Get Full Payment Certificate Form

The Full Payment Certificate (FPC) form, essential for all property transfers within the City of Chicago, represents a critical step in the property transaction process, facilitating the seamless change of ownership by certifying that all financial obligations to the city, particularly those related to water service, have been settled by the seller. Hosted by the Department of Finance and requiring a fee, unless the property is exempt from the Real Property Transfer Tax, this document calls for detailed information about the premises, including address, Property Index Number (P.I.N.), water account numbers, and property type – ranging from residential units to commercial or industrial properties. Applicants must verify the inclusion of required supporting documentation, which varies based on the nature of the property and transaction. The application also gathers comprehensive buyer and seller information, underscoring its role in ensuring that future billing is accurately directed to the new owner while facilitating the city’s update of billing records to reflect the property’s transfer. Crucially, the FPC plays a pivotal role in water service transactions, particularly in the context of foreclosures, receiverships, and exemptions from transfer taxes, underscoring its utility in both standard and complex property transactions. Completion and submission instructions provide clear directives for applicants, including considerations for metered properties and those acquired through judicial deeds, complementing the manifold purposes the FPC serves in Chicago’s property transfer landscape.

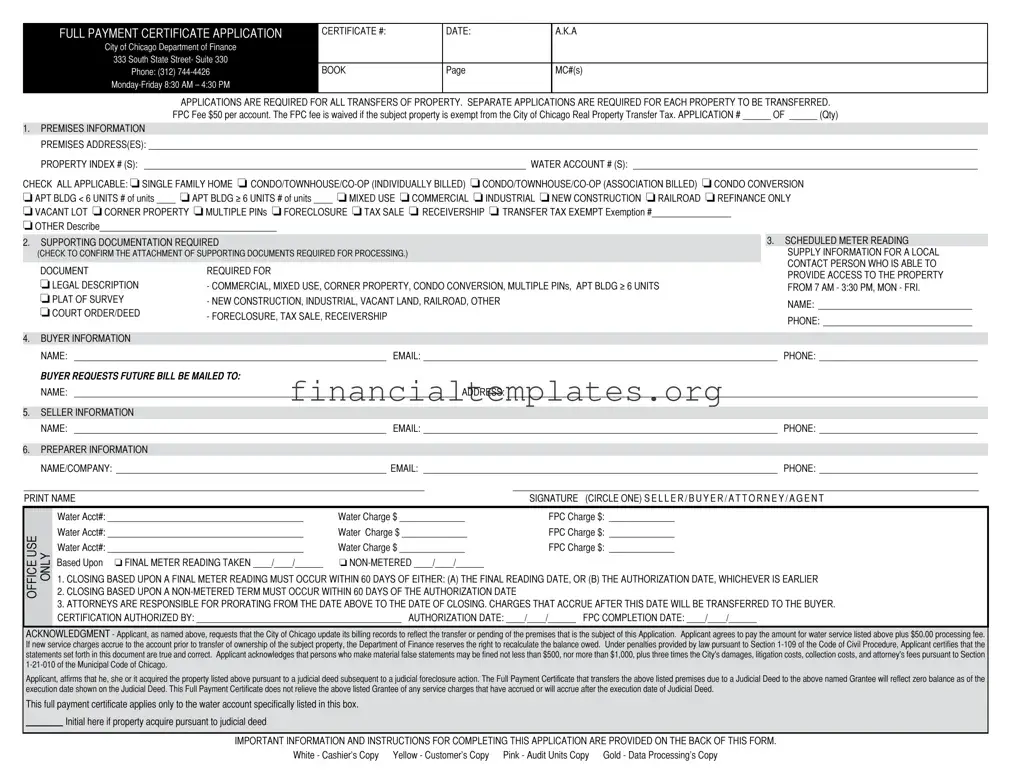

Full Payment Certificate Example

FULL PAYMENT CERTIFICATE APPLICATION

City of Chicago Department of Finance

333 South State Street- Suite 330

Phone: (312)

CERTIFICATE #: |

DATE: |

A.K.A |

|

|

|

BOOK |

Page |

MC#(s) |

|

|

|

APPLICATIONS ARE REQUIRED FOR ALL TRANSFERS OF PROPERTY. SEPARATE APPLICATIONS ARE REQUIRED FOR EACH PROPERTY TO BE TRANSFERRED.

