Get Ga Tax Wage Report Form

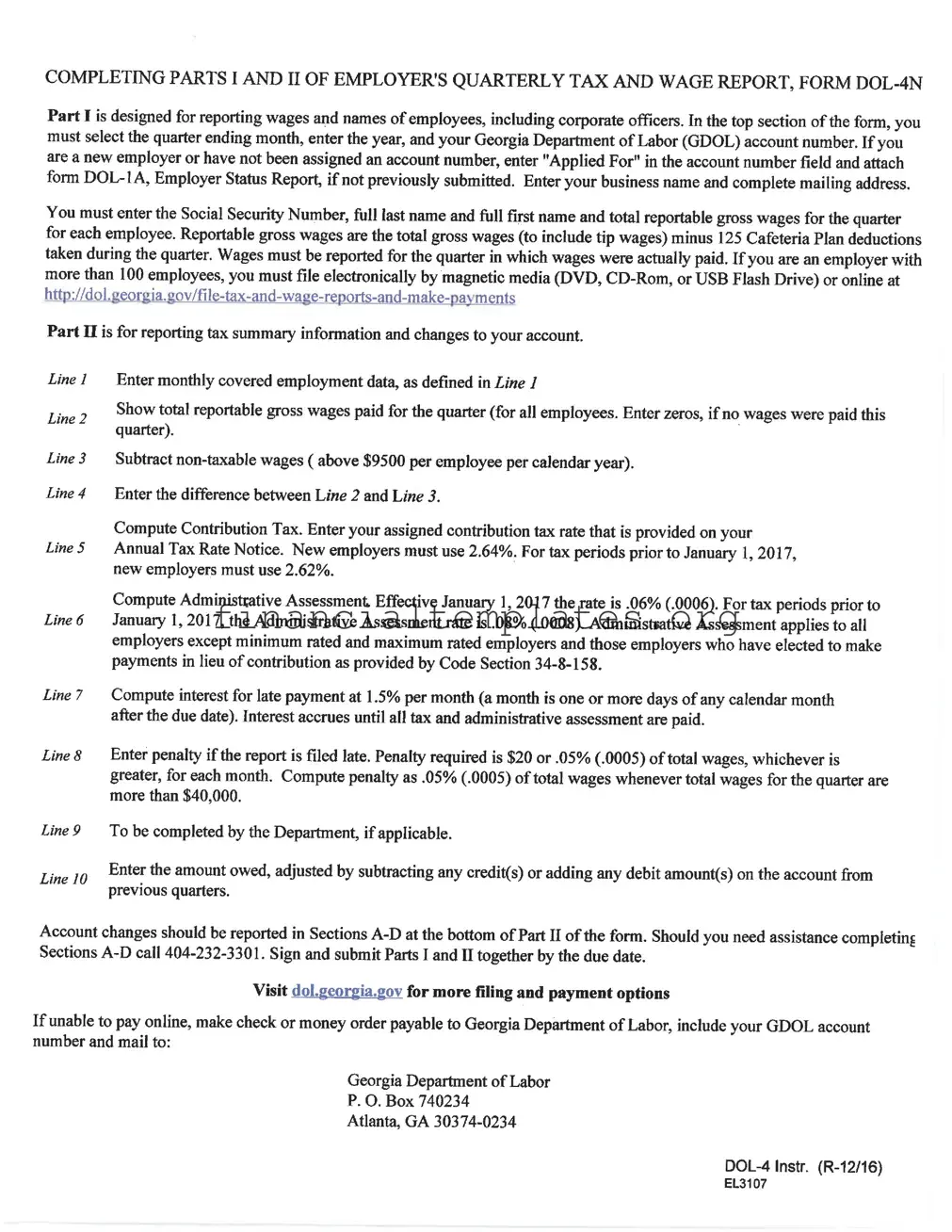

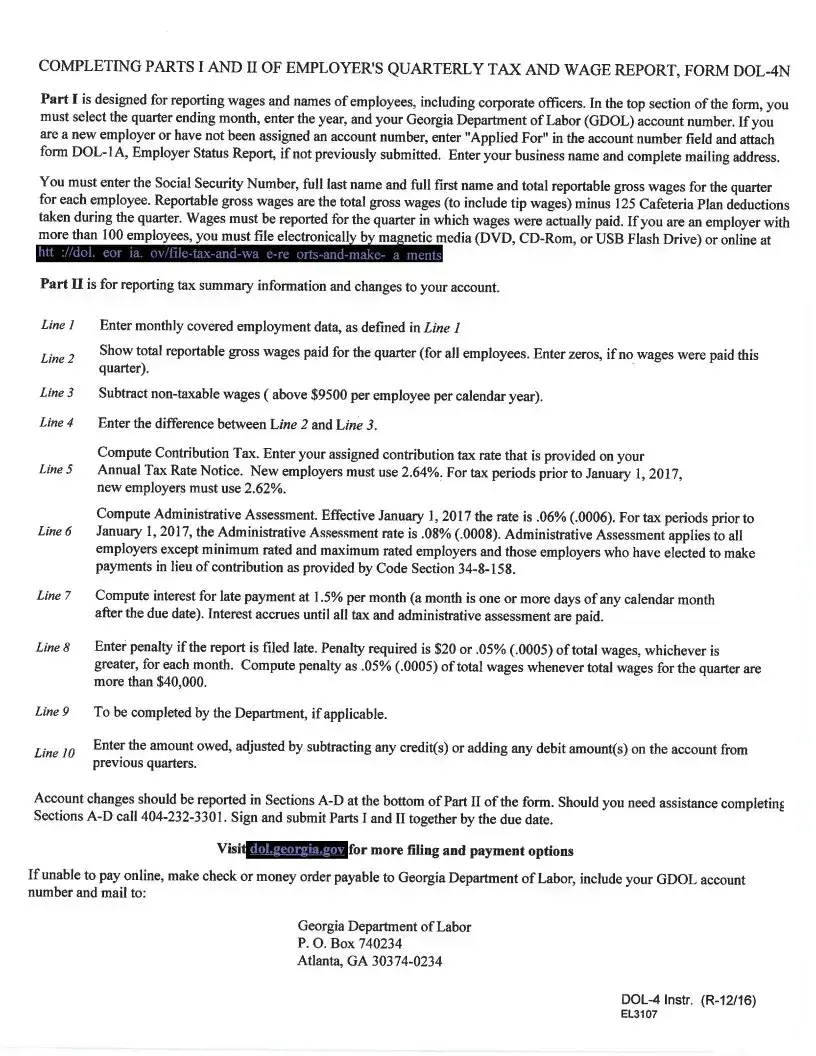

The Georgia Tax Wage Report form, officially known as Form DOL-4N, plays a critical role in how employers communicate employee wage and tax information to the Georgia Department of Labor (GDOL) on a quarterly basis. For effective reporting, the form is divided into two main parts: Part I focuses on the wages paid and the names of the employees, including any corporate officers, requiring detailed information such as social security numbers, full names, and total gross wages for each employee. On the other hand, Part II demands tax summary information, reporting total reportable gross wages, subtracting non-taxable wages, and calculating the contribution tax and administrative assessment based on the rates provided by the GDOL. Furthermore, this part of the report also covers penalties for late filing, interest calculations for overdue payments, and necessary adjustments to the account for any credits or debits from previous quarters. The form is designed to accommodate the needs of all kinds of employers, mandating electronic filing for those with over 100 employees. Additionally, it provides a section for reporting any changes to the employer's account, such as a change in business name, principal location, or ownership status. Notably, the careful completion and submission of this form are essential to compliance with Georgian labor laws and regulations, serving as a vital tool for maintaining accurate employment records and ensuring the proper calculation and payment of taxes and contributions.

