Get Hawaii Tax Bb1X Form

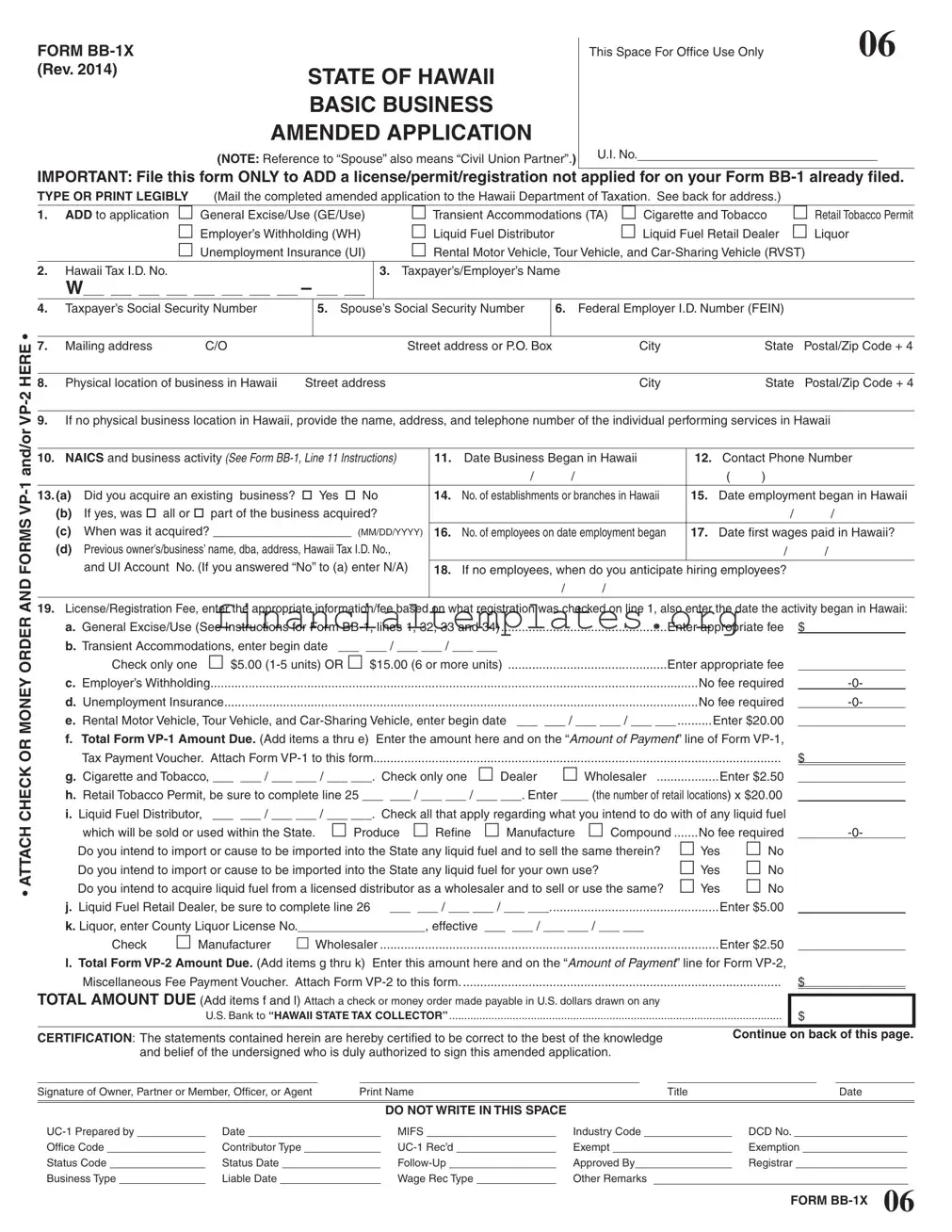

When businesses in Hawaii undergo changes or expansions not previously included in their initial registration, the Hawaii Tax BB-1X form plays a crucial role. This amended application allows for the addition of various licenses, permits, or registrations that were not part of the original Form BB-1. Such additions may include General Excise/Use Tax, Transient Accommodations, Liquor, and many others, addressing the need for a comprehensive update to the state's records. The form requires detailed information about the taxpayer, including Hawaii Tax I.D. No., Social Security Number, Federal Employer I.D. Number, and the physical location of the business in Hawaii. Additionally, it outlines the necessity of including the appropriate license or registration fees for the newly applied categories and mandates the submission of this form to the Hawaii Department of Taxation. The preparation and submission of this document encapsulate critical steps for business compliance, ensuring that all taxable activities are properly registered with the state.

