Get I9 Tax Form

In navigating the complexities of employment within the United States, the Form I-9, Employment Eligibility Verification, stands as a fundamental pillar established by the Department of Homeland Security and U.S. Citizenship and Immigration Services (USCIS). This document serves the pivotal purpose of verifying an employee's legal authority to work in the U.S., covering both citizens and noncitizens alike since November 6, 1986. Emphasizing the critical stance against discrimination, the form enforces an anti-discrimination notice, strictly prohibiting unfair employment practices based on national origin or citizenship status. Employers are mandated to complete this form without dictating specific documents employees may submit for verification. This process must unfold within three business days of the commencement of employment, embodying the scrutiny of documents to ascertain identity and work authorization. Additionally, the form elucidates scenarios for the necessity of reverification, ensuring employers comply with regulations to revalidate an employee’s work authorization should it approach expiration. The procedure encapsulates the preparer/translator certification for instances necessitating assistance in form completion. Importantly, the I-9 form is divided into sections that meticulously delineate the responsibilities resting on both employees and employers, underlining the legal obligations and anti-discrimination protections embodied in the comprehensive instructions and guidelines. This essence of verification, while straightforward in its intention to affirm work eligibility, embodies a critical compliance framework for employers, navigating through regulations that safeguard the employment rights of individuals in the United States.

I9 Tax Example

OMB No.

Department of Homeland Security

U.S. Citizenship and Immigration Services

Form

Instructions

Read all instructions carefully before completing this form.

What Is the Purpose of This Form?

The purpose of this form is to document that each new employee (both citizen and noncitizen) hired after November 6, 1986, is authorized to work in the United States.

When Should Form

All employees (citizens and noncitizens) hired after November 6, 1986, and working in the United States must complete Form

Filling Out Form

Section 1, Employee

This part of the form must be completed no later than the time of hire, which is the actual beginning of employment. Providing the Social Security Number is voluntary, except for employees hired by employers participating in the USCIS Electronic Employment Eligibility Verification Program (E- Verify). The employer is responsible for ensuring that

Section 1 is timely and properly completed.

Noncitizen nationals of the United States are persons born in American Samoa, certain former citizens of the former Trust Territory of the Pacific Islands, and certain children of noncitizen nationals born abroad.

Employers should note the work authorization expiration date (if any) shown in Section 1. For employees who indicate an employment authorization expiration date in Section 1, employers are required to reverify employment authorization for employment on or before the date shown. Note that some employees may leave the expiration date blank if they are aliens whose work authorization does not expire (e.g., asylees, refugees, certain citizens of the Federated States of Micronesia or the Republic of the Marshall Islands). For such employees, reverification does not apply unless they choose to present

in Section 2 evidence of employment authorization that contains an expiration date (e.g., Employment Authorization Document (Form

Preparer/Translator Certification

The Preparer/Translator Certification must be completed if Section 1 is prepared by a person other than the employee. A preparer/translator may be used only when the employee is unable to complete Section 1 on his or her own. However, the employee must still sign Section 1 personally.

Section 2, Employer

For the purpose of completing this form, the term "employer" means all employers including those recruiters and referrers for a fee who are agricultural associations, agricultural employers, or farm labor contractors. Employers must complete Section 2 by examining evidence of identity and employment authorization within three business days of the date employment begins. However, if an employer hires an individual for less than three business days, Section 2 must be completed at the time employment begins. Employers cannot specify which document(s) listed on the last page of Form

If an employee is unable to present a required document (or documents), the employee must present an acceptable receipt in lieu of a document listed on the last page of this form.

Receipts showing that a person has applied for an initial grant of employment authorization, or for renewal of employment authorization, are not acceptable. Employees must present receipts within three business days of the date employment begins and must present valid replacement documents within 90 days or other specified time.

Employers must record in Section 2:

1.Document title;

2.Issuing authority;

3.Document number;

4.Expiration date, if any; and

5.The date employment begins.

