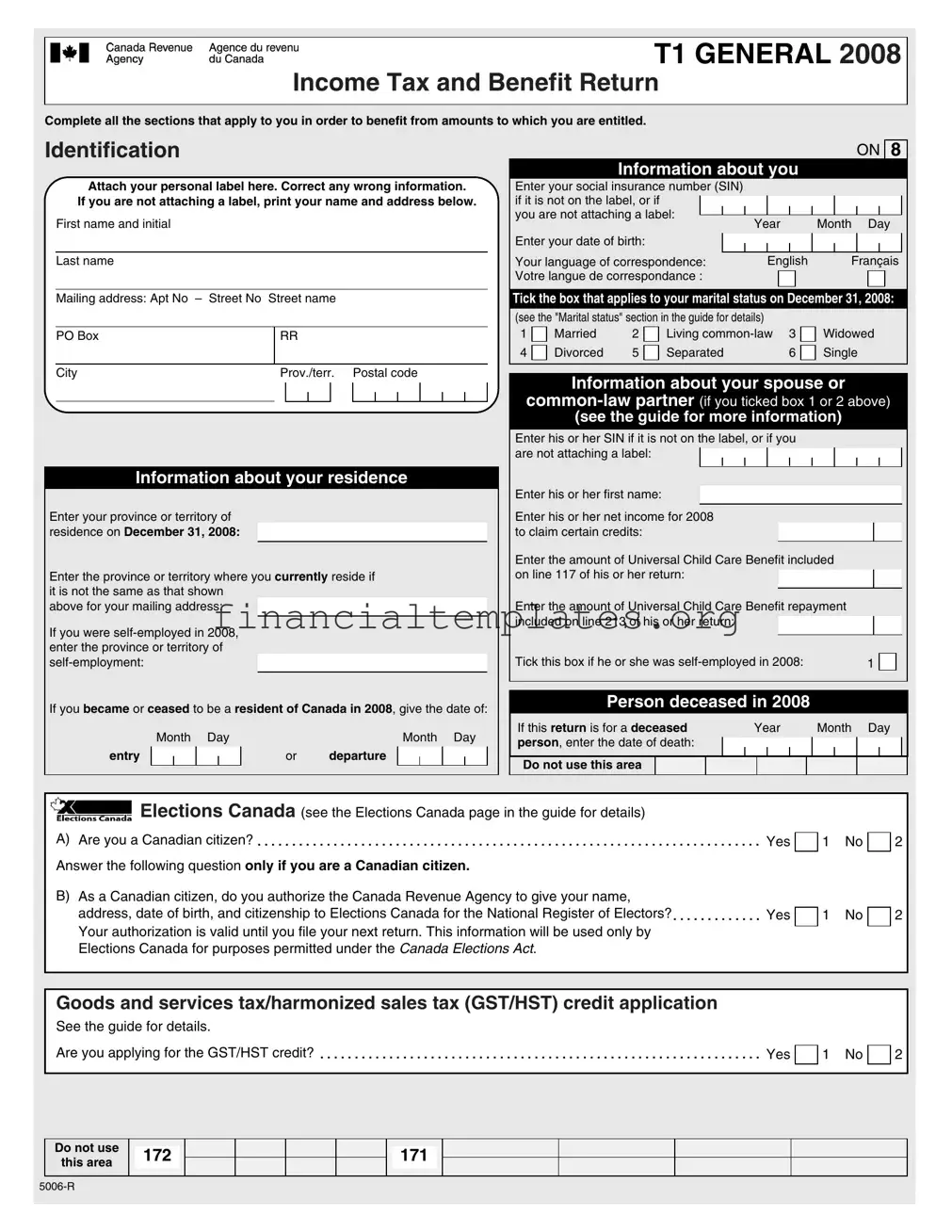

Get Income Tax And Benefit Return Form

Every year, individuals grapple with the complexity of navigating their Income Tax and Benefit Return, a task that, though daunting, is essential for accurately reporting one’s financial activities to the authorities. The filing process, encapsulated in the T1 General form, obliges Canadians to provide detailed information that ranges from personal identification to more intricate financial data concerning income, deductions, and benefits. Correctly completing the sections that apply ensures individuals can rightfully claim deductions and credits due to them, optimizing their financial outcomes. The form demands a thorough account of various income streams, including employment, self-employment, and investment returns, alongside information on personal circumstances that might affect tax liability, such as marital status, residence, and dependents' details. Furthermore, it integrates applications for specific tax credits and benefits, thereby serving a dual purpose as both a reporting document and a request for government assistance. This intricate interplay between reporting past income and applying for future benefits underscores the form’s pivotal role in the financial life of citizens, necessitating a detailed examination and understanding of its components and requirements.

