Get Illinois Tax Form

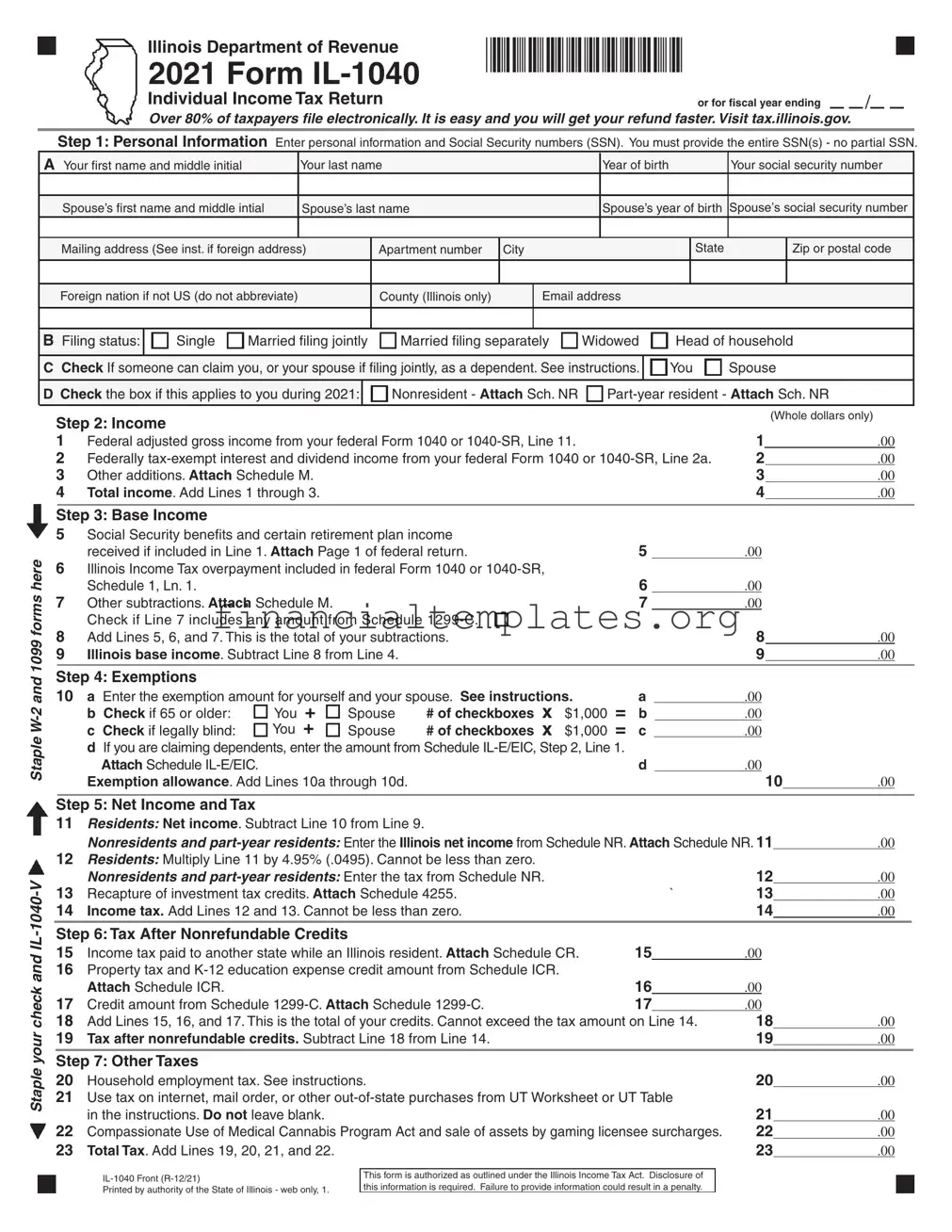

Filing taxes can often be seen as a daunting task, but understanding the process can vastly simplify it. The Illinois Department of Revenue provides the Form IL-1040 for individuals to report their income tax return each year, and for the fiscal year of 2020, a notable emphasis has been placed on the encouragement of electronic filing. Over 80% of taxpayers now opt for this method due to its ease and faster processing times for refunds. This particular form meticulously guides taxpayers through various steps starting with personal information, including complete Social Security numbers for both the taxpayer and spouse, if applicable. Taxpayers are then navigated through sections to report income, calculate base income after deductions, and determine the tax owed, taking into consideration exemptions that could lower their taxable income. The form also outlines options for reporting tax credits, other taxes owed, and payments already made through withholding or estimates. Notably, the form caters to both full-year residents and those who have lived in Illinois for only a part of the year, with different sections applicable based on residency status. Additionally, contributions to charitable donations can be made through this form, and taxpayers have the option to decide how they wish to receive their refund, demonstrating the state's flexibility in accommodating diverse taxpayer needs.

Illinois Tax Example

|

Illinois Department of Revenue |

*60012211W* |

|

|

|

|

|||||

|

2021 Form |

|

|

|

|

|

|

|

|

|

|

|

Individual Income Tax Return |

or for fiscal year ending |

|

|

|

/ |

|

|

|

|

|

Over 80% of taxpayers file electronically. It is easy and you will get your refund faster. Visit tax.illinois.gov.

Step 1: Personal Information Enter personal information and Social Security numbers (SSN). You must provide the entire SSN(s) - no partial SSN.

A Your first name and middle initial |

|

Your last name |

|

|

|

Year of birth |

|

|

Your social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s first name and middle intial |

Spouse’s last name |

|

|

|

Spouse’s year of birth |

Spouse’s social security number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (See inst. if foreign address) |

Apartment number |

City |

|

|

|

|

State |

|

