Get Georgia Hotel Tax Form

In the bustling world of hospitality, the Georgia Hotel Tax form plays an essential role in ensuring that specific travelers can enjoy their stays without worrying about extra tax burdens. Introduced through legislation in 1987, this provision specifically benefits government officials and employees in the state of Georgia, granting them a special exemption from county or municipal lodging taxes while traveling on official business. To take advantage of this exemption, a crucial document—the State of Georgia Certificate of Exemption of Local Hotel/Motel Excise Tax—needs to be presented at the time of accommodation. It's a straightforward process: upon verification of the official's identity and the relevant details provided on the form, including the name, title, government agency represented, and contact information for their accounting or fiscal office, hotel and motel operators are required to waive the usually applicable local hotel/motel taxes. Additionally, if these travelers take one step further by submitting the “Department of Revenue Sales Tax Certificate of Exemption Form (ST-5)”, they can also secure an exemption from the state’s sales tax, provided the payment is made through a state-issued credit card or direct billing to the governmental organization. Keeping a copy of this exemption form within hotel tax records is mandatory, serving as a document that verifies the individual's eligibility for the tax exemption. For those in the know, navigating these provisions can make official travel more cost-effective and streamlined, underscoring the importance of understanding and utilizing the Georgia Hotel Tax form properly.

