Get Hotel Tax Exemption Missouri Form

Understanding the Texas Hotel Occupancy Tax Exemption Certificate, designated as Form 12-302, is crucial for those who wish to claim exemptions from hotel tax under specific conditions outlined by the state of Texas. This comprehensive document serves as a gateway for individuals associated with various exempt entities, including religious, charitable, educational, and governmental organizations, to avoid hotel tax charges during their stays for official business. To claim such an exemption, it's necessary for the hotel guest to provide a completed certificate, alongside verification of their affiliation with the exempt entity, such as a photo ID or a business card. The form outlines several exemption categories, each with its particular requirements and limitations. These range from United States Federal Agencies and Foreign Diplomats to specific provisions for Texas State Government Officials, Charitable Entities, and Educational as well as Religious Organizations, each subject to state but not necessarily to local hotel tax exemptions. Additionally, a notable inclusion is the Permanent Resident Exemption for guests staying 30 consecutive days or more, offering a unique tax relief pathway. Hotels are instructed to retain all records, including completed exemption certificates, for four years, emphasizing the importance of documentation in this process. Through detailed outlines and explicit conditions, Form 12-302 embodies a critical tool for eligible individuals and entities aiming to navigate the intricacies of tax exemption during hotel stays in Texas.

Hotel Tax Exemption Missouri Example

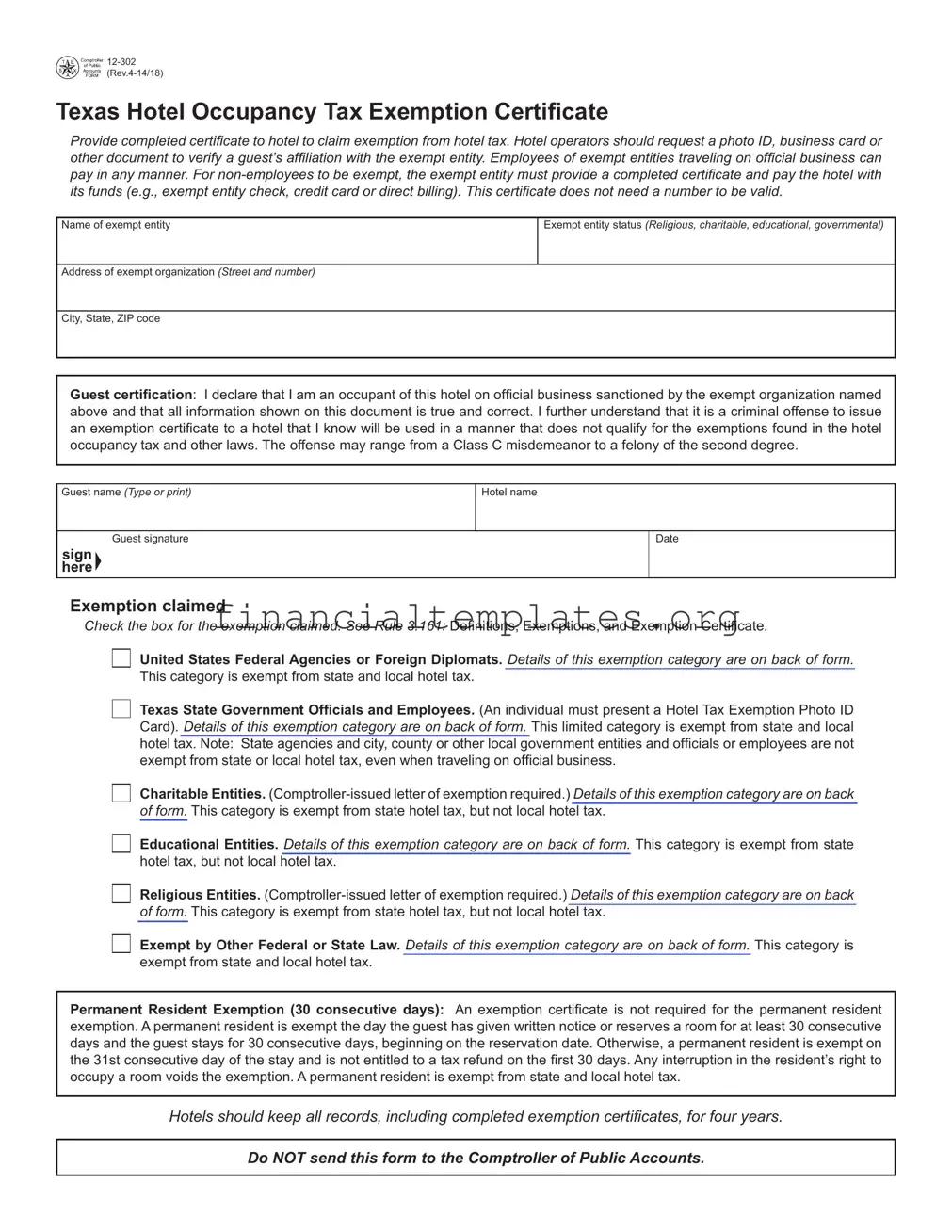

Texas Hotel Occupancy Tax Exemption Certificate

Provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo ID, business card or other document to verify a guest’s affiliation with the exempt entity. Employees of exempt entities traveling on official business can pay in any manner. For

Name of exempt entity

Exempt entity status (Religious, charitable, educational, governmental)

Address of exempt organization (Street and number)

City, State, ZIP code

Guest certification: I declare that I am an occupant of this hotel on official business sanctioned by the exempt organization named above and that all information shown on this document is true and correct. I further understand that it is a criminal offense to issue an exemption certificate to a hotel that I know will be used in a manner that does not qualify for the exemptions found in the hotel occupancy tax and other laws. The offense may range from a Class C misdemeanor to a felony of the second degree.

Guest name (Type or print)

Hotel name

Guest signature

Date

Exemption claimed

Check the box for the exemption claimed. See Rule 3.161: Definitions, Exemptions, and Exemption Certificate.

