Get How To Get A Pa Tax Exempt Number Form

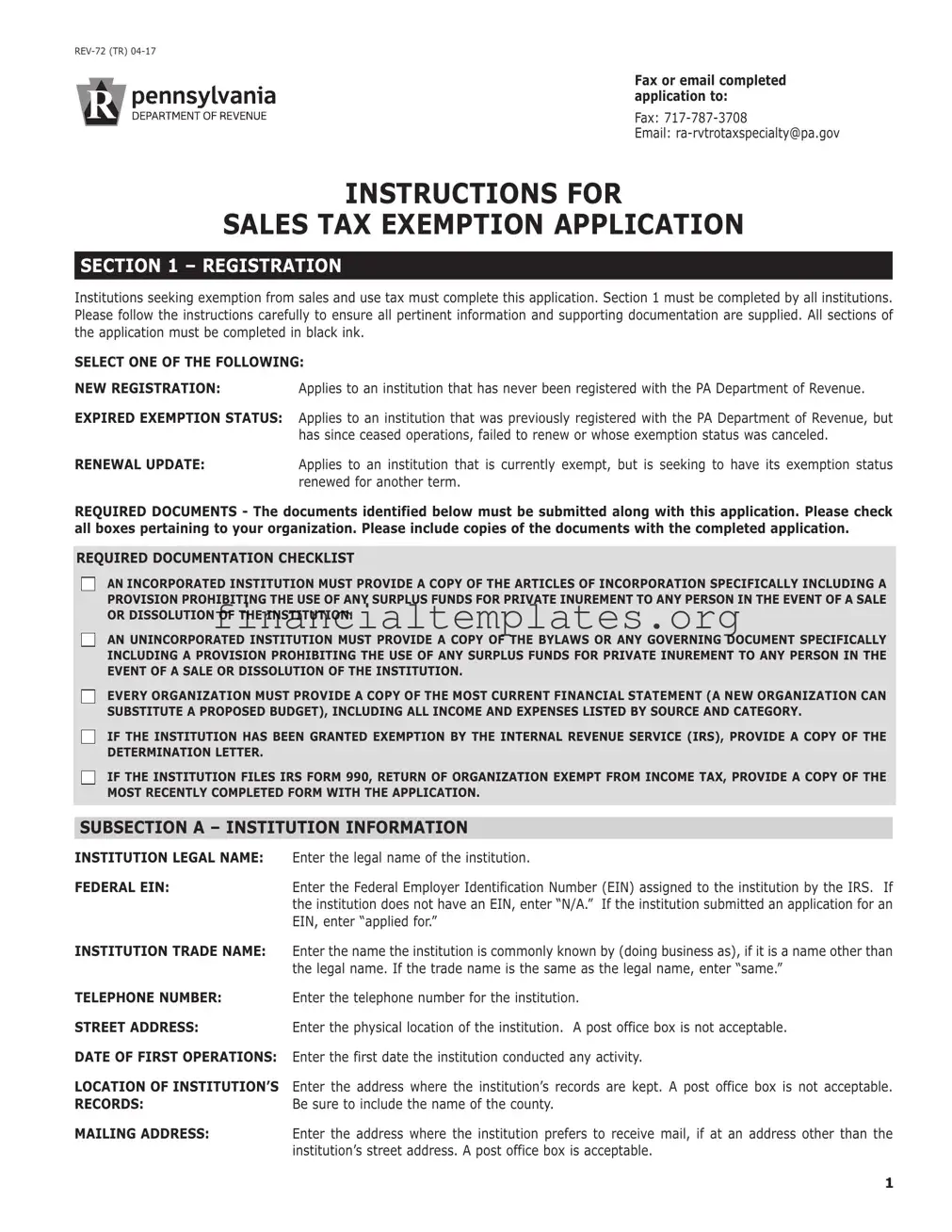

For institutions in Pennsylvania seeking exemption from sales and use tax, understanding and completing the How To Get A PA Tax Exempt Number form, officially known as REV-72 (TR) 04-17, is crucial. This comprehensive form requires institutions to supply detailed information, including their registration status—be it a new registration, renewal update, or an expired exemption status. The form mandates the inclusion of significant documentation, such as articles of incorporation for incorporated institutions, bylaws or governing documents for unincorporated ones, the most current financial statements, and, if applicable, IRS determination letters and Form 990s. Beyond basic organization and officer information, applicants must meticulously report on financial data, the nature of their operations, affiliations, and the specifics of the services provided, including their community impact and policies regarding the provision of services and fee adjustments based on recipients' ability to pay. Furthermore, organizations are obligated to keep the Pennsylvania Department of Revenue informed about any changes that might affect their exemption status, emphasizing the ongoing nature of their compliance obligations. This detailed application process not only demands thorough documentation and an understanding of the institution’s financial and operational overview but also necessitates thoughtful consideration of the institution's role and contributions to the community it serves.

How To Get A Pa Tax Exempt Number Example

Fax or email completed application to:

Fax:

Email:

INSTRUCTIONS FOR

SALES TAX EXEMPTION APPLICATION

SECTION 1 – REGISTRATION

Institutions seeking exemption from sales and use tax must complete this application. Section 1 must be completed by all institutions. Please follow the instructions carefully to ensure all pertinent information and supporting documentation are supplied. All sections of the application must be completed in black ink.

SELECT ONE OF THE FOLLOWING:

NEW REGISTRATION: Applies to an institution that has never been registered with the PA Department of Revenue.

EXPIRED EXEMPTION STATUS: Applies to an institution that was previously registered with the PA Department of Revenue, but has since ceased operations, failed to renew or whose exemption status was canceled.

RENEWAL UPDATE: Applies to an institution that is currently exempt, but is seeking to have its exemption status renewed for another term.

REQUIRED DOCUMENTS - The documents identified below must be submitted along with this application. Please check all boxes pertaining to your organization. Please include copies of the documents with the completed application.

REQUIRED DOCUMENTATION CHECKLIST

AN INCORPORATED INSTITUTION MUST PROVIDE A COPY OF THE ARTICLES OF INCORPORATION SPECIFICALLY INCLUDING A PROVISION PROHIBITING THE USE OF ANY SURPLUS FUNDS FOR PRIVATE INUREMENT TO ANY PERSON IN THE EVENT OF A SALE OR DISSOLUTION OF THE INSTITUTION.

AN UNINCORPORATED INSTITUTION MUST PROVIDE A COPY OF THE BYLAWS OR ANY GOVERNING DOCUMENT SPECIFICALLY INCLUDING A PROVISION PROHIBITING THE USE OF ANY SURPLUS FUNDS FOR PRIVATE INUREMENT TO ANY PERSON IN THE EVENT OF A SALE OR DISSOLUTION OF THE INSTITUTION.