Georgia Hotel Tax Example

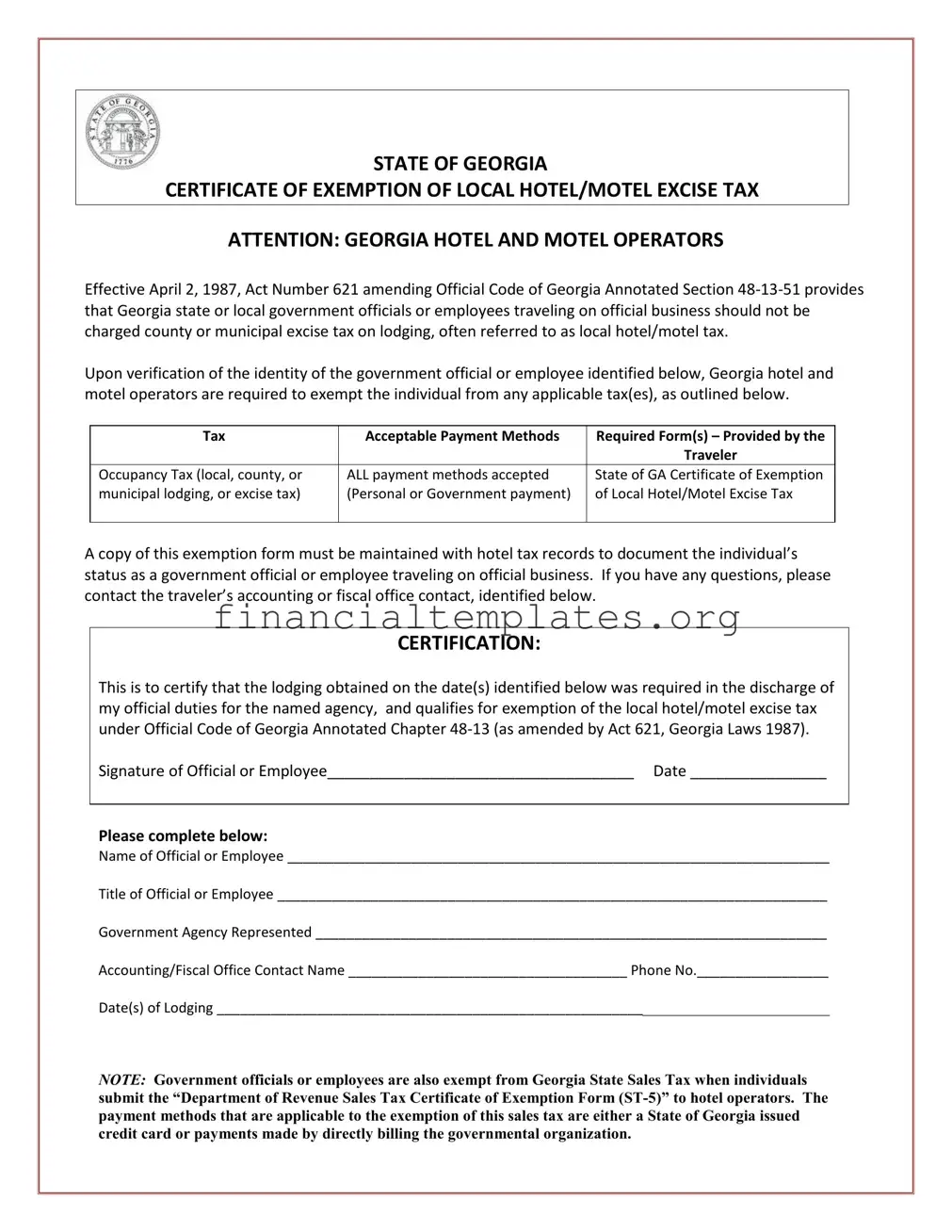

STATE OF GEORGIA

CERTIFICATE OF EXEMPTION OF LOCAL HOTEL/MOTEL EXCISE TAX

ATTENTION: GEORGIA HOTEL AND MOTEL OPERATORS

Effective April 2, 1987, Act Number 621 amending Official Code of Georgia Annotated Section

Upon verification of the identity of the government official or employee identified below, Georgia hotel and motel operators are required to exempt the individual from any applicable tax(es), as outlined below.

Tax |

Acceptable Payment Methods |

Required Form(s) – Provided by the |

|

|

Traveler |

|

|

|

Occupancy Tax (local, county, or |

ALL payment methods accepted |

State of GA Certificate of Exemption |

municipal lodging, or excise tax) |

(Personal or Government payment) |

of Local Hotel/Motel Excise Tax |

|

|

|

A copy of this exemption form must be maintained with hotel tax records to document the individual’s status as a government official or employee traveling on official business. If you have any questions, please contact the traveler’s accounting or fiscal office contact, identified below.

CERTIFICATION:

This is to certify that the lodging obtained on the date(s) identified below was required in the discharge of my official duties for the named agency, and qualifies for exemption of the local hotel/motel excise tax under Official Code of Georgia Annotated Chapter

Signature of Official or Employee____________________________________ Date ________________

Please complete below:

Name of Official or Employee ______________________________________________________________________

Title of Official or Employee _______________________________________________________________________

Government Agency Represented __________________________________________________________________

Accounting/Fiscal Office Contact Name ____________________________________ Phone No._________________

Date(s) of Lodging _______________________________________________________________________________

NOTE: Government officials or employees are also exempt from Georgia State Sales Tax when individuals submit the “Department of Revenue Sales Tax Certificate of Exemption Form

Document Specifics

| Fact | Detail |

|---|---|

| Effective Date | April 2, 1987 |

| Governing Law | Act Number 621 amending Official Code of Georgia Annotated Section 48-13-51 |

| Eligibility for Exemption | Georgia state or local government officials or employees traveling on official business |

| Type of Tax Exempted | Local hotel/motel excise tax on lodging |

| Payment Methods for Exemption | All payment methods accepted (personal or Government payment) |

| Required Form for Tax Exemption | State of GA Certificate of Exemption of Local Hotel/Motel Excise Tax |

| Additional Sales Tax Exemption | Georgia State Sales Tax exemption with “Department of Revenue Sales Tax Certificate of Exemption Form (ST-5)” |

Guide to Writing Georgia Hotel Tax

In Georgia, state and local government officials or employees are exempt from county or municipal excise taxes on lodging when traveling on official business. This exemption stems from an amendment in 1987 to the Official Code of Georgia, aiming to alleviate the financial burden on public servants. For hotel and motel operators, acknowledging and applying this exemption requires due diligence in verifying the status of the guests claiming it. Below is a step-by-step guide for accurately completing the Georgia Hotel Tax Exemption form, ensuring compliance and assisting eligible government personnel properly.

- Start by downloading the “State of GA Certificate of Exemption of Local Hotel/Motel Excise Tax” form from the provided link or the Georgia Department of Revenue's official website.

- Review the form to understand the information you'll need from the government official or employee seeking the exemption.