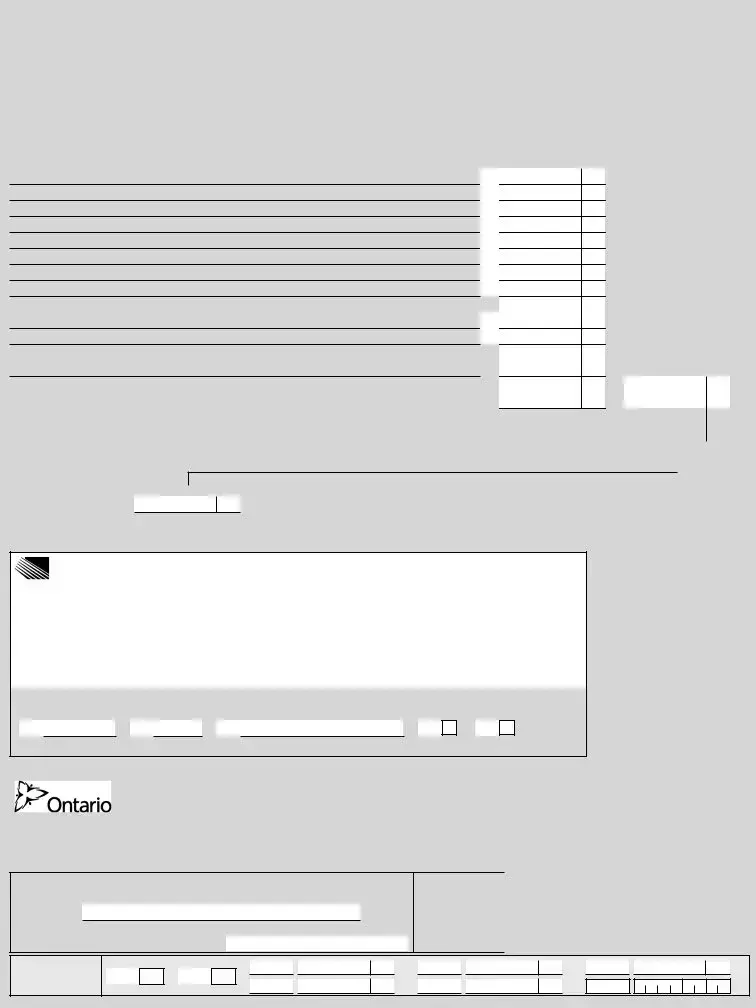

Income Tax And Benefit Return Example

T1 GENERAL 2008

Income Tax and Benefit Return

Complete all the sections that apply to you in order to benefit from amounts to which you are entitled.

Identification

Attach your personal label here. Correct any wrong information.

If you are not attaching a label, print your name and address below.

First name and initial

Last name

Mailing address: Apt No – Street No Street name

PO Box |

RR |

|

||||||

|

|

|

|

|

|

|||

City |

Prov./terr. Postal code |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information about your residence

Enter your province or territory of residence on December 31, 2008:

Enter the province or territory where you currently reside if it is not the same as that shown

above for your mailing address:

If you were

If you became or ceased to be a resident of Canada in 2008, give the date of:

|

Month Day |

|

|

Month Day |

||||||||

entry |

|

|

|

|

|

or |

departure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ON |

8 |

|

||

Information about you |

|

|

|

|

|

|

|

|||||||

Enter your social insurance number (SIN) |

|

|

|

|

|

|

|

|

|

|

|

|

||

if it is not on the label, or if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

you are not attaching a label: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

Month Day |

||||||||||||

|

|

|

||||||||||||

Enter your date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your language of correspondence: |

|

English |

|

Français |

||||||||||

Votre langue de correspondance : |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tick the box that applies to your marital status on December 31, 2008:

(see the "Marital status" section in the guide for details) |

|

|

|

|||||

1 |

|

Married |

2 |

|

Living |

3 |

|

Widowed |

|

|

|

||||||

4 |

|

Divorced |

5 |

|

Separated |

6 |

|

Single |

|

|

|

||||||

Information about your spouse or

(see the guide for more information)

Enter his or her SIN if it is not on the label, or if you are not attaching a label:

Enter his or her first name:

Enter his or her net income for 2008 to claim certain credits:

Enter the amount of Universal Child Care Benefit included

on line 117 of his or her return:

Enter the amount of Universal Child Care Benefit repayment included on line 213 of his or her return:

Tick this box if he or she was |

1 |

Person deceased in 2008

If this return is for a deceased |

|

|

Year |

|

Month Day |

|

|||||||

person, enter the date of death: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not use this area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elections Canada (see the Elections Canada page in the guide for details) |

|

|

|

|

A) |

Are you a Canadian citizen? |

Yes |

|

|

No |

|

1 |

||||

Answer the following question only if you are a Canadian citizen. |

|

|

|

|

|

B) |

As a Canadian citizen, do you authorize the Canada Revenue Agency to give your name, |

|

|

|

|

|

address, date of birth, and citizenship to Elections Canada for the National Register of Electors? |

Yes |

|

No |

|

|

|

1 |

|||

|

Your authorization is valid until you file your next return. This information will be used only by |

|

|

|

|

|

Elections Canada for purposes permitted under the Canada Elections Act. |

|

|

|

|

2

2

Goods and services tax/harmonized sales tax (GST/HST) credit application

See the guide for details.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Are you applying for the GST/HST credit? |