Employers must sign and date the certification in Section 2. Employees must present original documents. Employers may, but are not required to, photocopy the document(s) presented. If photocopies are made, they must be made for all new hires. Photocopies may only be used for the verification process and must be retained with Form

responsible for completing and retaining Form

Form

For more detailed information, you may refer to the |

|

Information about |

||

USCIS Handbook for Employers (Form |

|

allows participating employers to electronically verify the |

||

obtain the handbook using the contact information found |

|

employment eligibility of their newly hired employees, can be |

||

under the header "USCIS Forms and Information." |

|

obtained from our website at |

||

|

|

calling |

|

|

Section 3, Updating and Reverification |

|

|

|

|

Employers must complete Section 3 when updating and/or |

General information on immigration laws, regulations, and |

|||

procedures can be obtained by telephoning our National |

||||

reverifying Form |

||||

Customer Service Center at |

||||

authorization of their employees on or before the work |

||||

Internet website at www.uscis.gov. |

||||

authorization expiration date recorded in Section 1 (if any). |

||||

|

|

|

||

Employers CANNOT specify which document(s) they will |

|

|

|

|

|

Photocopying and Retaining Form |

|||

accept from an employee. |

|

|||

A. If an employee's name has changed at the time this form |

|

|

|

|

A blank Form |

||||

is being updated/reverified, complete Block A. |

||||

copied. The Instructions must be available to all employees |

||||

|

||||

B. If an employee is rehired within three years of the date |

completing this form. Employers must retain completed Form |

|||

this form was originally completed and the employee is |

||||

still authorized to be employed on the same basis as |

date employment ends, whichever is later. |

|||

previously indicated on this form (updating), complete |

|

Form |

||

Block B and the signature block. |

|

|||

|

authorized in Department of Homeland Security regulations |

|||

|

|

|||

C. If an employee is rehired within three years of the date |

|

at 8 CFR 274a.2. |

|

|

this form was originally completed and the employee's |

|

|

|

|

work authorization has expired or if a current |

|

|

|

|

|

Privacy Act Notice |

|

||

employee's work authorization is about to expire |

|

|

||

(reverification), complete Block B; and: |

|

|

|

|

The authority for collecting this information is the |

||||

|

||||

1. Examine any document that reflects the employee |

Immigration Reform and Control Act of 1986, Pub. L. |

|||

is authorized to work in the United States (see List |

(8 USC 1324a). |

|

||

A or C); |

|

This information is for employers to verify the eligibility of |

||

2. Record the document title, document number, and |

|

|||

|

individuals for employment to preclude the unlawful hiring, or |

|||

expiration date (if any) in Block C; and |

|

|||

|

recruiting or referring for a fee, of aliens who are not |

|||

|

|

|||

3. Complete the signature block. |

|

authorized to work in the United States. |

||

Note that for reverification purposes, employers have the |

|

|

|

|

option of completing a new Form |

|

This information will be used by employers as a record of |

||

Section 3. |

|

their basis for determining eligibility of an employee to work |

||

|

|

in the United States. The form will be kept by the employer |

||

What Is the Filing Fee? |

|

and made available for inspection by authorized officials of |

||

|

the Department of Homeland Security, Department of Labor, |

|||

|

|

|||

There is no associated filing fee for completing Form |

|

and Office of Special Counsel for |

||

|

Employment Practices. |

|

||

form is not filed with USCIS or any government agency. Form |

|

|

||

|

|

|

||

Submission of the information required in this form is |

||||

inspection by U.S. Government officials as specified in the |

||||

voluntary. However, an individual may not begin employment |

||||

Privacy Act Notice below. |

||||

unless this form is completed, since employers are subject to |

||||

|

||||

|

civil or criminal penalties if they do not comply with the |

|||

|

||||

USCIS Forms and Information |

Immigration Reform and Control Act of 1986. |

|||

|

|

|

|

|

To order USCIS forms, you can download them from our |

|

|

|

|

website at www.uscis.gov/forms or call our |

|

|

|

|

|

|

|

||

from our website at www.uscis.gov or by calling |

|

|

|

|

|

|

|

||

|

|

|

|

|

EMPLOYERS MUST RETAIN COMPLETED FORM |

Form |

|||

DO NOT MAIL COMPLETED FORM |

|

|||

Paperwork Reduction Act

An agency may not conduct or sponsor an information collection and a person is not required to respond to a collection of information unless it displays a currently valid OMB control number. The public reporting burden for this collection of information is estimated at 12 minutes per response, including the time for reviewing instructions and completing and submitting the form. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to: U.S. Citizenship and Immigration Services, Regulatory Management Division, 111 Massachusetts Avenue, N.W., 3rd Floor, Suite 3008, Washington, DC

completed Form

Form

OMB No.

Department of Homeland Security

U.S. Citizenship and Immigration Services

Form

Read instructions carefully before completing this form. The instructions must be available during completion of this form.