FPC Fee $50 per account. The FPC fee is waived if the subject property is exempt from the City of Chicago Real Property Transfer Tax. APPLICATION # ______ OF ______ (Qty)

1.PREMISES INFORMATION

PREMISES ADDRESS(ES): __________________________________________________________________________________________________________________________________________________________________________________

PROPERTY INDEX # (S): __________________________________________________________________________________ WATER ACCOUNT # (S): __________________________________________________________________________

CHECK ALL APPLICABLE: o SINGLE FAMILY HOME o

o VACANT LOT o CORNER PROPERTY o MULTIPLE PINs o FORECLOSURE o TAX SALE o RECEIVERSHIP o TRANSFER TAX EXEMPT Exemption #_________________

o OTHER Describe______________________________________

2.SUPPORTING DOCUMENTATION REQUIRED

(CHECK TO CONFIRM THE ATTACHMENT OF SUPPORTING DOCUMENTS REQUIRED FOR PROCESSING.)

DOCUMENT |

REQUIRED FOR |

o LEGAL DESCRIPTION |

- COMMERCIAL, MIXED USE, CORNER PROPERTY, CONDO CONVERSION, MULTIPLE PINs, APT BLDG ≥ 6 UNITS |

o PLAT OF SURVEY |

- NEW CONSTRUCTION, INDUSTRIAL, VACANT LAND, RAILROAD, OTHER |

o COURT ORDER/DEED |

- FORECLOSURE, TAX SALE, RECEIVERSHIP |

|

|

4. BUYER INFORMATION |

|

3.SCHEDULED METER READING SUPPLY INFORMATION FOR A LOCAL CONTACT PERSON WHO IS ABLE TO PROVIDE ACCESS TO THE PROPERTY FROM 7 AM - 3:30 PM, MON - FRI.

NAME: _________________________________

PHONE: ________________________________

NAME: ___________________________________________________________________ EMAIL: ____________________________________________________________________________ PHONE: __________________________________

BUYER REQUESTS FUTURE BILL BE MAILED TO:

NAME: __________________________________________________________________________________ ADDRESS: _____________________________________________________________________________________________________

5.SELLER INFORMATION

NAME: ___________________________________________________________________ EMAIL: ____________________________________________________________________________ PHONE: __________________________________

6.PREPARER INFORMATION

|

NAME/COMPANY: __________________________________________________________ EMAIL: ____________________________________________________________________________ PHONE: __________________________________ |

|||

______________________________________________________________________________________ |

____________________________________________________________________________________________________ |

|||

PRINT NAME |

|

SIGNATURE (CIRCLE ONE) S E L L E R / B U Y E R / A T T O R N E Y / A G E N T |

||

|

|

|

|

|

|

|

Water Acct#: __________________________________________ |

Water Charge $ ______________ |

FPC Charge $: ______________ |

OFFICEUSE |

|

Water Acct#: __________________________________________ |

Water Charge $ ______________ |

FPC Charge $: ______________ |

ONLY |

Water Acct#: __________________________________________ |

Water Charge $ ______________ |

FPC Charge $: ______________ |

|

Based Upon o FINAL METER READING TAKEN ____/____/______ |

o |

|

||

|

|

|

||

1. CLOSING BASED UPON A FINAL METER READING MUST OCCUR WITHIN 60 DAYS OF EITHER: (A) THE FINAL READING DATE, OR (B) THE AUTHORIZATION DATE, WHICHEVER IS EARLIER

2. CLOSING BASED UPON A

3. ATTORNEYS ARE RESPONSIBLE FOR PRORATING FROM THE DATE ABOVE TO THE DATE OF CLOSING. CHARGES THAT ACCRUE AFTER THIS DATE WILL BE TRANSFERRED TO THE BUYER. CERTIFICATION AUTHORIZED BY: ____________________________________________ AUTHORIZATION DATE: ____/____/______ FPC COMPLETION DATE: ____/____/______

ACKNOWLEDGMENT - Applicant, as named above, requests that the City of Chicago update its billing records to reflect the transfer or pending of the premises that is the subject of this Application. Applicant agrees to pay the amount for water service listed above plus $50.00 processing fee. If new service charges accrue to the account prior to transfer of ownership of the subject property, the Department of Finance reserves the right to recalculate the balance owed. Under penalties provided by law pursuant to Section

Applicant, affirms that he, she or it acquired the property listed above pursuant to a judicial deed subsequent to a judicial foreclosure action. The Full Payment Certificate that transfers the above listed premises due to a Judicial Deed to the above named Grantee will reflect zero balance as of the execution date shown on the Judicial Deed. This Full Payment Certificate does not relieve the above listed Grantee of any service charges that have accrued or will accrue after the execution date of Judicial Deed.