Zip or postal code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign nation if not US (do not abbreviate) |

|

|

County (Illinois only) |

|

Email address |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B Filing status: |

Single |

Married filing jointly |

Married filing separately |

Widowed |

Head of household |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C Check If someone can claim you, or your spouse if filing jointly, as a dependent. See instructions. |

|

You |

Spouse |

|||||||||||

D Check the box if this applies to you during 2021: |

|

Nonresident - Attach Sch. NR |

|

|||||||||||

Staple

Staple your check and

Step 2: Income |

|

|

|

|

(Whole dollars only) |

|

|

|

|

|

|

|

|

||

1 |

Federal adjusted gross income from your federal Form 1040 or |

|

|

1 |

.00 |

|

|

2 |

Federally |

2 |

.00 |

|

|||

3 |

Other additions. Attach Schedule M. |

|

|

3 |

.00 |

|

|

4 |

Total income. Add Lines 1 through 3. |

|

|

4 |

.00 |

|

|

|

|

|

|

|

|

|

|

Step 3: Base Income |

|

|

|

|

|

|

|

5 |

Social Security benefits and certain retirement plan income |

|

|

|

|

|

|

|

received if included in Line 1. Attach Page 1 of federal return. |

5 |

|

.00 |

|

|

|

6Illinois Income Tax overpayment included in federal Form 1040 or

|

Schedule 1, Ln. 1. |

|

|

|

|

|

|

6 |

.00 |

|

|

|

|

7 |

Other subtractions. Attach Schedule M. |

|

|

|

|

7 |

.00 |

|

|

|

|||

|

Check if Line 7 includes any amount from Schedule |

|

|

|

|

|

|

|

|

||||

8 |

Add Lines 5, 6, and 7. This is the total of your subtractions. |

|

|

|

8 |

.00 |

|

||||||

9 |

Illinois base income. Subtract Line 8 from Line 4. |

|

|

|

|

9 |

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 4: Exemptions |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

a Enter the exemption amount for yourself and your spouse. See instructions. |

|

a |

|

.00 |

|

|

|

|||||

|

b Check if 65 or older: |

You |

+ |

Spouse |

# of checkboxes x |

$1,000 |

= |

b |

|

.00 |

|

|

|

|

c Check if legally blind: |

You |

+ |

Spouse |

# of checkboxes x |

$1,000 |

= |

c |

|

.00 |

|

|

|

dIf you are claiming dependents, enter the amount from Schedule

Attach Schedule |

d |

.00 |

|

|

|

Exemption allowance. Add Lines 10a through 10d. |

|

10 |

.00 |

|

|

|

|

|

|

|

|

Step 5: Net Income and Tax

11Residents: Net income. Subtract Line 10 from Line 9.