EVERY ORGANIZATION MUST PROVIDE A COPY OF THE MOST CURRENT FINANCIAL STATEMENT (A NEW ORGANIZATION CAN SUBSTITUTE A PROPOSED BUDGET), INCLUDING ALL INCOME AND EXPENSES LISTED BY SOURCE AND CATEGORY.

IF THE INSTITUTION HAS BEEN GRANTED EXEMPTION BY THE INTERNAL REVENUE SERVICE (IRS), PROVIDE A COPY OF THE DETERMINATION LETTER.

IF THE INSTITUTION FILES IRS FORM 990, RETURN OF ORGANIZATION EXEMPT FROM INCOME TAX, PROVIDE A COPY OF THE MOST RECENTLY COMPLETED FORM WITH THE APPLICATION.

SUBSECTION A – INSTITUTION INFORMATION

INSTITUTION LEGAL NAME: |

Enter the legal name of the institution. |

FEDERAL EIN: |

Enter the Federal Employer Identification Number (EIN) assigned to the institution by the IRS. If |

|

the institution does not have an EIN, enter “N/A.” If the institution submitted an application for an |

|

EIN, enter “applied for.” |

INSTITUTION TRADE NAME: |

Enter the name the institution is commonly known by (doing business as), if it is a name other than |

|

the legal name. If the trade name is the same as the legal name, enter “same.” |

TELEPHONE NUMBER: |

Enter the telephone number for the institution. |

STREET ADDRESS: |

Enter the physical location of the institution. A post office box is not acceptable. |

DATE OF FIRST OPERATIONS: |

Enter the first date the institution conducted any activity. |

LOCATION OF INSTITUTION’S |

Enter the address where the institution’s records are kept. A post office box is not acceptable. |

RECORDS: |

Be sure to include the name of the county. |

MAILING ADDRESS: |

Enter the address where the institution prefers to receive mail, if at an address other than the |

|

institution’s street address. A post office box is acceptable. |

1

SUBSECTION B – TYPE OF ORGANIZATION

Check the box or fill in the blank to indicate the type of organization that applies to the institution. Examples would include sole proprietorship, partnership, corporation and association.

Enter the date of incorporation and the state of incorporation. If the institution is not incorporated, enter “N/A.”

Check the box to indicate whether the institution is operated for profit or as a nonprofit organization.

If the institution has applied to and been approved by the IRS as

All institutions are under a mandatory continuing obligation to report to the Pennsylvania Department of Revenue any change in exemption status with the IRS. Institutions are required to report all changes within 10 days in writing to the department. Such changes include but are not limited to a revocation of the exemption status or receiving an individual exemption where the organization was previously covered under a group exemption status.

All institutions are under a mandatory continuing obligation to report to the Pennsylvania Department of Revenue any court decision that may affect the institution’s tax exemption status. The court decision may be within the state of Pennsylvania or any other jurisdiction. Institutions are required to report all changes within 10 days in writing to the department.

All institutions are under a mandatory continuing obligation to report to the Pennsylvania Department of Revenue if the organization is currently being challenged by the IRS, the Commonwealth of Pennsylvania, a political subdivision or any

All correspondence should be sent to: |

Fax: |

|

Email: |

SUBSECTION C – ORGANIZATION INFORMATION

All activities carried on by the institution for a period of three years should be reported. This explanation must contain a detailed description of how the beneficiaries are selected. Additional sheets can be attached to the application, should the response require more room than the space provided. If bylaws or IRS Form 990 explain the organizational purpose in detail, those documents can be used to complete this section. Attach any additional documentation such as brochures or pamphlets that explain the institution’s purpose.

SUBSECTION D – AFFILIATE INFORMATION

In this section indicate whether the institution is affiliated with another organization. Affiliate is defined as a domestic or foreign corporation, association, trust or other organization that owns a 10 percent or greater interest in an institution of purely public charity. This definition also includes situations where an institution of purely public charity owns a 10 percent or greater interest in a domestic or foreign corporation, association, trust or other organization.

Please attach an organizational chart to the application.

For a parent institution to be considered an “other nonprofit entity” for purposes of Act 55, all of its subsidiaries must first qualify as an institution of purely public charity. An organization seeking to qualify as an “other nonprofit entity” is only required to complete Section 1.

2

SUBSECTION E – OFFICER INFORMATION

Enter the requested information for each officer. Additional sheets should be attached if the institution has more than four officers. This section must be completed even if the officers are not paid a salary from the organization. Organizations that complete IRS Form 990 may substitute Part V of the most recently completed return.

ANNUAL COMPENSATION: |

Indicate what each officer receives in the form of compensation from the organization before taxes |

|

and other payroll deductions. |

OTHER BENEFITS AND |

List the benefits each officer receives in addition to salary, and include the value of each benefit. |

AMOUNTS OF EACH: |

Such benefits include but are not limited to health insurance programs, life insurance, expense |

|

accounts and automobile usage. |

SUBSECTION F – SALARY INFORMATION

All organizations must complete this section. Organizations that file IRS Form 990 and complete Schedule A may substitute Schedule A of the most recently completed return.

NAME: |

List the names of the highest paid individuals within the organization, excluding the officers who |

|

were listed in Subsection E. |

POSITION: |

Indicate what positions they hold within the institution, i.e., director, manager. |

SALARY: |

Indicate their current salaries from the organization before taxes and other exclusions. |

OTHER BENEFITS AND |

List the benefits each individual receives in addition to salary, and include the value of each benefit. |

AMOUNTS OF EACH: |

Such benefits include but are not limited to health insurance programs, life insurance, expense |

|

accounts and automobile usage. |

SECTION 2 – FINANCIAL INFORMATION

All institutions must complete Part 1, Basic Questions, and all remaining parts as applicable. Volunteer fire companies and churches are only required to complete Part 1, Basic Questions. Organizations engaging only in fundraising activities should complete Part 1, Basic Questions and Part 4, Fundraising Activities. It is recommended that colleges and universities answer Part 1, Basic Questions as well as Part 2, Recipient Information, Questions 1, 4 and 5 to qualify. All other types of institutions should complete all of the parts as applicable. An institution may answer “NO” or “N/A” to any question that does not pertain to the institution.

An institution may either use the current year’s financial data or average the financial information for the five most recently completed fiscal years. If the institution does average the financial information, all financial statements used in the calculations must be submitted with the application. Institutions electing to average financial data should indicate the years from which they have used the data in the space provided.

PART 1 – BASIC QUESTIONS

LINE 1 – INCOME – List each activity from which the institution receives revenue. This question must be completed by all institutions.

