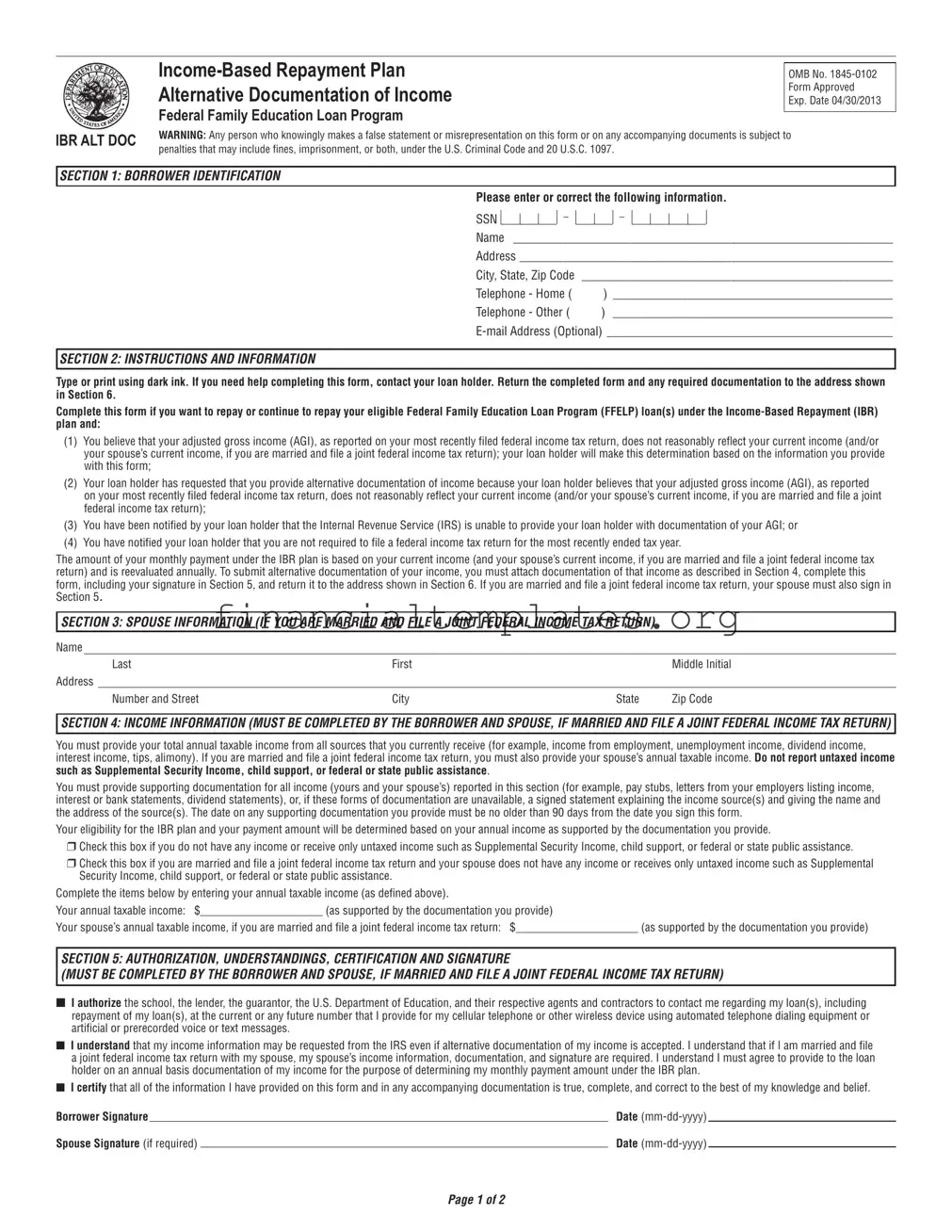

Get Income Based Repayment Plan Form

Navigating the landscape of loan repayments can be a challenging endeavor, especially when one's income doesn't reflect their current financial situation accurately. In such instances, the Income-Based Repayment Plan (IBR) offers a glimmer of hope, allowing for adjustments to monthly payments based on what one can afford rather than a flat rate determined by the loan amount. The IBR Plan Alternative Documentation of Income form becomes a pivotal document for those whose adjusted gross income (AGI) doesn't mirror their present earnings, including fluctuations due to life changes or errors in past tax returns. Specifically designed for borrowers within the Federal Family Education Loan Program, this form acts as a tool to petition for recalculated payment terms reflective of one's current economic status. Along with providing personal identification details, the form requires meticulous documentation of income—a task necessitated to ensure accuracy and fairness in recalculating monthly dues. Furthermore, the inclusion of spousal income, for those filing joint tax returns, underscores the comprehensive approach taken to gauge household financial health holistically. A stark warning against misrepresentation highlights the seriousness of the submission, emphasizing the legal ramifications of falsifying information in this sensitive declaration of financial capability.