|

Nonresidents and |

.00 |

|

||||

12 |

Residents: Multiply Line 11 by 4.95% (.0495). Cannot be less than zero. |

|

|

|

|

|

|

|

Nonresidents and |

|

|

12 |

.00 |

|

|

13 |

Recapture of investment tax credits. Attach Schedule 4255. |

` |

13 |

.00 |

|

||

14 |

Income tax. Add Lines 12 and 13. Cannot be less than zero. |

|

|

14 |

.00 |

|

|

|

|

|

|

|

|

|

|

Step 6: Tax After Nonrefundable Credits |

|

|

|

|

|

|

|

15 |

Income tax paid to another state while an Illinois resident. Attach Schedule CR. |

15 |

|

.00 |

|

|

|

16Property tax and

|

Attach Schedule ICR. |

16 |

|

.00 |

|

|

|

17 |

Credit amount from Schedule |

17 |

|

.00 |

|

|

|

18 |

Add Lines 15, 16, and 17. This is the total of your credits. Cannot exceed the tax amount on Line 14. |

18 |

.00 |

|

|||

19 |

Tax after nonrefundable credits. Subtract Line 18 from Line 14. |

|

|

19 |

.00 |

|

|

|

|

|

|

|

|

|

|

Step 7: Other Taxes |

|

|

|

|

|

|

|

20 |

Household employment tax. See instructions. |

|

|

20 |

.00 |

|

|

21Use tax on internet, mail order, or other

|

in the instructions. Do not leave blank. |

21 |

.00 |

22 |

Compassionate Use of Medical Cannabis Program Act and sale of assets by gaming licensee surcharges. |

22 |

.00 |

23 |

Total Tax. Add Lines 19, 20, 21, and 22. |

23 |

.00 |

Printed by authority of the State of Illinois - web only, 1.

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of this information is required. Failure to provide information could result in a penalty.

|

|

*60012212W* |

|

|

|

|

|

||

24 |

24 |

|

|

|

|||||

Total tax from Page 1, Line 23. |

|

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Step 8: Payments and Refundable Credit |

|

|

|

|

|

|

|

|

25 |

Illinois Income Tax withheld. Attach Schedule |

25 |

|

.00 |

|

|

|

|

|

26 |

Estimated payments from Forms |

|

|

|

|

|

|

|

|

|

|

including any overpayment applied from a prior year return. |

26 |

|

.00 |

|

|

|

|

27 |

27 |

|

.00 |

|

|

|

|

||

28 |

28 |

|

.00 |

|

|

|

|

||

29 |

Earned Income Credit from Schedule |

29 |

|

.00 |

|

|

|

|

|

30 |

Total payments and refundable credit. Add Lines 25 through 29. |

30 |

.00 |

|

|

|

|

|

|

Step 9: Total |

|

|

|

|

31 |

If Line 30 is greater than Line 24, subtract Line 24 from Line 30. |

31 |

.00 |

|

32 |

If Line 24 is greater than Line 30, subtract Line 30 from Line 24. |

32 |

.00 |

|

|

|

|

|

|

Step 10: Underpayment of Estimated Tax Penalty and Donations - Only complete Step 10 for

33 |

33 |

|

.00 |

a Check if at least

Check if at least

b Check if you or your spouse are 65 or older and permanently living in a nursing home.

Check if you or your spouse are 65 or older and permanently living in a nursing home.

c Check if your income was not received evenly during the year and you annualized your income on Form

Check if your income was not received evenly during the year and you annualized your income on Form

d Check if you were not required to file an Illinois Individual Income Tax return in the previous tax year.

