Get G 45 Tax Form

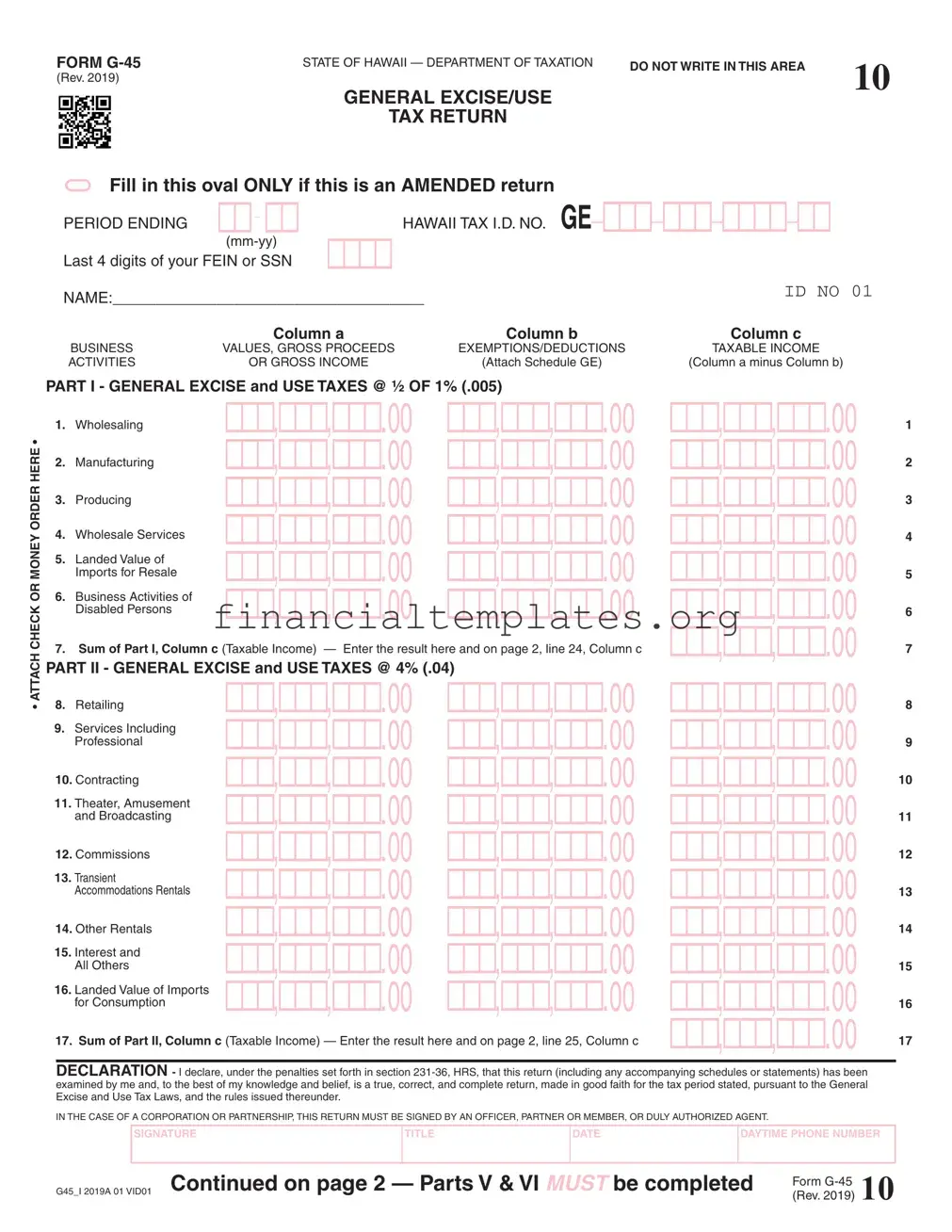

The Form G-45, recognized as the General Excise/Use Tax Return in Hawaii, serves as a critical document for individuals and entities required to report and remit taxes from business activities within the state. This form, updated for the year 2019, has been meticulously designed by the Department of Taxation to ensure the seamless calculation and submission of taxable income derived from various business values and gross proceeds. With specific sections dedicated to categories such as wholesaling, manufacturing, services, and retailing, amongst others, it bifurcates tax rates into distinct segments, thereby simplifying the process for taxpayers. Importantly, the form also accommodates amendments to previously filed returns, signifying its flexible utility in maintaining accurate financial records. Furthermore, it obligates taxpayers to declare taxation by district, guiding the equitable allocation of tax liabilities across regions. Complete with instructions for calculating additional charges like county surcharge and insurance commissions, the form embodies a comprehensive tool for fulfilling state tax obligations. A declaration section at the end reinforces the legal commitment of the filer to the veracity of the information provided, highlighting the importance of accuracy and good faith in tax reporting.

