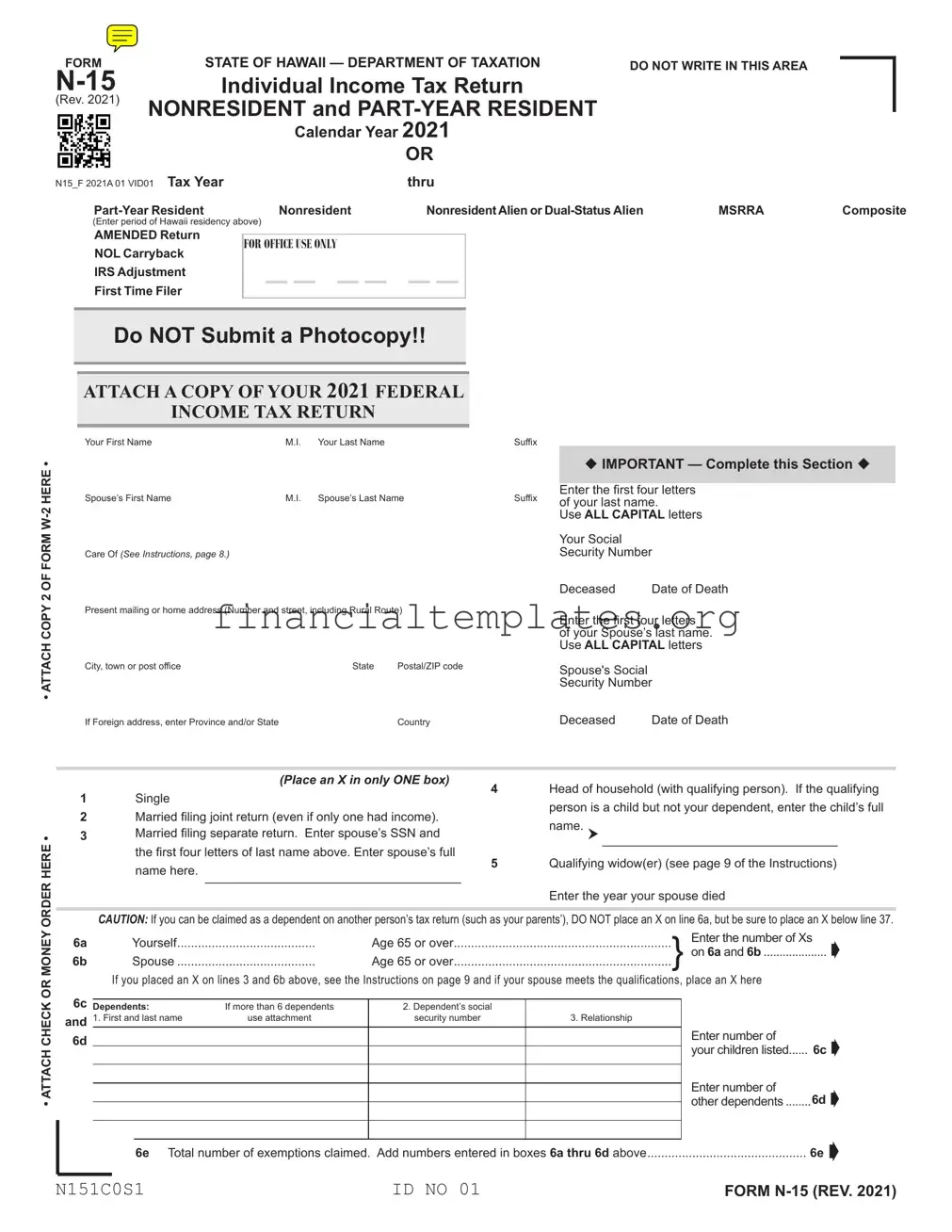

Get Hawaii N15 Tax Form

For individuals living or earning income in Hawaii who find themselves navigating the complexities of their tax obligations, the Hawaii N-15 Tax Form serves as a crucial tool. Tailored specifically for nonresidents and part-year residents, this form provides a structured way to report income earned in Hawaii during the tax year in question. Whether you have moved in or out of Hawaii during the year, are a nonresident alien, or are dealing with specific situations like adjustments from the IRS or carrying forward a net operating loss, the N-15 form addresses a wide range of circumstances. The form allows filers to detail wages, interest income, dividends, and more, while also making allowances for deductions and credits that can significantly impact the calculation of taxable income. With sections dedicated to everything from standard deductions and exemptions to specific credits like those for child care expenses, the Hawaii N-15 form aims to comprehensively capture an individual's financial activity within the state. As this form plays a pivotal role in ensuring the proper calculation of state income tax, understanding its components and accurately completing it is essential for meeting one's tax responsibilities in Hawaii.