A contribution includes any promise, grant, pledge or gift of money, property, goods, services, financial assistance or other similar remittance. It includes amounts received from individuals, trusts, corporations, estates and foundations, or raised by an outside professional

A

LINE 2 – ExPENSES – List each expense the institution incurs as a result of its charitable activity. Examples include salaries, supplies, equipment costs, postage and handling. All organizations must complete this question. If the institution completes IRS Form 990, the institution should attach a copy of the most recently completed year and may skip this question. The year of the IRS Form 990 must be identical to the year from which the remaining financial data is taken.

3

LINE 3 – A voluntary agreement is an agreement, contract or other arrangement whereby the institution is making contributions to a school district, municipality or county government in lieu of taxes. The term voluntary agreement also includes the establishment of public service foundations by institutions of purely public charity.

If an institution has such an arrangement with local governments, indicate so in the space provided. If an institution has more than one agreement with different taxing jurisdictions, include the total number of agreements. Each agreement must be attached to the application.

LINE 4 – Each person who donates time to the institution should be listed along with the reasonable number of hours per week and the number of weeks per year. The data must be from the same year as the financial data. Alternatively, the institution may list the number of individuals who contribute the same number of hours per week and weeks per year. A listing by names and hours worked should be available for inspection by the department if requested. For example, the institution may have three volunteers who each contribute three hours for 50 weeks and five volunteers who each contribute five hours per week for 26 weeks per year. The entry would appear as follows:

|

NAME OF INDIVIDUAL OR NUMBER OF INDIVIDUALS |

HOURS PER WEEK |

WEEKS PER YEAR |

|

|

|

|

|

|

|

3 |

3 |

50 |

|

5 |

5 |

26 |

|

|

|

|

|

|

|

LINE 5 – A. This figure represents the total number of individuals currently receiving goods or services from the institution. In calculating the number of individuals for purposes of this section, educational institutions may include the number of

B.This figure represents total registered members of the organization.

LINE 6 – This figure represents the number of individuals who are receiving goods or services free. The goods or services provided must be entirely free. Supply any documentation that can support this figure.

LINE 7 – This figure represents the number of individuals who pay a fee that is less than the cost the institution incurs in providing the goods or services. Regardless of the discount given, this figure should represent the total number of individuals who receive a discount. Do not include in the count the number of individuals who do not pay any fee.

LINE 8 – Check YES if any of the people who receive goods or services from the organization pay a fee that is equal to or greater than the cost of the goods or services provided to them.

LINE 9 – This question considers only those individuals who are receiving financial assistance from the institution. List the number of individuals who receive financial assistance, such as scholarships, grants, etc., from the institution.

LINE 10 – List the number who receive financial assistance of more than 10 percent of the cost of goods or services that are provided to them.

Volunteer fire companies and churches should stop here.

PART 2 – RECIPIENT INFORMATION

LINE 1 – This figure represents the percentage of individuals who receive goods or services from the institution who pay a fee that is at least 10 percent lower than the cost of the goods or services they receive. Supply any documentation that can support this figure.

LINE 2 – This figure should represent the cost the institution incurs in providing community services. Supply any documentation that can support this figure.

LINE 3 – This figure should represent the payments the institution receives for providing community services. Supply any documentation that can support this figure.

LINE 4 – This figure should represent the cost the institution incurs in providing education and research programs. Supply any documentation that can support this figure.

4

LINE 5 – This figure should represent the payments the institution receives for providing education and research programs. Supply any documentation that can support this figure.

LINE 6 – (A) The institution must indicate whether it supplies goods or services to individuals with mental retardation or to individuals who need mental health services.

(B)If the individual is mentally retarded or the recipient of mental health services, the institution must indicate whether it supplies an individual’s family or guardian in support of such goods or services.

(C) The institution must indicate whether it provides goods or services to individuals who are deemed dependent, neglected or delinquent children.

If the response to any of the above three questions is YES, then answer the next question. Otherwise, skip to Part 3. Check YES or NO as to whether any of the statutes or regulations apply to the organization.

PART 3 – GOODS OR SERVICES PROVIDED

LINE 1 – This figure is the full cost of providing goods or services for free. The institution cannot have received partial payments or even have attempted to collect payments. This figure is only the amounts the institution donates at 100 percent.

LINE 2 – This figure should include the loss that is incurred by the institution charging less than the full cost of goods or services the institution provides. This figure should not include bad debts or amounts deemed uncollectible. The cost of goods or services should only be those goods or services associated with the institution’s charitable purpose. The cost figure should include only actual cost incurred by the institution.

LINE 3 – The total amount of accounts deemed uncollectible should be included here. Uncollectible amounts are those that the institution has originally charged for, whether it be at full cost or at a discount, but for which the institution has not received payment. This figure is not the allowance for bad debts, or the bad debt expense, nor should it include any opportunity costs. Rather, it is only the actual cost of the goods or services provided for which the institution is unable to collect after reasonable and customary collection efforts have failed. If the institution did receive some payment, but not the full amount charged, include only what was uncollectible here.

LINE 4 – Check YES if the institution has a published, written policy that it provides goods or services to anyone who seeks them regardless of their ability to pay. If the institution does have such a written policy, attach a copy to the application.

LINE 5 – Check YES if the institution has a published, written policy that it provides goods or services to people based upon their ability to pay. If the institution does have such a written policy, attach a copy to the application.

LINE 6 – Check YES if the institution has a written fee schedule that outlines how much an individual will pay based upon their income level. A copy of the fee schedule must be enclosed with the application.

LINE 7 – If the goods that the individuals receive at no fee or at a reduced fee are of comparable quality and quantity to the goods or services offered at a higher cost, check YES.

LINE 8 – The institution should calculate the cost of providing goods or services only to those individuals who are recipients of government programs. The government programs include, among other things, Medicare and Medicaid. Supply any documentation that can support this figure.

LINE 9 – If the institution provides goods or services for free or at a reduced rate to government agencies or individuals eligible for government programs, check YES.

LINE 10 – If the institution provides goods or services to individuals who are eligible for government programs, check YES.

LINE 11 – This figure represents the cost of providing goods or services to individuals for whom the institution receives

5

LINE 12 – Check YES if the institution is licensed by the Department of Health or the Department of Public Welfare.

Attach a list showing the reasonable amount that the institution receives or donates to other charitable organizations in the form of contributions. The lists should be broken out according to each organization and the amount donated or received from each. Supply any documentation that can support this figure.

PART 4 – FUNDRAISING ACTIVITIES

LINE 1 – This question asks whether the institution operates to fund raise on behalf of or supply grants to another organization. This other organization must be an institution of purely public charity, an entity similarly recognized by another state or foreign jurisdiction, a qualifying religious organization or a government agency. The institution must make an actual contribution of a substantial portion of the funds it raises to the organization. A listing of the organizations who receive the contributions and the amount donated to each organization must accompany the application.