Check if you were not required to file an Illinois Individual Income Tax return in the previous tax year.

34 |

Voluntary charitable donations. Attach Schedule G. |

34 |

|

.00 |

|

|

35 |

Total penalty and donations. Add Lines 33 and 34. |

|

35 |

.00 |

|

|

|

|

|

|

|

|

|

Step 11: Refund

36If you have an amount on Line 31 and this amount is greater than Line 35, subtract Line 35 from Line 31.

This is your overpayment. |

36 |

.00 |

37 Amount from Line 36 you want refunded to you. Check one box on Line 38. See instructions. |

37 |

.00 |

38I choose to receive my refund by

a

direct deposit - Complete the information below if you check this box.

direct deposit - Complete the information below if you check this box.

You may also contribute |

Routing number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking or |

|

Savings |

||||

to college savings funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here. See instructions! |

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b

paper check.

39 Amount to be credited forward. Subtract Line 37 from Line 36. See instructions. |

39 |

.00 |

|

|

|

|

|

Step 12: Amount You Owe

40 If you have an amount on Line 32, add Lines 32 and 35. - or - |

|

|

If you have an amount on Line 31 and this amount is less than Line 35, |

|

|

subtract Line 31 from Line 35. This is the amount you owe. See instructions. |

40 |

.00 |

Step 13: If this is a joint return, both you and your spouse must sign below.

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Sign |

Your signature |

Date (mm/dd/yyyy) Spouse’s signature |

Date (mm/dd/yyyy) Daytime phone number |

|||

Here |

|

|

|

( |

) |

|

|

|

|

|

|

||

Paid |

Print/Type paid preparer’s name |

Paid preparer’s signature |

Date (mm/dd/yyyy) |

|

Check if |

Paid Preparer’s PTIN |

|

|

|

|

|||

Preparer |

Firm’s name |

|

Firm’s FEIN |

|

|

|

Use Only |

|

|

|

|

||

|

|

|

( |

) |

|

|

|

Firm’s address |

|

Firm’s phone |

|

||

Third |

Designee’s name (please print) |

Designee’s phone number |

|

Check if the Department may |

|

|||

Party |

|

|

|

|

discuss this return with the third |

|

||

|

|

( |

) |

|

||||

Designee |

|

party designee shown in this step. |

|

|||||

|

|

|

|

|

|

|

|

|

Refer to the 2021

.

DR |

|

AP |

|

RR DC IR ID |

Document Specifics

| Fact Name | Description |

|---|---|

| E-filing Encouragement | Over 80% of taxpayers file their Illinois Tax Return electronically, as it simplifies the process and accelerates refund delivery. |

| Form IL-1040 Purpose | The Illinois Department of Revenue uses Form IL-1040 for the collection of individual income tax for either the 2020 tax year or a fiscal year ending in 2020. |

| Required Attachments | Taxpayers must staple W-2 and 1099 forms to the front of the form if applying by paper, along with their check and Form IL-1040-V for payment. |

| Governing Law | The form is authorized under the Illinois Income Tax Act, highlighting the necessity to disclose relevant personal and financial information for tax purposes. |

Guide to Writing Illinois Tax

Filling out the Illinois Tax Form IL-1040 is a structured process aimed at reporting your income and calculating tax liability or refunds due. The form requires detailed personal and financial information, and following the steps outlined ensures accurate submission. With the advent of electronic filing, over 80% of taxpayers now choose this method for its efficiency and faster processing of refunds. However, whether you opt for a paper or electronic submission, the steps remain largely the same. Below is a guide to help you through each section of the form.

- Assemble Your Documents: Start by attaching your W-2 and 1099 forms where indicated. If you're including a payment by check, attach it with IL-1040-V payment voucher.

- Step 1: Personal Information:

- Provide full names, birth years, and Social Security numbers for yourself and, if applicable, your spouse.

- Fill in your mailing address, apartment number, city, and ZIP code. Include county for Illinois addresses or a foreign nation if applicable.

