Get Generic Commercial Loan Application Form

Navigating the waters of commercial lending can be intricate, and for many business owners, the Generic Commercial Loan Application form serves as a crucial navigational tool. This form, at its core, is designed to streamline the loan application process by gathering all essential information lenders require to assess a borrower’s eligibility. It encompasses various checklists tailored for either owner-occupied loans or investment property loans, ensuring that applicants provide comprehensive data relevant to their specific loan request. From general information, tax returns, and financial statements, to schedules detailing business debts and personal financial standings of principals, the form aims to paint a detailed financial portrait of both the business and its key stakeholders. Additionally, it requires information about the loan request itself, including the purpose, amount, and collateral. This form not only facilitates a smoother approval process by preempting lenders' informational needs but also encourages applicants to thoroughly evaluate their financial health and readiness for obtaining financing. With spaces for certifications and consents, it underscores the importance of accuracy and honesty in financial disclosures. Completing this form can be seen as the first step towards securing commercial financing, setting the stage for what is often a defining moment in a business’s journey.

Generic Commercial Loan Application Example

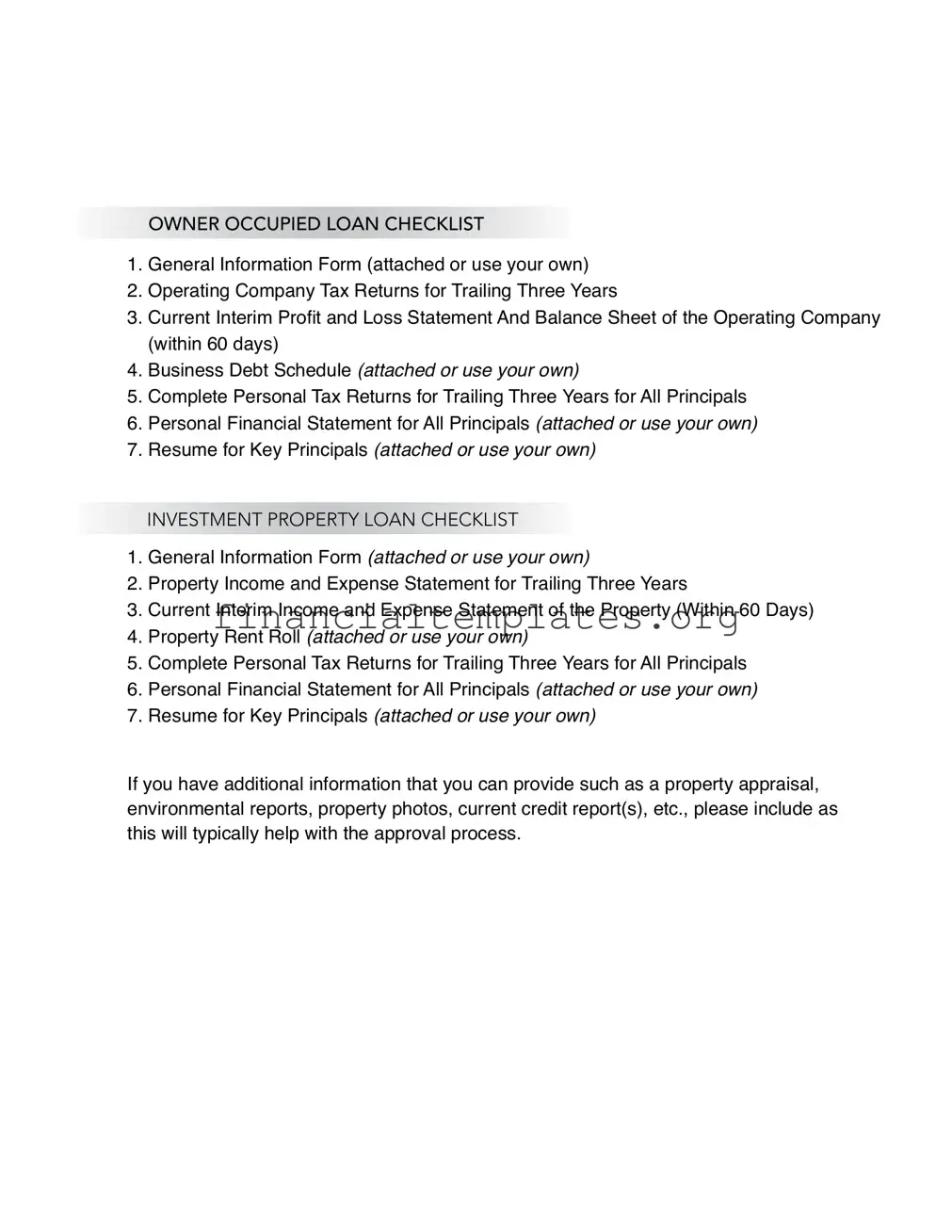

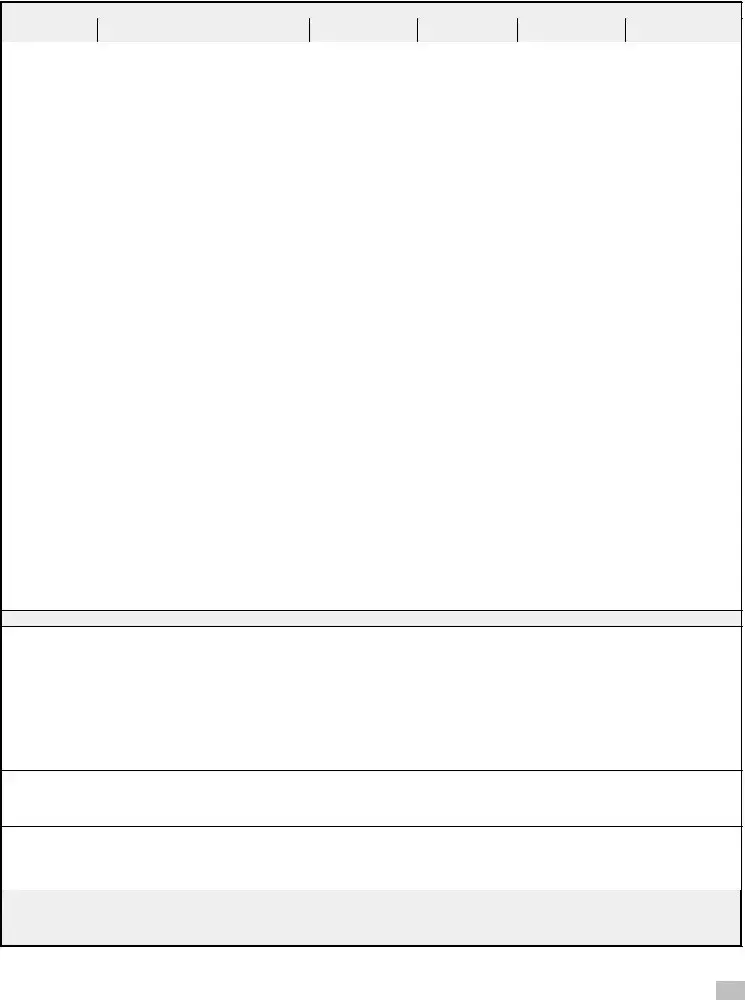

OWNER OCCUPIED LOAN CHECKLIST

1.General Information Form (attached or use your own)

2.Operating Company Tax Returns for Trailing Three Years

3.Current Interim Proit and Loss Statement And Balance Sheet of the Operating Company (within 60 days)

4.Business Debt Schedule (attached or use your own)

5.Complete Personal Tax Returns for Trailing Three Years for All Principals

6.Personal Financial Statement for All Principals (attached or use your own)

7.Resume for Key Principals (attached or use your own)

INVESTMENT PROPERTY LOAN CHECKLIST

1.General Information Form (attached or use your own)

2.Property Income and Expense Statement for Trailing Three Years

3.Current Interim Income and Expense Statement of the Property (Within 60 Days)

4.Property Rent Roll (attached or use your own)

5.Complete Personal Tax Returns for Trailing Three Years for All Principals

6.Personal Financial Statement for All Principals (attached or use your own)

7.Resume for Key Principals (attached or use your own)

If you have additional information that you can provide such as a property appraisal, environmental reports, property photos, current credit report(s), etc., please include as this will typically help with the approval process.

General Information Form

Loan Request Information (Please Complete All Information to Avoid Delays in Processing Your Application)

Application For:

Conventional Mortgage

Construction loan

Collateral Description:

1.

|

Purpose of Loan: |

SBA |

Source of Repayment: |

Church Finance |

Amount Requested: $ |

|

Term Requested: |

|