SUBSECTION D – AUTHORIZED SIGNATURE

SIGNATURE OF |

The application must be signed by a corporate officer who is responsible for the information |

CORPORATE OFFICER: |

provided. Enter the title of the person who signed the form. If not incorporated, the application should |

|

be signed by a responsible party. |

TYPE OR PRINT NAME: |

Type or print name of the person who signed, the date the form was signed and a daytime telephone |

|

number. |

PREPARER’S NAME: |

Type or print name of the preparer, the date, the preparer’s daytime telephone number and title. |

|

|

FAX OR EMAIL COMPLETED |

|

APPLICATION TO: |

Fax: |

|

Email: |

6

APPLICATION FOR

SALES TAX EXEMPTION

(Must be completed in black ink.)

SECTION 1 – REGISTRATION

ExEMPTION NUMBER: DATE OF ACTION: DENIAL REASON: EVALUATOR:

INSTITUTIONS SEEKING ExEMPTION FROM SALES AND USE TAx MUST COMPLETE THIS APPLICATION. PLEASE FOLLOW THE INSTRUCTIONS CAREFULLY TO ENSURE ALL PERTINENT INFORMATION AND SUPPORTING DOCUMENTATION ARE SUPPLIED.

CHECK THE APPROPRIATE BOx TO INDICATE THE REASON FOR THIS REGISTRATION.

o NEW REGISTRATION |

o ExPIRED ExEMPTION STATUS |

REQUIRED DOCUMENTATION CHECKLIST

oRENEWAL UPDATE

AN INCORPORATED INSTITUTION MUST PROVIDE A COPY OF THE ARTICLES OF INCORPORATION SPECIFICALLY INCLUDING A PROVISION PROHIBITING THE USE OF ANY SURPLUS FUNDS FOR PRIVATE INUREMENT TO ANY PERSON IN THE EVENT OF A SALE OR DISSOLUTION OF THE INSTITUTION.

AN UNINCORPORATED INSTITUTION MUST PROVIDE A COPY OF THE BYLAWS OR ANY GOVERNING DOCUMENT SPECIFICALLY INCLUDING A PROVISION PROHIBITING THE USE OF ANY SURPLUS FUNDS FOR PRIVATE INUREMENT TO ANY PERSON IN THE EVENT OF A SALE OR DISSOLUTION OF THE INSTITUTION.

EVERY ORGANIZATION MUST PROVIDE A COPY OF THE MOST CURRENT FINANCIAL STATEMENT (A NEW ORGANIZATION CAN SUBSTITUTE A PROPOSED BUDGET), INCLUDING ALL INCOME AND EXPENSES LISTED BY SOURCE AND CATEGORY.

IF THE INSTITUTION HAS BEEN GRANTED EXEMPTION BY THE INTERNAL REVENUE SERVICE (IRS), PROVIDE A COPY OF THE DETERMINATION LETTER.

IF THE INSTITUTION FILES FORM 990, PROVIDE A COPY OF THE MOST RECENTLY COMPLETED FORM WITH THE APPLICATION.

SUBSECTION A – INSTITUTION INFORMATION

INSTITUTION LEGAL NAME |

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER (EIN) * |

|

|

|

|

|

INSTITUTION TRADE NAME (IF DIFFERENT THAN LEGAL NAME) |

|

INSTITUTION TELEPHONE NUMBER |

|

|

|

|

|

INSTITUTION STREET ADDRESS (do not use PO box) |

|

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

DATE OF FIRST OPERATIONS |

|

|

|

|

LOCATION OF INSTITUTION RECORDS (street address) |

|

CITY |

|

|

|

|

|

COUNTY |

|

STATE |

ZIP CODE |

|

|

|

|

INSTITUTION MAILING ADDRESS (if different than street address) |

CITY |

STATE |

ZIP CODE |

* An organization granted 501(c)3 tax exemption status by the U.S. government should supply its federal EIN.

SUBSECTION B – TYPE OF ORGANIZATION

CHECK THE APPROPRIATE BOx: |

o CORPORATION |

|

o ASSOCIATION |

o OTHER |

|

|||

DATE OF INCORPORATION |

|

STATE OF INCORPORATION |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

IS THE INSTITUTION ORGANIZED FOR PROFIT OR NONPROFIT? |

o PROFIT |

o NONPROFIT |

|

|||||

IF THE INSTITUTION QUALIFIES AS ExEMPT FROM TAxATION THROUGH THE INTERNAL |

|

|

|

|||||

REVENUE SERVICE, INDICATE UNDER WHICH SECTION THE ORGANIZATION QUALIFIES: |

501(C)(____________________) |

|||||||

IF THE INSTITUTION HAS PREVIOUSLY BEEN GRANTED |

|

o YES |

o NO |

|||||

INTERNAL REVENUE SERVICE, HAS THAT STATUS CHANGED WITHIN THE PAST FIVE YEARS? |

|

|

|

|||||

HAS THERE BEEN A COURT DECISION IN PENNSYLVANIA OR ANY OTHER JURISDICTION THAT AFFECTS THE INSTITUTION’S LOCAL OR STATE TAx ExEMPTION WITHIN THE PAST FIVE YEARS?

IS THE

o YES |

o NO |

o YES |

o NO |

7

APPLICATION FOR

SALES TAX EXEMPTION

SUBSECTION C – ORGANIZATION INFORMATION

PROVIDE A DETAILED DESCRIPTION OF THE PAST, PRESENT AND PLANNED FUTURE ACTIVITIES OF THE INSTITUTION FOR A PERIOD OF THREE YEARS. INCLUDE A DESCRIPTION OF HOW BENEFICIARIES ARE SELECTED.

SUBSECTION D – AFFILIATE INFORMATION

ARE YOU A NONPROFIT PARENT CORPORATION THAT ELECTS TO BE CONSIDERED AS A SINGLE INSTITUTION IN CONJUNCTION WITH YOUR SUBSIDIARY, WHICH IS AN INSTITUTION OF PURELY PUBLIC CHARITY?

