Get Ga St 3 Tax Form

In March 2017, businesses operating in Georgia encountered a specific obligation: the filing of the Sales and Use Tax Return (Form ST-3) by the deadline of April 20, 2017. This form was designated for sales made during that month, introducing several considerations that businesses needed to navigate. For instance, enterprises with sales attributed to the City of Atlanta were tasked with providing detailed data in Part B of the form, highlighting the city's unique tax requirements. The essence of sourcing rules, as outlined by O.C.G.A. § 48-8-77, plays a crucial role in this document, defining sales sourced to a jurisdiction as those involving property delivery or service performance within it. The Georgia Department of Revenue facilitated electronic submissions through the Georgia Tax Center, supporting filers with instructional materials and frequently asked questions to ease the process. The form itself demanded meticulous record-keeping, from documenting total state sales, including exempt transactions, to accurately calculating taxes due on both sales and use, alongside specific categories like TSPLOST tax and pre-paid local sales/use tax for motor fuel. Moreover, the form catered to amendments and underscored scenarios with no taxable sales. It also provided a structure for reporting the distribution of sales tax across various jurisdictions and the calculation of due use taxes, further complicated by diverse scenarios like out-of-state purchases or withdrawals from inventory. Additionally, it outlined the calculation of vendor’s compensation based on the collected tax amount, underlining the financial implications of accurate tax reporting and compliance. Effortlessly bridging complex tax legislation and practical tax filing obligations, Form ST-3 was a critical component of Georgia's tax administration for the reporting period, encapsulating a broad spectrum of sales and use tax considerations specific to the time.

Ga St 3 Tax Example

Sales and Use Tax Return

**ATTENTION**

Effective date: This Form

Sourcing: Generally, sales sourced to a jurisdiction include all sales of property in which the property is delivered to the purchaser in the jurisdiction and sales of services that are performed in the jurisdiction. Please refer to O.C.G.A. §

Electronic filing: To file and pay electronically, please visit the Georgia Tax Center at https://gtc.dor.ga.gov. Additional information, instructional videos, and frequently asked questions about electronic filing can be found at

General Instructions:

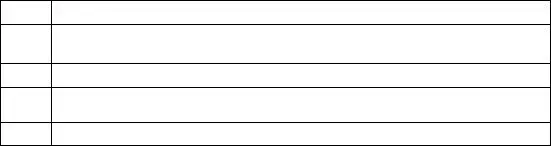

Record the Sales and Use Tax Number (STN), name, and address of the registered taxpayer. The Period Ending should be the end date (mm/dd/yy) of the reporting period. Check the Amended Return box if you are amending a previously filed return for the same period. Check the No Tax Due box if there were no taxable sales during this period. If there has been no sales and use tax activity during the period, do not complete this form. Please check the No Sales/Use Tax Activity box on Page 5, and complete and submit the payment voucher (Form

Part A - Tax Summary

LINE

1Record Total State Sales (all sales sourced to the State of Georgia) including leases and rentals.

2Record Total Exempt State Sales including leases and rentals. Include all sales that are exempt from state sales tax, even if such sales are subject to local sales tax.

3Subtract Exempt State Sales (Line 2) from Total State Sales (Line 1) and record Taxable State Sales. Complete Part B and Part C.

4Record the Total SALES Tax Amount (from Part B, Line 21).

5Record the Total USE Tax Amount (from Part B, Line 26).

6Record the TSPLOST tax (from Part C, Line 50).

7Record the

8Record Total Sales/Use Tax Collected for reporting period from taxpayer accounting records.

9Record the sum of Lines 4 – 7. (Add Line 4 + Line 5 + Line 6 + Line 7)

10Subtract Total Sales/Use Tax amount (Line 9) from Total Tax Collected (Line 8) amount and record the Excess Tax amount. Include the Excess tax amount in the appropriate sales/use category for vendor’s compensation.

11Record the Total Vendor’s Compensation (from Part D, Line 5).

12Record previous prepaid estimated tax, if applicable. Please reference your annual prepaid estimated tax letter.

13Record current prepaid estimated tax if applicable. Please reference your annual

Page 2

prepaid estimated tax letter.

14Add Lines 9 and 10, subtract Lines 11 and 12, and add Line 13 for the Total Amount Due.