G 45 Tax Example

FORM |

STATE OF HAWAII — DEPARTMENT OF TAXATION |

DO NOT WRITE IN THIS AREA |

10 |

|

(Rev. 2019) |

|

|

|

|

|

GENERAL EXCISE/USE |

|

|

|

|

TAX RETURN |

|

|

|

Fill in this oval ONLY if this is an AMENDED return |

|

|

||

PERIOD ENDING |

HAWAII TAX I.D. NO. GE |

|

|

|

|

|

|

|

|

Last 4 digits of your FEIN or SSN |

|

|

|

|

NAME:____________________________________ |

ID NO 01 |

|||

|

|

|||

|

Column a |

Column b |

Column c |

|

BUSINESS |

VALUES, GROSS PROCEEDS |

EXEMPTIONS/DEDUCTIONS |

TAXABLE INCOME |

|

ACTIVITIES |

OR GROSS INCOME |

(Attach Schedule GE) |

(Column a minus Column b) |

|

PART I - GENERAL EXCISE and USE TAXES @ ½ OF 1% (.005)

|

1. |

Wholesaling |

|

|

|

|

• |

|

|

|

|

|

|

HERE |

2. |

Manufacturing |

|

|

|

|

ORDER |

3. |

Producing |

|

|

|

|

|

|

|

|

|||

MONEY |

4. |

Wholesale Services |

|

|

|

|

|

|

Imports for Resale |

|

|

|

|

|

5. |

Landed Value of |

|

|

|

|

OR |

6. Business Activities of |

|

|

|

||

CHECK |

|

|

Disabled Persons |

|

|

|

7. |

Sum of Part I, Column c (Taxable Income) — |

Enter the result here and on page 2, line 24, Column c |

|

|||

ATTACH• |

|

|||||

8. |

Retailing |

|

|

|

||

|

PART II - GENERAL EXCISE and USE TAXES @ 4% (.04) |

|

|

|||

|

9. |

Services Including |

|

|

|

|

|

|

|

Professional |

|

|

|

|

10. Contracting |

|

|

|

||

|

11. Theater, Amusement |

|

|

|

||

|

|

|

and Broadcasting |

|

|

|

|

12. Commissions |

|

|

|

||

|

13. Transient |

|

|

|

||

|

|

|

Accommodations Rentals |

|

|

|

|

14. Other Rentals |

|

|

|

||

|

15. Interest and |

|

|

|

||

|

|

|

All Others |

|

|

|

|

16. Landed Value of Imports |

|

|

|

||

|

|

|

for Consumption |

|

|

|

|

17. Sum of Part II, Column c (Taxable Income) — Enter the result here and on page 2, line 25, Column c |

|

||||

|

|

|

||||

|

|

DECLARATION - I declare, under the penalties set forth in section |

||||

|

|

examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith for the tax period stated, pursuant to the General |

||||

|

|

Excise and Use Tax Laws, and the rules issued thereunder. |

|

|

|

|

|

|

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT. |

||||

|

|

|

SIGNATURE |

TITLE |

DATE |

DAYTIME PHONE NUMBER |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

G45_I 2019A 01 VID01 Continued on page 2 — Parts V & VI |

be completed |

(Rev. 2019) 10 |

|

|

Form |

FORM

Page 2 of 2 |

Name:___________________________________________________ |

|

|

|

Hawaii Tax I.D. No. GE |

|

ID NO 01 |

|

|

||

|

Last 4 digits of your FEIN or SSN |

|

PERIOD ENDING |

|

Column a |

Column b |

Column c |

BUSINESS |

VALUES, GROSS PROCEEDS |

EXEMPTIONS/DEDUCTIONS |

TAXABLE INCOME |

ACTIVITIES |

OR GROSS INCOME |

(Attach Schedule GE) |

(Column a minus Column b) |

PART III - INSURANCE COMMISSIONS @ .15% (.0015) |

|

Enter this amount on line 26, Column c |

|

18. Insurance |

|

|

|

Commissions |

|

|

18 |

PART IV - COUNTY SURCHARGE — Enter the amounts from Part II, line 17, Column c attributable to each county. Multiply Column c by the applicable county rate(s) and enter the total of the result(s) on Part VI, line 27, Column e.