This full payment certificate applies only to the water account specifically listed in this box.

Initial here if property acquire pursuant to judicial deed

IMPORTANT INFORMATION AND INSTRUCTIONS FOR COMPLETING THIS APPLICATION ARE PROVIDED ON THE BACK OF THIS FORM.

White - Cashier’s Copy Yellow - Customer’s Copy Pink - Audit Units Copy Gold - Data Processing’s Copy

INFORMATION AND INSTRUCTIONS FOR COMPLETING THE FULL PAYMENT CERTIFICATE

1. PREMISES INFORMATION

Premises Addresses(s): List address(es) of property. For Condominium or Townhouse, include the precise unit number.

Property Index Number(s): Provide all the P.I.N.s that are identiied with the property address(es) listed. P.I.N.s may be obtained from the property tax bill or the Cook County

Assessor.

Water Account Number(s): Provide the City of Chicago Water Account numbers for the property address(es) listed if known.

CHECK ALL APPLICABLE: Check all categories which apply to the property. For example, if the property is a 5 unit Apartment Building on a corner, check both APT BLDG<6 UNITS and CORNER PROPERTY; if it is a single family dwelling for reinancing only, check SINGLE FAMILY HOME and REFINANCE ONLY; if it is a foreclosure property transaction, check FORECLOSURE and TRANSFER TAX EXEMPT, etc.

their water bill through the Association. Further: (a) If the Association’s account relects no past due balance, an FPC will be issued without additional documentation; (b) if the Association’s account relects a past due balance, a formal “Paid Assessment Letter” is required. The Association balance may be obtained by calling (312)

TRANSFER TAX EXEMPT: Check this box if the property transfer is exempt from the CITY OF CHICAGO Real Property Transfer Tax Stamp (Municipal Code

indicate in the blank the exact code letter found on Page 2 of the Real Property Transfer Tax (RPTT) Declaration (form 7551) which describes the appropriate category for the property exemption. Contact the Department of Finance Tax division for more information concerning exemptions. The FPC fee is waived if the subject property is exempt from the City of Chicago Real Property Transfer Tax.

2. SUPPORTING DOCUMENTATION

Check the document category that corresponds to the property or transaction type listed and submit the required document(s) with the application. For NEW CONSTRUCTION, REHABS AND CONDO CONVERSIONS: a) All necessary plumbing permits must be obtained; (b) the Meter(s) must be set by a licensed, bonded plumbing contractor; (c) the Meter(s) must be “controlled” by the Meter Shop – necessary arrangements may be made by calling (312)

SPECIAL NOTE: In addition, it is possible that after ield review, properties not listed in the documentation categories may still require additional documents, such as Legal

descriptions and/or Plats of Survey to be submitted in order for the application to be processed.

3. SCHEDULE METER READING

Provide the necessary information if the property has a metered water service and there has not been a meter reading within the last 60 days. Applications requiring a meter read

should be submitted well in advance of the closing date.

Name/ Local Daytime Phone: Provide the name and local phone of a contact person who can provide access to the property so that a meter reading can be taken. This person

must be available to provide access on the scheduled reading date between the hours of 7 AM and 3:30 PM.

4. BUYER INFORMATION

Provide the name of the buyer, current contact phone and email address. Provide name of buyer’s attorney and phone number. Under BUYER REQUESTS FUTURE BILLS

BE MAILED TO, provide the exact address to which the buyer wishes the bills to be mailed. Clearly indicate if bills are to be sent in care of (c/o) a party or entity other than the buyer.

5. SELLER INFORMATION

Provide the name of the seller, current address, contact phone and email address. Provide the name of the seller’s attorney and contact phone.

6. PREPARER INFORMATION

Provide the name of the person and the company or irm they represent who is preparing the application, address, contact phone and email address.