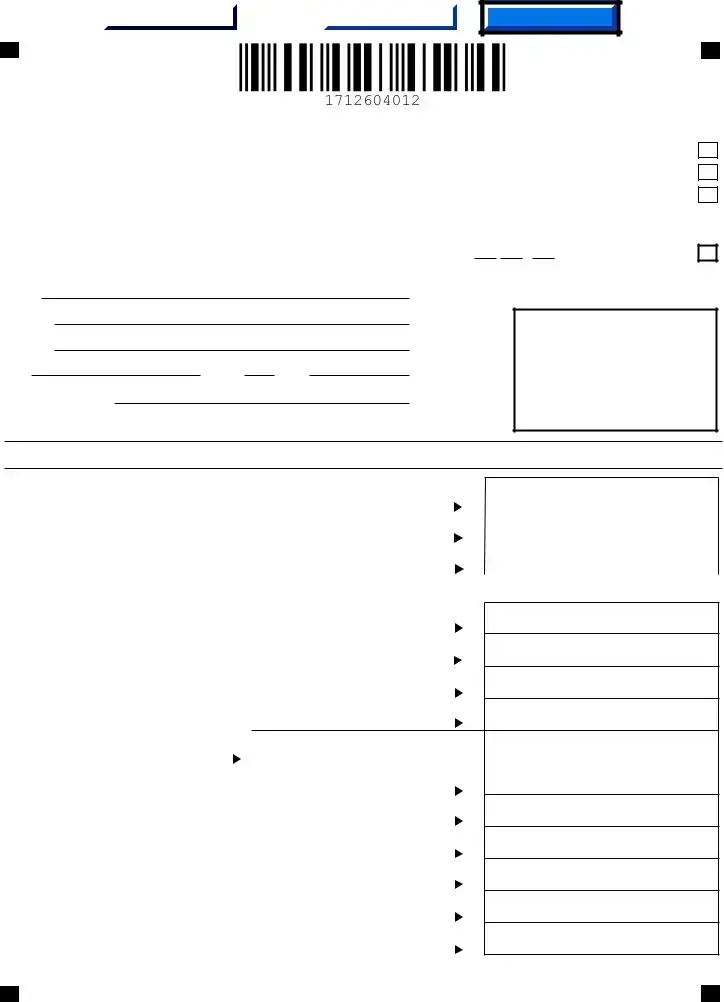

Part B - Sales Tax Distribution Table

Do not report Transportation Local Option (TSPLOST) sales and use tax in Part B. Transportation Local Option (TSPLOST) sales and use tax will be reported in Part C.

LINE

1Record the Taxable State Sales (total sales sourced to the State of Georgia LESS sales of energy to manufacturers and all other tax exempt sales). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount for the State.

2Record ONLY total sales sourced to the State of Georgia of energy sold to manufacturers. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

3Record taxable

4Record ONLY sales of motor vehicles subject to sales tax and sourced to the City of Atlanta. These sales are also required to be included in county sales below (044 Dekalb County and/or 060 Fulton County). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

5Record ONLY Taxable Sales of energy sold to manufacturers that are sourced to the City of Atlanta. These sales are also required to be included in county sales of energy to manufacturers below (044E Dekalb County and/or 060E Fulton County). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

6Record Taxable Sales for Clayton County (Total sales sourced to Clayton County LESS sales of jet fuel, sales of motor vehicles subject to sales tax, sales of energy to manufacturers, and all other tax exempt sales). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

7Record ONLY Taxable Sales of jet fuel sourced to Clayton County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record Sales Tax Amount.

8Record ONLY sales of motor vehicles subject to sales tax and sourced to Clayton County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record Sales Tax Amount.

9Record ONLY Taxable Sales of energy sold to manufacturers in Clayton County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

10Record Taxable Sales for Muscogee County (total sales sourced to Muscogee County LESS sales of motor vehicles subject to sales tax, sales of energy to manufacturers, and all other tax exempt sales). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

Page 3

11Record ONLY sales of motor vehicles subject to sales tax and sourced to Muscogee County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record Sales Tax Amount.

12Record ONLY Taxable Sales of energy sold to manufacturers that are sourced to

Muscogee County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

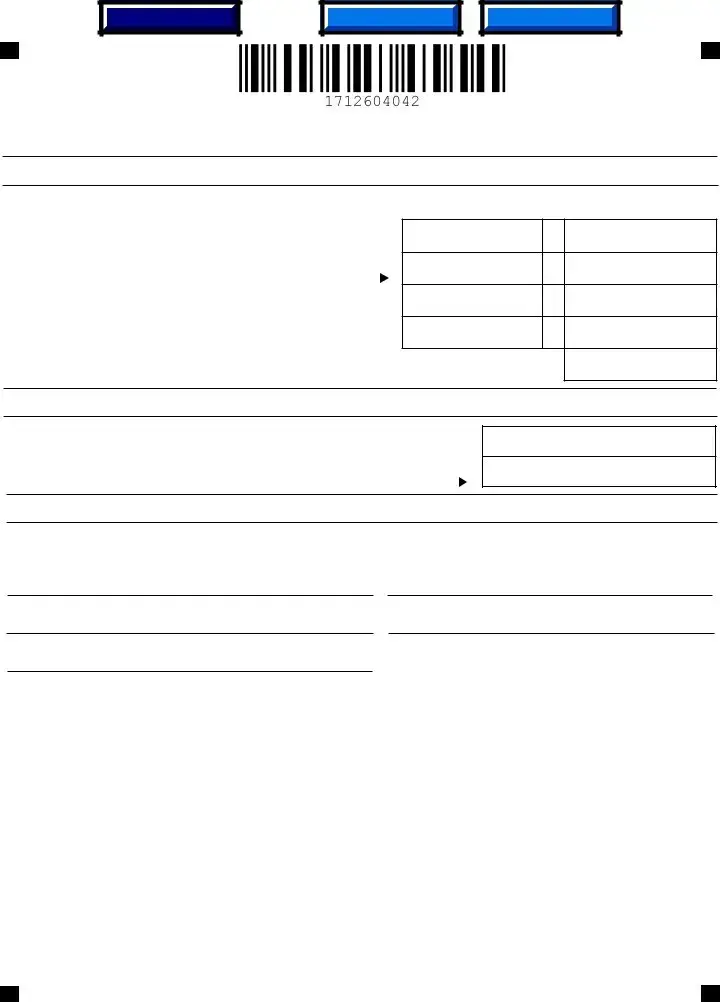

Example: Taxpayer has $50,000 in total taxable sales for Cobb County which includes $10,000 in energy sold to a manufacturer. On Line 13 (or next available Line item in Part B or related addendum) list Cobb County (jurisdiction code 033), record $40,000 in total sales to Cobb County ($50,000 less $10,000 energy sales to a manufacturer), multiply this amount by the applicable tax rate for Cobb County and record the Sales Tax Amount. On Line 14 (or next available line) list Cobb County (jurisdiction code 033E), record total sales of energy to manufacturers of $10,000, multiply this amount by the applicable tax rate for Cobb County (for energy sold to manufacturers), and record the Sales Tax Amount.

Line |

Jurisdiction |

Jurisdiction |

Taxable |

Tax |

Sales Tax Amount |

|

|

Code |

Sales |

Rate |

|

13. |

Cobb |

033 |

40,000 |

2% |

800 |

|

|

|

|

|

|

14. |

Cobb |

033E |

10,000 |

1.00% |

100 |

|

|

|

|

|

|

Additional addendum pages (Form

20If additional addendum pages were completed, record the total Sales Tax Amount from all forms.