19. Oahu (rate = .005) |

19 |

20. Maui |

20 |

21. Hawaii (rate = .005) |

21 |

22. Kauai (rate = .005) |

22 |

PART V — SCHEDULE OF ASSIGNMENT OF TAXES BY DISTRICT (ALL taxpayers MUST complete this Part and may be subject to a 10% penalty for noncompliance.)

DARKEN the oval of the taxation district in which you have conducted business. IF you did business in MORE THAN ONE district, darken the oval “MULTI” and attach Form

23. |

Oahu |

Maui |

Hawaii |

Kauai |

MULTI |

23 |

|

|

|

|

|

||

PART VI - TOTAL PERIODIC RETURN |

TAXABLE INCOME |

TAX RATE |

TOTAL TAX |

|

||

|

|

|

Column c |

Column d |

Column e = Column c X Column d |

|

24. |

Enter the amount from Part I, line 7 |

|

x .005 |

24. |

|

|

25. |

Enter the amount from Part II, line 17 |

|

x .04 |

25. |

|

|

26. |

Enter the amount from Part III line 18, Column c |

|

x .0015 |

26. |

|

|

27. |

COUNTY SURCHARGE TAX. See Instructions for Part IV. Multi district complete Form |

27. |

||

28. TOTAL TAXES DUE. Add column e of lines 24 through 27 and enter result here (but not less than zero). |

|

|||

|

If you did not have any activity for the period, enter “0.00” here |

28. |

||

29. |

Amounts Assessed During the Period,...................... PENALTY $ |

|

29. |

|

|

||||

|

(For Amended Return Only) |

INTEREST $ |

||

|

|

|

|

|

30. |

TOTAL AMOUNT. Add lines 28 and 29 |

|

30. |

|

31. |

TOTAL PAYMENTS MADE FOR THE PERIOD (For Amended Return ONLY) |

31. |

||

32. |

CREDIT TO BE REFUNDED. Line 31 minus line 30 (For Amended Return ONLY) |

32. |

||

33. |

ADDITIONAL TAXES DUE. Line 30 minus line 31 (For Amended Return ONLY) |

33. |

||

|

FOR LATE FILING ONLY |

PENALTY $ |

|

|

34. |

INTEREST $ |

34. |

||

|

|

|

|

|

35.TOTAL AMOUNT DUE AND PAYABLE (Original Returns, add lines 30 and 34;

Amended Returns, add lines 33 and 34) |

35. |

36.PLEASE ENTER THE AMOUNT OF YOUR PAYMENT. Attach a check or money order payable to “HAWAII STATE TAX COLLECTOR” in U.S. dollars to Form

I.D. No. on your check or money order. Mail to: HAWAII DEPARTMENT OF TAXATION, P. O. BOX 1425, HONOLULU, HI

If you are NOT submitting a payment with this return, please enter “0.00” here |

36. |

37.GRAND TOTAL OF EXEMPTIONS/DEDUCTIONS CLAIMED. (Attach Schedule

GE) If Schedule GE is not attached, exemptions/deductions claimed will be disallowed |

37. |

G45_I 2019A 02 VID01

Form

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Title | FORM G-45 STATE OF HAWAII — DEPARTMENT OF TAXATION |

| Form Revision Year | 2019 |

| Primary Purpose | General Excise/Use Tax Return |

| Amendment Option | Option to fill in an oval for amended returns |

| Identification Requirements | HAWAII TAX I.D. NO., last 4 digits of FEIN or SSN |

| Governing Law | General Excise and Use Tax Laws, and rules issued thereunder; penalties as set forth in section 231-36, HRS |

| Signature Requirement | Mandatory for corporations, partnerships by an officer, partner, member, or duly authorized agent |

| Tax Payment Information | Checks or money orders payable to “HAWAII STATE TAX COLLECTOR”, and electronic filing and payment option available |

Guide to Writing G 45 Tax

Filling out a tax form can often feel like a complex and daunting process, especially when you're dealing with the nuances of specific forms like the G-45 Tax Form for the State of Hawaii. This guide is designed to make the process as smooth and straightforward as possible. Below are the steps to take to ensure you fill out the form correctly, covering all necessary details to comply with Hawaii's taxation requirements.