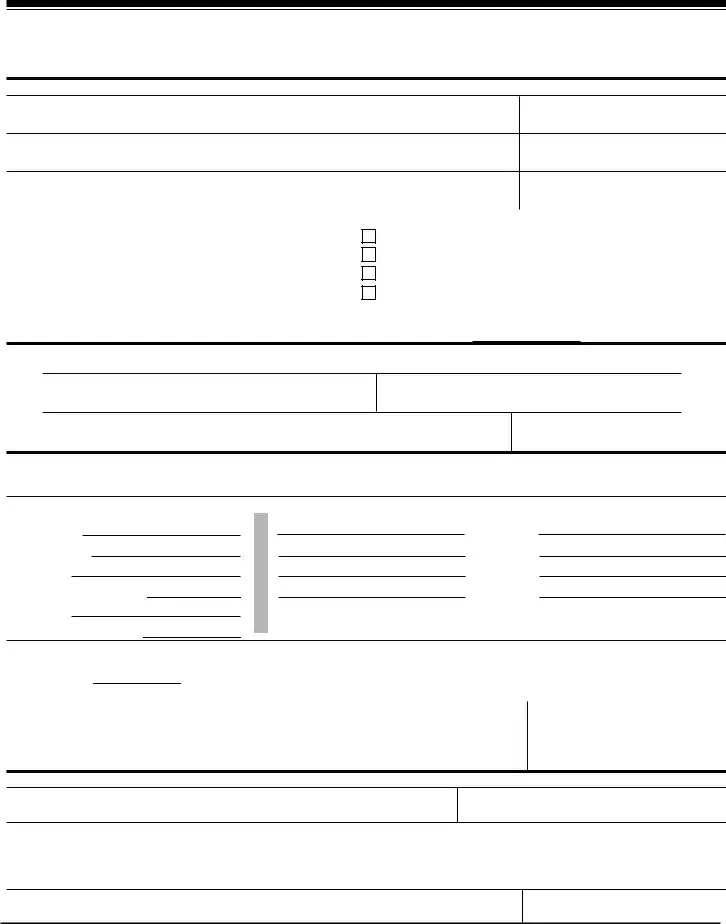

Section 1. Employee Information and Verification (To be completed and signed by employee at the time employment begins.)

Print Name: Last |

First |

Middle Initial |

Maiden Name

Address (Street Name and Number) |

Apt. # |

Date of Birth (month/day/year)

City |

State |

Zip Code |

Social Security #

I am aware that federal law provides for |

I attest, under penalty of perjury, that I am (check one of the following): |

|||||

A citizen of the United States |

||||||

imprisonment and/or fines for false statements or |

||||||

|

|

|

|

|

||

use of false documents in connection with the |

A noncitizen national of the United States (see instructions) |

|||||

|

|

|

|

|

||

completion of this form. |

A lawful permanent resident (Alien #) |

|

|

|||

|

An alien authorized to work (Alien # or Admission #) |

|

|

|||

|

until (expiration date, if applicable - month/day/year) |

|||||

Employee's Signature |

Date (month/day/year) |

|||||

|

||||||

Preparer and/or Translator Certification (To be completed and signed if Section 1 is prepared by a person other than the employee.) I attest, under penalty of perjury, that I have assisted in the completion of this form and that to the best of my knowledge the information is true and correct.

Preparer's/Translator's Signature

Print Name

Address (Street Name and Number, City, State, Zip Code)

Date (month/day/year)

Section 2. Employer Review and Verification (To be completed and signed by employer. Examine one document from List A OR examine one document from List B and one from List C, as listed on the reverse of this form, and record the title, number, and expiration date, if any, of the document(s).)

List A |

OR |

List B |

AND |

List C |

Document title:

Issuing authority:

Document #:

Expiration Date (if any):

Document #:

Expiration Date (if any):

CERTIFICATION: I attest, under penalty of perjury, that I have examined the document(s) presented by the

(month/day/year) |

and that to the best of my knowledge the employee is authorized to work in the United States. (State |

employment agencies may omit the date the employee began employment.)

Signature of Employer or Authorized Representative |

Print Name |

Title |

|

|

|

Business or Organization Name and Address (Street Name and Number, City, State, Zip Code) |

Date (month/day/year) |

|

Section 3. Updating and Reverification (To be completed and signed by employer.)

A. New Name (if applicable)

B. Date of Rehire (month/day/year) (if applicable)

C. If employee's previous grant of work authorization has expired, provide the information below for the document that establishes current employment authorization.