Income Based Repayment Plan Example

Federal Family Education Loan Program

OMB No.

Form Approved

Exp. Date 04/30/2013

IBR ALT DOC |

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying documents is subject to |

||||||||||||||||

|

|||||||||||||||||

|

penalties that may include ines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 1: BORROWER IDENTIFICATION |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please enter or correct the following information. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name _____________________________________________________________ |

||||||||||||||||

|

Address ____________________________________________________________ |

||||||||||||||||

|

City, State, Zip Code |

__________________________________________________ |

|||||||||||||||

|

Telephone - Home ( |

) _____________________________________________ |

|||||||||||||||

|

Telephone - Other ( |

) _____________________________________________ |

|||||||||||||||

|

|||||||||||||||||

SECTION 2: INSTRUCTIONS AND INFORMATION

Type or print using dark ink. If you need help completing this form, contact your loan holder. Return the completed form and any required documentation to the address shown in Section 6.

Complete this form if you want to repay or continue to repay your eligible Federal Family Education Loan Program (FFELP) loan(s) under the

(1)You believe that your adjusted gross income (AGI), as reported on your most recently iled federal income tax return, does not reasonably relect your current income (and/or your spouse’s current income, if you are married and ile a joint federal income tax return); your loan holder will make this determination based on the information you provide with this form;

(2)Your loan holder has requested that you provide alternative documentation of income because your loan holder believes that your adjusted gross income (AGI), as reported on your most recently iled federal income tax return, does not reasonably relect your current income (and/or your spouse’s current income, if you are married and ile a joint federal income tax return);

(3)You have been notiied by your loan holder that the Internal Revenue Service (IRS) is unable to provide your loan holder with documentation of your AGI; or

(4)You have notiied your loan holder that you are not required to ile a federal income tax return for the most recently ended tax year.

The amount of your monthly payment under the IBR plan is based on your current income (and your spouse’s current income, if you are married and ile a joint federal income tax return) and is reevaluated annually. To submit alternative documentation of your income, you must attach documentation of that income as described in Section 4, complete this form, including your signature in Section 5, and return it to the address shown in Section 6. If you are married and ile a joint federal income tax return, your spouse must also sign in Section 5.

SECTION 3: SPOUSE INFORMATION (IF YOU ARE MARRIED AND FILE A JOINT FEDERAL INCOME TAX RETURN)

Name

|

Last |

First |

|

Middle Initial |

Address |

|

|

|

|

|

Number and Street |

City |

State |

Zip Code |

SECTION 4: INCOME INFORMATION (MUST BE COMPLETED BY THE BORROWER AND SPOUSE, IF MARRIED AND FILE A JOINT FEDERAL INCOME TAX RETURN)

You must provide your total annual taxable income from all sources that you currently receive (for example, income from employment, unemployment income, dividend income, interest income, tips, alimony). If you are married and ile a joint federal income tax return, you must also provide your spouse’s annual taxable income. Do not report untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

You must provide supporting documentation for all income (yours and your spouse’s) reported in this section (for example, pay stubs, letters from your employers listing income, interest or bank statements, dividend statements), or, if these forms of documentation are unavailable, a signed statement explaining the income source(s) and giving the name and the address of the source(s). The date on any supporting documentation you provide must be no older than 90 days from the date you sign this form.

Your eligibility for the IBR plan and your payment amount will be determined based on your annual income as supported by the documentation you provide.

r Check this box if you do not have any income or receive only untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

r Check this box if you are married and ile a joint federal income tax return and your spouse does not have any income or receives only untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

Complete the items below by entering your annual taxable income (as deined above).