Amortization Requested: |

Market Value: |

Purchase Price |

Date of Purchase |

$ |

$ |

|

2. |

$ |

$ |

|

|

|

3. |

$ |

$ |

|

|

|

|

A. |

|

|

|

|

|

Applicant Information |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Legal Name of Applicant (Borrower) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DBA (If Applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax I.D. Number |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Principle Place of Business Address (not P.O. Box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

|

|

|

|

County |

|

|

|

|

Zip |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address (if different) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

Zip |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Key Contact Name |

|

|

|

|

|

|

|

|

|

|

|

Business Telephone Number |

|

Business Fax Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( ) |

|

|

|

|

|

|

( ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Date Business Established |

|

|

Current ownership (# of years) |

|

|

|

|

State of Registration |

|

|

|

|

Annual Sales |

|

Net |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Describe applicant's product/service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Employees |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Type of Ownership (Select One) |

General Partnership |

|

|

Limited Partnership |

|

Non Profit |

|

|||||||||||||||||

|

Proprietorship |

|

LLC |

|

|

Professional Association |

LLP |

|

Bankers Group to send me information via |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Who does applicant currently do their business banking with? |

|

|

|

|

|

Is applicant willing to move their banking relationship in conjunction with their loan? |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

B. |

|

|

|

|

|

Owners Information |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

Social Security Number |

|

|

% |

|

|

|

|

|

Title |

||||||||

|

|

|

|

|

|

|

|

Ownership |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Key Contact Name and Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

For more than four owners attach additional sheet(s). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

C. |

|

|

|

|

|

Loan Disclosures (Refinance) |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Current lender |

|

|

|

Rate |

|

|

|

|

|

Start date |

|

|

Monthly |

|

Current balance |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

payment |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Property gross annual revenues |

|

|

Annual expenses |

|

|

|

|

|

Type of property |

|

Number of |

|

Estimated value |

|||||||||||

|

|

|

|

|

|

|

|

|

Tenants |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. |

|

Loan Disclosures (Purchase) |

|

||

|

|

|

||||

|

|

|

|

|

|

|

|

Purchase price |

Will purchaser occupy 51% |

Type of property |

Down payment |

Estimated value |

|

|

or more of the property |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property gross annual |