Document Title: |

|

Document #: |

|

Expiration Date (if any): |

|

|

|

|

|

|

|

|

|

|

|

|

|

l attest, under penalty of perjury, that to the best of my knowledge, this employee is authorized to work in the United States, and if the employee presented document(s), the document(s) l have examined appear to be genuine and to relate to the individual.

Signature of Employer or Authorized Representative

Date (month/day/year)

Form

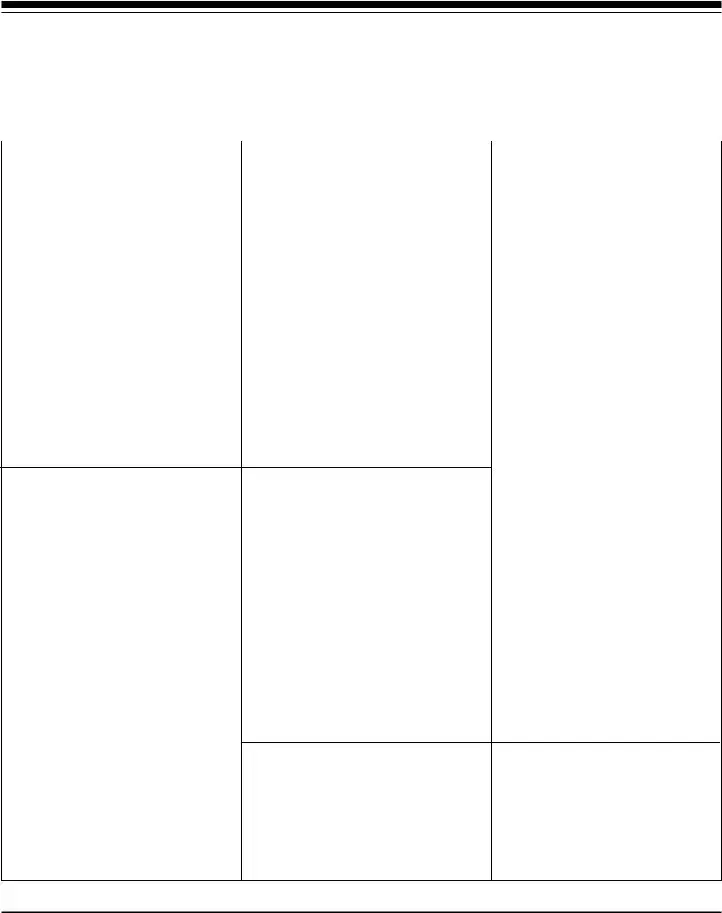

LISTS OF ACCEPTABLE DOCUMENTS

|

|

|

|

All documents must be unexpired |

|

|

|

|

|

|

|

LIST A |

|

|

|

LIST B |

|

|

|

LIST C |

|

|

Documents that Establish Both |

|

|

|

Documents that Establish |

|

|

|

Documents that Establish |

|

|

Identity and Employment |

|

|

|

Identity |

|

|

|

Employment Authorization |

|

|

Authorization |

OR |

|

AND |

|

|

||||

1. |

U.S. Passport or U.S. Passport Card |

|

1. |

Driver's license or ID card issued by |

1. |

Social Security Account Number |

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

a State or outlying possession of the |

|

|

|

card other than one that specifies |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

United States provided it contains a |

|

|

|

on the face that the issuance of the |

|

|

|

|

|

|

photograph or information such as |

|

|

|

card does not authorize |

|

|

|

|

|

|

|

|

|

|

||

2. |

Permanent Resident Card or Alien |

|

|

|

name, date of birth, gender, height, |

|

|

|

employment in the United States |

|

|

|

|

eye color, and address |

|

|

|

||||

|

Registration Receipt Card (Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Certification of Birth Abroad |

||

|

|

|

|

|

|

|

|

|||

|

|

|

2. |

ID card issued by federal, state or |

|

|

|

issued by the Department of State |

||

3. Foreign passport that contains a |

|

|

|

local government agencies or |

|

|

|

(Form |

||

|

temporary |

|

|

|

entities, provided it contains a |

|

|

|

|

|

|

|

|

|

photograph or information such as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