United States Federal Agencies or Foreign Diplomats. Details of this exemption category are on back of form. This category is exempt from state and local hotel tax.

Texas State Government Officials and Employees. (An individual must present a Hotel Tax Exemption Photo ID Card). Details of this exemption category are on back of form. This limited category is exempt from state and local hotel tax. Note: State agencies and city, county or other local government entities and officials or employees are not exempt from state or local hotel tax, even when traveling on official business.

Charitable Entities.

Educational Entities. Details of this exemption category are on back of form. This category is exempt from state hotel tax, but not local hotel tax.

Religious Entities.

Exempt by Other Federal or State Law. Details of this exemption category are on back of form. This category is exempt from state and local hotel tax.

Permanent Resident Exemption (30 consecutive days): An exemption certificate is not required for the permanent resident exemption. A permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive days and the guest stays for 30 consecutive days, beginning on the reservation date. Otherwise, a permanent resident is exempt on the 31st consecutive day of the stay and is not entitled to a tax refund on the first 30 days. Any interruption in the resident’s right to occupy a room voids the exemption. A permanent resident is exempt from state and local hotel tax.

Hotels should keep all records, including completed exemption certificates, for four years.

Do NOT send this form to the Comptroller of Public Accounts.

Form

Texas Hotel Occupancy Tax Exemptions

See Rule 3.161: Definitions, Exemptions, and Exemption Certificate for additional information.

United States Federal Agencies or Foreign Diplomats (exempt from state and local hotel tax)

This exemption category includes the following:

•the United States federal government, its agencies and departments, including branches of the military, federal credit unions, and their employees traveling on official business;

•rooms paid by vouchers issued by the American Red Cross and the Federal Emergency Management Agency; and

•foreign diplomats who present a Tax Exemption Card issued by the U.S. Department of State, unless the card specifically excludes hotel occupancy tax.

Federal government contractors are not exempt.

Texas State Government Officials and Employees (exempt from state and local hotel tax)

This exemption category includes only Texas state officials or employees who present a Hotel Tax Exemption Photo Identification Card. State employees without a Hotel Tax Exemption Photo Identification Card and Texas state agencies are not exempt. (The state employee must pay hotel tax, but their state agency can apply for a refund.)