Ga Tax Wage Report Example

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The form is identified as DOL-4N, the Employer’s Quarterly Tax and Wage Report for the Georgia Department of Labor. |

| Reporting Requirements | Employers must report wages, names of employees, including corporate officers in Part I, and provide tax summary information and account changes in Part II. |

| Electronic Filing Requirement | Employers with more than 100 employees are required to file the form electronically, through means such as DVD, CD-Rom, USB Flash Drive, or online. |

| Governing Laws | The form is governed by Georgia state law, particularly referring to the administrative assessment and payments in lieu of contribution as outlined in Code Section 34-8-158. |

| Penalty for Late Submission | A penalty is imposed for late submissions, calculated at $20 or .05% (.0005) of total wages, whichever is greater, for each month after the due date. |

Guide to Writing Ga Tax Wage Report

Filling out the Georgia Tax Wage Report form, officially known as Form DOL-4N, is an essential task for employers to comply with state labor laws. This document serves as a way for businesses to report wage and tax information to the Georgia Department of Labor (GDOL) on a quarterly basis. It involves two main parts: the first for reporting individual employee wages and the second for summarizing tax information. Getting this right is crucial not just for compliance, but also to ensure accurate calculation of taxes and contributions. Below is a straightforward guide to help employers fill out this form correctly.

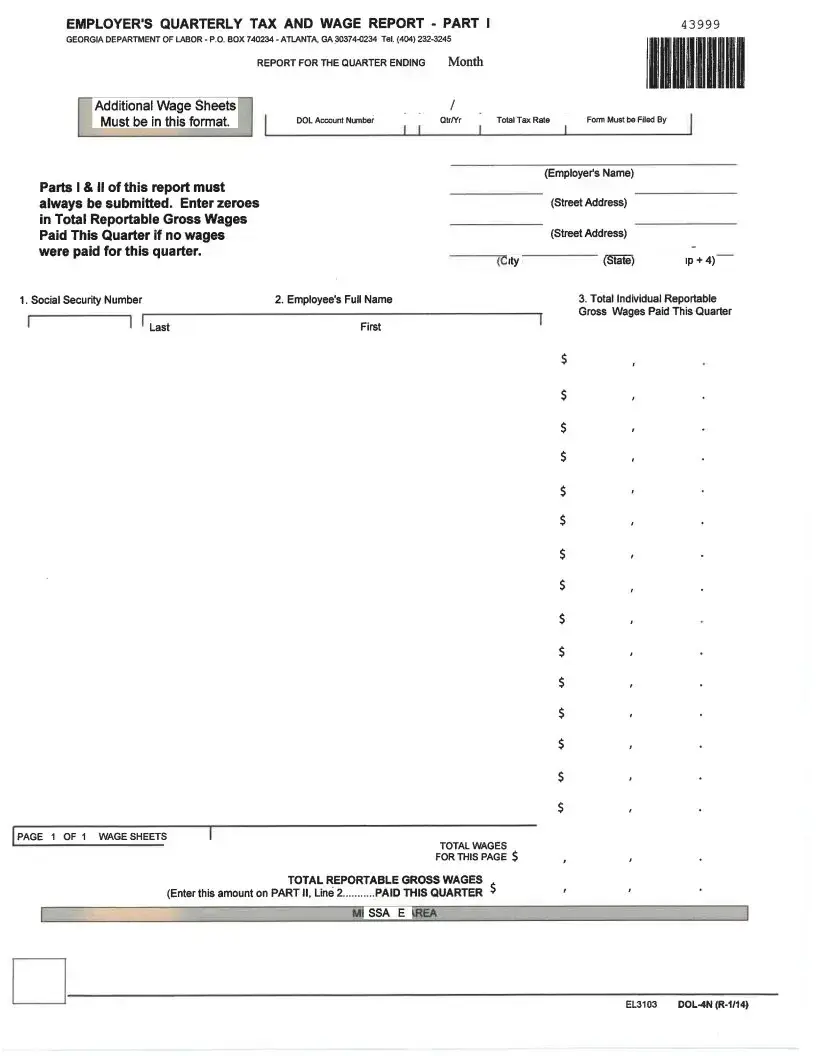

- Part I: Wage Information

- Select the quarter ending month at the top section of the form.

- Enter the respective year next to the quarter.

- Provide your Georgia Department of Labor (GDOL) account number. If you don't have one, write 'Applied For' and attach the DOL-1 A form if it's not already submitted.

- Write the complete business name and mailing address.

- For each employee: Enter their Social Security Number, full last name, full first name, and total reportable gross wages for the quarter. Note: Reportable gross wages are total gross wages minus 125 Cafeteria Plan deductions taken during the quarter.

- If employing more than 100 individuals, remember that filing must be done electronically.