readable immigrant visa |

|

|

|

name, date of birth, gender, height, |

|

|

3. Certification of Report of Birth |

||

|

|

|

|

|

eye color, and address |

|

|

|||

|

|

|

|

|

|

|

|

issued by the Department of State |

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

(Form |

|

4. |

Employment Authorization Document |

3. |

School ID card with a photograph |

|

|

|

||||

|

|

|

|

|

||||||

|

that contains a photograph (Form |

|

|

|

|

|

|

|

|

|

|

|

4. |

Voter's registration card |

4. |

Original or certified copy of birth |

|||||

|

|

|

||||||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

certificate issued by a State, |

|

5. |

In the case of a nonimmigrant alien |

|

5. |

U.S. Military card or draft record |

|

|

|

county, municipal authority, or |

||

|

authorized to work for a specific |

|

|

|

|

|

|

|

territory of the United States |

|

|

employer incident to status, a foreign |

|

6. |

Military dependent's ID card |

|

|

|

bearing an official seal |

||

|

|

|

|

|

|

|

||||

|

passport with Form |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

U.S. Coast Guard Merchant Mariner |

|

|

|

|

|

||

|

passport and containing an |

|

5. |

Native American tribal document |

||||||

|

|

|

|

Card |

||||||

|

endorsement of the alien's |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

nonimmigrant status, as long as the |

|

|

|

|

|

|

|

|

|

|

|

8. |

Native American tribal document |

|

|

|

|

|

||

|

period of endorsement has not yet |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

expired and the proposed |

|

|

|

|

|

|

6. U.S. Citizen ID Card (Form |

||

|

|

9. |

Driver's license issued by a Canadian |

|

|

|||||

|

employment is not in conflict with |

|

|

|

|

|

|

|||

|

|

|

|

government authority |

|

|

|

|

|

|

|

any restrictions or limitations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

identified on the form |

|

|

|

|

|

|

|

|

|

|

|

|

|

For persons under age 18 who |

7. |

Identification Card for Use of |

||||

|

|

|

|

|

||||||

|

|

|

|

|

are unable to present a |

|

|

|

Resident Citizen in the United |

|

|

|

|

|

|

document listed above: |

|

|

|

States (Form |

|

6.Passport from the Federated States of Micronesia (FSM) or the Republic of

the Marshall Islands (RMI) with |

10. |

School record or report card |

8. Employment authorization |

Form |

|

|

document issued by the |

|

|

||

nonimmigrant admission under the |

11. |

Clinic, doctor, or hospital record |

Department of Homeland Security |

|

|

||

Compact of Free Association |

|

|

|

Between the United States and the |

|

|

|

12. |

|

||

FSM or RMI |

|

||

|

|

|

|

Illustrations of many of these documents appear in Part 8 of the Handbook for Employers

Form

Document Specifics

| Fact | Detail |

|---|---|

| Form Number and Revision | Form I-9, Revision Date 08/07/09, OMB No. 1615-0047; Expires 08/31/12 |

| Form Purpose | To document that each new employee is authorized to work in the United States. |

| Usage Start Date | Applicable for employees hired after November 6, 1986. |

| Anti-Discrimination Notice | Illegal to discriminate against work-authorized individuals or specify documents they must provide. |

| Section 1 - Timing | Must be completed at the time of hire. |

| Section 2 - Employer Responsibility | Must be completed within three business days of the start date. Lists acceptable documents. |

| Electronic Verification (E-Verify) | Link to E-Verify program for electronic verification of employment eligibility. |

| Retention Requirement | Employers must retain Form I-9 for three years after the date of hire or one year after employment ends, whichever is later. |

| Avoiding Discrimination | Employers cannot refuse to hire based on documents with a future expiration date. |

Guide to Writing I9 Tax

Filling out the I-9 Tax Form is a critical step for employers and employees to ensure compliance with United States employment eligibility verification requirements. The process involves three main sections, each requiring attention to detail to affirm that an employee is authorized to work in the U.S. Whether you are an employer facilitating the process or an employee completing your part, it’s essential to carefully follow each step to avoid any legal complications.

- Complete Section 1 - Employee Information and Verification

- Enter your full name, including your last name, first name, and middle initial. If you have a maiden name, include it as well.

- Provide your address, including the street name and number, apartment number (if applicable), city, state, and zip code.

- Fill in your date of birth in the format of month/day/year.

- Enter your Social Security Number.

- Indicate your citizenship status by selecting the appropriate option: A citizen of the United States, a noncitizen national of the United States, a lawful permanent resident, or an alien authorized to work.

- If you are an alien authorized to work, provide your Alien Registration Number or Admission Number and the expiration date of your work authorization, if applicable.

- Sign and date the form.

- If someone helps you complete Section 1, they must fill out the Preparer/Translator Certification

- Complete Section 2 - Employer Review and Verification (For Employers)

- Review the employee's documents. Employees can present one document from List A or a combination of one document from List B and one document from List C.

- Record the document title, issuing authority, document number, and expiration date, if any.