21Record the sum of Lines

Part B – Use Tax Distribution Table

LINE

Page 4

Code Reason

01Georgia Use – item purchased

02 |

Georgia Withdrawal from Inventory. |

03

04 |

Examples of taxable transactions, Jurisdiction of Use, and Reason Codes include:

A contractor purchases an item for $600.00 in a Georgia county where the total Sales Tax rate is 6% and uses the item to fulfill a contract in a jurisdiction where the total sales tax rate is 8%. The contractor owes additional Use Tax of 2% and should record local use tax due of $12.00 ($600.00 x .02). The Use tax Reason Code is 01.

A Georgia furniture manufacturer withdraws a table worth $700.00 from inventory to use in the business’s break room. The manufacturer owes state and local use tax based on the fair market value of the table, at the rate in effect in the jurisdiction where the withdrawal from inventory occurs. The manufacturer should calculate the use tax due by multiplying the combined state and local use tax rate by $700.00 and recording the resulting use tax. The use tax Reason Code is 02.

A Georgia resident or Georgia business purchases an item for $800.00 via the internet or by catalog, and the seller does not charge Sales Tax. The purchaser owes Use Tax based on the rate in effect in the jurisdiction where the purchaser takes possession of the item. The purchaser should calculate State Use Tax by multiplying the applicable State Use Tax rate by $800, and recording the resulting State Use Tax due with the use tax Reason Code 03. The purchaser should calculate the Local Use Tax due by multiplying the applicable Local Use Tax rate by $800.00 and recording the resulting Local Use Tax due with the Use Tax Reason Code 04.

A Georgia resident or Georgia business purchases a $900.00 item outside of Georgia, pays the other state’s 5% state sales tax at the time of purchase and returns to Georgia with the item. The purchaser will receive credit against Georgia’s 4% state use tax due and thus owes no additional state use tax. The purchaser owes local use tax at the rate in effect in the jurisdiction where the purchaser lives or where the business is located. The purchaser should calculate the local use tax due by multiplying the applicable local use tax rate by $900.00 and recording the resulting local use tax due. The Use tax Reason Code is 04.

Additional addendum pages, (Form

25Record the Addendum Page Total.

26Record the sum of Lines

Page 5

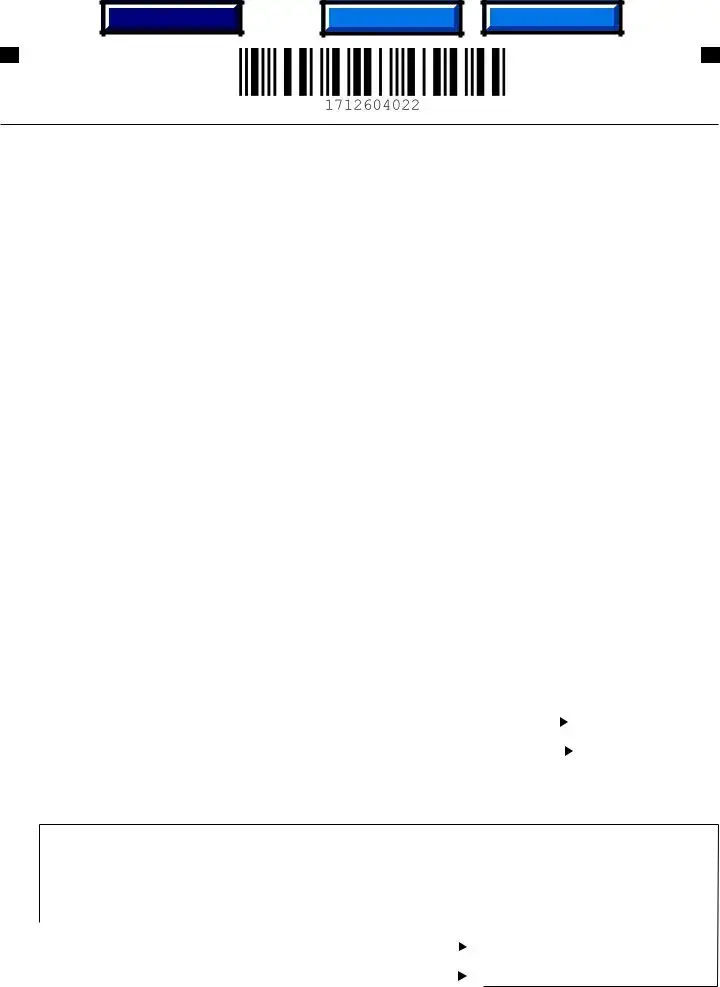

Part C – TSPLOST Sales & Use Tax

LINE

47

48

TSPLOST Sales and Use Tax – This section should ONLY be completed by individuals or businesses who have taxable sales sourced to or owe use tax to the jurisdictions listed in Part C (TSPLOST Sales & Use Tax).

Column A: TSPLOST Taxable Sales - Record Taxable Sales by county (Total County Sales LESS sales of energy to manufacturers and all other tax exempt sales).

Record the sum of taxable sales Lines

Column B: TSPLOST Use Tax - Record TSPLOST use tax amount due. Use tax is due if applicable TSPLOST Sales Tax was not paid on an item purchased or leased and that item has been placed into “use” within one of the listed jurisdictions.

49Record the sum of use tax Lines

50Record the sum of Lines 48 through 49 as total TSPLOST and record this amount on Part A, Line 6.

Part D – Vendor’s Compensation Calculation

LINE

1Record Total Sales and Use Tax on

.03) Vendor’s Compensation and record result.

2Record Total Sales and Use Tax on

3Record

4

5

Record State and Local Sales/Use Tax due on

Total above Vendor’s Compensation amounts for Total Vendor’s Compensation and record this amount on Part A, Line 11.