Hawaii Tax Bb1X Example

FORM |

|

(Rev. 2014) |

STATE OF HAWAII |

|

|

|

BASIC BUSINESS |

|

AMENDED APPLICATION |

|

(NOTE: Reference to “Spouse” also means “Civil Union Partner”.) |

This Space For Office Use Only |

06 |

U.I. No.

• ATTACH CHECK OR MONEY ORDER AND FORMS

IMPORTANT: File this form ONLY to ADD a license/permit/registration not applied for on your Form

TYPE OR PRINT LEGIBLY |

(Mail the completed amended application to the Hawaii Department of Taxation. See back for address.) |

|

|

||||||||||

|

|

|

|

|

|

|

|

||||||

1. |

ADD to application |

General Excise/Use (GE/Use) |

Transient Accommodations (TA) Cigarette and Tobacco |

Retail Tobacco Permit |

|||||||||

|

|

Employer’s Withholding (WH) |

Liquid Fuel Distributor |

|

Liquid Fuel Retail Dealer |

Liquor |

|||||||

|

|

Unemployment Insurance (UI) |

Rental Motor Vehicle, Tour Vehicle, and |

||||||||||

2. |

Hawaii Tax I.D. No. |

|

|

|

|

3. |

Taxpayer’s/Employer’s Name |

|

|

|

|

||

|

W___ ___ ___ ___ ___ ___ ___ ___ – ___ ___ |

|

|

|

|

|

|

|

|

||||

4. |

Taxpayer’s Social Security Number |

|

5. Spouse’s Social Security Number |

|

6. |

Federal Employer I.D. Number (FEIN) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Mailing address |

|

C/O |

|

|

|

Street address or P.O. Box |

|

City |

State |

Postal/Zip Code + 4 |

||

|

|

|

|

|

|

|

|

|

|

|

|||

8. |

Physical location of business in Hawaii |

Street address |

|

|

|

City |

State |

Postal/Zip Code + 4 |

|||||

9.If no physical business location in Hawaii, provide the name, address, and telephone number of the individual performing services in Hawaii

10. NAICS and business activity (SEE FORM |

11. |

Date Business Began in Hawaii |

12. |

Contact Phone Number |

||||

|

|

|

/ |

/ |

|

( |

) |

|

|

|

|

|

|

|

|||

13. (a) |

Did you acquire an existing business? Yes No |

14. |

No. of establishments or branches in Hawaii |

15. |

Date employment began in Hawaii |

|||

(b) |

If yes, was all or part of the business acquired? |

|

|

|

|

|

/ |

/ |

(c) |

When was it acquired? ____________________ (MM/DD/YYYY) |

16. |

No. of employees on date employment began |

17. |

Date first wages paid in Hawaii? |

|||

(d) Previous owner’s/business’ name, dba, address, Hawaii Tax I.D. No., |

|

|

|

|

|

/ |

/ |

|

|

and UI Account No. (If you answered “No” to (a) enter N/A) |

18. |

If no employees, when do you anticipate hiring employees? |

|

||||

|

|

|

||||||

|

|

|

/ |

/ |

|

|

|

|

19.License/Registration Fee, enter the appropriate information/fee based on what registration was checked on line 1, also enter the date the activity began in Hawaii:

