Get Homestead Tax Credit Form

The Homestead Tax Credit form provided by the Maryland State Department of Assessments & Taxation is a key tool for eligible resident homeowners to limit the assessment increase on their property taxes. Aimed at supporting homeowners by reducing the financial burden of property taxes, this application ensures that the tax credit benefit is applied only to one's primary residence, maintaining fairness and accuracy in the taxation process. Importantly, it outlines the necessity for homeowners to verify that their property is indeed their principal place of residence, a step aimed at preventing misuse of the tax credit. The form is detailed in requesting personal and property information, including social security numbers of the homeowners and their spouses, ensuring thorough verification. This includes checking against income tax and motor vehicle records to confirm the provided information's accuracy. Additionally, the process is made relatively convenient for applicants by allowing the form to be filled out on a PC, emphasizing the importance of legibility and the use of blue or black ink if completed by hand. Crucial contact information and guidance on how to submit the application are provided, simplifying the process for Maryland residents. Compliance and honesty in filling out the application are heavily stressed, with warnings about the penalties for providing false information, demonstrating the state's commitment to upholding the integrity of the Homestead Tax Credit program.

Homestead Tax Credit Example

Maryland State Department of Assessments & Taxation

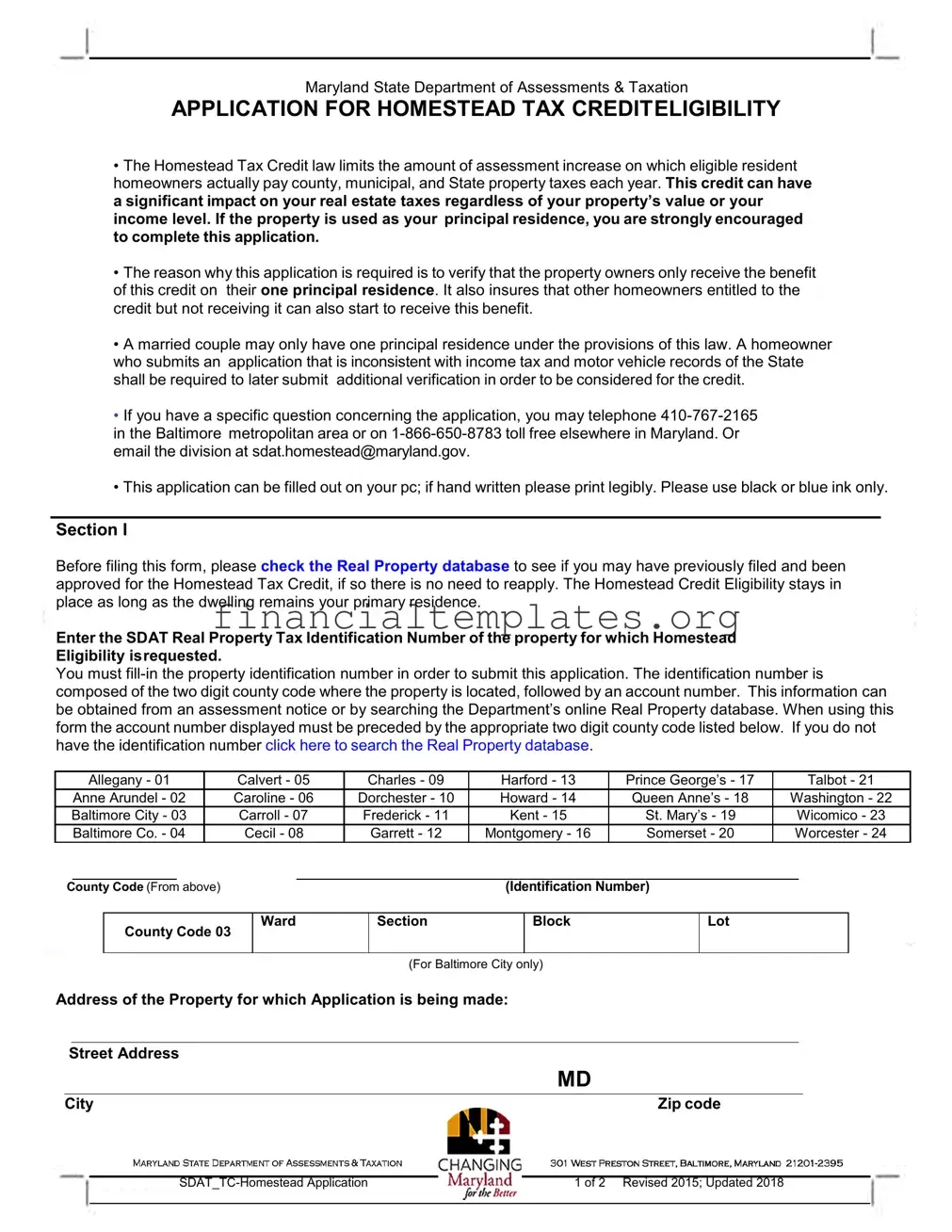

APPLICATION FOR HOMESTEAD TAX CREDITELIGIBILITY

•The Homestead Tax Credit law limits the amount of assessment increase on which eligible resident homeowners actually pay county, municipal, and State property taxes each year. This credit can have a significant impact on your real estate taxes regardless of your property’s value or your income level. If the property is used as your principal residence, you are strongly encouraged to complete this application.