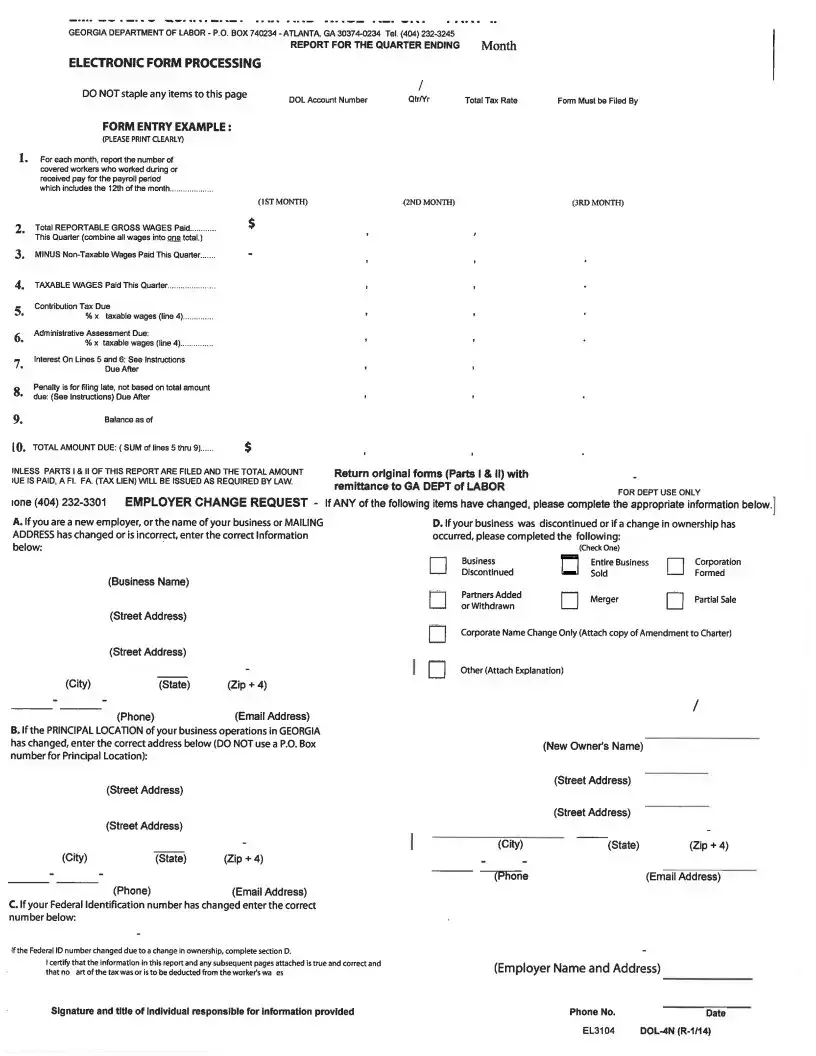

- Part II: Tax Summary Information

- Enter monthly covered employment data as required on Line 1.

- On Line 2, show the total reportable gross wages paid for the quarter.

- Subtract non-taxable wages on Line 3 (non-taxable wages are above $9,500 per employee per calendar year).

- Calculate taxable wages on Line 4 by subtracting Line 3 from Line 2.

- Enter the assigned contribution tax rate provided on your annual tax rate notice on Line 5. New employers use 2.64% or 2.62% for periods prior to January 1, 2017.

- Calculate the Administrative Assessment on Line 6 using the current rate of .06% (.0006) or .08% (.0008) for periods before January 1, 2017.

- Compute interest for late payments at 1.5% per month on Line 7.

- Enter any penalties for late filing on Line 8. The penalty is either $20 or .05% (.0005) of total wages, whichever is greater.

- Line 9 is reserved for department use.

- Calculate the total amount due, adjusting for any credits or debits from previous quarters, on Line 10.

- Review Sections A-D for any necessary account changes and call 404-232-3301 if assistance is needed.

- Sign the form and submit both Parts I and II together by the due date. If payment cannot be made online, prepare a check or money order payable to the Georgia Department of Labor, including the GDOL account number, and mail it to the provided address.

It's crucial to ensure the accuracy of this report to avoid potential issues with the Georgia Department of Labor. Employers should keep a copy of the completed form for their records. For further assistance, contacting the GDOL directly or consulting with a tax professional is advisable.

