Get Illinois Ptax 203 A Form

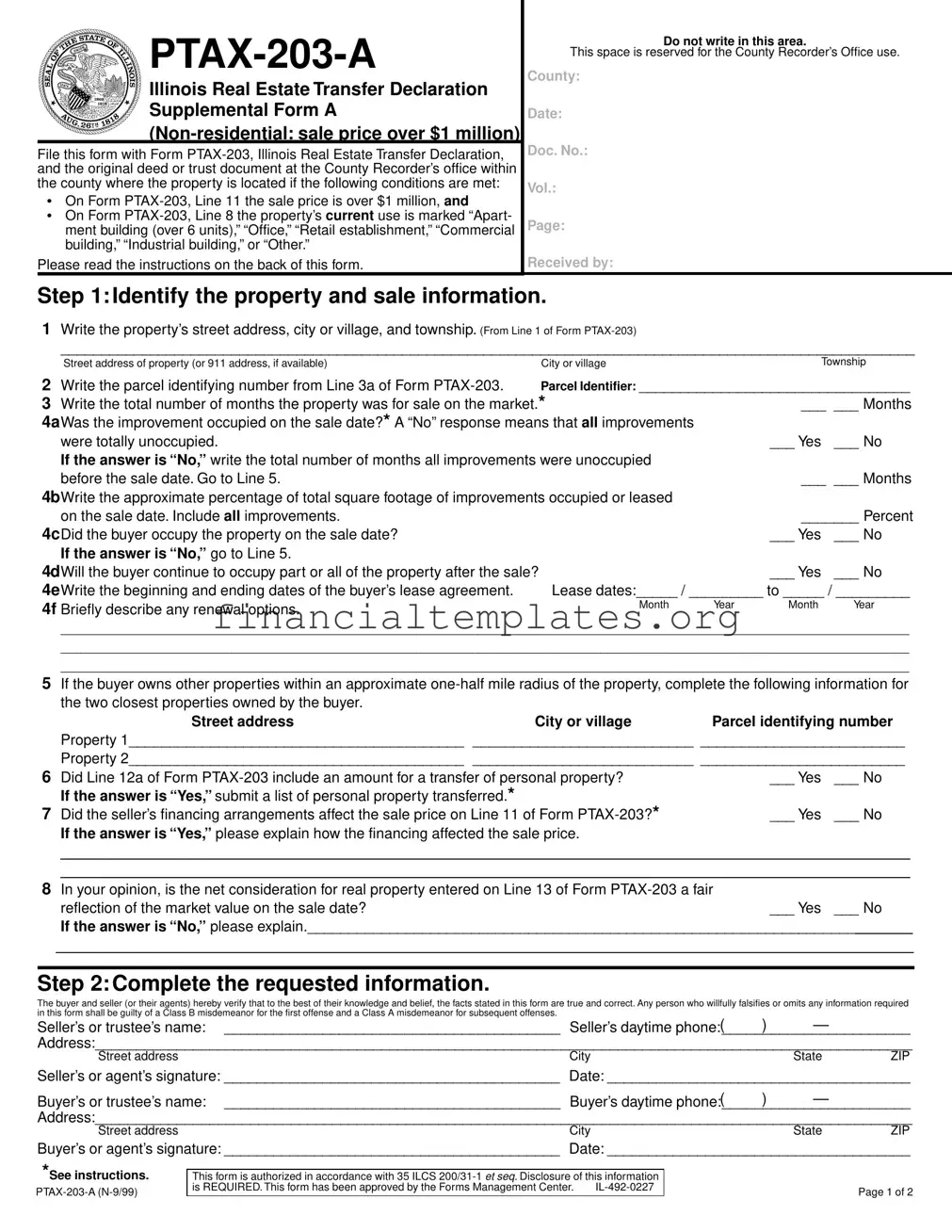

In the intricate world of real estate transactions within Illinois, the PTAX-203-A form plays a crucial role, especially in high-value transfers exceeding the $1 million mark. This supplemental form complements the main PTAX-203 Illinois Real Estate Transfer Declaration, extending its scope to cover non-residential property transactions such as apartment buildings with more than six units, offices, retail establishments, commercial or industrial buildings among others. It's meticulously designed to capture detailed information regarding the sale and the property itself, including occupancy status, square footage utilized, and the presence of any personal property included in the transaction. Furthermore, it delves into specifics about the buyer's intentions concerning the occupation of the property post-sale, and any existing financing arrangements that might have influenced the sale price, offering a comprehensive overview essential for accurate tax declarations. Coupled with crucial buyer and seller verification, the form underscores the importance of truthful disclosure, with stern reminders of the legal consequences of falsification. Filed alongside the original deed or trust document, the PTAX-203-A stands as a testament to the rigor applied in documenting significant real estate transactions in Illinois, aiming to ensure clarity, fairness, and legality in every high-value property transfer.

Illinois Ptax 203 A Example

Illinois Real Estate Transfer Declaration Supplemental Form A

File this form with Form

•On Form

•On Form

Please read the instructions on the back of this form.

Do not write in this area.

This space is reserved for the County Recorder’s Office use.

County:

Date:

Doc. No.:

Vol.:

Page:

Received by:

Step 1: Identify the property and sale information.

1Write the property’s street address, city or village, and township. (From Line 1 of Form

_________________________________________________________________________________________________________

|

Street address of property (or 911 address, if available) |

City or village |

|

|

Township |

2 |

Write the parcel identifying number from Line 3a of Form |

Parcel Identifier: _________________________________ |

|||

3 |

Write the total number of months the property was for sale on the market.* |

|

___ ___ Months |

||

4aWas the improvement occupied on the sale date?* A “No” response means that all improvements |

|

|

|

||

|

were totally unoccupied. |

|

|

___ Yes |

___ No |

|