•The reason why this application is required is to verify that the property owners only receive the benefit of this credit on their one principal residence. It also insures that other homeowners entitled to the credit but not receiving it can also start to receive this benefit.

•A married couple may only have one principal residence under the provisions of this law. A homeowner who submits an application that is inconsistent with income tax and motor vehicle records of the State shall be required to later submit additional verification in order to be considered for the credit.

•If you have a specific question concerning the application, you may telephone

in the Baltimore metropolitan area or on

• This application can be filled out on your pc; if hand written please print legibly. Please use black or blue ink only.

Section I

Before filing this form, please check the Real Property database to see if you may have previously filed and been approved for the Homestead Tax Credit, if so there is no need to reapply. The Homestead Credit Eligibility stays in place as long as the dwelling remains your primary residence.

Enter the SDAT Real Property Tax Identification Number of the property for which Homestead Eligibility isrequested.

You must

|

Allegany - 01 |

|

Calvert - 05 |

Charles - 09 |

Harford - 13 |

Prince George’s - 17 |

|

Talbot - 21 |

||

|

Anne Arundel - 02 |

|

Caroline - 06 |

Dorchester - 10 |

Howard - 14 |

Queen Anne’s - 18 |

Washington - 22 |

|||

Baltimore City - 03 |

|

Carroll - 07 |

Frederick - 11 |

Kent - 15 |

St. Mary’s - 19 |

Wicomico - 23 |

||||

|

Baltimore Co. - 04 |

|

Cecil - 08 |

Garrett - 12 |

Montgomery - 16 |

Somerset - 20 |

Worcester - 24 |

|||

|

|

|

|

|

|

|

|

|

||

County Code (From above) |

|

|

|

(Identification Number) |

|

|

||||

County Code 03

Ward

Section

Block

Lot

(For Baltimore City only)

Address of the Property for which Application is being made:

Street Address

|

MD |

|

|

City |

Zip code |

1 of 2 Revised 2015; Updated 2018 |

Maryland State Department of Assessments & Taxation

APPLICATION HOMESTEAD TAX CREDIT ELIGIBILITY

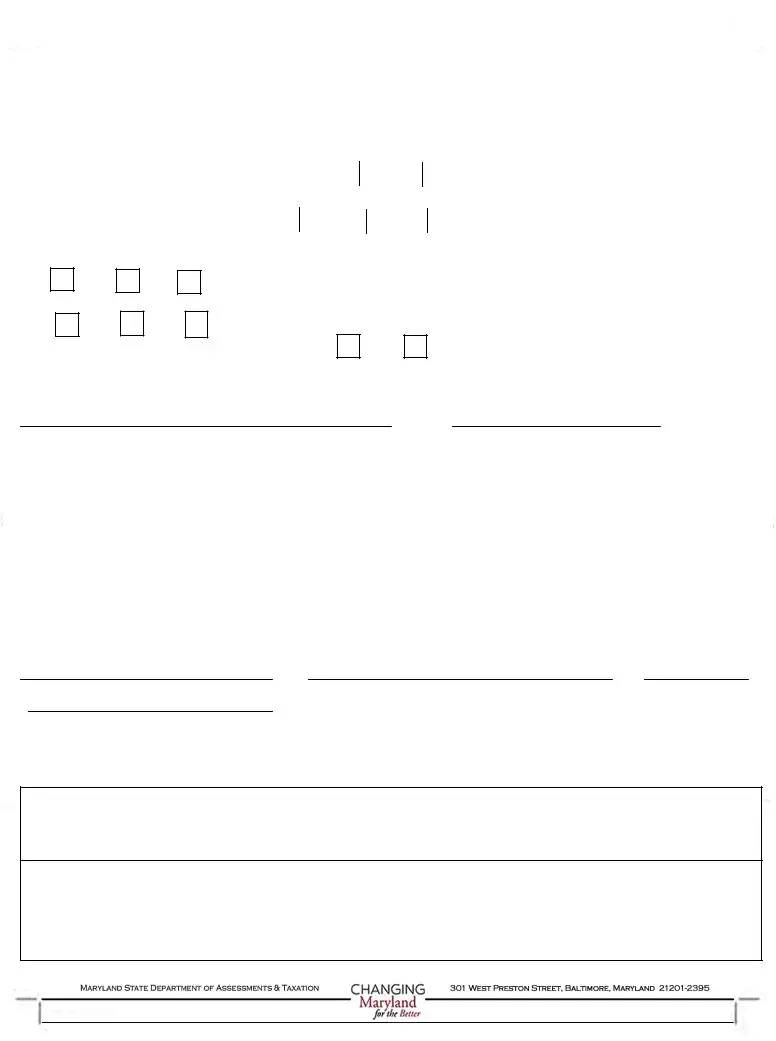

Section II

YOU MUST ANSWER ALL QUESTIONS AND INCLUDE THE SOCIAL SECURITY NUMBER OF ALL HOMEOWNER(S) AND SPOUSES’ (EVEN IF THEY ARE NOT LISTED AS AN OWNER ON THE DEED). A homeowner is defined as any living person listed on the deed.

1. |

Is the real property shown on this letter currently used, and expected to be used in the next calendar year as |

||||||||||||

the single principal residence of the homeowner(s)? |

[ |

|

] |

Yes |

[ |

] |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

2. |

Is this real property address the location where the homeowner(s) expect to file their next federal and |

||||||||||||

Maryland income tax return if oneis filed? |

[ ] |

Yes |

|

[ |

|

] |

No |

|

[ ] |

Not applicable (NotFiling) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Is this real property address the location from which the homeowner(s) have received a MD issued driver’s license or identification card, if applicable?

[ ] Yes [ ] No [ ] Not applicable(No License or Identification Card)

4. Is this real property address the location from which the homeowner(s) are registered to vote, if registered? [ ] Yes [ ] No [ ] Not applicable(Not Registered)

5. Is any portion of the principal residence rented? [ ] Yes [ ] No

All owners must complete the section below. If there are more than four (4) owners attach a separate sheet listing the additional names and Social Security numbers before mailing. Spouses’ are included even if they are not an owner.