Hawaii N15 Tax Example

FORM |

STATE OF HAWAII — DEPARTMENT OF TAXATION |

DO NOT WRITE IN THIS AREA |

|

|

||

Individual Income Tax Return |

|

|

|

|

||

(Rev. 2021) NONRESIDENT and |

|

|

|

|

||

|

|

|

|

|||

|

Calendar Year 2021 |

|

|

|

|

|

|

|

OR |

|

|

|

|

N15_F 2021A 01 VID01 Tax Year |

thru |

|

|

|

|

|

Nonresident |

Nonresident Alien or |

MSRRA |

Composite |

|||

(Enter period of Hawaii residency above) |

|

|

|

|

|

|

AMENDED Return

NOL Carryback

IRS Adjustment

First Time Filer

FOROFFICE USE ONLY

Do NOT Submit a Photocopy!!

• ATTACH COPY 2 OF FORM

ATTACH A COPY OF YOUR 2021 FEDERAL

INCOME TAX RETURN

Your First Name |

M.I. |

Your Last Name |

|

Suffix |

|

|

|

|

|

|

|

u IMPORTANT — Complete this Section u |

|

|

|

|

|

|

|

|

Spouse’s First Name |

M.I. |

Spouse’s Last Name |

Suffix |

Enter the first four letters |

||

of your last name. |

||||||

|

|

|

|

|

Use ALL CAPITAL letters |

|

|

|

|

|

|

Your Social |

|

Care Of (See Instructions, page 8.) |

|

|

|

|

Security Number |

|

|

|

|

|

|

Deceased |

Date of Death |

Present mailing or home address (Number and street, including Rural Route) |

|

Enter the first four letters |

||||

|

|

|

|

|

||

|

|

|

|

|

of your Spouse’s last name. |

|

|

|

|

|

|

Use ALL CAPITAL letters |

|

City, town or post office |

|

State |

Postal/ZIP code |

|

Spouse's Social |

|

|

|

|

|

|

Security Number |

|

If Foreign address, enter Province and/or State |

|

|

Country |

|

Deceased |

Date of Death |

ORDER HERE •

(Place an X in only ONE box)

1Single

2Married filing joint return (even if only one had income).

3Married filing separate return. Enter spouse’s SSN and the first four letters of last name above. Enter spouse’s full name here. _____________________________________

4Head of household (with qualifying person). If the qualifying person is a child but not your dependent, enter the child’s full

name. __________________________________

5Qualifying widow(er) (see page 9 of the Instructions) Enter the year your spouse died

• ATTACH CHECK OR MONEY

CAUTION: If you can be claimed as a dependent on another person’s tax return (such as your parents’), DO NOT place an X on line 6a, but be sure to place an X below line 37.

6a |

Yourself |

|

Age 65 or over |

Enter the number of Xs |

|

|||

|

||||||||

6b |

Spouse |

Age 65 or over |

|

|||||

|

If you placed an X on lines 3 and 6b above, see the Instructions on page 9 and if your spouse meets the qualifications, place an X here |

|

|

|||||

6c |

|

|

|

|

|

|

|

|

Dependents: |

If more than 6 dependents |

2. Dependent’s social |

|

|

|

|

||

and |

1. First and last name |

use attachment |

security number |

3. Relationship |

|

|

|

|

6d |

|

|

|

|

|

Enter number of |

|

6c  |

|

|

|

|

|

your children listed |

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Enter number of |

6d  |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

other dependents |

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

6e  |

||

|

|

|

|

|

|

|||

|

|

6e Total number of exemptions claimed. Add numbers entered in boxes 6a thru 6d above |

