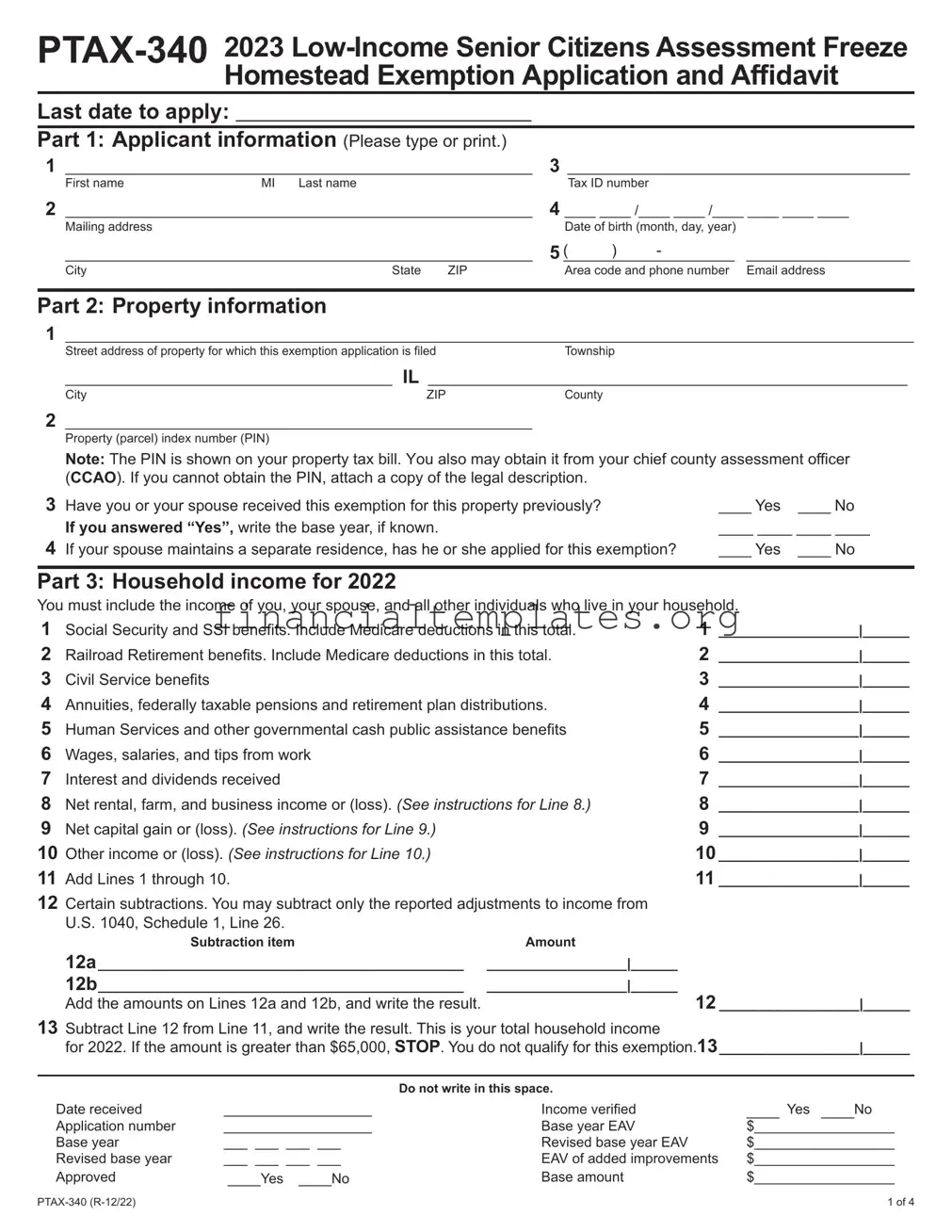

Get Illinois Ptax 340 Form

The Illinois PTAX-340 form plays a crucial role in supporting senior citizens in maintaining more stable living expenses as they age. Specifically designed for the Senior Citizens Assessment Freeze Homestead Exemption, this form is an annual necessity for qualifying residents aiming to "freeze" their home's equalized assessed value (EAV), effectively shielding them from some property tax increases driven by inflation. Detailed within the form are sections for applicant information, property details, a comprehensive outline of household income—including the requirement that total household income for the preceding year did not exceed $65,000—and an affidavit attesting to the truthfulness of the provided information. Additionally, the form caters to various living situations, such as individuals residing in health facilities, ensuring a broad applicability. Accompanying instructions guide applicants through the process, emphasizing the necessity of including all household income and the potential for required documentation submission to verify eligibility. Importantly, the PTAX-340 form underscores Illinois' commitment to assisting senior citizens in achieving a stable financial situation during their retirement years, with the deadline for submission clearly marked to prevent any lapse in exemption benefits. This strategic measure not only aids in financial planning for seniors but also indirectly supports the state's public policy objectives aimed at elder care and welfare.

Illinois Ptax 340 Example

Last date to apply: ______________________________________

Part 1: Applicant information (Please type or print.)