7. ACKNOWLEDGEMENT

Applicant must print name, sign and indicate the relationship to the transaction (seller, buyer, preparer, attorney, etc.).

ADDITIONAL INFORMATION:

FPC applications for Foreclosures, Tax Deeds, HUD properties, VA properties or Receiverships and requests related to Bankruptcies, Lien Releases and Payoff Letters must be directed

to the FPC Legal Services unit- PHONE: (312)

FPC APPLICATIONS BY FAX: Fax all applications to: (312)

for processing.

Document Specifics

| Fact Name | Description |

|---|---|

| Application Requirement | All transfers of property require a separate Full Payment Certificate (FPC) application for each property to be transferred. |

| Fee Information | The FPC application fee is $50 per account, but this fee is waived if the property is exempt from the City of Chicago Real Property Transfer Tax. |

| Documentation Needed | Supporting documents vary based on the property or transaction type, such as a legal description or plat of survey for certain properties, and a court order or deed for foreclosures, tax sales, and receiverships. |

| Buyer and Seller Information | Both buyer and seller must provide current contact information, and the buyer must specify where future bills will be sent. |

| Governing Law | The application processes and requirements are governed by the Municipal Code of Chicago, including consequences for false statements and specifics around water account balance transfer post-property acquisition via judicial deed. |

Guide to Writing Full Payment Certificate

After deciding to transfer a property, the Full Payment Certificate (FPC) form is an essential step in ensuring all financial obligations related to the property are settled. Completing this form accurately is crucial for a smooth transition. To assist in this process, carefully follow the provided steps to fill out the Full Payment Certificate Application. This guide is designed to make the application process straightforward, ensuring you understand what information is needed and where to provide it.

- Start by entering the CERTIFICATE # and DATE at the top of the form.

- Under the APPLICATION # section, fill in the quantity of applications if you are submitting for multiple properties.

- In the PREMISES INFORMATION section, provide the address(es) of the premises and the Property Index Number(s) (P.I.N.s). If known, include the Water Account Number(s).

- Check the applicable box(es) that describe the property type under the CHECK ALL APPLICABLE section (e.g., SINGLE FAMILY HOME, CONDO/TOWNHOUSE/CO-OP, etc.).

- Under SUPPORTING DOCUMENTATION REQUIRED, check the boxes next to the documents you are including with the application.

- For the SCHEDULED METER READING section, provide the name and phone number of a local contact person available to provide access for a meter reading.

- In the BUYER INFORMATION area, fill in the buyer's name, email, phone number, and the address where future bills should be mailed.

- Provide the seller's name, email, and phone number in the SELLER INFORMATION section.

- Under PREPARER INFORMATION, enter the details of the person or company preparing this application, including name/company, email, and phone number.

- In the ACKNOWLEDGMENT section, print the applicant's name, sign the form, and indicate the relationship to the transaction (seller, buyer, attorney, etc.).

- If applicable, initial to confirm the property was acquired through a judicial deed in the section provided for this declaration.

- Lastly, review the form to ensure all information provided is accurate and complete. Attach any required documents as specified in the SUPPORTING DOCUMENTATION section before submitting the application to the City of Chicago Department of Finance.

Following these steps will help ensure your Full Payment Certificate Application is filled out completely and accurately. Once submitted, the City of Chicago Department of Finance will process your application, which typically takes a minimum of 10 days. Be sure to plan accordingly and submit your application well in advance of your property transfer or closing date to avoid any delays.

Understanding Full Payment Certificate

-

What is a Full Payment Certificate (FPC), and why is it required for property transfers in Chicago?

An FPC is a document issued by the City of Chicago Department of Finance, confirming that all outstanding charges related to water service for a specific property have been paid in full. It is required for all property transfers to ensure that new owners do not inherit unpaid water bills from previous owners. This certificate is necessary for both the protection of the buyer and the city's interests in securing its revenues.

-

How do I apply for a Full Payment Certificate?

To apply for an FPC, you must fill out the Full Payment Certificate Application provided by the City of Chicago Department of Finance. Each property transfer requires a separate application. Along with the application, you must provide the property address(es), property index number(s), water account number(s), and indicate the type of property being transferred. Supporting documentation, such as a legal description or plat of survey, may also be required depending on the property type.