Yes |

|

1 No |

2

Do not use

this area

172

171

2

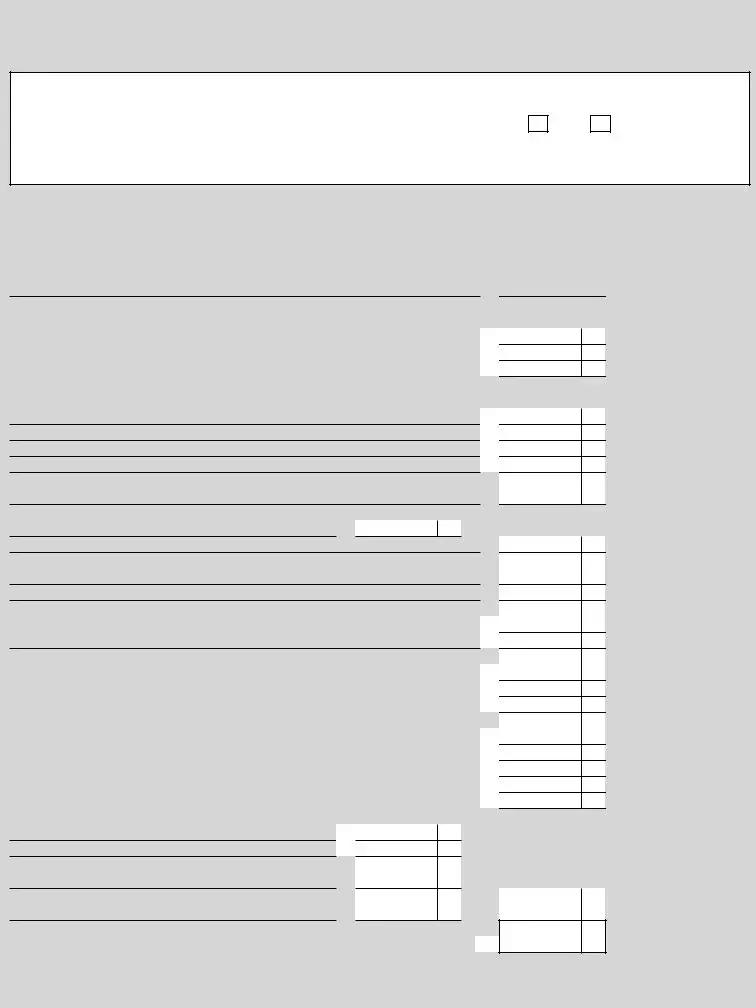

Your guide contains valuable information to help you complete your return.

When you come to a line on the return that applies to you, look up the line number in the guide for more information.

Please answer the following question:

Did you own or hold foreign property at any time in 2008 with a total cost of more than |

|

CAN$100,000? (see the "Foreign income" section in the guide for details) . . . . . . . . . . 266 Yes |

1 No |

If yes, attach a completed Form T1135.

2

If you had dealings with a

As a Canadian resident, you have to report your income from all sources both inside and outside Canada.

Total income

Employment income (box 14 on all T4 slips)

Commissions included on line 101 (box 42 on all T4 slips) |

|

102 |

|

|

|

Other employment income |

|

|

|

|

|

Old Age Security pension (box 18 on the T4A(OAS) slip) |

|

|

|

|

|

CPP or QPP benefits (box 20 on the T4A(P) slip) |

|

|

|

|

|

Disability benefits included on line 114 |

|

|

|

|

|

(box 16 on the T4A(P) slip) |

|

152 |

|

|

|

Other pensions or superannuation |

|

|

|

|

|

Elected

Universal Child Care Benefit (see the guide)

Employment Insurance and other benefits (box 14 on the T4E slip)

Taxable amount of dividends (eligible and other than eligible) from taxable Canadian corporations (see the guide and attach Schedule 4)

Taxable amount of dividends other than eligible dividends, |

|

included on line 120, from taxable Canadian corporations |

180 |

101

104

113

114

115

116

117

119

120

Interest and other investment income (attach Schedule 4)

Net partnership income: limited or

Registered disability savings plan income (from all T4A information slips)

Rental income |

Gross |

160 |

|

|

Net |

|

|

|

|

|

|

Taxable capital gains (attach Schedule 3)

Support payments received |

Total |

156 |

|

|

Taxable amount |

||

RRSP income (from all T4RSP slips) |

|

|

|

||||

Other income |

Specify: |

|

|

|

|

|

|

|

|||||||

|

Business income |

|

Gross |

162 |

|

|

Net |

|

Professional income |

|

Gross |

164 |

|

|

Net |

|

Commission income |

|

Gross |

166 |

|

|

Net |

|

Farming income |

|

Gross |

168 |

|

|

Net |

|

Fishing income |

|

Gross |

170 |

|

|

Net |

|

|

|

|

|

|

|

|

121

122

125

126

127

128

129

130

135

137

139

141

143

Workers' compensation benefits (box 10 on the T5007 slip)

Social assistance payments

Net federal supplements (box 21 on the T4A(OAS) slip)

Add lines 144, 145, and 146 (see line 250 in the guide).

144

145

146

147

Add lines 101, 104 to 143, and 147.