||||||

N151C0S1 |

ID NO 01 |

FORM

Form |

|

Page 2 of 4 |

|||

|

|

|

Your Social Security Number |

Your Spouse’s SSN |

|

N15_F 2021A 02 VID01 |

Name(s) as shown on return |

|

|

||

|

|

||||

|

|

|

|||

|

|

|

Col. A - Total Income |

Col. B - Hawaii Income |

|

7 |

Wages, salaries, tips, etc. (attach Form(s) |

7 |

|

||

8 |

Interest income from the worksheet on page 38 of |

|

|

||

|

the Instructions |

8 |

|

||

9 |

Ordinary dividends |

9 |

|

||

10 |

State income tax refund from the worksheet on |

|

|

||

|

page 38 of the Instructions |

10 |

|

||

11 |

Alimony received |

11 |

|

||

12 |

Business or farm income or (loss) |

12 |

|

||

13 |

Capital gain or (loss) from the worksheet on |

|

|

||

|

page 38 of the Instructions |

13 |

|

||

14 |

Supplemental gains or (losses) |

|

|

|

|

|

(attach Schedule |

14 |

|

||

15 |

IRA distributions |

15 |

|

||

16 |

Pensions and annuities (see Instructions and |

|

|

||

|

attach Schedule J, Form |

16 |

|

||

17 |

Rents, royalties, partnerships, estates, trusts, etc |

17 |

|

||

18 |

Unemployment compensation (insurance) |

18 |

|

||

19 |

Other income (state nature and source) |

|

|

||

|

________________________________ |

19 |

|

||

|

|

|

|||

20 |

Add lines 7 through 19 |

Total Income |

20 |

|

|

21 |

Certain business expenses of reservists, performing |

|

|

||

|

artists, and |

21 |

|

||

22 |

IRA deduction |

22 |

|

||

23 |

Student loan interest deduction from the worksheet |

|

|

||

|

on page 42 of the Instructions |

23 |

|

||

24 |

Health savings account deduction |

24 |

|

||

25 |

Moving expenses (attach Form |

25 |

|

||

26 |

Deductible part of |

26 |

|

||

27 |

27 |

|

|||

28 |

28 |

|

|||

29 |

Penalty on early withdrawal of savings |

29 |

|

||

30 |

Alimony paid (Enter name and SS No. of recipient) |

|

|

||

|

________________________________ |

30 |

|

||

|

|

|

|||

|

|

31 Payments to an individual housing account . |

31 |

|

|

|

|

32 First $7,152 of military reserve or Hawaii |

|

|

|

|

|

national guard duty pay |

32 |

|

|

|

|

|

|

|

|

N152C0S1 |

ID NO 01 |

FORM

Form |

Page 3 of 4 |

Your Social Security Number |

Your Spouse’s SSN |

Name(s) as shown on return

N15_F 2021A 03 VID01

33Exceptional trees deduction (attach affidavit)

|

(see page 21 of the Instructions) |

33 |

|

34 |

Add lines 21 through 33 |

......... Total Adjustments |

34 |

35 |

Line 20 minus line 34 .... |

Adjusted Gross Income |

35 |

36 |

Federal adjusted gross income (see page 22 of the Instructions) |

36 |

|

37 Ratio of Hawaii AGI to Total AGI. Divide line 35, Column B, by line 35, Column A (Compute to 3 decimal places and round to 2 decimal places) ... 37 CAUTION: If you can be claimed as a dependent on another person’s return, see the Instructions on page 22, and place an X here.

38If you do not itemize deductions, enter zero on line 39 and go to line 40a. Otherwise go to page 22 of the Instructions and enter your Hawaii itemized deductions here.

38a Medical and dental expenses |

|

(from Worksheet |

..............................38a |

38b |

Taxes (from Worksheet |

38b |

38c |

Interest expense (from Worksheet |

38c |

38d |

Contributions (from Worksheet |

38d |

38e |

Casualty and theft losses |

|

|

(from Worksheet |

38e |

38f |

Miscellaneous deductions |

|

|

(from Worksheet |

38f |

40a |

If you checked filing status box: 1 or 3 enter $2,200; |

|

|

2 or 5 enter $4,400; 4 enter $3,212 |

40a |

40b |

Multiply line 40a by the ratio on line 37 |

Prorated Standard Deduction 40b |

TOTAL ITEMIZED

DEDUCTIONS

39If your Hawaii adjusted gross income is above a certain amount, you may not be able to deduct all of your itemized deductions. See the

Instructions on page 27. Enter total here and go to line 41.

41 |

Line 35, Column B minus line 39 or 40b, whichever applies. (This line MUST be filled in) |

41 |

||

42a |

Multiply $1,144 by the total number of exemptions claimed on line 6e. If you and/or your spouse are blind, deaf, |

|

||

|

or disabled, place an X in the applicable box(es), and see the Instructions. |

|

||

|

Yourself |

Spouse |

42a |

|

42b |

Multiply line 42a by the ratio on line 37 |

Prorated Exemption(s) 42b |

||

43 |

Taxable Income. Line 41 minus line 42b (but not less than zero) |

Taxable Income 43 |

|||

44 |

Tax. Place an X if from: |

Tax Table; |

Tax Rate Schedule; or |

Capital Gains Tax |

|

|

( |

Place an X if tax from Forms |

|||

|

........................................................................................... |

Tax 44 |

|||

44a |

If tax is from the Capital Gains Tax Worksheet, enter |

|

|||

|

the net capital gain from line 8 of that worksheet |

44a |

|||

45 |

Refundable Food/Excise Tax Credit |

|

|

||

|

(attach Form |

.....45 |

|

||

46 |

Credit for |

|

|

||

|

Renters (attach Schedule X) |

46 |

|

||

47Credit for Child and Dependent Care

Expenses (attach Schedule X) |

47 |

|

|

||

48 Credit for Child Passenger Restraint |

|

|

|

||

System(s) (attach a copy of the invoice) |

48 |

|

|

||

49 |

Total refundable tax credits from |

|

|

|

|

|

|

Schedule CR (attach Schedule CR) |

49 |

|

|

50 |

Add lines 45 through 49 |

Total Refundable Credits |

50 |

||

|

51 |

Line 44 minus line 50. If line 51 is zero or less, see Instructions |

.............Adjusted Tax Liability |

51 |

|

N153C0S1 |

|

ID NO 01 |

|

||

Worksheet on page 41 of the Instructions.