Your annual taxable income: $_____________________ (as supported by the documentation you provide)

Your spouse’s annual taxable income, if you are married and ile a joint federal income tax return: $_____________________ (as supported by the documentation you provide)

SECTION 5: AUTHORIZATION, UNDERSTANDINGS, CERTIFICATION AND SIGNATURE

(MUST BE COMPLETED BY THE BORROWER AND SPOUSE, IF MARRIED AND FILE A JOINT FEDERAL INCOME TAX RETURN)

nI authorize the school, the lender, the guarantor, the U.S. Department of Education, and their respective agents and contractors to contact me regarding my loan(s), including repayment of my loan(s), at the current or any future number that I provide for my cellular telephone or other wireless device using automated telephone dialing equipment or artiicial or prerecorded voice or text messages.

nI understand that my income information may be requested from the IRS even if alternative documentation of my income is accepted. I understand that if I am married and ile a joint federal income tax return with my spouse, my spouse’s income information, documentation, and signature are required. I understand I must agree to provide to the loan holder on an annual basis documentation of my income for the purpose of determining my monthly payment amount under the IBR plan.

nI certify that all of the information I have provided on this form and in any accompanying documentation is true, complete, and correct to the best of my knowledge and belief.

Borrower Signature |

|

Date |

|

Spouse Signature (if required) |

|

Date |

|

Page 1 of 2

SECTION 6: WHERE TO SEND THE COMPLETED IBR PLAN ALTERNATIVE DOCUMENTATION OF INCOME FORM

Return the completed IBR Plan Alternative Documentation of Income form and any required documentation to: (If no address is shown, return to your loan holder.)

NELNET

P.O. BOX 82565

LINCOLN, NE

FAX: 1.866.545.9196

If you need help completing this form, call:

(If no telephone number is shown, call your loan holder.)

SECTION 7: IMPORTANT NOTICES

Privacy Act Notice

The Privacy Act of 1974 (5 U.S.C. 552a) requires that the following notice be provided to you:

The authority for collecting the requested information from and about you is §428(b)(2)(A) et seq. of the Higher Education Act (HEA) of 1965, as amended (20 U.S.C. 1078(b)(2)(A) et seq.) and the authorities for collecting and using your Social Security Number (SSN) are §484(a)(4) of the HEA (20 U.S.C. 1091(a)(4)) and 31 U.S.C. 7701(b). Participating in the Federal Family Education Loan (FFEL) Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

The principal purposes for collecting the information on this form, including your SSN, are to verify your identity, to determine your eligibility to receive a loan or a beneit on a loan (such as a deferment, forbearance, discharge, or forgiveness) under the FFEL Program, to permit the servicing of your loan(s), and, if it becomes necessary, to locate you and to collect and report on your loan(s) if your loan(s) become delinquent or in default. We also use your SSN as an account identiier and to permit you to access your account information electronically. The information in your ile may be disclosed, on a

in order to verify your identity, to determine your eligibility to receive a loan or a beneit on a loan, to permit the servicing or collection of your loan(s), to enforce the terms of the loan(s), to investigate possible fraud and to verify compliance with federal student inancial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default. To provide default rate calculations, disclosures may be made to guaranty agencies, to inancial and educational institutions, or to state agencies. To provide inancial aid history information, disclosures may be made to educational institutions. To assist program administrators with tracking refunds and cancellations, disclosures may be made to guaranty agencies, to inancial and educational institutions, or to federal or state agencies. To provide a standardized method for educational institutions eficiently to submit student enrollment status, disclosures may be made to guaranty agencies or to inancial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to inancial and educational institutions, or to federal, state, or local agencies.

In the event of litigation, we may send records to the Department of Justice, a court, adjudicative body, counsel, party, or witness if the disclosure is relevant and necessary to the litigation. If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U.S.C. Chapter 71. Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards. Disclosures may also be made to qualiied researchers under Privacy

Act safeguards.

Paperwork Reduction Notice

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a currently valid OMB control number. The valid OMB control number for this information collection is

have any comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to:

U.S. Department of Education, Washington, DC

If you have any comments or concerns regarding the status of your individual submission of this form, write directly to the address shown in Section 6.