Annual expenses |

|

Number of tenants |

Is the property under contract |

Anticipated settlement date |

|

revenues |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. |

Other Information |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Settlement agent name |

|

|

Insurance Company Phone Number ( |

) |

|

|

|

|

|||

|

Settlement agent phone number |

|

Insurance Company Fax Number |

( |

) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is the seller of the property willing to carry a second trust? (Purchase only) |

|

Yes* |

|

|

|

No |

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||

|

Has The Applicant Ever Declared Bankruptcy Or Had Any Judgments, Repossessions, |

|

Yes* |

|

|

|

No |

|||||

|

Garnishments Or Other Legal Proceeding Filed Against Them? |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

Is the applicant currently under contract with any other mortgage brokers? |

|

Yes* |

|

|

|

No |

|||||

|

|

|

|

|

|

|

|

|

||||

|

Are Any Tax Obligations, Including Payroll or Real Estate Taxes, Past Due? |

|

Yes* |

|

|

|

No |

|||||

|

|

|

|

|

|

|

|

|

||||

|

Is The Applicant Liable On Debts Not Shown, Including Any Contingent Liabilities Such As Leases, |

|

Yes* |

|

|

|

No |

|||||

Endorsements, Guarantees, Etc.? |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

Is The Applicant Currently A Defendant In Any Suit Or Legal Action? |

|

Yes* |

|

|

|

No |

|||||

|

*If you answered yes to any of the above questions, please provide an explanation on a separate sheet |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

F. |

Certification And Signatures |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Each of the undersigned hereby instructs, consents and authorizes the Lender/Broker, or any affiliate, subsidiary or assigns to obtain a consumer credit report and any other information relating to their individual credit status in the following circumstances: (a) relating to the opening of an account or upon application for a loan or other product or service offered by Lender by a commercial entity of which the undersigned is a principal, member, guarantor or other party, (b) thereafter, periodically according to the Lender’s credit review and audit procedures, and (c) relating to Lender’s review or collection of a loan, account, or other Lender product or service made or extended to a commercial entity of which the undersigned is a principal, member, guarantor or other party. The Applicant(s), individually and/or by the signature(s) of its authorized representative below, hereby certifies that: the foregoing has been carefully read by the Applicant and is given to the Lender/Broker for the purpose of obtaining the credit described above and

other credit from time to time in whatever form; the information in this Application and any other documents or information submitted in connection with this Application or any other credit request are true and correct statements of the Applicant’s financial condition and may be treated by the bank as a continuing statement thereof until replaced by a new Application or until the Applicant specifically notifies Lender/Broker in writing of any change; and the credit requested herein and any other credit obtained from

the Lender/Broker by the Applicant on the basis of the information contained in this Application shall be used solely for business and commercial purposes. The Applicant and each Guarantor authorize the Lender/Broker to verify at an time any information submitted to the Lender/Broker by or on behalf of the Applicant and/or any Guarantor; obtain further information concerning the credit standing of the Applicant, its representatives and Guarantors; and exchange such credit information with others. The Applicant agrees to provide additional information, financial or otherwise, upon request and agrees that, unless otherwise directed by the Applicant in writing, all statements and notices regarding any credit granted by the Lender/Broker to the Applicant shall be mailed or faxed to the Applicant at the address or number shown above. Any person(s) signing below is duly authorized and empowered to request credit on behalf of the Applicant.

Unless I/We initial here, the Lender/Broker is hereby authorized to share this application and credit information with its affiliates or other lenders, which may consider my/our application for loan approval/purchase. This statement does not limit the Lender/Broker's rights to sell or assign any loans to a third party.

Applicant and each Guarantor initials: _______________

Signature (Applicant)

Title

Print Name

Date

Signature (Guarantor)

Print Name

Date

Signature (Guarantor)

Print Name

Date

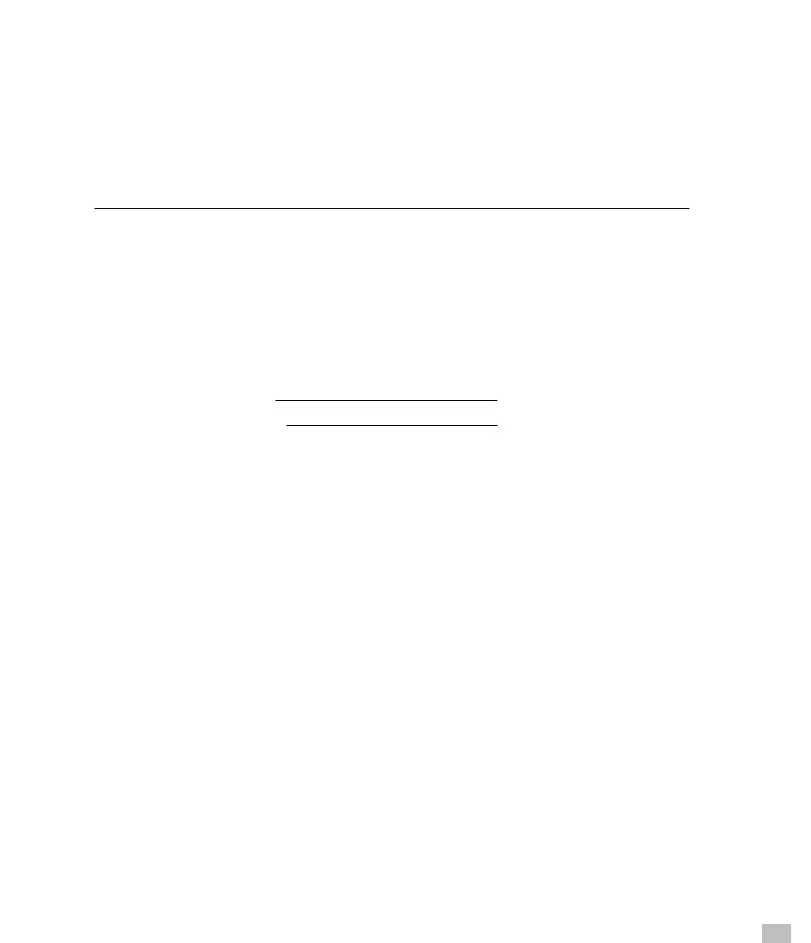

BUSINESS DEBT SCHEDULE

Furnish the following information on all installment debts, contracts, notes, and mortgages payable. Do not include accounts payable or accrued liabilities.