- Ask the guest for their identification to confirm their status as a state or local government official or employee traveling for official duties.

- Collect all required details for the form:

- Name of Official or Employee: Ensure the name matches the identification provided.

- Title of Official or Employee: Record the official's title within their government agency.

- Government Agency Represented: Document the name of the state or local government agency the individual is representing.

- Accounting/Fiscal Office Contact Name: Obtain the name of a contact person within the guest's governmental accounting or fiscal office, if applicable.

- Phone No.: Record the phone number of the provided accounting or fiscal office contact.

- Date(s) of Lodging: Enter the date or range of dates for which the lodging is required.

- Have the government official or employee sign the form to certify that their lodging is required for official duties and qualifies for the tax exemption.

- Verify that all information has been filled in correctly and completely. Incomplete forms may not be eligible for the tax exemption.

- Maintain a copy of the completed exemption form with your hotel tax records to document the exemption for future reference or in case of an audit.

- Submit the original form as required by your local or county regulations. This procedure may vary, so it’s important to consult with your tax advisor or local tax authority.

Completing the Georgia Hotel Tax Exemption form is a straightforward process that facilitates tax compliance and supports government employees in their official duties. It is essential for hotel and motel operators to familiarize themselves with the process, ensuring that all eligible guests can benefit from this exemption. Keeping detailed records and retaining copies of the exemption forms are critical steps in maintaining compliance and being prepared for any future audits or verifications.

Understanding Georgia Hotel Tax

- What is the purpose of the Certificate of Exemption of Local Hotel/Motel Excise Tax in Georgia?

The Certificate of Exemption of Local Hotel/Motel Excise Tax exists to exempt Georgia state or local government officials or employees traveling on official business from county or municipal excise tax on lodging. This exemption was established under Act Number 621, amending Official Code of Georgia Annotated Section 48-13-51, effective from April 2, 1987. - Who qualifies for this exemption?

Georgia state or local government officials or employees traveling on official duties qualify for this exemption. Verification of the individual's identity and official status is required for the exemption to be applied. - What forms of payment are acceptable to claim the exemption?

All payment methods are accepted to claim the exemption, whether personal or government payment. However, for exemption from Georgia State Sales Tax on lodging, the acceptable payment methods are limited to a State of Georgia issued credit card or payments made by directly billing the governmental organization. - Are there required forms to claim the exemption?

Yes, to claim the exemption from local hotel/motel excise tax, the traveler must provide the "State of GA Certificate of Exemption of Local Hotel/Motel Excise Tax." For sales tax exemption, the "Department of Revenue Sales Tax Certificate of Exemption Form (ST-5)" must be submitted to hotel operators. - Is documentation required to claim this exemption?

Yes, a copy of the exemption form must be maintained with hotel tax records to document the individual’s status as a government official or employee traveling on official business. - Who should be contacted in case of questions regarding the exemption?

For any questions regarding the exemption, the traveler’s accounting or fiscal office contact, as identified on the exemption form, should be contacted. - What information is required on the Certificate of Exemption form?

The required information includes the name and title of the official or employee, the government agency represented, accounting/fiscal office contact name and phone number, date(s) of lodging, and the signature of the official or employee certifying the official business travel. - Does this exemption also apply to Georgia State Sales Tax?

Yes, government officials or employees are also exempt from Georgia State Sales Tax on lodging when they submit the “Department of Revenue Sales Tax Certificate of Exemption Form (ST-5)” along with the applicable payment method. This is separate from the local hotel/motel excise tax exemption. - Since when has this exemption been effective?

This exemption has been effective since April 2, 1987, following the enactment of Act Number 621, which amended the Official Code of Georgia Annotated Section 48-13-51, to provide this benefit for government officials and employees traveling on official business.

Common mistakes

Filling out the Georgia Hotel Tax Exemption form might seem straightforward, but it's easy to make mistakes that can lead to the denial of an exemption. Understanding these common errors can help ensure that officials or employees traveling on official business can take advantage of the tax exemptions they're entitled to. Here are six common mistakes to avoid:

Not verifying the identity of the government official or employee adequately. It's essential to provide clear and verifiable identification to confirm that the individual seeking the exemption is indeed traveling on official government business.