- Certify that you have examined the documents, they appear to be genuine, relate to the individual, and that to the best of your knowledge the employee is authorized to work in the U.S.

- Sign and date the employer section.

- Complete Section 3 - Updating and Reverification (For Employers) - This section is to be filled out when updating and/or reverifying an employee's employment authorization.

- If the employee’s name has changed, complete Block A.

- For rehires within three years of the original hire date or when an employee's work authorization requires reverification, examine an acceptable document from List A or C, record the document title, number, expiration date if any in Block C, and complete the signature block.

Note that the completed Form I-9 must be retained by the employer and made available for inspection by U.S. Government officials. It should not be mailed to the U.S. Citizenship and Immigration Services or any other government agency unless requested. Accuracy and attention to every detail will ensure compliance and avoid potential legal issues.

Understanding I9 Tax

FAQ Section: Understanding the I-9 Tax Form

- What is the purpose of the I-9 Tax Form?

The I-9 Form is designed to verify the identity and employment authorization of individuals hired for employment in the United States. This includes both citizens and noncitizens, ensuring that only individuals authorized to work in the U.S. are employed.

- When should the I-9 Form be completed?

All employees hired after November 6, 1986, must complete the I-9 Form at the time of hire, which is the day they start work. Section 1 of the form must be filled out by the employee no later than their first day of employment, and the employer must complete Section 2 within three days of the employee's start date.

- Is providing a Social Security Number on the I-9 Form mandatory?

For most employees, providing a Social Security Number on the I-9 Form is voluntary. However, employees hired by employers participating in the E-Verify program must provide their Social Security Number as part of the verification process.

- What documents are accepted for the I-9 Form?

Employees can present various documents to establish their identity and employment authorization, divided into three lists:

- List A documents confirm both identity and employment authorization (e.g., U.S. Passport, Permanent Resident Card).

- List B documents confirm identity only (e.g., Driver's License).

- List C documents confirm employment authorization only (e.g., Social Security Card).

Employees should present one List A document or a combination of one List B and one List C document.

- Can photocopies of documents be used for the I-9 Form?

Employers must view original documents when completing the I-9 Form. They may, but are not required to, make photocopies of the documents for their records. If photocopies are made, they must be for all employees to ensure fair treatment and compliance.

- What is the retention period for the I-9 Form?

Employers must keep completed I-9 Forms for three years after the date of hire or for one year after employment ends, whichever is later. These forms must be available for inspection by authorized U.S. Government officials.

Common mistakes

Not completing the form on time: The form must be completed no later than the time of hire, which is the actual beginning of employment. Failing to do this can result in non-compliance with employment verification requirements.

Incorrectly using the Preparer/Translator Certification section: This section must be completed if someone other than the employee assists in filling out Section 1 of the form. However, the employee must still personally sign Section 1, even if a preparer or translator helps them.

Omitting the employee's work authorization expiration date: For employees who have a work authorization expiration date, this date must be indicated in Section 1. Neglecting to note this date can lead to issues with employment authorization reverification.

Specifying which documents can be presented: Employers cannot specify which document(s) they will accept from an employee for the purpose of completing Form I-9. Doing so is a common mistake and constitutes illegal discrimination.

Failure to properly verify documents in Section 2: Employers must examine and verify the documents presented by the employee within three business days of the start of employment. Accepting documents not listed or failing to verify the authenticity and relevance of the documents can lead to legal issues.

Improper retention and photocopying of documents: Employers are required to retain completed Form I-9s for three years after the date of hire or one year after employment ends, whichever is later. They may, but are not required to, make photocopies of the documents presented, but if they do so, they must do it for all employees to avoid discrimination allegations.

It's critical for both employees and employers to pay close attention to the form's requirements to ensure compliance and avoid possible sanctions. Understanding and avoiding these common mistakes can help streamline the employment verification process.

Documents used along the form

When handling the Form I-9, Employment Eligibility Verification, it's essential to understand that it often goes hand in hand with several other forms and documents to ensure full compliance with employment and tax laws in the United States. This overview aims to shed light on some of these additional necessary documents, providing a comprehensive approach to hiring and employment verification processes.

- W-4 Form (Employee's Withholding Certificate): This form is used by employers to determine the amount of federal income tax to withhold from an employee's paycheck. It is completed by the employee, indicating their filing status and any other relevant personal information that affects their withholding.