1 |

____________________________________________________________ |

3 ____________________________________________ |

|||||||

|

First name |

MI |

Last name |

|

|

Tax ID number |

|

|

|

2 |

____________________________________________________________ |

4 |

____ ____ /____ ____ /____ ____ ____ ____ |

||||||

|

Mailing address |

|

|

|

|

Date of birth (month, day, year) |

|

||

|

____________________________________________________________ |

5 |

( |

) |

- |

_____________________ |

|||

|

______________________ |

||||||||

|

City |

|

State |

ZIP |

|

Area code and phone number |

Email address |

||

Part 2: Property information

1_____________________________________________________________________________________________________________

Street address of property for which this exemption application is filedTownship

__________________________________________ |

IL ______________________________________________________________ |

|

City |

ZIP |

County |

2____________________________________________________________

Property (parcel) index number (PIN)

Note: The PIN is shown on your property tax bill. You also may obtain it from your chief county assessment officer

(CCAO). If you cannot obtain the PIN, attach a copy of the legal description.

3 |

Have you or your spouse received this exemption for this property previously? |

____ Yes |

____ No |

|

If you answered “Yes”, write the base year, if known. |

____ ____ ____ ____ |

|

4 |

If your spouse maintains a separate residence, has he or she applied for this exemption? |

____ Yes |

____ No |

Part 3: Household income for 2022

You must include the income of you, your spouse, and all other individuals who live in your household.

1 |

Social Security and SSI benefits. Include Medicare deductions in this total. |

1 |

__________________|______ |

2 |

Railroad Retirement benefits. Include Medicare deductions in this total. |

2 |

__________________|______ |

3 |

Civil Service benefits |

3 |

__________________|______ |

4 |

Annuities, federally taxable pensions and retirement plan distributions. |

4 |

__________________|______ |

5 |

Human Services and other governmental cash public assistance benefits |

5 |

__________________|______ |

6 |

Wages, salaries, and tips from work |

6 |

__________________|______ |

7 |

Interest and dividends received |

7 |

__________________|______ |

8 |

Net rental, farm, and business income or (loss). (See instructions for Line 8.) |

8 |

__________________|______ |

9 |

Net capital gain or (loss). (See instructions for Line 9.) |

9 |

__________________|______ |

10 |

Other income or (loss). (See instructions for Line 10.) |

10 __________________|______ |

|

11 |

Add Lines 1 through 10. |

11 __________________|______ |

|

12Certain subtractions. You may subtract only the reported adjustments to income from U.S. 1040, Schedule 1, Line 26.

Subtraction item |

Amount |

12a_______________________________________________ __________________|______ |

|

12b_______________________________________________ __________________|______ |

|

Add the amounts on Lines 12a and 12b, and write the result. |

12 __________________|______ |

13Subtract Line 12 from Line 11, and write the result. This is your total household income

for 2022. If the amount is greater than $65,000, STOP. You do not qualify for this exemption.13__________________|______

|

|

Do not write in this space. |

|

Date received |

___________________ |

Income verified |

____ Yes ____No |

Application number |

___________________ |

Base year EAV |

$__________________ |

Base year |

___ ___ ___ ___ |

Revised base year EAV |

$__________________ |

Revised base year |

___ ___ ___ ___ |

EAV of added improvements |

$__________________ |

Approved |

____Yes ____No |

Base amount |

$__________________ |

1 of 4 |

Part 4: Affidavit

Sworn under oath, I state the following:

1(Mark the statement that applies.)

On January 1, 2023, the property identified in Part 2, Line 1, was improved with a permanent structure a ____ that I used as my principal residence.

b ____ for which I received this exemption previously and is either unoccupied or used as my spouse’s principal residence. I am now a resident of a facility licensed under the Assisted Living and Shared Housing Act, Nursing Home Care Act, ID/DD (intellectually disabled/developmentally disabled) Community Care Act, or Specialized Mental Health Rehabilitation Act of 2013.

_______________________________________ |

_________________________________________________ |

Name of facility |

Mailing address |

2(Mark the statement that applies.)

On January 1, 2023, I

a ____ was the owner of record of the property identified in Part 2, Line 1.

b ____ had a legal or equitable interest by a written instrument in the property listed in Part 2, Line 1.

c ____ had a leasehold interest in the property identified in Part 2, Line 1, that was used as a

3I am liable for paying real property taxes on the property identified in Part 2, Line 1.

Note: If I have not received this exemption for this property previously, I also met the eligibility requirements listed in Part 4, Lines 1, 2, and 3 for this property on January 1, 2022.

4(Mark the statement that applies.)

a ____ In 2023, I am, or will be, 65 years of age or older.

b ____ In 2023, my spouse, who died in 2023, would have been 65 years of age or older. (Complete the following information.)

_____________________________________________ |

__________________________________________________ |

Deceased spouse’s name |

Tax ID number |

____ ____ /____ ____ /____ ____ ____ ____ |

____ ____ /____ ____ /____ ____ ____ ____ |

Date of birth (month, day, year) |

Date of death (month, day, year) |

5The property identified in Part 2, Line 1, is the only property for which I am applying for a

6The amount reported in Part 3, Line 13, of this form includes the income of my spouse and all persons living in my household and the total household income for 2022 is $65,000 or less.