Charitable Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes entities that have been issued a letter of tax exemption as a charitable organization and their employees traveling on official business. See website referenced below.

A charitable entity devotes all or substantially all of its activities to the alleviation of poverty, disease, pain and suffering by providing food, clothing, medicine, medical treatment, shelter or psychological counseling directly to indigent or similarly deserving members of society.

Not all 501(c)(3) or nonprofit organizations qualify under this category.

Educational Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes

A letter of tax exemption from the Comptroller of Public Accounts as an educational organization is not required, but an educational organization might have one.

Religious Organizations (exempt from state hotel tax, but not local hotel tax)

This exemption category includes nonprofit churches and their guiding or governing bodies that have been issued a letter of tax exemption from the Comptroller of Public Accounts as a religious organization and their employees traveling on official business. See website referenced below.

Exempt by Other Federal or State Law (exempt from state and local hotel tax)

This exemption category includes the following:

•entities exempted by other federal law, such as federal land banks and federal land credit associations and their employees traveling on official business; and

•Texas entities exempted by other state law that have been issued a letter of tax exemption from the Comptroller of Public Accounts and their employees traveling on official business. See website referenced below. These entities include the following:

•nonprofit electric and telephone cooperatives,

•housing authorities,

•housing finance corporations,

•public facility corporations,

•health facilities development corporations,

•cultural education facilities finance corporations, and

•major sporting event local organizing committees.

For Exemption Information

A list of charitable, educational, religious and other organizations that have been issued a letter of exemption is online at www.window.state.tx.us/taxinfo/exempt/exempt_search.html. Other information about Texas tax exemptions, including applications, is online at www.window.state.tx.us/taxinfo/exempt/index.html. For questions about exemptions, call

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Title and Revision | Texas Hotel Occupancy Tax Exemption Certificate, Revision 4-14/18 |

| Usage Purpose | To claim exemption from hotel tax for qualifying individuals or entities. |

| Verification Requirement | Hotel operators are advised to request a photo ID, business card, or other document to verify a guest's affiliation with the exempt entity. |

| Payment Method for Exemption | Exempt entities' employees can pay in any manner; for non-employees to be exempt, the payment must come directly from the exempt entity. |

| Exempt Entities | Includes United States Federal Agencies, Foreign Diplomats, Texas State Government Officials, Charitable, Educational, Religious Entities, and others exempt by federal or state law. |

| Permanent Resident Exemption | Guests become exempt from state and local hotel tax after 30 consecutive days under certain conditions. |

| Record Keeping | Hotels are required to keep all records, including completed exemption certificates, for four years. |

Guide to Writing Hotel Tax Exemption Missouri

Filling out the Texas Hotel Occupancy Tax Exemption Certificate is a process that allows certain entities and individuals to claim exemption from hotel taxes during their stay at a Texas hotel. This provides a financial benefit for eligible parties and is applicable under specific conditions outlined by the form itself. To accurately complete this form, one should follow a step-by-step process, ensuring all information is correct and up-to-date. This careful attention to detail aids in the exemption process, potentially saving time and resources for both the claimant and the hotel.

- Start by identifying the Name of exempt entity. This should be the official name of the organization claiming the tax exemption.

- Indicate the Exempt entity status. Choose between Religious, charitable, educational, governmental, or any other specified category that applies.

- Provide the Address of the exempt organization, including Street and number, ensuring it matches the official records.

- Fill in the City, State, ZIP code for the exempt organization accurately.

- Under Guest certification, the staying guest must declare their affiliation, purpose of the visit, and acknowledge their understanding of the legal implications of falsely claiming an exemption. The guest should carefully read this section.

- Type or print the Guest name.

- Specify the Hotel name where the exemption is being claimed.

- The form requires the Guest signature to validate the information provided and the claim being made.

- Next, accurately fill in the Date of the hotel stay or the date the form is being completed.

- Identify and check the box for the Exemption claimed. This section may require selecting the specific exemption type based on the categories provided on the form or as outlined in the accompanying information.