Business Name:_________________________________________________________________ |

*As of_____________, 20____ |

*Should match the inancial statement to be submitted. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Creditor |

Original |

Original |

Present |

|

Interest |

Maturity |

|

Monthly |

Security |

Current or |

Name/address |

amount |

date |

balance |

|

rate |

date |

|

payment |

delinquent |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total present |

|

|

|

Total monthly |

|

|

|

|

|

|

balance** |

|

|

|

payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Total must agree with balance shown on current inancial statement

Signature:_________________________________________________________ |

Title:______________________________________ |

Date Signed:___________________________ |

OMB APPROVAL NO. 32450188

EXPIRATION DATE:11/30/2004

PERSONAL FINANCIAL STATEMENT

U.S. SMALL BUSINESS ADMINISTRATION |

As of |

|

, |

|

|||

|

|

|

Complete this form for: (1) each proprietor, or (2) each limited partner who owns 20% or more interest and each general partner, or (3) each stockholder owning 20% or more of voting stock, or (4) any person or entity providing a guaranty on the loan.

Name |

|

|

|

|

|

|

|

Business Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residence Address |

|

|

|

|

|

|

Residence Phone |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, & Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name of Applicant/Borrower |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

(Omit Cents) |

|

|

LIABILITIES |

|

|

(Omit Cents) |

||

|

|

|

|

|

|

|

|

|

|

|||

Cash on hand & in Banks |

$ |

|

|

|

Accounts Payable |

|

|

|

$ |

|

|

|

Savings Accounts |

$ |

|

|

|

Notes Payable to Banks and Others |

$ |

|

|

||||

IRA or Other Retirement Account |

$ |

|

|

|

(Describe in Section 2) |

|

|

|

||||

Accounts & Notes Receivable |

$ |

|

|

|

Installment Account (Auto) |

|

|

|

$ |

|

|

|

Life InsuranceCash Surrender Value Only |

$ |

|

|

|

Mo. Payments |

$ |

|

|

|

|

|

|

(Complete Section 8) |

|

|

|

|

Installment Account (Other) |

$ |

|

|

||||

|

|

|

|

|

|

|

|

|||||

Stocks and Bonds |

$ |

|

|

|

Mo. Payments |

$ |

|

|

|

|

|

|

(Describe in Section 3) |

$ |

|

|

|

Loan on Life Insurance |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||||

Real Estate |

|

|

|

|

Mortgages on Real Estate |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||||

(Describe in Section 4) |

|

|

|

|

(Describe in Section 4) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

AutomobilePresent Value |

$ |

|

|

|

Unpaid Taxes |

|

|

|

$ |

|

|

|

Other Personal Property |

$ |

|

|

|

(Describe in Section 6) |

|

|

|

||||

(Describe in Section 5) |

|

|

|

|

Other Liabilities |

|

|

|

$ |

|

|

|

Other Assets |

|

$ |

|

|

|

(Describe in Section 7) |

|

|

|

|||

(Describe in Section 5) |

|

|

|

|

Total Liabilities |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

Net Worth |

|

|

|

|

|

|

|

Total |

$ |

|

|

|

|

Total |

$ |

|

|

||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 1. |

Source of Income |

|

|

|

|

Contingent Liabilities |

|

|

|

|

|

|

Salary |

|

$ |

|

|

|

As Endorser or CoMaker |

|

|

|

$ |

|

|

Net Investment Income |

$ |

|

|

|

Legal Claims & Judgments |

|

|

|

$ |

|

|

|

Real Estate Income |

$ |

|

|

|

Provision for Federal Income Tax |

$ |

|

|

||||

Other Income (Describe below)* |

$ |

|

|

|

Other Special Debt |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Other Income in Section 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Alimony or child support payments need not be disclosed in "Other Income" unless it is desired to have such payments counted toward total income.

Section 2. Notes Payable to Banks and Others. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed.)

Name and Address of Noteholder(s)

Original Balance

Current Balance

Payment

Amount

Frequency

(monthly,etc.)

How Secured or Endorsed

Type of Collateral

SBA Form 413 (300) Previous Editions Obsolete |

(tumble) |

This form was electronically produced by Elite Federal Forms, Inc.

Section 3. Stocks and Bonds. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed).

Number of Shares

Name of Securities

Cost

Market Value

Quotation/Exchange

Date of

Quotation/Exchange

Total Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 4. Real Estate Owned. |

(List each parcel separately. Use attachment if necessary. Each attachment must be identified as a part |

|||||||||

of this statement and signed.) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

|

|

Property A |

|

Property B |

Property C |

|||||

Type of Property |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Date Purchased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Present Market Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address of Mortgage Holder |

|

|

|

|

|

|

|

|

|

|

Mortgage Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mortgage Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Amount of Payment per Month/Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Status of Mortgage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Section 5. Other Personal Property and Other Assets. |

|

(Describe, and if any is pledged as security, state name and address of lien holder, amount of lien, terms |

||||||||

of |

payment and if delinquent, describe delinquency) |

|

|

|||||||

|

|

|

|

|

||||||

Section 6. |

Unpaid Taxes. |

(Describe in detail, as to type, to whom payable, when due, amount, and to what property, if any, a tax lien attaches.) |

|

|

|

Section 7. Other Liabilities. (Describe in detail.)