Printed Name of Homeowner (First Name, Middle Initial, Last, Suffix) |

Social SecurityNumber |

|

||

|

|

|

|

|

Printed Name of Spouse or 2nd Homeowner (First Name, Middle Initial, Last, Suffix) |

Social SecurityNumber |

|

||

|

|

|

|

|

Printed Name of Homeowner (First Name, Middle Initial, Last, Suffix) |

Social SecurityNumber |

|

||

|

|

|

|

|

Printed Name of Homeowner (First Name, Middle Initial, Last, Suffix) |

Social SecurityNumber |

|

||

In submitting this application I hereby declare under the penalties of perjury, pursuant to

Homeowner’s Signature

Telephone Number (Daytime)

Spouse |

Date |

Mail completed application to: Department of Assessments and Taxation Homestead Tax Credit Division

301 West Preston Street, 8th Floor Baltimore MD 21201

PENALTIES FOR PERJURY

A person who willfully or with intent to evade payment of a tax under this Article provides false information or a false answer to a property tax interrogatory/ application is guilty of a misdemeanor and on conviction is subject to a fine not exceeding $5,000 or imprisonment not exceeding 18 months or both. Tax- Property Article, §

PRIVACY AND STATE DATA SECURITY NOTICE

The principal purpose for which this information is sought is to determine your eligibility for a tax credit. Failure to provide this information will result in a denial of your application. Some of the information requested would be considered a “Personal Record” as defined in State Government Article, §

2 of 2 Revised 2015; Updated 2018 |

Document Specifics

| Fact | Detail |

|---|---|

| Application Purpose | The Homestead Tax Credit application is designed to verify that property owners receive credit only on their principal residence, ensuring fair tax benefits. |

| Eligibility Criteria | To be eligible, the property must be the homeowner's principal residence and subject to only one claim per married couple. |

| Contact Information | Homeowners can contact the department via telephone numbers 410-767-2165 (Baltimore area) or 1-866-650-8783 (toll-free) and email at sdat.homestead@maryland.gov. |

| Submission Requirement | The form requires the property identification number, composed of the county code and account number, for submission. |

| Governing Law | The Homestead Tax Credit is governed by the Tax-Property Article, 1-201, Annotated Code of Maryland. |

| Penalty for False Information | Providing false information on the application may result in a misdemeanor charge, with penalties up to $5,000 in fines or 18 months in imprisonment, or both. |

Guide to Writing Homestead Tax Credit

Filling out the Homestead Tax Credit form is an important step for Maryland homeowners looking to potentially limit the yearly increase in their real estate taxes. This form verifies that the property for which the credit is applied is the applicant's principal residence, ensuring that homeowners only receive this benefit for one property. It's crucial to provide accurate information to qualify for the credit and avoid penalties.

Follow these detailed steps to properly complete the application:

- Before starting, ensure you haven't already been approved for the Homestead Tax Credit by checking the Real Property database. If you have, no further action is required to maintain your credit.

- Locate the SDAT Real Property Tax Identification Number for your property. This can be found on your assessment notice or by searching the online Real Property database. This number includes the two-digit county code and your account number. If you don't have this number, you'll need to obtain it through the aforementioned database.

- Complete Section I with the requested property identification details, including the county code, and provide the full address of the property for which you're applying.

- In Section II, answer all questions honestly about your use of the property, including whether it's your principal residence, whether you plan to file your next federal and Maryland income tax returns from this address, whether you have a Maryland-issued driver’s license or identification card registered to this address, whether you are registered to vote from this address, and whether any portion of the property is rented.

- Fill in the names and Social Security numbers for all homeowners and spouses, even if they aren't listed as an owner on the deed. Use a separate sheet if there are more than four owners.

- Read the perjury statement carefully, understanding that providing false information can result in penalties, including fines or imprisonment.

- Sign and date the form, ensuring that all homeowners and co-owners do the same. Include a daytime telephone number where you can be reached.

- Mail the completed application to the Department of Assessments and Taxation, Homestead Tax Credit Division, at the provided address.