a. General Excise/Use (See Instructions for Form |

Enter appropriate fee |

$ |

|

b. Transient Accommodations, enter begin date ___ ___ / ___ ___ / ___ ___ |

|

|

|

Check only one $5.00 |

Enter appropriate fee |

|

|

c. Employer’s Withholding |

No fee required |

||

d. Unemployment Insurance |

No fee required |

||

e. Rental Motor Vehicle, Tour Vehicle, and |

___ ___ / ___ ___ / ___ ___ |

..........Enter $20.00 |

|

f.Total Form

Tax Payment Voucher. Attach Form |

|

$ |

|

g. Cigarette and Tobacco, ___ ___ / ___ ___ / ___ ___. Check only one Dealer |

Wholesaler |

|

|

Enter $2.50 |

|

||

h.Retail Tobacco Permit, be sure to complete line 25 ___ ___ / ___ ___ / ___ ___. Enter ____ (the number of retail locations) x $20.00

i. Liquid Fuel Distributor, ___ ___ / ___ ___ / ___ ___. Check all that apply regarding what you intend to do with of any liquid fuel |

|

||

which will be sold or used within the State. Produce Refine Manufacture Compound |

.......No fee required |

||

Do you intend to import or cause to be imported into the State any liquid fuel and to sell the same therein? |

Yes |

No |

|

Do you intend to import or cause to be imported into the State any liquid fuel for your own use? |

Yes |

No |

|

Do you intend to acquire liquid fuel from a licensed distributor as a wholesaler and to sell or use the same? |

Yes |

No |

|

j. Liquid Fuel Retail Dealer, be sure to complete line 26 |

___ ___ / ___ ___ / ___ ___ |

Enter $5.00 |

||||

k. Liquor, enter County Liquor License No. |

|

|

, effective ___ ___ / ___ ___ / ___ ___ |

|

||

Check |

Manufacturer |

Wholesaler |

.................................................................................................. |

Enter $2.50 |

||

l.Total Form

Miscellaneous Fee Payment Voucher. Attach Form |

|

$ |

|

|

TOTAL AMOUNT DUE (Add items f and l) Attach a check or money order made payable in U.S. dollars drawn on any |

|

|

|

|

|

|

|

|

|

|

$ |

|

||

U.S. Bank to “HAWAII STATE TAX COLLECTOR” |

|

|||

CERTIFICATION: The statements contained herein are hereby certified to be correct to the best of the knowledge |

Continue on back of this page. |

|||

|

|

|

|

|

and belief of the undersigned who is duly authorized to sign this amended application. |

|

|

|

|

Signature of Owner, Partner or Member, Officer, or Agent |

Print Name |

|

|

|

|

Title |

|

|

|

Date |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

DO NOT WRITE IN THIS SPACE |

|

|

|

|

|

|

|

|

|

|

|||||

|

Date |

|

|

MIFS |

|

|

Industry Code |

|

DCD No. |

|

|

|||||||||||||||

Office Code |

|

|

Contributor Type |

|

|

|

|

Exempt |

|

Exemption |

|

|

||||||||||||||

Status Code |

|

|

Status Date |

|

|

|

|

Approved By |

Registrar |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Type |

|

|

Liable Date |

|

|

Wage Rec Type |

|

|

Other Remarks |

|

|

|

|

|

|

|||||||||||

FORM

FORM

(REV. 2014) |

Page 2 |

|

20.Filing period for:

(a) |

General Excise/Use Tax |

Monthly |

Quarterly |

Semiannually |

(b) |

Transient Accommodations Tax |

Monthly |

Quarterly |

Semiannually |

(c) |

Rental Motor Vehicle, Tour Vehicle, and |

Monthly |

Quarterly |

Semiannually |

For items (a), (b), and (c): |

Check monthly if you expect to pay more than $4,000 a year of taxes in the respective taxes; |

||

|

Check quarterly if you expect to pay $4,000 or less a year in the respective taxes; or |

||

|

Check semiannually if you expect to pay $2,000 or less a year in the respective taxes. |

||

(d) Employer’s Withholding Tax |

Monthly |

Quarterly |

|

Check monthly if you expect to pay more than $5,000 a year in withholding taxes; or

Check quarterly if you expect to pay $5,000 or less a year in withholding taxes

(e) |

Unemployment Insurance Contributions |

...............................Monthly |

Quarterly (This must be filed on a quarterly basis) |

(f) |

Liquor Tax |

(This must be filed on a monthly basis) |

|

(g) |

Cigarette and Tobacco Taxes |

Monthly |

(This must be filed on a monthly basis) |

(h) |

Liquid Fuel Taxes |

Monthly |

(This must be filed on a monthly basis) |

21.Accounting period, check only one Calendar Year (The

Fiscal Year ending ___ ___ / ___ ___ (A

22.Accounting method, check only one Cash (Report income in the period when it was actually or constructively received.)