Part E – Bad Debt Reporting

LINE

1Record bad debt losses incurred on taxable Georgia sales.

2Record recoveries on Georgia bad debt that were previously written off.

Page 6

Part F – Certification and Signature

The return must be completed and signed in order to be considered timely filed.

Additional Instructions

Amended Returns

An amended return must be submitted on an

Master Accounts

Any dealer with four or more locations is required to report on a consolidated Sales and Use Tax form

Penalty and Interest on Delinquent Returns

Returns and payments are considered timely if postmarked by the due date of the return (the 20th day following the close of the reporting period). Taxpayers will be billed penalty and interest for all returns and payments filed after this date.

Penalty is calculated separately for the state and all local taxes in aggregate. A penalty of 5% (.05) of the tax due or five dollars ($5.00), whichever is greater, for the state and for the local taxes will be billed after the return is processed. This penalty will be billed for each month, or fraction of a month, when the return is delinquent. The penalty amount will be 25% (.25) or

For all periods beginning before July 1, 2016, interest is computed at 1% per month. For periods beginning on or after July 1, 2016, the annual interest rate will be the bank prime loan rate published on or after January 1 of each calendar year plus 3%. Interest will accrue on the tax amount owed from the date of the tax is due until the rate is paid.

Vendor’s Compensation is only given when both the payment and return are submitted timely. Taxpayers who are mandated to file electronically will not receive vendor’s compensation if a paper return and/or payment is submitted.

Mailing Instructions

Mail the return to the following address:

State of Georgia, Department of Revenue

PO BOX 105408

Atlanta, GA

Additional forms and information may be obtained from: Department of Revenue website/Forms, http://dor.georgia.gov

If you need additional assistance, please contact Taxpayer Service at

Print Blank Form |

|

|

|

|

|

|

|

|

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Sales & Use #

-

-

/

/

Name:

Address:

Address:

City:State: Zip:

County of Business:

Clear

Page 1

Check/Money Order

No Sales/Use Activity

No Tax Due

/ |

|

Amended Return |

DEPARTMENT USE ONLY

Part A Tax Summary

1. Total State Sales |

|

|

|

|

|

||

2. Total Exempt State Sales |

|

||

|

|||

3. Taxable State Sales |

|

|

|

4. |

Total Sales Tax (from Part B, Line 21) |

+ |

|

5. |

Total Use Tax (from Part B, Line 26) |

+ |

|

6. |

Total TSPLOST Tax (from Part C, Line 50) |

+ |

|

7. |

+ |

|

|

8. |

Total Tax Collected (from accounting records) |

|

|

|

|

||

9. |

Total Sales/Use Tax (Ln 4 + Ln 5+ Ln 6 + Ln 7) |

|

|

10. |

Excess Tax (Subtract Line 9 from Line 8) |

+ |

|

11. |

Total Vendor’s Compensation (from Part D, Line 5) |

- |

|

12. |

Previous Prepaid Amount |

- |

|

13. |

Current Prepaid Amount |

+ |

|

14. Total Amount Due..................................................................................................................................

Print Blank Form

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Clear

Page 2

|

Part B Sales Tax Distribution Table |

|

PERIOD ENDING |

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

JURISDICTION |

TAXABLE SALES |

|

TAX RATE |

SALES TAX AMOUNT |

|

|||||||||||||||

1. |

|

|

|

|

|

CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

State |

|

000 |

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

2. State (Energy to Manufacturers) |

|

|

000E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

||||||||

3. |

|

City of Atlanta |

|

999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1.5% |

|

|

|

|

|

|

|

|

|

|

|

||||||||

4. |

|

City of Atlanta (Motor Vehicle) |

|

|

999R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

0.5% |

|

|

|

|

|

|

|

|

|

|

|

||||||||

5. |

City of Atlanta (Energy to Manufacturers) |

|

999E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

6. |

Clayton |

031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

7. |

Clayton (Jet Fuel) |

|

|

031JF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8. |

Clayton (Motor Vehicle) |

|

|

031R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

9. |

Clayton (Energy to Manufacturers) |

|

|

031E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

1% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

10. Muscogee |

|

106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

11. Muscogee (Motor Vehicle) |

|

|

106R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

12. Muscogee (Energy to Manufacturers) |

|

|

106E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

1% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20. |

|

|

|

ADDENDUM PAGE TOTALS (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

21. |

|

|

|

|

TOTAL SALES TAX (Record on Part A, Line 4) |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part B Use Tax Distribution Table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

JURISDICTION OF |

JURISDICTION OF |

USE TAX |

|

|

|

|

STATE AND LOCAL |

|

|||||||||||||||

|

|

|

|

USE CODE |

REASON CODE |

|

|

|

|

USE TAX AMOUNT |

|

||||||||||||||||

22. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

23. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

25. |

|

|

|

ADDENDUM PAGE TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

26. |

|

TOTAL USE TAX (Record on Part A, Line 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Blank Form