If the answer is “No,” write the total number of months all improvements were unoccupied |

|

|

|

|

|

before the sale date. Go to Line 5. |

|

|

___ ___ Months |

|

4bWrite the approximate percentage of total square footage of improvements occupied or leased |

|

|

|

||

|

on the sale date. Include all improvements. |

|

|

_______ Percent |

|

4cDid the buyer occupy the property on the sale date? |

|

|

___ Yes |

___ No |

|

|

If the answer is “No,” go to Line 5. |

|

|

|

|

4dWill the buyer continue to occupy part or all of the property after the sale? |

|

|

___ Yes |

___ No |

|

4eWrite the beginning and ending dates of the buyer’s lease agreement. |

Lease dates:_____ / _________ to _____ / _________ |

||||

4f |

Briefly describe any renewal options. |

Month |

Year |

Month |

Year |

|

|

|

|

||

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

5If the buyer owns other properties within an approximate

|

Street address |

City or village |

Parcel identifying number |

|

|

Property 1_________________________________________ ___________________________ _________________________ |

|||

|

Property 2_________________________________________ ___________________________ _________________________ |

|||

6 |

Did Line 12a of Form |

___ Yes |

___ No |

|

|

If the answer is “Yes,” submit a list of personal property transferred.* |

|

|

|

7 |

Did the seller’s financing arrangements affect the sale price on Line 11 of Form |

___ Yes |

___ No |

|

|

If the answer is “Yes,” please explain how the financing affected the sale price. |

|

|

|

________________________________________________________________________________________________________

________________________________________________________________________________________________________

8In your opinion, is the net consideration for real property entered on Line 13 of Form

reflection of the market value on the sale date?___ Yes ___ No

If the answer is “No,” please explain.__________________________________________________________________________

_________________________________________________________________________________________________________

Step 2: Complete the requested information.

The buyer and seller (or their agents) hereby verify that to the best of their knowledge and belief, the facts stated in this form are true and correct. Any person who willfully falsifies or omits any information required in this form shall be guilty of a Class B misdemeanor for the first offense and a Class A misdemeanor for subsequent offenses.