Accrual (Report income when you earn it, whether or not you actually receive it.)

23. Do you qualify for a disability exemption? Yes |

No |

If yes, Form |

exemption of gross income of any blind, deaf, or totally disabled person and rate of ½ of 1% on the remaining gross income can be allowed.

24.(a) List by island the address(es) of your rental real property (e.g., land, building, apartments, condominiums, or hotels or other transient lodging).

(b)List by island the address(es) of your rental motor vehicle, tour vehicle, and/or

(c)If a transient accommodation (TA) or a rental motor vehicle, tour vehicle, or

|

(d) Attach a separate sheet of paper for additional listings. |

|

Check |

Check |

|

|

Address |

Island |

if TA |

if RVST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25.For the Retail Tobacco Permit, list separately each retail location you own, operate, or control, and for retail locations that are vehicles, include the Vehicle Identification Number (VIN) of

each vehicle (Attach a separate sheet of paper if more space is required). Have you ever been cited for either a tobacco and/or liquor violation? Yes No

|

Name |

Street Address |

Vehicle Identification No. (VIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26.For the Liquid Fuel Retail Dealer’s Permit, list separately each branch or place of business (Attach a separate sheet of paper if more space is required).

Street Address |

Island |

|

|

|

|

27.Name of Parent Corporation

28.Parent Corporation’s FEIN

29.Parent Corporation’s Mailing Address

MAILING ADDRESSES & TELEPHONE NUMBERS

Hawaii Department of Taxation |

|

P.O. Box 1425 |

|

Honolulu, HI |

|

Telephone: |

(808) |

Toll Free: |

|

|

|

|

Department of Labor and Industrial Relations |

|

|

|

|

|

Unemployment Insurance Division |

|

|

OAHU & MAINLAND |

MAUI |

|

HAWAII |

KAUAI |

|

830 Punchbowl St., #437 |

54 S. High St., #201 |

1990 Kinoole St., #101 |

3100 Kuhio Hwy C12 |

||

Honolulu, HI |

96813 |

Wailuku, HI |

96793 |

Hilo, HI 96720 |

Lihue, HI 96766 |

Telephone: |

(808) |

Telephone: |

(808) |

Telephone: (808) |

Telephone: (808) |

|

(808) |

|

|

|

|

FORM

DO NOT WRITE IN THIS SPACE

Type |

Number |

Date Issued |

Effective FYE |

|

|

|

|

Liquor Tax Permit |

|

|

|

Cigarette Tax and Tobacco Tax License |

|

|

|

Liquid Fuel Distributor’s License |

|

|

|

Liquid Fuel Retail Dealer’s Permit |

|

|

|

|

|

|

|

Document Specifics

| Fact | Detail |

|---|---|

| Form Name | FORM BB-1X |

| Revision Year | 2014 |

| Description | Basic Business Amended Application |

| Spouse Inclusion | References to "Spouse" also mean "Civil Union Partner" |

| Purpose | To add a license/permit/registration not applied for on the original Form BB-1 |

| Submission Method | Mail to the Hawaii Department of Taxation |

| Attachment Requirements | Attach check or money order and Forms VP-1 and/or VP-2 |

| Key Sections | Add licenses/permits, taxpayer information, business details |

| Governing Law | Hawaii State Tax Laws |

| Contact Information | Hawaii Department of Taxation and Department of Labor and Industrial Relations provided |

| Filing Requirement | Filed only when adding to an already filed Form BB-1 |

Guide to Writing Hawaii Tax Bb1X

Filling out the Hawaii Tax BB-1X form is necessary for businesses that need to amend their basic business application to add a license, permit, or registration not previously applied for. Taking care when compiling the needed documents and accurately completing the form ensures that your application is processed without unnecessary delays. Here's a step-by-step guide to help you fill out the form correctly.