- If applicable, understand the provisions for Permanent Resident Exemption and how they may apply to the stay in question.

Upon completing the form, it should be provided directly to the hotel. It's important to note that presenting supporting documentation, such as a photo ID, business card, or other verifiable document proving affiliation with the exempt entity, may be requested by the hotel operators. Keep in mind that this form is instrumental in claiming hotel tax exemptions but should not be sent to the Comptroller of Public Accounts. Additionally, the information should be kept on file by the hotel for four years, aligning with legal record-keeping requirements.

Understanding Hotel Tax Exemption Missouri

Who is eligible for a hotel tax exemption in Missouri using the Texas Hotel Occupancy Tax Exemption Certificate?

How can an exempt entity claim the hotel tax exemption?

Is there a need for a certificate number to validate the Texas Hotel Occupancy Tax Exemption Certificate?

Are there any restrictions on how an exempt entity's employees can pay for their hotel stay?

For entities not supported by exempt entity funds directly, how can they achieve exemption?

What types of documentation should be provided to the hotel alongside the exemption certificate for verification?

Are all guests staying on behalf of an exempt entity required to sign the hotel tax exemption certificate?

Can a hotel tax exemption be applied retroactively for permanent residents?

What obligations do hotels have concerning the exemption certificates?

Where can more information on exemption categories and specific exemption qualifications be found?

This certificate can be used by employees of exempt entities, including religious, charitable, educational, and governmental organizations, traveling on official business. Additionally, United States Federal Agencies, foreign diplomats, and specific Texas state government officials and employees with appropriate identification are eligible. Permanent residents (those staying 30 consecutive days or more) are also exempt without the need for a certificate.

An exempt entity can claim the hotel tax exemption by providing a completed Texas Hotel Occupancy Tax Exemption Certificate to the hotel. The payment for the hotel stay must be made with the funds of the exempt entity, such as a check, credit card, or direct billing from the entity.

No, this certificate does not require a number to be considered valid. The necessary information includes the name of the exempt entity, its status, and the address, along with the guest’s certification of official business and signature.

No, employees of exempt entities can pay in any manner when traveling on official business, provided that a completed exemption certificate is submitted to the hotel.

Non-employees of an exempt entity must have the exempt entity provide a completed exemption certificate and make the payment directly using the entity's funds to qualify for the exemption.

Hotel operators should request a photo ID, business card, or other documents to verify a guest’s affiliation with the exempt entity. This is to ensure the guest is authorized to claim the exemption.

Yes, guests claiming exemption on behalf of an exempt entity must sign the exemption certificate, certifying that they are occupying the hotel on official business sanctioned by the named entity and that all information provided is true and correct.

Permanent residents become exempt from the day they give written notice of a stay for at least 30 consecutive days or from the 31st consecutive day of their stay. They are not entitled to a tax refund on the first 30 days, implying that exemption cannot be applied retroactively for periods shorter than 30 days.

Hotels are required to keep all records, including completed exemption certificates, for four years but should not send this form to the Comptroller of Public Accounts.

Detailed information on exemption categories, including those for charitable, educational, religious entities, and others exempt by law, can be found online at the comptroller’s website or by contacting them directly.

Common mistakes

When completing the Texas Hotel Occupancy Tax Exemption Certificate, several common mistakes can be avoided to ensure the process goes smoothly. Understanding these errors can help individuals and entities properly claim their eligible exemptions.

- Incorrect Exempt Entity Status: Failing to accurately specify the exempt entity status (such as religious, charitable, educational, or governmental) can lead to the rejection of the exemption claim.

- Incomplete Organization Address: Not providing the full address of the exempt organization, including street, number, city, state, and ZIP code, can result in processing delays or disqualification of the exemption certificate.

- Overlooking Guest Certification: Omitting the guest certification section, wherein the guest declares their official business status and attests to the truthfulness of the information, can render the certificate invalid. It’s crucial to complete this part to comply with legal requirements.

- Lack of Verification Documents: Forgetting to attach or present a photo ID, business card, or other document to verify the guest’s affiliation with the exempt entity is a common oversight that hotel operators need to address.