- Select your filing status: Single, Married filing jointly, Married filing separately, Widowed, or Head of household.

- Indicate if someone can claim you or your spouse (if filing jointly) as a dependent.

- Mark if you were a nonresident or part-year resident and attach Schedule NR if necessary.

- Step 2: Income: Report your federal adjusted gross income and any federally tax-exempt interest and dividend income. Include other additions and calculate your total income.

- Step 3: Base Income: Adjust your total income by subtracting social security benefits, Illinois Income Tax overpayment, and other subtractions for your Illinois base income.

- Step 4: Exemptions: Calculate your exemption allowance, including amounts for age, blindness, and dependents.

- Step 5: Net Income and Tax: Determine your net income. Calculate the tax for residents by multiplying net income by the current rate, or enter the tax from Schedule NR for nonresidents and part-year residents.

- Step 6: Tax After Nonrefundable Credits: Subtract any credits for taxes paid to another state, property tax, and K-12 education expense from your income tax to find your tax after credits.

- Step 7: Other Taxes: Add any household employment tax, use tax, and other applicable surcharges.

- Step 8: Payments and Refundable Credit: List Illinois income tax withheld, estimated payments, and any pass-through withholdings. Include earned income credit if applicable.

- Step 9: Total: Compare your total payments and refundable credits against your total tax to determine if you have a refund or an amount due.

- Step 10: Underpayment of Estimated Tax Penalty and Donations: Fill in any late-payment penalties and specify if you're making a charitable donation.

- Step 11: Refund: If eligible for a refund, decide how you would like to receive it: direct deposit, debit card, or paper check. Complete the relevant details.

- Step 12: Amount You Owe: If you owe tax, calculate the total amount, including any underpayment penalties.

- Step 13: Signatures: Both you and your spouse, if filing jointly, must sign the return. Include contact information and, if applicable, details of the person who prepared the form.

After completing these steps, review your return carefully for any errors or omissions. If mailing, ensure to use the correct address as provided in the instructions. Retain a copy of the completed form and all attachments for your records.

Understanding Illinois Tax

Who needs to file an Illinois tax return using Form IL-1040?

Any individual who receives income while being an Illinois resident or earns income from Illinois sources must file a Form IL-1040 Individual Income Tax Return. This includes residents, nonresidents, and part-year residents.What documents are required to be attached with Form IL-1040?

When submitting Form IL-1040, you need to attach any W-2 and 1099 forms that report Illinois income. If you're paying by check, make sure to include Form IL-1040-V. Additionally, depending on specific situations, schedules such as Schedule NR for nonresidents or part-year residents, Schedule M for other additions or subtractions, Schedule ICR for tax credits, and Schedule IL-E/EIC for the Earned Income Credit may also be required.Can I file Form IL-1040 electronically?

Yes, over 80% of taxpayers file their Illinois tax returns electronically. Filing electronically is encouraged as it is easier and ensures you receive your refund faster. Visit tax.illinois.gov for more information on how to file electronically.How do I calculate my Illinois tax base income on Form IL-1040?

Your Illinois base income is calculated by adding your federal adjusted gross income with any federally tax-exempt interest and dividend income, along with other additions. From this total, you subtract any applicable Social Security benefits, certain retirement plan income, Illinois Income Tax overpayment included in your federal return, and other subtractions to find your Illinois base income.What are the tax rates applied to Form IL-1040?

For the tax year covered in the provided form, the Illinois tax rate for individual income is a flat rate of 4.95%. This rate applies to net income for residents. Nonresidents and part-year residents calculate their tax based on the Illinois net income from Schedule NR.How do you calculate exemptions on Form IL-1040?

You are allowed exemptions for yourself, your spouse if filing jointly, and any dependents. Additional exemptions apply for taxpayers who are 65 or older, or legally blind. The amounts for these exemptions are specified in the form's instructions and should be added together to calculate your total exemption allowance.What credits are available to reduce my Illinois tax?