ARE YOU AFFILIATED WITH ANOTHER ORGANIZATION?

o o

YES

YES

o o

NO

NO

LIST EACH AFFILIATE, ITS ADDRESS, THE DATE OF AFFILIATION/SUBSIDIARY, PERCENT OF OWNERSHIP IN EACH, THE TYPE OF INSTITUTION, THE RELATIONSHIP AND WHETHER IT IS ORGANIZED AS A

NAME OF AFFILIATE |

FEDERAL EIN |

PERCENT OF OWNERSHIP |

|

|

|

ADDRESS |

|

DATE OF AFFILIATION |

|

|

|

TYPE OF ORGANIZATION |

RELATIONSHIP |

PROFIT OR NONPROFIT |

|

|

|

NAME OF AFFILIATE |

FEDERAL EIN |

PERCENT OF OWNERSHIP |

|

|

|

ADDRESS |

|

DATE OF AFFILIATION |

|

|

|

TYPE OF ORGANIZATION |

RELATIONSHIP |

PROFIT OR NONPROFIT |

|

|

|

SUBSECTION E – OFFICER INFORMATION

THIS SECTION MUST BE COMPLETED IN FULL BY EVERY INSTITUTION, EVEN IF THE INSTITUTION DOES NOT COMPENSATE ITS OFFICERS. THE ANNUAL COMPENSATION SHOULD INCLUDE THE OFFICER’S SALARY FROM THE INSTITUTION, CONTRIBUTIONS MADE ON THE OFFICER’S BEHALF TO EMPLOYEE BENEFIT PROGRAMS AND DEFERRED COMPENSATION, EXPENSE ACCOUNT AND ANY OTHER FORM OF COMPENSATION. ATTACH ADDITIONAL SHEETS IF NECESSARY. IRS FORM 990 MAY BE SUBSTITUTED.

LAST NAME |

FIRST NAME |

TITLE |

ANNUAL COMPENSATION |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

TITLE |

ANNUAL COMPENSATION |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

TITLE |

ANNUAL COMPENSATION |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

TITLE |

ANNUAL COMPENSATION |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

8

APPLICATION FOR

SALES TAX EXEMPTION

SUBSECTION F – SALARY INFORMATION All organizations must complete this information.

IS COMPENSATION BASED IN ANY WAY ON THE FINANCIAL PERFORMANCE OF THE INSTITUTION? IF YES, PLEASE ExPLAIN ON A SEPARATE SHEET AND ATTACH IT TO THE APPLICATION.

DOES THE ORGANIZATION APPLY ALL REVENUE, LESS ExPENSES, FOR THE FURTHERANCE OF ITS CHARITABLE PURPOSE?

DO ANY OF THE INSTITUTION’S NET EARNINGS OR DONATIONS THAT IT RECEIVES INURE TO THE BENEFIT OF PRIVATE SHAREHOLDERS OR INDIVIDUALS?

o YES |

o NO |

o YES |

o NO |

o YES |

o NO |

LIST POSITION, SALARY AND OTHER COMPENSATION, INCLUDING BENEFITS, OF THE FOUR HIGHEST PAID INDIVIDUALS. DO NOT REPEAT THOSE OFFICERS LISTED IN SUBSECTION E (OFFICER INFORMATION). INDICATE IN THE SPACE ALLOTTED BELOW A STATE- MENT INDICATING THE BASIS OF COMPENSATION. IF THE INSTITUTION IS COMPRISED ONLY OF VOLUNTEERS, SKIP THIS SECTION BY WRITING “NOT APPLICABLE”. IF SCHEDULE A IS COMPLETED, IRS FORM 990 SCHEDULE A MAY BE SUBSTITUTED.

LAST NAME |

FIRST NAME |

POSITION |

SALARY |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

POSITION |

SALARY |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

POSITION |

SALARY |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

POSITION |

SALARY |

|

|

|

|

OTHER BENEFITS AND AMOUNTS OF EACH |

|

|

|

SECTION 2 – FINANCIAL DATA

PLEASE REFER TO THE INSTRUCTIONS BEFORE COMPLETING THIS SECTION.

INDICATE THE YEAR FROM WHICH FINANCIAL DATA WAS USED:

PART 1 – BASIC QUESTIONS

(1)INCOME – LIST ALL OF THE SOURCES OF INCOME, INCLUDING CONTRIBUTIONS, RECEIVED AS PART OF THE INSTITUTION’S CHARITABLE PURPOSE. ExAMPLE CATEGORIES ARE LISTED. ADDITIONAL SOURCES SHOULD BE LISTED AND IDENTIFIED UNDER “OTHER”. ATTACH ADDITIONAL SHEETS IF NECESSARY.

ACTIVITY |

DOLLAR AMOUNT |

CONTRIBUTIONS & DONATIONS |

|

FEES RECEIVED FOR GOODS OR SERVICES |

|

|

|

|

|

|

|

GOVERNMENT SUPPORT (ie. GRANTS, FUNDING, etc.) |

|

|

|

OTHER, LIST: |

|

TOTAL REVENUE |

|

(INCLUDING AMOUNTS LISTED |

$0.00 |

ON SEPARATE SHEETS) |

9

APPLICATION FOR

SALES TAX EXEMPTION

(2)ExPENSES – LIST THE ExPENSES DIRECTLY RELATED TO THE INSTITUTION’S CHARITABLE PURPOSE AND THEIR RESPECTIVE AMOUNTS. ATTACH ADDITIONAL SHEETS TO THE APPLICATION. (NOTE: ANY ExPENSES NOT INCLUDED IN THIS SECTION MAY BE SUBJECT TO SALES OR USE TAx.) IRS FORM 990 MAY BE SUBSTITUTED.

ACTIVITY |

DOLLAR AMOUNT |

|

|

|

|

|

|

|

|

TOTAL EXPENSES

(INCLUDING AMOUNTS LISTED |

|

$0.00 |

|

ON SEPARATE SHEETS) |

|

|

|

(3) DOES THE INSTITUTION HAVE A VOLUNTARY AGREEMENT (i.e. PILOT, SILOT, etc.) WITH A |

|

|

|

POLITICAL SUBDIVISION? ATTACH A COPY OF EACH AGREEMENT WITH THE APPLICATION. |

o YES |

o NO |

|

(4)VOLUNTEERS – THE INSTITUTION MAY ELECT TO LIST THE NAME OF EACH VOLUNTEER, ALONG WITH THE NUMBER OF HOURS WORKED EACH WEEK AND THE NUMBER OF WEEKS VOLUNTEERED FOR THE YEAR. ALTERNATIVELY, THE INSTITUTION MAY BREAK OUT THE LIST ACCORDING TO THE NUMBER OF VOLUNTEERS WHO CONTRIBUTE THE SAME NUMBER OF HOURS EACH WEEK AND WEEKS EACH YEAR. A LISTING BY NAMES AND HOURS WORKED SHOULD BE AVAILABLE FOR INSPECTION BY THE DEPARTMENT IF REQUESTED. ATTACH ADDITIONAL SHEETS AS NEEDED.