Section 8. |

Life Insurance Held. |

(Give face amount and cash surrender value of policies name of insurance company and beneficiaries) |

|

|

|

I authorize SBA/Lender to make inquiries as necessary to verify the accuracy of the statements made and to determine my creditworthiness. I certify the above and the statements contained in the attachments are true and accurate as of the stated date(s). These statements are made for the purpose of either obtaining a loan or guaranteeing a loan. I understand FALSE statements may result in forfeiture of benefits and possible prosecution by the U.S. Attorney General (Reference 18 U.S.C. 1001).

Signature: |

Date: |

Social Security Number: |

|

|

|

Signature: |

Date: |

Social Security Number: |

|

|

|

PLEASE NOTE: |

The estimated average burden hours for the completion of this form is 1.5 hours per response. If you have questions or comments |

|

|

concerning this estimate or any other aspect of this information, please contact Chief, Administrative Branch, U.S. Small Business |

|

Administration, Washington, D.C. 20416, and Clearance Officer, Paper Reduction Project (32450188), Office of Management and Budget, Washington, D.C. 20503. PLEASE DO NOT SEND FORMS TO OMB.

PERSONAL RESUME FORM

TO BE COMPLETED BY EACH PRINCIPAL INVOLVED IN THE LOAN

If you already have a prepared resume, submit in lieu of this form

Name

|

|

|

FIRST |

|

|

MIDDLE |

|

|

|

MAIDEN |

|

|

|

LAST |

||||||

Date of birth |

|

|

Place of birth |

|

|

|

|

|

Social Security No |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Citizen – If not, please provide alien registration number |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Home address |

|

|

|

|

|

City |

|

State |

|

|

Zip |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

From |

|

|

To |

|

Home phone |

|

|

|

|

Business phone |

|

|||||||||

Immediate past address |

|

|

|

|

|

City |

State |

|

|

Zip |

||||||||||

From |

|

|

To |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Are you employed by the U.S. Government?

If so, give the name of the agency and position

Military Service Background

Branch |

|

From |

|

To |

|

|||

Rank at discharge |

|

Honorable? |

|

|

|

|||

Job Description |

|

|

|

|

|

|

||

Work Experience

List chronologically, beginning with present employment

Name of company |

|

|

|

|

|

|

% of business owned |

|

|

|

|

|||||

Full address |

|

|

|

|

City |

|

|

State |

|

|

Zip |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

To |

Title |

|

Duties |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of company |

|

|

|

|

|

|

% of business owned |

|

|

|

|

|||||

Full address |

|

|

|

|

City |

|

|

State |

|

|

Zip |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

To |

Title |

|

Duties |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of company |

|

|

|

|

|

|

% of business owned |

|

|

|

|

|||||

Full address |

|

|

|

|

City |

|

|

State |

|

|

Zip |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

To |

Title |

|

Duties |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

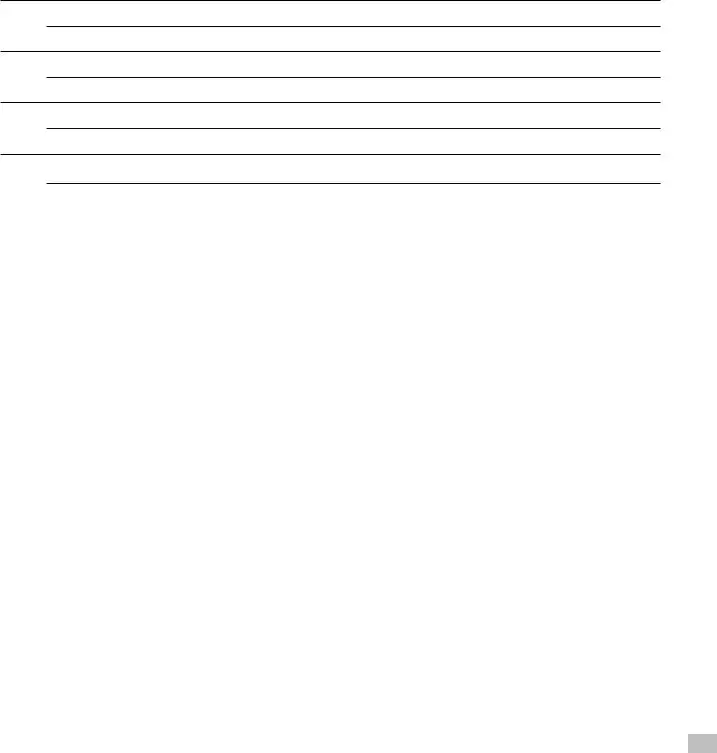

Education (College or Technical Training)

Name and Location |

Dates Attended |

Major |

Degree or Certiicate |

1.

Comments:

2.

Comments:

3.

Comments:

4.

Comments:

RENT ROLL

Unit # |

Unit Type |

Tenant Name |

Square Feet |

Monthly Rent |

|

Term |

Comments |

|

|

|

|

|

|

Start |

End |

(Renewals, Rent Increases, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals:

Rent Roll Certification:

I/We certify that the attached rent roll(s) dated _______________

for the property located at ________________________________________________

Is/are true and correct.