Misunderstanding which taxes are exempt. Remember, the exemption applies to local hotel/motel occupancy excise taxes, and, under certain conditions, the Georgia State Sales Tax. Mixing up these taxes or applying the exemption incorrectly is a common mistake.

Failing to provide all required forms. The State of GA Certificate of Exemption of Local Hotel/Motel Excise Tax must be accompanied by the Department of Revenue Sales Tax Certificate of Exemption Form (ST-5) for sales tax exemptions, where applicable. Skipping or forgetting a form will result in an incomplete application.

Incorrect payment methods. While all payment methods are accepted for the lodging excise tax exemption, the state sales tax exemption specifically requires either a State of Georgia issued credit card or direct billing to the governmental organization. Using an unauthorized payment method can invalidate the exemption request.

Not maintaining proper records. Operators must keep a copy of the exemption form with their hotel tax records. Failure to document the exemption properly can cause issues in case of an audit or review.

Overlooking the signature and date sections. A common oversight is forgetting to have the form signed by the official or employee, which certifies their official business travel. Ensure this section is completed to avoid processing delays.

Avoiding these mistakes requires attention to detail and a clear understanding of the exemption criteria. By doing so, government officials and employees can ensure their lodging during official business is properly exempt from certain taxes, making the process smoother for both the traveler and the hotel operator.

Documents used along the form

When dealing with the Georgia Hotel Tax form, it's essential to have a clear understanding of supplementary documents that might be required or useful in specific contexts. These forms and documents often complement the main tax exemption form, ensuring compliance and facilitating smooth operations in lodging establishments across Georgia. Here is a list of documents that are commonly used alongside the Georgia Hotel Tax form.

- Department of Revenue Sales Tax Certificate of Exemption Form (ST-5): This form is utilized by government officials or employees to exempt their lodging from Georgia State Sales Tax, aligning with the exemption provided under the local hotel/motel excise tax.

- Employee Identification Badge or Document: Used to verify the identity of the government official or employee. This could include a photo ID, work badge, or another form of identification issued by the represented government agency.

- Official Travel Orders: These documents outline the travel authorized by the government agency, including the purpose and duration, and are required to validate the official nature of the trip.

- Georgia Hotel Occupancy Registration Form: This form is used by hotels to register guests and document their stay, which can be crucial for tax exemption purposes.

- Business License or Permit: Hotels and motels must maintain current business licenses or permits as part of their operational records, ensuring they are legally permitted to operate within the state or municipality.

- Financial Transaction Records: These include receipts or invoices related to the lodging stay, essential for documenting exempt transactions and for accounting purposes.

- Direct Billing Authorization Form: Utilized when a government agency is directly billed for an official's stay, this form authorizes the hotel to charge the agency and provides billing details.

- Government Credit Card Policy Documentation: When the exemption applies to payments made with a State of Georgia issued credit card, this documentation outlines permissible uses and any restrictions on the card.

- Municipal Tax Exemption Forms: Some Georgia municipalities may have their own forms for local tax exemptions on lodging. These need to be completed in addition to the state-level forms for eligible government officials or employees.

Each of these documents plays a crucial role in ensuring that tax exemptions are correctly applied and that both the lodging establishments and government officials or employees are adhering to Georgia's tax laws. Keeping accurate records of these documents helps to streamline the exemption process and ensures compliance with state and local regulations.

Similar forms

The Georgia Hotel Tax form is closely related to the "Department of Revenue Sales Tax Certificate of Exemption Form (ST-5)" utilized in Georgia. Both forms serve to exempt specific individuals or entities from taxes, with the ST-5 specifically focusing on exempting state sales tax for qualifying purchases made by governmental organizations or their officials. Similar to the hotel tax form, the ST-5 form requires proof of the individual's or entity's eligibility for the exemption and is used to document tax-exempt transactions.

Another document that shares similarities with the Georgia Hotel Tax form is the "Federal Government Lodging Tax Exemption Form." This form is used by employees of the federal government traveling on official business to obtain exemption from lodging taxes in various states. Like the Georgia-specific form, it requires identification and certification of the traveler’s official status and purpose of travel. Both forms aim to reduce the cost of official travel by removing the burden of certain taxes.