YEAR FROM WHICH VOLUNTEER DATA WAS GATHERED:

NAME OF INDIVIDUAL OR NUMBER OF INDIVIDUALS |

HOURS PER WEEK |

WEEKS PER YEAR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5)A. HOW MANY PEOPLE RECEIVE GOODS OR SERVICES FROM THE INSTITUTION? B. HOW MANY REGISTERED MEMBERS ARE IN YOUR ORGANIZATION/CHURCH?

(6)HOW MANY PEOPLE RECEIVE THE GOODS OR SERVICES FOR FREE?

(7)HOW MANY PEOPLE PAY A REDUCED FEE FOR THE GOODS OR SERVICES?

(8)DO ANY OF THE PEOPLE RECEIVING GOODS OR SERVICES PAY A FEE EQUAL TO OR GREATER THAN THE COST OF THE GOODS OR SERVICES PROVIDED TO THEM?

(9)WHAT NUMBER OF INDIVIDUALS RECEIVE FINANCIAL ASSISTANCE FROM THE INSTITUTION?

(10)AFTER SUBTRACTING THE FINANCIAL ASSISTANCE GRANTED BY THE INSTITUTION, HOW MANY INDIVIDUALS PAID A FEE 90 PERCENT OR LESS OF THE COST OF THE GOODS OR SERVICES PROVIDED TO THEM?

o YES o NO

Volunteer fire companies and churches should stop here and turn to Page 12 to complete the authorized signature.

PART 2 – RECIPIENT INFORMATION

(1)WHAT PERCENTAGE OF INDIVIDUALS RECEIVING GOODS OR SERVICES FROM THE INSTITUTION RECEIVE A REDUCTION IN FEES OF AT LEAST 10 PERCENT OF THE COST OF THE GOODS OR SERVICES PROVIDED TO THEM?

(2)WHAT IS THE COST OF PROVIDING COMMUNITY SERVICES PROVIDED BY OR PARTICIPATED IN BY THE INSTITUTION? ATTACH A COPY OF SUPPORTING DOCUMENTATION TO

THE APPLICATION.

(3)WHAT AMOUNT DOES THE INSTITUTION RECEIVE AS PAYMENTS TO SUPPORT SUCH COMMUNITY SERVICES? ATTACH A COPY OF SUPPORTING DOCUMENTATION TO THE APPLICATION.

10

Document Specifics

| Fact Name | Detail |

|---|---|

| Application Identifier | REV-72 (TR) 04-17 |

| Application Submission | Fax: 717-787-3708, Email: ra-rvtrotaxspecialty@pa.gov |

| Purpose of Application | To seek exemption from sales and use tax for institutions. |

| Eligibility Categories | New registration, expired exemption status, renewal update. |

| Required Documents | Articles of Incorporation or governing documents for incorporated/independent institutions, most current financial statement or proposed budget, IRS exemption determination letter, recently completed IRS Form 990. |

| Mandatory Reporting | Institutions must immediately notify the PA Department of Revenue of any change in exemption status or relevant court decisions. |

| Section Details | Includes sections on registration, type of organization, organization and officer information, salary details, and financial information with detailed questions on income, expenses, voluntary agreements, volunteer contributions, and beneficiary counts. |

| Governing Law | Pennsylvania state law and Pennsylvania Department of Revenue regulations. |

Guide to Writing How To Get A Pa Tax Exempt Number

Gaining a PA Tax Exempt Number is a fundamental step for institutions looking to secure exemption from sales and use tax in Pennsylvania. To ensure a smooth and efficient application process, it's important to follow the guidelines carefully and provide all required documentation as specified in the application instructions. The steps listed below outline the procedure to complete the application form accurately. Immediate attention to detail and prompt submission of the application will facilitate a quicker review period, moving one step closer to obtaining the tax exemption status.

- First, determine the status of your registration by selecting "NEW REGISTRATION," "EXPIRED EXEMPTION STATUS," or "RENEWAL UPDATE" in SECTION 1 of the application form.

- Prepare and include all required documents listed in the REQUIRED DOCUMENTATION CHECKLIST. Check off each document type as you add it to your application packet.

- In the INSTITUTION INFORMATION subsection, accurately fill in your institution's legal name, Federal EIN, trade name (if applicable), telephone number, street address, date of first operations, location where the institution's records are kept, and mailing address.

- Under the TYPE OF ORGANIZATION section, indicate your institution's structure (e.g., sole proprietorship, partnership, corporation) and provide the date of incorporation and state of incorporation if applicable. Specify if operated for profit or as a nonprofit, and if tax-exempt, under which section of the Internal Revenue Code your institution qualifies.

- In the ORGANIZATION INFORMATION segment, describe all activities carried out by your institution over the past three years, how beneficiaries are selected, and attach any additional documentation that supports your organization's purpose.

- For AFFILIATE INFORMATION, indicate any affiliations and attach an organizational chart if necessary.

- Provide detailed OFFICER INFORMATION, including annual compensation and other benefits, for each officer. Use additional sheets if the institution has more than four officers.

- Complete the SALARY INFORMATION section for the highest paid individuals within the organization, excluding officers already listed, detailing their salaries and additional benefits.

- In SECTION 2, respond to all pertinent parts regarding financial information. This includes detailing your institution's income and expenses, voluntary agreements with local governments, volunteer contributions, and specifics about goods or services provided.

- Lastly, submit the complete application package, including all required documentation, via fax to 717-787-3708 or email at ra-rvtrotaxspecialty@pa.gov.

By meticulously following these steps and providing comprehensive and accurate information, your institution can efficiently navigate the process of applying for a PA Tax Exempt Number. Remember to report any changes in your institution's status, as outlined in the form, to maintain compliance and ensure uninterrupted tax-exempt status.

Understanding How To Get A Pa Tax Exempt Number

Who needs to complete the PA Tax Exempt Number form?

Institutions seeking exemption from sales and use tax in Pennsylvania must complete this form. This includes any institution not currently registered with the PA Department of Revenue, those with an expired exemption status, and currently exempt institutions seeking renewal of their exemption status.

What supporting documents are required for the application?

- A copy of the Articles of Incorporation for incorporated institutions, including a provision against private inurement.

- The bylaws or governing documents for unincorporated institutions, with provisions against private inurement.

- The most current financial statement or a proposed budget for new organizations.

- A copy of the IRS determination letter if the institution is granted exemption by the IRS.

- The most recently completed IRS Form 990 if the institution files this form.

Several documents are necessary:

Where should the completed application be sent?

Completed applications should be faxed to 717-787-3708 or emailed to ra-rvtrotaxspecialty@pa.gov. Ensure all sections are completed and required documents attached before submitting.

How is institution information filled out in the application?

In subsection A, you must enter the institution's legal name, Federal EIN, trade name if applicable, telephone number, street address, date of first operations, location of records, and mailing address. A post office box is not acceptable for the street address or the location of the institution's records.