Seller’s or trustee’s name: |

_________________________________________ |

Seller’s daytime phone:( |

) |

— |

|

Address:____________________________________________________________________________________________________ |

|||||

Street address |

|

City |

|

State |

ZIP |

Seller’s or agent’s signature: _________________________________________ |

Date: _____________________________________ |

||||

Buyer’s or trustee’s name: |

_________________________________________ |

Buyer’s daytime phone:( |

) |

— |

|

Address:____________________________________________________________________________________________________ |

|||||

Street address |

|

City |

|

State |

ZIP |

Buyer’s or agent’s signature: _________________________________________ |

Date: _____________________________________ |

||||

*See instructions.

This form is authorized in accordance with 35 ILCS

is REQUIRED. This form has been approved by the Forms Management Center. |

Page 1 of 2

Instructions for Completing Form

Step 1: Identify the property and sale information.

Line 3

Write the total number of months that the property was advertised for sale by a real estate agent, newspaper, trade publication, radio/electronic media, or a sign. If the property has been advertised for sale for more than 99 months, enter “99.”

Lines 4a through 4f

Line 4a — Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the improvement (i.e., structure) was occupied on the sale date. If the property has more than one improvement, answer “No” only if all the improvements were totally unoccupied on the sale date.

If the answer to Line 4a is “No,” write the total number of months that all improvements were totally unoccupied before the sale date and go to Line 5. If the property has been unoccupied for more than 99 months, enter “99.” If the answer to Line 4a is “Yes,” go to Lines 4b and 4c.

Line 4b — Write the approximate percentage of the total square footage of all the improvements that was occupied or leased on the sale date. This applies to the improvements only, not the land.

Line 4c — Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the buyer was a current occupant of the property at the time of the sale. If the answer is “No,” go to Line 5. If the answer is “Yes,” go to Line 4d.

Line 4d — Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the buyer will continue to occupy part or all of the property after the sale. If the answer is “No,” go to Line 5. If the answer is “Yes,” go to Line 4e.

Line 4e — Write the beginning and ending dates of the buyer’s lease agreement, if applicable.

Line 4f — Briefly describe in the space provided any options to renew the lease agreement between the seller and the buyer.

Example:

Line 5

If the buyer owns other properties within an approximate

Line 6

Answer “Yes” or “No” (indicate with an “X”) depending on whether or not Line 12a of Form

Line 7

Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the amount on Line 11 of the Form

If the answer is “Yes,” please explain, in the space provided, how the financing affected the sale price.

Line 8

Answer “Yes” or “No” (indicate with an “X”) depending on whether or not, in your opinion, the net consideration for real property entered on Line 13 of the Form

Step 2: Complete the requested information.

Write the requested information for the seller and the buyer. Write the addresses and daytime phone numbers where the seller and buyer can be contacted after the sale. The seller and the buyer (or their agents) must sign this form. By signing the form, the parties involved in the real estate transfer verify that

•they have examined the completed Form

•the information provided on this form is true and correct; and

•they are aware of the criminal penalties of law (printed in the instructions for Form

Page 2 of 2 |

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Designation | PTAX-203-A Illinois Real Estate Transfer Declaration Supplemental Form A (Non-residential: sale price over $1 million) |

| Condition for Use | Used when sale price is over $1 million and the property use is marked as “Apartment building (over 6 units),” “Office,” “Retail establishment,” “Commercial building,” “Industrial building,” or “Other” on Form PTAX-203, Line 8. |

| Filing Location | Must be filed with Form PTAX-203 and the original deed or trust document at the County Recorder’s office within the county where the property is located. |

| Legal Basis | Authorized in accordance with 35 ILCS 200/31-1 et seq. Mandatory disclosure of this information is required by law. |

| Criminal Penalties for Falsification | Willful falsification or omission of any required information on the form is subject to a Class B misdemeanor for the first offense and a Class A misdemeanor for subsequent offenses. |

Guide to Writing Illinois Ptax 203 A

Filling out the Illinois PTAX-203-A form is a necessary step in the process of transferring real estate, specifically for non-residential properties with a sale price over $1 million. This supplementary form provides additional details that complement the main PTAX-203 form. The details gathered through this form are crucial for accurately recording the property transfer. Below are step-by-step instructions that will guide you through the completion of the PTAX-203-A form ensuring all necessary details are provided accurately.