- Payment Method Errors: Misunderstanding payment procedures, such as not using the exempt entity’s funds (via check, credit card, or direct billing) for non-employee exemptions, could invalidate the exemption claim.

- Incorrect Exemption Category Check: Not accurately checking the box for the exemption being claimed according to Rule 3.161 can lead to confusion and potential rejection of the exemption.

- Failure to Provide Required Letters: For certain categories like charitable and religious entities, the need for a comptroller-issued letter of exemption is often overlooked, which is essential for claiming the exemption.

- Misinterpretation of Permanent Resident Exemption: Misunderstanding the criteria for the permanent resident exemption, including the requirement for a stay of at least 30 consecutive days, can lead to improper claims.

- Not Keeping Records: Hotels failing to keep all records, including completed exemption certificates, for four years as required might face compliance issues during audits or reviews.

- Sending the Form to the Wrong Place: Sending the exemption certificate to the Comptroller of Public Accounts, despite instructions not to, indicates a failure to follow the specified process.

By avoiding these mistakes, guests and hotel operators can ensure that the exemption process is conducted smoothly, efficiently, and in compliance with Texas law.

Documents used along the form

When utilizing the Hotel Tax Exemption Missouri form, several other forms and documents are often required to ensure a smooth process and compliance with tax exemption regulations. These documents play a crucial role in verifying the eligibility of the exemption claim and providing the necessary proof of entitlement.

- Photo Identification: A government-issued photo ID (e.g., driver's license, passport) is required to confirm the identity of the person claiming the exemption on behalf of the exempt entity.

- Business Card or Official Documentation: This serves to verify the individual's affiliation with the exempt entity. It could be a business card, a letterhead document, or any official documentation that clearly establishes the connection between the guest and the exempt organization.

- Letter of Tax Exemption: For certain categories such as charitable entities and religious organizations, a Comptroller-issued letter of tax exemption is necessary. This document officially recognizes the entity's exempt status and is a key piece of evidence when claiming hotel tax exemption.

- Hotel Tax Exemption Photo Identification Card: Specifically for Texas state government officials and employees claiming exemption, this ID card is mandatory to avail of the tax benefits.

- Direct Billing Authorization: When the exempt entity is covering the cost, direct billing authorization or documentation is required. This could include a purchase order or a letter authorizing the hotel to bill the entity directly.

- Exemption Certificate for Permanent Residents: Although not required for stays of 30 consecutive days or more, documentation supporting the long-term stay (like a lease agreement or written notice) may be requested by the hotel for internal record-keeping.

Each of these documents plays a vital role in substantiating the tax exemption claim. The exact requirements may vary depending on the specific circumstances of the stay and the policies of the hotel. Having the proper documentation prepared beforehand can streamline the process, ensuring that the tax exemption is applied accurately and efficiently.

Similar forms

The Sales Tax Exemption Certificate, similar to the Hotel Tax Exemption Missouri form, is used by entities that are exempt from paying sales tax on their purchases. Like the hotel tax exemption, the sales tax exemption requires qualifying organizations to provide proof of their exempt status, such as a certificate or identification card, to the seller at the point of purchase. Both forms serve to exempt eligible organizations from specific state taxes under certain conditions.

The Government Official Travel Credit Card Use Under Tax Exemption form parallels the Hotel Tax Exemption Missouri form as it applies specifically to government employees traveling on official business. This form is used to claim exemption from lodging and meal taxes that would otherwise be applied. In both instances, the exemption is contingent upon the purpose of the travel being for official government business and proper documentation being provided to validate the exempt status.

The Non-Profit Organization Tax Exemption Certificate shares similarities with the Hotel Tax Exemption Missouri form in that both documents are designed for entities that are exempt from certain taxes due to their non-profit status. These entities must submit relevant documentation to claim their exemption, whether it's from hotel occupancy taxes or other state-specific taxes. The primary purpose is to verify the organization's eligibility for tax exemption through its non-profit status.

The Educational Institution Tax Exemption Certificate is another document that bears similarities to the Hotel Tax Exemption Missouri form. Both are used by educational entities to claim exemption from taxes, with the former often being more broadly applicable to purchases and activities beyond just hotel occupancy. The criteria for exemption involve proving the educational nature of the institution and the purpose of the expenditures as related to educational activities.