- W-2 Form (Wage and Tax Statement): Employers issue this form to employees and the IRS at the end of the year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- State Withholding Certificate: Similar to the federal W-4 form, this document is for state tax withholdings. The requirements and forms vary by state.

- I-765 Form (Application for Employment Authorization): For noncitizens who may need to prove their eligibility to work in the United States, this form is used to apply for an Employment Authorization Document (EAD).

- SS-5 Form (Application for a Social Security Card): This form is used to apply for a new or replacement Social Security card. It is essential for individuals without a Social Security Number (SSN) to apply for one, as the SSN is required for payroll and tax purposes.

- M-274 (Handbook for Employers): Though not a form, this handbook provides detailed guidance on completing Form I-9, including the visualization of documents employers may accept for verification purposes.

- 1099 Form (Various Types): Used for reporting income other than wages, salaries, and tips. It's particularly relevant for independent contractors or self-employed individuals who might also be employed under certain conditions that necessitate Form I-9 completion.

These forms and documents play critical roles in ensuring both the employee and employer adhere to federal and state regulations concerning employment eligibility, tax withholdings, and income reporting. Proper completion and maintenance of these documents protect both parties and ensure a smooth employment process.

Similar forms

The W-4 Form, or Employee's Withholding Certificate, shares similarities with the I-9 Form in its requirement for new hires. While the I-9 verifies employment eligibility regardless of citizenship, the W-4 helps employers understand how much federal income tax to withhold from an employee's paycheck. Both forms are federal requirements for employment in the United States and must be completed by employees at the start of their employment.

Similarly, the W-2 Form, or Wage and Tax Statement, aligns with the I-9 in its employment context, although serving a different purpose. The W-2 is issued by employers annually to report an employee's annual wages and taxes withheld. Conversely, the I-9 does not concern taxes but confirms an employee's authorization to work in the U.S. Both are crucial for compliance with federal regulations.

The Employment Eligibility Verification Form I-9 also parallels state forms that verify an employee's ability to work legally. Many states require specific forms similar to the I-9 to address state tax withholdings or to further affirm work eligibility under state law. These documents collectively ensure employees are legally authorized and properly taxed at both federal and state levels.

Form 1099 is another tax document but geared towards independent contractors rather than traditional employees. Despite this difference, it similarily requires individuals to provide their Social Security Number or Taxpayer Identification Number, much like the I-9 requires identification to verify work eligibility. Both forms are essential for tax purposes and legal work status verification, but they cater to different types of workers.

The E-Verify system, though not a form, compliments the I-9 by electronically verifying the employment eligibility of newly hired employees. Employers use E-Verify in addition to completing the Form I-9, further ensuring their workforce is authorized to work in the United States. This system illustrates the government's efforts to automate and reinforce the verification process initiated by the I-9 form.

The DS-160, Online Nonimmigrant Visa Application, shares a purpose with the I-9 concerning individuals' authorization in the U.S. While the DS-160 is used for visa applications before employment eligibility, the I-9 confirms such eligibility once in the U.S. Both are integral to the legal framework permitting work for non-citizens.

The Social Security Card application (Form SS-5) also intersects with the I-9 in terms of identifying legally eligible workers. While the SS-5 is not exclusively for employment, obtaining a Social Security Number is a prerequisite for legal employment, making it a complement to the I-9 process, which requires such an identifier for U.S. citizens and authorized workers.

Last, the Form I-765, Application for Employment Authorization, directly ties to the eligibility that the I-9 seeks to confirm. This form is used by non-citizens to obtain the documentation necessary to prove eligibility to work legally in the U.S., which is then verified through the I-9 process. Both are essential steps for employment authorization for non-citizens.

Dos and Don'ts

When filling out the I-9 Tax Form, it is crucial to follow specific guidelines to ensure compliance and avoid legal complications. Here are seven important dos and don'ts to keep in mind:

DO:

-

Read all instructions carefully before starting to fill out the form to avoid making mistakes.

-

Ensure Section 1 is completed by the employee by their first day of employment (the actual beginning of employment).

-

Complete Section 2 as an employer by examining evidence of identity and employment authorization within three business days of the date employment begins.

-

Use a preparer/translator certification if someone other than the employee fills out Section 1 on behalf of the employee.

-

Retain the completed Form I-9 for three years after the date of hire or one year after the date employment ends, whichever is later.

-

Make sure the employee provides original documents that prove their identity and employment authorization.

-

Record the document title, issuing authority, document number, and expiration date (if any) accurately in Section 2.

DON'T:

-

Do not specify or demand specific documents from the employee for employment verification purposes.