-

What is the fee for obtaining an FPC?

The application fee for an FPC is $50 per account. However, this fee is waived if the property in question is exempt from the City of Chicago Real Property Transfer Tax. Exemptions might apply to certain types of property transfers, and it's essential to verify whether your transaction qualifies for such an exemption.

-

How long does it take to receive an FPC, and how will it be delivered?

After submitting your application, allow a minimum of 10 days for processing. Once processed, the FPC can be picked up at the Department of Finance Payment Processing Counter located in City Hall, Room 107. Ensure that all required information and documentation are complete to avoid delays in the application process.

-

Can I fax my FPC application, and if so, what is the process?

Yes, FPC applications can be submitted via fax to (312) 747-8321. When faxing your application, include all necessary supporting documentation as specified on the application form. Be sure to include an address on any legal documents faxed in as part of the application. Once processed, you will need to visit the Payment Processing Counter for pick-up.

-

What should I do if the property was acquired through foreclosure, tax deed, or similar circumstances?

Applications involving properties acquired through foreclosure, tax deeds, HUD properties, VA properties, receiverships, or related to bankruptcies, lien releases, and payoff letters must be directed to the FPC Legal Services unit at phone number (312) 747-8051. Ensure to provide all necessary documentation and details of the acquisition to facilitate the processing of your application.

Common mistakes

When filling out the Full Payment Certificate form, people often make several common mistakes. These errors can lead to delays in processing applications and may even impact property transfers. To ensure smooth and efficient handling, it's crucial to avoid these pitfalls:

Not checking all applicable property categories. It's important to thoroughly review and check off every category that applies to the property being transferred.

Forgetting to include the exact unit number for condominiums or townhouses. This detail is crucial for identifying the property correctly.

Omitting one or more Property Index Numbers (P.I.N.s). Each associated P.I.N. must be listed to correctly identify the property.

Failing to provide the City of Chicago Water Account numbers if known. These numbers are essential for processing the application related to water service charges.

Not attaching the required supporting documentation based on the property or transaction type. This can lead to incomplete applications.

Not scheduling a meter reading when necessary or failing to provide contact information for access to the property for the reading.

Incorrectly filling out the buyer or seller's information, including names, contact details, and mailing addresses for future bills.

Leaving the preparer information section incomplete. It's important to provide the name of the person and company preparing the application, along with contact details.

Forgetting to print the name, sign, and indicate the relationship to the transaction in the acknowledgment section. This is critical to authenticate the application.

Not utilizing the additional instructions provided on the back of the form for specific cases like foreclosures, tax deeds, and other special circumstances.

By attentively reviewing and completing each section of the Full Payment Certificate form, applicants can avoid these common mistakes, facilitating a smoother transaction process.

Documents used along the form

When processing a Full Payment Certificate (FPC), especially in the context of property transactions within the City of Chicago, the importance of thorough documentation cannot be overstated. An FPC is crucial in ensuring that a property's water service charges are up to date at the time of transfer. However, to facilitate a seamless property transfer, several other forms and documents are often needed alongside an FPC application. Below is a comprehensive list of these essential documents, each playing a pivotal role in property transactions.

- Title Insurance Policy: This document assures both buyer and lender of a clear property title, safeguarding against future claims or legal issues.

- Property Deed: The deed transfer legal ownership of the property from the seller to the buyer, and is a must-have at closing.

- Mortgage Payoff Statements: For properties under a mortgage, this statement details the outstanding amount required to pay off the current mortgage in full.

- Bill of Sale: This outlines all other items that come with the property purchase, outside of the physical structure—like appliances or fixtures.

- Home Inspection Reports: These provide an account of the property’s condition, disclosing any issues that might not be apparent during a casual walkthrough.

- Proof of Homeowners’ Insurance: This verification demonstrates that the buyer has secured property insurance, a prerequisite by lenders before closing.

- Closing Disclosure: A critical document for review, it itemizes the final terms, costs, and other transaction details for both buyers and sellers.

Alongside the Full Payment Certificate, these documents work together to ensure that the property transfer process is conducted with a high degree of diligence and legal compliance. From affirming ownership and insuring against future claims to satisfying lender requirements and assessing the property’s condition, each document serves a vital function. For anyone involved in a property transaction in Chicago or elsewhere, understanding these documents will facilitate a smoother, more informed transfer process.

