information at the top of the form, including your Taxpayer Account Number and if applicable, your spouse's Account Number, along with both of your Social Security Numbers.

- If you moved during the year, provide the date(s) and address(es) associated with the move.

- In Part I, indicate if you have only non-taxable income or are not required to file for any other reason. State your reasons and attach any necessary documentation.

- For Part II section on Income, refer to Worksheet A to calculate total wages and compensation. Input this amount in Line 1. If you have multiple jobs or sources of wage income, list them separately as required.

- Add any additional income (e.g., rental, partnership, farm income) in Line 2 using Worksheet B for accurate calculations.

- Calculate your net adjustments on Line 3 based on Worksheet C, ensuring you document and explain each entry thoroughly.

- Sum the amounts from Lines 1 through 3 for your Total Taxable Income on Line 4.

- Calculate your Springfield city tax by multiplying the total taxable income (Line 4) by 2% and write this amount in Line 5.

- In the Payments and Credits section, start with your estimated payments or prior year overpayment credits on Line 6.

- Enter the amount withheld for Springfield on Line 7, using your W-2 as reference.

- If applicable, calculate your other city tax credit or J.E.D.D. tax credit on Line 8, with Worksheet D guiding your calculations for allowable credits.

- Add the totals from Lines 6 through 8 for Total Payments and Credits on Line 9.

- Determine if there is a balance of tax due or an overpayment on Lines 10 through 15, applying the necessary calculations as directed in the instructions.

- Complete the declaration section in Part III, ensuring both you and, if applicable, your spouse sign the document. If a tax preparer completed the form, include their information and signature as well.

- Verify that all attached supporting documents, such as W-2s and federal schedules, are included with your return.

- Review the form and attached documents to ensure accuracy and completeness. Corrections or omissions can result in penalties or delays.

- Make your payment or request your refund based on the calculated balance. Ensure checks are made payable to the Commissioner of Taxation, Springfield, Ohio, if required.

- Submit the form and attachments to the City of Springfield Division of Taxation by the due date, typically April 15th of the following year, to avoid any late fees or additional penalties.

By methodically working through these steps, you can confidently complete and submit your income tax return. Remember, maintaining organized records and understanding your income and deductions are key to accurately filling out any tax return. If you encounter complexities beyond your understanding, consider seeking assistance from a tax professional to ensure compliance and accuracy.

Understanding Income Tax Return

-

When is the Springfield Income Tax Return Due?

The income tax return for the City of Springfield is due by April 15 of the year following the tax year. This means if you are filing for the tax year 2022, your return should be filed by April 15, 2023. It's crucial to adhere to this deadline to avoid potential penalties for late filing.

-

Am I required to file an income tax return if I only have non-taxable income?

No, if you have only non-taxable income for the year, you are not required to file an income tax return with the City of Springfield. However, it's essential to consult the instructions provided with your tax form to determine what is considered non-taxable income and ensure you meet the criteria for not filing.

-

How do I calculate my Springfield city tax?

To calculate your Springfield city tax, you will need to sum up your total taxable income from Part II (lines 1 through 3). Then, multiply this total by 2% (.02) to find out your city tax owed. This calculation is based on Springfield's city tax rate of 2%. Keep in mind, the information used to calculate your taxable income should be the same as used for your federal income tax purposes.

-

What should I do if I’ve made payments or credits throughout the year?

- Add any estimated payments you’ve made for the current tax year.

- Include amounts withheld specifically for Springfield tax as shown on your W-2 forms.

- If applicable, include any other city tax credit or Joint Economic Development District (JEDD) tax credit you're eligible for, using Worksheet D on the reverse side of the form.

- Sum these amounts together to find your total payments and credits, which you’ll then subtract from your Springfield city tax calculated (Part II, line 5) to determine your balance due or overpayment.

This step is vital to ensure you are credited for any taxes you’ve already paid throughout the year and to avoid overpaying your taxes.

Common mistakes

Not accurately reporting all sources of income can lead to discrepancies with federal income records. Taxpayers sometimes overlook or mistakenly omit various income sources such as rental income from properties, earnings from side jobs, or interest and dividends from investments. These oversights can result in the underreporting of income, leading to potential audits, penalties, or interest charges.

Failure to correctly calculate deductions and credits is another common mistake. The Income Tax Return form allows for various deductions and credits that can significantly reduce tax liability. However, inaccuracies in understanding what is fully deductible or eligible for credit can either inflate the taxpayer's obligations or underutilize legitimate tax-saving strategies. For example, misunderstanding the limitations on employee business expenses or the proration of income can lead to errors in the adjustments section of the form.

Incorrectly applying credits for taxes paid to other cities or Joint Economic Development Districts (JEDD) can also lead to errors. The form requires a careful calculation to determine the allowable credit, which is often capped at a certain percentage of taxable income earned in other jurisdictions. Misapplying these rules can result in either an overestimation or underestimation of the credit, impacting the overall tax due or refund expected.