7On January 1, 2023, the following individuals also used the property identified in Part 2, Line 1, for their principal residence.

My spouse is included if he or she used the property as his or her principal dwelling place on January 1, 2023. The total income of all individuals and my spouse (regardless of his or her principal residence) are included in Part 3. (Attach an

additional sheet if necessary.)

First and last name |

Tax ID number |

a __________________________________________________ |

__________________________________________________ |

b __________________________________________________ |

__________________________________________________ |

8(Mark the statement that applies.) On January 1, 2023, I was

a ____ single, widow(er), or divorced. b ____ married and living together. c ____ married, but not living together.

My spouse’s name and address is _____________________________________________________________________________

First nameMILast name

_____________________________________________________________________________________________________________

Street Address |

City |

State |

ZIP |

Under penalties of perjury, I state that, to the best of my knowledge, the information contained in this affidavit is true, correct, and complete.

_______________________________________ ____ ____/____ ____/____ ____ ____ ____

Signature of applicant |

Date (month, day, year) |

Note: The CCAO may conduct an audit to verify that the taxpayer is eligible to receive this exemption.

Mail your completed Form |

If you have any questions, please call: |

|

_________________Co. Chief County Assessment Officer |

(_________)__________________________________________ |

|

|

— |

|

_______________________________________________________ |

Last date to apply ___ ___/___ ___/___ ___ ___ ___ |

|

Mailing address |

Month Day |

Year |

____________________________________IL _________________

CityZIP

This form is authorized in accordance with the Illinois Property Tax Code. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

2 of 4

Printed by the authority of the state of

Form

What is the

The

Exemption (35 ILCS

citizen, to have your home’s equalized assessed value (EAV) “frozen” at a base year value and prevent or limit any increase due to inflation. The base year generally is the year before the year you first qualify and apply for the exemption. For example, if you first qualify and

apply in 2023, your property’s EAV will be “frozen” at the 2022 EAV.

The amount of the exemption is the difference between your base

year EAV and your current year EAV. For Cook County only, the

amount of the exemption is the difference between your base year

EAV and your current year EAV or $2,000, whichever is greater.

Freezing your property’s EAV does not mean that your property taxes will not increase, however. Other factors also affect your tax bill. For

example, your tax bill could increase if the tax rate, which is based on the amount of revenues taxing districts request, increases. Your EAV and tax bill may also increase if you add improvements to your home.

However, if your home’s EAV decreases in the future, you will benefit

from any reduction.

Who is eligible?

The

you will pay in 2024), are listed below.

•You will be 65 or older during 2023.

•Your total household income in 2022 was $65,000 or less.

•On January 1, 2022, and January 1, 2023, you

–used the property as your principal place of residence,

–owned the property, or had a legal or equitable interest in the property as evidenced by a written instrument, or had a leasehold interest in the property used as a

–were liable for the payment of property taxes.

You do not qualify for this exemption if your property is assessed under the mobile home privilege tax.

Surviving spouse – Even if you are not 65 or older during 2023, you are eligible for this exemption for 2023 (and possibly 2022) if your spouse died in 2023 and would have met all of the qualifications.

Residents in a health facility – Even if you did not use the property as your principal place of residence on January 1, 2023, you qualify for this exemption if you are a resident of a facility licensed under the Assisted Living and Shared Housing Act, Nursing Home Care Act, ID/DD (intellectually disabled/developmentally disabled) Community Care Act, or Specialized Mental Health Rehabilitation Act of 2013 and you meet all other requirements, have received this exemption previously, and your property is either unoccupied or is occupied by your spouse.

Residents of cooperatives – If you are a resident of a cooperative apartment building or cooperative

What is a household?

A household includes you, your spouse, and all other persons who used your residence as a principal dwelling place on January 1, 2023.

What is included in household income?

Household income includes your income, your spouse’s income, and the income of all individuals living in the household. Examples of

income that must be included in your household income are listed below. (For specific questions, see Part 3 on Page 4.)

•alimony or maintenance received

•annuities and other pensions

•Black Lung benefits

•business income

•capital gains

•cash assistance from the Illinois Department of Human Services and other governmental cash public assistance

•cash winnings from such sources as raffles and lotteries

•Civil Service benefits

•damages awarded in a lawsuit for nonphysical injury or sickness (for example, age discrimination or injury to reputation)

•dividends

•farm income

•Illinois Income Tax refund (only if you received Form

•interest

•interest received on life insurance policies

•long term care insurance (federally taxable portion only)

•lump sum Social Security payments

•miscellaneous income, such as from rummage sales, recycling aluminum, or baby sitting

•military retirement pay based on age or length of service

•monthly insurance benefits

•pension and IRA benefits (federally taxable portion only)

•Railroad Retirement benefits (including Medicare deductions)

•rental income

•Social Security income (including Medicare deductions)

•Supplemental Security Income (SSI) benefits

•all unemployment compensation

•wages, salaries, and tips from work

•Workers’ Compensation Act income

•Workers’ Occupational Diseases Act income

What is not included in household income?

Some examples of income that are not included in household income

are listed below. (For specific income questions, see Part 3 on

Page 4.)