Similar forms

The Full Payment Certificate form, integral in real estate transactions in ensuring property transfers are financially clear of city dues, closely mirrors the Real Property Transfer Tax Declaration. This declaration, often used in jurisdictions to report the transfer of property, has a dual purpose: it declares the property's transfer under applicable taxes and identifies exemptions similar to how the Full Payment Certificate can waive fees for tax-exempt transfers. Both documents serve as pivotal checks within the property transfer process, ensuring compliance with local taxation and finance regulations.

Another document akin to the Full Payment Certificate is the Title Insurance Policy, specifically the aspect of ensuring a clean title before transferring property ownership. While the Full Payment Certificate focuses on the clearance of dues related to city services, Title Insurance covers a broader scope of potential legal and financial claims against the property. Both documents safeguard the buyer and the financing institution against unforeseen liabilities, contributing to a secure transfer of property.

The HUD-1 Settlement Statement, now often replaced or accompanied by the Closing Disclosure in residential real estate transactions, shares similarities with the Full Payment Certificate through itemizing financial transactions. The HUD-1 lists all charges related to the property closing, while the Full Payment Certificate specifically addresses charges for water service and other related city charges. Both documents play crucial roles in the final accounting of financial obligations during property transfers.

The Warranty Deed, though primarily a document to transfer property title guaranteeing the property is free from liens and claims, parallels the Full Payment Certificate in its role of ensuring the buyer receives title clearance. In essence, while the Warranty Deed deals with the broader legal claims against the property, the Full Payment Certificate targets the financial clearances specifically related to municipal charges, both contributing to a clean property transfer.

The Grant Deed, similar to the Warranty Deed but with slightly less assurance against claims, can be compared to the Full Payment Certificate in the sense that both provide a form of guarantee related to the property's status. While the Grant Deed assures there are no undisclosed encumbrances, the Full Payment Certificate ensures all city-related financial obligations are settled, paving the way for a safer transaction.

Mortgage Payoff Statements are closely allied with the Full Payment Certificate form. These statements confirm the outstanding mortgage debt has been paid off, much like how the Full Payment Certificate verifies that all due payments related to city charges on the property are cleared. Both are critical in the closing process to prove there are no lingering financial obligations that could encumber the property transfer.

Operating Statements for real estate, which detail the property's income and expenses over a period, indirectly relate to the Full Payment Certificate’s objective of clarifying financial dues. Although Operating Statements are broader in scope, covering operational financial performance, the Full Payment Certificate’s clearance of city charges ensures that the operational costs associated with the property are up to date at the point of transfer.

Estoppel Certificates, used in commercial real estate to outline the terms and status of leases to prospective buyers or lenders, bear resemblance in their purpose of providing a snapshot of current financial obligations. Like the Full Payment Certificate confirms the status of municipal service charges, Estoppel Certificates clarify existing lease obligations, both crucial for transparent and secure property transactions.

Lastly, the Lien Release forms, which are documents confirming the removal of a lien from the property records, share a similar goal with the Full Payment Certificate. Both serve to update the financial and legal status of the property, ensuring that new owners receive their property free of specific past encumbrances—clearing the way for a transaction that acknowledges and settles previous claims.

Dos and Don'ts

When completing the Full Payment Certificate form, there are several do's and don'ts that are crucial to bear in mind to ensure the process goes smoothly and effectively. These tips will help avoid common mistakes and ensure your application is processed in a timely manner.

- Do gather all necessary documents before you begin filling out the form. This includes property legal descriptions, plat of surveys, and court orders/deeds if applicable.

- Do check all boxes that apply to your property type accurately to avoid delays in the processing of your application.

- Do provide accurate and complete information for the scheduled meter reading, including a local contact person who can provide access to the property.

- Do ensure that the buyer and seller information is filled out in full, including email addresses and phone numbers, to facilitate communication.

- Don't forget to sign and print your name at the acknowledgment section, indicating your relationship to the transaction.

- Don't omit any required supporting documentation that corresponds with the property or transaction type listed. Double-check that all necessary documents are attached before submitting.

- Don't ignore the special instructions for properties under foreclosure, tax deeds, HUD properties, VA properties, receiverships, bankruptcies, lien releases, and payoff letters. Direct those applications as instructed to the FPC Legal Services unit.