Completing the Homestead Tax Credit application accurately and submitting it as per the instructions is crucial. After submission, your eligibility will be reviewed, and you should receive notification of the outcome. Remember, this credit can have a significant impact on your property taxes, so it’s worth taking the time to apply if you qualify.

Understanding Homestead Tax Credit

Welcome to the FAQ section about the Homestead Tax Credit form. Here, we aim to provide answers to some common questions to help understand this beneficial program better.

Who is eligible for the Homestead Tax Credit?

The Homestead Tax Credit is designed for eligible resident homeowners to limit the amount of assessment increase on which property taxes are calculated each year. To qualify, the property must be used as your principal residence. That means if you own a home and live in it as your primary place of living, you're encouraged to apply. It's important to note that married couples are only allowed one principal residence for the purposes of this credit.

Why is an application required for the Homestead Tax Credit?

The application process is in place to verify that homeowners receive the credit only for their principal residence. This ensures that the benefit is fairly distributed and prevents individuals from claiming the credit on multiple properties. The verification process may involve cross-checking your information with state records, including income tax and motor vehicle databases. This thorough check is to make certain that everyone who qualifies for the credit receives it, while also protecting against fraud.

How can I apply for the Homestead Tax Credit?

You can fill out the application form either on your computer or by hand, ensuring clarity and legibility. Use only black or blue ink if you're completing it by hand. It's essential to include the SDAT Real Property Tax Identification Number for your property, which can be found on your assessment notice or through the department’s online Real Property database. The application must be mailed to the Department of Assessments and Taxation Homestead Tax Credit Division at the provided address.

What happens if I provide false information on my application?

It's crucial to provide truthful and accurate information on your Homestead Tax Credit application. Providing false information or intentionally misleading the state regarding the usage of your property as your principal residence is considered a misdemeanor. Such actions can lead to a fine not exceeding $5,000, imprisonment for up to 18 months, or both. The state takes these matters seriously to ensure fairness and integrity in the application process.

Is my personal information protected when I submit the Homestead Tax Credit application?

The primary purpose of collecting your personal information is to verify eligibility for the tax credit. This data is treated as a "Personal Record," and you have specific rights regarding inspecting and correcting your file under state law. Moreover, state officers and employees are prohibited from disclosing your information, except in compliance with a judicial or legislative order or for official duties. Data may also be shared with taxing officials of other states or the federal government as legally allowed, ensuring privacy and data security throughout the process.

Understanding the Homestead Tax Credit can provide significant savings on your property taxes, making it an important benefit for eligible Maryland homeowners. Should you have further questions not covered here, contacting the appropriate state department directly is highly recommended for personalized assistance.

Common mistakes

Not verifying eligibility beforehand: Many applicants start filling out the Homestead Tax Credit form without first checking if they have already been approved for the credit. The state of Maryland maintains a credit eligibility that continues as long as the dwelling remains the primary residence of the homeowner. A preliminary check in the Real Property database can save time and effort, ensuring that those who have previously been approved do not unnecessarily reapply.

Incorrect property identification: A common mistake involves incorrectly entering the property identification number, which is crucial for submitting the application. This number combines a two-digit county code with an account number. Errors or omissions in this section can lead to processing delays or even rejection of the application. Accurate entry of this information, as obtained from an assessment notice or the department's online database, is critical.

Omitting required personal information: The application mandates entering the social security numbers of all homeowners and their spouses, regardless of the spouse's ownership status on the deed. Sometimes, applicants overlook this requirement or hesitate to provide this sensitive information. However, failure to include all necessary social security numbers can result in the application's denial.

Failure to properly declare principal residence status: Applicants must affirm that the property in question is their principal residence and will remain so in the coming year. This includes consistency with income tax returns, motor vehicle records, voter registration, and Maryland-issued identification. Inaccuracies or discrepancies in this declaration can lead to additional verification requirements or disqualification from the credit. Honesty and accuracy in these responses are paramount.