Page 2 of 2

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The form is used to apply or continue the Income-Based Repayment (IBR) plan for Federal Family Education Loan Program (FFELP) loans when the applicant's adjusted gross income (AGI) does not accurately reflect their current income, or when alternative documentation is needed to prove income. |

| Penalties for False Statements | Submitting false information or misrepresentations on this form or accompanying documents can lead to fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097. |

| Eligibility and Documentation | Eligibility for the IBR plan and the monthly payment amount are determined based on the borrower's current income (and spouse's income, if filing jointly) as supported by the provided documentation. |

| Required Signatures | The borrower, and the spouse if filing jointly, must sign and date the form, authorizing contact regarding the loan(s) and affirming the accuracy of the provided information. |

| Privacy and Information Usage | The collected information, including Social Security Number (SSN), is primarily used to verify identity, determine loan or benefit eligibility, permit loan servicing, and for collection purposes if necessary. The information may be disclosed to various parties as authorized under routine uses. |

Guide to Writing Income Based Repayment Plan

When navigating the path to repay student loans, individuals often seek options that align with their financial circumstances. The Income-Based Repayment (IBR) Plan offers a solution, adjusting monthly payments according to income and family size, thereby easing the burden for borrowers. For those whose current income doesn't reflect what's reported on their tax returns, or facing unique financial situations not captured by a tax return, providing alternative documentation of income becomes essential. This process ensures that monthly payments under the IBR Plan accurately represent the borrower’s current financial situation. Below is a stepwise guide to filling out the IBR Plan Alternative Documentation of Income form to ensure accurate and timely processing.

- Section 1: Borrower Identification

- Enter your Social Security Number, full name, complete address, including city, state, and zip code.

- Provide both your home and alternative telephone numbers. Including your e-mail address is optional but recommended for better communication.

- Section 2: Instructions and Information

- Read through the instructions thoroughly. This section does not require any action but is crucial for understanding how to complete the form accurately.

- Section 3: Spouse Information (If applicable)

- If you are married and file a joint federal income tax return, enter your spouse’s full name, address, and additional contact details.

- Section 4: Income Information

- Document your total annual taxable income from all sources. If married and filing jointly, include your spouse's annual taxable income.

- Attach supporting documentation for all income stated. This could be pay stubs, letters from employers, interest or bank statements, and dividend statements. If formal documents are not available, a signed statement detailing the source(s) of income, including contact information, should be provided.

- Mark the relevant checkbox if you or your spouse (if filing jointly) do not have any income or only receive untaxed income, such as Social Security income, child support, or state public assistance.

- Section 5: Authorization, Understandings, Certification, and Signature

- Review the authorizations and understandings regarding contact, IRS information requests, and annual income documentation requirements.

- Certify the correctness of the information provided by signing and dating the form. If married and filing jointly, your spouse must also sign and date.

- Section 6: Where to Send the Completed Form

- If an address has been provided, send the completed form along with any required documentation to it. If no address is mentioned, return the form to your loan holder.

- Review Important Notices in Section 7.

- This section offers insights into privacy notices and the use of your information. Understanding these notices ensures you are informed about how your personal data is handled.

Completing the IBR Plan Alternative Documentation of Income form with meticulous attention to detail and providing thorough documentation ensures your monthly payment accurately reflects your financial standing. This care and diligence pave the way toward a more manageable and sustainable repayment strategy for your student loans.

Understanding Income Based Repayment Plan

What is the Income-Based Repayment Plan?

The Income-Based Repayment (IBR) Plan is designed to reduce monthly payments to make your Federal Family Education Loan Program (FFELP) loan repayment more manageable. Under the IBR plan, payments are based on your current income and family size, not on the amount of your loan. The IBR Plan requires a yearly reevaluation of your income and family size to adjust your monthly payment amount accordingly.

Who needs to provide alternative documentation of income?

You must submit alternative documentation of your income if:

- Your adjusted gross income (AGI) as reported on your most recently filed federal income tax return does not accurately reflect your (or your spouse's, if applicable) current income.

- Your loan servicer requests it because they believe your reported AGI does not reflect your current income.

- The IRS is unable to provide documentation of your AGI to your loan holder.

- You have informed your loan holder that you were not required to file a federal income tax return for the most recently ended tax year.

What happens if I mistakenly provide false information on the form?

Providing false information or deliberately making a misrepresentation on this form or on any accompanying documents has serious consequences. These can include but are not limited to fines, imprisonment, or both, pursuant to the U.S. Criminal Code and 20 U.S.C. 1097. It is crucial to ensure all information is accurate, complete, and truthful.

How do I submit the IBR Plan Alternative Documentation of Income form?