•cash gifts

•child support payments

•COBRA subsidy payments

•damages awarded in a lawsuit for a physical personal injury or sickness

•Energy Assistance payments

•federal income tax refunds

•IRA’s “rolled over” into other retirement accounts, unless “rolled over” into a Roth IRA

•lump sums from inheritances

•lump sums from insurance policies

•money borrowed against a life insurance policy or from any financial institution

•reverse mortgage payments

•spousal impoverishment payments

•stipends from Foster Parent and Foster Grandparent programs

•Veterans’ benefits

What if I have a net operating loss or capital loss carryover from a previous year?

You cannot include any carryover of net operating loss or capital loss from a previous year. You can include only a net operating loss or capital loss that occurred in 2022.

Will my information remain confidential?

All information received from your application is confidential and may be used only for official purposes.

When must I file?

File Form

exemption.

Note: The CCAO may require additional documentation

(i.e., birth certificates, tax returns) to verify the information in this

application.

What if I need additional assistance?

If you have questions about this form, please contact your CCAO, also known as the supervisor of assessments, or county assessor, at the address and phone number printed at the bottom of Page 2.

3 of 4 |

Form

Part 1: Applicant information

Lines 1 through 5 – Type or print the requested information.

Part 2: Property information

Lines 1 and 2 – Identify the property for which this application is filed.

Lines 3 and 4 – Answer the questions by marking an “X” next to your statement. If you answered “Yes” to the question on Line 3 and you know the base year, write it in the space provided.

Part 3: Household income for 2022

“Income” for this exemption means 2022 federal adjusted gross income, plus certain items subtracted from or not included in your federal adjusted gross income (320 ILCS 25/3.07). These include

loss carryovers, capital loss carryovers, and Social Security benefits. Income also includes public assistance payments from

a governmental agency, SSI, and certain taxes paid. These

The amounts written on each line must include the 2022 income for you, your spouse, and all the other individuals living in the household.

As an alternative income valuation, a homeowner who is enrolled in any of the following programs may be presumed to have household income that does not exceed the maximum income limitation for that tax year: Aid to the Aged, Blind or Disabled (AABD) Program or the Supplemental Nutrition Assistance Program (SNAP), both of which are administered by the Department of Human Services; the Low Income Home Energy Assistance Program (LIHEAP), which is administered by the Department of Commerce and Economic

Opportunity; The Benefit Access program, which is administered by

the Department on Aging; and the Senior Citizens Real Estate Tax Deferral Program.

Line 1 – Social Security and Supplemental Security Income (SSI) benefits

Write the total amount of retirement, disability, or survivor’s benefits (including Medicare deductions) the entire household received from

the Social Security Administration (shown on Form

3 or use box 5 only if there is a reduction of benefits). You also must

include any Supplemental Security Income (SSI) the entire household received and any benefits to dependent children in the household.

Do not include reimbursements under Medicare/Medicaid for medical expenses.

Note: The amount deducted for Medicare is already included in the amount in box 3 of Form

Line 2 – Railroad Retirement benefits

Write the total amount of retirement, disability, or survivor’s benefits (including Medicare deductions) the entire household received under the Railroad Retirement Act (shown on Forms

Line 3 – Civil Service benefits

Write the total amount of retirement, disability, or survivor’s benefits the entire household received under any Civil Service retirement plan (shown on Form

Line 4 – Annuities and other retirement income

Write the total amount of income the entire household received as an annuity from any annuity, endowment, life insurance contract, or similar contract or agreement (shown on Form

Line 5 – Human Services and other governmental cash public assistance benefits

Write the total amount of Human Services and other governmental cash public assistance benefits the entire household received. If the first two digits of any member’s Human Services case number are the

same as any of those in the following list, you must include the total

amount of any of these benefits on Line 5.

01 |

aged |

04 and 06 temporary assistance to |

02 |

blind |

needy families (TANF) |

03 |

disabled |

07 general assistance |

To determine the total amount of the household benefits, multiply the

monthly amount each person received by 12. You must adjust your figures accordingly if anyone in the household did not receive 12

equal checks during this period.

Food stamps and medical assistance benefits anyone in the house- hold may have received are not considered income and should not be added to your total income.

Line 6 – Wages, salaries, and tips from work

Write the total amount of wages, salaries, and tips from work for every household member (shown in box 1 of Form

Line 7 – Interest and dividends received

Write the total amount of interest and dividends the entire household received from all sources, including any government sources (shown on Forms

Line 8 – Net rental, farm, and business income or (loss)

Write the total amount of net income or loss from rental, farm, business sources, etc., the entire household received, as allowed on

U.S. 1040, Schedule 1, Lines 3, 5, and 6. You cannot use any net operating loss (NOL) carryover in figuring income.

Line 9 – Net capital gain or (loss)

Write the total amount of taxable capital gain or loss the entire household received in 2022, as allowed on U.S. 1040, Line 7 and

U.S. 1040, Schedule 1, Line 4. You cannot use a net capital loss carryover in figuring income.