Understanding Ga Tax Wage Report

How do I complete Part I of the Employer's Quarterly Tax and Wage Report, Form DOL-4N?

To complete Part I, start by selecting the quarter ending month and entering the year, alongside your GDOL account number. If you don't have this number, write “Applied For” and attach a DOL-1A form if it's your initial submission. Your business name and mailing address are also required. List each employee, recording their Social Security Number, full name, and total reportable gross wages for the quarter, which excludes 125 Cafeteria Plan deductions.

What are reportable gross wages and how should they be calculated?

Reportable gross wages include all wages paid to employees during the quarter, including tips, minus any 125 Cafeteria Plan deductions. These wages need to be reported for the quarter in which they were actually paid. This means if you pay your employees for work done at the end of one quarter but pay them in the next, the wages should be reported for the quarter in which the payment was made.

How do I complete Part II of the form?

In Part II, you'll provide tax summary information and account changes. Start by entering the monthly covered employment data. Calculate and report the total reportable gross wages before subtracting non-taxable wages. Enter the taxable wages and then compute the contribution tax based on your assigned rate. New employers use a default rate provided by GDOL. Also, calculate the administrative assessment rate applicable to your situation. If your payment is late, include interest at 1.5% per month and a late filing penalty, calculated as .05% of total wages when they exceed $40,000. Finally, adjust your total amount due by subtracting any credits or adding debit amounts.

What should I do if I need to report changes to my account?

If there are changes to your business name, mailing address, principal business location in Georgia, or Federal Identification number, report these in Sections A-D at the bottom of Part II. For significant changes, such as discontinuation of the business, changes in ownership, or corporate name changes, specific sections are provided for detailed information. Always provide the effective date of the change. For assistance, call the GDOL at the number provided on the form.

Common mistakes

-

Failing to accurately select the quarter ending month and enter the year can lead to the form being processed for the wrong period. This mistake can result in discrepancies in recorded wages, potentially affecting the employer's account status with the Georgia Department of Labor.

-

Entering an incorrect Georgia Department of Labor (GDOL) account number, or not indicating that an account number has been applied for by entering "Applied For" in the specified field, can delay the processing of the report. It's crucial for new employers or those without an assigned account number to attach the required form DOL-1A, Employer Status Report, if it has not previously been submitted.

-

Incorrectly reporting wages, including not deducting 125 Cafeteria Plan deductions from the total gross wages, can lead to inaccurate tax calculations. Wages must be accurately reported for the quarter in which they were actually paid, taking into account all applicable deductions to ensure the correct taxable wages are recorded.

-

Not filing electronically when required, which applies to employers with more than 100 employees, can result in non-compliance with the GDOL’s filing requirements. Employers must file via magnetic media (DVD, CD-ROM, or USB Flash Drive) or online, ensuring that their reports are submitted in the correct format and through the approved channels.

Each of these mistakes can impact the accuracy of the Employer’s Quarterly Tax and Wage Report and could lead to potential penalties or delays in processing. Employers should take care to review the form details thoroughly and ensure all information is correct before submission.

Documents used along the form

When businesses prepare and submit the Georgia Tax Wage Report form, also known as Form DOL-4N, there are several other forms and documents that they might need to use in conjunction. These documents are critical for employers to effectively manage their payroll taxes and comply with state labor regulations. Here is a list of these important documents along with a brief description of each:

- Form DOL-1A, Employer Status Report: This form is necessary for new employers or those who have not been assigned a Georgia Department of Labor (GDOL) account number. It registers the employer with the GDOL.

- Form UC-61, Unemployment Insurance Quarterly Tax and Wage Report: Similar to the DOL-4N, this form is used in other jurisdictions and is required for reporting employees’ wages and paying unemployment insurance taxes.

- Form W-2, Wage and Tax Statement: This IRS form is used by employers to report annual wages and taxes withheld from employees' paychecks.

- Form W-3, Transmittal of Wage and Tax Statements: Accompanies Form W-2 when submitted to the Social Security Administration, summarizing the employer’s total earnings, Social Security, and Medicare wages and withholding for all employees for the previous year.