- Begin by reading the entire form to familiarize yourself with the required information.

- Select the type of license/registration you are adding to your application by checking the appropriate box in section 1.

- Provide your Hawaii Tax I.D. Number in section 2.

- Enter your Taxpayer’s/Employer’s Name in section 3.

- Fill in the Taxpayer’s Social Security Number in section 4.

- If applicable, enter the Spouse’s Social Security Number in section 5.

- Provide your Federal Employer I.D. Number (FEIN) in section 6.

- Write your Mailing Address, including the city, state, and zip code in section 7.

- For the Physical location of the business in Hawaii, enter the street address, city, state, and zip code in section 8.

- If there is no physical business location in Hawaii, provide the contact details of the individual performing services in Hawaii in section 9.

- Describe your NAICS and business activity as instructed in section 10.

- Enter the Date Business Began in Hawaii in section 11.

- Provide a Contact Phone Number in section 12.

- Answer the questions regarding the acquisition of an existing business in sections 13.

- Indicate the Number of establishments or branches in Hawaii in section 14.

- Provide the dates related to employment in Hawaii in sections 15 and 17.

- If you have no employees, mention when you anticipate hiring in section 18.

- Calculate and enter the License/Registration Fee in sections 19 through 21, taking into account the detailed fees for each permit or license you are applying for.

- Complete the Certification section at the bottom of the form with the signature of the Owner, Partner, Member, Officer, or Agent, print name, title, and date.

- Review the entire form for accuracy and completeness before attaching a check or money order for the total amount due and any additional required forms (VP-1 and/or VP-2).

- Mail the completed amended application and payment to the Hawaii Department of Taxation. The mailing address is provided on the back for your convenience.

Once your form is submitted, your application will be processed, and any added licenses or permits will be officially recorded. It's essential to ensure all information is accurate to avoid processing delays. If you have any questions or need further assistance, you can contact the Hawaii Department of Taxation or the Department of Labor and Industrial Relations at the numbers provided. Remember, keeping accurate records and promptly updating your business information helps in maintaining compliance with Hawaii's tax laws and regulations.

Understanding Hawaii Tax Bb1X

What is the Hawaii Tax BB-1X Form used for?

The Hawaii Tax BB-1X Form, classified as a Basic Business Amended Application, is utilized exclusively for the purpose of adding a license, permit, or registration that was not applied for on the original Form BB-1. This form becomes necessary when a business owner decides to expand their services or products, requiring additional state permissions. Once completed, it should be mailed to the Hawaii Department of Taxation, accompanied by any applicable checks or money orders and forms VP-1 and/or VP-2, depending on the registration needed.

How can I choose the right tax and license fees on Form BB-1X?

Form BB-1X lists multiple licensure and registration options, each with corresponding fees. Deciding which applies depends on the business activity you are adding. For instance, if adding general excise/use, transient accommodations, rental motor vehicle, tour vehicle, and car-sharing vehicle surcharge, or liquor license activities, respective fees are outlined in the form. General excise/use license or a transient accommodations license carries specific fees based on the scale of operation. No fee is required for applying for employer’s withholding and unemployment insurance. Ensure to calculate the total amount due by adding the appropriate fees from sections f and l on the form. Carefully review each option to accurately determine the fees applicable to the added business activities.

What should I do if I acquire an existing business and need to update the license and permit information?

If you acquire either all or part of an existing business, the Form BB-1X must be used to update the license and permit information to reflect the new ownership. In section 13(a) of the form, indicate that you acquired an existing business, specifying whether it was a partial or complete acquisition, and provide the date of acquisition. Furthermore, you should furnish the previous owner's or business's name, dba (doing business as), address, Hawaii Tax I.D. Number, and UI (Unemployment Insurance) Account Number. If there were no changes in the business requiring additional licenses or permits initially unapplied for, consultation with a professional or the Hawaii Department of Taxation directly may be necessary to ensure compliance.

Where do I submit the completed Hawaii Tax BB-1X Form and attached payments?