By: ________________________________________________________

Document Specifics

| Fact Name | Detail |

|---|---|

| Application Types | Includes applications for Conventional Mortgage and Construction loan. |

| Loan Purpose | Clearly stated purpose for the loan on the application form. |

| Applicant Information | Requires legal name, tax ID, contact info, and business details. |

| Ownership Information | Information about all principals including personal financial statements and tax returns. |

| Financial Statements | Submission of both operating company and personal financial documents required. |

| Use of Loan | Loans intended solely for business and commercial purposes. |

| Disclosure Requirements | Includes current financial obligations and any legal proceedings against the applicant. |

| Additional Documentation | Option to include property appraisals, environmental reports, and other relevant documents. |

| Certification and Authorized Signatures | Required from the applicant and any guarantors for processing. |

| Governing Law(s) | While the form is generic, specific state laws may apply based on the location of the property or business. |

Guide to Writing Generic Commercial Loan Application

Completing a Generic Commercial Loan Application form is a crucial step in securing financing for your business endeavors, whether it involves owning and operating commercial property or expanding an investment portfolio. This process can be detailed, requiring specific documentation to be collected and presented accurately. The following steps will guide you through filling out this form, ensuring all necessary information is provided clearly and thoroughly. Remember, accuracy and completeness are vital to avoid any delays in the processing of your application.

- Collect Required Documents: Begin by assembling all necessary documents for the loan application. This includes the general information form, tax returns, financial statements, business debt schedules, personal financial statements, and resumes for all principals. For investment properties, ensure you have the property income and expense statements and rent roll.

- Fill in the Loan Request Information: Specify the type of loan you're applying for (e.g., Conventional Mortgage, Construction Loan) and provide a detailed description of the collateral. Include the loan amount, term, source of repayment, and any relevant financial data such as market value and purchase price.

- Applicant Information: Accurately fill in the legal name of the applicant, tax identification number, principal place of business, contact information, and details about the business, including the date established, annual sales, net profit, and type of ownership.

- Owners Information: List all principals, including their name, social security number, title, percentage of ownership, and contact information. Attach additional sheets if there are more than four owners.

- Loan Disclosures: Depending on whether the application is for a refinance or purchase, complete the appropriate section with information on current lenders, property revenues, expenses, and anticipated values.

- Other Information: Provide details of any pending legal actions, past bankruptcies, or tax obligations. Include information about the settlement agent and insurance company.

- Certification and Signatures: Read the certification and authorization statements carefully. Each principal and guarantor must provide their initials to give consent where required, then sign and date the form.

- Business Debt Schedule: Complete the business debt schedule, if applicable, with detailed information on all business-related debts, including creditor details, original amounts, current balances, and security.

- Personal Financial Statement: Each principal must also complete a personal financial statement, listing all assets, liabilities, sources of income, and contingent liabilities.

After filling out the application and all associated schedules and statements, review everything to ensure accuracy and completeness. Attach any additional information that may support your application, such as property appraisals or environmental reports. Being thorough and providing as much useful information as possible can significantly enhance the approval process.

Understanding Generic Commercial Loan Application

-

What documents do I need to complete for a Generic Commercial Loan Application for both owner-occupied and investment property loans?

For an owner-occupied loan, you will need to gather a series of documents including the General Information Form, Operating Company Tax Returns for the last three years, a current Profit and Loss Statement and Balance Sheet for the Operating Company, a Business Debt Schedule, Personal Tax Returns for the last three years for all principals, a Personal Financial Statement, and a Resume for Key Principals. For an investment property loan, the list is similar, requiring a General Information Form, Property Income and Expense Statement for the last three years, a current Income and Expense Statement for the property, a Property Rent Roll, Personal Tax Returns for the last three years for all principals, a Personal Financial Statement, and a Resume for Key Principals. If available, including additional information such as property appraisal, environmental reports, property photos, and current credit reports may assist in the approval process.

-

How detailed does the General Information Form need to be?

The General Information Form on the Generic Commercial Loan Application is quite detailed, requiring information about the loan request, including the amount, purpose, and type of loan, as well as detailed applicant information like legal name, place of business, key contact, business establishment date, and financials. Additionally, it asks for owner information, disclosures relating to refinancing if applicable, disclosures for purchase, and other relevant details such as anticipated settlement date and if the seller is willing to carry a second trust. Completeness and accuracy in filling out this form are critical to avoid delays in processing your application.

-

Are tax returns really necessary for the loan application, and why?

Yes, submitting complete personal tax returns for the trailing three years for all principals involved in the loan application, as well as tax returns for the operating company or property, is necessary. These documents play a crucial role in helping lenders assess the financial health and stability of both the individuals and the business involved in the loan. Tax returns provide a comprehensive view of the income, expenses, and ultimately the profitability of the business, which is essential for making an informed lending decision.

-

What is the importance of providing a Personal Financial Statement for all principals in the loan application process?

The requirement for a Personal Financial Statement for all principals is designed to give creditors a clear picture of the guarantors’ financial health, establishing their capacity to support the loan if the business itself cannot meet its obligations. This statement includes assets and liabilities, giving a net worth figure that helps lenders understand the financial strength of the individuals behind the business. By evaluating personal financial stability, lenders can assess the risk associated with the loan more accurately.