This is your total income. 150

Attach your Schedule 1 (federal tax) and Form 428 (provincial or territorial tax) |

3 |

|

here. Also attach here any other schedules, information slips, forms, receipts, |

|

|

|

|

|

|

and documents that you need to include with your return. |

|

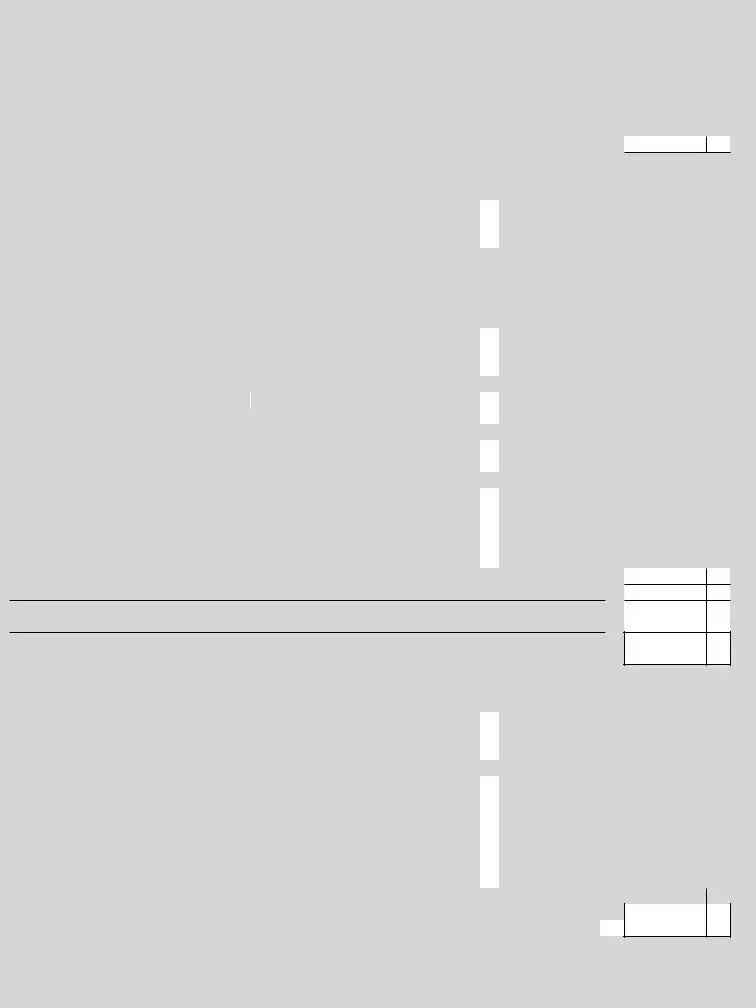

Net income

Enter your total income from line 150. |

150 |

||||

Pension adjustment |

|

|

|

|

|

(box 52 on all T4 slips and box 34 on all T4A slips) |

206 |

|

|

|

|

Registered pension plan deduction (box 20 on all T4 slips and box 32 on all T4A slips) |

207 |

|

|

|||||||

RRSP deduction (see Schedule 7 and attach receipts) |

|

208 |

|

|||||||

Saskatchewan Pension Plan deduction |

(maximum $600) |

209 |

|

|||||||

|

|

|

|

|

||||||

Deduction for elected |

210 |

|

||||||||

|

|

|

|

|||||||

Annual union, professional, or like dues (box 44 on all T4 slips, and receipts) |

212 |

|

||||||||

|

|

|

|

|

|

|||||

Universal Child Care Benefit repayment (box 12 on all RC62 slips) |

|

213 |

|

|||||||

Child care expenses (attach Form T778) |

|

214 |

|

|||||||

Disability supports deduction |

|

|

|

|

|

|

215 |

|

||

|

|

|

|

|

|

|

|

|

|

|

Business investment loss |

Gross 228 |

|

|

|

Allowable deduction |

217 |

|

|||

|

|

|

|

|||||||

Moving expenses |

|

|

|

|

|

|

|

219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Support payments made |

|

Total 230 |

|

|

|

Allowable deduction |

220 |

|

||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Carrying charges and interest expenses (attach Schedule 4) |

|

221 |

|

|||||||

Deduction for CPP or QPP contributions on |

|

|

|

|||||||

(attach Schedule 8) |

|

|

|

|

|

|

|

222 |

|

|

Exploration and development expenses (attach Form T1229) |

|

224 |

|

|||||||

Other employment expenses |

|

|

|

|

|

|

229 |

|

||

Clergy residence deduction |

|

|

|

|

|

|

231 |

|

||

Other deductions |

Specify: |

|

|

|

|

|

|

232 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Add lines 207 to 224, 229, 231, and 232. |

233 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

Line 150 minus line 233 (if negative, enter "0"). This is your net income before adjustments.

Social benefits repayment (if you reported income on line 113, 119, or 146, see line 235 in the guide) Use the federal worksheet to calculate your repayment.

Line 234 minus line 235 (if negative, enter "0"). If you have a spouse or

234

235

236

Taxable income

Canadian Forces personnel and police deduction (box 43 on all T4 slips) |

244 |

|

|

|

|

|

||

Employee home relocation loan deduction (box 37 on all T4 slips) |

248 |

|

|

|

||||

Security options deductions |

|

|

249 |

|

|

|

||

Other payments deduction |

|

|

|

|

|

|

|

|

(if you reported income on line 147, see line 250 in the guide) |

250 |

|

|

|

||||

Limited partnership losses of other years |

251 |

|

|

|

||||

|

|

252 |

|

|

|

|||

Net capital losses of other years |

|

|

253 |

|

|

|

||

Capital gains deduction |

|

|

254 |

|

|

|

||

|

|

|

|

|

|

|

||

Northern residents deductions (attach Form T2222) |

255 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

Additional deductions |

Specify: |

|

256 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Add lines 244 to 256. 257 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Line 236 minus line 257 (if negative, enter "0") |

|

|

||||

This is your taxable income. 260

Use your taxable income to calculate your federal tax on Schedule 1 and your provincial or territorial tax on Form 428.