- Form I-9, Employment Eligibility Verification: Employers must complete this form for each individual they hire to verify the employee's identity and eligibility to work in the United States.

- Form 941, Employer's Quarterly Federal Tax Return: This IRS form is used to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks and is required even if the employer has no employees during some quarters.

- State-specific New Hire Reporting Forms: Employers must report new hires to their state’s directory shortly after the date of hire, which helps in locating parents who owe child support.

- Form DOL-800, Separation Notice: In Georgia, this form must be given to an employee at the time of separation from employment, providing a reason for leaving and eligibility for unemployment benefits.

Each of these forms plays a vital role in complete and compliant payroll tax reporting and employee management. Employers must stay informed about the requirements for each form and the deadlines for submission to ensure compliance with both federal and state laws. Keeping accurate records and promptly addressing any changes in employment status or company information is paramount to managing a successful business.

Similar forms

The Federal Unemployment Tax Act (FUTA) tax return, often referred to as Form 940, is notably similar to the Georgia Tax Wage Report form. The FUTA form requires employers to report the annual federal unemployment taxes due for their employees. Similar to part I of the Georgia form, employers must provide employee names and compensation. Additionally, both forms calculate taxes owed based on employee wages, though the FUTA form focuses on annual rather than quarterly data. This federal counterpart also mandates detailing non-taxable wages and computing the tax due, paralleling the structure found in the Georgia Tax Wage Report's second part.

Form W-2, Wage and Tax Statement, shares commonalities with the Georgia Tax Wage Report, mainly in its function of reporting employee wages and tax withholdings. While the Georgia form collects data for state unemployment insurance contributions on a quarterly basis, the W-2 summarizes an employee's yearly wages and tax withholdings, including federal, state, and other taxes. Both documents necessitate the accurate reporting of each employee's earnings and personal information (such as Social Security Numbers) and play crucial roles in tax compliance and reconciliation for employers.

Form 941, the Employer’s Quarterly Federal Tax Return, is another document with significant similarities to the Georgia Tax Wage Report. Form 941 is used by employers to report federal withholdings from employee wages for income, Social Security, and Medicare taxes on a quarterly basis. The parallel between these two forms lies in their periodic reporting requirements that detail the compensation paid to employees and the calculation of taxes owed from these wages. Both are essential for adjusting and maintaining accurate tax records, and they ensure compliance with federal and state tax laws, respectively.

The State Unemployment Tax Act (SUTA) tax return, applicable in various forms across different states, resembles the Georgia Tax Wage Report form in its purpose to collect state-level unemployment taxes from employers. Like the Georgia form, SUTA returns require detailed employee wage reporting and tax calculation based on state-specific rates. Both forms are integral to funding state unemployment insurance benefits, with each necessitating periodic (usually quarterly) submissions that include detailed lists of employees, wages paid, and calculated taxes based on those wages, adjusted for any taxable wage base limits and rates specific to the state.

Dos and Don'ts

When filling out the Georgia Tax Wage Report form, there are specific practices that can ensure the process is both smooth and compliant with the state requirements. Paying attention to these do's and don'ts can save employers from potential errors and penalties.

Do:

- Review all sections before starting: Before filling out the form, take a look through all sections to understand what information is required.

- Enter accurate employee information: Make sure to input each employee's Social Security Number, full name, and total reportable gross wages accurately to prevent any discrepancies.

- File electronically if applicable: If you are an employer with more than 100 employees, remember to file the form electronically to comply with the Georgia Department of Labor's requirements.

- Report changes: Utilize Parts I and II to report any changes in your account, such as changes to your business's name or principal location, to ensure your records are up to date.

- Sign and submit by the due date: Ensure that Parts I and II of the form are fully completed, signed, and submitted by the due date to avoid any late penalties.

Don't:

- Skip filling out any required fields: Leaving fields blank, especially critical ones like the GDOL account number or total reportable gross wages, can lead to the rejection of the form.

- Estimate or round off figures: Provide exact amounts for wages paid and contributions due. Estimates or rounding off can cause discrepancies and potential audits.

- Forget to report non-taxable wages: Make sure to subtract non-taxable wages before reporting the total gross wages to ensure your tax calculations are correct.