Line 10 – Other income or (loss)

Write the total amount of other income or loss not included in Lines 1 through 9, that is included in federal adjusted gross income, such as alimony received, unemployment compensation, taxes withheld from oil or gas well royalties. You cannot use any net operating loss

(NOL) carryover in figuring income.

Line 11 – Add Lines 1 through 10.

Line 12 – Subtractions

You may subtract only the reported adjustments to income totaled on U.S. 1040, Schedule 1, Line 26. For example:

IRA deduction |

educator expenses |

Archer MSA deduction |

tuition and fees |

student loan interest |

domestic production |

deduction |

activities deduction |

jury duty pay you gave to your |

deductible part of |

employer |

|

penalty on early withdrawal of |

|

savings |

insurance deduction |

|

health savings account |

and qualified plans |

deduction |

alimony or maintenance paid |

moving expenses |

Line 13 – Total household income

Subtract Line 12 from Line 11. If this amount is greater than $65,000, you do not qualify for this exemption. See Page 3.

Part 4: Affidavit

Lines 1 through 4 – Mark the item that applies. Read the affidavit

carefully. The statements must apply.

Line 7 – Write the names and tax identification numbers of the

individuals, other than yourself, who used the property for their principal residence on January 1, 2023. Attach an additional sheet if necessary.

Line 8 – Follow the instructions on the form. If your spouse does not reside at this property, be sure to write his or her name and address.

Note: You must sign your Form

your CCAO. Return your completed Form

office or mail it to the address printed on the bottom of Page 2.

4 of 4 |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The PTAX-340 form is used for applying for the Senior Citizens Assessment Freeze Homestead Exemption in Illinois, which allows eligible senior citizens to freeze their property's equalized assessed value to limit increases due to inflation. |

| Eligibility Criteria | To qualify, applicants must be 65 or older, have a total household income of $65,000 or less, and the property must have been the principal residence of the owner on January 1 of the year prior and the year of application. The owner must also be liable for paying property taxes. |

| Governing Law | The exemption operates under the Illinois Property Tax Code, specifically under 35 ILCS 200/15-172. |

| Application Deadline | Applicants must file the PTAX-340 form with the Chief County Assessment Office by the due date printed on the bottom of the form's second page. The form must be filed annually to continue receiving the exemption. |

Guide to Writing Illinois Ptax 340

Preparing and submitting the Illinois PTAX-340 form for the Senior Citizens Assessment Freeze Homestead Exemption requires careful attention to the application's criteria and detailed instructions. Such an exemption can offer significant tax relief by preventing an increase in the equalized assessed value (EAV) of your home, thereby potentially lowering your property tax obligations. This exemption acknowledges the financial challenges that may come with aging, aiming to alleviate the burden of property taxes for senior citizens. Following a systematic approach will help ensure the process is completed accurately and efficiently.

- Part 1: Applicant Information

- Fill in your first name, middle initial, and last name alongside your tax ID number.

- Provide your mailing address, including the city, state, ZIP code, area code, phone number, and email address.

- Indicate your date of birth, ensuring to include the month, day, and year in the designated format.

- Part 2: Property Information

- Enter the street address of the property eligible for this exemption, specifying the township, city, ZIP code, and county within Illinois.

- Provide the Property (Parcel) Index Number (PIN). If not available, attach a copy of the property's legal description.

- Respond to the questions about prior receipt of the exemption and if your spouse has applied for it if maintaining a separate residence.

- Part 3: Household Income for 2020

- Report all applicable types of income, following the listed categories, including Social Security, Railroad Retirement benefits, Civil Service benefits, pensions, etc.

- Accurately calculate and enter the total household income, including that of yourself, your spouse, and any other household members.

- Take care to subtract allowable deductions and ensure the total household income does not exceed the $65,000 threshold.

- Part 4: Affidavit

- Read and mark the statements that apply to your situation, focusing on your residence status, ownership or interest in the property, liability for real property taxes, and eligibility criteria specific to 2021.

- List the names and tax identification numbers of other household members using the property as their principal residence.

- Verify your marriage status and provide details about your spouse if applicable.

- Sign and date the form, affirming under penalties of perjury that the information provided is true, correct, and complete.

- Finally, mail the completed PTAX-340 form to the address provided on the form for the Chief County Assessment Officer. Ensure it is sent before the application deadline for your county.

By following these steps, you can accurately complete your application for the Senior Citizens Assessment Freeze Homestead Exemption. Remember, the exemption aids in keeping property tax obligations manageable for seniors, making it critical to provide complete and accurate information. If questions arise during the application process, contact the Chief County Assessment Officer listed at the bottom of the form for guidance.

Understanding Illinois Ptax 340

- What is the Senior Citizens Assessment Freeze Homestead Exemption?

- Who is eligible for this exemption?

- What constitutes a household for this exemption?

- What income is considered in determining eligibility?

- Are there any types of income not included in the household income calculation?

- When is the deadline to apply for the exemption, and how often must it be filed?