Refund or Balance owing

Net federal tax: enter the amount from line 53 of Schedule 1 (attach Schedule 1, even if the result is "0") |

420 |

|

|

|

CPP contributions payable on |

421 |

|

||

Social benefits repayment (enter the amount from line 235) |

422 |

|

||

|

|

|

|

|

Provincial or territorial tax (attach Form 428, even if the result is "0") |

|

428 |

|

|

Add lines 420 to 428. |

|

|

|

|

This is your total payable. |

|

435 |

|

|

4

Total income tax deducted (see the guide)

Refundable Quebec abatement

CPP overpayment (enter your excess contributions)

Employment Insurance overpayment (enter your excess contributions)

Refundable medical expense supplement (use federal worksheet)

Working Income Tax Benefit (WITB) (attach Schedule 6)

Refund of investment tax credit (attach Form T2038(IND))

Part XII.2 trust tax credit (box 38 on all T3 slips)

Employee and partner GST/HST rebate (attach Form GST370)

Tax paid by instalments

Provincial or territorial credits (attach Form 479 if it applies)

Add lines 437 to 479.

These are your total credits.

437

440

448

450

452

453

454

456

457

476

479

482

Refund 484

|

|

|

|

Line 435 minus line 482 |

|

|

||||

If the result is negative, you have a refund. If the result is positive, you have a balance owing. |

|

|||||||||

|

|

|

Enter the amount below on whichever line applies. |

|

||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

|

Generally, we do not charge or refund a difference of $2 or less. |

|

|

|

|

|||||

|

Balance owing (see line 485 in the guide) |

|

|

|

||||||

|

485 |

|||||||||

|

|

|

|

|||||||

|

|

|

|

Amount enclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

486 |

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Direct deposit – Start or change (see line 484 in the guide)

You do not have to complete this area every year. Do not complete it this year if your direct deposit information has not changed.

Refund, GST/HST credit, and WITB advance payments – To start direct deposit or to change account information only, attach a "void" cheque or complete lines 460, 461, and 462.

Notes: To deposit your CCTB payments (including certain related provincial or territorial payments) into the same account, also tick box 463.

To deposit your UCCB payments into the same account, also tick box 491.

Branch |

Institution |

|

|

|

number |

number |

Account number |

CCTB |

UCCB |

460 |

461 |

462 |

463 |

491 |

(5 digits) |

|

(3 digits) |

(maximum 12 digits) |

|

Attach to page 1 a cheque or money order payable to the Receiver General. Your payment is due no later than April 30, 2009.

|

Ontario Opportunities Fund |

|

Amount from line 484 above |

|

|

|

|

1 |

|

|

|

|

|

|

|||

You can help reduce Ontario's debt by completing this area to |

|

Your donation to the |

|

|

|

|

|

|

|

Ontario Opportunities Fund |

465 |

|

2 |

||||

donate some or all of your 2008 refund to the Ontario |

|

|

||||||

|

Net refund (line 1 minus line 2) |

466 |

|

3 |

||||

Opportunities Fund. Please see the provincial pages for details. |

|

|

||||||

|

|

|

|

|

|

|

|

|

I certify that the information given on this return and in any documents attached is correct, complete, and fully discloses all my income.

Sign here

It is a serious offence to make a false return.

Telephone |

|

Date |

490 |

For |

Name: |

|

|

|

Address: |

|

|

|

professional |

|

|

||

|

|

|

||

tax preparers |

|

|

|

|

|

|

|

||

|

only |

|

|

|

|

|

Telephone: |

||

Do not use

this area

487 |

488 |

Privacy Act Personal Information Bank number

Document Specifics

| Fact Name | Description |

|---|---|

| Form Type | T1 GENERAL 2008 Income Tax and Benefit Return |

| Purpose | To report income for the year 2008 and claim benefits entitled to the taxpayer. |

| Identification Section | Includes personal label attachment, correction of information, and details such as name, address, and social insurance number. |

| Residency Information | Details taxpayer's province or territory of residence as of December 31, 2008, and information on changes in residency. |

| Income Reporting | Requires a detailed account of various sources of income, including employment, pensions, benefits, and investment. |

| Deductions and Credits | Provides options to claim deductions for expenses and credits for certain eligible situations. |

| Spousal Information | Includes sections for reporting income and other details about the taxpayer's spouse or common-law partner. |

| Elections Canada | Option to authorize the Canada Revenue Agency to share information with Elections Canada for the National Register of Electors. |

| GST/HST Credit Application | Section to apply for the Goods and Services Tax/Harmonized Sales Tax credit. |

| Final Calculations and Declarations | Includes the calculation of total income, deductions, taxable income, refund or balance owing, and a section for the taxpayer's certification. |

Guide to Writing Income Tax And Benefit Return

Before you embark on filling out the Income Tax and Benefit Return form, it’s vital to gather all necessary documents, including your income statements (like T4 slips), receipts for deductions or credits you plan to claim, and any other relevant financial information from the year. Starting with this preparation will make the process smoother and ensure accuracy in reporting your income and calculating any amount owed or refund due. Follow the steps detailed below to complete your form effectively.