FORM

Form |

Page 4 of 4 |

|

|

Your Social Security Number |

Your Spouse’s SSN |

|

Name(s) as shown on return |

|

N15_F 2021A 04 VID01 |

|

|

52 |

Total nonrefundable tax credits (attach Schedule CR) |

52 |

53 |

Line 51 minus line 52 |

Balance 53 |

54Hawaii State Income tax withheld (attach

(see page 30 of the Instructions for other attachments).....54

552021 estimated tax payments on

|

Forms |

TOTAL |

|

|

|

|

PAYMENTS |

56 |

Amount of estimated tax applied from 2020 return |

56 |

58 Add lines 54 through 57. |

|

|||

57 |

Amount paid with extension |

57 |

|

59If line 58 is larger than line 53, enter the amount OVERPAID

|

(line 58 minus line 53) (see Instructions) |

59 |

|

60 |

Contributions to (see page 30 of the Instructions): |

Yourself |

Spouse |

|

60a Hawaii Schools Repairs and Maintenance Fund |

$2 |

$2 |

|

60b Hawaii Public Libraries Fund |

$5 |

$5 |

|

60c Domestic and Sexual Violence / Child Abuse and Neglect Funds |

$5 |

$5 |

61 Add the amounts of the Xs on lines 60a through 60c and enter the total here |

61 |

||

62 |

Line 59 minus line 61 |

62 |

|

63Amount of line 62 to be applied to

|

your 2022 ESTIMATED TAX |

63 |

|

|

|

|

64a |

Amount to be REFUNDED TO YOU (line 62 minus line 63) If filing late, see page 31 of Instructions. |

Place an X here |

if this refund will |

|||

|

ultimately be deposited to a foreign |

|

|

|

||

64b |

Routing number |

64c Type: |

Checking |

Savings |

|

|

64d |

Account number |

|

........................... |

64a |

|

|

65 |

AMOUNT YOU OWE (line 53 minus line 58) |

|

65 |

|

|

|

66PAYMENT AMOUNT Submit payment online at hitax.hawaii.gov or attach check or

money order payable to “Hawaii State Tax Collector.” |

66 |

67Estimated tax penalty. (See page 31 of Instr.) Do not include this amount

|

in line 59 or 65. Check this box if Form |

67 |

|

68 |

AMENDED RETURN ONLY - Amount paid (overpaid) on original return. (See Instructions) (attach Sch. AMD) |

68 |

|

69 |

AMENDED RETURN ONLY - Balance due (refund) with amended return. (See Instructions) (attach Sch. AMD) |

69 |

|

DESIGNEE

If designating another person to discuss this return with the Hawaii Department of Taxation, complete the following. This is not a full power of attorney. See page 32 of the Instructions.

Designee’s name |

Phone no. |

Identification number |

HAWAII ELECTION |

|

Do you want $3 to go to the Hawaii Election Campaign Fund? |

Yes |

No |

CAMPAIGN FUND |

ÂIf joint return, does your spouse want $3 to go to the fund? |

Yes |

No |

|

(See page 32 of the Instructions) |

||||

Note: Placing an X in the “Yes” box will not increase your tax or reduce your refund.

PLEASE SIGN HERE

DECLARATION — I declare, under the penalties set forth in section

|

Your signature |

|

|

Date |

|

Spouse’s signature (if filing jointly, BOTH must sign) |

Date |

||||||

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Your Occupation |

|

|

Daytime Phone Number |

|

Your Spouse’s Occupation |

|

|

Daytime Phone Number |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

Paid |

Preparer’s |

|

|

|

|

Date |

Check if |

|

Preparer’s identification number |

|

|||

Preparer’s |

Signature |

|

|

|

|

|

|

|

|

|

|||

Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal E.I. No. |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Preparer’s Name |

|

|

|

|

|

|

|||||

|

|

Firm’s name (or yours |

|

|

|

Phone No |

|

|

|

|

|

||

|

|

if |

|

|

|

|

|

|

|

|

|||

|

|

Address, and ZIP Code |

|

|

|

|

|

|

|

|

|

||

N154C0S1 |

ID NO 01 |

FORM

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The N-15 form is for nonresident and part-year resident individuals. |