- Identify the property and sale information:

- Write the property’s street address, city or village, and township in the corresponding fields, referring to Line 1 of Form PTAX-203.

- Enter the parcel identifying number from Line 3a of Form PTAX-203.

- Indicate the total number of months the property was for sale on the market.

- For Section 4a, answer if the improvement was occupied on the sale date and proceed accordingly:

- If “No,” specify the total number of months all improvements were unoccupied before the sale date.

- For 4b, write the approximate percentage of total square footage of improvements occupied or leased on the sale date.

- Answer if the buyer occupied the property on the sale date for 4c.

- For 4d, indicate if the buyer will continue to occupy part or all of the property after the sale.

- Enter the beginning and ending dates of the buyer’s lease agreement for 4e.

- Describe any renewal options for the lease agreement in 4f.

- If the buyer owns other properties within an approximate one-half mile radius of the property, provide the requested details for the two closest properties owned by the buyer in Line 5.

- Answer whether Line 12a of Form PTAX-203 included an amount for a transfer of personal property and submit a list if applicable.

- Indicate if the seller’s financing arrangements affected the sale price on Line 11 of Form PTAX-203 and explain if necessary.

- Offer your opinion on whether the net consideration for real property entered on Line 13 of Form PTAX-203 is a fair reflection of the market value on the sale date and provide an explanation if you answer “No.”

- Complete the requested information:

- Provide the seller’s or trustee’s name, daytime phone, address, and signature along with the date.

- Repeat the above step for the buyer’s or trustee’s details.

Completing the PTAX-203-A form is an essential step in the property transfer process for certain transactions in Illinois. Ensuring that the information provided is accurate and complete will help streamline the transfer process and maintain compliance with state requirements.

Understanding Illinois Ptax 203 A

-

What is the Illinois PTAX-203-A form?

The Illinois PTAX-203-A form, also known as the Illinois Real Estate Transfer Declaration Supplemental Form A, is a document required for the transfer of certain non-residential properties in Illinois. Specifically, this form is necessary when the sale price of the property exceeds $1 million and when the property's current use is classified under categories such as apartment buildings (with more than six units), offices, retail establishments, commercial, industrial, or other similar uses. This form supplements the main PTAX-203 form and should be filed alongside the original deed or trust document at the County Recorder's office where the property is located.

-

Who needs to file the PTAX-203-A form?

This form must be filed by individuals or entities involved in the transfer of non-residential real estate in Illinois when two conditions are met: the sale price of the property is over $1 million, and the property is used for purposes such as apartment complexes with more than six units, offices, retail spaces, commercial or industrial buildings, among others. Both the buyer and seller, or their respective agents, are responsible for ensuring that this form, along with Form PTAX-203, is accurately filled out and filed.

-

Where do I file the PTAX-203-A form?

The PTAX-203-A form, together with Form PTAX-203 and the original deed or trust document, should be filed at the County Recorder's office located within the county where the property in question is situated. The filing must adhere to the specific requirements and deadlines set by the local office to ensure proper processing.

-

What information is required on the PTAX-203-A form?

The PTAX-203-A form requires detailed information about the property and sale. This includes the property's street address, city or village, township, and parcel identifying number, as well as details about the property's listing on the market, its occupancy status at the time of sale, any personal property transferred alongside the real estate, and specifics regarding the buyer's plans for occupying the property. Additionally, the form asks whether the sale price reflects the market value of the property and if the seller's financing arrangements affected the sale price.

-

Are there any penalties for not filing the PTAX-203-A form?

Yes, there are penalties for failing to file the PTAX-203-A form or for submitting incorrect or incomplete information. Specifically, individuals who willfully falsify or omit required information on the form may face criminal charges. The first offense is classified as a Class B misdemeanor, and subsequent offenses are classified as Class A misdemeanors.

-

Can the PTAX-203-A form be filed electronically?

Whether the PTAX-203-A can be filed electronically depends on the specific county's practices and capabilities. Some counties in Illinois may offer electronic filing options for real estate transfer documents. It is recommended to check directly with the County Recorder’s office in the county where the property is located for the most accurate and up-to-date information regarding their filing processes.

-

Where can I find the PTAX-203-A form?