Common mistakes

-

Not providing complete and accurate financial information is a common mistake. The Generic Commercial Loan Application form requires detailed financial records, including tax returns and personal financial statements for the past three years for all principals. It's crucial to ensure all financial information is current (within 60 days for interim reports), accurate, and thoroughly documented. Incomplete or inaccurate financial data can significantly delay the processing of the application or result in a denial.

-

Failing to include additional supporting documents can hinder the loan approval process. Applicants often overlook the importance of supplementing the application with extra materials such as property appraisals, environmental reports, property photos, and current credit reports. These documents provide a fuller picture of the applicant's financial position and the collateral's value, aiding in the approval process.

-

Incorrectly filling out the General Information Form, particularly the section related to the loan request information, is another mistake. Applicants sometimes leave fields incomplete, do not clearly state the purpose of the loan, or incorrectly describe the collateral. Each field on the application form should be completed thoroughly to avoid delays in processing.

-

Forgetting to sign and date the Certification and Signatures section can render the application incomplete. Each principal or guarantor must provide their signature to authorize the lender or broker to obtain a consumer credit report and verify the provided information. Unsigned applications cannot be processed, leading to unnecessary setbacks.

-

Omitting additional owner information if there are more than four owners involved. The form provides space for details regarding the principal owners, but in cases where more than four individuals own the business, additional sheets must be attached with the necessary information for each owner. Failing to provide this information could potentially misrepresent the business's ownership structure and impact the application's evaluation.

In summary, paying careful attention to detail when completing the Generic Commercial Loan Application is paramount. This includes ensuring financial information is complete and accurate, all supporting documents are included, the General Information Form is filled out correctly, the relevant parties have signed the application, and supplementary owner information is provided when applicable. Avoiding these mistakes will help streamline the loan application process.

Documents used along the form

When applying for a commercial loan, having a clear understanding of the required documents can significantly ease the process. The Generic Commercial Loan Application form is a fundamental part of this procedure, but it's often just the starting point. Several additional forms and documents are needed to provide a lender with a comprehensive view of your business's financial health and risk profile. Below is a list of other essential forms and documents typically required alongside the Generic Commercial Loan Application form.

- Business Plan: This document outlines your business's goals, the strategy to achieve them, market analysis, organizational structure, and a detailed financial plan. It helps lenders understand the vision and operational plan of your business.

- Credit Report Authorization Form: Signed by the applicant, this form permits the lender to obtain the credit history of the business and its principals.

- Lease Agreements: For businesses that rent real estate or equipment, current lease agreements verify the ongoing expenses associated with these rentals.

- Legal Documents: Depending on the business entity, these can include articles of incorporation, commercial leases, franchise agreements, and business licenses, which legally identify and allow the business to operate.

- Cash Flow Projections: These documents forecast the business's future financial position based on expected income and expenditures. Lenders use this to assess the capacity of your business to repay the loan.

- Collateral Documentation: For secured loans, documents describing the collateral asset's value and ownership. This could include real estate deeds, vehicle titles, or valuation reports for high-value equipment.

- Business Tax Returns: Often, lenders require tax returns for the previous three years to verify past income and profitability.

- Business Bank Statements: Recent statements provide a snapshot of the business's current financial health and cash flow.

- Debt Schedule: This outlines all current debts, including amounts, lenders, and repayment terms, giving lenders insight into your existing financial obligations.

- Proof of Insurance: Insurance documents ensure that the business's assets are adequately protected, reducing the risk for the lender.

Together, these documents play a crucial role in building a robust loan application package. They provide lenders with a clear, comprehensive understanding of your business operation, revenue cycle, and risk factors. Approaching your loan application with this complete set of documents prepared can improve your chances of a favorable loan decision. Lenders appreciate thoroughness and clarity, and providing a full suite of relevant documents is a significant step toward securing your business financing.

Similar forms

The Mortgage Loan Application shares common ground with the Generic Commercial Loan Application, particularly in the comprehensive gathering of financial information. Like its commercial counterpart, it demands details of the borrower's existing mortgages, property information, and the purpose of the loan, aiming to evaluate the borrower's financial stability and the property's worth. Both forms rigorously scrutinize the applicant's financial history and current standing, using personal and property financial statements to gauge the risk involved in lending.

A Personal Financial Statement is another document with similarities to the Generic Commercial Loan Application. This statement requires individuals to list their assets and liabilities, offering a snapshot of their net worth. The commercial loan application extends this requirement to include both personal and business financials of principals, aiming to understand the full scope of financial health and risk. Both documents use this information to assess the applicant's ability to repay the loan.

The Business Plan closely aligns with sections of the Generic Commercial Loan Application that require detailed descriptions of the business, including its operations, number of employees, sales, and overall profitability. Both documents are used to understand the business's operational framework and its financial viability, key components in determining loan eligibility and the venture's future success potential.

The Loan Amortization Schedule, although more of a post-approval document, shares a planning purpose with the Generic Commercial Loan Application. The application's sections on requested loan terms, amortization, and repayment sources hint at the structure that an amortization schedule will eventually formalize. Both guide lenders and borrowers in mapping out the repayment plan, illustrating the loan's impact on financials over time.

The Lease Agreement documentation exhibits parallels with the investment property loan section of the Generic Commercial Loan Application form. Each necessitates detailed property information, lease terms, and tenant details to evaluate the property's revenue-generating potential. Understanding the income and expense statements from these properties is crucial for both agreements, as it influences decision-making in loan approvals and lease negotiations.