The Diplomatic Tax Exemption Card, although not a form per se, functions similarly to the Hotel Tax Exemption Missouri form in that it provides tax exemption to a specific group, in this case, foreign diplomats and certain international organizations. Both the card and the hotel tax exemption form exempt the holder from paying certain taxes, based on their status, and require the individual to present the card or form to claim the exemption.

The Permanent Residence Hotel Tax Exemption form is akin to the Missouri form in offering tax relief for long-term stays, recognizing the difference in tax treatment for transient versus permanent guests. Both forms exempt eligible individuals from hotel occupancy taxes after a specified period, acknowledging that a prolonged hotel stay becomes more akin to a lease or rental agreement than a short-term accommodation.

The Direct Pay Permit allows organizations to purchase goods and services without paying sales tax at the point of sale, which is similar to the Hotel Tax Exemption Missouri form's function in the lodging sector. Both documents require the exempt entity to report and pay taxes directly to the state under specific conditions, bypassing the usual process of tax collection at the time of purchase.

The Charitable Contributions Deduction Receipt is used by individuals and organizations to claim tax deductions for charitable donations. While it primarily addresses income tax considerations rather than sales or occupancy taxes, it is similar to the Hotel Tax Exemption Missouri form in that it involves documentation to support a tax benefit based on the transaction's nature (charitable contribution vs. exempt status lodging). Both documents rely on the authenticity of the claims made to obtain a tax advantage.

Dos and Don'ts

Understanding the correct way to fill out the Hotel Tax Exemption Missouri form is crucial for ensuring compliance with tax laws and avoiding potential legal issues. Below are guidelines that should be followed to properly complete the form.

Do:

- Ensure that all information provided on the form is accurate and truthful. False declarations can carry legal consequences ranging from misdemeanors to felonies.

- Verify the exemption status and category of your entity before checking any boxes related to the exemption claimed on the form.

- Provide a valid address and contact information of the exempt entity to facilitate any necessary follow-ups or verifications.

- If claiming exemption as a permanent resident, ensure the stay is for at least 30 consecutive days without any interruption in the right to occupy the room.

- Present necessary identification, such as a photo ID and any other required document by the hotel, to verify affiliation with the exempt entity.

- Ensure the entity paying for the hotel stay is the exempt entity if the exemption requires payment to be made by the exempt entity's funds.

- Keep a copy of the completed certificate for your records, as hotels are required to keep these documents for four years.

Don't:

- Attempt to apply for exemptions that do not apply to your entity’s status (religious, charitable, educational, governmental, etc.).

- Forget to have the authorized guest sign the certificate to validate the exemption claim.

- Fill out the form after your stay has commenced. It should be provided at the time of check-in or reservation to ensure the exemption is applied correctly.

- Overlook the specific exemptions that apply to federal agencies, foreign diplomats, state government officials, and certain other entities. Make sure your entity qualifies.

- Ignore the requirement for a comptroller-issued letter of exemption for charitable and religious entities where applicable.

- Assume all exemptions apply to both state and local hotel taxes without verifying the specific rules for each exemption category.

- Send the completed form to the Comptroller of Public Accounts, as this is not required and could lead to misplacement of your documentation.

Misconceptions

Understanding the intricacies of the Hotel Tax Exemption in Missouri can often lead to confusion, primarily due to misinformation and misconceptions. Here, we'll address some of the most widespread misunderstandings to clarify the issue.

Only employees of exempt entities can claim the exemption: A common misconception is that only employees of an exempt organization can benefit from the Hotel Occupancy Tax Exemption. While employees traveling on official business are indeed eligible, non-employees can also qualify for exemption provided the stay is directly billed to or paid by the exempt entity using its funds.

Form must have a certificate number to be valid: Unlike some forms that require a unique number for identification or validation, the Texas Hotel Occupancy Tax Exemption Certificate does not need a number to be considered valid. The completeness and accuracy of the information provided on the form are what grant it legitimacy.