Errors in personal information, such as incorrect Social Security numbers or addresses, may seem minor but can have significant consequences. Such inaccuracies can delay the processing of the tax return, hinder direct communication from the tax office, and, in severe cases, misdirect refunds or notices. Ensuring accurate and current personal information is crucial for the smooth processing of the tax return.

When filing an Income Tax Return, attention to detail is paramount. Taxpayers must carefully review their forms for correctness in income reporting, calculation of deductions and credits, application of tax credits from other jurisdictions, and accuracy in personal information. Avoiding these mistakes can help prevent the unnecessary stress and potential financial repercussions of filing an incorrect tax return.

Documents used along the form

When preparing and filing an Income Tax Return, taxpayers often need to include additional forms and documents to ensure a complete and accurate filing. These documents provide vital information about the taxpayer's income, deductions, and credits. Understanding these forms can help taxpayers and professionals navigate the tax preparation process more effectively.

- Form W-2, Wage and Tax Statement: This form is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. It is essential for taxpayers who are employed and is a key document used to fill out the Income Tax Return form.

- Form 1099: Various versions of Form 1099 report different types of income other than wages, such as freelance or gig economy earnings, interest payments, dividends, and retirement distributions. This is crucial for individuals who have multiple income sources throughout the tax year.

- Schedule C, Profit or Loss From Business: Sole proprietors and single-member LLCs use this schedule to report the profit or loss from their business. It details the income and expenses related to their business activity.

- Schedule E, Supplemental Income and Loss: This form is used by taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, and trusts. It's important for individuals who receive income from these sources.

- Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return: If taxpayers need more time to file their tax return, they can submit this form to request a six-month extension. However, it's important to note that this extension applies to filing the return, not to the payment of any taxes owed.

Together with the Income Tax Return form, these documents form a comprehensive view of an individual's tax situation for a given year. Accurately completing and submitting these forms is crucial for compliant and efficient tax filing. Understanding the purpose of each form and how it relates to an individual's unique financial situation can demystify the filing process and help secure the best possible outcome.

Similar forms

The Income Tax Return form for the City of Springfield shares similarities with the Federal Income Tax Return Form, such as Form 1040. Both require the taxpayer to report income, calculate taxes owed, and identify any adjustments or credits that reduce tax liability. They mandate the inclusion of wages, compensation, and other income types, along with allowable deductions or tax credits that affect the final tax calculation. Essential in both is the declaration that the information provided is accurate, truthful, and complete, highlighting the consistency in legal accountability across tax reporting platforms.

Another document with significant resemblance is the State Income Tax Return Form that various states utilize. Like the Springfield form, these state forms often ask for income details, applicable deductions, credits, and tax payments already made through withholdings or estimated tax payments. Both sets of forms are designed to ensure taxpayers meet their obligations within their respective jurisdictions, adjusting for specific credits or taxes relevant to each area, such as local income taxes or credits for taxes paid to other jurisdictions.

The W-2 Form, or Wage and Tax Statement, is closely tied to the information required on the Income Tax Return form. It provides the taxpayer with an account of wages earned and taxes withheld by employers, which are then reported on the tax return. Both documents are instrumental in determining the individual's tax liability, ensuring that income is accurately reported and taxed according to federal, state, or local laws. The requirement to attach W-2 forms emphasizes the interconnectivity of these documents in the tax filing process.

Similarly, various Schedules and Worksheets that accompany federal returns (like Schedules C, E, F, and Worksheet B from the document) are echoed in the structure of the Springfield Income Tax Return. These schedules allow for the detailed reporting of sources of income or loss, such as business profits, rental income, or farm income, akin to the detailed breakdown required in the Springfield form. This structure aids in calculating net taxable income by allowing for specific income types and related expenses to be reported.

Form 2106, Employee Business Expenses, is another document with echoes in the Springfield form, specifically in the Adjustments section or Worksheet C. Both require detailed documentation and calculations for employment-related expenses that are not reimbursed by the employer. This similarity underscores the economic principle that individuals should only be taxed on their net income after legitimate work-related expenses have been considered.

The Credit for Other City Tax or Joint Economic Development District (JEDD) Tax Paid, as detailed in Worksheet D, has parallels to the concept of tax credits found in other tax-related documents, like the Federal Foreign Tax Credit. This provision allows taxpayers to avoid double taxation on income that might otherwise be taxed both by the City of Springfield and another jurisdiction. By permitting credits for taxes paid to other entities, both local and federal systems recognize the importance of equitable tax treatment and the reduction of undue burdens on taxpayers.

In essence, the Income Tax Return form for the City of Springfield incorporates elements from a comprehensive suite of tax-related documents, streamlining the intricate process of financial reporting and tax calculation to meet local taxation requirements while reflecting broader tax principles. Each document, whether it reports income, calculates taxes due, or allows for deductions and credits, plays a crucial role in the accurate and fair assessment of taxes within the wider tax ecosystem.