You may reduce your tax by claiming credits for income tax paid to another state, property tax, K-12 education expenses, and from Schedule 1299-C. Ensure you attach the corresponding schedules to claim these credits.How do I report use tax on my Illinois return?

Use tax for out-of-state purchases, including internet and mail order, must be reported on Form IL-1040 using the UT Worksheet or UT Table provided in the instructions. You should not leave this section blank, even if no use tax is due.How can I receive my Illinois tax refund?

You have the options to receive your Illinois tax refund via direct deposit into a bank account, contribution to college savings funds, Illinois Individual Income Tax refund debit card, or by paper check. Complete the appropriate section of the form to indicate your preference.What should I do if I owe tax?

If you find that you owe additional tax after calculating your total payments and credits, you should pay this amount by the due date to avoid penalties and interest. You can include a check with your Form IL-1040-V or pay online at tax.illinois.gov.

Common mistakes

Filling out tax forms can sometimes feel like navigating a maze. The Illinois IL-1040 form is no exception. Several common mistakes can lead to errors in processing, delays in refunds, or even penalties. Here are seven errors to avoid to make the process smoother and ensure your tax return is accurate.

Not attaching W-2 and 1099 forms: A crucial step in the process is to staple your W-2 and 1099 forms where indicated at the top of the IL-1040. These documents are essential for verifying income and tax withholdings.

Incorrect Social Security numbers: It's essential to provide the full and correct Social Security numbers for yourself and, if applicable, your spouse. Mistakes here can lead to processing delays or incorrect tax assessments.

Forgetting to sign and date: An unsigned tax return is like an unsent letter. Remember to sign and date the bottom of the form. If filing jointly, both spouses must sign.

Choosing the wrong filing status: Your filing status affects your tax rate and eligibility for credits. Make sure to select the status that correctly represents your situation.

Omitting income or deductions: All sources of income should be reported. Similarly, don't miss out on deductions and credits such as property tax or education expenses that could lower your bill.

Incorrect calculations: Whether it's addition or subtraction, mistakes in math can alter your tax liability. Double-check your calculations or consider using software that automatically calculates totals.

Not exploring e-filing: Over 80% of taxpayers now file electronically. E-filing is not only faster but also reduces the risk of errors in your return. The Illinois Department of Revenue highly recommends this method for a quicker refund.

Avoiding these seven common pitfalls can make filing your Illinois state tax return a less daunting task. However, if you ever feel uncertain, seeking assistance from a tax professional or utilizing available resources on tax.illinois.gov may provide the clarity you need.

Documents used along the form

When filing the Illinois Individual Income Tax Return, IL-1040, taxpayers often need additional forms and documents to accurately complete their return. These are crucial for reporting various types of income, claiming deductions or credits, and meeting specific tax situations that may apply. Below is an overview of some common documents and forms that typically accompany the IL-1040 form.

- W-2 Forms: These are wage and tax statements from employers. The W-2 form reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- 1099 Forms: Various 1099 forms report income other than wages, such as freelance income (1099-NEC), interest and dividends (1099-INT, 1099-DIV), and other types of income.

- Schedule NR: Nonresidents and part-year residents need to attach Schedule NR to delineate their Illinois source income and calculate the portion of income that is taxable by Illinois.

- Schedule M: This schedule is used for reporting additions and subtractions to income that affect your Illinois tax return.

- Schedule ICR: Schedule ICR is used to claim the Illinois Property Tax Credit and Education Expense Credit, providing tax breaks for eligible taxpayers.

- Schedule IL-E/EIC: Eligible individuals and families can claim the Illinois Earned Income Credit (EIC) on this schedule.

- Schedule 1299-C: This schedule is for claiming various tax credits offered by Illinois, such as the jobs tax credit or the research and development credit.

- Schedule IL-WIT: Illinois Income Tax withheld is reported here, especially relevant for taxpayers who have had Illinois Income Tax withheld but didn't receive a W-2.