- Locate the "PERIOD ENDING (mm-yy)" field at the top of the form and enter the appropriate date for the tax period you are reporting.

- Enter your "HAWAII TAX I.D. NO. GE" along with the "Last 4 digits of your FEIN or SSN" in the designated spaces.

- Fill in the "NAME" field with the legal name of the business or individual filing the return.

- If you are filing an amended return, fill in the oval indicated for this purpose near the top of the form.

- Under "PART I - GENERAL EXCISE and USE TAXES," enter your business activities, gross proceeds or gross income (Column a), exemptions/deductions (Column b), and taxable income (Column c) for the respective categories. Calculate the sums as instructed and enter the amount in Line 7.

- In "PART II - GENERAL EXCISE and USE TAXES," repeat the process for the specified categories relevant to your operations, entering your calculations up to Line 17.

- Sign and date the declaration at the bottom of the first page, providing your title and daytime phone number for any potential clarification or follow-up.

- Proceed to the second page, and, similar to the first page, enter your name, Hawaii Tax I.D. No., Period Ending, and the final digits of your FEIN or SSN.

- Complete "PART III - INSURANCE COMMISSIONS" by entering the amounts in Line 18, if applicable.

- Under "PART IV - COUNTY SURCHARGE," allocate the amounts from Part II, Line 17 to the respective counties if applicable, and do the calculations as outlined.

- In "PART V — SCHEDULE OF ASSIGNMENT OF TAXES BY DISTRICT," indicate the taxation district(s) where you conducted business. If business was conducted in multiple districts, select “MULTI” and attach Form G-75 as instructed.

- Fill out "PART VI - TOTAL PERIODIC RETURN" by inputting the calculated taxes in the respective lines (24 through 27) and completing the tax summary below, ensuring to include any amounts assessed during the period, penalty, interest, and total amount due.

- If a payment accompanies the form, attach a check or money order payable to "HAWAII STATE TAX COLLECTOR" and indicate the amount of your payment in Line 36. Ensure the filing period and Hawaii Tax I.D. No. are written on your check or money order.

- Finally, if you're claiming exemptions or deductions, remember to attach Schedule GE as indicated. Failure to do so can lead to disallowance of these claims as noted in Line 37.

Following these steps carefully will help ensure that your G-45 Tax Form is accurately completed and submitted in compliance with the requirements set forth by the Hawaii Department of Taxation. Remember, meeting tax obligations not only requires timely submission but also accurate and thorough documentation of taxable activities within the reporting period.

Understanding G 45 Tax

What is Form G-45 and who needs to file it?

Form G-45 is a General Excise/Use Tax Return required by the State of Hawaii Department of Taxation. It is necessary for individuals and businesses engaged in wholesale, retail, service, and other taxable activities within Hawaii. Taxpayers must report gross income, exemptions/deductions, and calculate the tax due for their business activities. Filing this form is mandatory for those conducting taxable transactions in Hawaii.

How do I determine the tax rate applicable to my business activities on Form G-45?

The tax rate varies depending on the type of activity conducted. For example, wholesaling, manufacturing, producing, and wholesale services imports for resale activities are taxed at ½ of 1% (.005). Retailing, services, contracting, among others, are taxed at 4% (.04). The form also includes specific rates for insurance commissions and a county surcharge for activities conducted in certain districts.

What are exemptions and deductions, and how do I claim them on Form G-45?

Exemptions and deductions are amounts that can be subtracted from your gross business income to calculate your taxable income. They can include business expenses and other qualifying amounts. To claim them, you must attach Schedule GE to your Form G-45, detailing these deductions. Without Schedule GE, your claimed deductions may be disallowed.

Can Form G-45 be amended if I made a mistake?

Yes, if you have made a mistake on your original submission, you can file an amended Form G-45. To do so, fill in the oval indicating that your submission is an amended return. You will need to adjust your numbers accordingly and submit any additional documentation required to support the changes.