-

Avoid discrimination against any individual by refusing to accept valid documentation that meets Form I-9 requirements.

-

Do not neglect the reverification process for employees with expiring employment authorization.

-

Do not photocopy documents unless you do it for all new hires, and remember that these photocopies must not be used for any purpose other than verifying the form.

-

Avoid delaying the completion of Section 1 beyond the employee's first day of employment.

-

Do not lose track of the retention timeline ; improperly retaining Form I-9 can result in compliance issues.

-

Never submit the completed Form I-9 to USCIS or ICE unless specifically requested. The form should be retained by the employer for inspection only.

Misconceptions

When it comes to navigating the complexities of employment eligibility verification in the United States, the Form I-9 plays a crucial role. However, there are several misconceptions about this form that can lead to confusion for both employers and employees. Let's clear up some of these misunderstandings.

Only Non-Citizens Need to Complete Form I-9: This is a common misconception. In reality, the Form I-9 must be completed by everyone hired to work in the United States after November 6, 1986, regardless of their citizenship. This includes U.S. citizens, permanent residents, and visa holders.

Employers Can Choose Which Documents They Accept for Form I-9: The truth is, employers cannot specify which documents they will accept from the Lists of Acceptable Documents. Employees have the freedom to choose which documentation they present from the list, as long as the document establishes both their identity and their eligibility to work in the United States.

Form I-9 Must Be Updated Annually: There's no requirement to renew or update Form I-9 on an annual basis. Reverification is only necessary for certain instances, such as if an employee's work authorization has expired. Otherwise, there is no need to update the form annually.

Form I-9s Are to be Filed with the Immigration and Customs Enforcement (ICE) or USCIS: Actually, employers should not send completed Form I-9s to ICE or the USCIS. Instead, employers must retain completed forms for three years after the date of hire or one year after the date of termination, whichever is later, and make them available for inspection if requested by authorized government officials.

Digital Copies of Form I-9 Are Not Acceptable: This is not correct. The Department of Homeland Security allows for Form I-9 to be completed, signed, and stored electronically, as long as employers comply with the guidelines set forth in the regulations. This means both digital and paper forms are acceptable, provided all requirements are met.

Understanding these key aspects of Form I-9 can help ensure compliance with employment eligibility verification requirements and reduce the potential for legal issues or penalties. Remember, the goal of the Form I-9 is to verify the identity and employment authorization of individuals hired for employment in the United States, contributing to lawful hiring practices.

Key takeaways

Understanding the I-9 Employment Eligibility Verification form is crucial for both employers and employees in the United States. This form is used to verify an individual's identity and their authorization to work legally in the U.S. Here are six key takeaways about filling out and utilizing the I-9 form:

- Anti-Discrimination Notice: The form includes an anti-discrimination notice clarifying that it's illegal to discriminate against individuals authorized to work in the U.S based on their citizenship status or national origin. Employers cannot choose which documents they will accept from employees as proof of identity and eligibility to work.

- Purpose of the Form: The primary purpose of the I-9 form is to document that every new hire, both citizens and noncitizens, after November 6, 1986, is authorized to work in the United States.

- Completion Timeline: Section 1 of the I-9 must be completed by the employee at the time of hire, which is the commencement of employment. Employers are responsible for completing Section 2 by examining evidence of identity and employment authorization within three business days of the employee starting work.

- Document Presentation: Employees have the flexibility to present any document from List A or a combination of one document from List B and one from List C. It's important for employers to know that they are not allowed to specify which documents employees can present.

- Receipts and Reverification: In some cases, employees can provide receipts for documents instead of the actual documents if they have applied for but not yet received certain documents. However, actual documents must be provided within 90 days. Additionally, reverification is required for employees with an employment authorization expiration date noted in Section 1 of the form.

- Record Keeping: Employers are required to retain completed I-9 forms for three years after the date of hire or one year after employment ends, whichever is later. They must also make the forms available for inspection by authorized U.S. Government officials upon request.

It's essential for both employees and employers to fully understand these key aspects of the I-9 form to ensure compliance with U.S. employment eligibility verification requirements and to avoid potential legal challenges.

Popular PDF Documents

San Jose Business License Search - Integral for maintaining an updated database of Inglewood's commercial landscape, aiding in local governance and economic policies.

Do I Have to File a 1099 - Form 8809 helps maintain orderly records by accommodating delays in data compilation.

What Is Amt Depreciation - It acts as a tool for enforcing tax equity by ensuring that all taxpayers contribute a baseline amount of income tax.