Following these guidelines will help ensure that your Full Payment Certificate form is accurately and thoroughly completed, which will aid in the efficient processing of your application.

Misconceptions

There are several misconceptions about the Full Payment Certificate (FPC) form required by the City of Chicago's Department of Finance. These misunderstandings can lead to confusion for individuals or entities looking to transfer property. Here are eight common misconceptions and the clarifications to set them straight.

All property transfers are treated the same: Many people think that the FPC application process is uniform for all properties. However, different types of properties and transactions require specific documentation and follow varying procedures. For example, condo conversions and new construction projects have unique requirements compared to single-family home transfers.

The FPC fee applies to all transactions: It is commonly misunderstood that every property transfer requires the payment of an FPC fee. In reality, the FPC fee is waived if the property is exempt from the City of Chicago Real Property Transfer Tax, indicating that not all transfers will incur this cost.

Any supporting document will suffice: A specific set of documents is required based on the property type and transaction nature. The form delineates what must be submitted, such as legal descriptions for commercial properties or court orders for foreclosures. Merely any document related to the property does not fulfill these requirements.

Final meter readings are optional: There's a belief that final meter readings are merely a formality. However, final meter readings are crucial for closing based on a metered term and must occur within 60 days prior to the closing or authorization date. This ensures accurate water billing up to the point of transfer.

Buyer information is for billing purposes only: While it's true that buyer information helps direct future billing, it also serves to ensure that the City’s records accurately reflect the new ownership. This information is vital for more than just billing purposes; it affects municipal records and potential future services.

Seller information is unnecessary if the buyer is known: Contrary to this belief, seller information is crucial to establish the chain of ownership and to ensure that any outstanding charges are properly addressed before the transfer.

Any preparer can sign off on the application: The person preparing the application must have an authorized role in the transaction, such as the seller, buyer, attorney, or agent. Incorrect assumption about who can sign can lead to the rejection of the application.

The application process is immediate: There's an expectation that the application process for an FPC is quick. However, the form specifically notes to allow a minimum of 10 days for processing. This timeframe is crucial for proper review and completion of the FPC.

Understanding these misconceptions and their realities can help parties involved in property transfers in Chicago navigate the process more smoothly and ensure compliance with the Department of Finance requirements.

Key takeaways

Filling out a Full Payment Certificate (FPC) form requires careful attention to detail and understanding of the process. Here are ten key takeaways to navigate this form effectively:

- Applications are a must for all property transfers: Regardless of the type of property involved, a separate FPC application is required for each property being transferred.

- Know your property details: Accurately providing premise information, including addresses and water account numbers, is critical. For condominiums or townhouses, include the precise unit number.

- Identify the property type correctly: Checking the appropriate box for your property type (e.g., single-family home, commercial, condominium) is essential for correct processing.

- Mandatory supporting documentation: Depending on the property or transaction type, specific supporting documents like legal descriptions, plats of survey, or court orders must be attached.

- Scheduled meter reading requirements: If your property has a metered water service without a reading in the last 60 days, providing contact information for access to the property is necessary.

- Buyer and seller information: Complete and accurate details for both parties are necessary, including contact information and mailing addresses for future water bills.

- Preparer's role: The person preparing the application should provide their name, company, contact details, and relationship to the transaction.

- Understanding fees: The FPC fee is $50 per account but is waived if the property is exempt from the City of Chicago Real Property Transfer Tax.

- Closures based on meter readings: Closures based on final meter readings must occur within 60 days of the reading date or authorization date, whichever comes first.

- Acknowledgment and certification: Applicants agree to pay the listed amount plus the processing fee, and they certify that all provided information is true and correct under penalties provided by law.

This list provides a foundational understanding of the FPC application process, ensuring that the transfer of property proceeds smoothly and in compliance with the City of Chicago's requirements.

Popular PDF Documents

Certain Government Payments - The 1099-G form documents any agricultural payments received from the government, ensuring they are reported for tax purposes.

Non Resident Alien Tax Withholding - By consulting IRS Notice 1392, non-citizens can better understand their tax withholding obligations and avoid over- or under-paying taxes.

Purchase Requisition - It allows the purchasing department to evaluate and manage requests in line with company priorities.