The Senior Citizens Assessment Freeze Homestead Exemption allows qualified senior citizens to freeze the equalized assessed value (EAV) of their homes at a base year level. This exemption can prevent or limit increases in property value due to inflation, potentially reducing future property tax increases. However, it's important to note that factors such as tax rate changes or improvements to the home could still result in higher tax bills. For Cook County residents, if there's a difference between the base year EAV and the current year EAV, or $2,000, whichever is greater, that amount will be considered for the exemption. Remember, this freeze does not guarantee that your property taxes will not increase, as other factors could affect your tax bill.

Eligibility for the exemption in 2021 requires the applicant to be 65 or older within the year, have a total household income of $65,000 or less for the year 2020, and meet certain property criteria on January 1, 2020, and January 1, 2021. These criteria include using the property as your principal residence, owning the property or having a legal, equitable, or leasehold interest in it, and being liable for the payment of property taxes. Surviving spouses and residents of cooperative apartments may also qualify under specific conditions.

A household includes the applicant, their spouse, and all other individuals using the applicant's residence as their principal place of residence on January 1, 2021. This definition is crucial for determining the total household income, which must not exceed $65,000 for eligibility.

Household income encompasses a wide range of income sources for the applicant, their spouse, and all persons living in the household. This includes, but is not limited to, social security benefits, pensions, wages, interest and dividends, rental income, government assistance, and unemployment compensation. Certain subtractions permitted on U.S. 1040, Schedule 1, are also accounted for in determining the total household income.

Certain income types are excluded from household income calculations. These exclusions include cash gifts, child support payments, federal income tax refunds, life insurance proceeds, reverse mortgage payments, and veterans' benefits, among others. It's important for applicants to review the comprehensive list provided in the form instructions to accurately calculate their household income.

Applicants must file Form PTAX-340 by the due date printed on their form, which is determined by the county's Chief County Assessment Office (CCAO). It is necessary to file this form annually and meet the qualifications for each respective year to continue receiving the exemption. Applicants may need to provide additional documentation, such as birth certificates or tax returns, to verify their eligibility.

Common mistakes

Filling out the Illinois PTAX-340 form accurately is crucial for senior citizens seeking a Senior Citizens Assessment Freeze Homestead Exemption. It's common to make mistakes, but these errors can lead to delays or the denial of the exemption. Here are eight common mistakes to avoid:

- Not verifying eligibility before applying: It's important to ensure that all qualifications are met, including age, income, and property criteria.

- Incorrectly reporting household income: All sources of income for both the applicant, their spouse, and all other individuals living in the household must be accurately reported. This includes not only wages but also Social Security benefits, pensions, and any public assistance received.

- Omitting or inaccurately reporting the Property Index Number (PIN): This number is crucial for identification and must be copied correctly from the property tax bill.

- Failure to disclose previous exemptions: If the exemption was received in the past, this must be stated along with the base year if known.

- Incomplete property information: All required fields in Part 2 must be fully and accurately completed, including details regarding the property's use and ownership status on the specified dates.

- Forgetting to include deductions in household income calculation: Legitimate deductions can lower the total household income, potentially qualifying applicants who might otherwise exceed the income limit.

- Not signing the affidavit in Part 4: The form is not valid without the applicant's signature, attesting to the accuracy and completeness of the information provided.

- Missing the application deadline: The form must be filed with the CCAO by the due date printed on the form to be considered for the exemption for the current tax year.

By avoiding these common pitfalls, applicants can improve their chances of successfully obtaining the Senior Citizens Assessment Freeze Homestead Exemption, which can provide significant tax relief.

Documents used along the form

When applying for the Illinois PTAX-340 Senior Citizens Assessment Freeze Homestead Exemption, it's crucial to understand that additional forms and documents might be required to support your application. Here's a list of commonly used documents alongside the PTAX-340 form:

- Proof of Age: A government-issued identification, such as a driver's license or state ID, to verify the applicant's age is 65 or older within the tax year.

- Proof of Ownership: A deed or title to the property demonstrating the applicant's ownership.

- Property Tax Bill: The most recent property tax bill serves as evidence of the property's location, ownership, and taxable status.

- Income Documentation: Tax return documents, including the federal 1040 form or other appropriate forms, to validate household income does not exceed the eligibility threshold.

- Social Security and SSI Benefits Statements: Form SSA-1099 or similar documentation for reporting Social Security and Supplemental Security Income benefits.

- Railroad Retirement Benefits Statements: Forms providing details on any railroad retirement benefits received, similar to the SSA-1099 for Social Security.

- Civil Service Benefits Statements: Documents showing any civil service benefits, important for establishing total household income.

- Annuity Statements: Evidence of annuities, pensions, and federally taxable retirement plan distributions.

- Government Assistance Documentation: Records of any human services benefits, public assistance, or other government aid received by the household.

- Rental, Farm, or Business Income Documentation: Any pertinent documentation showing net income or loss from rentals, farming, or business activities relevant to household income calculations.

Understanding which documents to gather can make the process of applying for the PTAX-340 exemption smoother and more efficient. Always check with the county's assessment office for the most current requirements and deadlines to ensure your application is complete and filed on time.