The Illinois PTAX-203-A form can be obtained from the Illinois Department of Revenue's website or directly from the County Recorder's office where the real estate transfer will be recorded. Additionally, legal professionals, such as real estate attorneys or tax advisors, often have access to this form and can assist in ensuring that it is filled out correctly and filed properly.

Common mistakes

When it comes to completing the Illinois PTAX-203-A Form, a high level of detail and accuracy is necessary. However, individuals often encounter certain pitfalls during the process. Here are seven common mistakes that should be avoided:

-

Not providing the full street address of the property, including city or village, and township: The form requires detailed information about the property's location. Leaving out any part of this information can cause delays or issues with the filing.

-

Incorrectly stating the parcel identifying number: This number is crucial for the identification of the property within county records. Errors in this field could lead to confusion or misfiling of your documentation.

-

Omitting the total number of months the property was listed for sale on the market: This information provides context about the sale timeline and must be accurately reported.

-

Failing to indicate the occupancy status at the time of sale: The form differentiates between properties that were occupied and those that were not at the time of sale. This status impacts various aspects of the property's valuation and selling conditions.

-

Not detailing the buyer's future occupancy plans: Whether or not the buyer intends to occupy part or all of the property after the sale must be clearly stated, as it may affect the property's use and valuation.

-

Forgetting to note if the transferred property includes personal property: If personal property is included in the sale, an itemized list must be attached. Missing this step could lead to incomplete documentation.

-

Overlooking the explanation of how the seller's financing arrangements affected the sale price: This is particularly crucial if the seller participates in the financing. The explanation provides transparency about the sale's financial aspects.

Each of these errors can potentially delay the selling process or lead to legal complications. Individuals are encouraged to review their form submissions carefully and ensure that all information is complete and accurate. Paying close attention to the detailed requirements of the Illinois PTAX-203-A Form will facilitate a smoother real estate transaction process.

Documents used along the form

When dealing with real estate transactions in Illinois, particularly for non-residential properties with a sale price over $1 million, understanding and organizing the necessary paperwork is crucial. The PTAX-203-A form, used alongside the standard PTAX-203, is just the beginning. There are several other forms and documents that often accompany these to ensure a smooth and legally compliant property transfer process.

- PTAX-203 Illinois Real Estate Transfer Declaration: This primary form is required for nearly all real estate transfers in Illinois. It captures essential details about the property, sale price, buyer, and seller.

- Real Property Transfer Tax Declaration: Many local municipalities require this form for the collection of transfer taxes. It's similar to the PTAX-203 but specific to local government requirements.

- Grant Deed or Warranty Deed: The deed officially transfers property ownership from the seller to the buyer. It must be filed with the county recorder's office where the property is located.

- Title Insurance Policy: This document protects the buyer (and lender, if applicable) from future claims against the property’s title. It ensures the title is free from defects.

- Bill of Sale for Personal Property: If personal property is included in the transaction, a detailed list and bill of sale may be required to accompany the PTAX forms.

- Seller’s Disclosure Statement: Although not always legally required, this statement provides the buyer with known information about the property’s condition and history.

- HUD-1 Settlement Statement: For transactions involving a mortgage, this form lists all charges and credits to the buyer and seller. It’s a comprehensive breakdown of the transaction costs.

- Land Survey: A current survey of the property might be necessary, especially if there are disputes or questions about property boundaries.

These documents, each serving a distinct and vital role, collectively ensure that the transfer of property is thoroughly documented and legally sound. Whether you are a buyer or a seller, understanding each component of this complex process can demystify real estate transactions and help protect your interests. Remember, this guidance does not replace professional advice tailored to your specific situation, consequently, consulting with professionals in real estate or legal fields is always wise when engaging in property transactions.

Similar forms

The Uniform Residential Loan Application is a document that mirrors the PTAX-203-A form in its comprehensive coverage of financial details for a real estate transaction. Like the PTAX-203-A, this application collects detailed information about the property being financed, including its value and the terms of any existing or proposed mortgage. It pays strict attention to the financial aspects of a real estate deal, ensuring that lenders have a clear picture of the borrower's ability to finance the property, paralleling how the PTAX-203-A provides tax authorities with information on a property's sale.