The "Exemption Certificate for Government Charge Card" is also similar to the Georgia Hotel Tax form. This certificate is used by government employees to claim exemption from taxes when making purchases with a government-issued charge card, including lodging expenses. Both documents facilitate tax-exempt transactions for government officials on official duty, ensuring that public funds are spent efficiently.

The "Non-Profit Organization Tax Exemption Certificate" shares a common purpose with the Georgia Hotel Tax form by providing a tax exemption to a specific group; however, it is geared towards non-profit organizations rather than government officials. This document allows non-profits to purchase goods and services without paying sales tax, akin to how government officials can avoid hotel taxes while on official business.

The "Vehicle Rental Tax Exemption Form" used in some states allows government employees or certain organizations to exempt themselves from taxes usually applied to car rentals. Similar to the hotel tax exemption, this form requires official documentation and verification of the individual’s or organization’s tax-exempt status. Both forms are designed to decrease the financial burden of official or exempt business-related travel.

The "Uniform Sales & Use Tax Exemption/Resale Certificate – Multijurisdiction" is a form that allows businesses to purchase goods tax-free for resale in multiple states. While its primary use is for commercial activities, it operates on the principle of exemption from taxes, akin to the Georgia Hotel Tax form. Both documents necessitate proper identification and qualification for the exemption to be granted.

The "Property Tax Exemption Form" is commonly used by homeowners who qualify for property tax relief based on certain criteria, such as senior citizen status, disability, or veteran status. Though it pertains to real estate rather than transient lodging, it shares with the Georgia Hotel Tax form the fundamental purpose of offering tax breaks to eligible parties, following a verification process.

The "Farm Equipment Tax Exemption Certificate" is used by farmers and agricultural producers to exempt purchases of certain farming equipment from sales tax. This form, while industry-specific, parallels the Georgia Hotel Tax form in its goal to provide financial relief through tax exemptions for qualified individuals, contributing to reduced operational costs.

"Streamlined Sales and Use Tax Agreement Certificate of Exemption" is a document designed for use in multiple states to simplify the tax exemption process for eligible sales and purchases. Like the Georgia Hotel Tax form, it benefits a range of entities by standardizing tax-exempt transactions, albeit on a wider scale covering various types of sales and use taxes.

Last but not least, the "Educational Institution Tax Exemption Certificate" allows schools and educational institutions to make tax-free purchases that contribute to learning and operations. This certificate, similar to the Georgia Hotel Tax form, underscores the importance of supporting governmental and public service entities by relieving them of certain tax burdens during official activities or operations.

Dos and Don'ts

When filling out the Georgia Hotel Tax form, it is essential to pay careful attention to both the required information and the specific exemptions allowed under Georgia law. To ensure accuracy and compliance, here are several dos and don'ts to consider:

- Do verify the official identity of the guest claiming exemption. Confirm they are a government official or employee traveling on official business.

- Do accept all payment methods for the lodging expenses, either personal or government-issued payments, when processing the tax exemption.

- Do provide the State of Georgia Certificate of Exemption of Local Hotel/Motel Excise Tax form to the guest for completion.

- Do maintain a copy of the completed exemption form with your hotel tax records to properly document the exemption.

- Don't charge county or municipal excise tax on lodging to eligible Georgia state or local government officials or employees traveling on official business.

- Don't overlook the need for the traveler to also submit a “Department of Revenue Sales Tax Certificate of Exemption Form (ST-5)” if they are to be exempt from Georgia State Sales Tax.

- Don't forget to ask for the accounting or fiscal office contact name and number for any questions regarding the exemption claim.

- Don't ignore the specific dates of lodging that should be included in the form to ensure the exemption applies only to the official business stay.

Following these guidelines when handling the Georgia Hotel Tax form will facilitate a smooth process for both hotel operators and government officials or employees, ensuring compliance with Georgia's tax exemption laws.

Misconceptions

Understanding the nuances of Georgia's Hotel Tax form and its implications for government officials and employees can be challenging. Below is a list of ten common misconceptions about the Georgia Hotel Tax form and explanations to clarify these aspects.