What type of organization information is required?

In subsection B, you'll need to indicate the type of organization (e.g., sole proprietorship, partnership, corporation), the date of incorporation, and the state of incorporation if applicable. Also, confirm if it is operated for profit, as a nonprofit, and if it's been approved by the IRS as tax-exempt, including under which section of the Internal Revenue Code it qualifies.

How should financial information be reported on the form?

All institutions must complete Part 1, Basic Questions, and other parts as applicable based on organization type. Information on income, expenses, voluntary agreements, volunteer contributions, and beneficiary details must be filled out comprehensively. For some questions, institutions may use either current year's data or an average from the last five fiscal years.

What happens if the institution's tax exemption status changes?

Institutions are under a continuing obligation to report any changes in their exemption status to the PA Department of Revenue within 10 days in writing. Changes may include revocation of the exemption status, receiving an individual exemption, or any court decision affecting the tax exemption status, among others.

Common mistakes

When applying for a Pennsylvania (PA) Tax Exempt Number using the REV-72 (TR) 04-17 form, applicants often make several common mistakes. Ensuring accuracy in your application is crucial for a successful exemption request. Here are seven key mistakes to avoid:

- Failing to complete all required sections in black ink. Each part of the application must be filled out meticulously, using only black ink. Overlooking this detail can lead to unnecessary delays.

- Incorrectly choosing the registration type. It is vital to correctly identify whether you are applying for a new registration, renewing an existing exemption, or updating an expired exemption status to ensure your application is processed correctly.

- Not providing all required documents. Pay close attention to the checklist provided in the instructions and include every necessary piece of documentation, such as Articles of Incorporation for incorporated institutions or the latest financial statements.

- Entering incomplete or inaccurate institution information. Ensure that the legal name, Federal EIN, and all other institution details are accurately and completely filled out. Any discrepancies can cause delays.

- Omitting Affiliate Information or Officer Information. Even if the officers are not paid, their details must be included. Similarly, details about any affiliated organizations must be accurately reported.

- Misreporting Financial Information. Whether averaging financial data over five years or reporting for the current year, accuracy is key. Failing to attach financial statements or incorrectly reporting income and expenses can negatively impact your application.

- Not adhering to the continuing obligation of reporting status changes. Remember, it's mandatory to report any changes in exemption status with the IRS or any legal challenges promptly within 10 days. Failing to do so could jeopardize your tax-exempt status.

Addressing these common pitfalls head-on will streamline the application process and improve the likelihood of securing your tax exemption status smoothly and efficiently.

Documents used along the form

When organizations are navigating the process of obtaining a Pennsylvania (PA) Tax Exempt Number through the REV-72 (TR) form, several other documents and forms often come into play throughout this undertaking. These additional documents are pivotal in establishing an institution’s eligibility for tax exemption, providing a comprehensive view of the entity's financial and operational standing. Below is an overview of seven key documents and forms frequently used alongside the REV-72 (TR) form.

- Articles of Incorporation: These are required for incorporated institutions, detailing the entity's purpose, location, duration, and the names of its initial directors. This document establishes the legal existence of the organization.

- Bylaws or Governing Documents: Essential for both incorporated and unincorporated institutions, bylaws or other governing documents outline the organizational structure, decision-making procedures, and operational guidelines, ensuring compliance with internal and external standards.

- Financial Statements: Current financial statements or a proposed budget for new organizations offer insights into the financial health and operational sustainability of the institution, including income sources and expense allocations.

- IRS Determination Letter: This letter is proof that the institution has been recognized by the IRS as exempt from federal income tax. It solidifies the organization’s status and is crucial for state-level exemptions.

- IRS Form 990: An annual reporting return that federally tax-exempt organizations must file with the IRS. It provides information on the organization's mission, programs, and finances.

- Organizational Chart: Required when there are affiliations with other organizations. This chart visually represents the structure of the institution, illustrating relationships and hierarchies within the entity.

- Voluntary Agreements: Documents detailing any contributions or services provided to local governments in lieu of taxes. These agreements reflect the institution’s commitment to community support and public service.

Together, these documents play a critical role in the application process for a PA Tax Exempt Number. Each piece of documentation serves to verify the legitimacy, operational integrity, and public benefit of the organization seeking tax exemption. The collective submission of these documents, alongside the REV-72 (TR) form, ensures a thorough review and aids in the successful acquisition of tax-exempt status.

Similar forms

The form known as the Application for Employer Identification Number (EIN), officially titled "Form SS-4," shares similarities with the "How To Get A Pa Tax Exempt Number form" because both involve the process of registration with government authorities for financial identification purposes. While the EIN form is used by entities to obtain a unique nine-digit number issued by the IRS for tax administration, the PA Tax Exempt form is specifically for institutions seeking exemption from sales and use tax in Pennsylvania. Both forms require detailed information about the organization, such as legal name, address, and type of organization, and mandate the institution's reporting obligations to the respective tax authority.

The "501(c)(3) Application," or IRS Form 1023, bears resemblance to the PA tax exemption application as they both aim to establish an organization’s tax-exempt status. Form 1023 is used by organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code, whereas the PA form is focused on exemption from state sales and use taxes. Each form demands comprehensive details about the organization's structure, financial data, governing documents, and the nature of activities performed, to assess eligibility for tax-exempt status.

Form 990, titled "Return of Organization Exempt from Income Tax," parallels the PA Tax Exempt Number form in its requirement for detailed financial information from organizations. While Form 990 is an annual return filed by exempt organizations to the IRS providing income, expenses, and activity disclosures, the PA Tax Exempt form serves as an application for exemption from state sales and use taxes, requiring similar financial disclosures to validate the nonprofit's operations and financial standing within the context of state tax law.

The "Articles of Incorporation" document, necessary for the establishment of a corporation's legal existence, shares elements with the PA Tax Exempt Number form, particularly in the context of providing foundational governance information. Entities must submit their Articles of Incorporation to prove their formal structure and stipulations regarding asset distribution upon dissolution, as required by the PA form. This document establishes a corporation's legal identity, critical for both the formation of the entity and its pursuit of tax-exempt status, emphasizing the legal basis for operation and compliance with tax laws.

The Uniform Commercial Code (UCC) financing statement can be considered akin to the PA Tax Exempt Number form because both involve declarations to government bodies that affect financial operations and obligations. The UCC filing publicly discloses a secured interest in assets or collateral, whereas the PA Tax Exempt form announces an organization's claim and substantiation for tax exemption. Although serving different purposes, both are procedural necessities for entities to delineate their financial standings and operational authorities.