- Begin by attaching your personal label in the identification section; if a label is not available, print your name, address, including apartment and street number, PO box or RR, city, province or territory, and postal code.

- Indicate your province or territory of residence as of December 31, 2008. If different, also include your current province or territory of residence.

- If you were self-employed in 2008, specify the province or territory of your self-employment.

- For changes in residency status in 2008, provide the date of entry or departure.

- Enter your Social Insurance Number (SIN), date of birth, and select your preferred language of correspondence.

- Mark the box that correctly identifies your marital status as of December 31, 2008.

- If applicable, provide the SIN, first name, net income for 2008, and other required details of your spouse or common-law partner.

- If filing for a deceased person, enter the date of death.

- Answer the questions related to Elections Canada regarding citizenship and authorization to share your information.

- Indicate whether you are applying for GST/HST credit.

- Confirm ownership or association with foreign property or entities, and if necessary, attach Form T1135.

- Accurately report your total income, breaking it down by categories such as employment income, pension amounts, benefits, and any other earnings.

- Attach your Schedule 1 for federal tax and Form 428 for provincial or territorial tax along with the form.

- Enter your net income after subtracting eligible deductions.

- Calculate your taxable income, accounting for any additional eligible deductions.

- Based on your taxable income, calculate your federal and provincial or territorial tax. Enter your net federal tax and list any other payable amounts.

- Detail the total income tax deducted and calculate your total credits, including specifics like the Refundable Quebec abatement or the Working Income Tax Benefit (WITB), if they apply.

- Determine if you have a refund or balance owing. If paying, include the amount and make checks payable to the Receiver General.

- For direct deposit, provide the required banking information to either initiate or update your records.

- If you are eligible and wish to donate part of your refund to the Ontario Opportunities Fund, specify the amount.

- Complete the certification section with a signature, date, and, if applicable, your professional tax preparer's information.

After completing these steps, review your form carefully to ensure all information is accurate and complete. Attach all necessary documents, including information slips, receipts, and supporting forms, before submitting your return by the deadline. This thorough approach helps in accurate reporting and ensures that you benefit from all deductions and credits available to you.

Understanding Income Tax And Benefit Return

Frequently Asked Questions about the Income Tax and Benefit Return Form

- What is the T1 General Income Tax and Benefit Return form?

- How do I correct my personal information if it's wrong on the label?

- What if my residential address and my mailing address are not the same?

- What information do I need to provide about my spouse or common-law partner?

- How do I report a change in marital status?

- What should I do if I owned foreign property or had foreign income?

- How do I authorize or change direct deposit information?

The T1 General Income Tax and Benefit Return form is a document used in Canada for individuals to file their annual income tax return. This form requires taxpayers to report their income from various sources, claim allowable deductions and credits, determine their taxable income, and calculate federal and provincial or territorial taxes. Completing all the sections that apply to you ensures you benefit from amounts to which you are entitled.

If the personal information on your label is incorrect, or if you're not using a label, you should manually correct or enter the accurate information directly on the form. This includes your first name and initial, last name, mailing address, city, province or territory, and postal code.

If your residential address differs from your mailing address, you need to provide both. Specify your province or territory of residence as of December 31 of the tax year on the designated line, and if different, also enter the province or territory where you currently reside.

If you were married or living common-law as of December 31 of the tax year, you must provide specific information about your spouse or common-law partner. This includes their Social Insurance Number (SIN), first name, net income for the year to claim certain credits, and details about the Universal Child Care Benefit if applicable.

You report a change in your marital status by ticking the box that applies to your situation as of December 31 of the tax year. Options include single, married, living common-law, widowed, divorced, or separated. Detailed instructions for each status can be found in the guide that accompanies the return form.

If you owned foreign property with a total cost of more than CAN$100,000 at any point in the tax year, or if you had dealings with a non-resident trust or corporation, you must indicate this by answering "Yes" to the question on the form and attach a completed Form T1135. All Canadian residents must report their income from all sources, both inside and outside Canada.

To authorize direct deposit or to change your current direct deposit information, you must attach a void cheque or complete the sections provided on the form with your banking information, including the branch number, institution number, and account number. If you want your Canada Child Benefit (CCTB) and Universal Child Care Benefit (UCCB) payments deposited into the same account, ensure you tick the corresponding boxes.

Common mistakes

Filling out an Income Tax and Benefit Return form can be a complex process, and making mistakes can lead to delays in processing or even penalties. Here are nine common mistakes people make when completing their tax returns:

Incorrect or incomplete personal information: Failing to attach the personal identification label correctly, or making errors in printing the name, address, and social insurance number if the label is not being used. It's crucial that all personal information is accurate and complete to avoid processing delays.

Residency status errors: Not correctly entering the province or territory of residence as of December 31, or the current residence if different from the mailing address can lead to incorrect tax calculations or benefit entitlements.

Marital status inaccuracies: Incorrectly ticking the marital status box or failing to update changes in marital status can affect eligibility for certain credits and benefits.

Omitting information about a spouse or common-law partner: Not providing the social insurance number, net income, or other relevant details of a spouse or common-law partner can result in the incorrect calculation of benefits and credits.

Income reporting mistakes: Forgetting to report all sources of income, including employment income, self-employment income, and other earnings, can lead to an underestimation of tax owed or incorrect benefit payments.