Documents used along the form

When individuals apply for the Homestead Tax Credit, it's part of a process that often requires gathering and providing additional documentation. This is primarily because eligibility for the Homestead Tax Credit intersects with different aspects of a property owner's legal and financial status. The documentation accompanying this application varies, aiming to verify ownership, residency, and other eligibility criteria. Below is a list of documents commonly used alongside the Homestead Tax Credit form, each serving its unique verification purpose.

- Proof of Residence: Utility bills, bank statements, or voter registration cards serve to prove the applicant's primary residence matches the property for which the tax credit is sought.

- Property Deed: A copy of the property deed confirms the applicant's ownership of the property.

- Driver's License or State ID: Government-issued identification aids in verifying the applicant's identity and residency.

- Income Tax Returns: Provides proof of the address used for filing taxes, aligning with the declared principal residence.

- Assessment Notice: This document from local property tax authorities outlines the property's assessed value, crucial for calculating potential credit.

- Mortgage Statement: A recent mortgage statement can be used to establish ownership and the applicant's financial interest in the property.

- Marriage Certificate: For married couples, this document might be required to verify marital status and ensure compliance with credit's regulations.

- Rental Agreement: If part of the property is rented out, a rental agreement can clarify the extent and terms, affecting eligibility.

- Proof of Age or Disability: In some jurisdictions, additional tax benefits are available for seniors or disabled individuals, necessitating proof through documents such as birth certificates or disability determinations.

- Social Security Numbers: Although part of the application, providing social security numbers for all homeowners is crucial for identity verification and cross-checking with other state records.

The necessity for these documents arises not just from a need to establish eligibility but also to prevent fraud and ensure that the tax credit benefits reach the intended recipients. The Homestead Tax Credit offers vital financial relief by limiting the yearly increase in real estate taxes, ensuring homeowners aren't disproportionately affected by spikes in property values. Collecting and organizing these documents can be a detailed process but ultimately supports a more equitable taxation system.

Similar forms

The Mortgage Interest Deduction Form, much akin to the Homestead Tax Credit Application, serves homeowners by allowing a portion of their mortgage interest paid throughout the year to be deducted from their taxable income. Both documents aim to reduce the financial burden on homeowners, albeit through different avenues: one focuses on property tax liability, while the other targets federal and state income tax obligations. These forms necessitate the homeowner's details about their residence, emphasizing its importance as a principal dwelling. Furthermore, accuracy and honesty in the submission process are critical, as both contain stern warnings against the furnishing of false information.

The Property Tax Appeal Form shares similarities with the Homestead Tax Credit Application in that both engage with the state’s valuation of residential property. Homeowners use these forms to ensure their property taxes are equitable - the Homestead Tax Credit Application by capping assessment increases, and the Property Tax Appeal Form by contesting the assessed value of their home. Each document requires specific property identification details and encourages the homeowner to furnish accurate, verifiable information to affect their property tax obligations.

The First-Time Homebuyer Tax Credit Form is another document whose intent mirrors that of the Homestead Tax Credit Application, designed to offer financial relief to homeowners. This form, aimed at first-time buyers, provides a tax credit to reduce the income tax liability of those entering the housing market. Both documents are testament to government efforts to make homeownership more accessible and financially viable, requiring homeowners to qualify based on their residence characteristics and usage.

The Energy Efficiency Tax Credit Form and the Homestead Tax Credit Application both play crucial roles in reducing homeowners' financial burdens, albeit via different methodologies. While the Homestead Tax Credit directly limits property tax increases, the Energy Efficiency Tax Credit provides tax relief for homeowners who make qualifying energy-saving improvements to their homes. These forms necessitate detailed information about the property and the investments made, underlining the importance of initiatives aimed at encouraging responsible homeownership and energy conservation.

The Senior Citizen Property Tax Relief Application parallels the Homestead Tax Credit Application in its objective to offer property tax relief, specifically targeting senior homeowners. Both documents require the homeowner to certify their residence as their principal dwelling and provide detailed property information. These forms highlight the importance of supporting specific homeowner groups, ensuring that property taxes do not become an insurmountable burden, especially on fixed incomes.