An Incorporation Bylaws document, detailing the rules and guidelines for the governance of an organization, complements the information required on the PA Tax Exempt Number form regarding institutional organization and purpose. Bylaws define roles, responsibilities, and the procedural framework within which organizations operate, a prerequisite for the PA application's inquiry into the entity’s operational blueprint, ensuring adherence to state law requirements for tax exemption eligibility.

The Statement of Financial Activities, akin to a nonprofit's income statement, parallels the financial information demands of the PA Tax Exempt Number form. This statement offers a comprehensive overview of an organization's revenues, expenses, and changes in net assets, correlating to the PA form’s requirement for detailed financial data to substantiate the application for tax exemption. Both documents essentially serve to disclose financial health and operational integrity, albeit for different regulatory review processes.

Dos and Don'ts

When filling out the "How To Get A Pa Tax Exempt Number" form, certain practices can ensure a smoother application process. Adhering to these guidelines can significantly increase the chances of your application being processed efficiently and successfully.

Do:

- Complete all sections in black ink: This ensures that the information is legible and can be processed without any delays.

- Provide all required documentation: Check the documentation checklist carefully and include copies of the necessary documents to prevent any hold-ups in the processing of your application.

- Enter accurate institution information: Double-check the legal name, Federal EIN, and other institution details to avoid confusion or misidentification.

- Indicate the type of organization accurately: Whether it's a new registration, an expired exemption status, or a renewal update, make sure to specify this correctly for appropriate processing.

- Include additional sheets if needed: If the space provided is insufficient for a detailed explanation of your institution's activities or officer information, attach extra pages.

Don't:

- Use a post office box for the physical location: Always provide an actual street address for the institution to meet the requirements of the application.

- Leave sections incomplete: Even if an item does not apply, fill it in with "N/A" or "none" to indicate that it has not been overlooked.

- Forget to indicate your exemption status with the IRS: Whether you're exempt or not, this information is crucial and aids in the decision-making process.

- Fail to report changes: Keep in mind the obligation to inform the PA Department of Revenue about any changes in your institution's status within 10 days.

- Submit without reviewing: Always double-check your application for completeness and accuracy before submitting to avoid delays or denials based on errors.

Misconceptions

When navigating the process of obtaining a Pennsylvania (PA) Tax Exempt Number, misconceptions can easily arise due to the complex nature of tax exemption regulations. Highlighting and correcting these misconceptions is crucial for institutions seeking tax-exempt status.

Only nonprofits can apply: A common misconception is that only 501(c)(3) organizations qualify. In reality, various types of organizations, including incorporated and unincorporated institutions, may be eligible as long as they meet the specific criteria set by the Pennsylvania Department of Revenue.

Email submission is always faster: While emailing the form to ra-rvtrotaxspecialty@pa.gov is an option, the processing time may not necessarily be quicker due to the volume of applications and the review process.

Post Office boxes are always acceptable: For the institution's physical location and record-keeping address, a Post Office box is not acceptable. This ensures the Department of Revenue can verify the institution's physical presence.

An EIN is optional: Every institution applying must provide their Federal Employer Identification Number (EIN). If an institution doesn't have an EIN, it must indicate "N/A" or "applied for," highlighting the importance of this federal identification.

Financial statements are not crucial: Submitting the most current financial statement or a proposed budget for new organizations is a requisite. This documentation is vital for assessing an institution's financial health and compliance with prohibiting private inurement.

No need to report changes in status: Institutions are under a mandatory continuing obligation to report any change in their exemption status or any relevant court decisions affecting their status to the Pennsylvania Department of Revenue within 10 days.

IRS exemption automatically qualifies for state exemption: While having an IRS exemption determination letter is beneficial, institutions must still apply and qualify for state-level exemption in Pennsylvania, as these processes are separate.

All parts of the application must be filled out by all organizations: The required sections of the application form vary depending on the organization's type and activities. For example, volunteer fire companies and churches have a shortened requirement list.

There’s no need to outline organizational activities: Institutions must provide a detailed description of their activities and how beneficiaries are chosen. This information is crucial for determining whether the institution's operations align with tax-exempt purposes.

Information on officers and salaries is optional: Providing details about officers, including their compensation and benefits, is mandatory. This transparency ensures compliance with regulations against private inurement.

Clarifying these misconceptions is essential for a smooth application process. Institutions seeking a PA Tax Exempt Number should thoroughly review the instructions and requirements outlined in the application form to ensure compliance and improve their chances of obtaining tax-exempt status.

Key takeaways

Filling out and using the "How To Get A PA Tax Exempt Number" form can be a straightforward process if approached methodically. Here are key takeaways to guide institutions through this essential task.

- Ensure that all sections of the application are completed meticulously in black ink. This requirement is not just about readability but adhering strictly to the Pennsylvania Department of Revenue's guidelines.

- Identify the nature of the registration being sought: whether it is a New Registration, Expired Exemption Status, or a Renewal Update. Each category has specific implications and requirements.

- Required documents vary depending on whether the institution is incorporated or unincorporated. Incorporate entities must supply a copy of the Articles of Incorporation, while unincorporated entities should provide their bylaws or equivalent governing documents.

- Submitting the most recent financial statement or a proposed budget (for new organizations) is crucial. This documentation should include all income and expenses, categorized by source.

- If the IRS has granted exemption to the institution, including a copy of the determination letter with the application is essential, as is the most recently completed IRS Form 990, if applicable.

- Accurate and complete details under Subsection A – Institution Information – are crucial for processing. This includes the legal name, EIN, trade name, and contact information.

- The type of organization and its operational status (for-profit or nonprofit) must be clearly indicated, as should any existing tax exemption status recognized by the IRS, under Subsection B.

- All institutions bear a continual responsibility to report any changes in their exemption status or any relevant court decisions to the Pennsylvania Department of Revenue within 10 days.

- The organization’s purpose, activities, officer, and affiliate information need thorough documentation. Providing detailed descriptions and attaching additional sheets or relevant documents like brochures will be beneficial.

- Salaries, benefits, and the scale of operation including the number of people served, the financial metrics of services provided, and specifics about goods or services aid should be clearly listed to comply with the Department's requirements.

Compliance with every detailed instruction and the provision of accurate, comprehensive information will aid in the smooth processing of an application. The goal of obtaining a PA Tax Exempt Number is not only about achieving tax exemption status but also about affirming the institution’s commitment to transparency and accountability. Remember, timely communication with the Pennsylvania Department of Revenue, especially concerning any changes in the institution’s status or operation, is pivotal for maintaining good standing and ensuring the continued benefit of tax exemption.

Popular PDF Documents

Dlstfd - Information on loan deferment, forbearance, and grace periods is provided, outlining options available during financial hardship.

3rd Party Designee - The form enables taxpayers to appoint a representative for interactions with the tax authorities.