Once you have completed the form and included all required documentation to support your income claims, you should return it to the address provided in Section 6 of the form. If you are sending it to NELNET, the address is P.O. BOX 82565, LINCOLN, NE 68501-2565. For fax submissions, use 1.866.545.9196. Should you require assistance in filling out the form or have questions, call the phone number provided in the document. If no specific contact information is given, reach out to your loan holder directly.

Common mistakes

When individuals fill out the Income-Based Repayment Plan form, making accurate and complete entries is crucial. However, some common mistakes tend to occur during the process. These errors can delay processing times or affect the outcome of the application. Below are five common mistakes made:

Incorrect or Incomplete Borrower Information: Applicants often enter incorrect Social Security Numbers (SSNs), names, or contact information. It's paramount to double-check this section to ensure the loan servicer can accurately identify and communicate with the borrower.

Failing to Provide Complete Income Information: A major requirement is the declaration of total annual taxable income. Applicants sometimes neglect to include all income sources or fail to provide the necessary documentation to support their reported income. This oversight can result in incorrect calculation of the repayment amount.

Omitting Spouse Information: For those who are married and file a joint federal income tax return, failing to include your spouse’s information and income details can lead to inaccuracies in your application. It is essential to provide both parties' information as instructed to accurately assess the monthly repayment amount.

Forgetting to Sign and Date the Form: An unsigned form is incomplete and will not be processed. Both the borrower and the spouse (if applicable) must sign and date the form. Electronic signatures may not be accepted, so make sure to check the requirements.

Ignoring the Documentation Requirements: Applicants must attach documentation of their income as described in the form. Failing to submit recent (no older than 90 days from the date signed on the form) and proper documentation, or neglecting to explain the sources of income if documentation is not available, will prevent accurate determination of the repayment plan.

Mistakes made on the Income-Based Repayment Plan form can be easily avoided by thoroughly reading the instructions, accurately completing each required field, and double-checking all provided information before submission. An accurate and complete application will expedite the process and help ensure that borrowers receive the repayment plan best suited to their financial circumstances.

Documents used along the form

When managing student loans, especially under programs like the Income-Based Repayment Plan (IBR), understanding the spectrum of necessary forms and documents is crucial for maintaining order and ensuring that all available benefits are fully utilized. Beyond the IBR Plan Alternative Documentation of Income form, several other forms and documents frequently play a supportive role in this process, integrating various aspects of federal student loan management and repayment strategies.

- Federal Income Tax Returns: Often required to verify income and family size, recent tax returns provide a snapshot of financial status and are critical for calculating repayment amounts under the IBR plan.

- W-2 Forms and/or Pay Stubs: For borrowers who do not file taxes or need to document their current income, pay stubs or W-2 forms serve as proof of earnings and employment.

- Other Income Documentation: If applicable, documentation of other types of income—such as unemployment benefits, alimony, or child support payments—is necessary for a comprehensive assessment of repayment capabilities.

- Loan Consolidation Application and Promissory Note: For borrowers combining multiple federal student loans into one for easier management, this document outlines the terms of the consolidation loan and repayment expectations.

- Economic Hardship Deferment Request: If facing financial hardship, borrowers may fill out this form to request a temporary halt on payments under specific conditions.

- Employment Certification for Public Service Loan Forgiveness: Essential for those seeking loan forgiveness through public service, this document verifies qualifying employment in a government or nonprofit sector.

- Annual Recertification Form: Since IBR payments are based on income and family size, borrowers must recertify these details annually to adjust payment amounts as necessary.

- Forbearance Request Forms: In times of financial distress not covered by deferment, borrowers can request forbearance to pause or reduce payments, although interest may continue to accrue.

As the landscape of federal student loan repayment evolves, staying informed about required documents and forms is essential for making educated decisions about managing loans. Each document plays a role in ensuring borrowers can navigate their repayment journey effectively, leveraging opportunities for relief or forgiveness according to their life circumstances. Attentiveness to detail and proactive management of these documents can significantly impact one's financial well-being and progress toward loan repayment or forgiveness. Understanding and utilizing these forms can pave the way toward a more manageable and informed repayment process.