Dos and Don'ts

When it comes to filling out your Income Tax Return form, especially for the City of Springfield, it's crucial to follow certain dos and don'ts to ensure the process is smooth and error-free. Below is a helpful guide of things you should and should not do:

What You Should Do:

- Double-check your Social Security number and those of your spouse if filing jointly. An incorrect number can lead to processing delays.

- Accurately report all income from W-2s, 1099s, and other income reports to avoid underreporting tax liabilities.

- Take advantage of all eligible deductions and credits to reduce your taxable income. Make sure you have documentation to support these claims.

- Ensure your filing status is correct. This influences your tax bracket and potential deductions.

- Include all necessary attachments and schedules, such as W-2s, 1099s, Schedule C for business income, or Schedule E for rental income.

- Sign and date your tax return. A missing signature can delay processing and payments.

What You Shouldn't Do:

- Don't leave any fields blank. If a section does not apply to you, write “0” or “N/A” instead of leaving it empty.

- Avoid rounding numbers. Report exact amounts as shown on your income documents to ensure accuracy.

- Don't forget to claim your refund if applicable. Check the box for a credit refund or transfer to a spouse if that's part of your filing strategy.

- Don’t disregard the instructions for Worksheets A, B, C, and D if you need to make adjustments to your income or claim credits.

- Do not miss the deadline of April 15 for filing your income tax return to avoid potential penalties for late filing.

- Do not send cash if you owe money. Use a check, money order, or electronic payment as instructed on the form.

Following these guidelines can help you navigate the complexities of completing your Income Tax Return form correctly, ensuring you meet your obligations without unnecessary stress or errors.

Misconceptions

When it comes to filling out Income Tax Return forms, many people encounter misunderstandings that can complicate the process. Here are six common misconceptions and the realities behind them:

- Only taxable income needs to be reported. All income, including non-taxable income, must be reported. The form requires a statement of all forms of income to ensure accurate calculation of taxable income and any applicable credits or deductions.

- Filing a return is not required if no tax is owed. Even if no tax is due, filing a return may still be necessary. Reasons for this include ensuring eligibility for certain credits and benefits, or simply fulfilling a legal requirement to file based on total annual income.

- Estimating payments and credits is acceptable. Actual numbers must be used when completing the form. Estimates can lead to discrepancies that may trigger an audit or result in penalties for underpayment.

- Deductions and business expenses are unlimited. Deductions and expenses must be legitimate and are subject to limits and conditions as specified in the tax instructions. Eligibility for these financial reductions requires careful documentation and sometimes specific qualifications.

- All losses can offset all types of income. The form often restricts how certain types of losses, such as those from business operations or rental properties, can be applied against other income categories. These rules prevent the misuse of deductions and ensure the equitable treatment of various income sources.

- Overpayments always result in refunds. While an overpayment may lead to a refund, taxpayers can also choose to apply it to future tax liabilities or, in certain scenarios, such as small amounts, may find that specific thresholds prevent a direct refund.

Understanding these aspects of the Income Tax Return form can help taxpayers navigate the complexities of tax reporting and avoid common pitfalls that can lead to errors or misunderstandings with tax authorities.

Key takeaways

Filing an Income Tax Return form can seem daunting, but understanding a few key aspects can simplify the process. Here are 6 essential takeaways for anyone navigating through their tax returns:

- Deadline Awareness: The tax return must be filed by April 15 of the following year. This crucial deadline helps avoid any penalties for late submissions, ensuring taxpayers remain in good standing.

- Accurate Reporting of Income: All sources of income must be reported accurately, including wages, compensation, and any other form of income, as detailed in Part II of the form. This is essential for calculating the total taxable income correctly.

- Understanding Taxable and Non-Taxable Income: The form distinguishes between taxable and non-taxable income. Taxpayers should carefully determine which categories their income streams fall into to ensure accurate filing and potentially maximize their returns.

- Claiming Credits and Deductions: It's important to identify any eligible credits or deductions such as estimated payments, prior year overpayment, withholding for Springfield, and other city tax credits or Joint Economic Development District (JEDD) tax credits. Properly utilizing these can substantially lower the overall tax liability.

- Penalties and Interest: Understanding the different penalties and interest charges for underpayment, late payment, or late filing is crucial. These can significantly increase the amount owed if not addressed promptly.

- Documentation and Amendments: Supporting documentation for all claims on the return is necessary, including W-2s, 1099s, and applicable Federal schedules. Additionally, if an audit of the Federal return affects the tax liability shown, an amended return must be filed within three months to correct any discrepancies.

Each of these points plays a vital role in the filing process. Taxpayers should approach their Income Tax Return with diligence and attention to detail to ensure compliance and optimize their tax outcomes.

Popular PDF Documents

IRS 720 - Businesses involved in the sale or manufacture of goods subject to excise tax, such as alcohol or tobacco, must submit Form 720 every quarter.

Form 990 Pf - Completing the 990-PF form accurately is essential for private foundations to avoid penalties and maintain their tax-exempt status.

New Idr Plan - Eligibility and monthly payment determinations under this plan are based on the borrower's current income and family size, reassessed annually.