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Clear

Page 3

PART C TSPLOST Sales & Use Tax

|

Jurisdiction |

Code |

A. TSPLOST |

B. TSPLOST |

|

Name |

Taxable Sales Amt |

Use Tax Amt |

|

|

|

|

|

|

1 |

Appling |

001 |

|

|

|

|

|

|

|

2 |

Bleckley |

012 |

|

|

|

|

|

|

|

3 |

Burke |

017 |

|

|

|

|

|

|

|

4 |

Candler |

021 |

|

|

|

|

|

|

|

5 |

Chattahoochee |

026 |

|

|

|

|

|

|

|

6 |

Clay |

030 |

|

|

7 |

Columbia |

036 |

|

|

|

|

|

|

|

8 |

Crisp |

040 |

|

|

|

|

|

|

|

9 |

Dodge |

045 |

|

|

10 |

Dooly |

046 |

|

|

11 |

|

|

|

|

Emanuel |

053 |

|

|

|

12 |

|

|

|

|

Evans |

054 |

|

|

|

13 |

|

|

|

|

Glascock |

062 |

|

|

|

14 |

|

|

|

|

Hancock |

070 |

|

|

|

15 |

|

|

|

|

Harris |

072 |

|

|

|

16 |

|

|

|

|

Jeff Davis |

080 |

|

|

|

17 |

|

|

|

|

Jefferson |

081 |

|

|

|

18 |

|

|

|

|

Jenkins |

082 |

|

|

|

19 |

|

|

|

|

Johnson |

083 |

|

|

|

20 |

|

|

|

|

Laurens |

087 |

|

|

|

21 |

|

|

|

|

Lincoln |

090 |

|

|

|

|

|

|

|

|

22 |

Macon |

094 |

|

|

|

|

|

|

|

23 |

Marion |

096 |

|

|

|

|

|

|

|

|

Jurisdiction |

Code |

A. TSPLOST |

B. TSPLOST |

|

Name |

Taxable Sales Amt |

Use Tax Amt |

|

|

|

|||

|

|

|

|

|

24 |

McDuffie |

097 |

|

|

|

|

|

|

|

25 |

Montgomery |

103 |

|

|

|

|

|

|

|

26 |

Muscogee |

106 |

|

|

|

|

|

|

|

27 |

Quitman |

118 |

|

|

|

|

|

|

|

28 |

Randolph |

120 |

|

|

|

|

|

|

|

29 |

Richmond |

121 |

|

|

30 |

Schley |

123 |

|

|

|

|

|

|

|

31 |

Stewart |

128 |

|

|

|

|

|

|

|

32 |

Sumter |

129 |

|

|

33 |

Talbot |

130 |

|

|

|

|

|

|

|

34 |

Taliaferro |

131 |

|

|

|

|

|

|

|

35 |

Tattnall |

132 |

|

|

|

|

|

|

|

36 |

Taylor |

133 |

|

|

|

|

|

|

|

37 |

Telfair |

134 |

|

|

|

|

|

|

|

38 |

Toombs |

138 |

|

|

|

|

|

|

|

39 |

Treutlen |

140 |

|

|

|

|

|

|

|

40 |

Warren |

149 |

|

|

|

|

|

|

|

41 |

Washington |

150 |

|

|

|

|

|

|

|

42 |

Wayne |

151 |

|

|

|

|

|

|

|

43 |

Webster |

152 |

|

|

|

|

|

|

|

44 |

Wheeler |

153 |

|

|

|

|

|

|

|

45 |

Wilcox |

156 |

|

|

|

|

|

|

|

46 |

Wilkes |

157 |

|

|

|

|

|

|

|

TSPLOST Taxable Sales (Add Column A Lines 1 through 46)

48TSPLOST Sales Tax (Multiply Line 47 by 0.01)

49TSPLOST Use Tax (Add Column B Lines 1 through 46)

50Total TSPLOST Tax (Add Line 48 & Line 49, also enter on Part A Line 6)

Print Blank Form

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Clear

Page 4

Part D Vendor’s Compensation Calculation

TAX AMOUNTS RATE VENDOR’S COMPENSATION

1. State and Local

2. State and Local

3.

4. State and Local

5. TOTAL VENDOR’S COMPENSATION(Record on Part A, Line 11)

3%

.5%

3%

3%

Part E Bad Debt Reporting

1. Bad Debt

2. Bad Debt Recovered ..........................................................................................................

Part F Certification and Signature

I certify that this return, including any accompanying schedules or statements, has been examined by me and is to the best of my knowledge and belief a true and complete return made in good faith for the period stated. This_____________ day of ___________________________, ________.

Return prepared by: |

Phone Number |

Title |

Email Address |

Signature

This return must be filed and paid by the 20th of the month following the period for which the tax is due in order to avoid loss of vendor’s compensation and the application of penalty and interest. Businesses must file a timely return for each period even though no tax is due. Do not remit cash in the mail.

Document Specifics

| Fact Name | Description |

|---|---|

| Effective Date and Due Date | This Form ST-3 is only effective for sales made during March 2017 and is due by April 20, 2017. |

| Sourcing Rules | Sales are sourced to a jurisdiction based on delivery location for property and performance location for services, as detailed in O.C.G.A. § 48-8-77. |

| Electronic Filing | Taxpayers are encouraged to file and pay electronically via the Georgia Tax Center at https://gtc.dor.ga.gov, with additional resources available at http://dor.georgia.gov/georgia-tax-center-info. |

| Sales and Use Tax Breakdown | The form requires taxpayers to record total state sales, exempt state sales, and calculates taxable state sales, sales tax, and use tax amounts, among other tax-related calculations. |

| TSPLOST and Vendor's Compensation | Form ST-3 includes sections for reporting Transportation Local Option (TSPLOST) tax and calculating Vendor’s Compensation based on sales and use tax collected. |

Guide to Writing Ga St 3 Tax

Filling out the GA ST-3 Tax Form is a crucial process for businesses to ensure they comply with Georgia's sales and use tax laws. This form is designed for reporting and paying taxes collected from sales made within a specific period – in this case, March 2017. Accuracy and timeliness in completing this form can help businesses avoid penalties and interest. Below are step-by-step instructions to guide you through the process of correctly filing the Form ST-3 for sales made during March 2017, which is due by April 20, 2017.

- Begin by accessing the Georgia Tax Center website at https://gtc.dor.ga.gov to file electronically, which is strongly recommended for efficiency and accuracy.

- Enter the Sales and Use Tax Number (STN), the registered taxpayer's name, and address in the designated sections.

- Specify the reporting period's end date in the Period Ending field, using the mm/dd/yy format.

- If amending a previously filed return for the same period, check the Amended Return box.

- If there were no taxable sales during this period, check the No Tax Due box. Skip the rest of the form and proceed to complete and submit the payment voucher (Form PV-ST Sales and Use Tax Voucher) only if there were no sales and use tax activity.