| 2 | It is used for the 2020 tax year. |

| 3 | This form includes sections for reporting both standard income and Hawaii-specific income. |

| 4 | Filers can claim various deductions, including IRA deductions and student loan interest deductions. |

| 5 | It accommodates different filing statuses, such as single, married filing jointly, and head of household. |

| 6 | Special categories for deductions include exceptional trees and moving expenses. |

| 7 | The form allows for adjustments to income, like contributions to an individual housing account and certain business expenses. |

| 8 | There are provisions for refundable credits such as the Refundable Food/Excise Tax Credit and Credit for Low-Income Household Renters. |

| 9 | Filers can make contributions directly on the form to funds like the Hawaii Schools Repairs and Maintenance Fund. |

| 10 | The form is governed by the Hawaii Income Tax Law, Chapter 235, HRS. |

Guide to Writing Hawaii N15 Tax

When the time comes to file the Hawaii N-15 Tax Form, careful attention to detail helps ensure the process is completed accurately. This task, although it may seem daunting at first, can be tackled with precision by following clear steps. Whether you're a nonresident, part-year resident, or fall into a specific category like nonresident alien or dual-status alien, this guide is crafted to guide you through the form, section by section. Before mailing your completed form, ensure each part is thoroughly reviewed to reflect your financial activities within the state of Hawaii for the tax year concerned.

- Start by gathering all necessary documentation, including your Federal Income Tax Return and any Forms W-2 received.

- On the top section of page 1, select your filing status by checking the appropriate box for your situation: Nonresident, Part-Year Resident, Nonresident Alien, or Dual-Status Alien. Also, indicate if the return is an AMENDED Return, involves an NOL Carryback, or IRS Adjustment.

- Enter your name, your spouse’s name (if filing jointly), and your mailing address in the spaces provided.

- Provide Social Security Numbers (SSNs) for you and your spouse, along with the first four letters of your last names in capital letters. If applicable, include deceased dates.

- Select your filing status by marking the appropriate box, considering your or your spouse's age over 65 and any dependents.

- List all dependents’ names, social security numbers, and their relationship to you, along with the total number of exemptions claimed.

- Transition to page 2, where you'll report your income. Fill in your total and Hawaii-specific income in Columns A and B across lines 7 through 19.

- Deduct any eligible adjustments from your income on lines 21 through 33, sum these adjustments, and subtract from your total income to find your Adjusted Gross Income (AGI).

- On page 3, compare your Federal AGI with your Hawaii AGI to determine the ratio of Hawaii income to total income, and calculate your prorated standard deduction and exemptions accordingly.

- Itemize deductions if applicable and calculate your taxable income after considering exemptions and deductions.

- Calculate the tax owed by referring to the tax table or tax rate schedules recommended in the instructions and identify any credits you're eligible for.

- On page 4, summarize nonrefundable credits, and calculate the total payments including withholdings, estimated tax payments, and any amounts paid with extension requests.

- Determine your overpayment or amount owed after subtracting credits from the tax liability and decide on the allocation of any refund due or make arrangements for payment if you owe additional taxes.

- If designating a third party to discuss this return with the Department of Taxation, fill out the designated section.

- Decide whether you wish to allocate funds to the Hawaii Election Campaign Fund.

- Review the declaration, then sign and date the form. If filing jointly, ensure your spouse also signs. Provide contact numbers for both.

- If a paid preparer completed the form on your behalf, they must also sign and provide their identification number and contact information.

- Attach Copy 2 of your Form W-2 and a copy of your Federal Income Tax Return to the designated areas on the first page.

- Finally, review the entire form to confirm all information is accurate and complete. Make a copy for your records, then mail the original form to the address provided in the form's instructions.

By carefully following these outlined steps, you will have successfully completed and prepared your Hawaii N-15 Tax Form for submission. Ensuring the accuracy and completeness of every entered detail significantly contributes to a smooth processing experience.

Understanding Hawaii N15 Tax

Here are some frequently asked questions about the Hawaii N-15 Tax Form:

- Who needs to file the Hawaii N-15 Tax Form?

The Hawaii N-15 Tax Form is designed for individuals who are either nonresidents or part-year residents of Hawaii during the tax year. This includes those who have moved to or from Hawaii within the tax year, individuals who live outside of Hawaii but earn income from Hawaiian sources, and nonresident aliens or dual-status aliens for tax purposes. If you fall into one of these categories, you must report your income from Hawaii sources using Form N-15.

- What are the key sections to be aware of on the Form N-15?