Similar forms

The Income Based Repayment Plan form shares similarities with the Public Service Loan Forgiveness (PSLF) Application form in its focus on aiding borrowers in managing their student loans under specific conditions. Both forms seek to alleviate the financial burden by offering terms that adjust payments based on the borrower’s current financial situation. They require borrowers to provide detailed personal and income information to qualify for the benefits, emphasizing the importance of accurate, truthful reporting to avoid penalties.

Just like the Income-Based Repayment Plan form, the Loan Consolidation Application process requires borrowers to gather and report their financial information comprehensively. This similarity lies in the necessity for borrowers to detail their income and personal data, enabling the servicer to determine eligibility for consolidation and, potentially, more favorable repayment terms based on their consolidated financial obligations.

The Deferment Request forms for federal student loans also parallel the Income-Based Repayment Plan form. These forms are used by borrowers who wish to temporarily suspend or reduce their loan payments due to specific life circumstances, such as unemployment or economic hardship, again relying on the accurate portrayal of their current financial status, much like the IBR form requires.

Forbearance Request forms, similar to the Income-Based Repayment Plan form, offer short-term relief for borrowers facing financial difficulty. Both forms necessitate the submission of personal and financial information to evaluate eligibility for reduced payments or a temporary pause in payments, highlighting the necessity of providing current income data to qualify for assistance.

The Employment Certification for Public Service Loan Forgiveness (PSLF) form, while primarily designed to confirm a borrower’s employment in a public service job, shares the IBR form's emphasis on the importance of accurate documentation. Both forms are critical steps in accessing special loan repayment conditions, requiring detailed personal information and meticulous record-keeping.

The Annual Recertification for Income-Driven Repayment (IDR) forms necessitate yearly submission of income and family size information from borrowers, akin to the IBR plan requirements. This process ensures that payment amounts remain aligned with the borrower’s financial situation, emphasizing the need for updated personal data similar to the IBR's annual reevaluation premise.

The Total and Permanent Disability (TPD) Discharge Application, while serving a different primary purpose—discharging loans due to a borrower’s inability to work because of disability—requires comprehensive personal and financial information similar to the IBR form. Both documents facilitate a change in the borrower’s loan repayment obligations based on significant life changes.

Income-Driven Repayment Plan Request forms are closely akin to the IBR form, as they both aim to adjust a borrower’s monthly payment amounts based on their income and family size. These forms require detailed financial information to assess eligibility for reduced payments, underlining the necessity of accurate income documentation.

The Teacher Loan Forgiveness Application form, like the Income-Based Repayment Plan form, offers specific benefits to a certain group—teachers working in low-income schools or educational service agencies. Both require strict documentation of personal and professional circumstances, highlighting the role of accurate information in accessing loan forgiveness or reduced payments.

Lastly, the Direct PLUS Loan Application form for parents shares the requirement of personal and financial information with the IBR form, though it is used for obtaining loans rather than adjusting repayment terms. Both forms assess financial situations to make decisions regarding loans, underscoring the importance of detailed and truthful submissions.

Dos and Don'ts

When filling out the Income-Based Repayment Plan form, there are important steps to follow and common pitfalls to avoid. To ensure accuracy and compliance with requirements, here are four things you should and shouldn't do:

- Do carefully read all instructions provided in the form to ensure thorough understanding and correct completion.

- Do use dark ink and print legibly or type your responses to avoid any misinterpretation of your information.

- Do provide all required documentation of income as requested in the form, including, but not limited to, pay stubs or letters from employers if applicable.

- Do ensure that any supporting documentation for income you provide is dated no older than 90 days from the date you sign the form.

- Don't leave any required fields blank. If a particular section does not apply to you, write "N/A" (not applicable) to indicate that you have seen and acknowledged the question.

- Don't include unsupported or undocumented income; it is crucial that all reported income can be verified through the documents you provide.

- Don't submit the form without checking for accuracy and completeness. A quick review can catch mistakes that might delay processing.

- Don't forget to sign and date Section 5 of the form. If you are married and file a joint federal income tax return, make sure your spouse also signs and dates where required.

Misconceptions

Many individuals have misunderstandings about the Income-Based Repayment Plan (IBR), particularly when it comes to the documentation and information required. Clarifying these misconceptions is essential for borrowers considering this option for their Federal Family Education Loan Program (FFELP) loans.

- Misconception #1: Income information is only based on past tax returns.

While past tax returns can be used, alternative documentation is accepted if your current income does not accurately reflect what was reported on your latest tax return. This includes more recent pay stubs or a signed statement explaining income sources if documentation is unavailable.