- In Part A - Tax Summary, accurately record the totals for state sales, exempt state sales, taxable state sales, total sales tax amount, total use tax amount, TSPLOST tax, and pre-paid local sales/use tax for on-road motor fuel as instructed in lines 1 through 10.

- Calculate and record the Excess Tax amount and Total Vendor’s Compensation as per lines 10 and 11 instructions.

- Update previous and current prepaid estimated tax where applicable.

- In Part B and Part C, meticulously distribute sales tax and TSPLOST sales & use tax by sourcing sales to the correct jurisdiction and calculating the tax accordingly.

- Follow the instructions to fill out the Vendor’s Compensation Calculation in Part D and the Bad Debt Reporting in Part E, if applicable.

- Review the form for accuracy. Ensure that all required sections are completed and calculations are correct to minimize errors.

- Submit the completed form by April 20, 2017, either electronically through the Georgia Tax Center or as directed by the Georgia Department of Revenue if submitting by mail.

This step-by-step guide aims to make the process of filing your GA ST-3 Tax Form as straightforward as possible. Paying close attention to the details and ensuring that all information is accurate and submitted by the deadline will help maintain compliance with Georgia tax laws.

Understanding Ga St 3 Tax

What is the effective date for the Form ST-3, and when is it due?

The Form ST-3 is specifically for sales made during March 2017. It must be submitted by April 20, 2017.

Who needs to fill out Part B, Lines 3 through 5 on the Form ST-3?

Taxpayers with sales sourced to the City of Atlanta are required to complete Part B, Lines 3 through 5.

How do I determine if my sales are sourced to a jurisdiction?

Sales are generally sourced to a jurisdiction if the property is delivered to the purchaser within that jurisdiction or if the services are performed there. For specific rules, refer to O.C.G.A. § 48-8-77.

Can I file the Ga ST-3 Tax Form electronically?

Yes, electronic filing is encouraged. Visit the Georgia Tax Center website at https://gtc.dor.ga.gov to file and pay electronically. Additional resources and FAQs about electronic filing can be found at http://dor.georgia.gov/georgia-tax-center-info.

What are the steps to fill out the Tax Summary in Part A of the Form ST-3?

- Record Total State Sales, including leases and rentals.

- Document Total Exempt State Sales.

- Subtract Exempt State Sales from Total State Sales to record Taxable State Sales.

- Complete Parts B and C as required and record the totals of Sales Tax, Use Tax, TSPLOST tax, and Pre-paid Local Sales/Use Tax for on-road motor fuel in the corresponding sections.

- Calculate the Excess Tax amount and record Vendor’s Compensation, if applicable.

What is the Vendor’s Compensation, and how is it calculated?

Vendor’s Compensation is an allowance for taxpayers who collect and remit taxes on time. It is calculated by applying a 3% rate to the first $3000 of total non-motor fuel Sales and Use Tax, and a .5% rate to amounts over $3000. For pre-paid local sales/use tax of on-road motor fuel, a 3% rate is also applied.

How do I report Use Tax on the Form ST-3?

Report State and Local Use Tax in Part B using the appropriate jurisdiction of use codes and reason codes. Use tax must be calculated for purchases or leases where Georgia sales tax was not originally paid and the item is put to use within Georgia. Detailed instructions and reason codes for reporting Use Tax are provided in the form.

Where can I find additional forms or addendums for the Form ST-3?

Additional forms, such as the ST-3 Addendum Sales or Use, are available on the Georgia Department of Revenue’s website at http://dor.georgia.gov.

What should I do if there were no taxable sales during the reporting period?

If there were no taxable sales or use tax activity, do not complete the ST-3 form. Instead, check the No Sales/Use Tax Activity box on Page 5 and complete and submit only the payment voucher (Form PV-ST Sales and Use Tax Voucher).

Common mistakes

When filling out the Georgia State Sales and Use Tax Return (ST-3) form, individuals and businesses often encounter several common pitfalls. Recognizing these errors can assist taxpayers in ensuring accurate reporting and compliance with the Georgia Department of Revenue regulations. The following outlines four frequent mistakes:

-

Incorrect Sourcing of Sales: Taxpayers sometimes misinterpret the rules regarding the sourcing of their sales. The correct approach is to source sales to the jurisdiction where the property is delivered or the service is performed. This mistake can lead to the misallocation of tax liabilities among the different jurisdictions within Georgia, especially concerning Part B, Lines 3 through 5 for sales sourced to the City of Atlanta.

-

Failure to Distinguish between Taxable and Exempt Sales: Another common oversight is not properly separating taxable from exempt sales when recording totals in Part A, Lines 1 and 2 of the form. Taxable sales need to be clearly differentiated from those that are exempt from state sales tax (even if subject to local sales tax). This distinction is critical for accurately calculating the taxable sales base.

-

Incorrect Calculation of Taxes Due: Taxpayers often err in the calculation of the Total Amount Due, particularly at the stage of subtracting vendor’s compensation and adding prepayments in Part D, Lines 1 through 5. Errors in this area can result from misunderstandings about how to apply compensation rates or from miscalculating the taxable amount after exemptions and prepayments.

-

Neglecting to Report Use Tax Properly: A significant area of confusion lies in the reporting of use tax in Part B, specifically Lines 22 through 26. This is frequently seen when taxpayers do not apply the correct jurisdiction of use codes or reason codes for items purchased outside of Georgia or via the internet where Georgia sales tax was not collected at the time of purchase. Correctly understanding and applying these codes is crucial for fulfilling use tax obligations accurately.

Mindfulness of these errors when completing the ST-3 form can enhance accuracy and aid in maintaining compliance with Georgia tax laws. The complex nature of tax compliance underscores the importance of paying close attention to detail and seeking clarification when necessary to avoid these common pitfalls.