Overlooking deductions and credits: Many individuals miss out on valuable deductions and credits, such as RRSP contributions, child care expenses, or moving expenses, simply because they fail to claim them.

Errors in calculating taxable income: Missteps in calculating total income, deductions, and net or taxable income can result in incorrect tax owed or refund amounts.

Miscalculating or not requesting the GST/HST credit: Incorrectly answering the question about applying for the GST/HST credit can mean missing out on this benefit.

Direct deposit errors: Providing incorrect banking information for direct deposit, or failing to update this information, can delay refunds or credits.

Ensuring accuracy and completeness when filling out the Income Tax and Benefit Return form is crucial for the timely processing of the return and for maximizing potential refunds or credits.

Documents used along the form

Filing your Income Tax and Benefit Return is a significant step in managing your finances and navigating through tax season. Alongside the primary T1 General form, several other documents and forms are often required to ensure a thorough and accurate tax filing process. It's important to understand what each of these forms is for and how they play into the bigger picture of your tax responsibilities.

- Form T4, Statement of Remuneration Paid: This slip shows the income you earned as an employee, along with the taxes and deductions taken out by your employer over the tax year.

- Form T5, Statement of Investment Income: If you've earned interest, dividends, or certain types of foreign income, this form documents those earnings for tax purposes.

- Schedule 1, Federal Tax: Used to calculate your detailed federal tax, Schedule 1 is where you'll account for income tax owed after considering various non-refundable tax credits.

- Schedule 3, Capital Gains (or Losses): This form is necessary if you've sold property or investments for more or less than their purchase price, documenting profits or losses from such sales.

- Form T1135, Foreign Income Verification Statement: Required if you own foreign property worth more than a certain amount, this form tracks international income sources and investments.

- Form T2201, Disability Tax Credit Certificate: For those eligible for the Disability Tax Credit, this form, certified by a medical practitioner, helps reduce the amount of income tax they might need to pay.

These forms and documents each serve unique purposes but collectively ensure your tax returns are complete and accurate, potentially optimizing your refunds or minimizing what you owe. Staying organized and keeping track of these documents will make tax filing smoother and more straightforward each year.

Similar forms

The Form 1040, used in the United States for filing individual federal income tax returns, shares key similarities with Canada's T1 General Income Tax and Benefit Return form. Both documents are crucial for individuals to report their annual income, claim allowances, deductions, and tax credits, and determine their tax liability or refund for the year. Taxpayers in both countries must provide personal information, income details from various sources, deductions, and credits to accurately calculate their taxes due or refunds owed. Moreover, they may need to attach additional schedules or forms to support their income and deductions claims.

State or Provincial Tax Returns, such as the New Jersey State Tax Return in the U.S. or the Ontario Provincial Tax Return in Canada, resemble the T1 General form regarding their function for regional tax reporting. They require individuals to report income earned within the particular state or province and calculate applicable taxes or refunds based on the region’s tax laws. These forms typically request similar information found on the federal returns, including income from wages, investments, and other sources, while also allowing for region-specific deductions and credits.

Schedule C (Form 1040), Profit or Loss from Business, parallels the self-employment income section of the T1 General form. Both documents are designed for individuals to report income or loss from a business they operate or a profession they practice as sole proprietors. Taxpayers use these forms to detail their business's revenue, expenses, and net profit (or loss), which then contributes to their overall tax calculations on their general income tax return.

The W-2 form in the United States and the T4 slip in Canada serve similar purposes for employees, although they are not directly completed by taxpayers themselves. Employers issue these documents to report an employee's annual wages and the amount of taxes withheld from their paychecks. Taxpayers then use this information to fill out their respective income tax returns (1040 form in the U.S. and T1 General in Canada), ensuring the income and tax withholdings are accurately reported.

Form 1099-DIV, Dividends and Distributions, in the U.S. and the T5 slip in Canada are issued to taxpayers who receive dividends or other distributions from investments. These forms provide details on the amount of dividends taxpayers earned, distinguishing between eligible, non-eligible dividends, and other distributions, which is essential information for filling out the income tax and benefit return forms in both countries. This information helps individuals accurately report investment income and calculate the tax owed.

Schedule A (Form 1040), Itemized Deductions, in the United States compares to the deductions sections of the T1 General form in Canada. These sections of the tax forms allow taxpayers to list and subtract allowable deductions from their gross income to arrive at their taxable income. Deductions can include medical and dental expenses, taxes paid, interest paid, gifts to charity, and losses from theft or disaster, among others. The principle behind both is to reduce the amount of income subject to tax by recognizing certain allowable expenses incurred throughout the year.

The Child Tax Credit forms, used in both countries, also share similarities with the family tax benefits sections on the T1 General form. In the U.S., Form 1040 allows taxpayers to claim the Child Tax Credit, while in Canada, taxpayers can apply for the Canada Child Benefit (CCB) through the T1 General. These provisions aim to help families by reducing their tax liability based on the number of dependent children, thereby providing financial relief and acknowledging the cost of raising children.

Dos and Don'ts

Filing your Income Tax and Benefit Return form is an essential process for residents in Canada, ensuring compliance with tax laws and possibly availing of benefits. Here are ten do's and don'ts to help guide you through this process smoothly and efficiently:

Do:- Double-check your personal information: Ensure your name, address, social insurance number (SIN), and all other personal details are accurately filled out. If you're using a personal label, correct any errors you find.