- Schedule K-1-P or K-1-T: These schedules are used by beneficiaries of trusts or partners in partnerships to report pass-through income and withholding from entities.

- IL-505-I: If estimates payments were made during the tax year, this form is used to calculate and document those payments for the state tax return.

Each of these additional forms ensures that Illinois taxpayers can thoroughly report their income, claim eligible deductions and credits, and comply with all state tax regulations. By accurately completing and attaching these required documents to the IL-1040, taxpayers can ensure they meet their tax obligations and, in many cases, maximize their potential refund or minimize the amount owed to the state.

Similar forms

The federal Form 1040 Individual Income Tax Return closely mirrors the Illinois Tax form IL-1040. Both forms require taxpayers to provide personal information, report income, and calculate the taxes owed or refund due based on the income reported. They share a structure that begins with personal details, moves to income reporting, deduction applications, and ends with a calculation of the tax liability.

Form W-2 is integral to both the Illinois Tax form and federal tax filing as it documents the income earned by employees, taxes withheld, and other pertinent information needed to accurately fill out tax returns. Taxpayers must attach their W-2 forms to their tax returns as evidence of the income and tax withholding reported.

The 1099 forms, similar to the W-2, are necessary for completing both the Illinois Tax form and the federal tax returns. These forms report various types of income outside of traditional employment, such as freelance earnings, interest, dividends, and government payments, playing a crucial role in ensuring complete income reporting.

Schedule M, necessary for reporting certain additions and subtractions to income on the Illinois form, has a federal counterpart that adjusts income based on specific criteria. Both schedules are designed to ensure taxpayers only pay taxes on their adjusted gross income, after accounting for allowable adjustments.

Form IL-1040-V, a payment voucher included with the Illinois Tax form, is similar to the federal Form 1040-V. These vouchers are used when making payments by check or money order, providing a structured way for governments to track and process tax payments efficiently.

The Illinois Schedule NR, required for nonresidents and part-year residents, echoes the federal nonresident income tax return. Both forms calculate tax liability based on income earned within the respective tax jurisdictions, ensuring that taxpayers pay the correct amount to each state or federal government.

Schedule ICR, which offers credits for property tax and educational expenses in Illinois, reflects the federal approach to tax credits. By offering specific tax credits, both the state and federal systems aim to reduce the tax burden on individuals based on eligible expenses or activities.

Schedule IL-E/EIC, pertaining to the Illinois Earned Income Credit, parallels the federal Earned Income Tax Credit (EITC) form. These credits aim to support working families with low to moderate income, demonstrating both systems' efforts to use tax policy to address income inequality.

Lastly, the Illinois Use Tax and the federal use tax address purchases made out-of-state where sales tax was not collected. Both taxes ensure that taxpayers pay their fair share of tax on all purchases, whether they are made in-state or not, preventing a loophole in tax collection.

Together, these documents ensure the comprehensive and fair assessment of taxes at both the state and federal levels, seeking to capture all forms of income and eligible deductions or credits to accurately determine the tax liability or refund due to each taxpayer.

Dos and Don'ts

When completing the Illinois Tax Form IL-1040, individuals should pay close attention to detail to ensure accuracy and compliance. The following lists outline best practices (do's) and common mistakes (don'ts) to avoid during the process.

Do:

- Ensure that all personal information is filled out completely and accurately, including the full Social Security numbers for both you and your spouse, if applicable.

- Staple any required forms, such as W-2 and 1099 forms, to your IL-1040 form where indicated to provide proof of income and tax withholding.

- Double-check calculations for income, deductions, and tax credits to ensure that the numbers listed are correct and the final tax obligation or refund due is accurate.

- Consider electronic filing, which is preferred by over 80% of taxpayers for its ease and faster processing time for refunds.

- If you are making a payment with your return, include an IL-1040-V payment voucher and staple your check to the voucher, not the income tax return form itself.

Don't:

- Provide partial Social Security numbers or incorrect personal information, as this can lead to processing delays or issues with your tax return.