The completed Hawaii Tax BB-1X Form, along with any checks or money orders for the required fees, should be submitted to the Hawaii Department of Taxation at the address provided on the form. Specific mailing addresses and telephone numbers for additional support can be found at the end of the form, ensuring you can direct your application accurately and seek any necessary clarifications. Payments must be in U.S. dollars drawn on a U.S. bank, made payable to "HAWAII STATE TAX COLLECTOR". It's crucial to ensure all parts of the application are filled out accurately and legibly before submission to avoid delays or issues in the processing of your amended application.

Common mistakes

Filling out the Hawaii Tax BB-1X form is crucial for accurately updating your business information. However, mistakes can happen. Here are ten common errors to watch out for:

- Failing to attach the necessary check or money order along with Forms VP-1 and/or VP-2.

- Incorrectly entering the Hawaii Tax I.D. No. This should match the number previously provided.

- Omitting or inaccurately filling out the Taxpayer’s/Employer’s Name, which is crucial for identity verification.

- Mistaking the social security numbers for both the taxpayer and spouse, if applicable.

- Not providing or incorrectly entering the Federal Employer I.D. Number (FEIN).

- Skipping or wrongly filling in the mailing address, which can lead to issues with communication.

- Forgetting to provide the physical location of the business in Hawaii if one exists.

- Misunderstanding the section related to the acquisition of an existing business.

- Incorrectly calculating or misunderstanding the fees required for the licenses, registrations, or permits added.

- Selecting the wrong filing period or accounting method, which could affect tax reporting and payment.

Making sure that every part of the form is filled out correctly can save a lot of time and prevent potential issues with your business’s taxation and legal status in Hawaii. These errors are fully avoidable with careful review and accuracy when completing the form.

Documents used along the form

When businesses in Hawaii need to update or amend their licensing and registration details, completing the BB-1X form is a critical step. This form allows businesses to add additional licenses or permits not originally applied for. However, completing the BB-1X form is often just one part of the process. Several other forms and documents usually accompany or follow the BB-1X submission to ensure full compliance and proper registration of amendments with the relevant Hawaiian state departments. Here are a few key forms that are often used in conjunction with the BB-1X form:

- Form VP-1 (Tax Payment Voucher): This form is essential for submitting any payment due for general excise/use tax, Transient Accommodations, Retail Tobacco Permit, and other fees related to the BB-1X form amendments. It ensures your payments are correctly processed and applied.

- Form VP-2 (Miscellaneous Fee Payment Voucher): Similar to Form VP-1, this voucher is used for submitting payments for miscellaneous fees, such as those for Cigarette and Tobacco, Liquor licenses, and Liquid Fuel Dealer's permits. This form facilitates the accurate processing of specialized fees.

- Form N-172 (Disability Exemption Application): If the applicant qualifies for a disability exemption, this form must be completed and submitted. It helps applicants to claim exemptions allowable under Hawaii law for gross income adjustments based on disability status.

- Form UC-1 (Employer’s Quarterly Wage, Contribution and Employment and Training Assessment Report): This form is critical for reporting wages and paying unemployment insurance contributions. It's necessary if the amended application includes the addition of an Employer’s Withholding License or if the business has employees.

- Liquor Tax Permit Application: For businesses that are applying for or amending their liquor license through the BB-1X form, a specific application for a county liquor tax permit must be completed. This permit is separate from the state registration and is required for the legal sale of liquor.

- Cigarette Tax and Tobacco Tax License Application: If a business intends to deal in cigarettes or tobacco products and this was not included in the initial BB-1 application, completing the relevant license application for cigarette and tobacco taxes is necessary. This allows for the legal sale and distribution of these products within Hawaii.

Understanding and completing these auxiliary forms correctly plays a pivotal role in ensuring your business complies with Hawaii's state regulations. They each serve specific purposes, from facilitating the correct application of payments to ensuring that your business is legally licensed for certain activities. It's crucial to review each form carefully and provide accurate, up-to-date information to avoid potential complications. Remember, these forms not only support your BB-1X submission but also help maintain the legal standing and operational compliance of your business in Hawaii.