The Rental Property Registration Form, while distinct in its target audience, shares a foundational similarity with the Homestead Tax Credit Application. Both documents necessitate the submission of detailed property information. However, the former is utilized by landlords to register their properties for rental, contrasting with the homestead application's focus on owner-occupied residences. Accuracy and compliance with local regulations emerge as key themes in both, ensuring property use aligns with governmental records.

Disability Exemption for Property Taxes Form bears resemblance to the Homestead Tax Credit Application in its purpose to offer tax relief to a specific group of homeowners. This form caters to homeowners with disabilities, offering them a reduction or exemption from property taxes as a form of financial assistance. Both forms underline the importance of submitting thorough and truthful information regarding one's living situation and the characteristics of the dwelling to receive benefits.

The Veterans’ Property Tax Relief Form, akin to the Homestead Tax Credit Application, is designed to afford financial relief, specifically to veterans and, in some cases, their surviving spouses. This form provides veterans with a reduction or exemption from property taxes, recognizing their service. Like the homestead tax credit, it necessitates detailed property information and serves as a reminder of societal commitment to supporting veterans through beneficial policies.

The Agricultural Property Tax Credit Form, while catering to a more specialized segment of property owners, parallels the Homestead Tax Credit Application in its fiscal relief purpose. This form provides tax incentives to owners of agricultural land, aiming to support farming and conservation efforts. Both documents share the requirement of precise property information and underscore the broader theme of offering tax relief to encourage and maintain specific beneficial land uses.

Finally, the Solar Energy System Tax Credit Form, like the Homestead Tax Credit Application, facilitates a reduction in tax liability for homeowners who take certain actions regarding their property; in this case, the installation of solar energy systems. Both initiatives exemplify government encouragement for homeowners to invest in their properties in ways deemed beneficial socially or environmentally, necessitating detailed documentation of the property and the improvements made.

Dos and Don'ts

Filling out the Homestead Tax Credit form requires both attention to detail and an understanding of eligibility requirements. To help ensure the process is completed correctly, here are key dos and don'ts:

Do:- Verify your eligibility before applying. Confirm that the property for which you're applying is used as your principal residence, as the Homestead Tax Credit is designed to benefit those who use their property as their primary place of living.

- Check for prior applications. Before you start filling out the form, look into whether you have previously applied and been approved for the Homestead Tax Credit, as reapplication might not be necessary if your dwelling continues to serve as your primary residence.

- Use black or blue ink if completing the form by hand to ensure that all information is legible and can be processed efficiently by the Maryland State Department of Assessments & Taxation.

- Be complete and accurate with your responses, especially when providing the Social Security Number of all homeowner(s) and spouses, even if they aren't listed as owners on the deed. This information is critical for verifying your eligibility for the tax credit.

- Overlook the need for additional verification. If your application information is inconsistent with income tax and motor vehicle records, be prepared to submit further documentation to validate your eligibility for the credit.

- Apply for multiple properties. Remember that a married couple may only claim one principal residence under the law. Applying for the credit on more than one property can lead to legal issues and penalties.

- Provide incomplete answers. Failing to answer all questions on the form or excluding required information can result in the denial of your application. It's vital to thoroughly review your answers before submission.

- Use incorrect identification numbers. Ensure you enter the correct property identification number, including the two-digit county code followed by the account number. This information is crucial for processing your application accurately.

Misconceptions

Many individuals have common misunderstandings regarding the Maryland Homestead Tax Credit form and its eligibility criteria. Misconceptions can often lead to missed opportunities for homeowners to save on property taxes. Here are nine typical misconceptions and their clarifications to help homeowners better understand the Homestead Tax Credit.

Only homeowners with a high income can apply. The Homestead Tax Credit is not dependent on income level. All homeowners using the property as their principal residence can apply, making it beneficial across all income brackets.