- Forget to attach Schedule NR if you are a nonresident or part-year resident, or any other schedules and forms required based on your specific tax situation.

- Leave blank any sections that apply to you, such as the Property Tax Credit or the K-12 Education Expense Credit. Fill out every applicable section meticulously.

- Submit your form without reviewing the calculations for your net income, tax, and any credits or deductions you are claiming. Errors can result in an incorrect tax liability.

- Ignore the instructions for direct deposit of your refund or making a payment if you owe taxes. Incorrect banking information or failing to correctly calculate the amount owed can delay refunds or result in penalties.

Misconceptions

Understanding the Illinois Tax Form IL-1040 can be challenging, leading to various misconceptions among taxpayers. Here are eight common misunderstandings and the truths behind them:

- Electronic filing is complicated. Contrary to this belief, over 80% of taxpayers choose electronic filing because it's straightforward and accelerates the refund process.

- Providing partial Social Security numbers is acceptable. In fact, the form mandates that the complete Social Security numbers for you and your spouse are provided, ensuring accurate processing of your return.

- Filing status doesn't impact the tax calculation much. This is a misconception; your filing status can significantly affect your tax liability and eligibility for certain credits and deductions.

- All types of income are taxed the same way. Illinois categorizes income differently, where some types of income are exempt or taxed differently, necessitating an accurate report of income types.

- Social Security benefits are always tax-exempt. While this is true at the federal level under certain conditions, Illinois may tax Social Security benefits if they are part of your federal adjusted gross income.

- Claiming dependents is always beneficial. While claiming dependents can offer tax benefits, eligibility requirements must be met, and it may not always result in a lower tax bill, depending on your overall income and deductions.

- Refund options are limited. Illinois provides taxpayers with multiple refund options, including direct deposit, contributing to college savings funds, or receiving a paper check or a state-issued debit card.

- Errors on your tax form always lead to audits. While errors should be avoided, Illinois' Department of Revenue often corrects minor mistakes without auditing. However, significant discrepancies can indeed trigger an audit.

These misconceptions can lead to errors and potentially missed opportunities for taxpayers. It's crucial to understand the details of your tax obligations and to consult with a professional if you have specific concerns or questions about your return.

Key takeaways

Filing the Illinois Tax Form IL-1040 involves several key steps that taxpayers need to follow carefully to ensure accuracy and compliance with state law. Here are five important takeaways about completing and using this form:

- Personal Information is crucial, and taxpayers must provide complete Social Security numbers for both themselves and their spouses, if applicable. The form also requires detailed information about filing status and residency to accurately process the tax return.

- Income Reporting requires taxpayers to accurately report their federal adjusted gross income along with any federally tax-exempt interest and dividend income. This initial step is critical as it forms the basis for calculating the Illinois base income.

- Adjustments to Income can significantly affect the taxable amount. Taxpayers are allowed to subtract specific items like Social Security benefits if included in federal adjusted gross income, Illinois Income Tax overpayment, and other subtractions detailed in Schedule M.

- Exemptions and Credits can reduce the amount of tax owed. It's important for taxpayers to claim exemptions for themselves, their spouse, and dependents accurately. Additionally, credits for property tax, K-12 education expenses, and income tax paid to another state may be available.

- Electronic Filing is encouraged, as over 80% of taxpayers file electronically. This method is not only easier but can also expedite the refund process. The Illinois Department of Revenue's website provides resources and assistance for electronic filing.

Overall, the key to successfully filing the IL-1040 form lies in the careful documentation of income, adjustments, exemptions, and credits. Accurate and complete entries, along with taking advantage of electronic filing, can make the process smoother for Illinois taxpayers.

Popular PDF Documents

IRS 2439 - It ensures that investors receive credit for taxes paid on capital gains that have not been distributed to them.

Form Dr-835 - The DR 835 form is particularly important for taxpayers seeking professional help with audits, appeals, or tax collection issues within the specified jurisdiction.

License and Permits - Offers assurance to businesses in Oakland that their operational plans are solidified within zoning regulations.