A Deed of Trust is another document that shares similarities with the PTAX-203-A form, especially in its involvement in property transactions. This document, commonly used in place of a traditional mortgage in some states, involves a trustee, who holds the property's title until the loan is paid off. Like the PTAX-203-A, it is crucial in property transactions over $1 million, ensuring the legal and financial stipulations are clearly documented and adhered to in the transfer process.

The Commercial Lease Agreement, while primarily focused on the rental rather than sale of property, echoes the PTAX-203-A form in detailing the terms of use for commercial properties. The agreement outlines the responsibilities of both the landlord and tenant, similar to how the PTAX-203-A outlines the details surrounding a property sale, including occupancy and use terms upon sale completion.

The Property Disclosure Statement, required in many real estate transactions, is akin to the PTAX-203-A in its purpose to inform. This document discloses the condition and any known issues with a property to potential buyers, akin to how the PTAX-203-A provides tax authorities and other interested parties with important details about a property's sale, including conditions affecting the sale price and occupancy details.

An Environmental Impact Assessment (EIA) Report shares a common goal with the PTAX-203-A form: assessment and documentation. While the EIA focuses on the environmental implications of development projects, including any potential harm or benefits, the PTAX-203-A assesses the financial and usage aspects of real estate transactions, ensuring that all relevant details are documented for tax purposes.

The Title Insurance Policy, an essential document in real estate transactions, offers protection against financial loss from defects in the title to real property. It is similar to the PTAX-203-A form in its role as a safeguard—while the PTAX-203-A helps ensure the correct tax assessment based on the property's sale details, the Title Insurance Policy protects the buyer's or lender's financial interest in the property.

The HUD-1 Settlement Statement, though no longer universally required in residential real estate transactions, closely resembles the PTAX-203-A in its detailed account of the transaction's financial aspects. Both documents itemize the financial details related to the sale, including the sale price, any adjustments, and other relevant financial information, providing a clear overview of the financial transaction.

The Mortgage Agreement, fundamental in property financing, shares its core purpose with the PTAX-203-A form by detailing the financial obligations related to property ownership. This agreement outlines the borrower's loan terms, paralleling how the PTAX-203-A provides detailed records of the sale for taxation purposes.

A Real Estate Purchase Agreement, laying out the terms and conditions of a property sale, mirrors the PTAX-203-A in its role in recording transaction details. Both documents ensure that all parties involved have a mutual understanding of the sale's terms, including sale price, property description, and conditions of sale, crucial for legal and tax considerations.

Lastly, the Annual Property Tax Bill, while a direct consequence of property ownership rather than a part of its sale, reflects the PTAX-203-A form's focus on the financial implications of property transactions. This bill, based on the property's assessed value and the current tax rate, is influenced by the sale price and details documented in the PTAX-203-A, underscoring the interconnectedness of real estate documentation and financial obligations.

Dos and Don'ts

Filling out the Illinois PTAX-203-A form, especially for transactions involving non-residential properties with a sale price over $1 million, requires careful attention to detail. Below is a guide to ensure accuracy and compliance during this process:

Do:

- Ensure that the sale price and the current use of the property are correctly entered on Form PTAX-203, Lines 11 and 8, respectively, to confirm the necessity of filing Form PTAX-203-A.

- Provide accurate and detailed information about the property and the sale, including accurate property description, total months on the market, occupancy details, and buyer’s information as required in Step 1 of the form.

- Be transparent about any transfer of personal property and seller’s financing arrangements that could affect the sale price, as these details are crucial for Line 12a and Line 7 of the form.

- Complete the buyer and seller (or their agents) verification section with accurate contact information and signatures, acknowledging the truthfulness of the information provided and understanding the legal consequences of falsification.

Don't:

- Omit details about the property's occupancy status, including whether it was occupied on the sale date and any lease agreements with the buyer, as this information is critical for Lines 4a through 4f.

- Ignore the instructions for completing the form, especially those regarding the listing of nearby properties owned by the buyer within a one-half mile radius if applicable, as required in Line 5.