- Miss reporting monthly covered employment data: Accurately report the number of covered workers each month as this data is crucial for determining your contribution tax rate and administrative assessment.

- Use outdated forms: Always use the most current version of the form available from the Georgia Department of Labor to ensure your report meets all current regulations and rates.

Misconceptions

Understanding the Georgia Tax Wage Report Form DOL-4N is crucial for employers, as misconceptions can lead to mistakes in filing. Below are seven common misunderstandings about this form and clarifications to help navigate the process accurately.

Every employer has to submit the form manually: Many believe that they have to submit their Georgia Tax Wage Report Form by mail or in person. In fact, employers with over 100 employees are required to file electronically, which can be more efficient and secure.

You can leave the GDOL account number blank if you don't know it: It’s a mistake to submit the form without your Georgia Department of Labor (GDOL) account number. If you are a new employer and have not been assigned a number yet, you should enter 'Applied For' and attach the necessary Employer Status Report form (DOL-1A).

Wages are reported when earned, not paid: This form requires that wages be reported for the quarter in which they were actually paid to employees, not when they are earned. This distinction is critical for accurate wage reporting.

All wages paid are taxable: There is a misconception that all wages reported on the form are subject to taxes. However, the form allows employers to subtract non-taxable wages, such as earnings above $9,500 per employee per calendar year, from the total reportable gross wages.

The Administrative Assessment rate is the same every year: The Administrative Assessment rate has changed over time. For instance, it was .08% prior to January 1, 2017, but it was reduced to .06% (.0006) after this date. Employers need to apply the correct rate for the period being reported.

Interest and penalties apply only if taxes are unpaid: While it’s true that interest and penalties are a concern for unpaid taxes and administrative assessments, penalties can also apply if the report itself is filed late. The penalty is not solely based on the total amount due.

It’s unnecessary to report company changes in the report: Some employers mistakenly think that updates to their company’s information (such as changes in the business name or address) should not be included in the wage report. However, the form provides specific sections (A-D) for reporting these changes to ensure the state’s records are up to date.

Clearing up these misunderstandings can help ensure that the process of completing and submitting the Georgia Tax Wage Report Form is smooth and error-free. This is essential for compliance and for avoiding unnecessary penalties or interest charges due to misreporting.

Key takeaways

Filling out and using the Georgia Tax Wage Report form, officially known as Form DOL-4N, is essential for employers for accurate tax reporting and compliance with state regulations. Here are seven key takeaways:

- Part I of the form requires employers to report wages and names of employees, including corporate officers. This section is critical for documenting employee earnings accurately.

- When completing the top section, employers must specify the quarter ending month, enter the year, and provide their Georgia Department of Labor (GDOL) account number. For those without an assigned account number, "Applied For" should be entered, and Form DOL-1A attached if it hasn't been submitted previously.

- The necessary information for each employee includes their Social Security Number, full last name, full first name, and total reportable gross wages for the quarter. Such detailed entries ensure employee wages are precisely captured for the period.

- Reportable gross wages are calculated as the total gross wages (including tip wages) minus any 125 Cafeteria Plan deductions taken during the quarter. This formula helps employers determine the correct wages subject to reporting.

- If an employer has more than 100 employees, they are required to file electronically. This could be via magnetic media (DVD, CD-ROM, or USB Flash Drive) or online, ensuring efficient and secure submission of wage reports.

- Part II focuses on reporting tax summary information and any account changes. This segment is vital for accurately calculating taxes due and updating any relevant account information.

- Employers must submit Parts I and II together by the due date to avoid penalties. Prompt submission is crucial for compliance and avoiding unnecessary fees.

For additional guidance on filling out Sections A-D or any other part of the form, employers are encouraged to call 404-232-3301. Moreover, visiting doLgeorgia.gov is recommended for more filing and payment options. It’s important for employers to stay informed and compliant with state requirements to ensure smooth operations and avoid penalties.

Popular PDF Documents

Office Depot Nonprofit Discount - To facilitate processing, the form must be filled out with accurate and complete information.

What Does G Mean on Costco Receipt - Essential information for tax-exempt entities on claiming a sales tax exemption for Costco.com orders, emphasizing document submission.

T1098 - Facilitates a detailed examination of expenses in relation to gross income to assess financial efficiency.