- Misconception 1: Any hotel stay is exempt from local hotel/motel tax. In reality, only the stays of Georgia state or local government officials or employees traveling on official business are exempt.

- Misconception 2: The exemption applies automatically without any action required from the government official or employee. However, to qualify for the exemption, individuals must present a completed State of GA Certificate of Exemption of Local Hotel/Motel Excise Tax form.

- Misconception 3: All taxes related to hotel stays are exempt for government officials and employees. The exemption specifically applies to local hotel/motel excise tax, and they are also exempt from Georgia State Sales Tax under certain conditions.

- Misconception 4: This tax exemption also applies to federal government employees without exception. The form only explicitly mentions Georgia state or local government officials or employees, thus requiring federal employees to verify if their status qualifies for any exemptions.

- Misconception 5: Exemption applies regardless of the payment method used for the hotel stay. Contrary to this belief, acceptable payment methods include personal or government payments, and for sales tax exemption, either a State of Georgia issued credit card or direct billing to the governmental organization is required.

- Misconception 6: Third-party bookings (e.g., through travel agents or online platforms) are eligible for tax exemption. The exemption process requires verification of the individual’s government status and official business travel, which might not be feasible through third-party bookings.

- Misconception 7: Every hotel or motel is required to offer this tax exemption. While most should comply with the law, challenges may arise due to misunderstandings or unfamiliarity with the procedures. It's advisable to confirm with the accommodation in advance.

- Misconception 8: The exemption certificate is valid indefinitely. The certificate pertains to specific date(s) of lodging that are directly related to the discharge of official duties, meaning new documentation is needed for each distinct stay.

- Misconception 9: The exemption form serves as a blanket exemption for all travelers within a government entity. Each individual traveler must be verified and present their own completed exemption form to qualify.

- Misconception 10: Upon presenting the exemption form, no further documentation is required. For compliance and record-keeping purposes, hotels must maintain a copy of the exemption form with their tax records, which implies the need for proper documentation from the traveler.

Understanding these misconceptions and corresponding clarifications will help government officials, employees, and hotel operators navigate the application of Georgia's Hotel Tax exemption more efficiently.

Key takeaways

When filling out and using the Georgia Hotel Tax form, there are several key takeaways to keep in mind to ensure the process is completed correctly and efficiently. Understanding these points can help both government officials or employees traveling on official business and hotel operators manage the exemption process smoothly.

- Eligibility for Exemption: The form is designed for Georgia state or local government officials or employees who are traveling on official business. These individuals are exempt from paying county or municipal excise taxes on lodging, often referred to as local hotel/motel tax.

- Acceptable Payment Methods: To qualify for the tax exemption, all payment methods are accepted, whether personal or government payments. This flexibility ensures that government officials or employees can use the most convenient payment option available to them without affecting their eligibility for the exemption.

- Required Documentation: The "State of GA Certificate of Exemption of Local Hotel/Motel Excise Tax" form must be completed and provided by the traveler to the hotel or motel operator. Additionally, to exempt from Georgia State Sales Tax, the "Department of Revenue Sales Tax Certificate of Exemption Form (ST-5)" must be submitted, with payments made via a State of Georgia issued credit card or by directly billing the governmental organization.

- Record-Keeping: A copy of the exemption form must be maintained with the hotel’s tax records. This documentation serves as proof of the individual’s status as a government official or employee traveling on official business, ensuring the hotel or motel operator complies with state regulations.

Understanding these key aspects of the Georgia Hotel Tax form can help ensure that government officials or employees receive the exemptions they are entitled to, while also aiding hotel and motel operators in maintaining compliance with Georgia tax laws.

Popular PDF Documents

What Is a W4p Form - It’s a tool for managing cash flow in retirement, helping ensure that one doesn't overpay taxes and is left with insufficient monthly income.

Irs Form 9423 Where to Mail - Encourages proactive taxpayer engagement with the IRS to resolve disputes before they escalate to legal challenges.

IRS 1094-C - Despite its technical nature, the ultimate purpose of Form 1094-C is to facilitate a healthier workforce by ensuring that employers offer adequate health insurance.