The form is divided into several sections, each requiring detailed information about income, deductions, and tax credits specific to the state of Hawaii. Some of the key sections include:

- Total and Hawaii income - where you report wages, interest, dividends, and other forms of income.

- Deductions - where you can claim specific expenses to reduce your taxable income.

- Tax credits - aimed at reducing the amount of tax you owe to the state, including credits for low-income households, child and dependent care, and others.

- Payments - including Hawaii state income tax withheld, estimated tax payments, and amounts paid with an extension.

- How do you determine if you're a part-year resident or a nonresident for the purpose of the N-15 Form?

Part-year residents are individuals who were residents of Hawaii for only a portion of the tax year. This could be due to moving to or leaving Hawaii during the tax year. Nonresidents, on the other hand, did not establish residency in Hawaii but may have earned income from sources within the state. Your residence status affects which income is subject to Hawaii state tax and the type of deductions or credits you may claim.

- What are the critical deadlines for filing the N-15 Form?

The standard deadline for filing the N-15 Form is on or before April 20th of the year following the tax year. However, for those who find themselves unable to meet this deadline, Hawaii does offer an extension option, allowing individuals to file later without penalty, provided certain conditions are met, such as paying estimated tax owed by the original deadline. It's important to submit a request for extension by the filing deadline to avoid penalties for late filing.

Common mistakes

Filling out tax forms can be a daunting task, and making mistakes is not uncommon. Especially when dealing with the Hawaii N-15 Tax Form, which is used by nonresidents and part-year residents of Hawaii, certain errors can lead to processing delays or incorrect tax calculations. Being aware of common pitfalls can help taxpayers avoid them. Here are six mistakes people often make when filling out the Hawaii N-15 Tax Form:

Not attaching required documents: Taxpayers forget to attach copies of their W-2 forms or their Federal income tax return. These documents are crucial for verifying income and tax credits.

Incorrectly filling out residency information: Part-Year residents often incorrectly fill out the period of Hawaii residency. It's important to accurately enter the dates to ensure the right calculation of taxes owed for the time spent in Hawaii.

Failing to report all income: Some may overlook or incorrectly report income earned outside of Hawaii, not realizing that all income must be reported, even if it was earned while being a nonresident.

Incorrectly calculating deductions: Deductions can reduce your taxable income, but they must be calculated correctly. Incorrect calculations can result from misunderstanding which deductions are allowed for nonresidents and part-year residents.

Not selecting the correct filing status: The filing status affects the taxation rate and standard deductions. Choosing the wrong status can significantly impact the amount of tax owed or the size of the refund.

Omitting the Social Security Number (SSN) for dependents: Forgetting to include the SSNs of dependents can lead to denied personal exemptions, increasing the tax liability.

In addition to these mistakes, it's also common for taxpayers to:

Miss calculation errors: Mathematical errors are a common issue that can either inflate a refund or increase the amount of tax owed.

Misunderstand the tax codes or instructions: Tax laws are complex, and misunderstanding the instructions can lead to incorrectly filled forms.

Fail to apply for tax credits they are eligible for: Missing out on applicable tax credits means paying more in taxes than necessary.

Avoiding these errors requires careful attention to detail and a thorough understanding of the tax code. When in doubt, consulting with a tax professional can help navigate the complexities of the Hawaii N-15 Tax Form and ensure a correct and favorable tax outcome.

Documents used along the form

Filing taxes can often feel like navigating through a maze, especially when dealing with specialized forms such as the Hawaii N-15 Tax Form, used by nonresidents or part-year residents of Hawaii. This form is just one piece of the puzzle when it comes to accurately reporting income and calculating tax owed to the state of Hawaii. There are several other forms and documents that may need to be utilized alongside the N-15 to ensure a thorough and correct tax filing process. Understanding these documents can ease the stress of tax season, ensuring that all necessary information is accounted for and in compliance with Hawaii tax laws.

- Form W-2: This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It's essential for verifying income and tax withheld when completing the N-15 form.

- Schedule D-1: Used for reporting capital gains and losses. If you have transactions that result in gains or losses, this schedule is necessary to calculate the proper amounts to report on your N-15 form.

- Schedule J (Form N-11/N-15/N-40): This is required for reporting income from pensions and annuities. It helps determine the taxable portion of these income sources to be reported on the N-15.

- Form N-139: Related to moving expenses, this form is for individuals who moved in connection with the start of work at a new job location and wish to deduct these expenses on their tax return.

- Schedule CR: For claiming various nonrefundable tax credits. If you qualify for any credits, this schedule is necessary for detailing the amounts to be deducted from your total tax liability.

- Form N-311: Used to claim the refundable Food/Excise Tax Credit. This credit is available to taxpayers who meet certain income thresholds, helping to offset the general excise tax paid on food and other necessities.