Similar forms

The Hawaii Tax BB-1X form shares similarities with the IRS Form 1040 Schedule C, which is used for reporting income or loss from a business you operated or a profession you practiced as a sole proprietor. Both forms are integral to business operations, allowing businesses to amend previously reported information or declare additional sources of income. Specifically, the BB-1X form is designed to add licenses or permits not initially applied for, similar to how Schedule C may be used to report additional business-related income or expenses that were not previously accounted for.

Another document resembling the Hawaii Tax BB-1X form is the IRS Form 8822-B, which is used to inform the IRS about a change of address or the identity of a business’s responsible party. Just as the BB-1X form includes sections for updating business address details and contact information for businesses operating in Hawaii, Form 8822-B ensures that the IRS has current information on where to send correspondence and who is responsible for the business.

The Uniform Business Identifier (UBI) application found in many states is also akin to the BB-1X form. These applications are typically used when a business needs to obtain a unified state identifier for tax, regulatory, and licensing purposes. Similar to how the BB-1X form incorporates various permits and licenses into one application, the UBI streamlines multiple state business requirements under one identifier, facilitating easier compliance and administration for businesses.

The local County Business License application often mirrors the functionality of the Hawaii Tax BB-1X form in that it allows businesses to apply for or amend local business licenses. While the BB-1X is more broadly focused on state-level licenses and permits, a county business license application plays a similar role at the local level, enabling businesses to comply with municipal regulations and requirements.

State-specific Sales and Use Tax Permit applications are comparable to the BB-1X form in terms of allowing businesses to register for sales and use taxes. Just as the BB-1X form enables businesses to add a General Excise/Use Tax license among others, state sales and use tax permit applications are essential for businesses to legally sell goods and services within a state and collect the appropriate taxes on sales.

The Employer Identification Number (EIN) application process through the IRS Form SS-4 shares objectives with parts of the BB-1X form. While an EIN is federal and the BB-1X form is state-specific, both processes are critical for new or expanding businesses. Applying for an EIN is a foundational step for tax identification purposes, similar to how applying or amending information on the BB-1X form is foundational for a business’s compliance with state tax, employment, and licensing obligations in Hawaii.

Lastly, the modification aspects of the BB-1X form bear resemblance to the Alcohol and Tobacco Tax and Trade Bureau (TTB) Permits Online system for amending federal permits, labels, and reports. Similar to how businesses use the BB-1X to amend or add to their license and permit registrations in Hawaii, the TTB’s online system allows for the digital amendment and management of federally regulated alcohol and tobacco product permissions. Both systems provide a streamlined approach to regulatory compliance through the amendment and updating of essential business operations and products.

Dos and Don'ts

When dealing with the Hawaii Tax BB1X form, individuals must navigate the fine line between thoroughness and accuracy. Attention to detail can make a significant difference. Here are some essential dos and don'ts to help you effectively complete the form:

- Do read all the instructions carefully before you begin to fill out the form. This will help you understand each section and what is required.

- Do use legible handwriting if you are filling out the form by hand, or better yet, type out your responses for clarity.

- Do review your form thoroughly for any errors or omissions before submitting it. Accuracy is key to avoid delays or issues.

- Do attach all necessary documentation, such as checks, money orders, and any required forms like VP-1 or VP-2.

- Do use the correct Hawaii Tax I.D. Number to ensure your form is processed efficiently.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Don't skip sections that apply to your business. If a section is relevant to the additional license/permit/registration you are applying for, it must be filled out.

- Don't hesitate to contact the Hawaii Department of Taxation for clarification if you are unsure about how to complete any part of the form.

- Don't overlook the mailing addresses and telephone numbers provided on the form for both the Hawaii Department of Taxation and the Department of Labor and Industrial Relations. Use them if you need assistance or have questions.

Misconceptions

Many people have misconceptions about the Hawaii Tax BB-1X form, which can lead to errors when trying to add licenses, permits, or registrations to an existing business application. Understanding these misconceptions is crucial for ensuring the process is completed correctly.

- Misconception 1: The form is only for new businesses establishing themselves in Hawaii.