Similar forms

The Illinois PTAX-340 form is similar to the IRS Form 1040 for U.S. Individual Income Tax Returns in the way it requires detailed financial information from applicants. Both forms require taxpayers to report income from various sources, such as wages, salaries, retirement benefits, and investment income. Moreover, deductions and subtractions are part of calculating the total income or adjusted gross income, which determines eligibility for certain tax benefits or exemptions. This process mirrors the PTAX-340’s need to assess total household income to qualify for the Senior Citizens Assessment Freeze Homestead Exemption.

Similar to the Illinois PTAX-340 form, the Schedule CR (Credit for Tax Paid to Other States) on the Illinois tax return also deals with specialized tax situations. In both instances, taxpayers must provide specific details to calculate the correct tax benefit. For the Schedule CR, taxpayers must detail income taxed by other states to avoid double taxation. This involves a nuanced understanding of tax responsibilities and benefits, akin to how the PTAX-340 requires a deep dive into household income to determine eligibility for a property tax exemption.

The IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), bears resemblance to the PTAX-340 form in terms of its target demographic and the calculation of financial thresholds for eligibility. Both forms cater to specific groups – Form 8863 to students and the PTAX-340 to senior citizens – and determine benefits based on income levels. Applicants must report their financial information meticulously to qualify for the respective benefits, emphasizing the importance of accurate and comprehensive financial reporting.

The HUD-1 Settlement Statement, used in real estate transactions, shares similarities with the Illinois PTAX-340 in its requirement for detailed property and financial information. Though the HUD-1 primarily focuses on the closing costs of buying or selling property, both documents necessitate precision in reporting property-related financial specifics. This accuracy is crucial for the proper processing and approval of different types of property-related applications, whether for tax exemptions or real estate transactions.

Form SSA-1099, Social Security Benefit Statement, and the PTAX-340 form are alike in that they both require information regarding benefits that substantially impact the household's financial status. Applicants for the PTAX-340 must include their Social Security benefits in their household income calculation, similar to how recipients of Form SSA-1099 must report their Social Security income on their federal tax returns. Thus, both forms play a pivotal role in understanding an individual's or household's financial picture.

The VA Form 21-526EZ, Application for Disability Compensation and Related Compensation Benefits, is analogous to the PTAX-340 in catering to a specific population needing to detail personal and financial information to receive benefits. Applicants of both forms disclose sensitive information to demonstrate eligibility, focusing on a nuanced eligibility criterion that revolves around personal circumstances, such as age or disability status, influencing financial or tax benefits.

Form 1099-INT, Interest Income, is similar to the PTAX-340 in how it necessitates individuals to report specific financial income types. Interest income reported via Form 1099-INT must be included in the PTAX-340’s household income section, highlighting the interconnectivity between various forms of income documentation and the comprehensive financial overview required for exemption eligibility or tax obligations.

The Property Tax Appeal Board (PTAB) Appeal Form, like the Illinois PTAX-340, is directly involved with property taxes in Illinois. Both forms deal with the assessment and potential reduction of property tax burdens. Where the PTAX-340 form is for freezing the assessment value of senior citizens' homes, the PTAB Appeal Form is used to dispute assessment errors. Each form serves as a measure for Illinois residents to manage or mitigate their property tax liabilities under specific circumstances.

Lastly, the Illinois Form IL-1040, Individual Income Tax Return, and the PTAX-340 share the requirement for Illinois residents to report their annual income and calculate tax liabilities or exemptions. While the IL-1040 encompasses the broad scope of individual income tax for state residents, the PTAX-340 specifically addresses property tax exemptions for seniors based on their income level. Both serve as critical components of the state’s taxation and exemption processes, ensuring eligible individuals receive the appropriate financial considerations.

Dos and Don'ts

When completing the Illinois PTAX-340 form, which is the Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, accuracy and attentiveness to detail are paramount. This form aids qualified senior citizens in freezing the equalized assessed value (EAV) of their property, potentially limiting increases due to inflation. The following list provides guidance on what you should and shouldn't do to ensure the form is completed correctly and efficiently.

Do:- Read instructions carefully: Before filling out the form, thoroughly review the provided instructions to avoid common mistakes.

- Use black or blue ink: If completing the form by hand, use black or blue ink to ensure the information is legible and can be scanned properly.

- Verify your eligibility: Confirm that you meet all eligibility criteria for the tax year you are applying for, including age, income, and residency requirements.

- Include all required income information: Accurately report all sources of income for you, your spouse, and other household members as defined by the form's guidelines.

- Double-check parcel index number (PIN): Ensure you have the correct PIN by verifying it against your property tax bill or through your chief county assessment officer (CCAO).

- Sign and date the affidavit section: Your signature validates the affidavit, declaring under penalties of perjury that the information provided is true, complete, and correct.

- Mail the form before the deadline: Submit the completed form to the appropriate CCAO address by the specified due date to avoid penalties or disqualification.

- Leave fields blank: If a section does not apply to you, write "N/A" to indicate this to reviewers. Blank fields may cause processing delays or suggest incomplete information.

- Estimate financial figures: Provide exact numbers for all financial information. Estimations can lead to inaccuracies and potential disqualification.

- Ignore household income components: Make sure to include all forms of income as outlined in the form's instructions, including Social Security benefits, wages, and any public assistance received.