Managing taxes doesn't have to be a daunting task. With the right forms and a bit of guidance, individuals can confidently navigate their tax obligations in Hawaii. Whether you're a part-year resident adjusting to Hawaii's tax landscape or a nonresident managing income sources within the state, the key to a smooth tax season is understanding which documents apply to your situation and how they interconnect with the N-15 form. Remember, when in doubt, seeking the advice of a tax professional can further simplify the process, ensuring peace of mind and compliance with state tax laws.

Similar forms

The 1040NR form used by the United States Internal Revenue Service (IRS) is quite similar to the Hawaii N-15 form, as both are designed for nonresident filers. The 1040NR form is employed by nonresident aliens of the United States to report their income from US sources. Like the N-15, it requires detailed information on income, deductions, and credits applicable specifically to nonresident filers, ensuring they are taxed appropriately for their activities within the respective jurisdiction.

Another comparable document is the 1040 form, the standard federal income tax form used by residents in the United States. While the 1040 is for residents and citizens, mirroring the purpose of the N-15 for Hawaii state residents, both forms collect extensive data on earned income, allowable deductions, and credits to calculate the tax obligation. The principle behind both forms is to capture an accurate financial snapshot for tax assessment purposes, although the 1040NR addresses the status and considerations relevant to nonresidents on a federal level.

California's 540NR form bears resemblance to Hawaii's N-15 in purpose and design, targeting nonresidents and part-year residents of California for state tax purposes. It parallels the N-15 by requiring details on income earned within the state, adjustments, deductions, and credits applicable to the filer's residency status. Through the 540NR, California ensures that individuals who earn income within its borders meet their tax responsibilities, aligning with the N-15's aim for Hawaii.

The Schedule C appended to the federal 1040 form is related to the N-15 in its focus on income or loss from a business operated by the filer. Though the N-15 is a comprehensive tax document and Schedule C is a supplemental form, both require detailed financial information for determining the net income that contributes to taxable income. They cater to self-employed individuals or sole proprietors by tailoring taxation to their unique income situations.

Hawaii's N-11 form, intended for residents filing their state income tax, is naturally akin to the N-15 form but tailored to those with full-year residency. Both forms serve the main purpose of calculating income tax due to the state, guiding filers through income reporting, deductions, and credits to establish tax liability. The primary difference lies in residency status, with the N-11 addressing the tax situations of residents rather than nonresidents or part-year residents.

The IRS's Schedule E is analogous to sections within the N-15 that involve reporting income from rentals, royalties, partnerships, estates, and trusts. Although Schedule E is an attachment to the federal 1040 form and not a standalone document like the N-15, it shares the goal of accounting for specific types of income. This similarity underscores the comprehensive approach both the IRS and the Hawaii Department of Taxation take toward capturing all possible income sources for taxation.

Oregon's Form 40P is yet another example of a state-specific tax form tailored to part-year residents and nonresidents, akin to Hawaii's N-15. It delineates income earned within Oregon and calculates taxes owed based on the part of the year the filer was a resident. Like the N-15, it ensures that individuals pay their fair share based on their time spent and income earned in the state, respecting the principle of taxation by residency.

New York State's IT-203 form, designed for nonresidents and part-year residents, is similar to the Hawaii N-15 in its objective to fairly tax individuals based on their earnings and duration of residency within the state. The IT-203 captures income, deductions, and tax credits with an emphasis on accurately attributing state tax liability to those who live or work in New York part of the year, reflecting the N-15’s role in Hawaii tax processes.

Dos and Don'ts

When filling out the Hawaii N-15 Tax Form, certain practices can enhance the accuracy and compliance of your tax return, while others can lead to problems or delays with the Hawaii Department of Taxation. Here are some guidelines to follow:

Things You Should Do

- Ensure all personal information is accurate. This includes your Social Security Number(s), mailing address, and the first four letters of your last name in all capital letters as requested on the form.

- Attach all required documents. This includes a copy of your federal income tax return and Form W-2, as well as any other applicable schedules or forms that substantiate your income, deductions, and credits.

- Review the instructions pertaining to your specific filing situation—whether you're a nonresident, part-year resident, or falling under a special filing category such as a nonresident alien or dual-status alien. Tailor your form to these instructions carefully.

- Double-check your calculations, especially in sections requiring you to compute ratios, adjusted gross income, and taxable income. Minor math errors can lead to processing delays or incorrect tax assessments.

Things You Shouldn't Do

- Don't leave mandatory fields blank. If a section does not apply to you, make sure to enter "0" or "N/A" where possible, instead of leaving it empty.