Documents used along the form

When preparing the Georgia Sales and Use Tax Return (ST-3), it's vital to have a comprehensive understanding of related documents and forms that could be necessary to accurately report and file taxes. These documents may vary based on specific circumstances such as the type of business, the goods or services sold, or additional tax liabilities. Below is a list of other forms and documents often used alongside the Ga ST 3 Tax form to ensure thorough and compliant tax reporting.

- Form ST-3 Motor Fuel: This form is used to report pre-paid local sales/use tax for on-road motor fuel. It's necessary for businesses that sell motor fuel to accurately compute the taxes that have been collected and need to be remitted.

- Form ST-3 Addendum Sales: Provides additional space for reporting sales tax amounts for various jurisdictions. This addendum is crucial when the primary ST-3 form does not have sufficient space for all necessary entries.

- Form ST-3 Addendum Use: Similar to the sales addendum, this form is used for detailed reporting of Use Tax by jurisdiction. It is especially useful for businesses that have use tax liabilities in multiple jurisdictions.

- PV-ST Sales and Use Tax Voucher: A payment voucher used when submitting sales and use tax payments. This is particularly important for taxpayers who are not filing electronically and need to submit their payments by mail.

- Off-Road Fuel Worksheet: While not filed with the return, this worksheet is used to calculate state and local sales/use tax due on off-road motor fuel. Keeping this worksheet is crucial for record-keeping and verification purposes.

- Annual Prepaid Estimated Tax Letter: References the taxpayer's obligations regarding prepaid estimated taxes. This document provides essential details to accurately fill out the sections on prepaid tax in the Ga ST 3 form.

- Electronic Filing Credentials: Information necessary for electronic filing through the Georgia Tax Center, including login details. As electronic filing is encouraged, having this information readily available simplifies the filing process.

- Bad Debt Recovery Documentation: Records and documents detailing recoveries on bad debt that were previously written off. This information is important for completing Part E of the ST-3 form where bad debt adjustments are reported.

The integration of these forms and documents with the Ga ST 3 Tax form facilitates accurate tax computation and compliance with Georgia tax laws. Each document plays a crucial role in ensuring that all relevant information is reported, which not only aids in the direct filing process but also assists in audit and verification procedures. It's imperative for taxpayers to familiarize themselves with these documents and maintain up-to-date records to alleviate the complexities related to tax filing.

Similar forms

The Ga St 3 Tax Form, known as the Sales and Use Tax Return, shares similarities with many other tax documents, each serving unique functions yet intertwined by their purpose of tax reporting and compliance. First among these is the Form 1040 used by individuals to file federal income tax returns. Similar to the Ga St 3, the Form 1040 collects detailed financial information, calculates taxes owed, and ensures accurate reporting to tax authorities. Both forms are pivotal for financial accountability and adherence to tax laws.

The Uniform Sales & Use Tax Exemption/Resale Certificate - Multijurisdiction form, like the Ga St 3, is utilized by businesses to declare tax-exempt purchases or sales. This form allows businesses to navigate through various state tax laws by providing a standardized document to claim exemptions, mirroring the Ga St 3’s functionality of reporting specific tax details to state tax departments.

Another document, the Business License Application, shares a connection with the Ga St 3 by requiring businesses to report certain aspects of their operations, including estimated sales or use tax. Although serving a different primary purpose, this application ensures businesses are registered for tax purposes, echoing the Ga St 3’s role in maintaining tax compliance.

The Employer’s Quarterly Federal Tax Return (Form 941) parallels the Ga St 3 in its periodic reporting requirement. While Form 941 is used to report federal payroll taxes, the Ga St 3 addresses sales and use taxes, both critical for business operations and tax obligations fulfillment.

State-specific sales tax forms from other jurisdictions exhibit similarities to the Ga St 3, as they collect and report sales and use tax information relevant to their specific states. These documents ensure businesses accurately report their taxable activities across different regions, highlighting the importance of geographic-specific tax compliance.

The VAT (Value Added Tax) return, used in many countries outside the United States, is akin to the Ga St 3 in its purpose of reporting taxes collected on sales. Although VAT and sales tax have different structural elements, the documentation process serves a similar function of tracking and remitting taxes on goods and services sold.

Form PV-ST, mentioned within the Ga St 3 instructions, is specifically designed for payment vouchers for sales and use tax. This document complements the Ga St 3 by facilitating the actual payment of calculated taxes, thereby ensuring that the reporting on Ga St 3 is financially reconciled with the state tax department through actual payments.

The Use Tax Return forms, which many states have, serve a role similar to the use tax portion of the Ga St 3 form. These forms are dedicated exclusively to reporting use tax, a tax on the use, storage, or consumption of taxable goods or services on which sales tax has not been paid. The focused nature of these forms highlights the nuanced areas of tax liability addressed by broader documents like the Ga St 3.

The Quarterly Retail Sales Tax Return is another document with significant overlap with the Ga St 3, catering specifically to retail businesses. It focuses on the periodic reporting of retail sales activities and the associated sales tax, reflecting the comprehensive nature of tax documentation and its sector-specific applications.

Lastly, the Motor Fuel Tax Return, like the portion of the Ga St 3 dealing with motor fuel sales and use taxes, addresses taxes related to fuel transactions. Each return captures the nuances of tax responsibility within this specialized sector, underscoring the complexity and breadth of tax reporting requirements encountered by businesses.

In conclusion, while each of these documents serves specific facets of tax reporting and compliance, their collective purpose aligns closely with that of the Ga St 3 Tax Form. Together, they encapsulate the multifaceted nature of tax obligations businesses and individuals must navigate to maintain financial and legal integrity within their operations.

Dos and Don'ts

When completing the Georgia State Sales and Use Tax Return (ST-3) form, it is crucial to follow best practices to ensure accuracy and compliance. Here are five dos and don'ts to consider:

Do:- Verify the effective date to confirm the form is correct for the sales period you are reporting. This ensures the information provided is relevant to the specified time frame.