- Forget to attach necessary documentation: If additional documents are required (e.g., proof of age, income verification), ensure they are included with your application.

- Overlook the spouse and household member section: If you have a spouse or other individuals living in your household, their information and income must be accurately reported.

- Misspellings or inaccuracies in personal information: Errors in names, addresses, or tax identification numbers can delay processing or affect exemption eligibility.

- Submit form without reviewing: Always review the form in its entirety before submission to catch and correct any mistakes or omissions.

Misconceptions

When it comes to the Illinois PTAX-340 form, there are several misconceptions that can lead to confusion among eligible senior citizens applying for the Senior Citizens Assessment Freeze Homestead Exemption. Addressing these misconceptions can help ensure that applicants understand the process and make the most of this beneficial exemption.

- Misconception 1: You only need to file the PTAX-340 form once.

- Misconception 2: The PTAX-340 completely freezes your property tax bill.

- Misconception 3: All senior citizens are eligible for the exemption.

- Misconception 4: Household income does not include Social Security benefits.

- Misconception 5: You can't apply for the exemption if you live in a cooperative or a life care facility.

- Misconception 6: Income from all members living in the household is not considered.

- Misconception 7: If your property’s EAV decreases, the exemption is no longer beneficial.

- Misconception 8: The PTAX-340 form is complicated and difficult to complete.

- Misconception 9: There is no deadline for the PTAX-340 application.

This is not true. Eligible senior citizens must file the PTAX-340 form annually to continue receiving the Senior Citizens Assessment Freeze Homestead Exemption. The requirement for yearly filing ensures that the homeowner still meets the eligibility criteria.

The form does not freeze your property tax bill; it freezes the Equalized Assessed Value (EAV) of your home. Other factors, such as tax rates and levies from taxing districts, can still cause your overall tax bill to change.

Eligibility for the exemption is not solely based on age. Applicants must also meet income requirements and other conditions related to property ownership and residency.

When calculating household income for the PTAX-340, you must include Social Security and Supplemental Security Income (SSI) benefits, contrary to what some believe. However, certain subtractions are allowed which may affect the total income calculation.

Residents of cooperative apartment buildings or life-care facilities who are liable for paying property taxes on their residence are eligible to apply for the exemption, provided they meet the other eligibility criteria.

The total household income calculation must include the income of the applicant, the applicant's spouse, and all other individuals living in the household, making it a comprehensive assessment of financial resources.

Even if your home's EAV decreases, you can still benefit from the exemption. The exemption aims to protect eligible homeowners from spikes in property taxes due to rising home values, but a lower EAV does not negate its value.

While the form does require detailed information, the instructions are designed to guide applicants through each part of the form. Assistance is available from the county assessor’s office for those who have questions.

There is a specific deadline each year by which the PTAX-340 form must be filed. Missing the deadline can result in losing the exemption for that tax year, so it's important to be aware of this date, which may vary by county.

By clarifying these misconceptions, eligible senior citizens can accurately complete their PTAX-340 forms and enjoy the financial benefits of the Senior Citizens Assessment Freeze Homestead Exemption, provided they meet all qualifying conditions.

Key takeaways

Filling out the Illinois PTAX-340 form, which is the Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, involves several steps that must be carefully followed to ensure eligibility for a freeze on the property's equalized assessed value (EAV). Here are six key takeaways to guide applicants through this process:

- The PTAX-340 form is specifically designed to benefit senior citizens by potentially preventing or limiting property tax increases due to inflation. This is achieved by "freezing" the property's EAV at a base year value, which is usually the year before you first qualify and apply.

- Eligibility for this exemption requires that the applicant be 65 years of age or older in the year of application, have a total household income of $65,000 or less for the previous year, and meet certain criteria regarding property ownership, residence, and responsibility for property taxes.

- The term "household" encompasses not just the applicant, but also the applicant's spouse and anyone else who used the property as their principal dwelling place as of January 1 of the application year. Consequently, the income of the entire household must be considered when determining eligibility for the exemption.

- Household income includes a wide variety of sources, such as Social Security benefits, Railroad Retirement benefits, pensions, wages, salaries, tips, interest, dividends, net rental income, and more. It's crucial to accurately report the income of all household members to ensure the application is processed correctly.

- Applicants need to file the PTAX-340 form annually by the due date indicated on the form to continue receiving the exemption. It is important to note that changes in household income or property ownership could affect eligibility.

- If additional assistance is needed or if there are specific questions about the form or the application process, applicants are encouraged to contact their County Chief Assessment Officer (CCAO). This contact information is provided on the PTAX-340 form.

Filling out the PTAX-340 form correctly and comprehensively is crucial for senior citizens in Illinois hoping to benefit from the Senior Citizens Assessment Freeze Homestead Exemption. Staying informed about the eligibility criteria and seeking assistance when necessary can help ensure that the benefits of this exemption are fully realized.

Popular PDF Documents

IRS E-file Signature Authorization - The tax preparer must provide the taxpayers with a copy of their return when using Form 8879.

Credits for Qualifying Children and Other Dependents - It serves as a critical tool in maximizing federal tax returns for eligible families.