- Leave out specifics regarding the transfer of personal property if applicable (Line 6), or the impact of seller’s financing on the sale price (Line 7), as these greatly influence the assessment of the transaction.

- Provide misleading or inaccurate information regarding the fairness of the net consideration for real property as reflected on Line 13 of the Form PTAX-203. This could have significant legal implications and affect the validity of the form.

Misconceptions

When dealing with Illinois real estate transactions that exceed $1 million, the PTAX-203-A form becomes an essential document. However, numerous misconceptions surround its usage and requirements. Let's discuss ten common ones and set the record straight.

- Only residential properties need to fill out PTAX-203-A. This is incorrect. Form PTAX-203-A is specifically required for non-residential property transactions over $1 million.

- PTAX-203-A replaces Form PTAX-203. Actually, PTAX-203-A is a supplemental form that must be filed along with Form PTAX-203. It's not a substitute but an addition.

- The form is optional if the sale price is above $1 million. On the contrary, filing the PTAX-203-A is mandatory for non-residential sales over $1 million.

- Personal property transfers do not need to be declared. This is a misconception. If personal property is part of the transaction, it must be listed on the PTAX-203-A form.

- You only need to complete it if the buyer or seller requests it. This statement is false. The requirement to file the form is based on the sale's conditions, not the preferences of the parties involved.

- Information about the property's square footage is not necessary. Incorrect again. The form requests details on the square footage of the property that was occupied or leased at the time of sale.

- Filing the form online is an option. As of the last update, the PTAX-203-A form needs to be filed with the county recorder's office, not online.

- No penalties exist for not filling out the form accurately. Misleading information can result in criminal charges, including misdemeanors for falsifying or omitting needed information.

- Seller financing details do not influence the PTAX-203-A filing. This is false, as any seller's financing arrangements affecting the sale price must be disclosed on the form.

- Ownership of nearby properties by the buyer is irrelevant. Actually, if the buyer owns other properties within a half-mile radius, this information must be included on the PTAX-203-A form.

Understanding the real requirements and debunking common misconceptions ensure that parties involved in real estate transactions over $1 million in Illinois comply correctly with state regulations. This prevents potential legal pitfalls and streamlines the sale process for non-residential properties.

Key takeaways

When dealing with the sale of non-residential real estate in Illinois with a value over $1 million, it's crucial to understand the requirements and implications of the PTAX-203-A form. This document supplements the main Real Estate Transfer Declaration form, PTAX-203, and provides the county with additional details on the transaction. Here are key takeaways regarding the PTAX-203-A form:

- This form is specifically designed for transactions involving non-residential properties such as apartment buildings (over six units), office spaces, retail establishments, commercial, or industrial buildings, where the sale price exceeds $1 million.

- Filling out the form requires detailed information about the property, such as its address, parcel identifying number, and information about occupancy and leasing at the time of the sale. The accuracy of this information is crucial, as it can impact the assessment of the property's value for tax purposes.

- The form also asks for specifics about any personal property that was included in the sale and whether the sale price was influenced by the seller's financing arrangements, along with a candid evaluation of whether the net consideration reflects the property's market value.

- Both the buyer and the seller (or their authorized agents) must verify the information on the form. It's a declaration made under the penalty of law, emphasizing the importance of providing true and correct information. Willful falsification or omission of required information can lead to misdemeanor charges.

- The PTAX-203-A form must be filed alongside the primary PTAX-203 form and the original deed or trust document at the County Recorder's office in the county where the property is located. This ensures that all pertinent details of the sale are officially recorded and considered in the transfer of ownership and assessment of property taxes.

Understanding and correctly completing the PTAX-203-A form is vital for all parties involved in the sale of significant non-residential real estate in Illinois. It ensures compliance with state law, helps maintain accurate public records, and aids in the proper assessment of property taxes.

Popular PDF Documents

Scholarships Bahamas - Cost and fees per year, broken down into tuition, room & board, and other expenses, provide a clear financial overview to the committee.

1065 Vs 1120 - Used to report a shareholder's individual earnings, losses, and dividends from an S corporation.