Rental properties qualify for the credit. This credit is only applicable to the homeowner's principal residence. Portions of the home that are rented out may affect the credit eligibility, as the entire property must be used as the primary residence.

You must reapply annually. Once approved, homeowners do not need to reapply for the credit yearly. The credit remains in place as long as the property continues to be the owner’s principal residence.

The credit applies to all types of property taxes. The Homestead Tax Credit specifically limits the increase in taxable assessments for county, municipal, and state property taxes. It does not apply to federal taxes or other types of state taxes.

Married couples who own more than one property can receive multiple credits. A married couple may only claim the Homestead Tax Credit for one property—the one used as their principal residence. Owning multiple properties does not entitle a couple to multiple credits.

Application complexity requires professional assistance. While it's always wise to consult with professionals when in doubt, the application for the Homestead Tax Credit is straightforward. It's designed for homeowners to fill out without requiring expert help.

The credit only benefits homeowners in certain counties. Eligibility for the Homestead Tax Credit extends to homeowners in all Maryland counties. The key requirement is the property's use as the principal residence, not its location.

Approval is based on a property's value. The credit's aim is to limit the increase of property tax assessments, independent of the property’s actual value. All homeowners, regardless of their property value, can benefit as long as the home is their primary residence.

Failure to report all household occupants disqualifies the application. While all homeowner names and Social Security numbers must be listed on the application, the focus is on the property's usage as the principal residence. The critical factor is the homeowners listed on the deed, not the complete list of inhabitants.

Understanding these misconceptions can empower homeowners to take full advantage of the Homestead Tax Credit, potentially saving a significant amount on property taxes. For complete and accurate advice tailored to specific circumstances, homeowners are encouraged to contact the relevant Maryland State Department of Assessments & Taxation office or a legal professional.

Key takeaways

Filling out and using the Homestead Tax Credit form correctly is crucial for homeowners seeking to limit their property tax increases. Here are key takeaways to ensure you navigate this process effectively:

- The Homestead Tax Credit is designed to cap the increase in real estate taxes, offering significant financial relief to eligible homeowners, regardless of the property's value or the owner's income level.

- Eligibility for the credit requires the property to be the homeowner's principal residence, reinforcing the importance of applying for the credit to receive its benefits on your primary home only.

- A married couple is limited to claiming just one principal residence under this law, emphasizing the need for accuracy and honesty in the application process.

- Inconsistencies between the application and state records, such as income tax and motor vehicle information, may necessitate further verification, highlighting the importance of consistency across all legal documents.

- Before applying, verify whether you have previously filed and been approved for the Homestead Tax Credit to avoid unnecessary applications, as the eligibility remains as long as the dwelling is your primary residence.

- You must provide the specific identification number of the property when applying, which includes a two-digit county code and account number, obtainable through an assessment notice or the Department’s online Real Property database.

- Completing Section II accurately is mandatory, including answering all questions and including the social security numbers of all homeowners and their spouses, if applicable, to define clearly who benefits from the credit.

- The integrity of your application is paramount, as intentionally providing false information can lead to misdemeanor charges, including fines or imprisonment, underscoring the legal ramifications of dishonesty.

- The information provided on the application is protected for your privacy and is primarily used to assess eligibility for the tax credit, with lawful stipulations in place for the correction of inaccurate or incomplete information.

Adherence to these guidelines will support a seamless application process, ensuring eligible homeowners can effectively claim and benefit from the Homestead Tax Credit, thus reducing their annual property tax burden.

Popular PDF Documents

Federal 1120 - The IRS scrutinizes Form 1120 closely to ensure corporations are paying their fair share of taxes.

IRS 5695 - Homeowners planning to install or who have installed solar panels use this to determine their credit amount.

Az Lsu Form - Integrates the role of quality control reviews, emphasizing the importance of thoroughness in the loan approval process.