What is the County Surcharge and how is it calculated?

The County Surcharge applies to taxable activities conducted in specific counties (Oahu, Maui, Hawaii, and Kauai). The surcharge rate is additional to the state tax rate and depends on the county. The applicable surcharge must be calculated by multiplying the taxable income attributable to each county by the county's rate and entered in the designated section of the form.

What should I do if I conduct business in more than one district?

If your business operates in multiple districts, you must darken the oval marked "MULTI" in the Schedule of Assignment of Taxes by District section. Additionally, you are required to attach Form G-75, providing details of your business activities in each district. Failing to complete this part accurately may result in a 10% penalty for noncompliance.

How do I submit payment with my Form G-45?

Payment for the taxes due as calculated on Form G-45 can be made by attaching a check or money order payable to "HAWAII STATE TAX COLLECTOR" in U.S. dollars. Ensure you write the filing period and your Hawaii Tax I.D. No. on your check or money order. You may also opt to file and pay electronically via the Hawaii Department of Taxation's website. It's important to enter the exact amount of your payment in the designated area on the form.

Common mistakes

Completing the Form G-45, the General Excise/Use Tax Return in Hawaii, correctly is crucial for ensuring that tax obligations are met accurately. Unfortunately, errors can lead to potential fines, delays, or audits. Here are some common mistakes to avoid:

- Not signing the form: The declaration at the end of the form requires a signature to validate its authenticity. Failing to sign the form can render it invalid.

- Omitting the Hawaii Tax I.D. No: This unique identifier is crucial for tracking your tax filings and correspondence with the Department of Taxation.

- Incorrectly reporting taxable income: Taxable income must be calculated with precision, by subtracting eligible exemptions/deductions from gross income or gross proceeds.

- Miscalculating tax due: Each section of Part I and II requires careful calculation to ensure the tax due is accurate. Mistakes here can significantly impact the total tax reported.

- Forgetting to include exemptions/deductions: If applicable, Schedule GE must be attached to claim exemptions or deductions. Failing to do so can lead to disallowed claims.

- Ignoring county surcharge: Part IV requires calculation based on the county rate(s), a step that's often overlooked, leading to an inaccurate tax calculation.

- Not completing the Schedule of Assignment of Taxes by District: Compliance with this section is mandatory and helps ensure taxes are allocated correctly. Neglecting it could result in penalties.

- Incorrect calculation of total taxes due: The final tax amount should represent the sum of all applicable taxes, including the county surcharge. Errors in addition can lead to underpayments or overpayments.

- Failure to check the "Amended Return" oval when necessary: If submitting an amended return, the corresponding oval at the top of the form must be filled. This mistake can confuse the processing of your documentation.

Attention to detail and thorough review before submission can mitigate these errors. If in doubt, consulting with a tax professional or the Department of Taxation directly can provide clarity and assistance.

Documents used along the form

Filing taxes often involves a web of paperwork that extends beyond just a single form. When dealing with the Form G-45 for general excise/use tax return in Hawaii, there are several other forms and documents you might need to complement your tax filing. Let's look at a few of these and briefly understand what each is for.

- Schedule GE - This is specifically mentioned in the Form G-45 and is necessary for detailing exemptions or deductions from gross income or gross proceeds. It helps to break down the taxable income figures you report on the G-45.

- Form G-75 - Required if you conduct business in more than one district in Hawaii. It's used alongside Form G-45 to properly allocate taxes by district, ensuring that each area receives its fair share based on where business activities were conducted.

- Form G-49 - This is the Annual Return & Reconciliation form. It complements the periodic filings of the G-45, offering a yearly overview. Essentially, it summarizes your taxable business activities throughout the year and reconciles these with the taxes you've already paid via the G-45 forms.

- Form HW-14 - While not directly related to the G-45, the HW-14 is important for businesses with employees. It details withheld income taxes from employees' wages, a critical part of tax compliance for employers.

- Form G-6 - This application is used to request a license for your business under the Hawaii General Excise Tax Law. It is a prerequisite for legal business operations and necessary before you can file a G-45.

- Form BB-1 - The Basic Business Application, used to register a new business in Hawaii. It's a vital first step in setting up your business's tax accounts, including the general excise tax account required for filing Form G-45.