- Report all income sources: Include every source of income to avoid any legal issues. This includes employment income, self-employment income, investment income, and any other earnings you may have received during the year.

- Ensure accuracy in your deductions and credits: Claim all deductions and credits you're entitled to, but make sure you have documentation to back them up, such as receipts or forms.

- Check your residency information: Correctly indicate your province or territory of residence as of December 31st of the tax year as it can affect your tax calculations.

- Review your marital status: Your marital status can impact your tax return, affecting your eligibility for certain credits and benefits, so make sure it's up to date.

- Apply for the GST/HST credit if eligible: Don't forget to apply for this credit if you meet the eligibility criteria. It can provide significant savings.

- Forget to sign and date your return: An unsigned tax return is like an unsigned check – it's not valid. Make sure you sign and date the document before submitting.

- Miss the deadline: Submit your return and any amount you owe by April 30th to avoid interest and penalties.

- Overlap information: When filling out your information, ensure there's no overlap or contradictions in the data provided. Every detail from income to investment deductions needs to be clear and consistent.

- Ignore election-related questions if you're a Canadian citizen: Your participation in the election process is valuable. Provide consent to share your information with Elections Canada if you are comfortable doing so.

- Discard records too soon: Keep all relevant documents, receipts, and information slips for at least six years in case the Canada Revenue Agency (CRA) asks to see them. They are essential for verifying the claims on your tax return.

Following these tips can help ensure that you fill out your Income Tax and Benefit Return form correctly and take full advantage of the benefits available to you. Remember, when in doubt, consulting with a tax professional can provide clarity and assistance tailored to your unique tax situation.

Misconceptions

When it comes to filing the Income Tax and Benefit Return form, there are several misconceptions that can lead to confusion or errors. Understanding these can help ensure that your tax filing process is smooth and accurate.

- Misconception #1: All sections of the form must be completed by everyone.

This is not the case. You should only complete the sections that apply to your specific situation to benefit from amounts to which you are entitled. Not everyone will have information for every section, and trying to fill out irrelevant sections can lead to unnecessary errors.

- Misconception #2: You need to attach your personal label for the form to be processed.

While attaching a personal label can save time, it's not mandatory. If you do not have a label, simply print your name and address in the designated area. The most critical part is ensuring that any information provided, label or not, is accurate.

- Misconception #3: Your current residence and address for mailing must be the same.

The form allows for different information regarding your current residence and mailing address. This flexibility is crucial for those who may be living temporarily in a different location from their permanent address, such as students or temporary workers.

- Misconception #4: Marital status is only a concern if you're married or living common-law.

Your marital status impacts your tax situation regardless of what it is. The form includes options for widowed, divorced, separated, and single individuals because each status can affect the credits and deductions you're eligible for.

- Misconception #5: Universal Child Care Benefit (UCCB) should not be reported if you're not claiming child care expenses.

Even if you're not claiming child care expenses, the UCCB amounts received and repaid must be reported. This information impacts your eligibility for certain credits and benefits, underlining the importance of reporting all relevant income sources.

Understanding these misconceptions can make the tax filing process less daunting and help ensure that you receive any refunds or credits due accurately and promptly.

Key takeaways

Filling out the Income Tax and Benefit Return form is vital for accurately reporting yearly income, claiming deductions, and receiving any refunds or credits due. Here are nine key takeaways:

- Ensure all personal information is correct, including your social insurance number (SIN), name, mailing address, and date of birth. If a personal label is not used, manually correct any outdated information.

- Clearly state your residency status as of December 31 of the tax year, including any changes in residency if applicable. If self-employed, indicate the province or territory of your self-employment.

- Select your language preference for correspondence, ensuring you can receive and comprehend all communication from the tax authority.

- Accurately report your marital status and provide detailed information about your spouse or common-law partner if required, which can affect credits and benefits.

- If filing a return for a deceased person, the date of death must be correctly entered, which can have implications for final tax settlements.

- Consider if you are eligible for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit and apply if applicable, as this can provide financial benefits.

- Disclose information about foreign property and other international dealings if the total cost exceeds the specified threshold, as global income and assets can affect tax liability.

- Comprehensively report all sources of income, including employment, self-employment, investments, and other income types, to ensure accurate taxation.

- Understand the deductions and credits available to you, including RRSP deductions, medical expenses, moving expenses, and more, to accurately calculate your taxable income and potential refunds or balances owing.

Always attach necessary schedules, receipts, and other documentation as required to substantiate claims on your return. Additionally, ensure that your return is signed and dated to validate its accuracy and completeness. Being thorough and precise when completing the Income Tax and Benefit Return form can help to maximize your benefits and ensure compliance with tax legislation.

Popular PDF Documents

Illinois Rut-75 Tax Form - The nuanced requirements of Form RUT-75 underscore the importance of accurate record-keeping for all aircraft and watercraft owners.

Total Ordinary Dividends Vs Qualified Dividends - Instructions for individuals with over $100,000 in line 7 income to use alternative tax calculation methods.

IRS Schedule 2 1040 or 1040-SR - This form acts as an add-on for taxpayers with unique financial situations that result in additional tax obligations.