- Misconception #2: Only taxable income needs to be reported.

All current annual income must be reported, not just taxable income. This includes income from employment, unemployment income, dividend income, and interest income, among others. However, untaxed income like Supplemental Security Income or child support does not need to be included.

- Misconception #3: Spousal income is not considered.

If you are married and file a joint federal income tax return, your spouse's income must also be provided along with supporting documentation. This plays a crucial role in determining your monthly payment under the IBR plan.

- Misconception #4: The form is difficult to complete and requires legal or financial expertise.

While the form does request detailed information, individuals can complete it without specialized knowledge. Assistance is available from your loan holder if you encounter difficulty.

- Misconception #5: Once submitted, the income documentation is valid indefinitely.

Your eligibility and payment amount under the IBR plan are reevaluated annually. Thus, you must submit updated income documentation each year.

- Misconception #6: Penalties for false information are rarely enforced.

It's crucial to understand that providing false information or misrepresentation on this form or any accompanying documentation is a serious offense. Penalties may include fines, imprisonment, or both under the U.S. Criminal Code and 20 U.S.C. 1097.

- Misconception #7: All borrowers are required to use this form to apply for IBR.

This form is specifically for individuals who need to submit alternative documentation of their income under certain circumstances, such as when the IRS cannot provide documentation of AGI or when the borrower's current income significantly deviates from their most recently filed tax return. Other borrowers may not need to fill out this particular form to apply for or continue under the IBR plan.

Correcting these misconceptions can help ensure that borrowers are fully informed about the requirements and process of applying for the IBR plan, thereby making a well-informed decision about managing their student loan repayment.

Key takeaways

When approaching the process of filling out the Income Based Repayment (IBR) Plan form, it is pivotal to arm yourself with comprehensive knowledge about the requirements, the documentation needed, and the implications of the information you provide. This guidance aims to distill the essential points to ensure clarity and compliance in your submission.

Accuracy is paramount: Every participant is responsible for the truthfulness and accuracy of the information provided on the form. False statements can lead to severe penalties, including fines or imprisonment, underscoring the legal obligation to be honest and meticulous in completing the form.

The form is applicable under specific circumstances: Designed for borrowers under the Federal Family Education Loan Program, it caters to those whose current income does not reflect their adjusted gross income as reported on their most recent tax return, among other specific scenarios.

Annual reevaluation of payment amounts: Bear in mind that the IBR plan recalculates payments based on your annual income, a process that occurs yearly, necessitating up-to-date and accurate income documentation.

Documentation is crucial: Provision of supporting documents for the income declared is mandatory. These documents must be current (dated no more than 90 days prior to the application) and may include pay stubs, employer letters, or bank statements. This rule applies to both the borrower and their spouse, in cases of a joint tax return.

Marriage impacts your application: If married and filing taxes jointly, your spouse's income and documentation are integral to the application, emphasizing the collective evaluation of household income.

Contact information authorization: By signing the form, you authorize various entities, including educational institutions and federal departments, to contact you about your loan using automated methods or written communications.

Privacy considerations: The collection of information, including Social Security Numbers, upholds the Privacy Act of 1974. This act outlines the use, protection, and disclosure boundaries related to the personal data you provide.

Paperwork Reduction Act Notice: This act ensures that the collected information is necessary and the burden of collection (estimated at one hour) is justified, demonstrating the government’s consideration for the respondents' time.

Consequences of data disclosure: Information from your form may be shared with third parties under specific conditions, aiming to verify eligibility, facilitate loan servicing, and ensure program compliance, or as part of legal proceedings, emphasizing the importance of understanding the scope of consent given through your participation.

Understanding these facets of the IBR Plan form submission helps in navigating the process with confidence. Ensuring accurate and up-to-date information, being aware of the documentation requirements, and comprehending the privacy implications are imperative steps for compliance and making informed decisions about managing your student loans under the IBR plan.

Popular PDF Documents

IRS Schedule K-1 1065 - It breaks down types of income such as rental, interest, dividends, and capital gains among partners.

IRS 8282 - It reassures donors that their significant gifts are reported and managed according to federal laws and guidelines.

Driver Contract Agreement With Vehicle Owner - Included are sections for capturing fuel source type and if the vehicle is wheelchair accessible, important for operational specifics.