Together, these forms create a comprehensive portfolio for managing your business's tax obligations in Hawaii. From detailing your business's income and deductions to ensuring proper tax allocation across districts and complying with employment tax requirements, each document plays a crucial role in the broader tax landscape. Understanding these forms and documents can streamline your tax filing process, ensuring compliance and potentially saving you from penalties associated with missed or incorrect filings.

Similar forms

The Form 1040, U.S. Individual Income Tax Return, shares similarities with the G-45 Tax Form in that it requires taxpayers to report their income, calculate taxable income after deductions and exemptions, and determine the amount of tax owed or refund due. Both forms serve the purpose of reconciling the year's financial activities with tax liabilities, albeit the 1040 form focuses on individual income while the G-45 targets business transactions specific to Hawaii's General Excise and Use Tax.

Form 1120, which is used by corporations to report their incomes, gains, losses, deductions, and to calculate their federal income tax liability, exhibits parallels to the G-45. Like the G-45, Form 1120 involves detailed income reporting and deductions before arriving at a taxable income figure. However, Form 1120 is specific to corporate entities and their federal tax responsibilities, contrasting with the G-45’s focus on state-level taxes for business activities.

The Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), is akin to the G-45 Tax Form as both require businesses to report gross income, allowable deductions, and the net profit or loss from business operations. The primary difference lies in their tax environments; Schedule C pertains to federal income tax for sole proprietors, while the G-45 addresses Hawaii's General Excise and Use Tax for various business activities.

Form 941, Employer’s Quarterly Federal Tax Return, is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees’ paychecks, and to pay the employer's portion of social security or Medicare tax. It parallels the G-45 in its periodic reporting requirement and in calculating taxes due based on operational financial figures. However, Form 941 focuses on payroll taxes at the federal level, unlike the G-45's scope of business and sales taxes at the state level.

The Sales and Use Tax Return forms, which vary by state, share a common purpose with the G-45, requiring businesses to report gross sales, taxable sales, and to calculate the tax due on sales and purchases. While each state's form may have unique features, they all align with the G-45's role in managing tax liabilities related to commercial transactions, albeit within the specific rules and rates of their respective states.

Form W-2, Wage and Tax Statement, shares a procedural similarity with the G-45, as both involve reporting to tax authorities and providing summaries of financial activities impacting tax calculations. The W-2 form focuses on reporting an employee's annual wages and the amount of taxes withheld from their paycheck, contrasting the G-45's business-oriented tax calculations and payments.

Finally, the Form 1099 series, utilized for reporting various types of income other than wages, salaries, and tips (like independent contractor income), parallels the G-45 in its purpose to inform tax authorities about taxable transactions. Both sets of forms play crucial roles in the taxation process by ensuring that income is accurately reported for tax liability calculations, albeit serving different participants and types of income within the tax ecosystem.

Dos and Don'ts

Do ensure that all information provided is accurate and up to date. Double-check the Hawaii Tax I.D. No., the last four digits of your FEIN or SSN, and all other personal and business details to prevent any processing delays or issues.

Do attach Schedule GE if you report any exemptions or deductions in Column b. Failure to attach this schedule when claiming deductions can lead to disallowance of the claims, impacting the accuracy of taxable income reported.

Do fill in the oval indicating an amended return only if you are correcting information on a previously filed G-45 form. This helps the Department of Taxation quickly identify the purpose of the submission.

Do use the correct tax rates for Part I and Part II taxable income calculations. This is crucial for accurately determining the amount of tax due and avoiding under or overpayment.

Don't leave the taxation district oval in Part V blank. Indicate the appropriate district where you conducted business or select "MULTI" if applicable. Failure to comply can result in a penalty.

Don't forget to sign and date the form. For corporations or partnerships, an authorized officer, partner, or agent must sign the form. Unsigned forms are not valid and will not be processed.

Don't send payment without including the filing period and Hawaii Tax I.D. No. on your check or money order. This information ensures your payment is credited to the correct account.

Don't enter incorrect amounts in the Total Periodic Return section. Ensure that the taxable income, tax rate, and total tax due are correctly calculated and reported to avoid discrepancies and potential penalties.