- Accurately record the Sales and Use Tax Number (STN), name, and address at the top of the form. This basic information is essential for the form to be processed correctly.

- Use the electronic filing option by visiting the Georgia Tax Center website, which simplifies the submission process and may provide additional guidance and resources.

- Thoroughly review each section, including Part A for Tax Summary, Parts B and C for Sales and Use Tax Distribution, ensuring accurate entry of sales and exempt sales figures.

- Consult the instructional videos and frequently asked questions on the Georgia Department of Revenue's website if you encounter any issues or need clarification.

- Overlook checking the "Amended Return" or "No Tax Due" boxes if they apply to your situation. Failing to indicate these conditions can lead to incorrect processing of your return.

- Ignore specific instructions for sourcing sales to the correct jurisdiction, as errors in allocation can result in incorrect tax calculations and potential compliance issues.

- Forget to include taxable sales of specific categories like non-motor vehicle sales for the City of Atlanta or sales of energy to manufacturers, as these require careful attention to ensure correct tax amounts are reported.

- Omit details on the use tax if applicable, especially for items purchased or leased without paying Georgia Sales Tax but used within the state. Accurate reporting of use tax is crucial for compliance.

- Fail to check for and submit any required addendums, particularly if your sales activities extend across multiple jurisdictions or involve nuanced tax situations.

Misconceptions

Understanding the Georgia State Form ST-3, the Sales and Use Tax Return, can often be tricky. Misconceptions about this form can lead to errors when filing. Here's a closer look at some common misunderstandings and clarifications to help navigate these waters smoothly.

It's only for businesses in Atlanta: While the form does require specific information from businesses operating within the City of Atlanta, it is actually a statewide form. This form is necessary for all Georgia businesses that need to report sales and use tax.

Only physical goods are taxable: A common misconception is that sales tax only applies to physical goods sold. However, the ST-3 form also requires reporting on the leases, rentals, and certain services deemed taxable by Georgia law.

You only file it once: The form is not a one-time filing requirement. Businesses must submit the ST-3 form monthly if they are collecting sales tax from customers. The due date is typically the 20th of the month following the reporting period.

Electronic filing is optional: While it may have been more flexible in the past, electronic filing is now the standard for most tax filings, including the ST-3. The Georgia Department of Revenue strongly encourages, and in some cases requires, electronic submission through the Georgia Tax Center.

Exempt sales don't need to be reported: All sales, including those that are exempt from state sales tax, must be reported on the ST-3 form. This helps to provide a full picture of a business's operations and ensures compliance with Georgia's tax laws.

Use Tax is rarely applicable: This is incorrect. Use Tax applies in several common scenarios, such as when taxable items are purchased out of state or online without paying Georgia Sales Tax. Businesses and individuals are responsible for paying Use Tax in these circumstances.

No sales equals no filing: Even if a business has not made any taxable sales during a reporting period, it must still submit a "zero" return. Failing to file could result in penalties, as it appears as non-compliance to the Department of Revenue.

TSPLOST is reported with regular sales tax: Transportation Local Option Sales Tax (TSPLOST) must be reported separately in Part C of the ST-3 form, not combined with general sales tax figures in Parts A or B. This ensures the accurate distribution of taxes to the correct jurisdictions.

Clearing up these misconceptions is crucial for accurate and compliant filing of the ST-3 form in Georgia. Understanding the nuances of this form can save businesses from unnecessary stress and potential penalties. Always refer to the latest guidelines from the Georgia Department of Revenue and, when in doubt, seek advice from a tax professional.

Key takeaways

When approaching the process of completing and utilizing the Georgia State Form ST-3, also known as the Sales and Use Tax Return, it's crucial to grasp its key components to ensure compliance and accuracy. Here are four essential takeaways to consider:

- Understanding the effective date and specific requirements: The Form ST-3 is designated for transactions made within a specific timeframe, exemplified by the one effective for sales made during March 2017, which was due by April 20, 2017. Particularly for businesses in Atlanta, additional data entries on Part B, Lines 3 through 5, may be mandatory, underscoring the importance of noting such date-sensitive instructions and regional stipulations.

- The significance of sourcing rules: Sales are generally sourced to the jurisdiction where the property is delivered or where the service is performed. Given the specific sourcing rules outlined in O.C.G.A. § 48-8-77, understanding these regulations is pivotal for correctly filling out the form, as they directly influence how sales and taxes are reported based on geographical criteria.

- Electronic filing advantages: The encouragement to file and pay electronically via the Georgia Tax Center highlights a streamlined process for managing tax obligations. The provision of additional information, instructional videos, and frequently asked questions at the designated online platforms supports taxpayers through the electronic filing process, offering a more efficient and potentially less error-prone alternative to paper filing.

- Detailed instructions for accurate reporting: Form ST-3 encompasses detailed sections for reporting sales, exemptions, and taxes collected, among other financial data. It is structured to capture a comprehensive snapshot of a taxpayer's sales and use tax activities. Not only does it require a thorough record of total state sales (including specifics like leases and rentals) and exempt state sales, but it also entails calculations for taxable sales, tax amounts due, and vendor's compensation. These detailed reporting requirements emphasize the necessity for meticulous record-keeping and an understanding of taxable versus exempt transactions within the state of Georgia.

Adhering to these key takeaways when dealing with the Form ST-3 can significantly aid businesses and individuals in maintaining compliance with Georgia's tax laws, ensuring that all sales and use tax responsibilities are accurately met in a timely manner.

Popular PDF Documents

2024 Ev Rebate - Accuracy in completing form 8936 is paramount, as errors can delay or even deny the tax credit.

California Workers Compensation Forms - A first step in the workers' compensation claim process, detailing the employee's injury or illness and subsequent actions.

Massachusetts Tax Payment - Employs a systematic approach to vendor payments, featuring sections for detailed descriptions of the transaction and vendor certification.