- Misconception 2: There's no need to attach payment for the additional licenses or permits when filing the form.

- Misconception 3: You can add as many licenses or registrations as you want at one time without any additional information.

- Misconception 4: The BB-1X form also serves as an application for Unemployment Insurance (UI) contributions.

- Misconception 5: If no employees have been hired yet, there's no need to complete certain sections.

- Misconception 6: Filing the BB-1X form can be postponed until the business begins operations in Hawaii.

This is incorrect. The BB-1X form is specifically designed for businesses that have already submitted a Form BB-1 and need to amend their application to add additional licenses, permits, or registrations not originally applied for.

Actually, businesses must attach a check or money order for the total amount due for the additional licenses or registrations they are applying for, along with Forms VP-1 and/or VP-2 if applicable.

Each license or registration requires specific information related to the start date and, in some cases, a fee. For example, the General Excise/Use license and Transient Accommodations license each require you to enter a start date and the appropriate fee.

While the form does ask if you intend to apply for an Unemployment Insurance account, it does not replace the need to separately apply for UI contributions through the appropriate state department.

Even if a business has not yet hired employees, it must indicate when it anticipates hiring. This information is crucial for unemployment insurance and other employment-related licenses.

The form should be filed as soon as a business realizes the need to add licenses, permits, or registrations not included in their original BB-1 form application. Delaying this filing can result in operating without necessary legal permissions.

By understanding and correcting these misconceptions, businesses can ensure they are fully compliant with Hawaii's tax and licensing requirements, thereby avoiding unnecessary complications or penalties.

Key takeaways

When filling out the Hawaii Tax BB-1X form, understanding the key takeaways can make the process smoother and ensure compliance with state taxation rules. Here are eight crucial points to remember:

- Purpose of Form BB-1X: This form is specifically designed for businesses that need to amend their basic business application. It should only be used to add a license, permit, or registration not previously applied for on the original Form BB-1.

- Attachments Required: When submitting Form BB-1X, you must attach any necessary payment and additional forms, such as Forms VP-1 and/or VP-2, to the application.

- Selecting Licenses/Permits: The form allows businesses to add various types of licenses or permits, including General Excise/Use, Transient Accommodations, Employer’s Withholding, and several others. It's crucial to accurately identify and apply for the specific licenses or permits your business requires.

- Registration Fees: Some licenses and permits require a fee. The form outlines the fee structure for each type of registration, such as the General Excise/Use tax and the Transient Accommodations license, among others. Ensure the correct fee is calculated and included with the form.

- Business Details: You must provide detailed information about your business, including the Hawaii Tax I.D. No., Taxpayer/Employer’s Name, Social Security Number, Federal Employer I.D. Number (FEIN), and both the mailing and physical locations of the business.

- Employment Information: If your business has employees, you must provide information about employment start dates, the number of employees, and the date when the first wages were paid in Hawaii. If you anticipate hiring employees, this should also be indicated on the form.

- Filing and Accounting Preferences: You're required to specify your filing period (monthly, quarterly, semiannually) for various taxes, choose your accounting period (calendar year or fiscal year), and select your accounting method (cash or accrual). This helps determine how and when you report income.

- Contact Information for Additional Locations: For businesses with multiple branches or locations, including transient accommodations or rental motor vehicle businesses, detailed addresses must be provided for each. This also applies to retail tobacco permit applications and liquid fuel retail dealer’s permits.

It's important to complete the BB-1X form with accurate and current information to comply with Hawaii's taxation requirements. If you have any questions or need clarification on certain sections, consulting with a tax advisor or the Hawaii Department of Taxation directly can provide guidance.

Popular PDF Documents

Certain Government Payments - If you've received payment under a government-sponsored unemployment program, you'll receive a 1099-G form for tax purposes.

IRS Schedule A 990 or 990-EZ - This form is essential for certain types of charities, especially those classified under Sections 509(a)(1) and 170(b)(1)(A)(vi), to prove their public charity status.

Wv Sales and Use Tax Form - States the requirement for purchasers to have a clear principle business activity to qualify for exemptions listed.