All non-profit organizations automatically qualify for the exemption: It's a common fallacy that being a non-profit organization automatically entitles the entity to hotel tax exemptions. However, specific criteria define eligibility, especially for charitable, educational, and religious entities. Additionally, a Comptroller-issued letter of exemption is necessary for these categories, further emphasizing the need for formal recognition and qualification.

Exemption applies to both state and local hotel taxes: Another misunderstanding arises concerning the scope of the exemption. While certain categories such as United States federal agencies or foreign diplomats are exempt from both state and local hotel taxes, entities like charitable, educational, and religious organizations are only exempt from state hotel tax.

Direct billing is not a mandatory requirement for exemption: For non-employees of an exempt organization to avail of the tax exemption, the payment must be made directly by the exempt entity, either through direct billing, exempt entity credit card, or a check. This requirement ensures the exempt entity's direct involvement in the financial aspect of the hotel stay.

Permanent residents are exempt from day one of their stay: There exists a misconception regarding the Permanent Resident Exemption; it’s often believed it applies from the first day of a long-term stay. In reality, the exemption takes effect on the 31st consecutive day of the stay or immediately if the guest arranges for at least a 30-day continuous stay from the outset, with no tax refund for the first 30 days.

All educational institutions are exempt: Not all educational entities automatically qualify for exemption. The exemption specifically includes in-state and out-of-state school districts, and Texas institutions of higher education, with out-of-state colleges and universities not being exempt. This distinction is crucial for educational entities planning lodging in relation to official business or events.

By dispelling these myths, the goal is to illuminate the correct pathways through which eligible entities can claim exemptions, thereby ensuring compliance and accurate application of the Texas Hotel Occupancy Tax Exemptions.

Key takeaways

Filling out and using the Texas Hotel Occupancy Tax Exemption Certificate requires detailed attention to ensure eligibility and compliance. Here are key takeaways to guide you through the process:

- Eligibility Determination: The certificate caters to various groups, including United States Federal Agencies, Foreign Diplomats, Texas State Government Officials, Employees, Charitable, Educational, and Religious Entities, as well as entities exempt by other Federal or State Law. Identifying the appropriate category is crucial for a valid exemption claim.

- Required Documentation: When submitting the form, individuals must provide supplementary evidence of their affiliation with the exempt entity, such as a photo ID or business card, to verify their eligibility for the exemption.

- Payment Method: The payment for the hotel stay must be made through the exempt entity's funds directly, such as through a check, credit card, or direct billing authorized by the exempt entity, for non-employees to qualify for the exemption.

- No Certificate Number Needed: A unique aspect of this exemption certificate is that it does not require a number to be deemed valid, simplifying the process.

- Filing and Record-Keeping: Hotels should not send the completed exemption certificates to the Comptroller of Public Accounts but are required to keep all records, including the exemption certificates, for four years for auditing purposes.

- Permanent Resident Exemption: Guests who stay for 30 consecutive days or more become "permanent residents" and are exempt from state and local hotel taxes starting from the 31st day, without needing to submit an exemption certificate. Any interruption in stay voids this exemption.

- Criminal Offense Warning: Falsely claiming an exemption constitutes a criminal offense, which can range from a Class C misdemeanor to a felony of the second degree, emphasizing the importance of accuracy and honesty in completing the certificate.

- Exemption Specifics: The form provides details on categories exempt from state hotel tax, state and local hotel tax, or local hotel tax only. It is essential to understand these specifics to correctly claim exemptions.

It is highly recommended that individuals and entities seeking to use the Texas Hotel Occupancy Tax Exemption Certificate thoroughly review and comply with the guidelines provided to ensure proper usage and to avoid legal complications.

Popular PDF Documents

Fasfa Parent Plus Loan - Information on how the college processes the loan request form and the role of the Financial Aid Office.

U.S. Corporation Income Tax Return - Taxable income reported on Form 1120 is crucial for determining a corporation's eligibility for certain tax credits and deductions.

Form Dr-835 - This authorization form is a key component of estate planning, ensuring that tax responsibilities are adequately managed in the taxpayer’s absence.