Misconceptions

Discussing tax forms can often lead to a labyrinth of confusion, particularly when delving into specific forms such as the State of Hawaii's Form G-45, which deals with General Excise and Use Tax Returns. There are several misconceptions surrounding this form that can steer taxpayers off course. Let's clear the air on some of these misconceptions:

Only businesses with physical presence in Hawaii need to file. Many think that only those businesses with a physical storefront or office in Hawaii need to worry about Form G-45. However, this form applies to all entities conducting business in the state, regardless of whether they maintain a physical presence. This includes online businesses that sell goods or services to people in Hawaii.

Form G-45 is for annual tax filing. Unlike the misconception that Form G-45 is an annual filing, it's actually used for periodic filings. Businesses may need to file monthly, quarterly, or semi-annually, depending on their tax liability and the rules set forth by the Hawaii Department of Taxation.

The form is the same for all taxpayers. While the form itself might look the same for everyone, the way it's filled out can differ significantly. This is because businesses might engage in various activities that are taxed differently, leading to different rates and exemptions being applied in different sections of the form.

Gross income equals taxable income. A common misunderstanding is that gross income, as reported on Form G-45, directly translates to taxable income. However, there are allowable exemptions and deductions that can reduce this gross income to a lower taxable income figure, which is then subject to taxation.

Filing an amended return is optional. Some might think that amending a previously filed Form G-45 is a matter of choice. In reality, if you discover errors that lead to an underpayment or overpayment of taxes, you are obliged to file an amended return to correct these mistakes, ensuring compliance with Hawaii tax laws.

Only goods are subject to General Excise Tax. This is incorrect, as the General Excise Tax (GET) in Hawaii applies to nearly all business activities. This encompasses services, rental income, and commissions, among others, not just the sale of tangible goods.

County surcharges do not apply to all islands. While it's true that the county surcharge rates might differ, it's a misconception that these surcharges don't apply across all counties. Surcharges are indeed applicable in some form across different counties, affecting the total tax liability based on where the business activity was conducted.

Penalties and interest are rare. Some might downplay the likelihood of facing penalties or interest for late filings or payments. However, these are common and can significantly inflate the amount owed. Being punctual and accurate with your Form G-45 filings is crucial to avoid these additional charges.

Understanding these key points about the Form G-45 can demystify the filing process and ensure businesses remain compliant with Hawaii's General Excise and Use Tax requirements. It's always advisable to consult with a tax professional or the Hawaii Department of Taxation directly if you have specific questions or concerns about your tax situation.

Key takeaways

Understanding the G-45 Tax Form is essential for conducting business in Hawaii. Here are key takeaways to ensure accurate completion and filing:

- The Form G-45 is used for the General Excise and Use Tax Return in the state of Hawaii.

- Businesses need to report gross income, exemptions or deductions, and taxable income across various categories, including wholesaling, retailing, services, and more.

- If amending a previously filed return, it’s crucial to fill in the oval indicating that the submission is an amended return.

- Calculation of taxes due requires careful attention to the specific rates that apply to different business activities, such as 0.5% for wholesaling and manufacturing, and 4% for retailing and most services.

- The form includes a section for calculating taxes due on insurance commissions and a county surcharge applicable to certain districts.

- Schedule GE must be attached to claim exemptions or deductions, or those claims may be disallowed.

- Businesses conducting operations in more than one taxation district must complete the Schedule of Assignment of Taxes by District and, if applicable, attach Form G-75 for multi-district operations.

- Penalties and interest may be applied for late filings or amendments, underlining the importance of timely and accurate submissions.

- Payment of taxes calculated on Form G-45 must be made payable to the “HAWAII STATE TAX COLLECTOR” and include the business’s Hawaii Tax I.D. No. and the filing period on the check or money order.

- Electronic filing and payment options are available, offering a convenient alternative to mailing physical documents and payments.

Adherence to these guidelines will help ensure compliance with Hawaii’s tax obligations, avoiding potential penalties and ensuring that your business contributes its fair share to the state’s economy.

Popular PDF Documents

What Is T2 in Canada - Eligible corporations can opt for a shorter version of this form, known as the T2SHORT.

IRS 5695 - The potential tax savings can serve as an important motivator for homeowners considering renewable energy installations.

Where to Report Interest Income on 1040 - Schedule B 1040 is a tax form used for reporting interest and dividend income above certain thresholds during the tax year.