Dos and Don'ts

When filling out the Generic Commercial Loan Application form, it's crucial to follow guidelines to ensure your application is processed smoothly and efficiently. Here are some key dos and don'ts:

- Do gather all necessary documents before starting the application. This includes tax returns for the last three years, financial statements, and any additional information such as property appraisals or current credit reports.

- Do carefully read each section and question to understand what is required. Accurate and complete answers will facilitate the approval process.

- Do ensure that all financial information is up-to-date and reflects the current state of affairs. This includes the most recent interim profit and loss statements and balance sheets.

- Do use a computer to fill out the form if possible. Typed applications are easier to read than handwritten ones, reducing the chance of errors or misinterpretation.

- Don't leave any sections blank. If a section does not apply, indicate with "N/A" (not applicable) or "None" to show that you have considered each question.

- Don't forget to sign and date the application. Unsigned applications are incomplete and cannot be processed.

- Don't provide false or misleading information. Everything on your application should be truthful and accurate to the best of your knowledge.

- Don't hesitate to ask for help if you're unsure about what's required. Misunderstandings can lead to errors, so it's better to seek clarification.

Remember, the goal of the application is to present your case as effectively as possible to the lender. Following these tips can significantly improve your chances of success.

Misconceptions

There are several misconceptions about the Generic Commercial Loan Application form that can steer people in the wrong direction. Understanding these misconceptions can help in preparing and submitting an application more effectively.

- Misconception 1: The form is only for large businesses. This form applies to businesses of all sizes. Whether you are a small startup or a well-established company, this form is the first step in applying for commercial funding.

- Misconception 2: Personal financial information is not required. The application actually requires comprehensive personal financial statements from all principals involved, emphasizing the personal guarantee aspect of the loan.

- Misconception 3: You must use the attached forms. While the checklist includes forms like the General Information Form and Business Debt Schedule, it clearly states that applicants can use their own versions if they have them. This flexibility allows businesses to provide information in a format that may already be prepared.

- Misconception 4: Only the financial documents listed are needed. The checklist does provide a straightforward list of required documents, but it also mentions including additional information like environmental reports or property photos, which can aid in the approval process. This indicates that the list is not exhaustive.

- Misconception 5: A completed application guarantees a loan. Completing the application is merely the first step of many in the process. Approval depends on a detailed review of the financial documents and credit history, among other factors.

- Misconception 6: All sections of the loan application must be completed. In reality, some sections may not apply to every applicant, such as the section on investment property loans. It's important to fill out only the sections relevant to your loan request.

- Misconception 7: The form is the same for every lender. While the Generic Commercial Loan Application form provides a comprehensive overview of the information required by many lenders, each lender might have their own specific form or additional requirements.

- Misconception 8: You cannot discuss your application with the lender. Applicants are encouraged to provide additional information, financial or otherwise, upon request and communicate with the lender about the status of their application or to clarify information.

Understanding the facts about the Generic Commercial Loan Application can make the process smoother and increase the chances of obtaining the necessary funding for your business. It's always beneficial to review all instructions carefully and consult with a financial advisor or the lender directly for specific guidance.

Key takeaways

When preparing a Generic Commercial Loan Application, several key details and documents are required to ensure a smooth and efficient approval process. Understanding these requirements can significantly impact the application's success. Here are seven essential takeaways:

- Organization of Financial Documents: Applicants must gather comprehensive financial records, which include the last three years of tax returns for the operating company or investment property, current profit and loss statements, and a balance sheet. These documents provide lenders with a clear view of the financial health and operational history of the business or property involved.

- Detailed Personal Financial Information: For all principles involved in the application, personal financial statements and the last three years of personal tax returns are crucial. This personal financial involvement helps lenders assess the overall risk associated with the loan.

- Business and Property Specifics: The application requires detailed information about the business or the investment property, including legal name, DBA if applicable, principal place of business, and key contact information. When the loan is for purchasing a property, details such as market value, purchase price, and anticipated settlement date are essential.

- Disclosure of Financial Obligations: Applicants must be transparent about all current financial obligations. This includes existing debts, contingent liabilities such as leases or guarantees, and any legal proceedings that might impact financial status. Complete accuracy in these disclosures is crucial for building trust and credibility with lenders.

- Goal and Purpose of the Loan: The application asks for explicit clarification on the purpose of the loan, whether it's for acquiring a conventional mortgage, construction loan, or for refinancing purposes. The intended use of the loan must align with the lender’s product offerings and requirements.

- Additional Information Could Increase Approval Chances: Providing supplementary information like property appraisals, environmental reports, property photographs, and current credit reports could be beneficial. This additional data can help in painting a fuller picture of the applicant's situation, potentially aiding in the approval process.

- Authorization and Certification: A critical part of the application process involves the certification and signature section where the applicant authorizes the lender or broker to obtain consumer credit reports and verify the information provided in the application. This section also underscores the commitment of the applicant that the information given is true and that any credit granted will be used solely for business and commercial purposes.

Twofold, the application illustrates the importance of thorough preparation and transparency. By carefully compiling required documents, offering comprehensive financial details, and presenting additional supporting information, applicants can significantly enhance their prospects for loan approval. Equally, understanding every element of the application ensures informed and confident submission, critical for successful financing strategies.

Popular PDF Documents

Icbc Bill of Sale - Dictates the surrender of previous registration, certificates, and plates upon new registration.

Ach Form to Receive Payment - The ACH Vendor/Miscellaneous Payment Enrollment Form facilitates electronic payments to vendors via the Automated Clearing House network.

IRS 1099-R - Excessive contributions returned to taxpayers from retirement accounts are reported on the 1099-R, including any income earned on those contributions.