- Avoid submitting photocopies of the form. The instruction "Do NOT Submit a Photocopy!!" indicates the importance of using the original form provided by the Department of Taxation or an officially accepted downloaded form from their website.

- Don't guess on dates or figures. If you're unsure about specific details, such as the exact amount of income or deductions, refer back to your financial records or consult a tax professional before proceeding.

- Refrain from attaching checks or money orders to the form itself. While it instructs to “ATTACH CHECK OR MONEY ORDER HERE,” it's more about ensuring payment accompanies the form rather than physically attaching it, which could cause processing issues.

Misconceptions

When it comes to filing taxes in Hawaii, specifically using the N-15 form for nonresidents and part-year residents, there are several misconceptions that can lead to confusion and errors. It's important to address and clarify these misconceptions in order to help taxpayers correctly complete their tax returns and understand the specifics of Hawaii's tax laws.

Everyone Must File the N-15: A common misconception is that all individuals in Hawaii must file the N-15 form. In reality, the N-15 form is specifically designed for nonresidents or part-year residents of Hawaii. Full-time residents should file using the N-11 form instead.

Only Income Earned in Hawaii is Taxable: Another misconception is that if you're filing the N-15, only your Hawaii-earned income is taxable. While the form does differentiate between Hawaii income and total income, nonresidents and part-year residents could be taxed on certain types of income from other states or sources that are considered Hawaii-sourced. It's important to understand what constitutes Hawaii-sourced income.

No Need to Attach Federal Return: The instruction to attach a copy of your 2020 federal income tax return is often overlooked. Many think it's unnecessary, but it can be crucial for verifying information and ensuring your Hawaii tax return is accurate.

Part-Year Residents Are Taxed Differently: Some believe that part-year residents are taxed differently. While their tax situation might differ due to the period they resided in Hawaii, they use the same form (N-15) and need to follow the instructions for dividing income between residency periods.

Married Couples Must File Jointly: Though married couples can file a joint return, it is not a requirement. The N-15 form clearly provides options for married filing separately, allowing couples to choose the filing status that is most beneficial for their situation.

Filing Status Doesn't Affect Deductions or Credits: Your filing status can significantly affect the deductions and credits you're eligible for, as well as the calculation of your taxable income on the N-15 form. Each status has different implications for how your taxes are calculated.

Nonresident Aliens Can't File the N-15: Nonresident aliens can and should file the N-15 if they have earned income from Hawaii sources. Misunderstanding who needs to file can lead to failing to report income correctly.

All Income Is Treated the Same: Different types of income are treated differently on the N-15 form. For instance, business income, capital gains, and employment income might have different rates or requirements for reporting and taxation.

Electronic Filing Isn't Available: Many people believe that for specific forms like the N-15, electronic filing isn't an option. However, Hawaii does offer electronic filing options which can make the submission process easier and faster.

Understanding these misconceptions and learning about the correct filing practices can help ensure that your tax filing process is as smooth and accurate as possible. Remember, when in doubt, consulting the instructions for the form or a tax professional can provide clarity and assistance.

Key takeaways

Filling out and understanding the Hawaii N-15 Tax Form is essential for nonresidents and part-year residents of Hawaii to accurately report their income and calculate their tax obligations. This form is designed specifically for individuals who do not reside in Hawaii year-round but have earned income from the state. Here are five key takeaways to help navigate this important document:

- Identifying your status is the first step in filling out the form correctly. The N-15 form is for nonresidents or part-year residents. This classification impacts how you report income and calculate your taxes owed to the state of Hawaii.

- Income reporting must include all sources earned within Hawaii. Page 2 of the form lists various types of income, from wages and salaries to business or farm income. You must report income accurately to avoid potential penalties.

- Deductions and credits offer opportunities to reduce your taxable income. The N-15 form outlines specific deductions and credits available, including those related to moving expenses, self-employment tax, or exceptional tree deductions. Carefully review these to maximize your tax benefits.

- Attachment requirements include Form W-2 for wages and any other relevant documentation to support your income, deductions, and credits claimed. Ensuring that all necessary documents are attached is crucial for the timely processing of your return.

- Understanding the differentiated columns for "Total Income" and "Hawaii Income" is essential for correctly filling out the form. Income earned in Hawaii should be reported in the "Hawaii Income" column, which is critical for calculating the correct amount of state tax owed.

Familiarizing yourself with these takeaways can help simplify the process of completing the Hawaii N-15 Tax Form. It's always advisable to consult with a tax professional if you have specific questions or complicated tax situations.

Popular PDF Documents

Tax Form 8829 - Form 8829 addresses both direct expenses, such as painting or repairs in the home office, and indirect expenses like whole-house utilities.

Form 5060 - Entities exempt by other federal or state laws can also benefit from state and local hotel tax exemptions using this form.